Home > Analyses > Industrials > Pentair plc

Pentair plc transforms how industries and homes manage water, delivering solutions that touch daily life globally. Its leadership in industrial machinery spans advanced filtration systems, pumps, and water treatment technologies under renowned brands like Everpure and Sta-Rite. Pentair’s innovation drives efficiency in residential pools to complex wastewater treatment. As the water sector evolves, I ask: does Pentair’s robust market position and product portfolio still justify its current valuation and growth expectations?

Table of contents

Business Model & Company Overview

Pentair plc, founded in 1966 and headquartered in London, stands as a global leader in industrial machinery focused on water solutions. Its integrated ecosystem spans residential pools, commercial water treatment, and complex industrial fluid management. The company’s diverse portfolio under brands like Everpure, Sta-Rite, and Pentair Water Solutions forms a cohesive mission to enhance water quality and flow across markets.

Pentair’s revenue engine balances durable hardware—pumps, valves, filtration systems—with specialized industrial and consumer solutions. It serves critical sectors in the Americas, Europe, and Asia, blending one-time sales with recurring maintenance and service contracts. This strategic diversification builds a formidable economic moat, positioning Pentair as a key architect of water management technologies worldwide.

Financial Performance & Fundamental Metrics

I analyze Pentair plc’s income statement, key financial ratios, and dividend payout policy to reveal its underlying financial health and shareholder value approach.

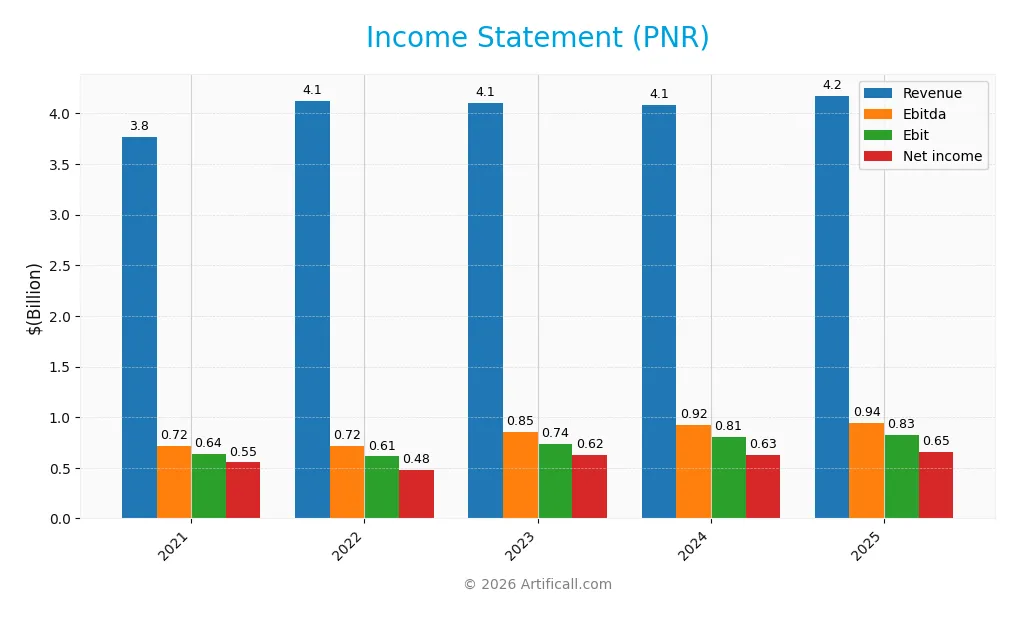

Income Statement

The table below summarizes Pentair plc’s key income statement figures over the past five fiscal years, reflecting revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.76B | 4.12B | 4.10B | 4.08B | 4.18B |

