Home > Analyses > Technology > Paycom Software, Inc.

Paycom Software, Inc. revolutionizes how businesses manage their workforce by integrating human capital management into a seamless cloud platform. Its cutting-edge software empowers small to mid-sized companies with tools that streamline recruitment, payroll, and compliance, reshaping the employee lifecycle. Renowned for innovation and robust analytics, Paycom commands respect in the fast-evolving HR tech space. The critical question: does its current valuation reflect sustainable growth amid intensifying competition and market shifts?

Table of contents

Business Model & Company Overview

Paycom Software, Inc., founded in 1998 and headquartered in Oklahoma City, dominates the US human capital management (HCM) software sector. Its cloud-based HCM ecosystem integrates recruitment, payroll, talent management, and compliance into a seamless platform. This unified approach simplifies the employment lifecycle for small to mid-sized companies, enhancing operational efficiency and workforce insight.

Paycom’s revenue engine balances software-as-a-service subscriptions with advanced data analytics and proprietary tools like Microfence. Its strong foothold in the Americas drives steady recurring revenue from payroll and talent solutions. I see its competitive advantage in scalable innovation and deep customer integration, creating a robust economic moat that shapes the future of workforce management technology.

Financial Performance & Fundamental Metrics

I will analyze Paycom Software, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its underlying financial health and growth potential.

Income Statement

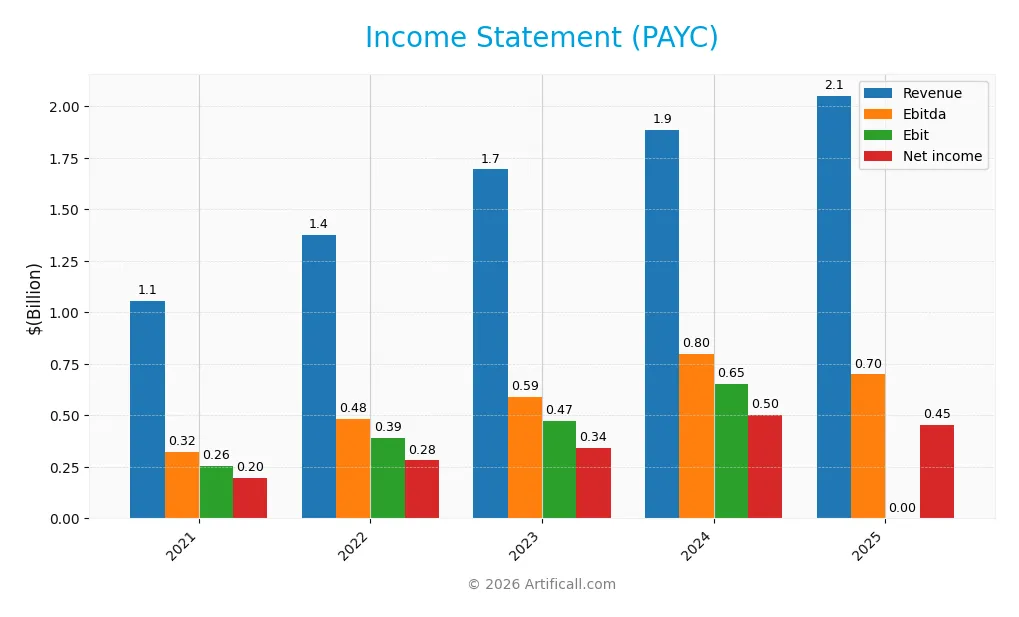

The table below summarizes Paycom Software, Inc.’s key income statement figures for fiscal years 2021 through 2025, providing a clear view of its financial performance.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.06B | 1.38B | 1.69B | 1.88B | 2.05B |

| Cost of Revenue | 162M | 213M | 276M | 335M | 345M |

| Operating Expenses | 640M | 784M | 966M | 914M | 1.05B |

| Gross Profit | 894M | 1.16B | 1.42B | 1.55B | 1.71B |

| EBITDA | 323M | 485M | 588M | 798M | 698M |

| EBIT | 256M | 392M | 474M | 652M | 0 |

| Interest Expense | 0 | 3M | 2M | 3M | 3M |

| Net Income | 196M | 281M | 341M | 502M | 453M |

| EPS | 3.39 | 4.86 | 5.91 | 8.93 | 8.13 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-20 | 2026-02-11 |

