Home > Analyses > Technology > Perfect Corp.

Perfect Corp. is transforming how millions experience beauty and fashion through cutting-edge AI and augmented reality technology. As a pioneer in SaaS solutions, it delivers innovative virtual try-on and personalized beauty tools that redefine customer engagement and retail experiences worldwide. With a strong foothold in the tech-driven beauty sector and a reputation for quality and creativity, Perfect Corp. stands at a crossroads—do its current fundamentals support the promising growth investors anticipate?

Table of contents

Business Model & Company Overview

Perfect Corp., founded in 2015 and headquartered in New Taipei City, Taiwan, stands as a leader in AI-driven augmented reality solutions within the beauty and fashion tech industry. Its ecosystem integrates virtual try-on technology, AI-powered facial and skin analysis, and multiple YouCam applications, creating a seamless digital experience that redefines personal care and style. This cohesive platform has positioned Perfect Corp. as a key innovator in software applications tailored to consumer interaction and enhancement.

The company’s revenue engine is fueled by its SaaS model, blending advanced AI software with recurring service offerings that cater to global markets across the Americas, Europe, and Asia. By leveraging its extensive portfolio of AR and AI tools, Perfect Corp. generates value through subscription services and enterprise partnerships, sustaining growth beyond hardware dependencies. Its robust technological moat and comprehensive product suite secure its pivotal role in shaping the future of digital beauty and fashion solutions.

Financial Performance & Fundamental Metrics

In this section, I analyze Perfect Corp.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment appeal.

Income Statement

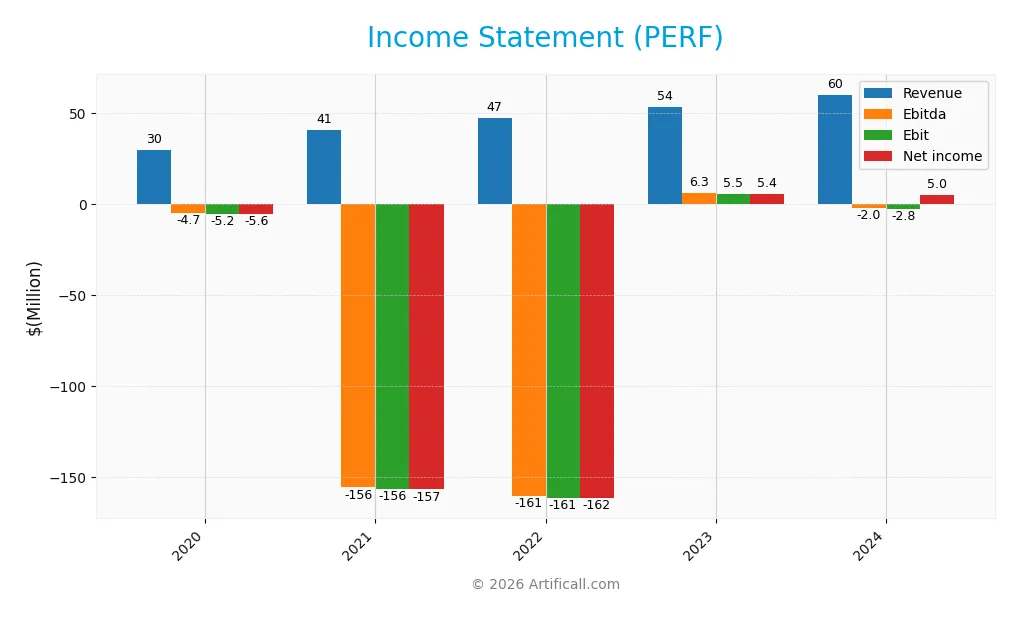

The table below presents Perfect Corp.’s key income statement figures for fiscal years 2020 through 2024, reflecting revenue, costs, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 29.9M | 40.8M | 47.3M | 53.5M | 60.2M |

