Home > Analyses > Industrials > Pool Corporation

Pool Corporation transforms the leisure and outdoor living industry by supplying essential products that keep pools and recreational spaces vibrant and functional. As the world’s largest distributor of swimming pool supplies and equipment, Pool Corp commands a leading position with a broad portfolio ranging from maintenance chemicals to advanced pool construction materials. Renowned for its extensive distribution network and innovation, the company shapes how millions enjoy their outdoor environments. Yet, as market dynamics evolve, investors must ask: does Pool Corp’s current valuation reflect its growth potential and operational fundamentals?

Table of contents

Business Model & Company Overview

Pool Corporation, founded in 1993 and headquartered in Covington, Louisiana, stands as a leading distributor in the industrial sector, specializing in swimming pool supplies and leisure products. With a network of 410 sales centers across North America, Europe, and Australia, the company delivers a comprehensive ecosystem of maintenance chemicals, repair parts, pool construction materials, and outdoor living products, supporting builders, remodelers, and commercial clients alike. This extensive portfolio solidifies its market position as an essential partner in the pool and irrigation industries.

The company’s revenue engine is driven by a balanced mix of product categories, including consumables like chemicals and parts, durable goods such as fiberglass pools and hot tubs, and building materials for both new construction and remodeling projects. Pool Corporation leverages its global footprint to serve diverse markets in the Americas, Europe, and Asia, ensuring steady demand across regions. Its competitive advantage lies in the integrated supply chain and broad product offering, creating a resilient economic moat that shapes the future landscape of pool distribution worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Pool Corporation’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and profitability.

Income Statement

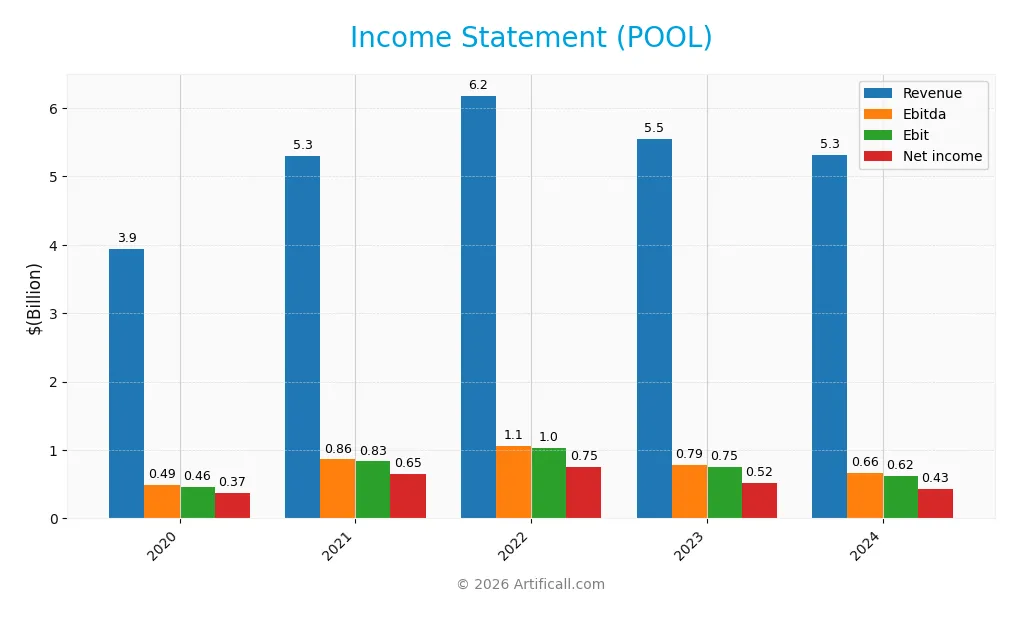

The table below presents Pool Corporation’s key income statement figures for the fiscal years 2020 through 2024, illustrating revenue, expenses, and profitability trends.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.94B | 5.30B | 6.18B | 5.54B | 5.31B |

