Home > Analyses > Utilities > PPL Corporation

PPL Corporation powers millions daily, shaping how communities access essential energy through a blend of traditional and renewable sources. As a key player in the regulated electric utility sector, PPL serves a diverse customer base across the US and UK, recognized for its reliable service and steady innovation in energy generation and distribution. With a century-long legacy and evolving energy landscape, the critical question remains: does PPL’s current financial health and strategic direction support continued growth and shareholder value in 2026?

Table of contents

Business Model & Company Overview

PPL Corporation, founded in 1920 and headquartered in Allentown, Pennsylvania, stands as a dominant player in the regulated electric utility industry. Serving over 2.7 million customers across the United States and the United Kingdom, PPL integrates electricity and natural gas delivery into a comprehensive energy ecosystem. Its operations span Kentucky, Pennsylvania, and southwestern Virginia, encompassing generation from coal, gas, hydro, and solar sources, reflecting a diversified energy portfolio.

The company’s revenue engine balances regulated electric and natural gas services with power generation and wholesale electricity sales. This blend ensures consistent cash flow from recurring utility rates while leveraging generation assets across key markets in North America and the UK. PPL’s strategic positioning in these global regions underpins its strong economic moat, securing its role as a foundational energy provider shaping the future of regulated utilities.

Financial Performance & Fundamental Metrics

I will analyze PPL Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its financial health and stability.

Income Statement

The table below presents PPL Corporation’s key income statement figures for the fiscal years 2020 through 2024, reflecting revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 5.47B | 5.78B | 7.90B | 8.31B | 8.46B |

| Cost of Revenue | 2.69B | 3.07B | 5.02B | 5.04B | 5.07B |

| Operating Expenses | 1.20B | 1.29B | 1.51B | 1.65B | 1.65B |

| Gross Profit | 2.79B | 2.71B | 2.89B | 3.28B | 3.39B |

| EBITDA | 2.67B | 2.56B | 2.66B | 2.93B | 3.21B |

| EBIT | 1.59B | 1.44B | 1.43B | 1.59B | 1.85B |

| Interest Expense | 634M | 918M | 513M | 666M | 738M |

| Net Income | 1.47B | (1.48B) | 756M | 740M | 888M |

| EPS | 1.91 | (1.93) | 1.02 | 1.00 | 1.20 |

| Filing Date | 2021-02-18 | 2022-02-18 | 2023-02-17 | 2024-02-16 | 2025-02-13 |

Income Statement Evolution

Between 2020 and 2024, PPL Corporation’s revenue increased substantially by 54.6%, though the one-year growth rate of 1.8% in 2024 was unfavorable. Net income declined by nearly 40% over the entire period, reflecting volatile profitability. Margins showed mixed trends: gross margin remained favorable at 40.1%, EBIT margin improved to 21.9%, and net margin stood at a favorable 10.5%, despite overall net margin contraction over five years.

Is the Income Statement Favorable?

In 2024, PPL reported revenue of $8.46B with a net income of $886M, producing a net margin of 10.5%—a favorable level. EBIT grew 16.6% year-over-year, and EPS rose 20% to $1.20, indicating improved operational efficiency. Interest expense was stable relative to revenue. Overall, the income statement’s fundamentals are favorable, supported by margin improvements and positive earnings growth, though revenue growth showed some deceleration.

Financial Ratios

The following table presents key financial ratios of PPL Corporation for the fiscal years 2020 through 2024, offering a snapshot of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 27% | -26% | 10% | 9% | 10% |

