Home > Analyses > Communication Services > Paramount Skydance Corporation Class B Common Stock

Paramount Skydance Corporation shapes the way millions experience entertainment daily, from blockbuster films to popular streaming series and live television. As a powerhouse in the media and entertainment industry, it commands a diverse portfolio including CBS Television Network, Paramount+, and Paramount Pictures, renowned for innovation and high-quality content. With evolving consumer habits and competitive pressures, I explore whether Paramount Skydance’s current fundamentals support its market valuation and future growth potential.

Table of contents

Business Model & Company Overview

Paramount Skydance Corporation Class B Common Stock, founded in 1914 and headquartered in New York City, stands as a dominant player in the global entertainment industry. Its ecosystem integrates TV Media, Direct-to-Consumer streaming, and Filmed Entertainment, creating a multifaceted platform that spans broadcast networks, premium cable channels, and international free-to-air services. This cohesive approach fuels its mission to deliver diverse content across multiple formats and audiences worldwide.

The company’s revenue engine balances traditional and digital revenue streams through its extensive portfolio of broadcast networks, subscription streaming services like Paramount+ and Pluto TV, and film production and distribution arms. Operating across the Americas, Europe, and Asia, it leverages advertising, licensing, and subscription fees to generate consistent cash flow. This broad yet integrated presence cements its competitive advantage and shapes the future landscape of global media consumption.

Financial Performance & Fundamental Metrics

In this section, I analyze Paramount Skydance Corporation Class B Common Stock’s income statement, key financial ratios, and dividend payout policy to assess its financial health.

Income Statement

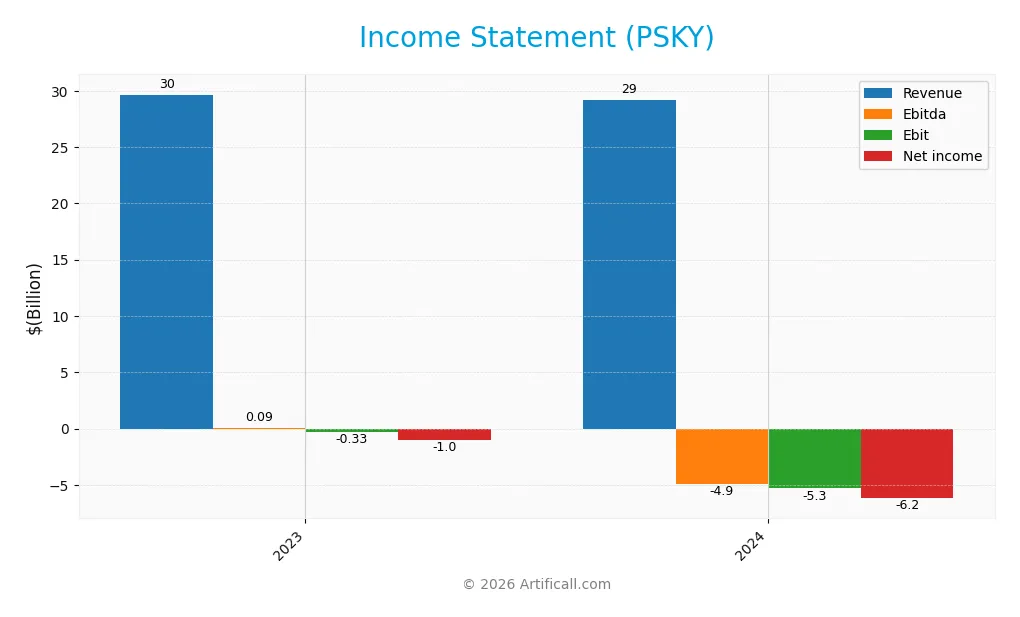

The table below summarizes the key financial figures of Paramount Skydance Corporation Class B Common Stock (PSKY) for fiscal years 2023 and 2024, reported in USD.

