Home > Analyses > Energy > Phillips 66

Phillips 66 fuels daily life by refining crude oil into essential products like gasoline, aviation fuel, and renewable energy. It commands a strong position in oil & gas refining and marketing, supported by a diversified business model spanning midstream logistics, chemicals, and specialty products. Renowned for operational excellence and innovation, Phillips 66 shapes energy supply chains across the U.S. and Europe. The key question: does its robust foundation justify continued growth amid evolving energy markets?

Table of contents

Business Model & Company Overview

Phillips 66, founded in 1875 and headquartered in Houston, Texas, stands as a dominant player in the oil & gas refining and marketing sector. Its integrated operations span Midstream, Chemicals, Refining, and Marketing & Specialties, forming a cohesive energy ecosystem. The company refines crude oil and manufactures specialty chemicals, supporting a diversified energy supply chain essential to global markets.

The company’s revenue engine balances refining crude oil at 12 U.S. and European refineries with marketing refined products and chemicals. Its Midstream segment ensures efficient transport and storage across the Americas, Europe, and Asia. This broad geographic footprint, combined with fee-based logistics and specialty product sales, builds a robust economic moat that underpins Phillips 66’s influence on the energy sector’s future.

Financial Performance & Fundamental Metrics

I analyze Phillips 66’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder return strategy.

Income Statement

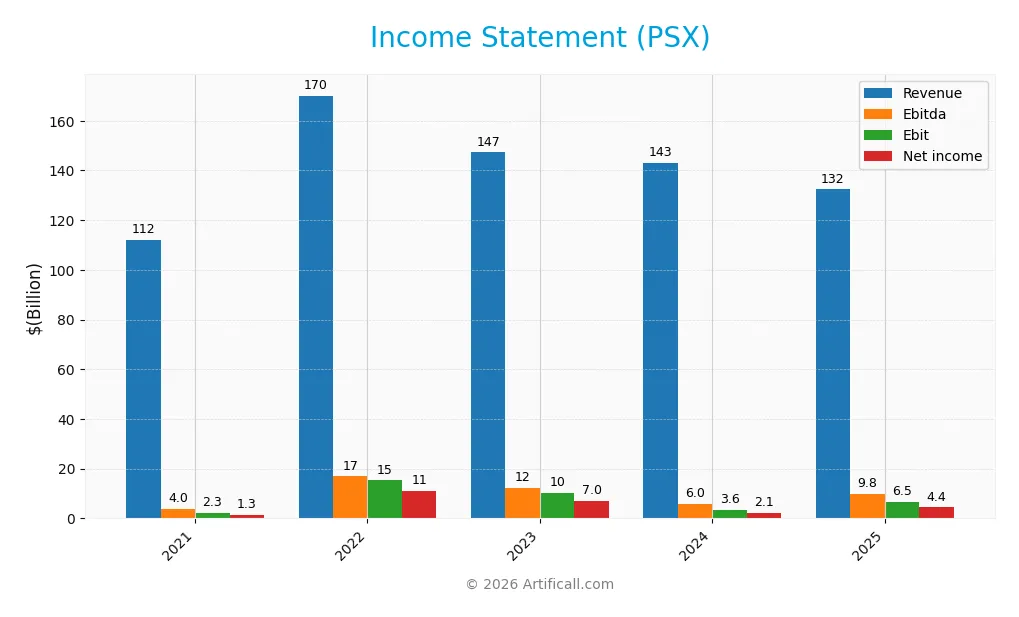

The table below summarizes Phillips 66’s key income statement figures for fiscal years 2021 to 2025. All values are in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 112B | 170B | 147B | 143B | 132B |