| ROE | 11% | -11% | 5% | 5% | 6% |

| ROIC | 3.0% | 0.2% | 3.0% | 3.5% | 3.6% |

| P/E | 15 | -15 | 28 | 27 | 27 |

| P/B | 1.62 | 1.67 | 1.55 | 1.43 | 1.70 |

| Current Ratio | 1.39 | 2.16 | 0.75 | 0.88 | 0.86 |

| Quick Ratio | 1.37 | 2.02 | 0.63 | 0.73 | 0.71 |

| D/E | 1.19 | 0.82 | 1.02 | 1.12 | 1.19 |

| Debt-to-Assets | 33% | 34% | 38% | 40% | 41% |

| Interest Coverage | 2.50 | 1.55 | 2.68 | 2.45 | 2.36 |

| Asset Turnover | 0.11 | 0.17 | 0.21 | 0.21 | 0.21 |

| Fixed Asset Turnover | 0.22 | 0.23 | 0.26 | 0.26 | 0.26 |

| Dividend Yield | 5.9% | 5.6% | 3.7% | 3.5% | 3.1% |

Evolution of Financial Ratios

From 2020 to 2024, PPL Corporation’s Return on Equity (ROE) trended downward, declining from 11.0% in 2020 to 6.3% in 2024, indicating a slowdown in shareholder profitability. The Current Ratio decreased significantly from 1.39 in 2020 to 0.86 in 2024, reflecting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased from 1.19 in 2020 to 1.19 in 2024, suggesting a stable but relatively high leverage position over this period.

Are the Financial Ratios Favorable?

In 2024, PPL showed a mixed financial profile: profitability metrics such as net margin (10.5%) and dividend yield (3.12%) were favorable, while ROE (6.3%) and return on invested capital (3.6%) were unfavorable compared to the weighted average cost of capital (5.6%). Liquidity ratios, including current (0.86) and quick ratios (0.71), were unfavorable, signaling tight short-term financial flexibility. Leverage ratios remained neutral to unfavorable, with a debt-to-equity ratio of 1.19 and interest coverage around 2.5. Overall, the global ratio evaluation classified the company’s financial ratios as unfavorable.

Shareholder Return Policy

PPL Corporation consistently pays dividends with a payout ratio near 84%, a dividend yield around 3.1%, and a stable dividend per share slightly above $1. Despite negative free cash flow per share, the dividend is moderately covered by operating cash flow. No explicit share buyback data is reported.

This distribution approach suggests a commitment to returning capital, though reliance on operating cash flow rather than free cash flow presents sustainability risks. The policy appears balanced but warrants close monitoring to ensure long-term shareholder value is not compromised by cash flow constraints.

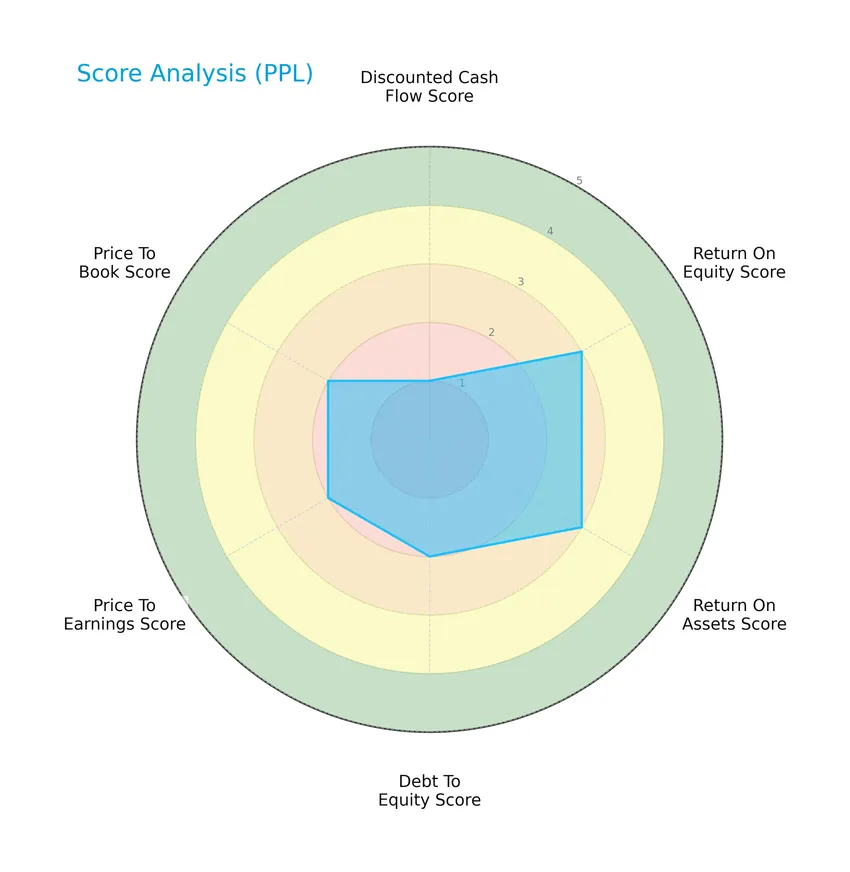

Score analysis

The following radar chart illustrates PPL Corporation’s key financial scores to aid in evaluating its investment potential:

PPL Corporation’s scores show moderate returns on equity and assets at 3 each, with moderate debt-to-equity, price-to-earnings, and price-to-book scores at 2. The discounted cash flow score is very unfavorable at 1, reflecting some concerns in valuation metrics.