| Cost of Revenue | 4.0M | 5.7M | 7.1M | 10.4M | 13.3M |

| Operating Expenses | 28.8M | 40.0M | 111.2M | 48.8M | 50.1M |

| Gross Profit | 25.9M | 35.0M | 40.2M | 43.1M | 46.9M |

| EBITDA | -4.7M | -156.0M | -160.7M | 6.3M | -2.0M |

| EBIT | -5.2M | -156.4M | -161.4M | 5.5M | -2.8M |

| Interest Expense | 9K | 9K | 8K | 15K | 7K |

| Net Income | -5.6M | -156.9M | -161.7M | 5.4M | 5.0M |

| EPS | -0.05 | -1.33 | -1.37 | 0.05 | 0.05 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2023-03-30 | 2024-03-29 | 2025-03-28 |

Income Statement Evolution

From 2020 to 2024, Perfect Corp. demonstrated consistent revenue growth, rising from $29.9M to $60.2M, a 101.5% increase. Net income improved markedly from a loss of $5.6M in 2020 to a positive $5.0M in 2024, with net margin increasing to 8.34%. However, the EBIT margin remained negative at -4.72%, reflecting ongoing operational challenges despite favorable gross margins near 78%.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals. Revenue growth of 12.5% year-on-year was supported by an 8.9% increase in gross profit, maintaining strong profitability at the gross level. Operating expenses grew proportionally, but the negative EBIT margin of -4.72% and a significant decline in EBIT by 151% indicate operating profitability pressures. Nevertheless, net income margin and EPS growth remain positive, suggesting controlled interest expenses and improved bottom-line performance.

Financial Ratios

The following table presents key financial ratios for Perfect Corp. (PERF) over the fiscal years 2020 to 2024, providing insight into profitability, liquidity, valuation, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -18.7% | -3.85% | -342% | 10.1% | 8.34% |

| ROE | 15.6% | 82.4% | -88.9% | 3.89% | 3.42% |

| ROIC | -3.9% | -7.2% | -38.3% | -3.9% | -2.1% |

| P/E | -213.7 | -7.43 | -5.22 | 62 | 56.6 |

| P/B | -33.4 | -6.12 | 4.64 | 2.41 | 1.93 |

| Current Ratio | 6.37 | 4.42 | 8.39 | 5.84 | 5.52 |

| Quick Ratio | 6.36 | 4.41 | 8.39 | 5.83 | 5.52 |

| D/E | -0.0095 | -0.0034 | 0.0019 | 0.0062 | 0.0035 |

| Debt-to-Assets | 0.39% | 0.72% | 0.16% | 0.51% | 0.28% |

| Interest Coverage | -316 | -557 | -8,884 | -377 | -449 |

| Asset Turnover | 0.35 | 0.46 | 0.22 | 0.31 | 0.33 |

| Fixed Asset Turnover | 38.7 | 39.7 | 77.3 | 43.6 | 57.9 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2024, Perfect Corp.’s Return on Equity (ROE) showed a decline, reaching 3.42% in 2024, indicating reduced profitability. The Current Ratio remained elevated above 4.4, peaking at 8.39 in 2022 before settling at 5.52 in 2024, reflecting strong liquidity. The Debt-to-Equity Ratio was consistently minimal, near zero, denoting low leverage and limited reliance on debt financing.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (8.34%) were neutral, while ROE (3.42%) and Return on Invested Capital (ROIC) were unfavorable. Liquidity showed mixed signals with a favorable quick ratio (5.52) but an unfavorable current ratio (5.52). Leverage ratios, including debt-to-equity (0.0) and debt-to-assets (0.28%), were favorable, indicating low risk. Efficiency metrics like asset turnover (0.33) were unfavorable, and market valuation ratios such as price-to-earnings (56.6) were also unfavorable, leading to an overall slightly unfavorable ratios assessment.

Shareholder Return Policy

Perfect Corp. has not paid dividends over the past five years, reflecting a reinvestment strategy likely aimed at growth and innovation. No share buyback programs are reported, suggesting capital is retained for operational or strategic uses rather than immediate shareholder returns.