| 2023 | 2024 | |

|---|---|---|

| Revenue | 29.65B | 29.21B |

| Cost of Revenue | 22.39B | 20.95B |

| Operating Expenses | 7.72B | 6.66B |

| Gross Profit | 7.26B | 8.27B |

| EBITDA | 85M | -4.93B |

| EBIT | -333M | -5.32B |

| Interest Expense | 920M | 860M |

| Net Income | -1.05B | -6.19B |

| EPS | -1.69 | -9.34 |

| Filing Date | 2024-02-28 | 2025-02-26 |

Income Statement Evolution

Paramount Skydance Corporation’s revenue declined slightly by 1.48% from 29.65B in 2023 to 29.21B in 2024, while gross profit grew 13.79%, reflecting improved gross margins at 28.3%, which is favorable. However, operating expenses decreased proportionally, and EBIT margin sharply worsened to -18.2%, indicating significant operational challenges despite stable cost management.

Is the Income Statement Favorable?

The 2024 income statement reveals unfavorable fundamentals overall, with a net loss widening to -6.19B and a net margin of -21.19%. Interest expense remains well-controlled at 2.94% of revenue. Yet, EBIT deteriorated substantially, contributing to a negative EPS of -9.34. Despite gross margin strength, the company struggles with profitability, as reflected in 71.43% unfavorable income statement indicators.

Financial Ratios

The following table summarizes key financial ratios for Paramount Skydance Corporation Class B Common Stock (PSKY) over the fiscal years 2023 and 2024:

| Ratios | 2023 | 2024 |

|---|---|---|

| Net Margin | -3.52% | -21.19% |

| ROE | -4.64% | -37.93% |

| ROIC | -0.79% | 4.16% |

| P/E | -9.45 | -1.10 |

| P/B | 0.44 | 0.42 |

| Current Ratio | 1.32 | 1.30 |

| Quick Ratio | 1.17 | 1.15 |

| D/E | 0.72 | 0.97 |

| Debt-to-Assets | 30.10% | 34.29% |

| Interest Coverage | -0.49 | 1.87 |

| Asset Turnover | 0.55 | 0.63 |

| Fixed Asset Turnover | 10.41 | 11.33 |

| Dividend Yield | 4.53% | 2.48% |

Evolution of Financial Ratios

Between 2023 and 2024, Paramount Skydance’s Return on Equity (ROE) deteriorated sharply from -4.64% to -37.93%, indicating a significant decline in profitability. The Current Ratio remained relatively stable, close to 1.3, reflecting steady short-term liquidity. The Debt-to-Equity Ratio increased from 0.72 to 0.97, suggesting a moderate rise in leverage, but still within a manageable range.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-21.19%) and ROE (-37.93%) were unfavorable, signaling operational challenges. Liquidity ratios showed mixed results: the Current Ratio was neutral at 1.3, while the Quick Ratio was favorable at 1.15. Debt levels appeared neutral with a Debt-to-Equity of 0.97. Market valuation metrics, including Price-to-Earnings (negative at -1.1) and Price-to-Book (0.42), were favorable, as was dividend yield at 2.48%. Overall, the financial ratios are slightly favorable, balancing some strengths against notable profitability weaknesses.

Shareholder Return Policy

Paramount Skydance Corporation Class B Common Stock (PSKY) does pay dividends, with a 2024 dividend per share of 0.25 USD and a yield around 2.48%. However, the dividend payout ratio is negative, reflecting net losses, and raises concerns about the sustainability of its distributions. No explicit share buybacks are mentioned.

The company’s negative net margins and free cash flow coverage below 1 suggest limited capacity to fund dividends sustainably. This shareholder return approach appears to face risks, potentially impacting long-term value creation unless profitability improves.