Income Statement Evolution

Paycom Software, Inc. shows robust revenue growth, rising 95% from 2021 to 2025. Net income surged 131% over the same period, highlighting strong profitability expansion. Gross margins remain consistently high near 83%, while net margins improved by 19%, although operating income declined sharply in the last year, signaling margin pressure.

Is the Income Statement Favorable?

In 2025, revenue grew 9% year-over-year to $2.05B, with gross profit up 10% to $1.71B. Despite rising operating expenses matching revenue growth, net income declined 10% to $453M, compressing net margin to 22.1%. Favorable gross margin and interest expense contrast with an unfavorable EBIT margin of zero, presenting a mixed but generally favorable income statement.

Financial Ratios

The following table summarizes key financial ratios for Paycom Software, Inc. over the past five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 18.6% | 20.5% | 20.1% | 26.7% | 22.1% |

| ROE | 21.9% | 23.8% | 26.2% | 31.9% | 0% |

| ROIC | 15.8% | 17.9% | 19.4% | 24.9% | 0% |

| P/E | 123 | 64 | 35 | 23 | 20 |

| P/B | 26.9 | 15.2 | 9.2 | 7.3 | 0 |

| Current Ratio | 1.13 | 1.16 | 1.11 | 1.10 | 0 |

| Quick Ratio | 1.13 | 1.16 | 1.11 | 1.10 | 0 |

| D/E | 0.03 | 0.02 | 0.06 | 0.05 | 0 |

| Debt-to-Assets | 0.9% | 0.7% | 1.8% | 1.4% | 0 |

| Interest Coverage | 0 | 151.5 | 237.5 | 186.6 | -166.8 |

| Asset Turnover | 0.33 | 0.35 | 0.40 | 0.32 | 0 |

| Fixed Asset Turnover | 3.02 | 3.42 | 2.96 | 2.93 | 0 |

| Dividend Yield | 0% | 0% | 0.54% | 0.74% | 0.95% |

Evolution of Financial Ratios

Over 2021-2025, Paycom’s profitability showed mixed trends. Net profit margin improved to 22.1% in 2025 from 18.6% in 2021 but declined from a 26.7% peak in 2024. The current ratio remained stable around 1.1 until 2024 but dropped to zero in 2025. Debt-to-equity stayed minimal, indicating low leverage and stable capital structure.

Are the Financial Ratios Favorable?

The 2025 ratios show a favorable net margin and low debt levels, supporting financial stability. However, zero values in current and quick ratios, alongside negative interest coverage, raise liquidity and solvency concerns. Market valuation metrics like P/E at 19.6 are neutral, but overall, the ratio profile is unfavorable due to weak liquidity and efficiency indicators.

Shareholder Return Policy

Paycom Software, Inc. pays dividends with a payout ratio near 19%, yielding just under 1%. Dividend per share has steadily increased, supported by robust free cash flow and modest capital expenditures, indicating disciplined capital allocation. The company also conducts share buybacks, enhancing shareholder value.

This balanced approach aligns with sustainable long-term value creation. The dividend yield remains low compared to market averages, suggesting retention of earnings for growth. The combination of dividends and buybacks reflects prudent financial management without risking excessive distributions.