| Cost of Revenue | 2.45B | 2.76B | 2.59B | 2.48B | 2.49B |

| Operating Expenses | 682.3M | 769.3M | 780.0M | 795.0M | 832.8M |

| Gross Profit | 1.32B | 1.36B | 1.52B | 1.60B | 1.69B |

| EBITDA | 717M | 719M | 852M | 922M | 944M |

| EBIT | 639M | 612M | 737M | 808M | 826M |

| Interest Expense | 12.5M | 61.8M | 118.3M | 88.6M | 69.4M |

| Net Income | 553M | 481M | 623M | 625M | 654M |

| EPS | 3.34 | 2.92 | 3.77 | 3.78 | 3.99 |

| Filing Date | 2022-02-22 | 2023-02-21 | 2024-02-20 | 2025-02-25 | 2026-02-03 |

Income Statement Evolution

Pentair’s revenue rose moderately by 2.3% in 2025 to $4.18B, continuing a favorable 10.9% growth since 2021. Gross profit expanded faster at 5.7%, improving the gross margin to 40.5%. Operating expenses grew in line with revenue. EBIT margin stabilized near 19.8%, supporting steady net income growth and margin expansion over the period.

Is the Income Statement Favorable?

In 2025, Pentair delivered $654M net income, translating to a 15.7% net margin, which is favorable compared to industry benchmarks. Interest expense remained low at 1.7% of revenue, supporting healthy profitability. EPS rose 5.9%, reflecting efficient capital allocation. Overall, the income statement fundamentals appear solid, with strong margin improvements offsetting modest revenue growth.

Financial Ratios

The following table summarizes key financial ratios for Pentair plc over the past five fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 15% | 12% | 15% | 15% | 16% |

| ROE | 23% | 18% | 19% | 18% | 17% |

| ROIC | 15% | 10% | 13% | 13% | 12% |

| P/E | 22 | 15 | 19 | 27 | 26 |

| P/B | 5.0 | 2.7 | 3.7 | 4.7 | 4.4 |

| Current Ratio | 1.24 | 1.47 | 1.65 | 1.60 | 1.61 |

| Quick Ratio | 0.70 | 0.72 | 0.94 | 0.92 | 0.95 |

| D/E | 0.41 | 0.89 | 0.65 | 0.50 | 0.42 |

| Debt-to-Assets | 21% | 37% | 32% | 27% | 24% |

| Interest Coverage | 51 | 10 | 6 | 9 | 12 |

| Asset Turnover | 0.79 | 0.64 | 0.63 | 0.63 | 0.61 |

| Fixed Asset Turnover | 9.5 | 9.7 | 8.8 | 8.6 | 11.1 |

| Dividend Yield | 1.1% | 1.9% | 1.2% | 0.9% | 1.0% |

Evolution of Financial Ratios

From 2021 to 2025, Pentair’s Return on Equity (ROE) showed a general decline from 22.8% to 16.9%, indicating moderated profitability. The Current Ratio improved steadily, rising from 1.24 to 1.61, enhancing liquidity. Debt-to-Equity Ratio notably decreased from 0.65 in 2023 to 0.42 in 2025, reflecting lower leverage and improved financial stability.

Are the Financial Ratios Favorable?

Pentair’s 2025 ratios show favorable profitability with a 15.7% net margin and ROE of 16.9%, exceeding many sector averages. Liquidity is solid, supported by a current ratio of 1.61, though the quick ratio remains neutral at 0.95. Leverage is conservative, with a debt-to-equity ratio of 0.42 and strong interest coverage near 12x. Market valuation ratios like P/E at 26.1 and dividend yield below 1% are less favorable. Overall, the financial profile is predominantly favorable but with valuation and yield risks.

Shareholder Return Policy

Pentair plc maintains a consistent dividend policy with a payout ratio near 25% and a yield around 0.96%. The dividend per share has steadily increased, supported by robust free cash flow coverage above 90%. The company also executes share buybacks, enhancing shareholder value.

This balanced approach aligns dividend distributions with sustainable cash generation, avoiding excessive payouts or buybacks. Such discipline supports long-term value creation while preserving financial flexibility amid market cycles and operational demands.

