Home > Analyses > Industrials > Proto Labs, Inc.

Proto Labs revolutionizes manufacturing by turning digital designs into physical parts with unmatched speed and precision. As a pioneer in e-commerce-driven custom prototyping and on-demand production, it leads the metal fabrication industry with advanced 3D printing and CNC machining technologies. Known for innovation and quality, Proto Labs empowers engineers worldwide to accelerate product development. The key question now: does its robust market position and growth momentum fully justify its current valuation?

Table of contents

Business Model & Company Overview

Proto Labs, Inc. operates as a leading digital manufacturer specializing in custom prototypes and on-demand production parts. Founded in 1999 and headquartered in Maple Plain, Minnesota, it has built a cohesive ecosystem spanning injection molding, CNC machining, 3D printing, and sheet metal fabrication. This integrated platform serves engineers worldwide, enabling rapid product development through e-commerce-driven solutions.

The company generates revenue by balancing quick-turn hardware fabrication and software-enabled design services. Its global footprint spans the Americas, Europe, and Asia, catering to a diverse industrial client base. Proto Labs’ competitive advantage lies in its ability to combine speed, customization, and scale, carving a durable economic moat that shapes the future of metal fabrication and digital manufacturing.

Financial Performance & Fundamental Metrics

I will analyze Proto Labs, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

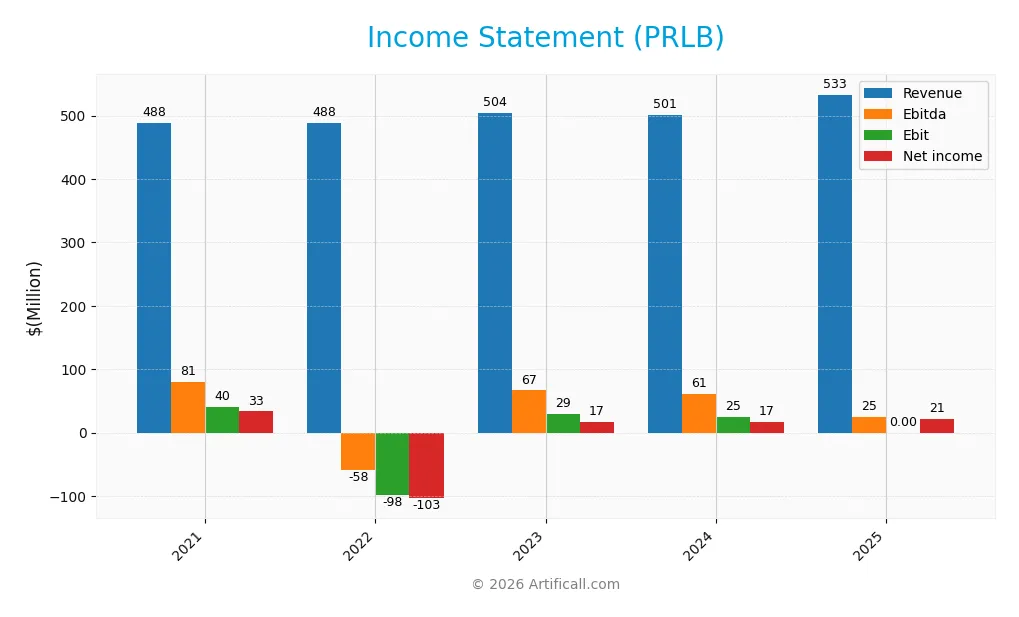

Income Statement

Below is Proto Labs, Inc.’s annual income statement summary for the past five fiscal years, reflecting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 488.1M | 488.4M | 503.9M | 500.9M | 533.1M |

