Home > Analyses > Healthcare > Pfizer Inc.

Pfizer shapes global health with breakthrough medicines and vaccines that touch billions of lives. Its portfolio spans cardiovascular, oncology, immunology, and infectious diseases, anchored by flagship drugs like Comirnaty and Eliquis. Known for relentless innovation and strategic collaborations, Pfizer commands a leading position in biopharma. As we analyze its current valuation, the key question is whether Pfizer’s robust fundamentals can sustain growth amid evolving industry dynamics and competitive pressures.

Table of contents

Business Model & Company Overview

Pfizer Inc., founded in 1849 and headquartered in New York City, stands as a global leader in the drug manufacturing sector. It operates a vast ecosystem of biopharmaceutical products, spanning vaccines, small molecules, biologics, and immunotherapies. Its portfolio includes flagship brands such as Comirnaty, Eliquis, and Prevnar, reflecting a core mission to improve health across diverse therapeutic areas worldwide.

The company’s revenue engine balances innovative drug development with extensive manufacturing and contract services. Pfizer’s reach spans the Americas, Europe, and Asia, serving hospitals, pharmacies, and government agencies. Its substantial market presence and collaborative partnerships create a formidable economic moat, positioning Pfizer at the forefront of pharmaceutical innovation and industry leadership.

Financial Performance & Fundamental Metrics

I analyze Pfizer Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

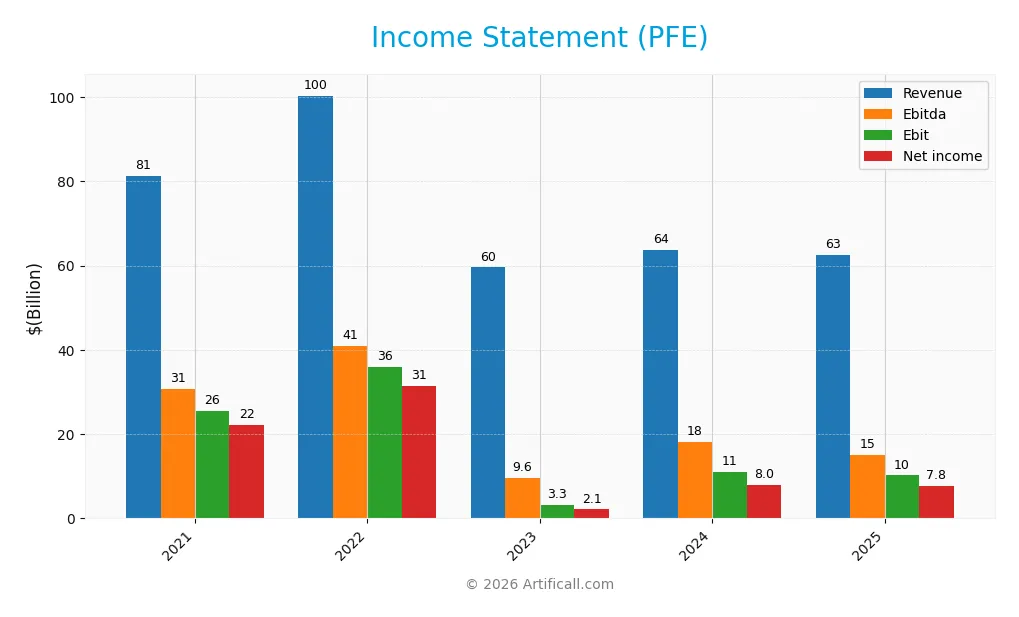

This table summarizes Pfizer Inc.’s key income statement items for the fiscal years 2021 through 2025, showing trends in revenue, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 81.3B | 100.3B | 59.6B | 63.6B | 62.6B |

| Cost of Revenue | 34.4B | 38.2B | 29.2B | 21.8B | 18.6B |

| Operating Expenses | 26.1B | 24.5B | 25.0B | 25.4B | 28.6B |

| Gross Profit | 46.9B | 62.1B | 30.3B | 41.8B | 44.0B |

| EBITDA | 30.8B | 41.0B | 9.6B | 18.1B | 15.1B |

| EBIT | 25.6B | 36.0B | 3.3B | 11.1B | 10.2B |

| Interest Expense | 1.3B | 1.2B | 2.2B | 3.1B | 2.7B |

| Net Income | 22.1B | 31.4B | 2.1B | 8.0B | 7.8B |

| EPS | 3.95 | 5.59 | 0.38 | 1.42 | 1.36 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-27 | 2026-02-03 |

Income Statement Evolution

Pfizer’s revenue declined by 1.65% from 2024 to 2025, continuing a downward trend with a 23% drop over five years. Net income dropped sharply by nearly 65% over the same period. Despite this, gross margin improved to 70.33%, indicating better cost control, while net margin contracted, reflecting pressure on profitability.