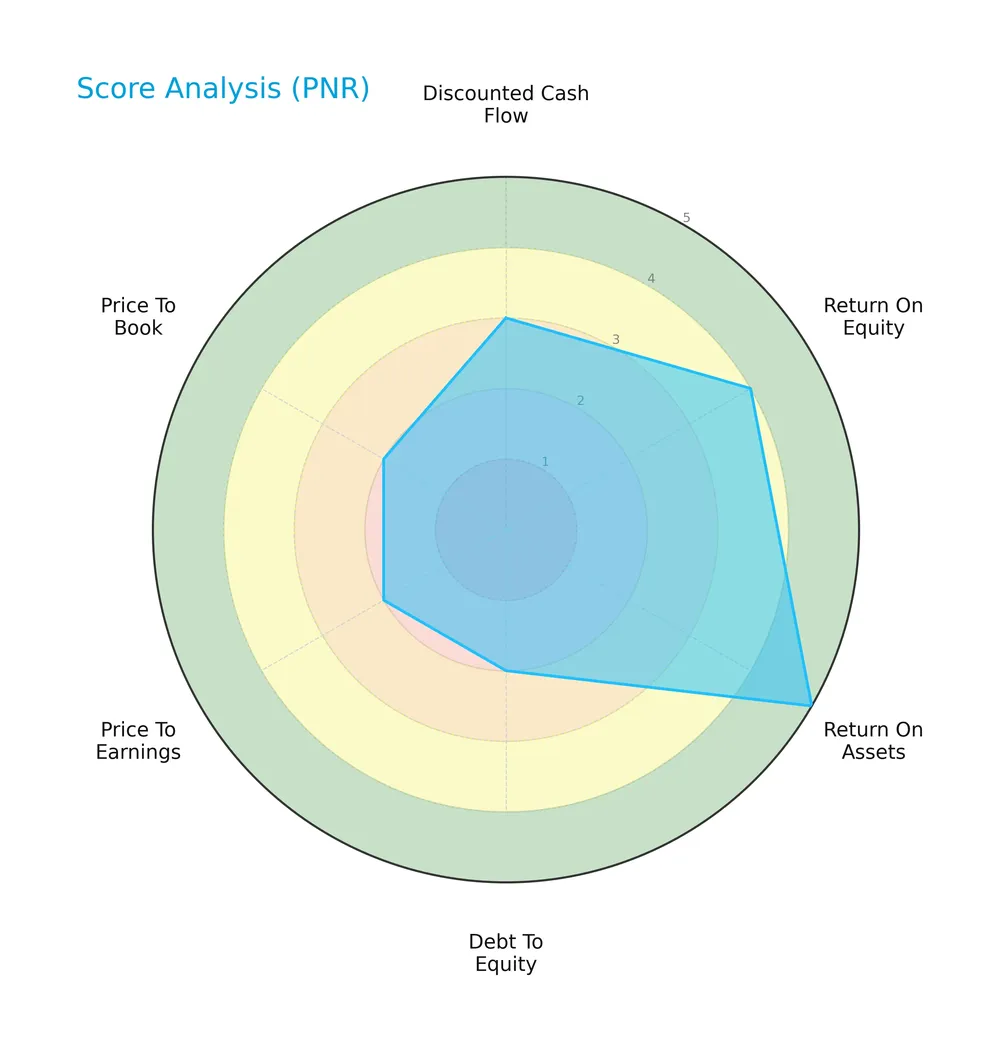

Score analysis

The radar chart below illustrates Pentair plc’s key financial scores across valuation, profitability, and leverage metrics:

Pentair shows a moderate discounted cash flow score and moderate leverage, with favorable ROE and very favorable ROA scores. Valuation metrics (PE and PB) remain moderate, indicating balanced market expectations.

