Home > Analyses > Basic Materials > PPG Industries, Inc.

PPG Industries transforms everyday environments with its advanced paints, coatings, and specialty materials. Its innovations protect everything from bridges and aircraft to consumer electronics, defining industry standards worldwide. Known for its cutting-edge technologies and broad portfolio, PPG commands respect across automotive, aerospace, and industrial sectors. As it navigates evolving market demands and sustainability pressures, the critical question remains: does PPG’s robust foundation justify its current valuation and future growth prospects?

Table of contents

Business Model & Company Overview

PPG Industries, Inc., founded in 1883 and headquartered in Pittsburgh, dominates the specialty chemicals sector with a comprehensive ecosystem of paints, coatings, and specialty materials. Its portfolio integrates solutions for automotive, aerospace, industrial, and consumer markets, forming a cohesive mission to protect and enhance surfaces globally. The company leverages its innovation and scale to maintain a competitive advantage in high-performance coatings and materials.

PPG’s revenue engine balances diverse streams across Performance and Industrial Coatings segments, combining hardware products like paints and sealants with software and on-site services. Its strategic footprint spans the Americas, Europe, and Asia, serving industries from commercial aviation to packaging. I recognize PPG’s formidable economic moat, built on advanced technology and a broad global presence, positioning it as a key architect in the future of protective and specialty coatings.

Financial Performance & Fundamental Metrics

I analyze PPG Industries’ income statement, key financial ratios, and dividend payout policy to reveal its profitability, efficiency, and shareholder return framework.

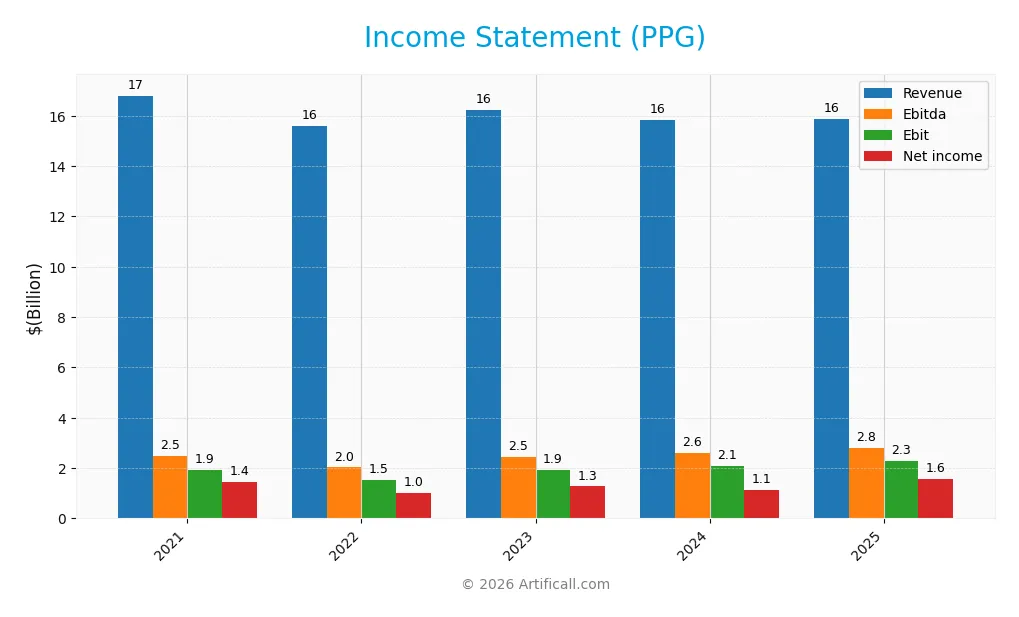

Income Statement

The table below presents PPG Industries, Inc.’s key income statement figures from 2021 to 2025, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 16.8B | 15.6B | 16.2B | 15.8B | 15.9B |

| Cost of Revenue | 10.3B | 10.0B | 9.7B | 9.3B | 9.8B |

| Operating Expenses | 4.8B | 4.0B | 4.5B | 4.3B | 3.9B |

| Gross Profit | 6.5B | 5.6B | 6.6B | 6.6B | 6.0B |

| EBITDA | 2.5B | 2.0B | 2.5B | 2.6B | 2.8B |

| EBIT | 1.9B | 1.5B | 1.9B | 2.1B | 2.3B |

| Interest Expense | 121M | 167M | 247M | 241M | 241M |

| Net Income | 1.4B | 1.0B | 1.3B | 1.1B | 1.6B |

| EPS | 6.06 | 4.35 | 5.38 | 4.77 | 6.96 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-20 | 2026-01-27 |