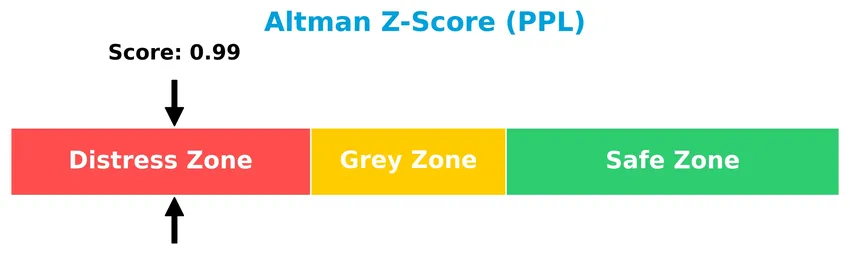

Analysis of the company’s bankruptcy risk

The Altman Z-Score places PPL Corporation in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

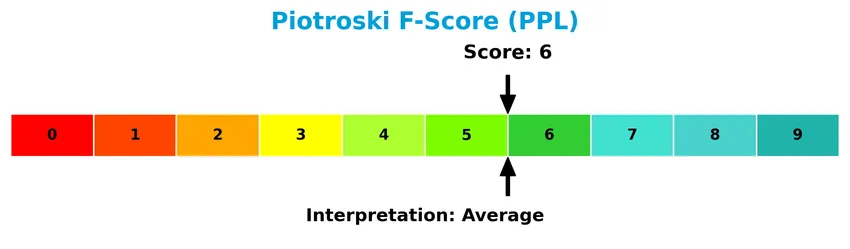

This Piotroski diagram presents PPL Corporation’s financial strength based on nine key criteria:

With a Piotroski Score of 6, PPL Corporation is assessed as having average financial health, suggesting moderate financial strength without clear indicators of either strong or weak performance.

Competitive Landscape & Sector Positioning

This sector analysis will examine PPL Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether PPL holds a competitive advantage over its industry peers in the regulated electric utility sector.

Strategic Positioning

PPL Corporation focuses on a geographically concentrated portfolio within the US, primarily in Kentucky, Pennsylvania, and Rhode Island, with a shift away from the UK market since 2020. Its product portfolio centers on regulated electric and natural gas utilities, reflecting a stable, regionally diversified utility holding strategy.