| Cost of Revenue | 109B | 157B | 136B | 138B | 126B |

| Operating Expenses | 2.15B | 2.70B | 3.02B | 2.54B | 3.23B |

| Gross Profit | 3.38B | 13B | 11.3B | 4.86B | 6.56B |

| EBITDA | 3.95B | 16.9B | 12.4B | 6.0B | 9.76B |

| EBIT | 2.32B | 15.3B | 10.4B | 3.58B | 6.46B |

| Interest Expense | 581M | 619M | 897M | 907M | 1.04B |

| Net Income | 1.32B | 11B | 7B | 2.12B | 4.4B |

| EPS | 2.97 | 23.36 | 15.56 | 5.01 | 10.84 |

| Filing Date | 2022-02-18 | 2023-02-22 | 2024-02-21 | 2025-02-21 | 2026-02-04 |

Income Statement Evolution

Phillips 66’s revenue declined by 7.5% from 2024 to 2025, reversing prior growth trends. Despite this, gross profit surged nearly 35%, boosting margins. EBIT and net income also rose strongly, with net margin doubling, signaling improved profitability amid lower sales. Over 2021–2025, revenue and net income grew 18% and 235%, respectively, reflecting rising operational efficiency.

Is the Income Statement Favorable?

In 2025, Phillips 66 posted a 4.96% gross margin and a 3.33% net margin, both classified as neutral. Interest expense at 0.78% of revenue was favorable, supporting healthy cost control. EBIT margin improved to 4.88%, driving an 80% EBIT increase year-over-year. The overall income statement exhibits mostly favorable fundamentals, with strong earnings growth offsetting revenue pressure.

Financial Ratios

The following table presents key financial ratios for Phillips 66 (PSX) over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 1.17% | 6.48% | 4.76% | 1.48% | 3.33% |

| ROE | 6.86% | 37.38% | 22.90% | 7.72% | 0 |

| ROIC | 2.53% | 12.83% | 10.34% | 3.19% | 0 |

| P/E | 24.25 | 4.45 | 8.56 | 22.61 | 11.90 |

| P/B | 1.66 | 1.66 | 1.96 | 1.75 | 0 |

| Current Ratio | 1.15 | 1.38 | 1.26 | 1.19 | 0 |

| Quick Ratio | 0.88 | 1.17 | 1.02 | 0.92 | 0 |

| D/E | 0.77 | 0.58 | 0.63 | 0.73 | 0 |

| Debt-to-Assets | 26.51% | 22.49% | 25.64% | 27.64% | 0 |

| Interest Coverage | 2.11 | 16.27 | 9.22 | 2.56 | 3.21 |

| Asset Turnover | 2.01 | 2.23 | 1.95 | 1.97 | 0 |

| Fixed Asset Turnover | 4.99 | 4.84 | 4.12 | 4.06 | 0 |

| Dividend Yield | 4.97% | 3.65% | 3.14% | 3.93% | 3.67% |

Note: Missing values indicate data not reported or unavailable for the respective year.

Evolution of Financial Ratios

Phillips 66’s Return on Equity and profitability margins trended downward from 2022 to 2025, showing a marked decline in net profit margin from 6.48% to 3.33%. The Current Ratio also deteriorated, reaching zero in 2025, indicating potential liquidity issues. Debt-to-Equity ratios remained stable and favorable, suggesting consistent leverage management despite profitability pressure.

Are the Financial Ratios Favorable?

In 2025, profitability ratios like net margin and ROE were unfavorable, pointing to weak profit generation. Liquidity ratios were zero, signaling a critical red flag. Conversely, leverage ratios, including debt-to-equity and debt-to-assets, remained favorable, reflecting prudent capital structure. Market valuation metrics like the P/E ratio at 11.9 and dividend yield at 3.67% were positive. Overall, Phillips 66’s financial ratios appear slightly unfavorable.

Shareholder Return Policy

Phillips 66 maintains a dividend payout ratio near 44% in 2025, with a stable dividend per share rising to $4.73 and a 3.7% yield. Share buybacks supplement returns, supported by free cash flow coverage above 100%, suggesting disciplined capital allocation.