| Cost of Revenue | 2.81B | 3.68B | 4.25B | 3.88B | 3.74B |

| Operating Expenses | 667M | 787M | 908M | 913M | 958M |

| Gross Profit | 1.13B | 1.62B | 1.93B | 1.66B | 1.58B |

| EBITDA | 493M | 863M | 1.06B | 787M | 663M |

| EBIT | 464M | 833M | 1.03B | 747M | 617M |

| Interest Expense | 12M | 9M | 41M | 58M | 50M |

| Net Income | 367M | 651M | 748M | 523M | 434M |

| EPS | 9.14 | 16.21 | 18.89 | 13.45 | 11.37 |

| Filing Date | 2021-02-25 | 2022-02-25 | 2023-02-24 | 2024-02-27 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, Pool Corporation’s revenue increased by 34.91%, reflecting overall growth despite a 4.16% decline in the last year. Net income also grew by 18.43% over the period but dropped 13.39% in margin last year. Margins remain generally favorable with a 29.66% gross margin and an 8.18% net margin, although recent contraction signals emerging pressure on profitability.

Is the Income Statement Favorable?

The 2024 income statement shows revenue at $5.31B and net income at $434M, with a net margin of 8.18%, which is positive compared to many peers. However, declines in revenue, gross profit, EBIT (down 17.33%), and EPS (down 15.36%) year-over-year temper the outlook. Interest expense remains low at 0.95% of revenue, supporting operating leverage, but the mix of favorable margins and unfavorable growth leads to a neutral overall assessment of fundamentals.

Financial Ratios

The following table presents key financial ratios for Pool Corporation over the last five fiscal years, illustrating profitability, liquidity, leverage, efficiency, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 9.3% | 12.3% | 12.1% | 9.4% | 8.2% |

| ROE | 57.4% | 60.7% | 60.6% | 39.9% | 34.1% |

| ROIC | 28.3% | 25.6% | 26.1% | 20.4% | 17.7% |

| P/E | 40.7 | 34.7 | 15.9 | 29.5 | 29.8 |

| P/B | 23.4 | 21.1 | 9.6 | 11.8 | 10.2 |

| Current Ratio | 2.3 | 2.4 | 3.0 | 2.4 | 2.0 |

| Quick Ratio | 0.71 | 0.58 | 0.63 | 0.58 | 0.52 |

| D/E | 1.0 | 1.3 | 1.3 | 1.0 | 1.0 |

| Debt-to-Assets | 36% | 44% | 47% | 40% | 38% |

| Interest Coverage | 38.0 | 96.4 | 25.1 | 12.8 | 12.3 |

| Asset Turnover | 2.3 | 1.6 | 1.7 | 1.6 | 1.6 |

| Fixed Asset Turnover | 12.5 | 12.6 | 13.3 | 10.5 | 9.4 |

| Dividend Yield | 0.62% | 0.53% | 1.26% | 1.09% | 1.39% |

All figures are scaled for clarity: ratios are rounded and percentages converted accordingly.

Evolution of Financial Ratios

Over recent years, Pool Corporation’s Return on Equity (ROE) has trended downward from 60.79% in 2022 to 34.11% in 2024, indicating a moderation in profitability. The Current Ratio declined from 2.99 to 2.05, suggesting reduced but still strong liquidity. The Debt-to-Equity Ratio fell from 1.34 in 2022 to a neutral 1.0 in 2024, reflecting more balanced leverage. Profit margins showed a slight decrease, signaling stable yet moderated profitability.

Are the Financial Ratios Favorable?

In 2024, Pool Corporation’s profitability ratios like ROE (34.11%) and Return on Invested Capital (17.69%) are favorable, while Net Margin (8.18%) remains neutral. Liquidity is mixed: Current Ratio (2.05) is favorable, but Quick Ratio (0.52) is unfavorable. Leverage ratios are neutral, with Debt-to-Equity at 1.0 and Debt-to-Assets at 37.76%. Efficiency metrics such as Asset Turnover (1.58) and Interest Coverage (12.28) are favorable. Market valuation ratios Price-to-Earnings (29.84) and Price-to-Book (10.18) are unfavorable, resulting in an overall slightly favorable assessment.

Shareholder Return Policy

Pool Corporation maintains a consistent dividend payout ratio around 20-41%, with dividend per share rising from $2.29 in 2020 to $4.73 in 2024, yielding approximately 1.4% annually. The dividend payments are well covered by free cash flow, and the company also engages in share buybacks, supporting shareholder returns.

This balanced approach of growing dividends alongside buybacks appears sustainable given the solid free cash flow coverage and moderate payout ratios. Such a policy suggests prudent capital allocation aimed at maintaining long-term shareholder value without excessive distribution risks.