Income Statement Evolution

From 2021 to 2025, PPG’s revenue declined by 5.5%, signaling headwinds in topline growth. Despite this, net income rose 9.5%, reflecting improved profitability. Margins show strength: gross margin steadied near 38%, while net margin expanded by nearly 16%, indicating better cost control and operational efficiency over the period.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable. Revenue growth was flat at 0.2%, yet gross profit dropped 8.5%, suggesting margin pressure on core operations. Conversely, EBIT rose 9.2%, and net margin surged 41%, driven by disciplined operating expenses and lower interest costs. Earnings per share growth of 46% underscores strong bottom-line improvement despite modest revenue growth.

Financial Ratios

The following table summarizes key financial ratios for PPG Industries, Inc. from 2021 to 2025, providing insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.56% | 6.57% | 7.82% | 7.04% | 9.93% |

| ROE | 22.89% | 15.56% | 16.22% | 16.45% | -44.48% |

| ROIC | 8.0% | 7.7% | 8.9% | 11.0% | 43.1% |

| P/E | 28.47 | 28.93 | 27.79 | 25.02 | 14.71 |

| P/B | 6.52 | 4.50 | 4.51 | 4.12 | -6.54 |

| Current Ratio | 1.42 | 1.52 | 1.47 | 1.31 | 1.62 |

| Quick Ratio | 0.97 | 1.04 | 1.09 | 0.94 | 1.22 |

| D/E | 1.19 | 1.16 | 0.84 | 0.94 | -2.10 |

| Debt-to-Assets | 35.0% | 36.8% | 30.5% | 32.9% | 93.6% |

| Interest Coverage | 13.93 | 9.98 | 8.24 | 9.49 | 9.00 |

| Asset Turnover | 0.79 | 0.75 | 0.75 | 0.82 | 1.99 |

| Fixed Asset Turnover | 3.88 | 3.76 | 4.04 | 3.90 | 0.00 |

| Dividend Yield | 1.31% | 1.92% | 1.69% | 2.23% | 2.71% |

Evolution of Financial Ratios

From 2021 to 2025, PPG Industries’ Return on Equity (ROE) declined sharply, turning negative at -44.5% in 2025, signaling deteriorating profitability. Meanwhile, the Current Ratio improved steadily from 1.42 to 1.62, reflecting better liquidity. The Debt-to-Equity ratio shifted from positive near 1.19 to a negative -2.1, indicating complex leverage dynamics and possible accounting impacts.

Are the Financial Ratios Fovorable?

In 2025, PPG shows a mixed profile: profitability appears challenged with a negative ROE and neutral net margin near 10%. Liquidity ratios, including current (1.62) and quick (1.22), are favorable, supporting short-term financial health. Leverage metrics are mixed; a highly unfavorable 93.5% debt-to-assets contrasts with a favorable negative debt-to-equity of -2.1. Market valuation ratios and asset turnover remain favorable, with a strong interest coverage of 9.49. Overall, 71% of key ratios are favorable, suggesting cautious optimism.

Shareholder Return Policy

PPG Industries maintains a consistent dividend policy with a payout ratio around 40% in 2025 and a dividend yield near 2.7%. The dividend per share has steadily increased, supported by stable earnings, though free cash flow coverage remains negative, signaling potential pressure on cash resources. The company also pursues share buybacks, complementing dividends in returning capital to shareholders.

While the payout ratio is moderate, negative free cash flow per share raises caution about sustainability. Continuous dividend increases and buybacks suggest management prioritizes shareholder returns, but reliance on cash flow outside net income may limit long-term value if not addressed. This policy balances income distribution with potential funding risks.