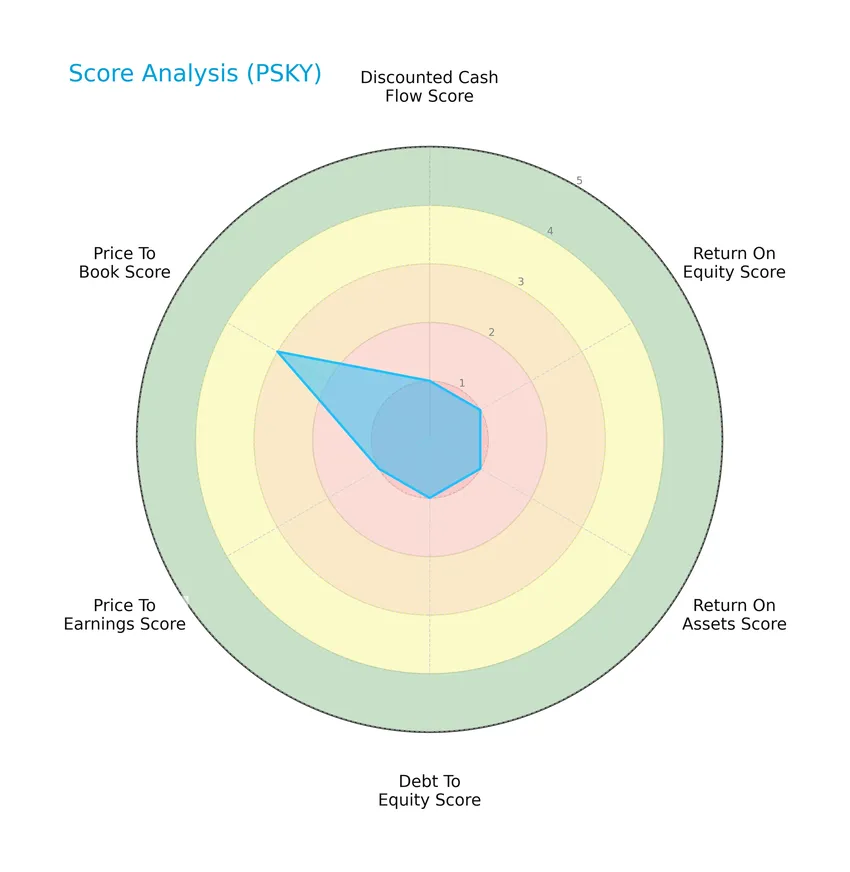

Score analysis

The following radar chart presents an overview of key financial scores for Paramount Skydance Corporation Class B Common Stock:

The scores indicate a generally very unfavorable financial profile, with low marks in discounted cash flow, return on equity, return on assets, debt to equity, and price to earnings. The price to book score is moderately better, suggesting some valuation support despite overall weakness.

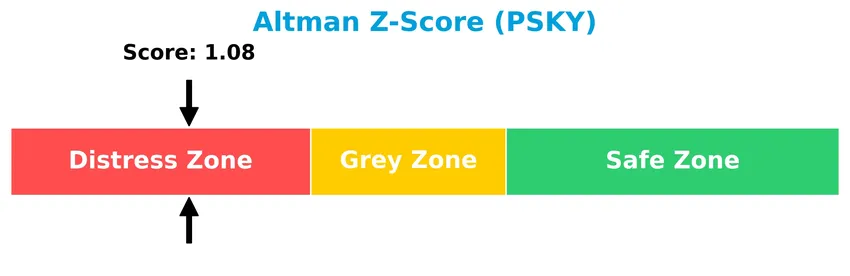

Analysis of the company’s bankruptcy risk

Paramount Skydance Corporation currently falls into the distress zone according to its Altman Z-Score, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

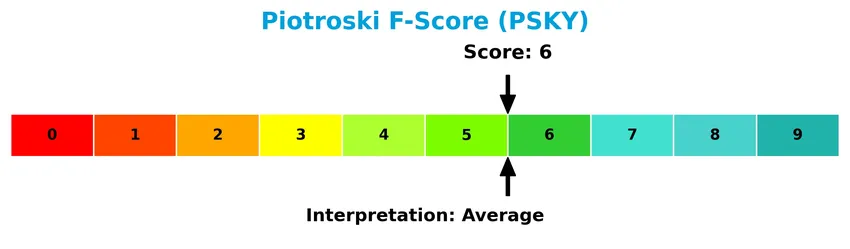

The Piotroski Score diagram illustrates the company’s financial health based on nine fundamental criteria:

With a Piotroski score of 6, the company’s financial condition is considered average, reflecting moderate strength but not indicating robust financial health.