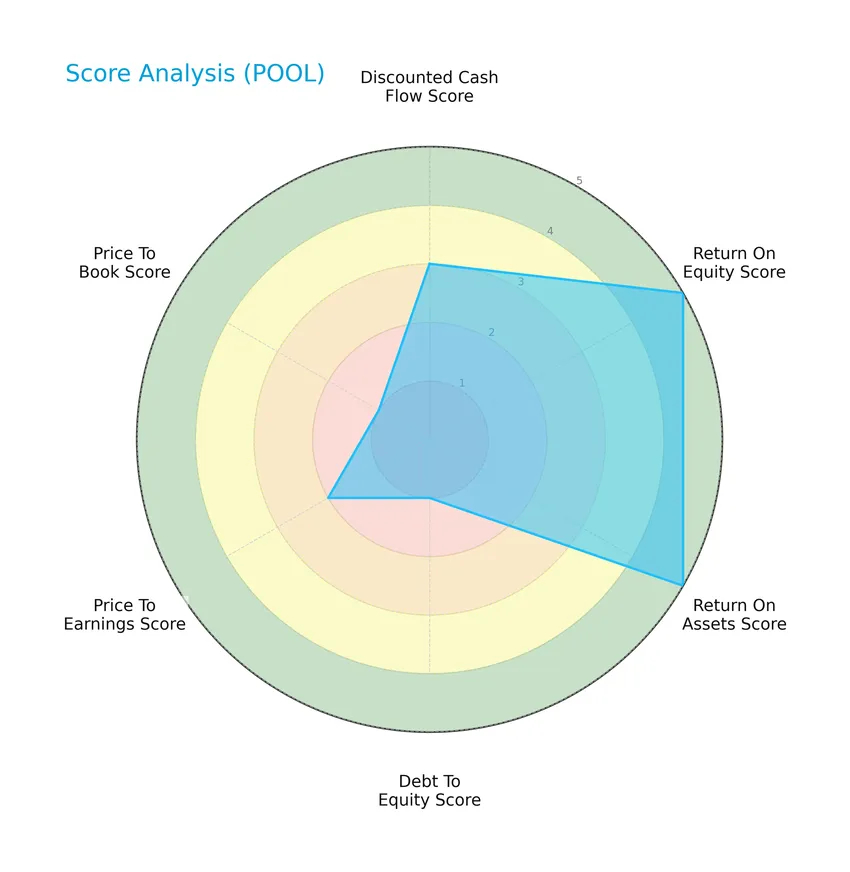

Score analysis

The following radar chart presents an overview of Pool Corporation’s key financial scores for investor consideration:

Pool Corporation shows very favorable returns on equity and assets with scores of 5 each, indicating efficient profitability. However, debt-to-equity and price-to-book scores are very unfavorable at 1, reflecting higher leverage and valuation concerns. Discounted cash flow and price-to-earnings scores are moderate, suggesting balanced valuation metrics.

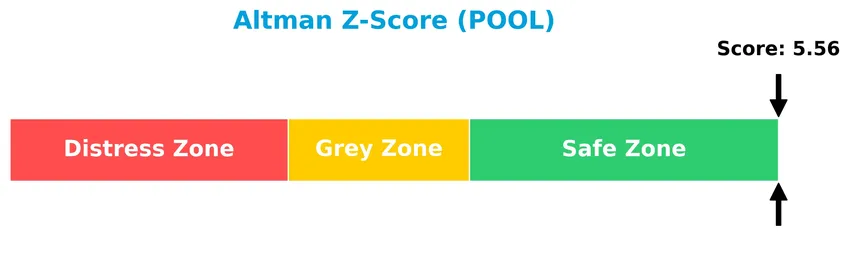

Analysis of the company’s bankruptcy risk

Pool Corporation’s Altman Z-Score places it securely in the safe zone, indicating a very low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

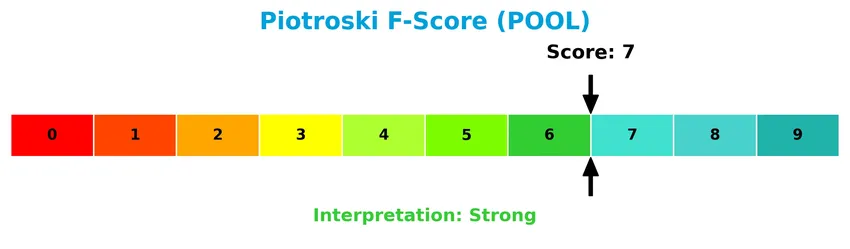

The Piotroski F-Score diagram highlights Pool Corporation’s financial strength based on nine key criteria:

With a Piotroski score of 7, Pool Corporation demonstrates strong financial health, reflecting solid profitability, efficiency, and moderate leverage management. This score suggests the company is financially robust though not at the highest strength tier.