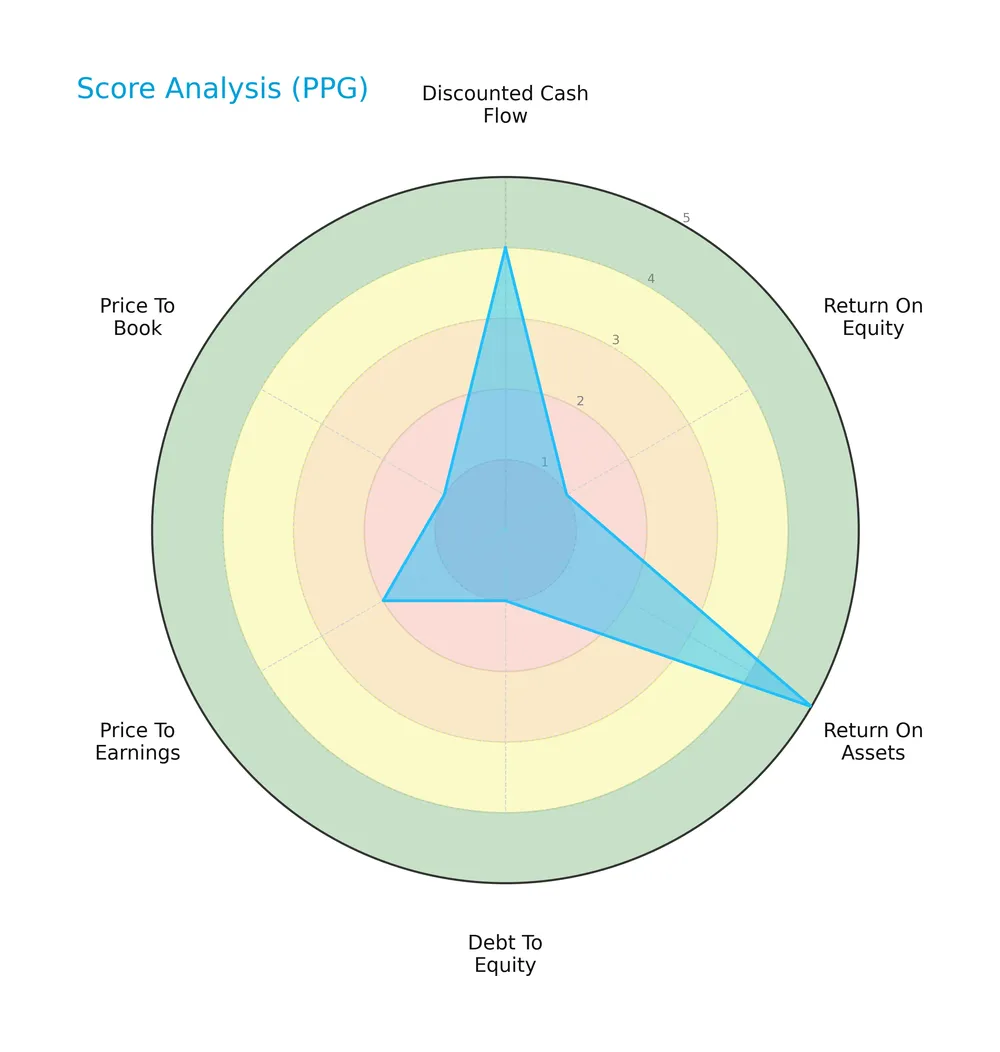

Score analysis

The following radar chart illustrates key financial metrics that shape the company’s valuation and risk profile:

The discounted cash flow score rates favorable at 4, indicating solid intrinsic value. Return on assets shines with a top score of 5, demonstrating efficient asset use. However, return on equity, debt to equity, and price to book scores are very unfavorable at 1, signaling potential profitability and leverage concerns. Price to earnings is moderate at 2, reflecting cautious market valuation.

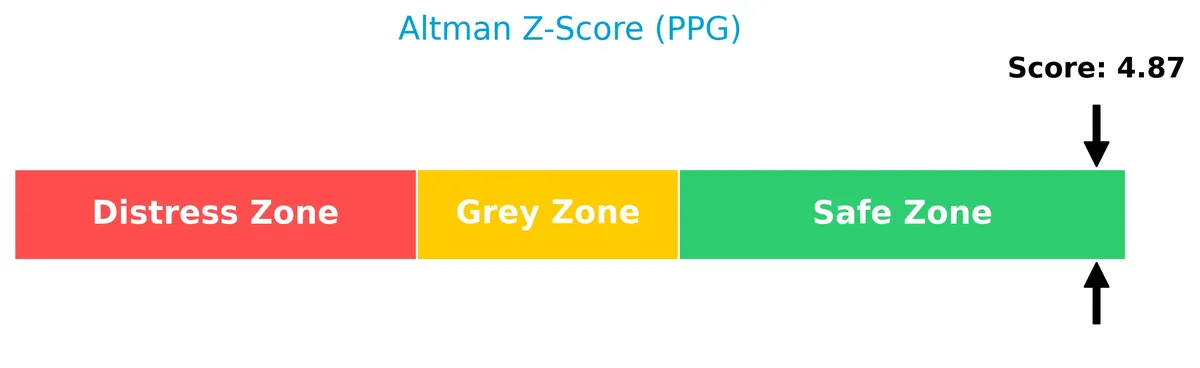

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company comfortably in the safe zone, signaling low bankruptcy risk and strong financial stability:

Is the company in good financial health?

