Home > Analyses > Utilities > Pinnacle West Capital Corporation

Pinnacle West Capital Corporation powers the lives of over a million customers in Arizona, delivering reliable electricity through a diverse mix of coal, nuclear, gas, oil, and solar energy. As a dominant player in the regulated electric utility sector, Pinnacle West combines extensive infrastructure with a commitment to innovation and sustainability. As we analyze its current valuation and growth outlook, the key question remains: does Pinnacle West’s strong market position and evolving energy portfolio justify its investment potential today?

Table of contents

Business Model & Company Overview

Pinnacle West Capital Corporation, founded in 1985 and headquartered in Phoenix, Arizona, stands as a dominant player in the regulated electric industry. Through its subsidiary, Arizona Public Service Company, it delivers a comprehensive electric ecosystem encompassing generation, transmission, and distribution. Serving approximately 1.3M customers, the company integrates coal, nuclear, gas, oil, and solar assets, supporting a robust energy infrastructure with thousands of miles of overhead and underground lines.

The company’s revenue engine balances regulated generation capacity of about 6,323 MW with extensive transmission and distribution networks, creating steady cash flow from retail and wholesale electric services primarily in Arizona. While its core market is regional, Pinnacle West’s strategic infrastructure investment and diversified energy mix establish a strong economic moat, positioning it as a key shaper of the future electric utility landscape.

Financial Performance & Fundamental Metrics

This section provides a concise analysis of Pinnacle West Capital Corporation’s income statement, key financial ratios, and dividend payout policy to guide investment decisions.

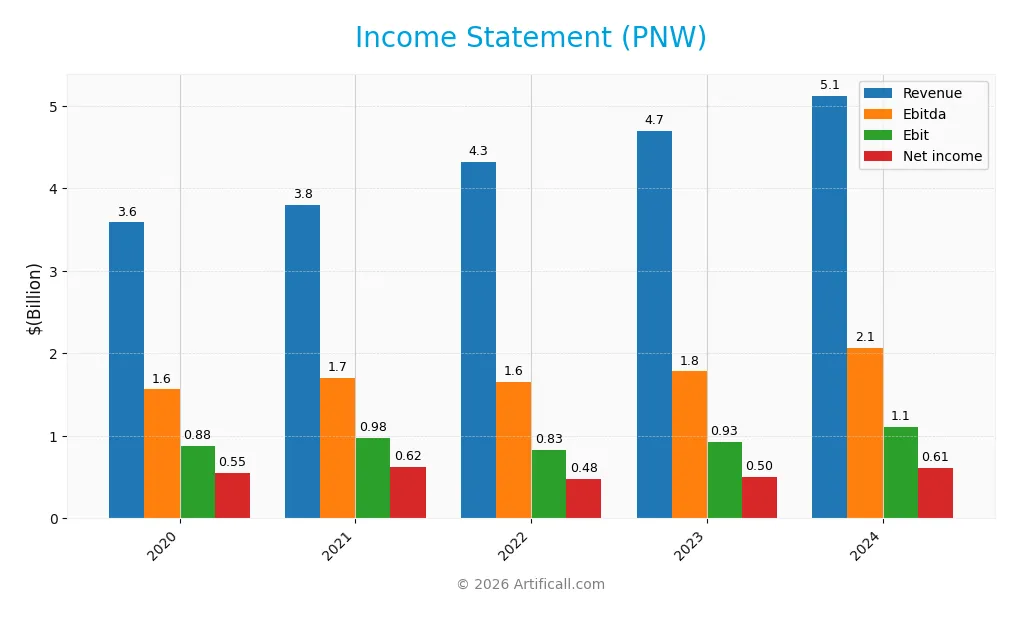

Income Statement

The table below presents Pinnacle West Capital Corporation’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.59B | 3.80B | 4.32B | 4.70B | 5.12B |