Competitive Landscape & Sector Positioning

This sector analysis will examine Pool Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Pool Corporation holds a competitive advantage over its industry peers.

Strategic Positioning

Pool Corporation maintains a concentrated product portfolio focused on swimming pool supplies, equipment, and related leisure products, generating $5.31B in revenue for FY 2024. Geographically, the company is heavily concentrated in the United States, with $4.94B in sales, and a smaller international presence of $374M across North America, Europe, and Australia.

Revenue by Segment

The pie chart illustrates Pool Corporation’s revenue distribution by segment for the full fiscal year 2024.

In 2024, Pool Corporation reported total segment revenue of 5.31B USD. The data aggregates into a single identified reportable segment, indicating a concentrated revenue stream without further breakdown. This suggests the company’s business is currently dominated by one main revenue source, with no visible diversification or notable shifts within segments for the year. Investors should monitor future disclosures for emerging segment detail or diversification.

Key Products & Brands

The following table presents Pool Corporation’s main products and brands with their descriptions:

| Product | Description |

|---|---|

| Maintenance Products | Chemicals, supplies, and accessories essential for swimming pool upkeep. |

| Repair & Replacement Parts | Equipment components like cleaners, filters, heaters, pumps, and lights for pool maintenance and repair. |

| Fiberglass Pools & Hot Tubs | Prefabricated pools and hot tubs, along with packaged pool kits for in-ground and above-ground installations. |

| Pool Equipment & Components | Materials used in new pool construction and remodeling, including walls, liners, braces, and coping. |

| Irrigation & Lawn Care | Irrigation system components and professional lawn care equipment and supplies. |

| Building Materials | Concrete, plumbing, electrical components, pool surfaces, decking, tiles, hardscapes, and natural stones for pool construction and remodeling. |

| Commercial Products | Heaters, safety equipment, commercial pumps, and filters for larger facilities such as hotels and universities. |

| Outdoor Living Products | Recreational and discretionary outdoor living items, including grills and outdoor kitchen components. |

Pool Corporation offers a comprehensive range of products serving pool builders, remodelers, specialty retailers, and commercial customers, with a strong focus on pool maintenance, construction, and outdoor living solutions.

Main Competitors

There are 3 competitors in the Industrials – Industrial Distribution sector; the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| W.W. Grainger, Inc. | 47.7B |

| Fastenal Company | 46.4B |

| Pool Corporation | 8.6B |

Pool Corporation ranks 3rd among its competitors with a market cap about 20.7% of the sector leader, W.W. Grainger, Inc. It is positioned below both the average market cap of the top 10 (34.2B) and the median market cap in the sector (46.4B). Notably, Pool Corporation has a substantial gap of +369.34% to the next competitor above it, highlighting a significant scale difference.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does POOL have a competitive advantage?

Pool Corporation presents a competitive advantage as it creates value with an ROIC exceeding WACC by 8.8%, indicating efficient use of invested capital despite a declining profitability trend. The company benefits from a broad product range and a strong distribution network with 410 sales centers across North America, Europe, and Australia.

Looking ahead, Pool Corporation’s future outlook includes expansion opportunities in international markets and potential growth through new leisure and outdoor living products. Continued innovation in pool equipment, remodeling materials, and commercial offerings could support its position in the industrial distribution sector.

SWOT Analysis

This SWOT analysis highlights Pool Corporation’s internal capabilities and external environment to guide investment decisions.

Strengths

- Strong market position in pool supplies distribution

- Robust ROE of 34.11% indicating efficient equity use

- Wide geographic footprint with 410 sales centers

Weaknesses

- Recent 4.16% revenue decline signals short-term challenges

- High price-to-book ratio of 10.18 suggests overvaluation

- Declining ROIC trend warns of weakening profitability

Opportunities

- Expansion in international markets beyond US and Europe

- Growing demand for outdoor recreational products

- Innovation in eco-friendly pool maintenance solutions

Threats

- Competitive pressure in industrial distribution sector

- Economic downturns affecting discretionary spending

- Rising raw material and logistics costs impacting margins

Overall, Pool Corporation maintains solid strengths and growth potential but faces near-term revenue pressures and valuation concerns. Strategic focus should be on leveraging its market position and innovation to counteract profitability decline and external risks.