This policy aligns with a focus on long-term value creation through reinvestment rather than distribution. While it may limit near-term income for shareholders, it supports sustainable growth potential, provided the company maintains financial discipline and positive profitability trends.

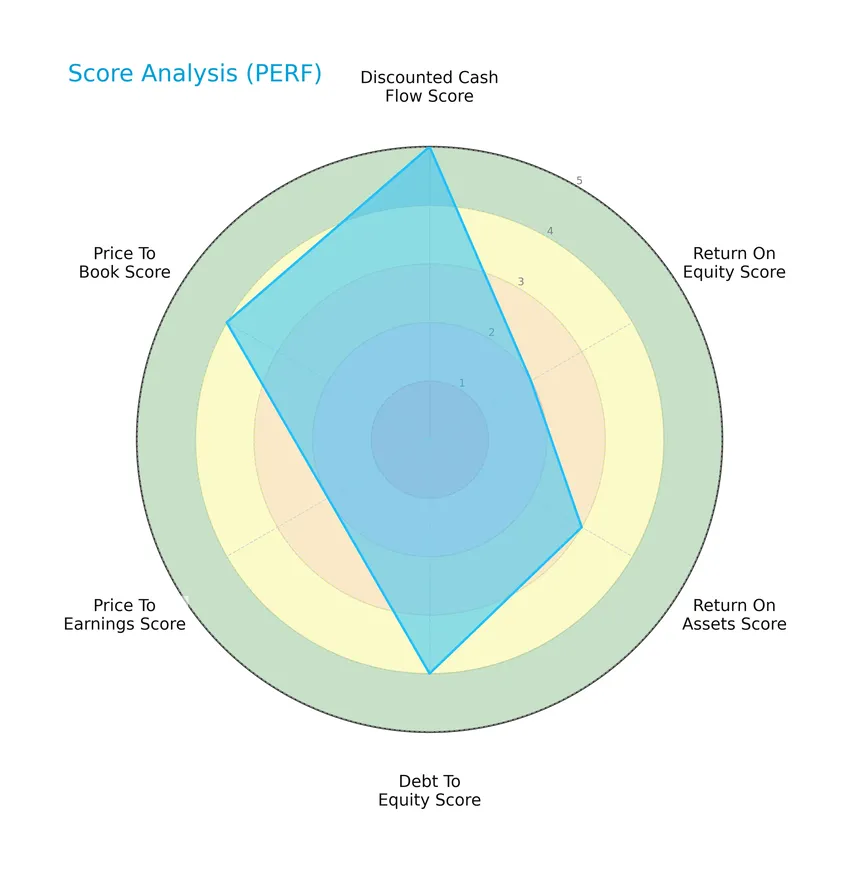

Score analysis

The following radar chart displays Perfect Corp.’s key financial scores across valuation and performance metrics:

Perfect Corp. shows a very favorable discounted cash flow score of 5, indicating strong intrinsic value. However, returns on equity and assets are moderate at 2 and 3 respectively. The company maintains favorable debt-to-equity and price-to-book scores at 4 each, while its price-to-earnings score remains moderate at 2. Overall, the scores reflect a generally favorable financial profile with some areas of moderate performance.

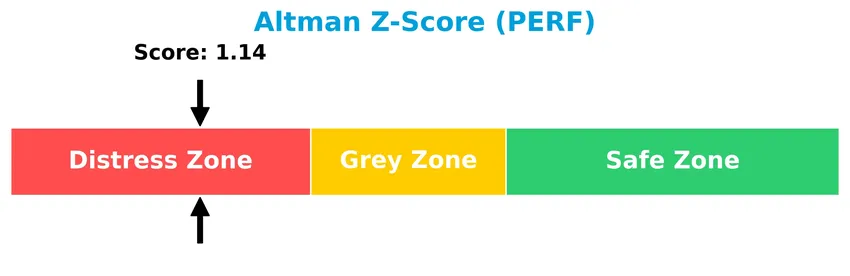

Analysis of the company’s bankruptcy risk

Perfect Corp.’s Altman Z-Score places it in the distress zone, indicating a higher likelihood of financial distress and bankruptcy risk:

Is the company in good financial health?