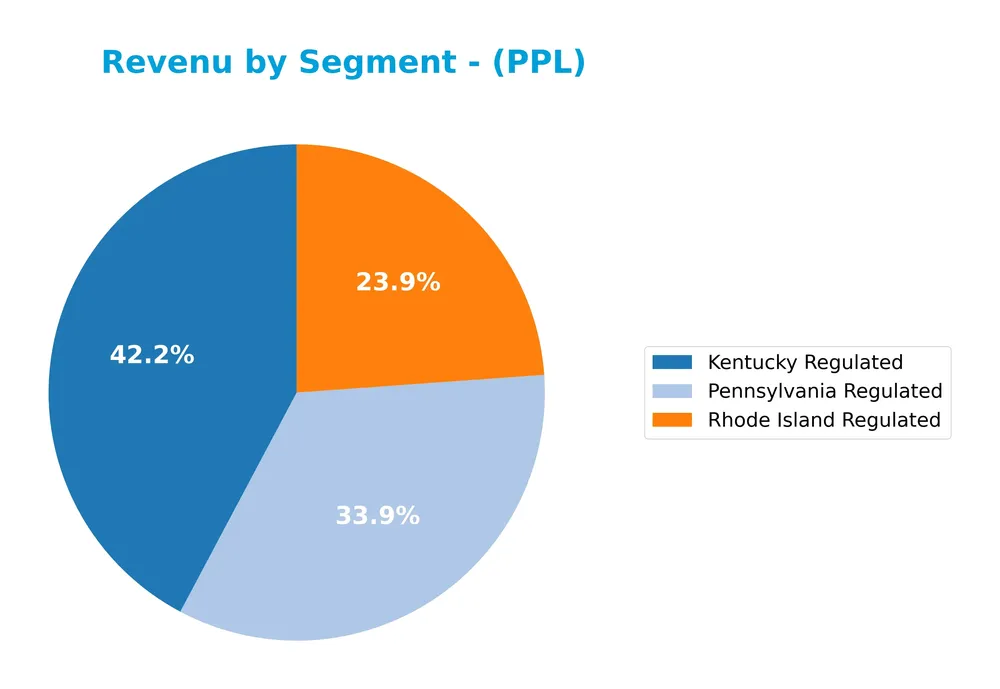

Revenue by Segment

This pie chart illustrates PPL Corporation’s revenue distribution by regulated segments for the fiscal year 2024, highlighting the contribution of key geographic areas.

In 2024, Kentucky Regulated remains the dominant revenue driver at 3.6B, followed by Pennsylvania Regulated with 2.9B and Rhode Island Regulated at 2.0B. The steady growth in Rhode Island contrasts with a slight decline in Pennsylvania from the previous year, indicating a shift in regional revenue balance. Overall, the business shows moderate concentration risk in regulated markets, with Kentucky maintaining a strong and consistent presence.

Key Products & Brands

The table below highlights PPL Corporation’s key products and service segments with their respective descriptions:

| Product | Description |

|---|---|

| Kentucky Regulated | Electricity delivery and generation from coal, gas, hydro, and solar for over 867K customers in Kentucky and parts of Virginia. |

| Pennsylvania Regulated | Electric utility services to approximately 1.4M customers across Pennsylvania. |

| Rhode Island Regulated | Regulated electric services in Rhode Island contributing to recent revenues. |

PPL Corporation primarily operates through regulated electric utility segments in Kentucky, Pennsylvania, and Rhode Island. These segments encompass electricity delivery, generation, and natural gas services to over 2.6M customers across the United States.

Main Competitors

There are 23 competitors in the regulated electric sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

PPL Corporation ranks 16th among 23 competitors, with a market cap approximately 16% that of the sector leader, NextEra Energy. The company sits below both the average market cap of the top 10 competitors (67.5B) and the median market cap of the sector (34B). Its position is closely behind the next competitor above by about 2.4%, indicating a narrow gap with its nearest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PPL have a competitive advantage?

PPL Corporation currently shows a slightly unfavorable competitive advantage, as its ROIC is below WACC by 2%, indicating value destruction despite a growing profitability trend. Its income statement is generally favorable, with strong margins and positive growth in EBIT and net margin over the past year.

Looking ahead, PPL’s revenue streams are diversified across regulated electric markets in Kentucky, Pennsylvania, and Rhode Island, with opportunities to capitalize on expanding customer bases and renewable energy generation. The company’s growing ROIC trend suggests improving efficiency, which may support future value creation in these core markets.

SWOT Analysis

This SWOT analysis highlights PPL Corporation’s key internal strengths and weaknesses alongside external opportunities and threats to support informed investment decisions.

Strengths

- stable regulated utility operations

- favorable gross and net margins

- consistent dividend yield of 3.12%

Weaknesses

- unfavorable ROE and ROIC

- moderate financial distress risk (Altman Z-Score in distress zone)

- high debt-to-equity ratio of 1.19

Opportunities

- expanding revenue in Rhode Island segment

- growing ROIC trend signaling improving profitability

- renewable energy integration potential

Threats

- regulatory risks in US and UK markets

- exposure to energy price volatility

- competition from alternative energy providers

Overall, PPL’s solid regulated utility base and improving profitability offer a stable foundation, but financial leverage and risk of distress require cautious monitoring. Strategic focus on renewables and geographic growth can enhance resilience against regulatory and market threats.