Is the Income Statement Favorable?

In 2025, Pfizer reported a 12.42% net margin and a 16.29% EBIT margin, both favorable by industry standards. However, revenue and net income growth were negative, signaling weakening top-line and bottom-line performance. Interest expense remains manageable at 4.27% of revenue. Overall, fundamentals appear challenged, with more unfavorable trends than favorable.

Financial Ratios

The following table presents key financial ratios for Pfizer Inc. across multiple fiscal years, offering a snapshot of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 27% | 31% | 4% | 13% | 12% |

| ROE | 29% | 33% | 2% | 9% | 8% |

| ROIC | 14% | 21% | 3% | 9% | N/A |

| P/E | 15 | 9 | 76 | 19 | 18 |

| P/B | 4.3 | 3.0 | 1.8 | 1.7 | 1.5 |

| Current Ratio | 1.40 | 1.22 | 0.91 | 1.17 | 0 |

| Quick Ratio | 1.19 | 1.00 | 0.69 | 0.92 | 0 |

| D/E | 0.48 | 0.36 | 0.80 | 0.76 | 0 |

| Debt-to-Assets | 20% | 18% | 31% | 31% | 0% |

| Interest Coverage | 16.1 | 30.3 | 2.4 | 5.3 | 5.8 |

| Asset Turnover | 0.45 | 0.51 | 0.26 | 0.30 | 0 |

| Fixed Asset Turnover | 5.46 | 6.17 | 3.14 | 3.46 | 0 |

| Dividend Yield | 2.6% | 3.1% | 5.7% | 6.3% | 6.9% |

Evolution of Financial Ratios

Pfizer’s Return on Equity (ROE) declined from 32.79% in 2022 to 8.35% in 2025, signaling weakening profitability. The Current Ratio trended downward, hitting zero in 2025, indicating worsening liquidity. Debt-to-Equity ratios fell to zero in 2025, diverging from previous moderate leverage levels, reflecting a significant capital structure shift.

Are the Financial Ratios Fovorable?

In 2025, Pfizer shows mixed signals: net margin at 12.42% is favorable, but ROE and Return on Invested Capital (ROIC) are unfavorable versus sector benchmarks. Liquidity ratios are absent and marked unfavorable, raising caution. Leverage ratios appear favorable with zero debt reported. Market multiples like P/E and P/B are neutral, while dividend yield is moderate, leading to a slightly unfavorable overall ratio profile.

Shareholder Return Policy

Pfizer maintains a robust dividend policy with a payout ratio above 100%, yielding nearly 7%. Dividends show a steady increase, supported by share buybacks, though payout exceeding net income signals potential sustainability risk.

This approach balances rewarding shareholders and capital allocation, but the elevated payout ratio warrants careful monitoring to ensure long-term value creation remains viable.