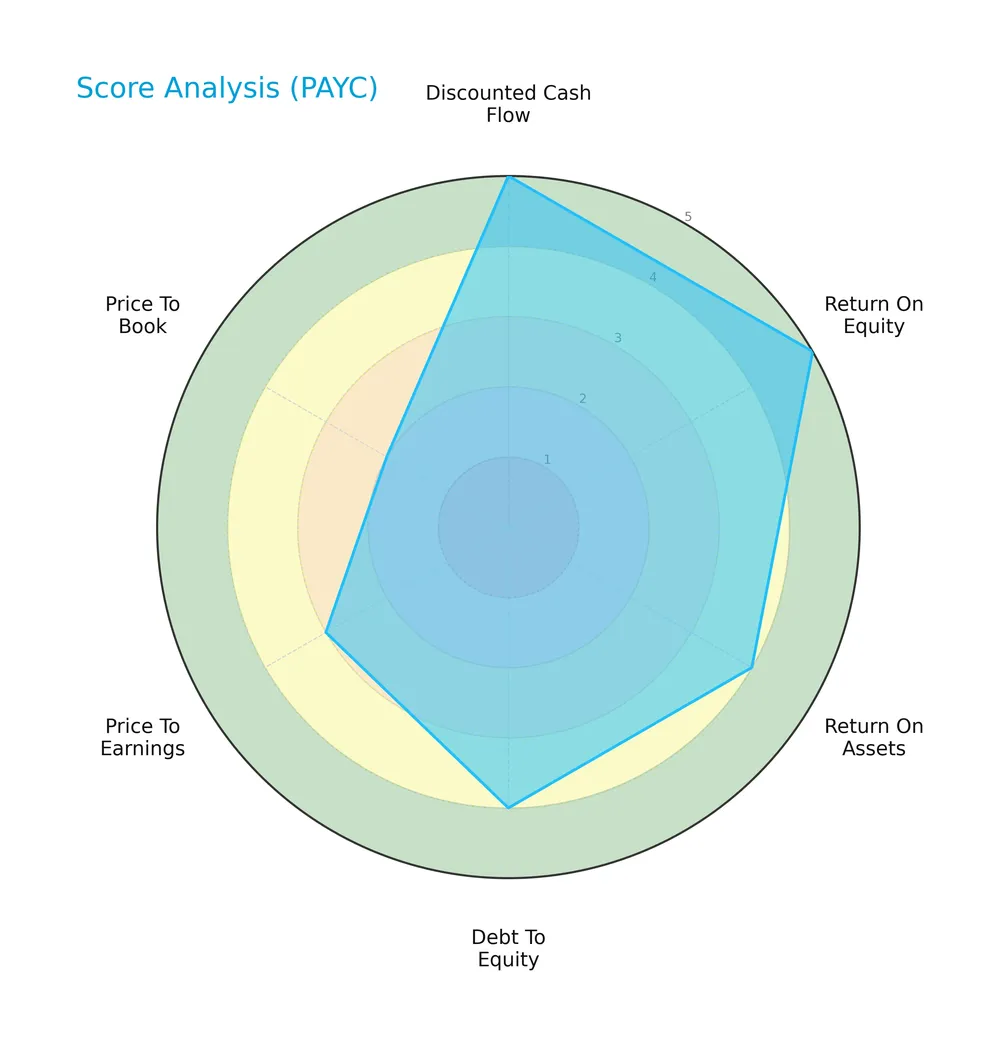

Score analysis

The radar chart below illustrates Paycom Software, Inc.’s key financial scores across valuation and performance metrics:

Paycom scores very favorably on discounted cash flow and return on equity, indicating strong profitability and valuation. Return on assets and debt-to-equity are favorable, showing efficient asset use and manageable leverage. Price-to-earnings is moderate, while price-to-book is unfavorable, suggesting valuation concerns in book value terms.