| Cost of Revenue | 265.4M | 272.9M | 281.9M | 277.7M | 296.0M |

| Operating Expenses | 194.9M | 188.5M | 193.6M | 197.7M | 212.0M |

| Gross Profit | 222.7M | 215.5M | 222.0M | 223.2M | 237.1M |

| EBITDA | 80.7M | -58.5M | 66.6M | 60.7M | 25.1M |

| EBIT | 40.2M | -97.9M | 29.1M | 24.9M | 0.0 |

| Interest Expense | 0.0 | 0.0 | 1.1M | 0.2M | 0.0 |

| Net Income | 33.4M | -103.5M | 17.2M | 16.6M | 21.2M |

| EPS | 1.21 | -3.77 | 0.66 | 0.66 | 0.89 |

| Filing Date | 2022-02-18 | 2023-02-21 | 2024-02-16 | 2025-02-21 | 2026-02-06 |

Income Statement Evolution

Proto Labs’ revenue grew moderately by 6.4% in 2025, continuing a favorable overall growth trend of 9.2% since 2021. Gross profit rose 6.2%, supporting a stable gross margin near 44.5%. However, operating expenses rose proportionally, and EBIT declined sharply to zero, indicating margin pressure despite revenue gains.

Is the Income Statement Favorable?

In 2025, Proto Labs posted a net income of $21.2M with a net margin of 4.0%, reflecting modest profitability. EBIT margin collapsed to 0%, signaling operational challenges. Interest expense remained negligible, supporting financial stability. The mixed signals with flat EBIT but rising net income produce a neutral fundamental stance for the income statement.

Financial Ratios

The following table presents key financial ratios for Proto Labs, Inc. (PRLB) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 6.8% | -21.2% | 3.4% | 3.3% | 4.0% |

| ROE | 4.0% | -14.8% | 2.5% | 2.5% | 0% |

| ROIC | 2.6% | 3.6% | 2.4% | 2.5% | 0% |

| P/E | 42.5 | -6.8 | 59.2 | 59.1 | 57.0 |

| P/B | 1.71 | 1.00 | 1.47 | 1.46 | 0 |

| Current Ratio | 3.34 | 2.61 | 4.04 | 3.66 | 0 |

| Quick Ratio | 3.10 | 2.42 | 3.76 | 3.43 | 0 |

| D/E | 0.009 | 0.031 | 0.008 | 0.005 | 0 |

| Debt-to-Assets | 0.008 | 0.027 | 0.007 | 0.005 | 0 |

| Interest Coverage | 0 | 0 | 25.8 | 127.5 | 0 |

| Asset Turnover | 0.53 | 0.61 | 0.65 | 0.67 | 0 |

| Fixed Asset Turnover | 1.70 | 1.75 | 1.94 | 2.17 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, Proto Labs’ ROE showed a decline, reaching zero in 2025, indicating deteriorating profitability. The Current Ratio fluctuated, peaking above 4 in 2023 before dropping to zero by 2025, reflecting worsening liquidity. Debt-to-Equity remained minimal and stable, signaling consistent low leverage. Profit margins narrowed overall, with net margin falling to 3.98% in 2025.

Are the Financial Ratios Favorable?

In 2025, Proto Labs’ profitability metrics, including ROE and net margin, are unfavorable, suggesting weak earnings performance. Liquidity ratios are unavailable or zero, raising concerns about short-term financial flexibility. Leverage ratios, including debt-to-equity and debt-to-assets, remain favorable due to minimal debt. Market valuation shows a high P/E ratio (56.98), considered unfavorable. Overall, 71.43% of ratios are unfavorable, indicating caution.

Shareholder Return Policy

Proto Labs, Inc. (PRLB) does not pay dividends, reflecting a reinvestment strategy focused on growth and operational stability. The company maintains free cash flow, with no dividend payout ratio or yield, and no share buyback programs reported.

This approach aligns with sustainable long-term value creation by prioritizing capital allocation to growth initiatives. However, shareholders should monitor potential shifts in cash deployment as the firm balances reinvestment with returning capital.