The payout is sustainable, covering dividends plus capex by 1.19 times, indicating balanced distribution and reinvestment. This approach aligns with steady shareholder value creation, avoiding excessive payouts or repurchases that could strain financial flexibility.

Score analysis

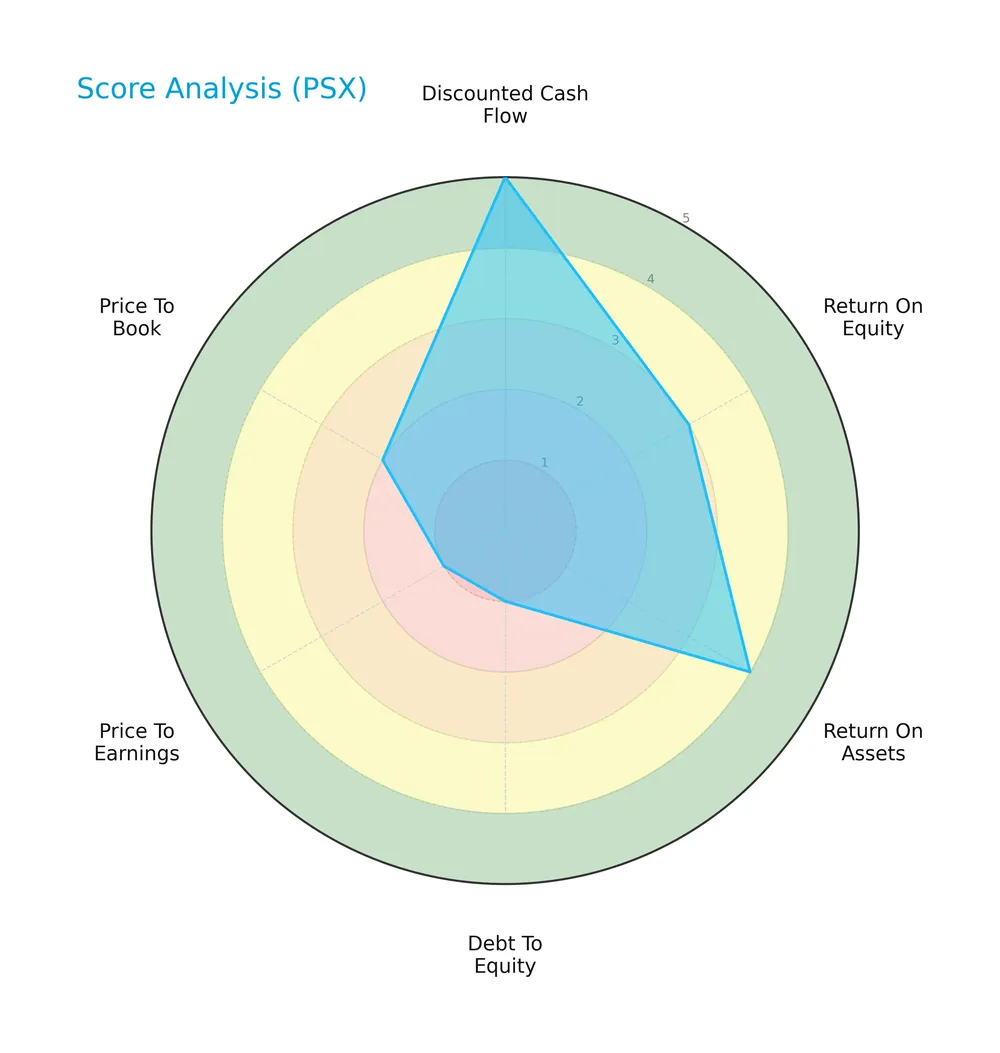

The following radar chart presents Phillips 66’s key financial scores across various valuation and profitability metrics:

Phillips 66 scores very favorably on discounted cash flow (5) and return on assets (4). Return on equity is moderate (3). However, debt-to-equity (1) and price-to-earnings (1) scores are very unfavorable, indicating leverage and valuation concerns. Price-to-book stands at a moderate level (2).