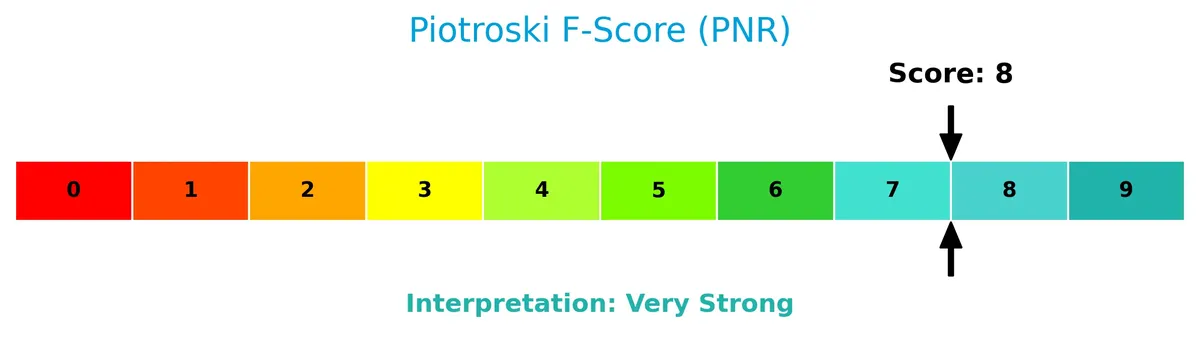

Analysis of the company’s bankruptcy risk

Pentair’s Altman Z-Score of 4.21 places it firmly in the safe zone, signaling low bankruptcy risk and strong financial stability:

Is the company in good financial health?

The Piotroski Score diagram highlights Pentair’s robust financial health, reflecting strength across profitability, leverage, and liquidity:

With a very strong Piotroski Score of 8, Pentair demonstrates solid financial fundamentals, supporting its overall investment quality.

Competitive Landscape & Sector Positioning

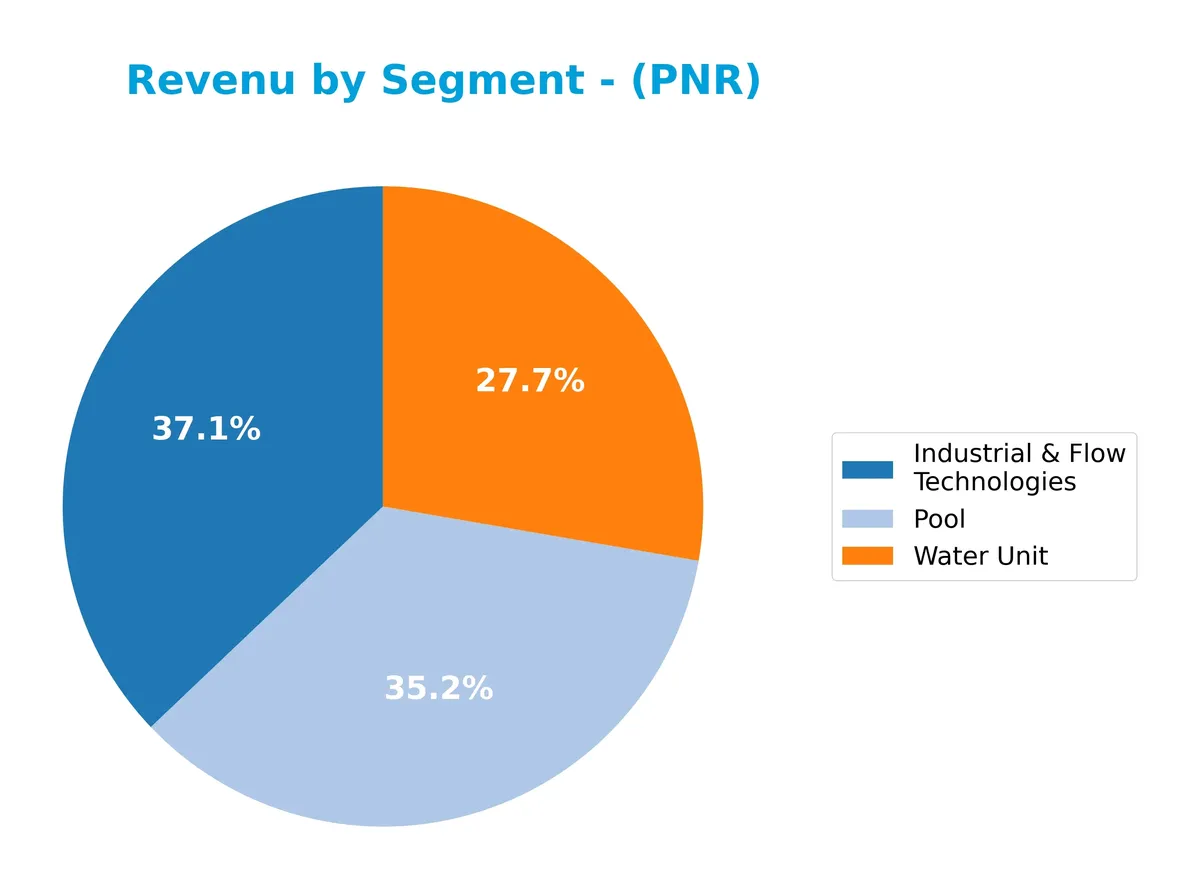

This analysis examines Pentair plc’s sector positioning, revenue segments, key products, and main competitors. I will assess whether Pentair holds a competitive advantage over its industry peers.