| Cost of Revenue | 1.95B | 2.11B | 2.62B | 2.85B | 2.99B |

| Operating Expenses | 847M | 892M | 976M | 1.02B | 1.13B |

| Gross Profit | 1.63B | 1.70B | 1.71B | 1.84B | 2.14B |

| EBITDA | 1.56B | 1.70B | 1.65B | 1.78B | 2.07B |

| EBIT | 877M | 979M | 831M | 927M | 1.11B |

| Interest Expense | 229M | 233M | 256M | 331M | 377M |

| Net Income | 551M | 619M | 484M | 502M | 609M |

| EPS | 4.89 | 5.48 | 4.27 | 4.42 | 5.35 |

| Filing Date | 2021-02-24 | 2022-02-25 | 2023-02-27 | 2024-02-27 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Pinnacle West Capital Corporation’s revenue increased by 42.9% to $5.12B, with net income rising 10.6% to $609M. Despite the solid revenue growth, net margin declined by 22.6% overall, although it improved by 11.2% in the last year, reaching 11.9%. Gross and EBIT margins remained favorable at 41.7% and 21.7%, respectively, indicating steady profitability.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals. Revenue grew 9.1% year-over-year, supported by a 15.9% gross profit increase and a 20.2% EBIT growth. Net margin at 11.9% and EPS growth of 18.8% also signal operational strength. However, operating expenses grew at the same rate as revenue, which is an unfavorable aspect. Overall, nearly 79% of key income statement metrics are positive, supporting a favorable evaluation.

Financial Ratios

The table below summarizes key financial ratios of Pinnacle West Capital Corporation (PNW) for the fiscal years 2020 through 2024, providing a clear view of the company’s profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 16% | 11% | 11% | 12% |

| ROE | 9.8% | 10.5% | 8.0% | 8.1% | 9.0% |

| ROIC | 3.7% | 3.3% | 3.0% | 3.1% | 3.5% |

| P/E | 16.4 | 12.9 | 17.8 | 16.2 | 15.9 |

| P/B | 1.60 | 1.35 | 1.42 | 1.32 | 1.43 |

| Current Ratio | 0.88 | 0.88 | 0.99 | 0.67 | 0.59 |

| Quick Ratio | 0.64 | 0.67 | 0.74 | 0.50 | 0.42 |

| D/E | 1.23 | 1.39 | 1.47 | 1.67 | 1.64 |

| Debt-to-Assets | 35% | 37% | 39% | 42% | 42% |

| Interest Coverage | 3.4x | 3.5x | 2.9x | 2.5x | 2.7x |

| Asset Turnover | 0.18 | 0.17 | 0.19 | 0.19 | 0.20 |

| Fixed Asset Turnover | 0.23 | 0.23 | 0.25 | 0.25 | 0.25 |

| Dividend Yield | 3.9% | 4.6% | 4.4% | 4.7% | 4.1% |

Evolution of Financial Ratios

From 2020 to 2024, Pinnacle West Capital Corporation’s Return on Equity (ROE) displayed a downward trend, declining from 9.77% in 2020 to 9.01% in 2024, indicating reduced profitability. The Current Ratio steadily decreased, falling from 0.88 in 2020 to 0.59 in 2024, reflecting worsening short-term liquidity. The Debt-to-Equity Ratio increased from 1.23 in 2020 to 1.64 in 2024, signaling a rise in financial leverage over the period.

Are the Financial Ratios Fovorable?

In 2024, profitability metrics show mixed signals: net profit margin at 11.88% is favorable, yet ROE at 9.01% and return on invested capital (ROIC) at 3.48% are unfavorable. Liquidity ratios are weak, with a current ratio of 0.59 and quick ratio at 0.42, both unfavorable. Leverage remains high with a debt-to-equity ratio of 1.64, also unfavorable. Market valuation ratios are mostly neutral or favorable, including a price-to-book ratio of 1.43 and dividend yield of 4.09%, but overall the financial ratios suggest a slightly unfavorable profile for 2024.

Shareholder Return Policy

Pinnacle West Capital Corporation (PNW) maintains a consistent dividend policy with a payout ratio around 65%, paying approximately $3.47 per share in 2024 and yielding about 4.1% annually. Despite negative free cash flow, dividends and share buybacks are supported by operating cash flow, though coverage ratios suggest some financial strain.