Stock Price Action Analysis

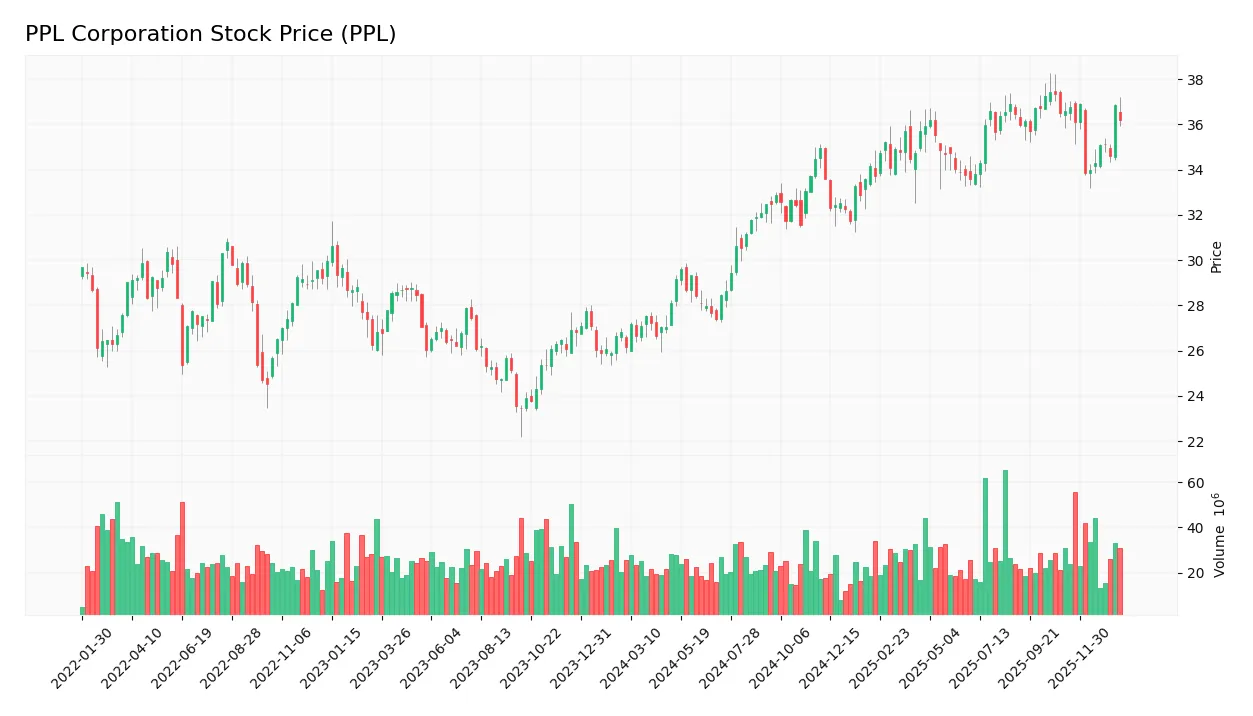

The weekly stock chart below illustrates PPL Corporation’s price movements over the past 12 months, highlighting key fluctuations and trend phases:

Trend Analysis

Over the past 12 months, PPL’s stock price increased by 38.52%, indicating a bullish trend with deceleration in momentum. The highest price reached 37.44 and the lowest was 26.14, with a volatility measured by a standard deviation of 3.17. Recent weeks show a slight negative change of -1.01%, reflecting a neutral short-term trend.

Volume Analysis

Trading volume over the last three months shows an increasing trend with total volume exceeding 3.1B shares. Buyer activity dominates at 58.46% during the recent period, indicating slightly buyer-driven sentiment. This suggests growing market participation and moderate investor confidence in PPL’s stock.

Target Prices

The consensus target price for PPL Corporation indicates moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 44 | 36 | 40.29 |

Analysts expect the stock to trade within a range of 36 to 44, with an average consensus around 40.29, suggesting a balanced outlook with cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the recent ratings and consumer feedback related to PPL Corporation’s market performance and services.

Stock Grades

The following table presents recent verified analyst grades for PPL Corporation from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Wells Fargo | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| BMO Capital | Maintain | Outperform | 2025-10-21 |

| B of A Securities | Maintain | Buy | 2025-10-16 |

| Barclays | Maintain | Equal Weight | 2025-10-14 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Morgan Stanley | Maintain | Overweight | 2025-09-25 |

Overall, the consensus among major analysts remains stable, with a predominance of positive ratings such as Overweight, Buy, and Outperform. No recent downgrades or upgrades indicate a steady outlook on PPL Corporation’s stock.

