Home > Analyses > Technology > PagerDuty, Inc.

PagerDuty, Inc. revolutionizes how businesses detect and resolve critical digital issues, ensuring seamless operations across industries. As a leader in application software, its flagship digital operations management platform harnesses advanced machine learning to transform raw data into actionable insights. Renowned for innovation and reliability, PagerDuty empowers sectors from technology to financial services. But in 2026, the key question remains: do its fundamentals still warrant confidence in its growth and valuation?

Table of contents

Business Model & Company Overview

PagerDuty, Inc., founded in 2009 and headquartered in San Francisco, California, operates a leading digital operations management platform. The company’s ecosystem integrates data from virtually any software-enabled system, employing machine learning to interpret signals and anticipate issues. Serving sectors from technology and telecommunications to retail and financial services, PagerDuty holds a dominant position in the application software industry, connecting diverse industries with real-time operational intelligence.

PagerDuty’s revenue engine combines recurring software services with advanced data analytics, creating value through continuous platform usage across global markets including the Americas, Europe, and Asia. Its model leverages machine learning to enhance operational efficiency, ensuring client systems run smoothly and predictively. This strategic blend of technology and global reach forms a robust economic moat, securing PagerDuty’s role as a pivotal force in shaping the future of digital operations management.

Financial Performance & Fundamental Metrics

In this section, I analyze PagerDuty, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and performance.

Income Statement

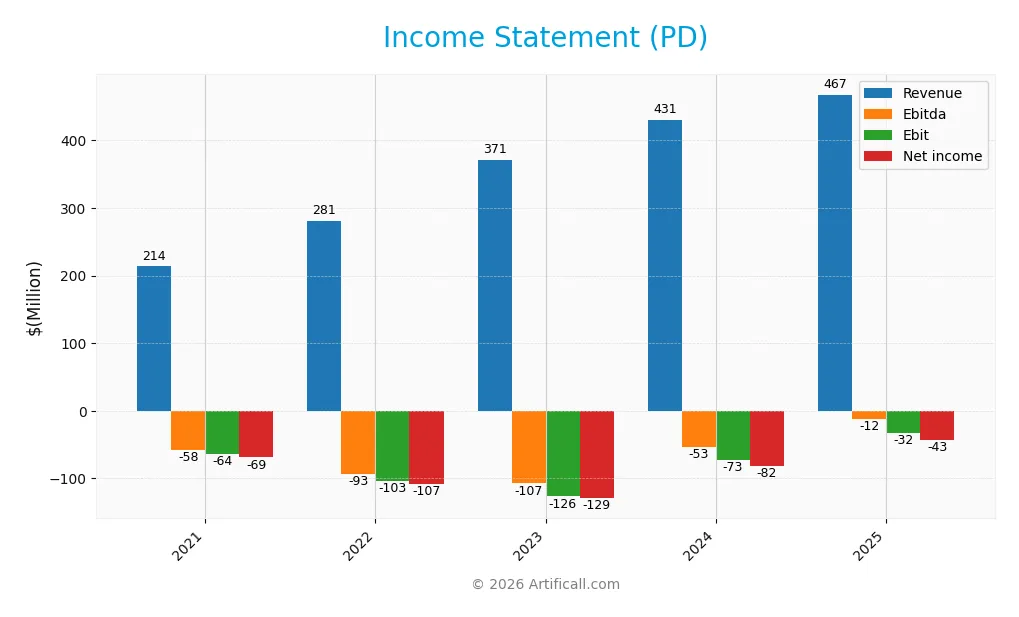

The table below presents PagerDuty, Inc.’s income statement figures for fiscal years 2021 through 2025, reflecting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 214M | 281M | 371M | 431M | 467M |

| Cost of Revenue | 31M | 48M | 70M | 78M | 80M |

| Operating Expenses | 249M | 335M | 430M | 449M | 448M |

| Gross Profit | 183M | 233M | 300M | 353M | 388M |

| EBITDA | -58M | -93M | -107M | -53M | -12M |

| EBIT | -64M | -103M | -126M | -73M | -32M |

| Interest Expense | 10M | 5M | 5M | 7M | 9M |

| Net Income | -69M | -107M | -129M | -82M | -43M |

| EPS | -0.87 | -1.27 | -1.46 | -0.89 | -0.59 |

| Filing Date | 2021-03-19 | 2022-03-17 | 2023-03-16 | 2024-03-18 | 2025-03-17 |

Income Statement Evolution

From 2021 to 2025, PagerDuty, Inc. experienced consistent revenue growth, increasing by 119% overall, with a notable 8.5% rise in the latest year. Gross profit also expanded by nearly 10% year-over-year, maintaining a favorable gross margin of 83%. Despite this, net income remained negative, though it improved by nearly 38% over the period, reflecting better but still unfavorable net margins.

Is the Income Statement Favorable?