Strategic Positioning

Pentair plc maintains a diversified product portfolio spanning Consumer Solutions and Industrial & Flow Technologies segments, generating roughly balanced revenues near $4.2B in 2024. Geographically, it relies heavily on the U.S. market ($2.8B), supplemented by Western Europe and developing countries, reflecting broad but U.S.-centered exposure.

Revenue by Segment

This pie chart illustrates Pentair plc’s revenue distribution by business segment for the full fiscal year 2024.

In 2024, Industrial & Flow Technologies led with $1.51B, closely followed by Pool at $1.44B and Water Unit at $1.13B. The shift from Water Solutions to Water Unit reflects rebranding or restructuring. Industrial & Flow Technologies remains the core driver, showing steady growth. Pool segment also accelerated, signaling stronger demand. The revenue spread suggests moderate concentration risk, reliant on these three segments.

Key Products & Brands

The table below outlines Pentair plc’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| Consumer Solutions | Residential and commercial pool equipment and water treatment products, including pumps, filters, heaters, cleaners, and water softening systems. Brands: Everpure, Ken’s Beverage, Kreepy Krauly, Pentair Water Solutions, Pleatco, RainSoft, Sta-Rite. |

| Industrial & Flow Technologies | Fluid treatment products such as membrane filtration, pumps, valves, spray nozzles, and process filtration systems for various industrial applications. Brands: Pentair, Aurora, Berkeley, Codeline, Fairbanks-Nijhuis, Haffmans, Hydromatic, Hypro, Jung Pumpen, Myers, Sta-Rite, Shurflo, Südmo, X-Flow. |

Pentair operates through two main segments: Consumer Solutions focuses on pool and water treatment equipment under multiple established brands. Industrial & Flow Technologies delivers advanced fluid management and filtration solutions across diverse industries, leveraging a broad brand portfolio.

Main Competitors

The Industrials sector includes 24 competitors; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

Pentair plc ranks 15th among 24 competitors in Industrial – Machinery. Its market cap equals 12.2% of Eaton Corporation’s, the sector leader. Pentair sits below the 72.4B average market cap of the top 10 and under the sector median of 32.4B. It holds a +72.75% market cap gap from the next closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Pentair have a competitive advantage?

Pentair demonstrates a slight competitive advantage, creating value with a ROIC exceeding its WACC by 3.5%, despite a declining ROIC trend. Its favorable income margins and steady net income growth support this position.

Looking ahead, Pentair’s diverse water solutions portfolio and global footprint position it to capture opportunities in residential, commercial, and industrial water treatment markets. Expansion in developing countries and innovation in filtration technologies offer potential growth avenues.

SWOT Analysis

This SWOT analysis distills Pentair plc’s competitive position to guide strategic investment decisions.

Strengths

- strong global brand portfolio

- favorable margins with 40.5% gross margin

- solid value creation with ROIC above WACC

Weaknesses

- declining ROIC trend signals profitability pressure

- moderate revenue growth of 2.3% last year

- high valuation multiples with PE at 26.1

Opportunities

- expanding water treatment markets in developing countries

- growing demand for sustainable industrial solutions

- innovation in filtration and fluid technologies

Threats

- cyclical industrial sector risks

- rising raw material and energy costs

- competitive pressure from global and regional players

Pentair’s strengths in profitability and brand equity underpin its value creation. However, slowing growth and declining returns require strategic focus on innovation and market expansion to mitigate industrial headwinds.