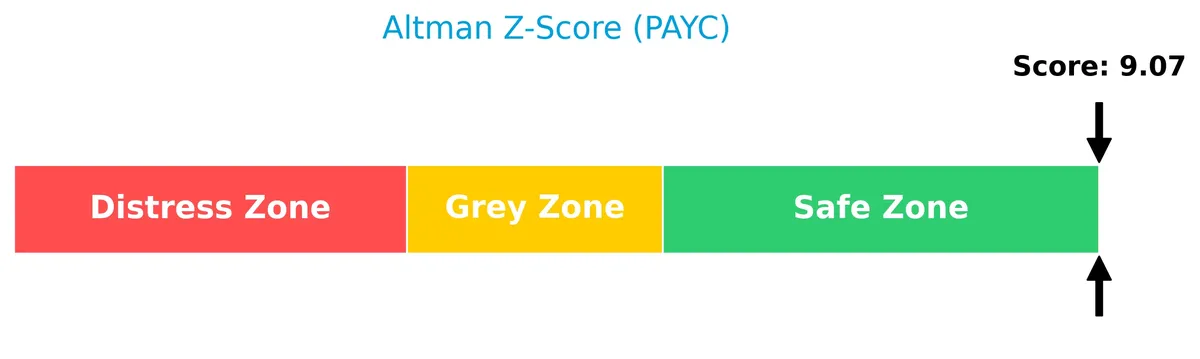

Analysis of the company’s bankruptcy risk

Paycom’s Altman Z-Score firmly places it in the safe zone, signaling very low bankruptcy risk and financial stability:

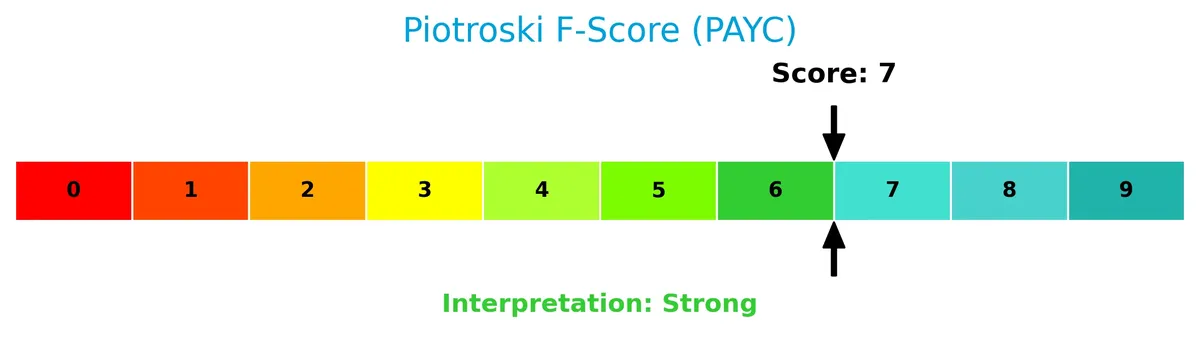

Is the company in good financial health?

The Piotroski Score diagram highlights Paycom’s solid financial strength according to nine key criteria:

With a strong Piotroski Score of 7, Paycom demonstrates robust profitability, liquidity, and operational efficiency, indicating good financial health overall.

Competitive Landscape & Sector Positioning

This sector analysis will examine Paycom Software, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Paycom holds a sustainable competitive advantage in its market.

Strategic Positioning

Paycom Software, Inc. concentrates on cloud-based human capital management solutions, generating over 98% of revenue from recurring software services. Its product portfolio focuses on end-to-end employment lifecycle management for U.S. small to mid-sized companies, reflecting a specialized and geographically concentrated strategy.