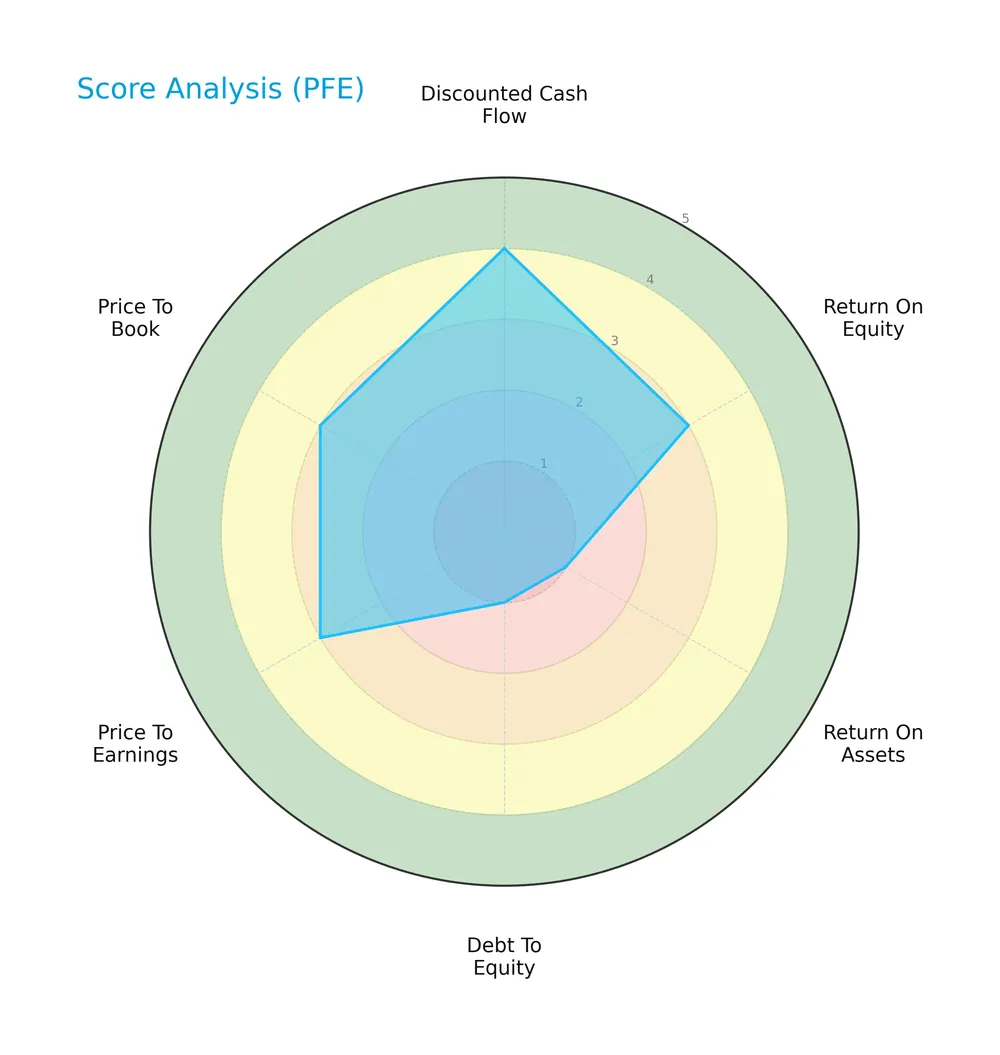

Score analysis

The following radar chart displays Pfizer Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Pfizer shows a favorable discounted cash flow score of 4, indicating solid intrinsic value. Return on equity, price-to-earnings, and price-to-book scores stand moderate at 3. However, return on assets and debt-to-equity scores are very unfavorable at 1, signaling efficiency and leverage concerns.

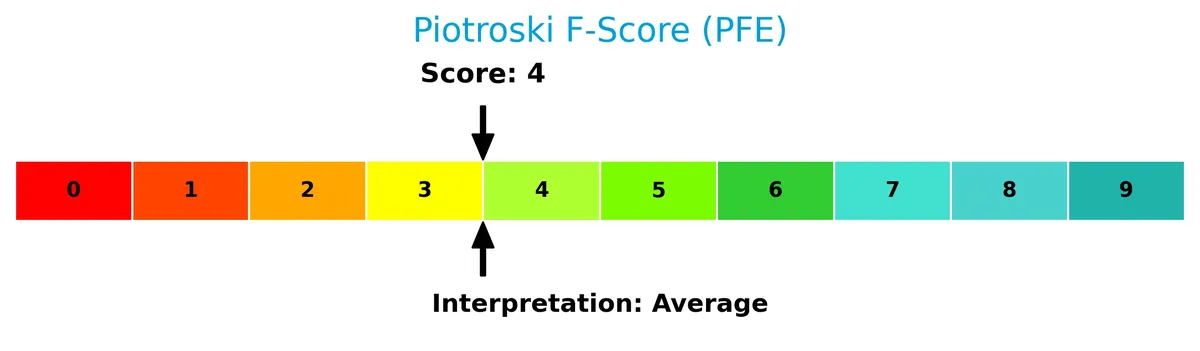

Is the company in good financial health?