Stock Price Action Analysis

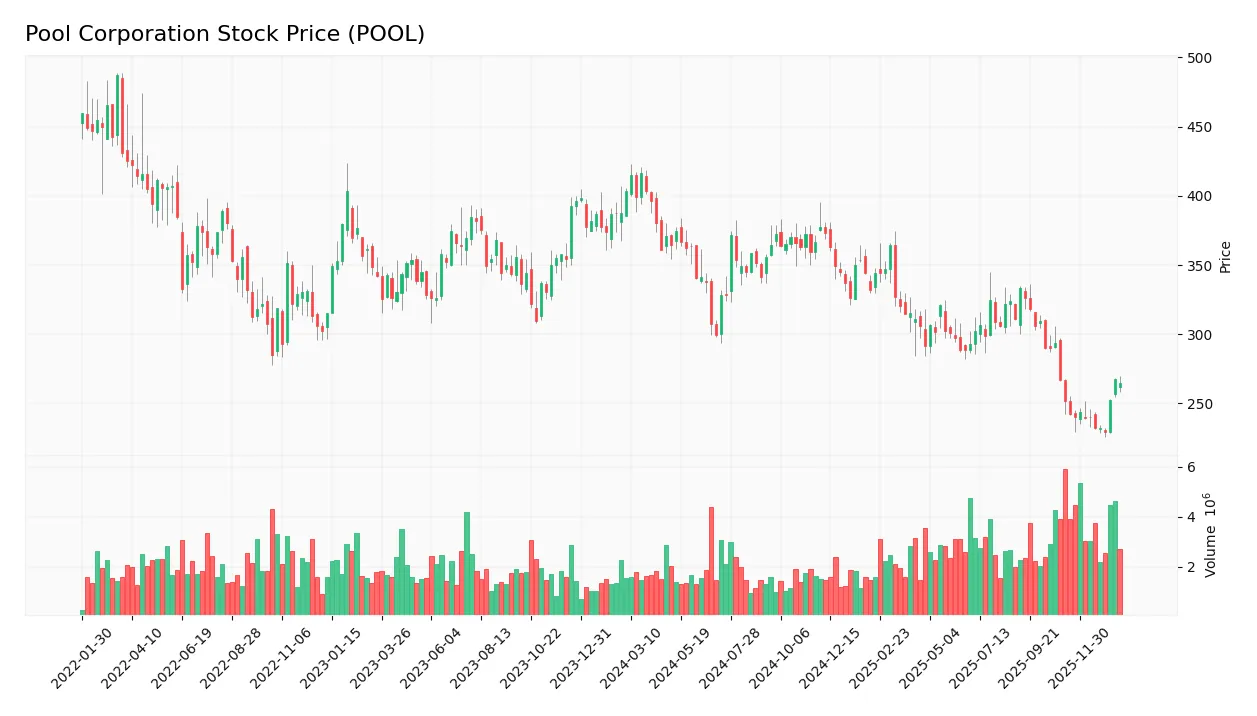

The following weekly chart illustrates Pool Corporation’s stock price movements over the past 12 months, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, Pool Corporation’s stock price declined by 34.31%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 416.38 and a low of 229.71, with a high volatility reflected by a 43.5 standard deviation.

Volume Analysis

Trading volume has been increasing over the last three months, with seller volume exceeding buyer volume at 26.3M versus 19.6M. Buyer activity represents 42.7%, indicating a slightly seller-dominant environment, which suggests cautious investor sentiment and moderate market participation.

Target Prices

The consensus target prices for Pool Corporation indicate a generally positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 320 | 250 | 296 |

Analysts expect Pool Corporation’s stock to trade between $250 and $320, with a consensus target price near $296, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide insight into Pool Corporation’s market perception.

Stock Grades

Here is the latest overview of Pool Corporation’s stock ratings from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2026-01-13 |

| Baird | Upgrade | Outperform | 2026-01-12 |

| CFRA | Upgrade | Buy | 2025-12-23 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| William Blair | Downgrade | Market Perform | 2025-10-15 |

| Oppenheimer | Maintain | Outperform | 2025-07-29 |

| Baird | Maintain | Neutral | 2025-07-25 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-08 |

| Stephens & Co. | Maintain | Overweight | 2025-04-28 |

The bulk of recent ratings indicate a positive outlook with several upgrades to Buy or Outperform, though some firms maintain neutral or equal weight stances. Overall, the consensus leans toward a Buy rating, reflecting moderate analyst confidence.