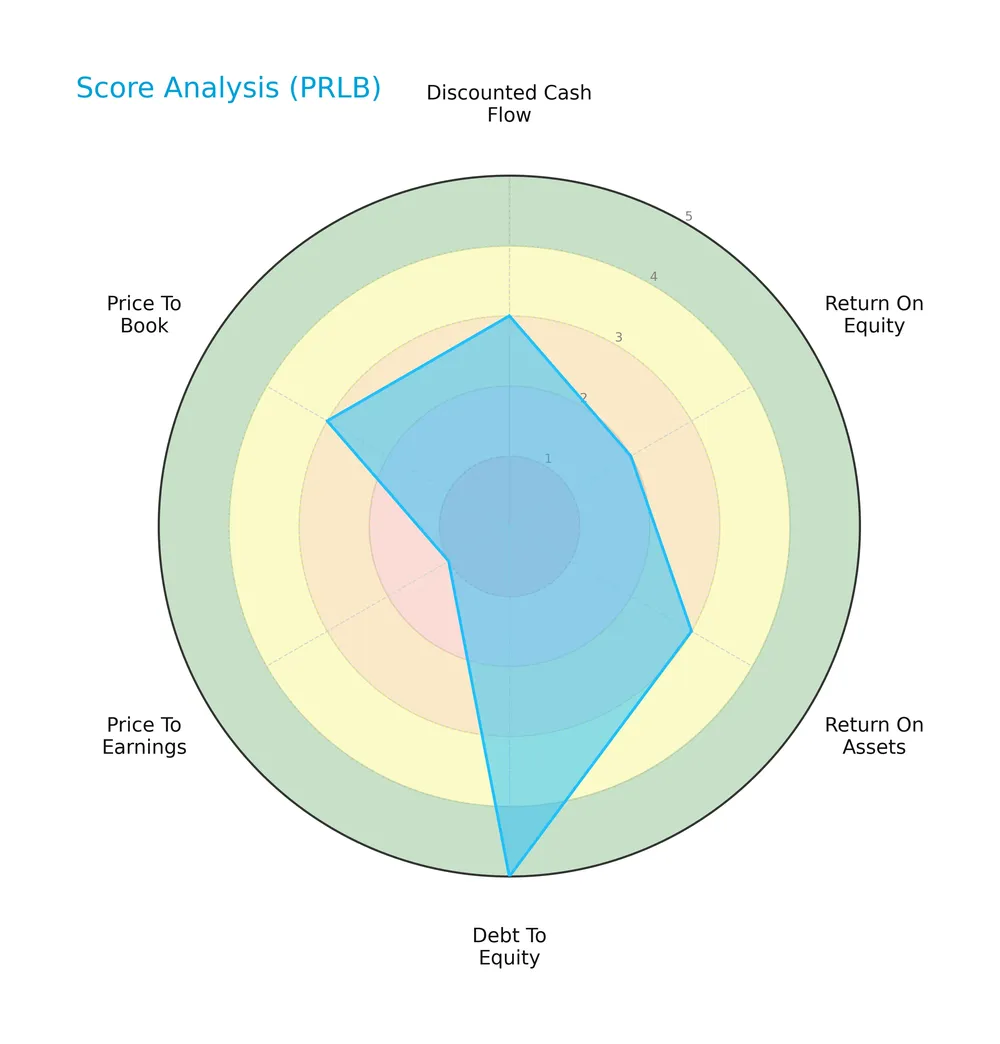

Score analysis

Here is a radar chart illustrating Proto Labs, Inc.’s key financial scores across valuation and performance metrics:

The company shows moderate results in discounted cash flow, return on assets, and price-to-book ratios. Return on equity is unfavorable, while debt-to-equity stands out as very favorable. Price-to-earnings remains very unfavorable.