The Piotroski diagram illustrates Pfizer’s financial strength based on nine accounting criteria:

With a Piotroski Score of 4, Pfizer is in average financial health. This score suggests mixed signals in profitability and balance sheet quality, warranting cautious monitoring of its fundamentals over time.

Competitive Landscape & Sector Positioning

This section examines Pfizer Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will analyze whether Pfizer holds a sustainable competitive advantage over its peers in the drug manufacturing sector.

Strategic Positioning

Pfizer concentrates its portfolio heavily in biopharmaceuticals, generating $62.4B in 2024, while maintaining a global geographic footprint. The U.S. market dominates revenue at $38.7B, with significant contributions from developed and emerging markets, reflecting a balanced yet focused international presence.

Revenue by Segment

This pie chart illustrates Pfizer Inc.’s revenue distribution by business segments for the full fiscal year 2024, highlighting the contribution of the Biopharma segment.

Pfizer’s revenue in 2024 centers overwhelmingly on the Biopharma segment, generating $62.4B. This dominance reflects the company’s strategic focus on innovative pharmaceuticals. Notably, the Business Innovation segment, visible in 2023 with $1.3B, has not yet scaled significantly. The 2024 data shows a stable concentration in Biopharma, underscoring both growth potential and concentration risk if diversification does not follow.

Key Products & Brands

Pfizer’s main products and brands span multiple therapeutic areas and biopharmaceutical categories:

| Product | Description |

|---|---|

| Premarin family & Eliquis | Medicines in cardiovascular metabolic and women’s health areas. |

| Ibrance, Xtandi, Sutent | Biologics, small molecules, immunotherapies, and biosimilars for oncology and specialty care. |

| Sulperazon, Medrol, Zavicefta, Zithromax, Vfend, Panzyga, Paxlovid | Sterile injectable, anti-infective medicines, and oral COVID-19 treatment. |

| Comirnaty/BNT162b2, Nimenrix, FSME/IMMUN-TicoVac, Trumenba, Prevnar family | Vaccines for pneumococcal, meningococcal, tick-borne encephalitis, and COVID-19 diseases. |

| Xeljanz, Enbrel, Inflectra, Eucrisa/Staquis, Cibinqo | Biosimilars targeting chronic immune and inflammatory diseases. |

| Vyndaqel/Vyndamax, BeneFIX, Genotropin | Treatments for amyloidosis, hemophilia, and endocrine diseases. |

Pfizer’s portfolio reflects a broad therapeutic reach, anchored by strong biopharmaceutical brands and vaccines. This diversity supports resilience amid shifting healthcare demands.

Main Competitors

The Healthcare sector’s Drug Manufacturers – General industry includes 10 key competitors. The table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eli Lilly and Company | 970B |

| Johnson & Johnson | 500B |

| AbbVie Inc. | 405B |

| AstraZeneca PLC | 285B |

| Merck & Co., Inc. | 268B |

| Amgen Inc. | 176B |

| Gilead Sciences, Inc. | 151B |

| Pfizer Inc. | 143B |

| Bristol-Myers Squibb Company | 109B |

| Biogen Inc. | 26B |

Pfizer ranks 8th among the top 10 competitors. Its market cap is 15.5% that of Eli Lilly, the sector leader. Pfizer’s valuation sits below both the average top 10 market cap of 303B and the sector median of 222B. The company maintains a narrow 0.17% gap above its closest rival, Gilead Sciences, highlighting a tight race in the mid-tier segment.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Pfizer have a competitive advantage?

Pfizer does not currently present a competitive advantage. Its ROIC is 5.82% below WACC, indicating value destruction and declining profitability over 2021-2025.

The company’s broad portfolio spans vaccines and biopharmaceuticals with global reach. Future opportunities include expanding contract manufacturing and collaborations with biotech firms in emerging markets.

SWOT Analysis

This SWOT analysis highlights Pfizer Inc.’s key internal strengths and weaknesses, alongside external opportunities and threats shaping its strategic outlook.

Strengths

- strong global brand

- diversified product portfolio

- robust dividend yield

Weaknesses

- declining revenue growth

- negative ROIC trend

- weak liquidity ratios

Opportunities

- expansion in emerging markets

- growing vaccine demand

- strategic collaborations

Threats

- patent expirations

- regulatory pressures

- increasing competition

Pfizer’s solid brand and diversified products underpin resilience despite revenue decline and profitability erosion. The company must leverage emerging markets and innovation while managing patent and regulatory risks carefully.