Consumer Opinions

Consumers of Pool Corporation (POOL) generally express mixed sentiments, reflecting both satisfaction with product variety and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| Wide selection of pool supplies and equipment | Some products are priced higher than competitors |

| Helpful and knowledgeable customer service | Delivery times can be inconsistent |

| Reliable product quality | Limited availability in certain regions |

Overall, customers appreciate Pool Corporation’s comprehensive product range and expert support but often note pricing and occasional delivery delays as areas needing improvement.

Risk Analysis

Below is a summary table outlining key risks associated with Pool Corporation (POOL), highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (29.84) and P/B (10.18) ratios suggest potential overvaluation risks. | Moderate | High |

| Leverage | Debt-to-equity ratio of 1.0 and unfavorable debt score indicate moderate financial leverage risk. | Moderate | Moderate |

| Liquidity | Low quick ratio (0.52) despite a favorable current ratio (2.05) points to some liquidity concerns. | Moderate | Moderate |

| Economic Cyclicality | Exposure to discretionary leisure products may cause sensitivity to economic downturns. | Moderate | High |

| Competitive Pressure | Intense competition in pool supplies and equipment distribution could affect market share. | Moderate | Moderate |

| Supply Chain Risks | Global operations across North America, Europe, and Australia expose POOL to supply chain disruptions. | Low to Moderate | Moderate |

The most likely risks for Pool Corporation are valuation pressures and economic cyclicality, given its high valuation multiples and reliance on discretionary consumer spending. Despite strong financial health indicated by an Altman Z-Score in the safe zone (5.56) and a strong Piotroski score (7), investors should monitor leverage and liquidity metrics closely, as well as market conditions affecting consumer demand.

Should You Buy Pool Corporation?

Pool Corporation appears to be generating robust value creation with a slightly favorable competitive moat despite a declining ROIC trend. Its leverage profile could be seen as substantial, and the overall rating suggests a very favorable but cautious investment profile for prudent investors.

Strength & Efficiency Pillars

Pool Corporation exhibits strong profitability and financial health, underscored by a return on equity of 34.11% and a return on invested capital (ROIC) of 17.69%. Importantly, its ROIC exceeds the weighted average cost of capital (WACC) of 8.88%, confirming the company as a clear value creator. The Altman Z-score of 5.56 places Pool comfortably in the safe zone, indicating low bankruptcy risk, while a Piotroski score of 7 signals strong financial strength. These metrics collectively highlight operational efficiency and robust value generation.

Weaknesses and Drawbacks

Despite solid fundamentals, Pool faces valuation and leverage concerns that could pressure its stock performance. The price-to-earnings ratio stands at 29.84 and price-to-book at 10.18, both reflecting high premium valuations that may limit upside potential. Additionally, the quick ratio is weak at 0.52, flagging liquidity risks despite a favorable current ratio of 2.05. Seller dominance is slightly evident with a buyer volume percentage of 42.74% in the recent period, contributing to short-term market headwinds amid a broader bearish trend with a 34.31% price decline.

Our Verdict about Pool Corporation

Pool Corporation’s long-term fundamental profile appears favorable, supported by strong profitability and a solid financial footing. However, the recent slightly seller-dominant market behavior and elevated valuation metrics suggest a cautious stance. Despite the company’s value creation and operational strength, recent market pressures might imply a wait-and-see approach could be prudent for investors seeking better entry points.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Makes New Investment in Pool Corporation $POOL – MarketBeat (Jan 24, 2026)

- Earnings Preview: What to Expect From Pool Corporation’s Report – Barchart.com (Jan 19, 2026)

- Pool Corporation Announces the Retirement of Kenneth G. St. Romain and the Appointment of John B. Watwood – Yahoo Finance (Jan 12, 2026)

- Latham Dives in as an Official Sponsor of USA Artistic Swimming – Pool Magazine (Jan 20, 2026)

- Pool Corporation announces leadership changes as St. Romain to retire – Investing.com (Jan 12, 2026)

For more information about Pool Corporation, please visit the official website: poolcorp.com