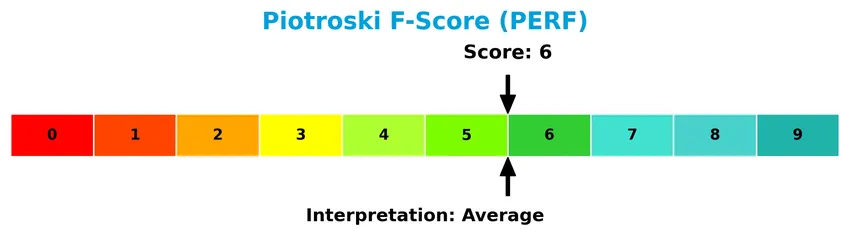

The Piotroski Score diagram illustrates Perfect Corp.’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 6, Perfect Corp. is classified as having average financial health. This suggests moderate financial strength but also leaves room for improvement in operational efficiency and profitability metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Perfect Corp.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Perfect Corp. holds a competitive advantage over its rivals in the software application industry.

Strategic Positioning

Perfect Corp. concentrates on SaaS AI and AR solutions in beauty and fashion tech, offering a diverse product portfolio including virtual try-ons and AI analyzers. Geographically, it generates significant revenue from the United States, Europe, and Asia Pacific, reflecting a balanced but focused international exposure.

Key Products & Brands

The following table summarizes Perfect Corp.’s main products and brands in the beauty and fashion tech sector:

| Product | Description |

|---|---|

| AR Makeup Virtual Try-On | Augmented reality solution allowing users to try on makeup products virtually. |

| YouCam Tutorial | Interactive tutorial app for beauty techniques and product use. |

| AI Foundation Shade Finder | Artificial intelligence tool for matching foundation shades to individual skin tones. |

| AI Virtual Background Changer | AI-powered feature to change virtual backgrounds in videos and photos. |

| AI Skin Analysis | AI technology that analyzes skin condition for personalized beauty recommendations. |

| AI Face Analyzer | Tool that assesses facial features for customized cosmetic suggestions. |

| AI Face Reshape Simulator | Simulator that allows virtual reshaping of facial features. |

| AI Personality Finder | Application that identifies personality traits using AI for personalized beauty advice. |

| In-Store Barcode Try-On | Technology enabling virtual product try-on via barcode scanning in physical stores. |

| AI Virtual Hair Color Try-On | AR solution for testing hair color changes virtually. |

| AR Hairstyle Virtual Try-On | Augmented reality app for experimenting with different hairstyles. |

| AI Beard Dye and Style Try-On | Virtual try-on for beard coloring and styling options. |

| Hat and Headband Virtual Try-On | AR feature for trying on hats and headbands virtually. |

| AI-Powered Virtual Try-On for Glasses | AI-driven virtual fitting for eyeglasses. |

| Virtual Try-On for Nails | Augmented reality tool for testing nail polish colors and designs. |

| AR Watch Virtual Try-On | Virtual try-on experience for wristwatches using AR technology. |

| AR Ring Virtual Try-On | Augmented reality application to try on rings virtually. |

| AR Bracelet Virtual Try-On | AR technology allowing users to try bracelets on virtually. |

| AR Earring Virtual Try-On | Virtual try-on solution for earrings using augmented reality. |

| YouCam Makeup App | Mobile application for makeup try-on and beauty enhancements. |

| YouCam Perfect App | App providing photo editing and beautification features. |

| YouCam Video App | Video app with beauty and augmented reality effects. |

| YouCam Cut App | Haircut and style simulation app powered by AR. |

| YouCam Nails App | Mobile app focused on nail design and virtual try-on. |

| YouCam Fun App | Entertainment app with AR filters and effects related to beauty and fashion. |

Perfect Corp. specializes in AI and AR-based beauty and fashion technologies, offering a wide range of virtual try-on and analysis tools through both enterprise solutions and consumer apps.