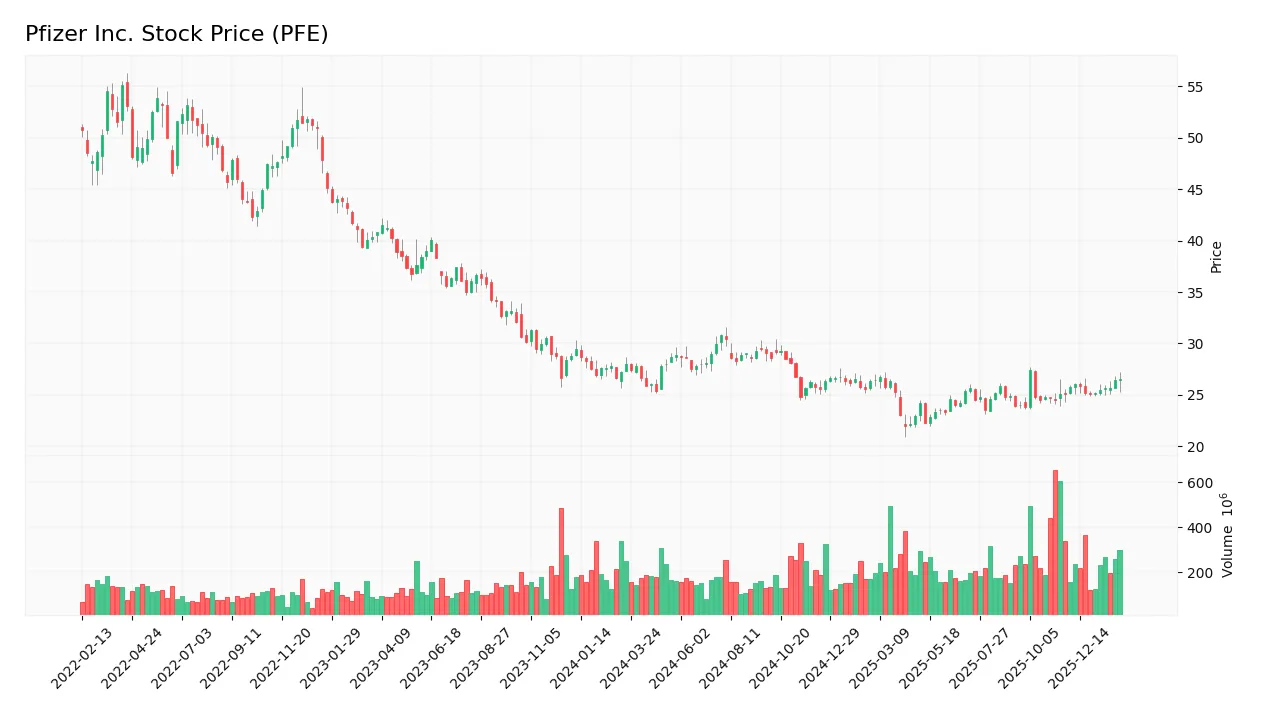

Stock Price Action Analysis

The weekly stock chart below illustrates Pfizer Inc.’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Pfizer’s stock price declined by 5.19%, indicating a bearish trend with accelerating downside momentum. The price ranged between a high of 30.77 and a low of 21.91. Recent months show a mild recovery of 5.79% with low volatility (std dev 0.47), suggesting a tentative upward slope since late 2025.

Volume Analysis

Trading volumes have increased recently, with buyers accounting for 60% of activity over the last three months. This buyer dominance and rising volume suggest growing investor interest and moderate confidence in the stock’s near-term prospects. Seller activity remains significant but less pronounced, highlighting cautious optimism among market participants.

Target Prices

Analysts set a clear consensus on Pfizer Inc.’s target price range.

| Target Low | Target High | Consensus |

|---|---|---|

| 24 | 35 | 28 |

The consensus target price of $28 indicates moderate analyst confidence, with upside potential up to $35 reflecting optimism about future growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Pfizer Inc.’s recent analyst grades and consumer feedback to gauge market sentiment and user experience.