Stock Price Action Analysis

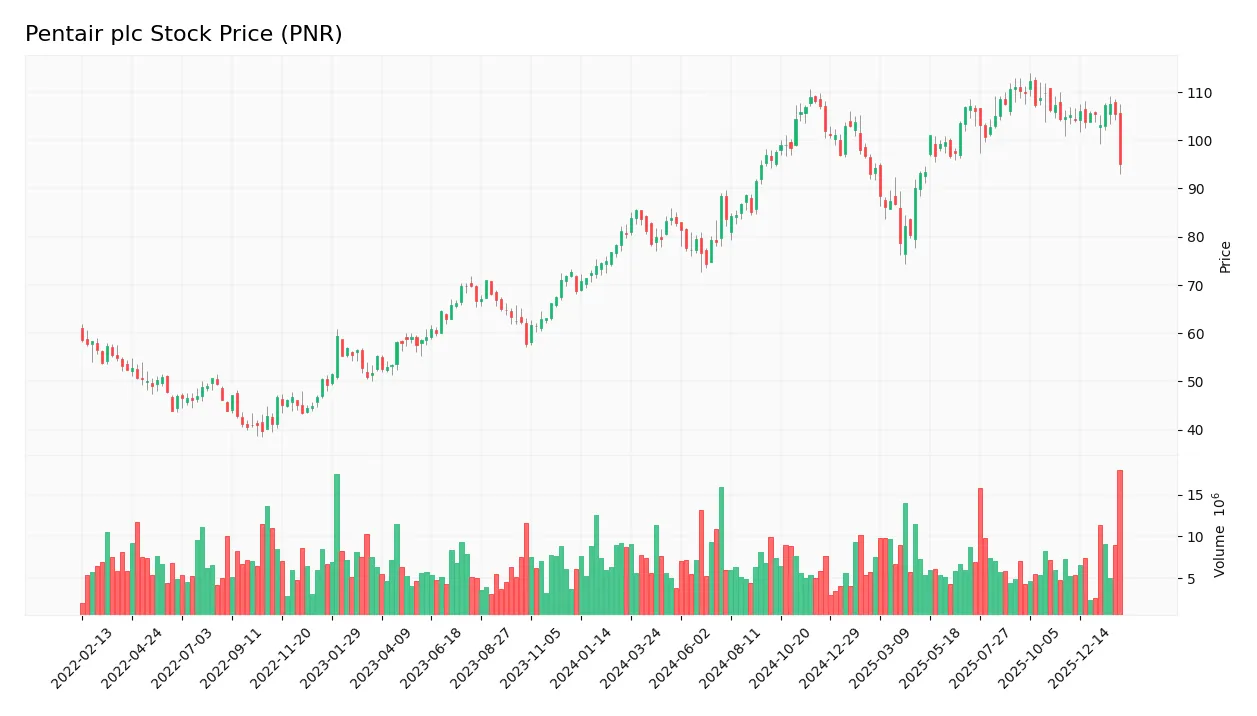

The following weekly chart illustrates Pentair plc’s stock price movements over the past 100 weeks, revealing key support and resistance levels:

Trend Analysis

Over the past 12 months, PNR’s stock price rose 17.78%, confirming a bullish trend despite decelerating momentum. The price ranged between 74.39 and 112.23, with a volatility level marked by a 10.7 standard deviation, indicating notable price fluctuations.

Volume Analysis

Total trading volume reached 854M shares, with buyers accounting for 56%. However, volume has been decreasing overall. In the recent three months, seller dominance intensified, with buyers at 40%, signaling cautious investor sentiment amid declining market participation.

Target Prices

Analysts set a clear target consensus for Pentair plc, signaling bullish expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 90 | 135 | 118.56 |

The target range spans from 90 to 135, with a consensus near 119, reflecting optimism about Pentair’s growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Pentair plc’s recent analyst ratings and consumer feedback to gauge market sentiment and customer satisfaction.

Stock Grades

Here are the latest verified stock grades from leading financial institutions for Pentair plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-04 |

| Oppenheimer | Maintain | Outperform | 2026-02-04 |

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-12 |

| BNP Paribas Exane | Downgrade | Underperform | 2026-01-07 |

| TD Cowen | Downgrade | Sell | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-10 |

| Barclays | Downgrade | Equal Weight | 2025-12-04 |

| Oppenheimer | Maintain | Outperform | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-10-22 |

The overall trend shows a mixed consensus, with a majority of firms maintaining positive ratings such as Buy and Outperform. However, recent downgrades to Underperform and Sell signal rising caution among some analysts.