Competitive Landscape & Sector Positioning

This sector analysis will explore Paramount Skydance Corporation’s strategic positioning, revenue streams, key products, and main competitors. I will also assess whether the company holds a competitive advantage over its peers within the entertainment and media industry.

Strategic Positioning

Paramount Skydance Corporation exhibits a diversified product portfolio spanning advertising, affiliate and subscription services, licensing, and theatrical releases, with significant revenue concentration in the US market at $23.7B in 2024 and $5.5B from international operations, reflecting broad geographic exposure and multiple entertainment segments.

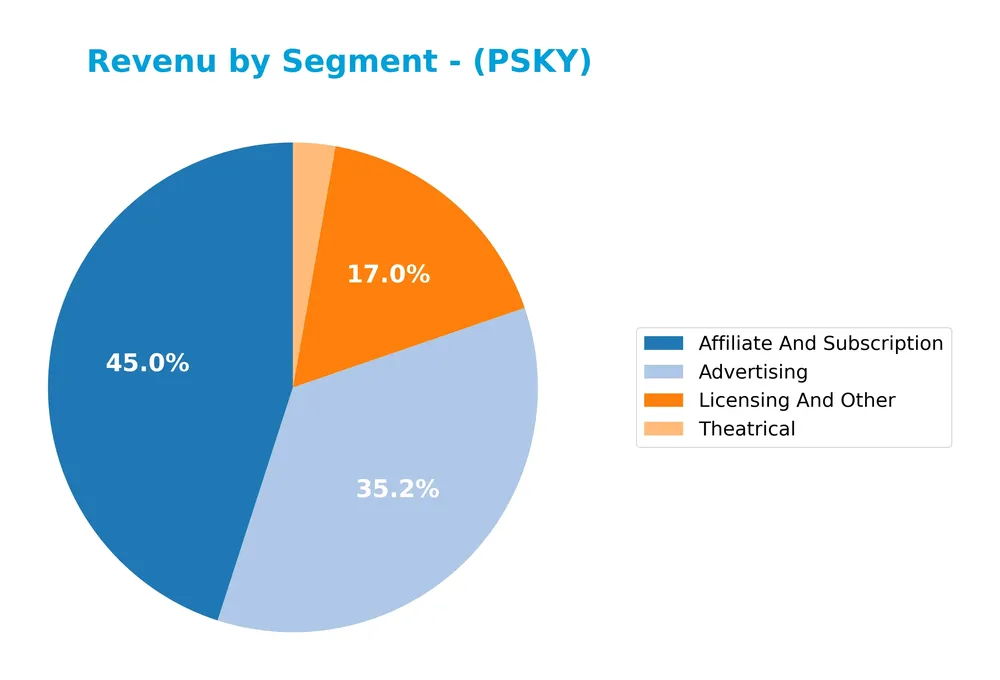

Revenue by Segment

This pie chart presents Paramount Skydance Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s diverse income sources.

In 2024, Affiliate and Subscription led revenues at $13.2B, followed by Advertising at $10.3B, showing strong contributions from digital and media monetization. Licensing and Other generated $4.9B, while Theatrical remained a smaller but notable segment at $813M. The data indicates a steady shift towards subscription services with advertising remaining robust, though theatrical revenue has declined compared to previous years, suggesting evolving consumer preferences and potential concentration risks in growing digital segments.

Key Products & Brands

The following table presents Paramount Skydance Corporation’s key products and brand segments with their descriptions:

| Product | Description |

|---|---|

| TV Media | Operates CBS Television Network, CBS Stations, international free-to-air networks (Network 10, Channel 5, Telefe, Chilevisión), and cable networks such as Nickelodeon, MTV, CMT, Comedy Central, BET, Paramount+, Showtime, and others. Includes CBS Studios, Paramount Television Studios, Showtime/MTV Entertainment Studios, CBS Media Ventures, and digital properties like CBS News Streaming and CBS Sports HQ. |