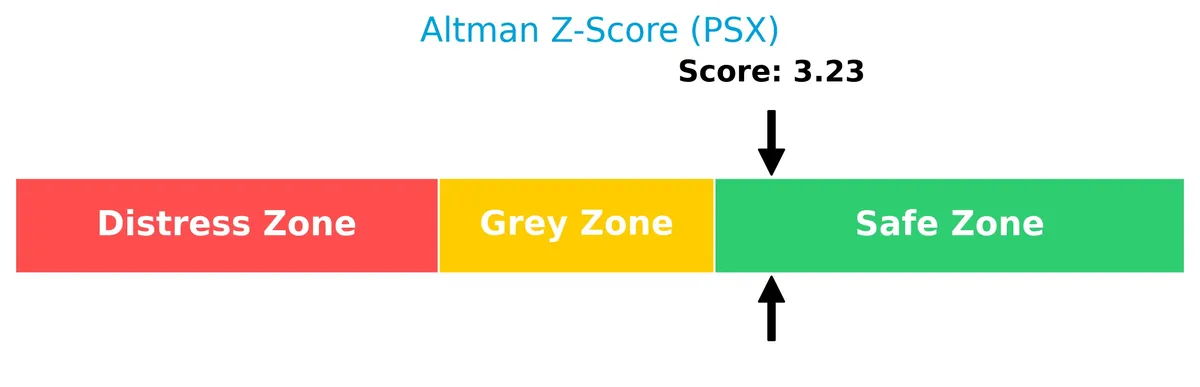

Analysis of the company’s bankruptcy risk

Phillips 66’s Altman Z-Score places it firmly in the safe zone, suggesting a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

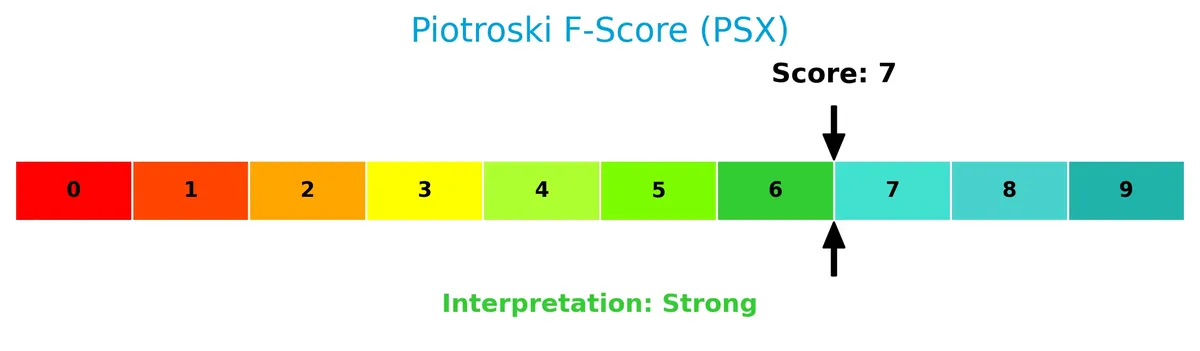

The Piotroski Score diagram highlights Phillips 66’s strong financial health based on profitability, leverage, and liquidity metrics:

With a score of 7, Phillips 66 demonstrates strong fundamentals, reflecting sound financial management and resilience relative to peers.

Competitive Landscape & Sector Positioning

This section examines Phillips 66’s strategic positioning, revenue streams, key products, main competitors, and competitive advantages. I will assess whether Phillips 66 holds a sustainable edge over its peers in the energy sector.

Strategic Positioning

Phillips 66 maintains a diversified product portfolio across Midstream, Chemicals, Refining, and Marketing segments. Its geographic exposure centers primarily on the U.S., with significant revenues also from the UK and Germany, reflecting a balanced but U.S.-focused energy operations footprint.