Stock Grades

Here is the latest verified grading data for Pfizer Inc. from leading industry analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-04 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-27 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| B of A Securities | Maintain | Neutral | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-12 |

| Guggenheim | Maintain | Buy | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-10 |

| B of A Securities | Maintain | Neutral | 2025-10-03 |

| Citigroup | Maintain | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

The consensus demonstrates a stable outlook with most analysts maintaining neutral or equal-weight ratings. Guggenheim stands out with a consistent buy rating, reflecting some divergent optimism within the analyst community.

Consumer Opinions

Consumers express a mix of trust and frustration toward Pfizer Inc., reflecting its complex role in healthcare.

| Positive Reviews | Negative Reviews |

|---|---|

| Effective vaccines with proven results | High drug prices cause affordability issues |

| Reliable product quality and innovation | Occasional delays in customer service |

| Transparent communication on safety | Side effects concerns in some cases |

Overall, consumers appreciate Pfizer’s innovation and product efficacy but frequently cite pricing and service delays as pain points. This duality underscores the challenges pharmaceutical companies face balancing access and profitability.

Risk Analysis

Below is a summary table outlining key risks Pfizer faces, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in drug approval processes or increased regulatory scrutiny | Medium | High |

| Competitive Risk | Intense competition from generics and biosimilars impacting market share | High | Medium |

| Financial Risk | Weak liquidity ratios signal potential cash flow constraints | Medium | High |

| Patent Expiry | Loss of exclusivity on key drugs leading to revenue decline | High | High |

| Operational Risk | Supply chain disruptions or manufacturing delays affecting product delivery | Low | Medium |

Pfizer’s liquidity ratios are notably unfavorable, raising caution about short-term financial flexibility. Patent expirations remain the most critical threat, as they erode revenue and pricing power. Competition from biosimilars intensifies, pressuring margins despite a solid dividend yield.

Should You Buy Pfizer Inc.?

Pfizer appears to be navigating a challenging phase with deteriorating operational efficiency and a very unfavorable moat due to declining profitability. Despite manageable leverage concerns, its moderate rating of B- suggests cautious value creation potential amid these headwinds.

Strength & Efficiency Pillars

Pfizer Inc. boasts a strong gross margin of 70.33% and a net margin of 12.42%, reflecting solid profitability. Its EBIT margin at 16.29% underscores operational efficiency. The company’s weighted average cost of capital (WACC) stands at a favorable 5.82%, although its return on invested capital (ROIC) is at 0%, signaling no value creation. The Piotroski score of 4 indicates average financial health, while a debt-to-equity ratio status is favorable, evidencing manageable leverage.

Weaknesses and Drawbacks

Pfizer faces significant headwinds with a declining revenue trend of -1.65% over the past year and a steep -23.02% over five years. Return on equity is weak at 8.35%, and ROIC’s null value signals value destruction. Liquidity ratios are unavailable or unfavorable, raising red flags on short-term financial stability. Moderate P/E of 18.21 and P/B of 1.52 suggest neither bargain nor premium valuation, but overall growth weakness and bearish stock trends imply caution.

Our Verdict about Pfizer Inc.

The company’s long-term fundamental profile appears unfavorable due to deteriorating profitability and declining returns on capital. Despite recent slight buyer dominance and a mild positive trend, the overall bearish momentum and financial weaknesses suggest Pfizer may appear as a cautious hold. Investors could consider waiting for clearer signs of operational turnaround before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Pfizer (PFE) Announces Positive Phase 2b Results for Obesity Drug Showing 12.30% Weight Loss – Yahoo Finance (Feb 04, 2026)

- Adell Harriman & Carpenter Inc. Purchases 45,578 Shares of Pfizer Inc. $PFE – MarketBeat (Feb 04, 2026)

- Pfizer: Messy Q4 Earnings Mask An Improving Business (NYSE:PFE) – Seeking Alpha (Feb 03, 2026)

- Pfizer’s Newly Acquired Drug Shows Weight Loss Of Just Around 13%, Stock Drops – Pfizer (NYSE:PFE) – Benzinga (Feb 03, 2026)

- Pfizer (PFE) Q4 Earnings and Revenues Beat Estimates – Yahoo Finance (Feb 03, 2026)

For more information about Pfizer Inc., please visit the official website: pfizer.com