| Direct-to-Consumer | Offers domestic and international pay and free streaming services, including Paramount+, Pluto TV, and BET+. |

| Filmed Entertainment | Produces and acquires films, series, and short-form content through Paramount Pictures, Paramount Players, Paramount Animation, Nickelodeon Studio, Awesomeness, and Miramax. Distributes content in theaters, streaming, television, digital home entertainment, and physical formats. |

| Advertising | Revenue generated from advertising across various media platforms. |

| Affiliate and Subscription | Income from affiliate fees and subscription services related to streaming and cable networks. |

| Licensing and Other | Includes licensing revenues and miscellaneous income sources. |

| Theatrical | Revenue from theatrical releases of films and related content. |

Paramount Skydance Corporation’s business is diversified across TV media networks, streaming services, filmed entertainment, and multiple revenue streams including advertising, subscriptions, licensing, and theatrical releases.

Main Competitors

There are 8 competitors in the Communication Services sector within the Entertainment industry; the table lists the top 8 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

| TKO Group Holdings, Inc. | 16.9B |

| News Corporation | 16.6B |

| News Corporation | 14.8B |

| Paramount Skydance Corporation Class B Common Stock | 14.1B |

Paramount Skydance Corporation ranks 8th among its 8 competitors by market capitalization. Its market cap is only 3.25% of the leader, Netflix, Inc. The company is below both the average market cap of the top 10 competitors (73.2B) and the median market cap in the sector (25.1B). Paramount Skydance has an 18.36% gap below its nearest competitor, News Corporation (14.8B).

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PSKY have a competitive advantage?

Paramount Skydance Corporation (PSKY) currently shows a slightly unfavorable competitive advantage, as it is shedding value with a ROIC below its WACC, indicating value destruction despite growing profitability. Its entertainment portfolio, including TV Media, streaming services, and filmed content, supports a broad market presence but profitability challenges persist.

Looking ahead, PSKY’s outlook includes opportunities in expanding its streaming offerings such as Paramount+, Pluto TV, and BET+, along with content production across multiple platforms and international markets. This diversification and growth in digital services could enhance its competitive positioning in the evolving media landscape.

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting Paramount Skydance Corporation’s strategic positioning.

Strengths

- diversified media and streaming portfolio

- strong brand presence with CBS and Paramount franchises

- favorable gross margin at 28.3%

Weaknesses

- negative net margin at -21.19%

- declining revenue growth at -1.48%

- low profitability with negative ROE and ROIC

Opportunities

- growth in international streaming markets

- increasing demand for original content

- potential synergies from media and filmed entertainment segments

Threats

- intense competition in streaming and entertainment

- shifting consumer preferences

- regulatory risks in global markets

Overall, Paramount Skydance shows strong brand and content assets but faces profitability and growth challenges. Strategic focus should be on improving operational efficiency and capitalizing on expanding streaming opportunities to mitigate competitive threats.