Main Competitors

There are 33 competitors in the Technology sector for Perfect Corp., with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Perfect Corp. ranks 33rd among 33 competitors, with a market cap just 0.07% of the leader Salesforce, Inc. It stands well below both the average market cap of the top 10 competitors (143.6B) and the sector median (18.8B). The company has a significant gap of +94.68% to the next competitor above it, indicating a much smaller scale in this competitive environment.

Does PERF have a competitive advantage?

Perfect Corp. shows a slightly unfavorable competitive advantage as it is currently shedding value with ROIC below WACC, despite demonstrating a growing ROIC trend. The company’s overall profitability is increasing but remains insufficient to create economic profits.

Looking ahead, Perfect Corp. has opportunities to expand through its diverse AI and AR beauty tech solutions, including virtual try-ons and personalized analysis tools. These innovative offerings could help the company tap into new markets and enhance revenue growth potential.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Perfect Corp.’s internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- strong SaaS AI and AR technology portfolio

- high gross margin at 78%

- rapid revenue growth over 100% since 2020

Weaknesses

- negative EBIT margin at -4.7%

- low ROE at 3.4% indicating weak capital efficiency

- Altman Z-score in distress zone signaling financial risk

Opportunities

- expanding global demand for AI-powered beauty tech

- potential to leverage growing AR applications in retail

- increasing digital transformation in fashion and cosmetics sectors

Threats

- intense competition in AI and AR software markets

- technological obsolescence risk

- macroeconomic volatility impacting discretionary tech spending

Overall, Perfect Corp. demonstrates robust growth and innovative strengths but faces profitability and financial stability challenges. Strategic focus should balance accelerating revenue growth with improving operational efficiency and risk management to enhance shareholder value.

Stock Price Action Analysis

The weekly stock chart below illustrates Perfect Corp.’s price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, Perfect Corp.’s stock price declined by 32.0%, indicating a bearish trend. The price range fluctuated between a high of 2.7 and a low of 1.61, with a deceleration in the downward trend. The recent 2.5-month period shows an 11.92% drop, confirming continued bearish momentum with low volatility (std deviation 0.06).

Volume Analysis

Trading volume has been increasing overall, with sellers dominating recent activity, representing 61.76% of trades between November 2025 and January 2026. This seller-driven volume suggests weak investor confidence and increased market participation by those exiting positions.

Target Prices

Analysts present a clear consensus on Perfect Corp.’s target price.

| Target High | Target Low | Consensus |

|---|---|---|

| 7 | 7 | 7 |

The uniform target price of 7 indicates a stable outlook with no expected significant volatility according to current analyst estimates.

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback related to Perfect Corp. to inform investors.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Below is a table presenting the latest verified analyst grades for Perfect Corp., highlighting their recent recommendations and grade changes:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2024-02-29 |

| Goldman Sachs | Maintain | Neutral | 2023-10-26 |

| Piper Sandler | Maintain | Neutral | 2023-10-25 |

| Piper Sandler | Maintain | Neutral | 2023-07-26 |

| Piper Sandler | Maintain | Neutral | 2023-07-25 |

| Piper Sandler | Maintain | Neutral | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-19 |

| Oppenheimer | Downgrade | Perform | 2023-04-18 |

| Piper Sandler | Maintain | Neutral | 2023-03-08 |

The consensus among analysts is stable at a “Hold” rating with no active buy or sell recommendations. Notably, Oppenheimer downgraded from “Outperform” to “Perform” in April 2023, while Piper Sandler consistently maintained a neutral stance throughout the last year.

Consumer Opinions

Consumers have shared a variety of insights about Perfect Corp., reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “The AI-powered beauty tools are incredibly accurate and user-friendly.” | “Some features lag on older devices, causing frustration.” |

| “Customer support is responsive and helpful with troubleshooting.” | “Subscription pricing feels a bit high for casual users.” |

| “The app updates frequently with useful new functionalities.” | “Occasional bugs disrupt the virtual try-on experience.” |

Overall, users appreciate Perfect Corp.’s innovative technology and responsive support but express concerns about device compatibility and subscription costs. Addressing these issues could enhance user satisfaction significantly.