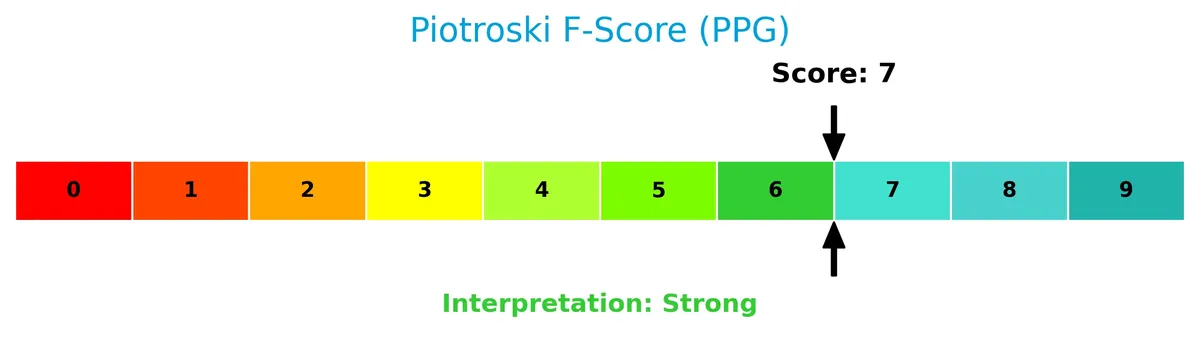

The Piotroski Score diagram highlights the company’s financial strength across profitability, leverage, liquidity, and efficiency criteria:

With a strong score of 7, the company demonstrates robust financial health and operational soundness, positioning it above average among peers in value investing terms.

Competitive Landscape & Sector Positioning

This sector analysis explores PPG Industries’ strategic positioning, revenue segments, and key products. I will assess whether PPG holds competitive advantages over its main rivals.