Stock Price Action Analysis

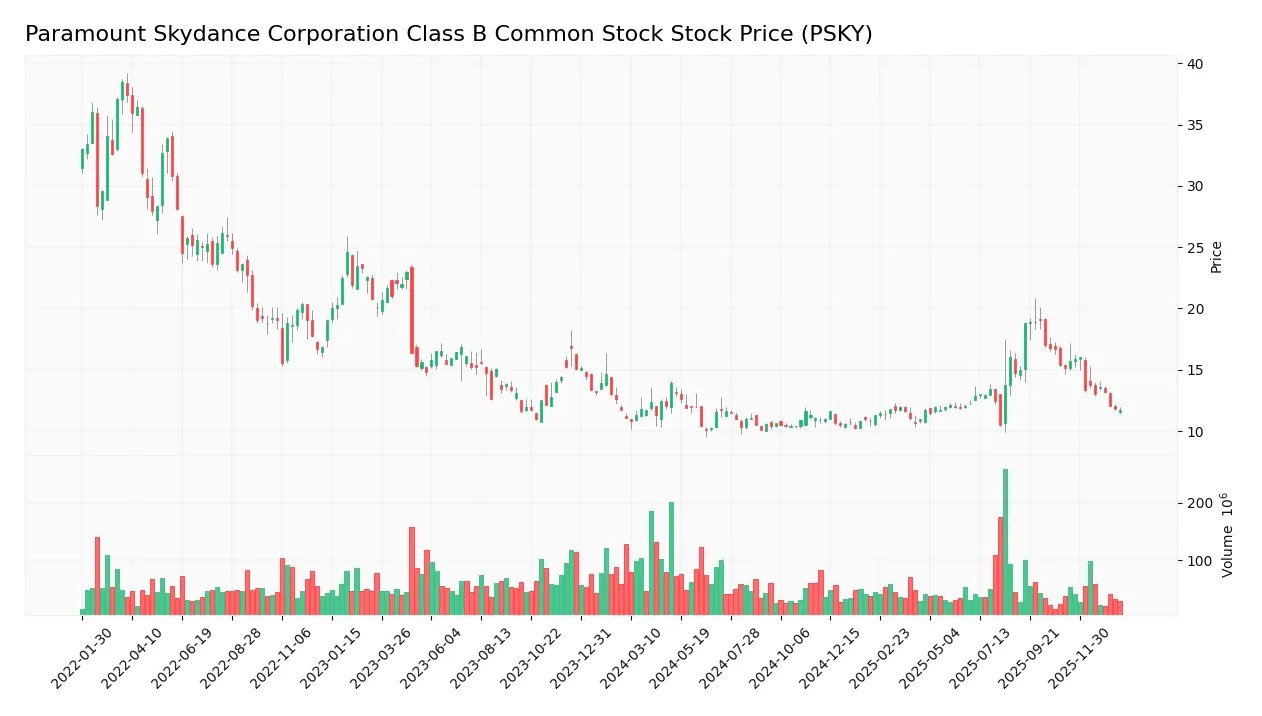

The weekly stock chart for Paramount Skydance Corporation Class B Common Stock (PSKY) over the past 100 weeks illustrates price fluctuations and recent market behavior:

Trend Analysis

Over the past 12 months, PSKY’s stock price increased by 5.5%, indicating a bullish trend with deceleration in momentum. The price ranged between a low of 10.09 and a high of 19.09, with a volatility measure of 2.1. However, from November 2025 to January 2026, the stock declined 22.52%, showing a short-term bearish slope of -0.4 and less volatility at 1.5.

Volume Analysis

In the last three months, trading volume has been decreasing overall, with seller volume (271M) slightly exceeding buyer volume (241M) and buyer dominance at 47.11%. This balanced but slightly seller-driven activity suggests cautious or neutral investor sentiment and moderate market participation during this period.

Target Prices

The consensus target price for Paramount Skydance Corporation Class B Common Stock indicates moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 16 | 12 | 13.5 |

Analysts expect the stock to trade between $12 and $16, with an average consensus target around $13.5, suggesting cautious optimism in its near-term valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Paramount Skydance Corporation Class B Common Stock (PSKY).

Stock Grades

Here is the latest overview of Paramount Skydance Corporation Class B Common Stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Underweight | 2025-12-09 |

| Guggenheim | Maintain | Neutral | 2025-11-12 |

| Bernstein | Maintain | Underperform | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| B of A Securities | Maintain | Underperform | 2025-11-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-11 |

| Evercore ISI Group | Maintain | In Line | 2025-11-11 |

| JP Morgan | Maintain | Underweight | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-23 |

| UBS | Maintain | Sell | 2025-10-08 |

The consensus of grades shows a mixed outlook, leaning toward cautious or negative sentiment with several underweight and sell ratings, while a minority maintain buy or hold positions. This diversity reflects a cautious market stance on the stock’s near-term prospects.

Consumer Opinions

Consumers have voiced a mix of enthusiasm and concerns about Paramount Skydance Corporation, reflecting varied experiences with the company’s offerings and services.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive innovation in content creation and consistent quality.” | “Customer support response times are often slow.” |

| “Strong brand recognition and good value for subscription costs.” | “Some platform glitches disrupt viewing experience.” |

| “Frequent updates and engaging new releases keep me subscribed.” | “Limited availability of certain popular titles.” |

Overall, consumer feedback praises Paramount Skydance’s innovative content and brand strength but points to technical issues and customer service delays as areas needing improvement.