The company’s commitment to dividends alongside share repurchases is balanced but poses risk if cash flow issues persist. This distribution approach appears cautiously managed, aiming to sustain long-term shareholder value, yet requires monitoring of cash flow adequacy to avoid unsustainable payouts or excessive leverage.

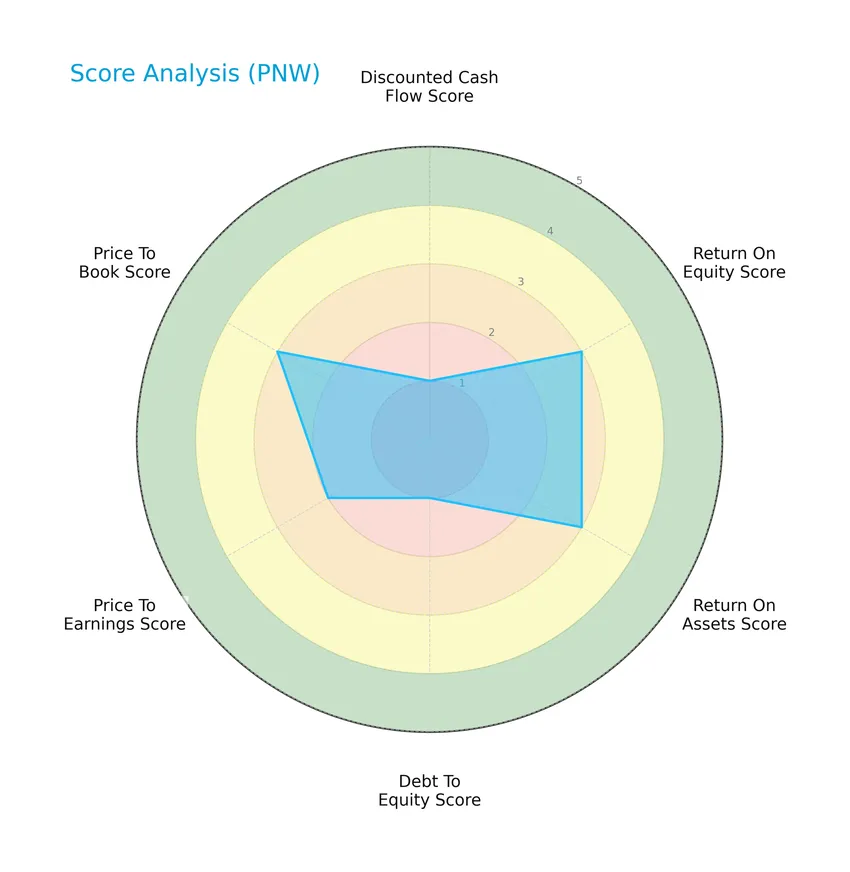

Score analysis

The following radar chart displays Pinnacle West Capital Corporation’s key financial scores for a comprehensive overview:

The company’s discounted cash flow and debt-to-equity scores are very unfavorable at 1, while return on equity and return on assets hold moderate scores of 3. Price-to-earnings and price-to-book ratios also show moderate scores, reflecting a balanced but cautious financial profile.

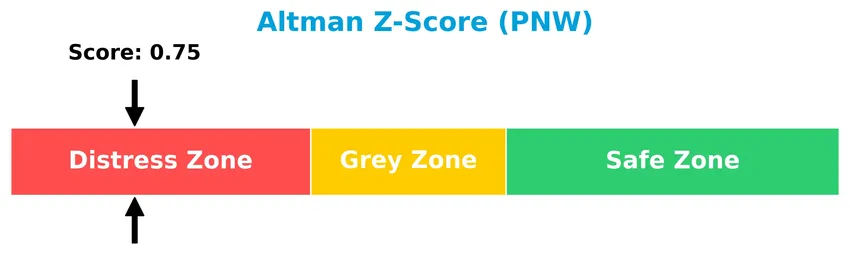

Analysis of the company’s bankruptcy risk

Pinnacle West Capital Corporation’s Altman Z-Score of 0.75 places it in the distress zone, indicating a high probability of financial distress and potential bankruptcy risk:

Is the company in good financial health?