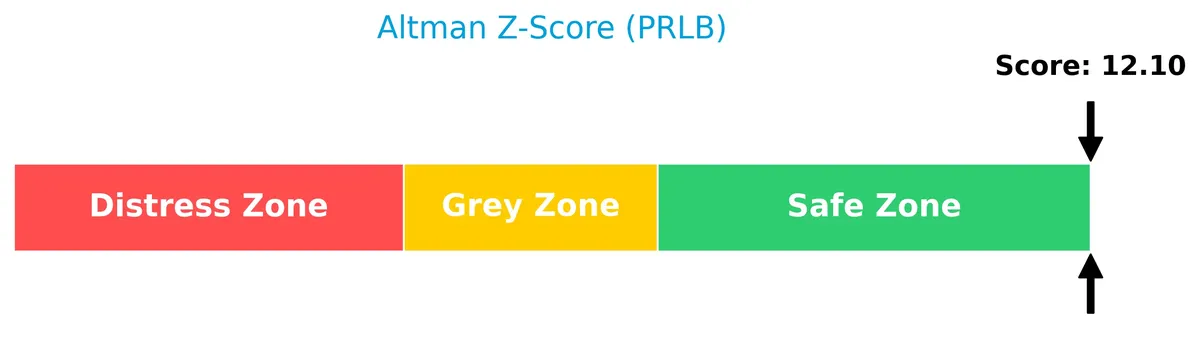

Analysis of the company’s bankruptcy risk

Proto Labs, Inc. scores well above distress thresholds on the Altman Z-Score, indicating a strong financial position and low bankruptcy risk:

Is the company in good financial health?

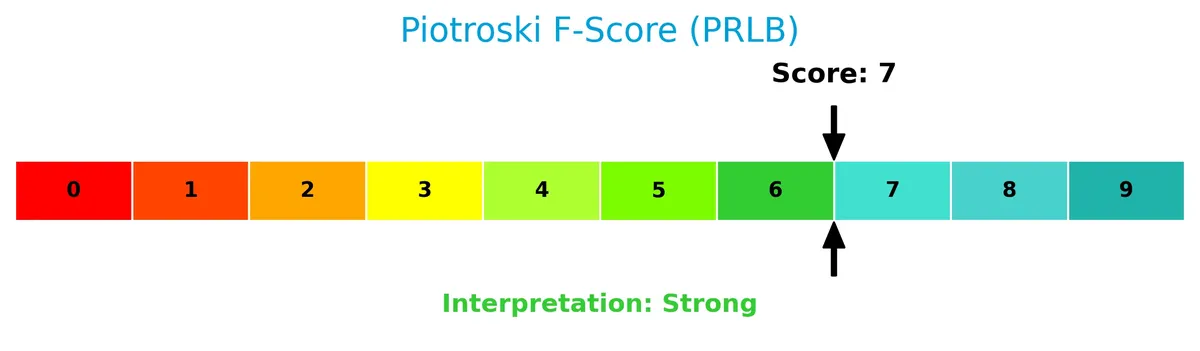

The Piotroski Score diagram below summarizes key financial health indicators for Proto Labs, Inc.:

A score of 7 suggests strong financial health, reflecting solid profitability, liquidity, and operational efficiency relative to peers.

Competitive Landscape & Sector Positioning

This sector analysis will explore Proto Labs, Inc.’s strategic positioning, revenue breakdown, key products, competitors, and strengths. I will assess whether Proto Labs holds a competitive advantage in the manufacturing and metal fabrication industry.

Strategic Positioning

Proto Labs maintains a diversified product portfolio spanning injection molding (194M), CNC machining (207M), 3D printing (84M), and sheet metal fabrication (15M) as of 2024. Geographically, it concentrates mainly in the U.S. (396M) with significant exposure to Europe (105M), reflecting a balanced yet focused industrial manufacturing footprint.