Risk Analysis

Below is a summary table outlining key risk factors for Paramount Skydance Corporation Class B Common Stock (PSKY):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-21.19%) and ROE (-37.93%), with Altman Z-Score in distress zone (1.08) | High | High |

| Market Volatility | Beta of 1.188 indicates above-market volatility, increasing price fluctuation risks | Medium | Medium |

| Debt and Interest | Interest coverage is negative (-6.18), signaling difficulty servicing debt | Medium | High |

| Streaming Competition | Intense competition in streaming may pressure revenues and margins | High | Medium |

| Dividend Sustainability | Dividend yield at 2.48% but weak profitability raises concerns on long-term payouts | Medium | Medium |

The most critical risks stem from Paramount Skydance’s weak profitability and financial distress signals, highlighted by its negative ROE, net margin, and an Altman Z-Score well below safe thresholds. Combined with negative interest coverage, these factors suggest elevated bankruptcy risk. Market volatility and competitive streaming pressures add further uncertainty. Caution and close monitoring are advised.

Should You Buy Paramount Skydance Corporation Class B Common Stock?

Paramount Skydance appears to be a company with improving operational efficiency but a slightly unfavorable competitive moat, as it is currently shedding value despite growing profitability. Its leverage profile seems manageable, yet financial health indicators suggest caution, reflected in a C- rating.

Strength & Efficiency Pillars

Paramount Skydance Corporation Class B Common Stock (PSKY) shows pockets of financial resilience despite challenges. The company benefits from a favorable weighted average cost of capital (WACC) at 6.03%, alongside a solid quick ratio of 1.15, indicating reasonable short-term liquidity. Its fixed asset turnover stands at an impressive 11.33, reflecting efficient use of fixed assets. The dividend yield of 2.48% also signals some shareholder value return. However, the return on invested capital (ROIC) at 4.16% falls below the WACC, indicating that PSKY is currently not a value creator.

Weaknesses and Drawbacks

PSKY faces substantial headwinds underscored by a net margin of -21.19% and a return on equity (ROE) of -37.93%, highlighting persistent unprofitability. The Altman Z-score of 1.08 places the company firmly in the distress zone, suggesting elevated bankruptcy risk. Furthermore, a negative interest coverage ratio of -6.18 reveals difficulties in meeting interest obligations, raising concerns about leverage management. Recent market dynamics are also unfavorable, with seller dominance at 52.89% over the last months and a 22.52% decline in price, which may pressure investor sentiment and liquidity.

Our Verdict about Paramount Skydance Corporation Class B Common Stock

Paramount Skydance presents an unfavorable long-term fundamental profile given its profitability deficits and financial distress indicators. While the overall stock trend is bullish with a 5.5% price rise over a longer horizon, recent seller dominance and a 22.52% price drop suggest caution. Despite some operational efficiencies, these factors might suggest a wait-and-see approach for a more attractive entry point rather than immediate exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- PARAMOUNT REAFFIRMS COMMITMENT TO DELIVERING SUPERIOR $30 PER SHARE ALL-CASH OFFER TO WARNER BROS. DISCOVERY SHAREHOLDERS – Quantisnow (Jan 21, 2026)

- Paramount and Skydance Announce Anticipated Closing Date, Deadlines to Elect Merger Consideration and Change of Ticker Symbol Effective at the Closing – Investor Relations | Paramount (Jul 25, 2025)

- AI for investors – MLQ.ai (Dec 31, 2025)

- Paramount Skydance Corporation (PSKY) Appoints New CFO and Direc – GuruFocus (Jan 15, 2026)

- Paramount-Skydance Merger Expected to Close Aug. 7 – thewrap.com (Jul 25, 2025)

For more information about Paramount Skydance Corporation Class B Common Stock, please visit the official website: paramount.com