Revenue by Segment

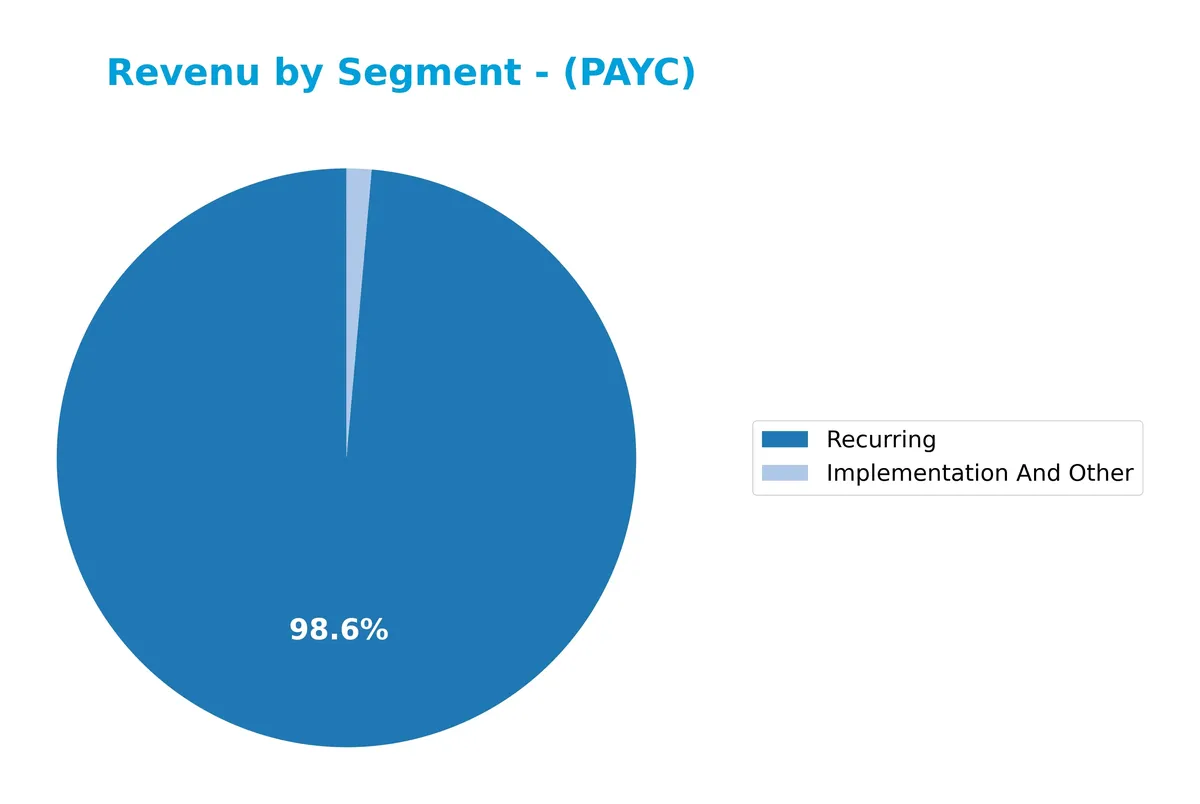

This pie chart illustrates Paycom Software, Inc.’s revenue breakdown by segment from 2018 through 2024, highlighting the composition between Recurring and Implementation And Other revenue streams.

Paycom’s revenue base is overwhelmingly driven by its Recurring segment, which grew from $557M in 2018 to $1.73B in 2024. Implementation And Other remains a small but steady contributor, increasing modestly to $24M in 2024. The data reveals accelerating growth in Recurring revenue, reflecting strong customer retention and expanding service adoption. The company’s heavy concentration in Recurring revenue underscores its subscription-based business model but also signals concentration risk if market dynamics shift.

Key Products & Brands

The following table outlines Paycom Software, Inc.’s principal products and brand offerings:

| Product | Description |

|---|---|

| Human Capital Management (HCM) Solution | Cloud-based SaaS platform for managing the entire employment lifecycle from recruitment to retirement for US SMBs. |

| Talent Acquisition | Modules include applicant tracking, candidate tracker, background checks, onboarding, e-verify, and tax credit services. |

| Time and Labor Management | Features time and attendance, scheduling, time-off requests, labor allocation, geofencing, and Microfence Bluetooth. |

| Payroll Applications | Handles employee transactions, payroll and tax management, expense and mileage tracking, garnishment, and GL concierge. |

| Talent Management | Includes employee self-service, compensation budgeting, performance and position management, learning subscriptions, and analytics. |

| Manager On-the-Go | Mobile tools for supervisors to approve requests, communicate, manage compliance, benefits, personnel actions, and surveys. |

| Clue | Secure workforce vaccination and testing data collection, tracking, and management application. |

| Implementation and Other Services | Non-recurring revenue from setup and additional services supporting product deployment and usage. |

| Recurring Revenue | Subscription-based income primarily from ongoing access to the HCM platform and associated modules. |

Paycom’s offerings center on a comprehensive HCM suite that integrates payroll, talent acquisition, time management, and compliance tools. Its recurring revenue stream dominates, reflecting strong customer retention and SaaS model stability.