Strategic Positioning

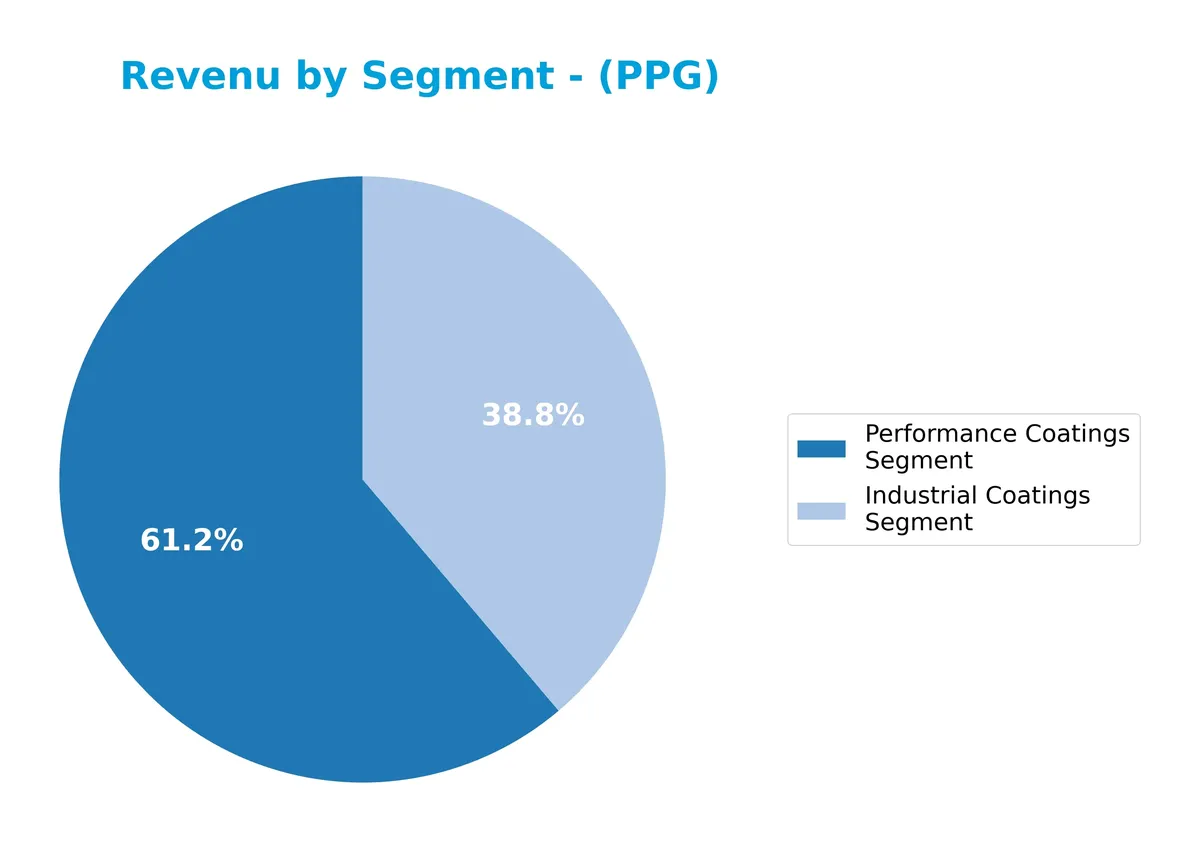

PPG Industries maintains a diversified product portfolio with two main segments: Performance Coatings ($11.2B in 2023) and Industrial Coatings ($7.1B). Geographically, revenue spans North America ($7.5B), EMEA ($5.6B), Asia Pacific ($2.9B), and Latin America ($2.3B), reflecting broad global exposure.

Revenue by Segment

This pie chart breaks down PPG Industries’ revenue by segment for the fiscal year 2023, illustrating the relative size of each business unit.

In 2023, Performance Coatings led revenue with $11.16B, outpacing Industrial Coatings at $7.08B. Both segments showed steady growth over recent years, with Performance Coatings accelerating slightly more. The business remains concentrated in these two segments, reflecting PPG’s focused market strategy without notable diversification shifts. This concentration demands monitoring for cyclical risks tied to industrial and performance coatings markets.

Key Products & Brands

PPG Industries’ key products and brands span two main segments, reflecting its diversified coatings and specialty materials portfolio:

| Product | Description |

|---|---|

| Performance Coatings Segment | Offers coatings, solvents, adhesives, sealants, and software for automotive, transport, industrial, and specialty applications including aircraft and metal protection. |

| Industrial Coatings Segment | Provides coatings, adhesives, sealants, metal pretreatments, and on-site services for appliances, automotive parts, packaging, electronics, and specialty substrates. |

PPG’s portfolio combines high-value specialty coatings with broad industrial applications. This dual focus supports steady revenue growth and underpins its competitive positioning in the specialty chemicals sector.

Main Competitors

There are 9 main competitors in the Chemicals – Specialty industry; the table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200.4B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.4B |

| Air Products and Chemicals, Inc. | 55.8B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

PPG Industries ranks 5th among nine competitors by market capitalization. Its market cap equals 13.93% of the leader, Linde plc. PPG stands below the average market cap of the top 10 ($55.7B) but above the sector median ($23.4B). It maintains a significant 99.7% gap from its closest larger rival, Air Products and Chemicals.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PPG have a competitive advantage?

PPG Industries demonstrates a very favorable competitive advantage with a ROIC exceeding its WACC by over 35%, indicating strong value creation and efficient capital use. The company’s profitability has grown substantially over 2021-2025, reflecting a sustainable competitive moat.

Looking ahead, PPG’s diverse specialty coatings and materials portfolio spans multiple industries and geographies, supporting steady innovation and market penetration. Opportunities in advanced coatings for aerospace, automotive, and industrial applications may enhance its growth prospects.

SWOT Analysis

This analysis highlights PPG Industries’ internal capabilities and external market factors shaping its strategic direction.