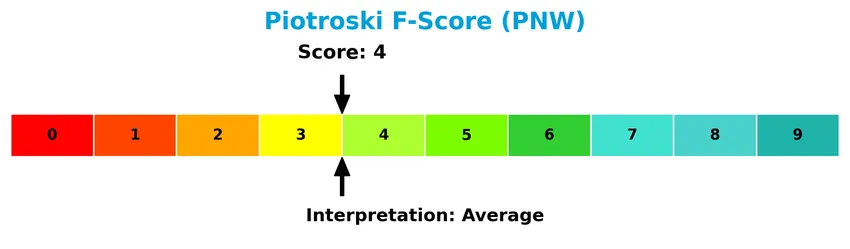

The Piotroski Score diagram provides insight into Pinnacle West Capital Corporation’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 4, the company is considered to have average financial health, suggesting moderate performance in profitability, leverage, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This section provides an overview of Pinnacle West Capital Corporation’s strategic position within the regulated electric utilities sector. It covers the company’s revenue streams, key products, main competitors, and competitive advantages. I will assess whether Pinnacle West Capital holds a competitive advantage relative to its peers in this industry.

Strategic Positioning

Pinnacle West Capital Corporation focuses predominantly on regulated electric services, generating over $2.5B in electric service revenue in 2024, primarily within Arizona through its subsidiary. The company maintains a concentrated geographic and product portfolio centered on electricity generation, transmission, and distribution.

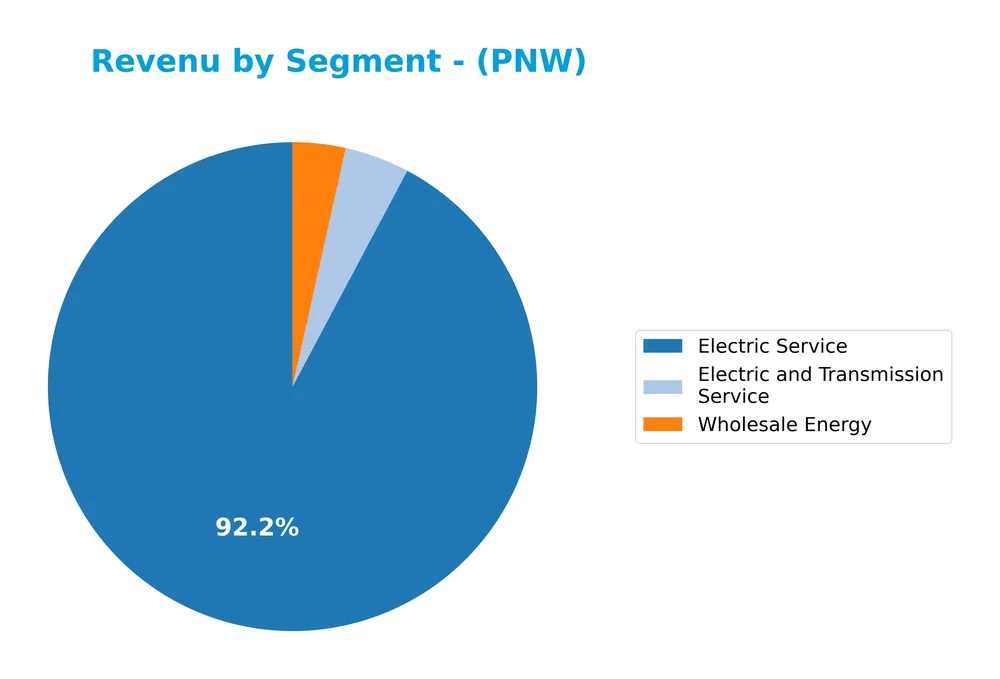

Revenue by Segment

This pie chart illustrates Pinnacle West Capital Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s key business areas and their contribution to total revenue.

In 2024, Electric Service remains the dominant revenue driver at 2.56B, showing steady growth from 1.92B in 2020. Electric and Transmission Service generated 120M, a slight decrease compared to 139M in 2023. Wholesale Energy revenue declined significantly to 97M from 209M in 2023, indicating a slowdown in this segment. Overall, the business shows concentration risk in Electric Service, with slower growth or volatility in smaller segments.