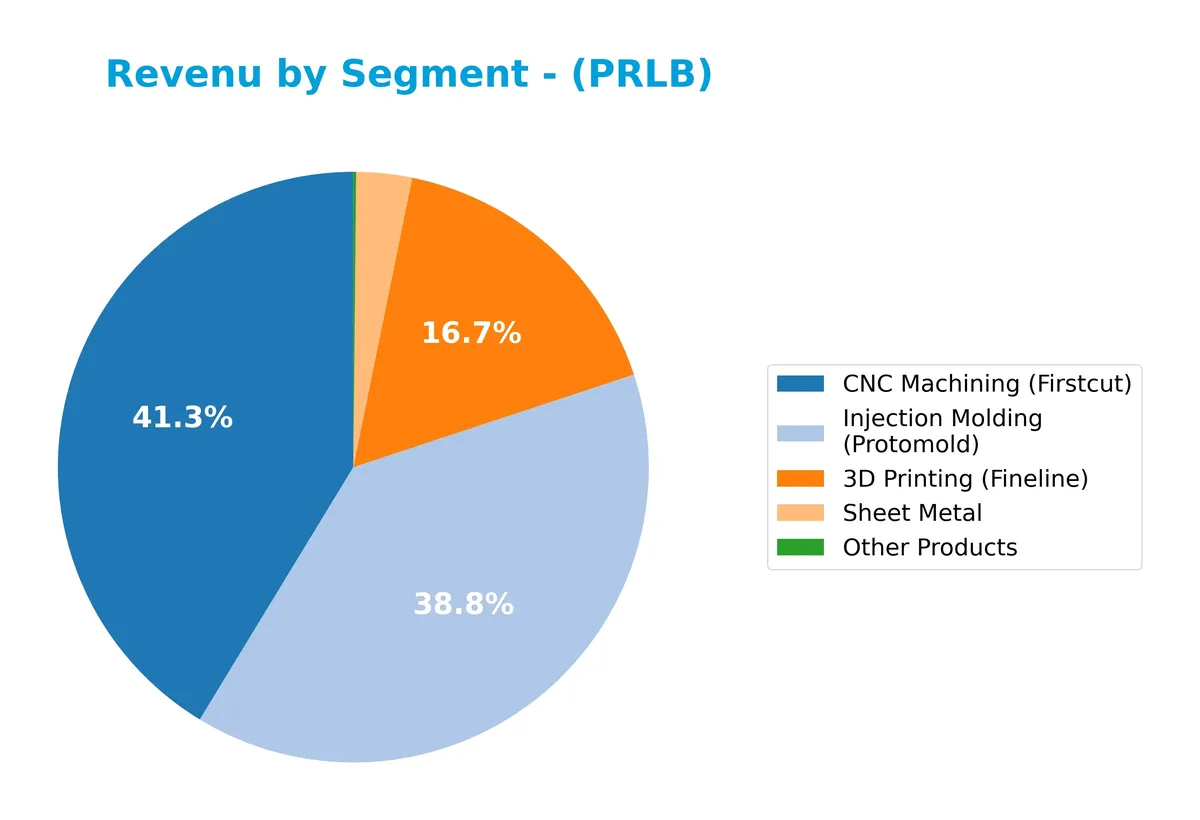

Revenue by Segment

The pie chart illustrates Proto Labs, Inc.’s revenue distribution by product segments for fiscal year 2024, highlighting contributions from 3D Printing, CNC Machining, Injection Molding, Sheet Metal, and Other Products.

In 2024, Injection Molding leads with $194M, closely followed by CNC Machining at $207M. 3D Printing contributes $84M, showing steady growth over recent years. Sheet Metal and Other Products remain minor revenue streams, underlining the firm’s concentration in core manufacturing technologies. The recent year shows a slight slowdown in Injection Molding but steady CNC Machining growth, suggesting stable segment balance with moderate concentration risk.

Key Products & Brands

The table below summarizes Proto Labs, Inc.’s main products and brands with their descriptions:

| Product | Description |

|---|---|

| Injection Molding (Protomold) | Custom injection molded parts produced on demand, serving various industrial applications. |

| CNC Machining (Firstcut) | Computer numerical control machining services delivering precision metal and plastic components. |

| 3D Printing (Fineline) | Advanced 3D printing technologies including stereolithography and metal laser sintering for prototypes. |

| Sheet Metal | Quick-turn, custom sheet metal fabrication enabled by e-commerce platforms. |

| Other Products | Miscellaneous custom manufacturing products outside core categories. |

Proto Labs focuses on rapid, on-demand manufacturing through digital platforms. Its diversified product lineup covers injection molding, CNC machining, 3D printing, and sheet metal fabrication, catering primarily to developers and engineers across industries.