Consumer Opinions

Pentair plc garners mixed yet insightful consumer sentiments, reflecting its operational strengths and areas needing attention.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable water treatment solutions | Customer service response times can lag |

| Durable, high-quality products | Installation process sometimes complex |

| Strong focus on sustainability | Pricing perceived as premium by some clients |

Overall, consumers appreciate Pentair’s product durability and sustainability focus. However, recurring criticism targets customer service delays and occasional installation challenges, suggesting areas for operational improvement.

Risk Analysis

Below is a summary of key risk factors affecting Pentair plc’s business and financial position:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Beta of 1.22 indicates moderately higher sensitivity to overall market swings. | Medium | Medium |

| Valuation Risk | Elevated P/E of 26.1 and P/B of 4.42 suggest the stock trades at a premium, increasing downside risk. | High | High |

| Liquidity Risk | Quick ratio near 1.0 signals tight short-term liquidity, potentially limiting flexibility. | Medium | Medium |

| Debt Risk | Debt-to-equity ratio of 0.42 is manageable but requires monitoring amid rising interest rates. | Low | Medium |

| Dividend Yield | Modest yield of 0.96% may disappoint income-focused investors during market stress. | Medium | Low |

| Economic Cycles | Industrial machinery demand can contract sharply during recessions, affecting revenue. | Medium | High |

The most significant risks are valuation and cyclical demand. Pentair’s premium multiples amplify downside in a market correction. Historically, industrial firms face sharp earnings swings in downturns. Despite strong financial health—evidenced by a safe Altman Z-score (4.21) and robust Piotroski score (8)—these external risks warrant cautious position sizing.

Should You Buy Pentair plc?

Pentair appears to be a moderately profitable company with a slightly favorable competitive moat, evidenced by value creation despite a declining ROIC trend. Its leverage profile seems manageable, supporting a very favorable B+ rating, suggesting a balanced risk-return profile for investors.

Strength & Efficiency Pillars

Pentair plc exhibits robust profitability with a net margin of 15.66% and a return on equity of 16.9%. Its return on invested capital stands at 12.46%, comfortably above the weighted average cost of capital at 8.96%, confirming the company as a clear value creator. Financial health is solid, supported by an Altman Z-Score of 4.21 in the safe zone and a very strong Piotroski score of 8. These metrics underscore Pentair’s efficiency in capital allocation and operational strength.

Weaknesses and Drawbacks

Pentair faces valuation challenges, with a high price-to-earnings ratio of 26.14 and a price-to-book ratio of 4.42, signaling a premium that may constrain upside potential. The dividend yield is modest at 0.96%, which could limit income appeal. Market dynamics have shifted recently, evidenced by seller dominance at 60.24% and a price decline of 9.37% since late 2025. These factors introduce short-term risks amid a backdrop of decelerating momentum.

Our Verdict about Pentair plc

Pentair’s long-term fundamentals appear favorable, driven by strong profitability and financial stability. However, recent market pressure and seller dominance suggest caution. Despite its value-creating profile, investors might consider a wait-and-see approach until price action stabilizes or presents a more attractive entry point. The combination of premium valuation and short-term weakness tempers enthusiasm for immediate commitment.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Pentair plc (PNR) Beats Q4 Earnings and Revenue Estimates – Yahoo Finance (Feb 03, 2026)

- Pentair Q4 Earnings & Sales Surpass Estimates, Increase Y/Y – TradingView (Feb 05, 2026)

- Allianz Asset Management GmbH Sells 195,671 Shares of Pentair plc $PNR – MarketBeat (Feb 04, 2026)

- Pentair PLC (NYSE:PNR) Beats Q4 Estimates and Raises Dividend Amid Mixed Segment Results – Chartmill (Feb 03, 2026)

- Pentair shares slide on water segment sales drop and residential restructuring (PNR:NYSE) – Seeking Alpha (Feb 03, 2026)

For more information about Pentair plc, please visit the official website: pentair.com