Main Competitors

Paycom Software, Inc. faces competition from 33 companies, with the following top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 84B |

| Snowflake Inc. | 73B |

| Autodesk, Inc. | 61B |

| Workday, Inc. | 55B |

Paycom ranks 25th among 33 competitors, with a market cap just 2.78% of Salesforce’s. It sits well below both the average market cap of the top 10 (143B) and the sector median (18.7B). The company holds a 48% premium over the next competitor above, highlighting a meaningful gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PAYC have a competitive advantage?

Paycom Software, Inc. offers a comprehensive cloud-based human capital management suite with strong gross and net margins, reflecting operational efficiency and market relevance. However, its declining ROIC trend and unavailable ROIC vs. WACC data obscure clear evidence of a sustainable economic moat.

Looking ahead, Paycom’s integrated talent acquisition and payroll solutions position it well to capture growth in small to mid-sized U.S. companies. Continued innovation in analytics and mobile management tools could unlock new market opportunities despite recent margin pressures.

SWOT Analysis

This analysis highlights Paycom Software’s core competitive position and challenges for strategic decision-making.

Strengths

- strong 83% gross margin

- solid 22% net margin

- safe Altman Z-score at 9.07

Weaknesses

- declining ROIC trend

- unfavorable EBIT margin

- weak liquidity ratios

Opportunities

- expanding cloud HCM market

- growing demand for data analytics

- potential for cross-selling services

Threats

- intense software competition

- margin pressure from rising OPEX

- regulatory compliance risks

Paycom’s robust profitability and financial health provide a strong foundation. However, declining returns and operational inefficiencies require focus. The company must leverage market growth and analytics capabilities while managing competitive and regulatory threats carefully.

Stock Price Action Analysis

The weekly stock chart for Paycom Software, Inc. (PAYC) reveals significant price movements and volatility over the last 12 months:

Trend Analysis

Over the past year, PAYC’s stock price fell sharply by 37.78%, signaling a bearish trend. The decline slowed recently, indicating a deceleration phase. The stock reached a high of 265.71 and bottomed at 119.76, with a high volatility level of 34.15% standard deviation.

Volume Analysis

Trading volume over the last three months shows a clear seller dominance, with buyers accounting for only 23.6% of activity. Volume has decreased, reflecting waning market participation and bearish investor sentiment during this period.

Target Prices

Analysts set a target consensus reflecting tempered optimism for Paycom Software, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 115 | 210 | 152 |

The target range indicates expectations of substantial upside potential balanced by caution. Analysts foresee growth but acknowledge market volatility risks.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback related to Paycom Software, Inc.’s recent market performance and reputation.

Stock Grades

Here are the latest verified stock grades from established financial institutions for Paycom Software, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Market Perform | 2026-02-12 |

| Mizuho | Maintain | Neutral | 2026-02-12 |

| BTIG | Maintain | Buy | 2026-02-12 |

| Keybanc | Maintain | Overweight | 2026-02-12 |

| Barclays | Maintain | Equal Weight | 2026-02-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-12 |

| Guggenheim | Maintain | Buy | 2026-02-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-29 |

| UBS | Maintain | Buy | 2026-01-26 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

The grades mostly reflect a balanced stance, with a consensus leaning toward Hold. Buy recommendations remain significant but are matched by numerous Neutral and Equal Weight ratings, indicating cautious optimism among analysts.