Strengths

- strong ROIC at 43% well above WACC

- diversified global footprint across North America, EMEA, Asia Pacific

- favorable net margin growth and healthy cash flow generation

Weaknesses

- high debt-to-assets ratio at 93.55% signals leverage risk

- negative return on equity at -44.48% raises capital efficiency concerns

- declining revenue growth over past years

Opportunities

- growing demand for specialty coatings in emerging markets

- expansion into sustainable and advanced materials

- technology integration in coatings and chemical management

Threats

- raw material price volatility impacting margins

- intense competition in specialty chemicals

- geopolitical risks affecting global supply chains

PPG’s robust competitive advantage and margin expansion provide a solid foundation. However, elevated leverage and weak ROE require cautious capital management. Pursuing innovation and market expansion while mitigating supply risks will be critical.

Stock Price Action Analysis

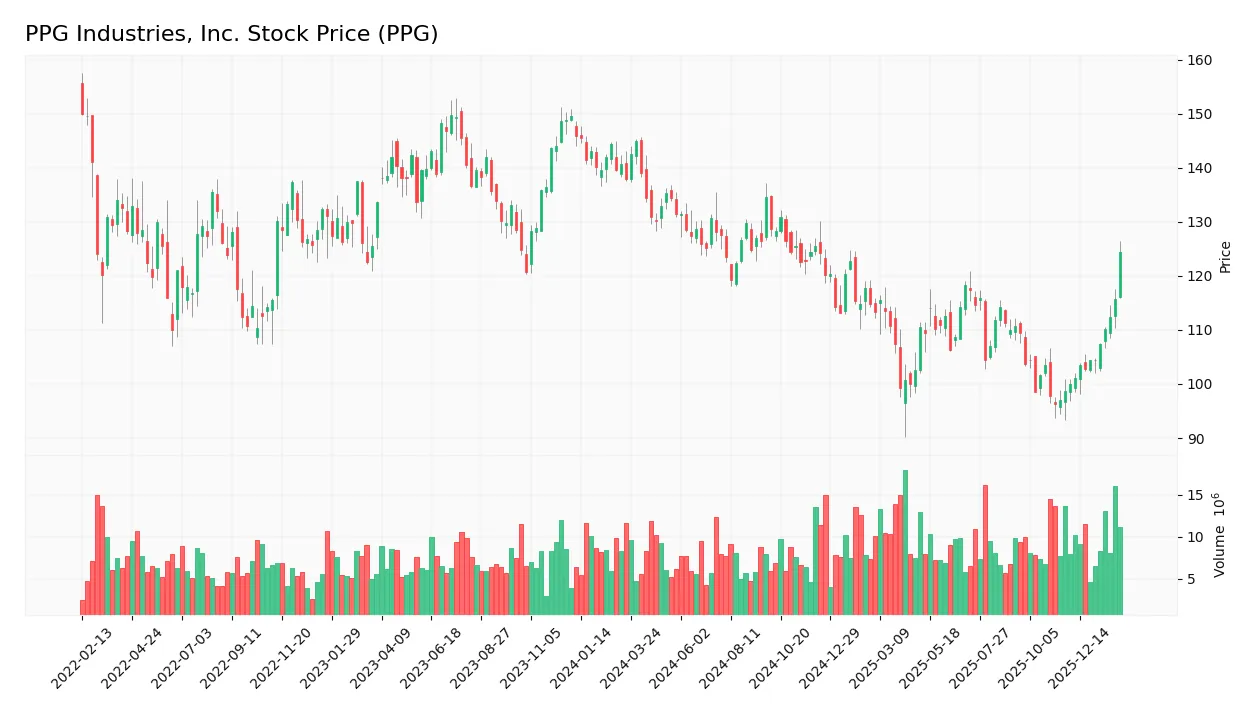

The weekly chart below displays PPG Industries, Inc.’s stock price movements over the past 12 months, reflecting notable volatility and price shifts:

Trend Analysis

Over the past year, PPG’s stock price declined by 9.75%, confirming a bearish trend with accelerating downward momentum. The price ranged between 144.9 at its peak and 96.25 at its low, with a high volatility level of 11.57%. Recent months show a short-term 26.06% rebound, signaling a potential trend shift.

Volume Analysis

Trading volume has increased overall, with buyer volume slightly exceeding sellers at 50.49%. In the recent three-month period, volume is strongly buyer-driven, with buyers accounting for 90.39%. This surge suggests heightened investor interest and market participation favoring accumulation.

Target Prices

Analysts present a moderately bullish consensus for PPG Industries, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 115 | 135 | 126 |

The target range from 115 to 135 reflects analyst confidence in steady growth. The consensus at 126 indicates a positive outlook compared to current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insight into PPG Industries, Inc.’s market perception.