Key Products & Brands

The table below outlines Pinnacle West Capital Corporation’s main products and services with brief descriptions:

| Product | Description |

|---|---|

| Electric Service | Retail electric service primarily in Arizona, involving generation, transmission, and distribution. |

| Electric and Transmission Service | Transmission and related electric services, including overhead and underground lines and substations. |

| Wholesale Energy | Sale of energy to wholesale customers, complementing retail electric operations. |

Pinnacle West Capital Corporation focuses on regulated electric services with core offerings in retail electricity, transmission infrastructure, and wholesale energy sales, serving approximately 1.3 million customers mainly in Arizona.

Main Competitors

There are 23 competitors in the regulated electric utilities sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Pinnacle West Capital Corporation ranks 23rd among 23 competitors with a market cap at 6.54% of the sector leader, NextEra Energy. The company is below both the average market cap of the top 10 competitors (67.5B) and the sector median (34B). Its market cap is 1.64% lower than the next closest competitor above, highlighting a modest gap in scale relative to its peers.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PNW have a competitive advantage?

Pinnacle West Capital Corporation does not currently present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over the 2020-2024 period is negative, reinforcing a very unfavorable economic moat status.

Looking ahead, Pinnacle West Capital Corporation operates a diverse generation portfolio and extensive transmission infrastructure serving 1.3M customers in Arizona, which may offer opportunities to leverage regulated assets. However, its future outlook regarding new products or market expansion was not explicitly provided in the data.

SWOT Analysis

This SWOT analysis highlights Pinnacle West Capital Corporation’s key internal and external factors to aid investment decision-making.

Strengths

- Stable regulated electric utility with 1.3M customers

- Favorable revenue and profit growth trends

- Attractive dividend yield of 4.09%

Weaknesses

- Declining ROIC and value destruction

- High debt-to-equity ratio (1.64)

- Low liquidity ratios (current 0.59, quick 0.42)

Opportunities

- Expansion in renewable energy sources

- Regulatory support for clean energy transition

- Growing demand for reliable power in Arizona

Threats

- Regulatory and environmental compliance risks

- Competition from alternative energy providers

- Economic downturn impacting customer consumption

Overall, Pinnacle West shows solid revenue growth and dividend appeal but faces challenges with profitability trends and financial leverage. The company’s strategy should focus on improving operational efficiency and capital structure while leveraging growth in renewables to mitigate regulatory and market risks.

Stock Price Action Analysis

The following weekly stock chart illustrates Pinnacle West Capital Corporation’s price movements over the past 100 weeks:

Trend Analysis

Over the past 12 months, Pinnacle West Capital Corporation’s stock price increased by 35.44%, indicating a bullish trend with acceleration. The price ranged from a low of 68.05 to a high of 94.45, supported by a volatility measure of 6.5 standard deviation, confirming strong upward momentum.

Volume Analysis

In the last three months, trading volume has been increasing with a total of 66M shares exchanged. Buyer volume slightly lags seller volume at 49.14%, indicating neutral buyer behavior. This balanced activity suggests cautious investor sentiment and moderate market participation.

Target Prices

Analysts present a target consensus that reflects moderate upside potential for Pinnacle West Capital Corporation.

| Target High | Target Low | Consensus |

|---|---|---|

| 115 | 85 | 96.11 |

The target prices indicate that experts expect the stock to trade between 85 and 115, with an average consensus near 96, suggesting cautious optimism in the market.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest grades and consumer feedback related to Pinnacle West Capital Corporation (PNW).

Stock Grades

Here is the latest summary of Pinnacle West Capital Corporation’s stock grades from leading financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Keybanc | Downgrade | Sector Weight | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-10-15 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Barclays | Maintain | Equal Weight | 2025-10-07 |

| Argus Research | Maintain | Buy | 2025-09-30 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

| UBS | Maintain | Neutral | 2025-09-12 |

The majority of recent grades for Pinnacle West Capital Corporation reflect a Hold or Equal Weight consensus, with limited variation and only one downgrade noted. This suggests a broadly neutral outlook from major analysts.