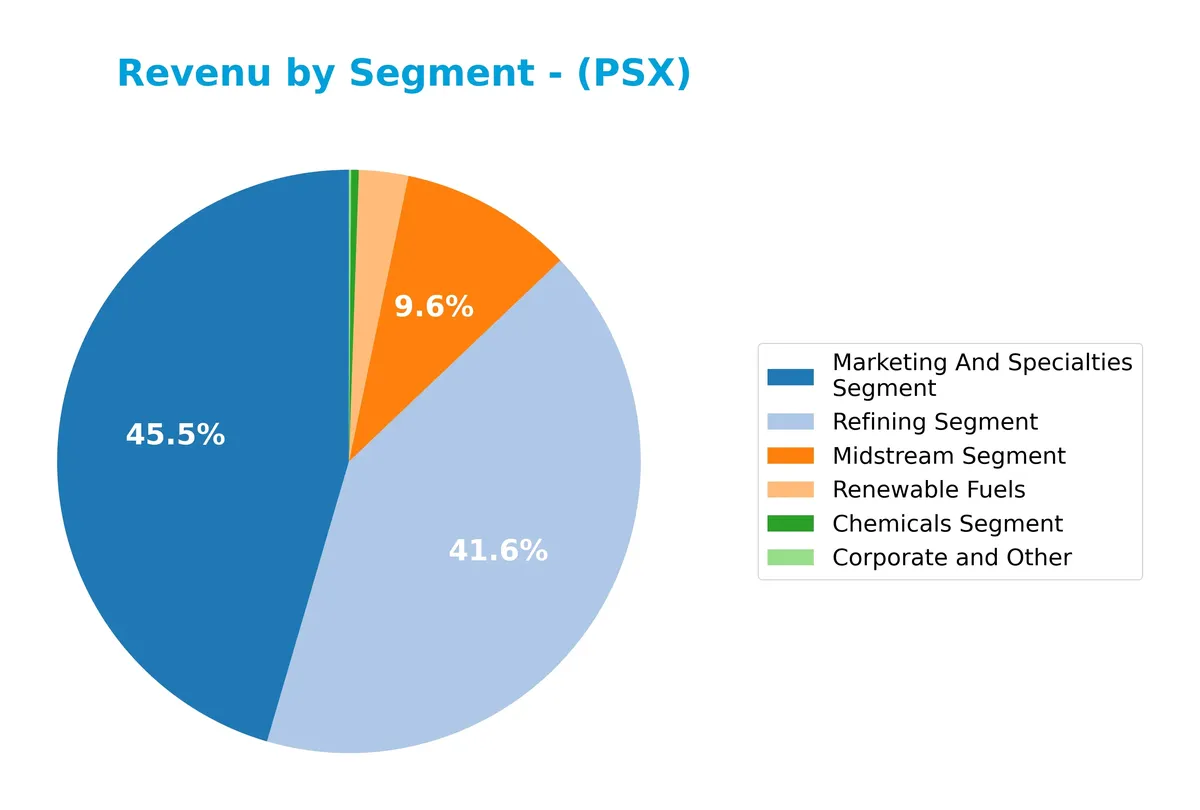

Revenue by Segment

This pie chart presents Phillips 66’s revenue distribution by segment for the fiscal year 2024, highlighting the composition of its business units and their relative financial contributions.

In 2024, the Marketing And Specialties Segment leads with $92.8B, closely followed by the Refining Segment at $85B, showcasing their dominance in Phillips 66’s revenue mix. The Midstream Segment contributes $19.7B, while Renewable Fuels and Chemicals remain minor contributors. Notably, a large negative Consolidation and Eliminations figure of -$58.7B indicates significant internal adjustments, affecting reported totals. The revenue concentration in marketing and refining suggests strategic focus but also exposes the company to sector volatility.