Consumer Opinions

Consumers express a mix of admiration and frustration toward Paycom Software, Inc., reflecting its impact on payroll technology.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive interface simplifies payroll | Customer support response times lag |

| Streamlines HR processes efficiently | Occasional software glitches |

| Robust reporting features | Learning curve for new users |

| Regular updates improve functionality | High subscription costs |

Overall, users praise Paycom for its powerful automation and reporting tools. However, slow customer service and occasional bugs remain persistent concerns.

Risk Analysis

Below is a summary of key risks facing Paycom Software, Inc., highlighting their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Ratios | Several critical ratios such as ROE, ROIC, current and quick ratios are unfavorable or zero. | Medium | High |

| Market Volatility | Stock price range is wide (106.76-267.76), showing significant price swings. | High | Medium |

| Dividend Yield | Low dividend yield of 0.95%, potentially limiting income appeal for dividend-focused investors. | Medium | Low |

| Debt & Interest Risk | Low debt levels but negative interest coverage ratio signals potential earnings pressure. | Low | Medium |

| Industry Competition | Intense competition in cloud-based HCM solutions could pressure margins and growth. | Medium | High |

| Valuation | Price-to-earnings is neutral at 19.61, but price-to-book is unfavorable at zero, indicating valuation concerns. | Medium | Medium |

Financially, Paycom’s Altman Z-Score of 9.07 places it firmly in the safe zone, signaling low bankruptcy risk. Its Piotroski score of 7 denotes strong financial health. However, unfavorable profitability ratios such as zero ROE and ROIC highlight operational challenges. The wide trading range suggests market uncertainty. Investors should weigh these risks carefully despite the company’s strong market position and growth prospects.

Should You Buy Paycom Software, Inc.?

Paycom Software, Inc. appears to be a company with robust profitability and strong operational efficiency, supported by a manageable leverage profile. While its competitive moat shows signs of decline, the overall rating remains very favorable, suggesting a solid financial position.

Strength & Efficiency Pillars

Paycom Software, Inc. maintains a strong profitability profile with a net margin of 22.1%, reflecting solid operational control. The company’s Piotroski Score of 7 indicates strong financial health and efficient capital allocation. Although specific ROIC and WACC data are unavailable, the safe zone Altman Z-Score of 9.07 confirms robust solvency. Historical revenue growth of 94.4% over five years and 131.4% net income growth underscore Paycom’s capability to scale profitably in a competitive market environment.

Weaknesses and Drawbacks

Despite solvency strength, Paycom faces notable weaknesses. The bearish stock trend, with a price drop of 37.8% overall and 25.7% recently, signals market skepticism. Buyer dominance has slipped to 23.6%, indicating seller pressure. Valuation metrics are mixed: a neutral P/E of 19.61 contrasts with an unfavorable P/B ratio. Liquidity ratios, including current and quick ratios, are absent or unfavorable, posing short-term liquidity concerns. Additionally, the interest coverage ratio is negative, which raises red flags about debt-servicing capacity.

Our Final Verdict about Paycom Software, Inc.

Paycom presents a fundamentally strong profile with solid profitability and no immediate insolvency risk, supported by a robust Altman Z-Score. However, the current bearish momentum and seller dominance suggest caution. Despite long-term operational strength, the recent market pressure may warrant a wait-and-see approach for better entry points. Overall, Paycom might appear attractive but requires careful risk management given recent technical weakness.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Paycom Software Q4: After The Massive Selloff, An Attractive Opportunity (Upgrade) (PAYC) – Seeking Alpha (Feb 12, 2026)

- Jefferies Financial Group Lowers Paycom Software (NYSE:PAYC) Price Target to $130.00 – MarketBeat (Feb 12, 2026)

- AI HR tool projects 431% ROI and 3,600 work hours saved – Stock Titan (Feb 12, 2026)

- Jefferies Adjusts Paycom Software (PAYC) Price Target to $130 | – GuruFocus (Feb 12, 2026)

- How Recent Analyst Resets Are Reframing The Story For Paycom Software (PAYC) – Yahoo Finance (Feb 12, 2026)

For more information about Paycom Software, Inc., please visit the official website: paycom.com