Risk Analysis

Below is a summary table outlining key risks associated with Perfect Corp., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in distress zone indicates elevated bankruptcy risk. | High | High |

| Profitability | Low ROE (3.42%) and negative ROIC (-2.1%) reflect weak profitability and capital efficiency. | Medium | Medium |

| Valuation | High P/E ratio (56.6) signals overvaluation risk. | Medium | Medium |

| Liquidity | Unfavorable current ratio (5.52) despite favorable quick ratio, posing short-term risk. | Low | Medium |

| Market Volatility | Beta of 0.454 suggests lower stock volatility but also limited market responsiveness. | Low | Low |

| Dividend Policy | No dividend yield could deter income-focused investors. | Medium | Low |

| Competitive Risk | Rapid tech changes in AI/AR beauty space demand continuous innovation and investment. | Medium | High |

The most pressing risk is financial distress, as the Altman Z-Score below 1.8 signals high bankruptcy probability despite a favorable debt profile. Coupled with weak profitability metrics and high valuation, investors must exercise caution. The company’s competitive environment requires ongoing innovation to maintain growth.

Should You Buy Perfect Corp.?

Perfect Corp. appears to be improving operational efficiency amid a slightly unfavorable competitive moat, suggesting value destruction despite ROIC growth. Its leverage profile could be seen as manageable, supported by a very favorable A- rating, reflecting a cautiously optimistic financial health.

Strength & Efficiency Pillars

Perfect Corp. exhibits solid profitability with a net margin of 8.34% and a modest but positive gross margin of 77.98%. While return on equity is low at 3.42%, the company maintains a strong balance sheet evidenced by a debt-to-equity ratio of 0.0 and a favorable debt-to-assets ratio of 0.28%. Its weighted average cost of capital (WACC) stands at 5.98%, but the return on invested capital (ROIC) is negative at -2.1%, indicating the firm is currently shedding value. However, the Piotroski score of 6 suggests average financial health, and the Altman Z-score of 1.14 places the company in the distress zone, signaling caution.

Weaknesses and Drawbacks

Significant red flags emerge in valuation and operational efficiency. The price-to-earnings ratio at 56.6 points to a highly premium valuation, raising risk if earnings do not meet expectations. The current ratio of 5.52 is unusually high and flagged as unfavorable, possibly indicating inefficient use of current assets or liquidity management issues. Interest coverage is deeply negative (-406.29), implying challenges in meeting interest obligations despite low interest expense. Additionally, a bearish overall stock trend with a 32% price decline and recent seller dominance at 38.24% volume creates immediate market pressure, underscoring short-term headwinds.

Our Verdict about Perfect Corp.

The long-term fundamental profile of Perfect Corp. may appear mixed to unfavorable due to value destruction and financial distress signals. Despite some profitability and balance sheet strengths, the combination of high valuation multiples and weak operational metrics suggests caution. Given the bearish overall trend and recent seller dominance, despite increasing volume, the situation might suggest a wait-and-see approach to seek a more favorable entry point for investors considering long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Perfect Corp (PERF): Exploring Valuation as Shares Lose Momentum – Yahoo Finance (Oct 21, 2025)

- Perfect Corp.: A Perfect Fit For My AI Small-Cap Pocket (NYSE:PERF) – Seeking Alpha (Dec 15, 2025)

- Perfect Corp. Unveils Range of New Modular APIs to Power Next Generation of Fashion Virtual Try-On Experiences Powered by Generative AI – Business Wire (Jan 15, 2026)

- Perfect Corp. (NYSE:PERF) Short Interest Update – MarketBeat (Jan 13, 2026)

- Perfect Corp. Partners with PHOENIX Pharma Italia to Launch AI Skin Analysis and Product Recommendation Experience Powered by Skincare Pro in Pharmacies – Morningstar (Jan 08, 2026)

For more information about Perfect Corp., please visit the official website: perfectcorp.com