Stock Grades

Here are the latest verified grades from reputable financial institutions for PPG Industries, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| Jefferies | Maintain | Hold | 2026-01-29 |

| UBS | Maintain | Neutral | 2026-01-29 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-29 |

| Mizuho | Maintain | Outperform | 2026-01-28 |

The consensus shows a steady favor toward buying, with no recent downgrades. Most firms maintain positive or neutral stances, reflecting confidence without aggressive upgrades.

Consumer Opinions

Consumers express a mixed but generally favorable view of PPG Industries, highlighting product quality alongside areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “PPG’s coatings deliver exceptional durability and finish.” | “Customer service response times can be slow.” |

| “The variety of products meets diverse industrial needs.” | “Pricing feels high compared to competitors.” |

| “Consistently reliable performance in harsh environments.” | “Some delays in order fulfillment reported.” |

Overall, consumers praise PPG’s product quality and range, key strengths in industrial coatings. However, service delays and pricing concerns recur as notable weaknesses.

Risk Analysis

Below is a summary table highlighting key risks for PPG Industries, Inc. based on financial and operational factors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Leverage Risk | Debt to assets ratio at 93.55% signals very high leverage. | High | High |

| Profitability | Negative return on equity (-44.48%) indicates poor shareholder returns. | Moderate | High |

| Industry Cyclicality | Specialty chemicals sector is sensitive to economic cycles and raw material costs. | Moderate | Moderate |

| Asset Efficiency | Fixed asset turnover at zero suggests potential asset utilization issues. | Low | Moderate |

| Dividend Risk | Dividend yield at 2.71% is stable but could be pressured if earnings weaken. | Low | Low |

The most significant risks for PPG stem from its unusually high leverage and negative ROE, which pose threats during economic downturns. Despite a safe Altman Z-score and strong Piotroski score, I remain cautious given the sector’s cyclicality and asset efficiency concerns.

Should You Buy PPG Industries, Inc.?

PPG Industries appears to be creating strong value with a durable competitive moat supported by growing ROIC well above WACC. While profitability shows mixed signals, its leverage profile is substantial. The overall rating suggests a moderately favorable investment profile.

Strength & Efficiency Pillars

PPG Industries, Inc. displays robust financial health, anchored by a safe Altman Z-Score of 4.87 and a strong Piotroski Score of 7. Profitability metrics are solid, with a net margin near 9.93% and an ROIC of 43.13%, well above its WACC of 7.87%. This confirms PPG as a clear value creator. Its asset turnover of 1.99 and interest coverage of 9.49 further highlight operational efficiency and financial stability. The company’s favorable discounted cash flow and return on assets scores reinforce its efficiency pillars.

Weaknesses and Drawbacks

Despite strengths, PPG faces notable challenges. Its return on equity is deeply negative at -44.48%, signaling potential inefficiencies or capital structure issues. Debt-to-assets ratio stands high at 93.55%, reflecting heavy leverage risk despite a favorable debt-to-equity score. The stock’s bearish overall trend with a 9.75% price decline adds market pressure. Although recent buyer dominance is strong, the overall volume trend and price weakness could signal short-term headwinds. Moderate valuation metrics, including a P/E of 14.71, offer some valuation comfort but warrant caution.

Our Verdict about PPG Industries, Inc.

PPG’s long-term fundamentals appear favorable due to its strong value creation and financial health. However, the bearish price trend and recent mixed leverage signals suggest prudence. Despite the company’s operational strengths, recent market pressure might call for a wait-and-see approach before committing. This profile may appear attractive for investors willing to balance growth potential with leverage risks and market volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- PPG Industries: Buy This Dividend Aristocrat At Below Average Price – Seeking Alpha (Feb 02, 2026)

- Bernstein Raises PPG Industries (PPG) PT to $130, Cites Revenue Beat Despite Q4 Earnings Miss – Yahoo Finance (Feb 04, 2026)

- Earnings call transcript: PPG Industries Q4 2025 misses EPS forecast, stock rises – Investing.com (Feb 03, 2026)

- PPG Industries Inc (PPG) Trading 4.2% Higher on Feb 3 – GuruFocus (Feb 03, 2026)

- PPG introduces PPG STEELGUARD 652 coating for interior structural steel – Chartmill (Feb 02, 2026)

For more information about PPG Industries, Inc., please visit the official website: ppg.com