Consumer Opinions

Consumer sentiment around PPL Corporation reflects a mix of appreciation for its reliability and concerns over pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently reliable energy supply, minimal outages.” | “Customer service can be slow to respond during peak times.” |

| “Transparent billing and helpful online tools.” | “Rates have increased noticeably in the past year.” |

| “Strong commitment to renewable energy initiatives.” | “Some areas experience occasional power quality issues.” |

Overall, consumers praise PPL for dependable service and transparency, but recurring issues include rising rates and customer support delays. This suggests a need for improved responsiveness and cost management.

Risk Analysis

Below is a summary table of the key risks associated with investing in PPL Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score indicates distress zone, risk of default | High | High |

| Profitability | Unfavorable ROE and ROIC suggest weak returns on capital | Medium | Medium |

| Liquidity | Current and quick ratios below 1 signal liquidity concerns | Medium | Medium |

| Debt Level | Debt to equity ratio above 1 with moderate interest coverage | Medium | Medium |

| Market Valuation | Elevated PE ratio may limit upside potential | Medium | Medium |

| Dividend Stability | Dividend yield favorable but depends on cash flow stability | Low | Medium |

| Regulatory | Exposure to regulated electric markets adds compliance risks | Medium | Medium |

The most critical risk is PPL’s financial distress indicated by an Altman Z-Score below 1, signaling a high probability of financial difficulties. Coupled with weak profitability and liquidity ratios, investors should exercise caution. Regulatory risks and moderate leverage also require close monitoring given the utility sector’s nature.

Should You Buy PPL Corporation?

PPL Corporation appears to be a firm with improving operational efficiency but a slightly unfavorable moat, as it currently destroys value despite growing returns. Its leverage profile remains substantial, and the overall rating suggests a moderate financial health profile with caution warranted.

Strength & Efficiency Pillars

PPL Corporation exhibits solid profitability with a net margin of 10.49% and an EBIT margin of 21.91%, underscoring operational efficiency. The company maintains a moderate ROE of 6.31% and ROIC at 3.59%, although these returns fall below its WACC of 5.6%, indicating it is currently not a value creator. Financial health is mixed: the Altman Z-score of 0.99 places PPL in the distress zone, signaling bankruptcy risk, while a Piotroski score of 6 suggests average financial strength. Dividend yield at 3.12% adds an income component to the investment case.

Weaknesses and Drawbacks

Several cautionary factors temper PPL’s outlook. Its high debt-to-equity ratio of 1.19 and weak liquidity metrics—current ratio at 0.86 and quick ratio at 0.71—highlight leverage and short-term solvency risks. Valuation appears elevated, with a P/E ratio of 26.97, implying a premium price relative to earnings. Asset turnover ratios are notably low (0.21), reflecting potential inefficiencies in asset utilization. These factors, combined with a distressed Altman Z-score, underscore financial vulnerability and operational headwinds.

Our Verdict about PPL Corporation

PPL’s long-term fundamental profile may appear mixed to unfavorable given its value destruction and financial distress signals. However, the stock’s technical trend remains bullish, supported by buyer dominance at 58.46% in the recent period. Despite the underlying weaknesses, this combination suggests that PPL could represent an opportunity for investors with a higher risk tolerance, though a cautious, wait-and-see approach might be prudent before committing capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- PPL Corporation statement on Trump-Shapiro call for new power auction to spur construction of power plants paid for by data centers – PR Newswire (Jan 20, 2026)

- PPL Corporation Earnings Preview: What to Expect – Yahoo Finance (Jan 15, 2026)

- PPL responds to Trump, governors’ call for PJM special auction – Investing.com (Jan 20, 2026)

- PPL Price Target Adjusted by Barclays Amidst Equal-Weight Rating – GuruFocus (Jan 22, 2026)

- Precision Trading with Ppl Corporation (PPL) Risk Zones – Stock Traders Daily (Jan 20, 2026)

For more information about PPL Corporation, please visit the official website: pplweb.com