Consumer Opinions

Consumers express a mix of appreciation and concerns regarding Pinnacle West Capital Corporation, reflecting diverse experiences with the company’s services and operations.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages. | Customer service response times can be slow. |

| Transparent billing and reasonable rates. | Occasional issues with billing accuracy reported. |

| Strong commitment to renewable energy initiatives. | Some customers find communication about outages lacking. |

Overall, Pinnacle West Capital Corporation is praised for dependable energy delivery and progressive green energy efforts, though customers advise improvements in customer service responsiveness and billing clarity.

Risk Analysis

The following table summarizes key risks affecting Pinnacle West Capital Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (0.75) indicates high bankruptcy risk; weak liquidity ratios (Current ratio 0.59) | High | High |

| Debt Management | High debt-to-equity ratio (1.64) and moderate interest coverage (2.95) increase financial leverage risks | Medium | Medium |

| Market Volatility | Low beta (0.54) reduces stock volatility but limits growth potential in bull markets | Low | Low |

| Operational | Exposure to regulatory changes in the electric utility sector in Arizona | Medium | Medium |

| Profitability | Unfavorable ROE (9.01%) and ROIC (3.48%) suggest limited efficiency in generating returns | Medium | Medium |

Pinnacle West faces significant financial risks, particularly from its distressed Altman Z-Score and poor liquidity, signaling a heightened chance of financial distress. Debt levels and regulatory environment add moderate risks, while the stable beta limits volatility but may cap upside potential. Caution and close monitoring are advised.

Should You Buy Pinnacle West Capital Corporation?

Pinnacle West Capital Corporation appears to be facing challenges with a deteriorating competitive moat and substantial leverage profile, reflected in declining value creation and financial distress signals. While profitability shows modest operational efficiency, the overall rating suggests a cautious, moderate profile.

Strength & Efficiency Pillars

Pinnacle West Capital Corporation exhibits solid profitability metrics, with a net margin of 11.88% and an EBIT margin of 21.74%, reflecting efficient cost management and earnings generation. The company maintains a gross margin of 41.7%, supporting its core operations effectively. While the return on equity (ROE) of 9.01% and return on invested capital (ROIC) of 3.48% are moderate, the weighted average cost of capital (WACC) at 4.78% exceeds ROIC, indicating the company is currently shedding value. Financial health is challenged, with an Altman Z-score of 0.75 placing it in the distress zone, and a Piotroski score of 4 signaling average business strength.

Weaknesses and Drawbacks

Pinnacle West faces several headwinds, including a high debt-to-equity ratio of 1.64, which raises concerns about leverage and financial risk. Liquidity is constrained, with a current ratio of 0.59 and a quick ratio of 0.42, both unfavorable and signaling potential difficulties in meeting short-term obligations. Valuation metrics are moderate, with a price-to-earnings (P/E) ratio of 15.85 and price-to-book (P/B) ratio of 1.43, neither indicating strong undervaluation. Market pressure has increased recently, as seller dominance edged buyers out with 50.86% share during the recent period, suggesting some short-term caution.

Our Verdict about Pinnacle West Capital Corporation

The long-term fundamental profile of Pinnacle West Capital may appear unfavorable due to value destruction and financial distress signals. Despite a bullish overall stock trend with a 35.44% price gain and volume increasing in favor of buyers, recent market behavior shows neutral buyer dominance and slight seller pressure. This juxtaposition suggests that while the company has underlying strengths, recent market dynamics may advise a wait-and-see approach before committing to a position.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Los Angeles Keychain Pinnacle West Capital Corporation $PNW Shares Sold By Yaupon Capital Event Merchandising – Prost International (Jan 20, 2026)

- Rakuten Investment Management Inc. Takes $2.23 Million Position in Pinnacle West Capital Corporation $PNW – MarketBeat (Jan 24, 2026)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 20, 2026)

- Is Pinnacle West Capital Corporation(PNW) Building Momentum? – AAII Investor (Jan 23, 2026)

- A Look At Pinnacle West Capital (PNW) Valuation As Q4 Results Approach After Strong Q3 And Upgraded Outlook – simplywall.st (Jan 24, 2026)

For more information about Pinnacle West Capital Corporation, please visit the official website: pinnaclewest.com