Key Products & Brands

Phillips 66’s operations span four main segments and related product lines as outlined below:

| Product | Description |

|---|---|

| Midstream Segment | Transports crude oil, natural gas liquids; offers storage, terminaling, and processing services. |

| Chemicals Segment | Produces ethylene, olefins, aromatics, styrenics, and specialty chemical products. |

| Refining Segment | Refines crude oil and feedstocks into gasolines, distillates, aviation, and renewable fuels. |

| Marketing and Specialties (M&S) Segment | Markets refined petroleum products and manufactures specialty products like base oils and lubricants. |

Phillips 66 generates revenue primarily from refining and marketing petroleum products, supported by chemical manufacturing and midstream logistics. This diversified product mix reflects its integrated energy business model.

Main Competitors

There are 3 competitors in total, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Phillips 66 | 52.6B |

| Valero Energy Corporation | 51.6B |

| Marathon Petroleum Corporation | 49.6B |

Phillips 66 ranks 1st among its competitors, boasting a market cap 18% above the next largest rival. It sits above both the average market cap of the top 10 and the sector median. The company leads with a 20.55% gap to the second-largest competitor, confirming its dominant positioning in Oil & Gas Refining & Marketing.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Phillips 66 have a competitive advantage?

Phillips 66 operates across diversified segments in energy manufacturing and logistics with a solid market presence in the US and Europe. However, data on its ROIC versus WACC is unavailable, and its ROIC trend shows a decline, limiting insight into its economic moat.

The company’s broad footprint in refining, chemicals, and midstream services supports resilience amid sector volatility. Future opportunities may arise from expanding specialty products and renewable fuels, leveraging its integrated operations across established markets.

SWOT Analysis

This SWOT analysis identifies Phillips 66’s key internal and external factors to guide strategic decisions.

Strengths

- Diverse business segments

- Strong dividend yield (3.67%)

- Favorable interest coverage (6.22x)

Weaknesses

- Declining ROIC trend

- Negative revenue growth last year (-7.5%)

- Weak liquidity ratios (current and quick ratios at 0)

Opportunities

- Growing chemical segment demand

- Expansion in international markets

- Increasing renewable fuels production

Threats

- Volatile oil prices

- Regulatory pressure on fossil fuels

- High debt to equity concerns

Phillips 66’s strengths in diversified operations and solid cash flow support resilience. However, declining operational returns and liquidity pose risks. The company must leverage growth in chemicals and renewables while managing exposure to oil price swings and regulatory shifts.

Stock Price Action Analysis

The weekly stock chart illustrates Phillips 66’s price movements over the last 100 weeks, highlighting key levels and trend shifts:

Trend Analysis

Over the past 100 weeks, Phillips 66’s stock declined by 2.89%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 170.75 and a low of 97.38, reflecting significant volatility with a standard deviation of 13.46%.

Volume Analysis

Trading volumes over the last three months show buyer dominance at 62.76% share. Despite strong buyer activity, total volume is decreasing, suggesting waning market participation but sustained investor interest from buyers. Seller volumes remain notably lower at 50M compared to buyers’ 85M.

Target Prices

Analysts set a strong target consensus for Phillips 66, reflecting confidence in its growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 140 | 162 | 151.13 |

The target range from 140 to 162 shows a positive outlook, with consensus centered at 151.13, indicating steady upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Phillips 66’s recent analyst ratings and consumer feedback to evaluate market sentiment and brand perception.

Stock Grades

Here are the latest verified stock grades for Phillips 66 from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-02-05 |

| Piper Sandler | Maintain | Neutral | 2026-02-05 |

| Wells Fargo | Maintain | Overweight | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-01-14 |

| JP Morgan | Maintain | Overweight | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-12 |

| Mizuho | Maintain | Neutral | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-08 |

| Freedom Capital Markets | Downgrade | Sell | 2026-01-06 |

The consensus reflects a stable outlook, with most institutions maintaining Neutral or Equal Weight ratings. Notably, Freedom Capital Markets stands out with a Sell downgrade, contrasting the broader positive bias.