Main Competitors

There are 2 competitors in total; the table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| ESAB Corporation | 6.8B |

| Proto Labs, Inc. | 1.2B |

Proto Labs ranks 2nd among its peers with a market cap just 23% of the leader ESAB Corporation. It sits below both the average market cap of the top 10 and the median for the sector. The company enjoys a significant 326% market cap gap versus the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Proto Labs have a competitive advantage?

Proto Labs operates in digital manufacturing with a strong gross margin of 44.5%, but its EBIT margin and ROIC trend show weaknesses, indicating limited evidence of a durable competitive advantage. The company’s e-commerce platform and rapid prototyping capabilities serve engineers worldwide, yet the declining ROIC trend suggests challenges in sustaining value creation compared to industry peers.

Looking ahead, Proto Labs’ expansion in 3D printing and sheet metal fabrication opens new product and market opportunities. Its focus on quick-turn production and digital services could drive growth if operational efficiency improves. However, profitability and capital efficiency remain key areas to monitor for future competitive positioning.

SWOT Analysis

This analysis highlights Proto Labs, Inc.’s key internal and external factors shaping its competitive position and growth potential.

Strengths

- strong market presence in digital manufacturing

- robust gross margin at 44.5%

- safe Altman Z-score indicating financial stability

Weaknesses

- zero EBIT margin signals profitability challenges

- unfavorable ROE and ROIC metrics

- high P/E ratio at 57 suggests overvaluation risk

Opportunities

- growing demand for rapid prototyping and on-demand production

- expansion potential in Europe and Japan markets

- technological advances in 3D printing methods

Threats

- intensifying competition in metal fabrication

- rising operational expenses impacting margins

- macroeconomic uncertainties affecting industrial demand

Proto Labs holds a strong niche with solid financial stability but faces margin pressure and valuation concerns. Strategic focus on operational efficiency and international growth can mitigate risks and unlock shareholder value.

Stock Price Action Analysis

The weekly stock chart for Proto Labs, Inc. (PRLB) shows significant price movement and volatility over the past year:

Trend Analysis

Over the past 12 months, PRLB’s stock price rose by 97.04%, indicating a strong bullish trend. The price accelerated, reaching a high of 67.17 and a low of 26.71. The standard deviation of 8.43 reflects notable volatility. Recent three-month gains of 37.56% confirm sustained momentum with a positive trend slope of 0.86.

Volume Analysis

Trading volumes over the last three months show a buyer-driven pattern with 63.87% buyer dominance. Despite this, overall volume is decreasing, suggesting reduced market participation. This decline may indicate cautious optimism among investors rather than aggressive accumulation or distribution phases.

Target Prices

Analysts set a clear target price range for Proto Labs, Inc., reflecting measured optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 34 | 44 | 38.5 |

The target prices suggest analysts expect moderate upside potential, with a consensus near 38.5. This range indicates confidence balanced by market uncertainties.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback concerning Proto Labs, Inc. (PRLB).

Stock Grades

The following table presents the latest verified stock grades from respected financial firms for Proto Labs, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-01 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-02-10 |

| Needham | Maintain | Hold | 2025-02-07 |

| Needham | Maintain | Hold | 2025-01-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-11-04 |

| Craig-Hallum | Maintain | Hold | 2024-11-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-07-30 |

| Benchmark | Maintain | Buy | 2024-05-29 |

| Craig-Hallum | Maintain | Hold | 2024-05-06 |

Most firms maintain a neutral to moderately positive stance, with multiple “Hold” and “Overweight” grades alongside consistent “Buy” ratings by Benchmark. The overall pattern suggests steady confidence without aggressive upgrades.