Consumer Opinions

Consumer sentiment around Phillips 66 reflects a blend of respect for its operational reliability and concerns over environmental practices.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently reliable fuel quality and availability. | Environmental impact and carbon footprint worries. |

| Strong customer service at retail locations. | Perceived lack of transparency on sustainability. |

| Competitive pricing compared to major competitors. | Limited presence in renewable energy initiatives. |

Overall, consumers appreciate Phillips 66’s dependable service and pricing but frequently express disappointment with its environmental responsibility. This tension mirrors broader industry challenges balancing profitability and sustainability.

Risk Analysis

Below is a summary table presenting key risks faced by Phillips 66, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Oil price fluctuations affect refining margins and cash flow stability. | High | High |

| Operational Risk | Refinery outages or accidents could disrupt production and increase costs. | Medium | High |

| Financial Health | Weak liquidity ratios and moderate leverage risk tightening credit access. | Medium | Medium |

| Regulatory Risk | Environmental regulations could increase compliance costs significantly. | Medium | High |

| Macroeconomic | Global economic downturns reduce fuel demand and pressure earnings. | Medium | High |

Phillips 66’s most pressing risks stem from volatile oil prices and regulatory pressures. Despite a safe Altman Z-score of 3.23 and a strong Piotroski score of 7, liquidity concerns (current and quick ratios at zero) signal caution. The company’s moderate leverage and exposure to cyclical demand require close monitoring.

Should You Buy Phillips 66?

Phillips 66 appears to be a moderately profitable company with a declining ROIC trend, suggesting an eroding competitive moat. Despite a challenging leverage profile, its overall rating is a favorable B, reflecting solid value creation but notable financial risks.

Strength & Efficiency Pillars

Phillips 66 exhibits robust financial health, anchored by an Altman Z-score of 3.23, placing it securely in the safe zone against bankruptcy risk. The Piotroski score of 7 confirms strong operational efficiency and financial strength. Favorable interest coverage at 6.22x and a dividend yield of 3.67% reflect disciplined capital allocation and shareholder returns. Although ROIC data is unavailable, the stable debt-to-equity and debt-to-assets ratios suggest prudent leverage management and moderate financial risk.

Weaknesses and Drawbacks

The company faces challenges with a bearish overall stock trend, marked by a -2.89% price decline and a volatility standard deviation of 13.46. Net margin is subdued at 3.33%, reflecting limited profitability. The current and quick ratios are unfavorable, indicating potential liquidity constraints. While the P/E ratio at 11.9 appears reasonable, the lack of data on ROIC versus WACC limits clarity on value creation. Revenue contraction of -7.51% over the last year signals near-term operational headwinds.

Our Verdict about Phillips 66

Phillips 66’s long-term fundamentals appear favorable, underpinned by strong financial health and operational metrics. The recent buyer-dominant market behavior, with 62.76% buyer volume from late 2025 to early 2026, suggests improving sentiment. Despite near-term revenue and margin pressures, the profile might appear attractive for disciplined investors seeking exposure in an energy sector name with solid balance sheet resilience.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Phillips 66 (NYSE: PSX) Q4 2025 earnings call transcript – MSN (Feb 05, 2026)

- Phillips 66 (PSX) Q4 EPS Surge To US$7.21 Challenges Earnings Volatility Concerns – simplywall.st (Feb 05, 2026)

- Phillips 66 (PSX) Plans Major Workforce Reduction at California Refinery – GuruFocus (Feb 05, 2026)

- Wells Fargo & Company Issues Positive Forecast for Phillips 66 (NYSE:PSX) Stock Price – MarketBeat (Feb 05, 2026)

- Phillips 66 (NYSE:PSX) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 05, 2026)

For more information about Phillips 66, please visit the official website: phillips66.com