Consumer Opinions

Consumer sentiment around Proto Labs, Inc. (PRLB) reveals a blend of admiration for its innovation and frustration with service hiccups.

| Positive Reviews | Negative Reviews |

|---|---|

| Fast turnaround times impress clients. | Occasional delays in customer support. |

| High-quality prototypes meet expectations. | Pricing can be steep for small orders. |

| User-friendly online platform simplifies ordering. | Communication during order issues lacks clarity. |

Overall, consumers praise Proto Labs for rapid delivery and quality outputs, but recurring complaints about customer service responsiveness and pricing suggest room for improvement.

Risk Analysis

Below is a summary of key risks facing Proto Labs, Inc. with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability | Low net margin of 3.98% limits earnings cushion and reinvestment | Medium | High |

| Valuation | Elevated P/E ratio near 57 suggests overvaluation risk | High | Medium |

| Liquidity | Current and quick ratios at zero indicate potential short-term stress | Medium | High |

| Operational | Asset turnover and fixed asset turnover at zero signal inefficiency | Medium | Medium |

| Leverage | Favorable low debt-to-equity reduces default risk | Low | Low |

| Dividend Policy | No dividend yield may deter income-focused investors | Medium | Low |

The most pressing risks are Proto Labs’ stretched valuation and weak liquidity metrics. Despite a strong Altman Z-Score placing it in the safe zone, the zero current ratio raises caution on short-term financial flexibility. The company’s low profitability amid a competitive manufacturing sector demands close monitoring of capital allocation and operational efficiency.

Should You Buy Proto Labs, Inc.?

Proto Labs, Inc. appears to be a moderately profitable company with improving operational efficiency but a declining ROIC trend, suggesting an eroding moat. Supported by a very favorable leverage profile and a solid B rating, the investment case suggests moderate value creation.

Strength & Efficiency Pillars

Proto Labs, Inc. posts a solid gross margin of 44.48%, signaling robust operational efficiency. Despite this, its net margin holds at a modest 3.98%, and both ROE and ROIC register at 0%, indicating weak profitability. The Altman Z-Score of 12.10 firmly places Proto Labs in the safe zone, confirming financial stability. However, without available WACC data, I cannot verify value creation through ROIC comparison, limiting the positive interpretation to operational margins alone.

Weaknesses and Drawbacks

Proto Labs faces significant headwinds. Its P/E ratio stands at an elevated 56.98, suggesting a premium valuation that could deter value-conscious investors. The current ratio and quick ratio data are missing but flagged as unfavorable, hinting at potential short-term liquidity risks. Additionally, unfavorable scores in return on equity and asset turnover point to operational inefficiencies. Market demand remains buyer-dominant recently, but the overall volume trend is decreasing, reflecting possible waning investor enthusiasm.

Our Final Verdict about Proto Labs, Inc.

Proto Labs presents a mixed profile. Its strong financial health indicated by a high Altman Z-Score and a bullish long-term trend suggests underlying resilience. However, weak profitability and premium valuation metrics introduce caution. Given the recent buyer dominance and declining volume, the profile might appear attractive for long-term exposure but could benefit from a wait-and-see approach to confirm sustained momentum.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Protolabs Reports Financial Results for the Fourth Quarter and Full Year 2025 – Business Wire (Feb 06, 2026)

- Proto Labs Inc (PRLB) Q4 2025 Earnings Call Highlights: Record R – GuruFocus (Feb 06, 2026)

- Proto Labs (NYSE:PRLB) Reports Upbeat Q4 CY2025, Stock Jumps 14.7% – Finviz (Feb 06, 2026)

- Proto Labs Expects Q1 Results To Improve; Stock Up Over 13% In Pre-Market – Nasdaq (Feb 06, 2026)

- Proto Labs: Q4 Earnings Snapshot – kens5.com (Feb 06, 2026)

For more information about Proto Labs, Inc., please visit the official website: protolabs.com