The 2025 income statement shows favorable fundamentals in revenue growth and margin expansion, with an 8.5% rise in operating expenses proportional to revenue growth. The gross margin remains strong at 83%, while EBIT margin and net margin, though still negative at -7% and -9%, respectively, have improved significantly. Interest expense is low and favorable, supporting overall positive momentum despite ongoing net losses.

Financial Ratios

The following table presents key financial ratios for PagerDuty, Inc. (ticker: PD) over the fiscal years 2021 to 2025, offering insights into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -32% | -38% | -35% | -19% | -9% |

| ROE | -19% | -40% | -54% | -48% | -33% |

| ROIC | -10% | -17% | -23% | -15% | -10% |

| P/E | -58.5 | -26.0 | -20.5 | -26.7 | -39.9 |

| P/B | 11.0 | 10.5 | 11.0 | 12.7 | 13.1 |

| Current Ratio | 3.70 | 2.84 | 2.21 | 2.50 | 1.87 |

| Quick Ratio | 3.70 | 2.84 | 2.21 | 2.50 | 1.87 |

| D/E | 0.68 | 1.15 | 1.25 | 2.69 | 3.57 |

| Debt-to-Assets | 31% | 38% | 37% | 50% | 50% |

| Interest Coverage | -6.65 | -18.8 | -23.8 | -14.8 | -6.46 |

| Asset Turnover | 0.27 | 0.35 | 0.45 | 0.47 | 0.50 |

| Fixed Asset Turnover | 5.72 | 7.32 | 11.45 | 20.11 | 16.61 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the period, PagerDuty’s Return on Equity (ROE) consistently declined, reaching -32.92% in 2025, indicating worsening profitability. The Current Ratio showed a downward trend from a high of 3.70 in 2021 to 1.87 in 2025, reflecting reduced liquidity but remaining above 1. Meanwhile, the Debt-to-Equity Ratio increased steadily to 3.57, signaling higher leverage and financial risk.

Are the Financial Ratios Fovorable?

In 2025, PagerDuty’s profitability ratios, including net margin (-9.14%) and ROE (-32.92%), were unfavorable, alongside high leverage with a debt-to-equity ratio of 3.57 and debt-to-assets at 50%. Liquidity ratios such as current and quick ratios were favorable at 1.87. Asset turnover was neutral at 0.5, while fixed asset turnover was favorable at 16.61. Market valuation ratios like price-to-book at 13.12 were unfavorable. Overall, the financial ratios suggest an unfavorable profile for 2025.

Shareholder Return Policy

PagerDuty, Inc. does not pay dividends, reflecting its sustained net losses and reinvestment focus amid ongoing growth and operational challenges. The company also does not engage in share buybacks, which aligns with its strategy to preserve cash for development and expansion.

This lack of distributions suggests a prioritization of long-term shareholder value creation through reinvestment rather than immediate returns. While this approach supports growth potential, it requires careful monitoring of financial health and profitability trajectories to ensure future sustainability.

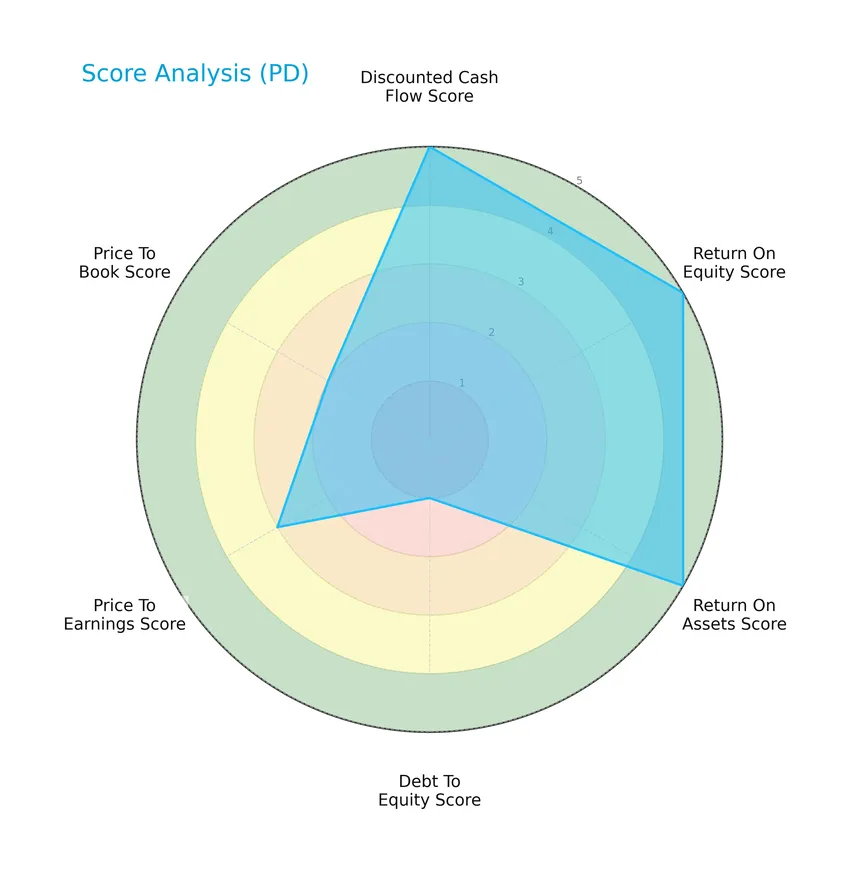

Score analysis

The following radar chart presents a comprehensive overview of PagerDuty, Inc.’s key financial scores:

PagerDuty exhibits very favorable scores in discounted cash flow, return on equity, and return on assets, each rated 5. However, its debt-to-equity score is very unfavorable at 1, while price-to-earnings and price-to-book scores stand at moderate levels of 3 and 2 respectively.

Analysis of the company’s bankruptcy risk

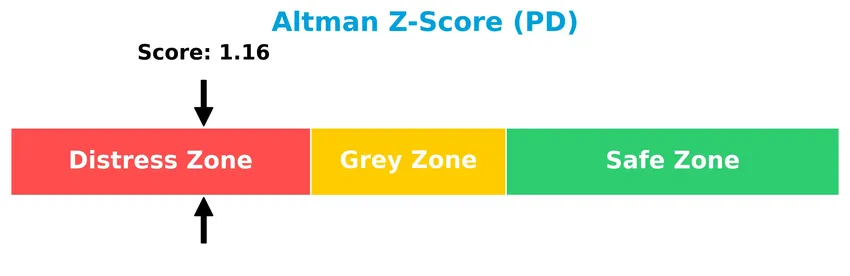

PagerDuty’s Altman Z-Score of 1.16 places it in the distress zone, indicating a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

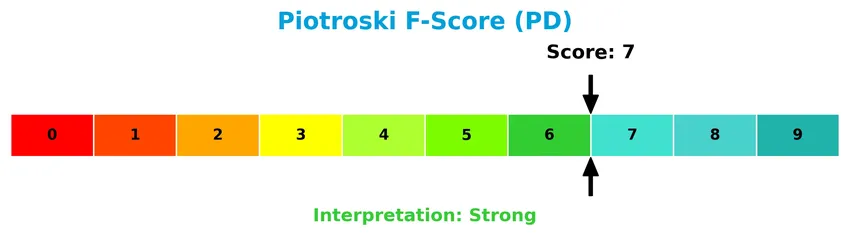

The Piotroski Score diagram provides insight into PagerDuty’s financial strength and efficiency metrics:

With a Piotroski Score of 7, PagerDuty is considered financially strong, reflecting solid profitability and operational efficiency despite some concerns in leverage.

Competitive Landscape & Sector Positioning

This sector analysis will explore PagerDuty, Inc.’s strategic positioning, revenue breakdown, key products, main competitors, and overall market standing. I will assess whether PagerDuty holds a competitive advantage within the software application industry.

Strategic Positioning

PagerDuty, Inc. operates a focused digital operations management platform, primarily serving the US market, which accounted for $338M of $467M total revenue in FY2025. The company maintains international exposure with $130M revenue outside the US, indicating moderate geographic diversification within the software application sector.

Key Products & Brands

Below is an overview of PagerDuty, Inc.’s key product and brand offering:

| Product | Description |

|---|---|

| Digital Operations Management Platform | A platform that collects digital signals from software-enabled systems or devices, using machine learning to correlate, process, and predict operational opportunities and issues across various industries. |

PagerDuty’s core product is its digital operations management platform, designed to enhance operational efficiency and issue prediction through advanced data analytics and machine learning. It serves multiple industries globally.

Main Competitors

PagerDuty, Inc. faces competition from 33 companies in its sector, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

PagerDuty, Inc. ranks 31st among 33 competitors by market capitalization, with a market cap only 0.42% that of the sector leader, Salesforce, Inc. The company is positioned well below both the average market cap of the top 10 competitors (143.6B) and the median market cap in the sector (18.8B). Notably, PagerDuty’s market cap is 217% smaller than the next competitor above it, indicating a significant gap in scale.

Does PD have a competitive advantage?

PagerDuty, Inc. currently does not present a strong competitive advantage as it is shedding value with a negative ROIC compared to WACC, despite showing a growing ROIC trend. The overall moat status is slightly unfavorable, indicating challenges in sustaining excess returns.

Looking ahead, PagerDuty’s platform leverages machine learning across diverse industries and geographies, with increasing revenue from both U.S. and non-U.S. markets. Continued innovation in digital operations management could provide new growth opportunities and help improve profitability over time.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights PagerDuty, Inc.’s key internal strengths and weaknesses, along with external opportunities and threats to inform strategic investment decisions.

Strengths

- Strong revenue growth of 119% over 5 years

- High gross margin at 83%

- Expanding international sales with Non-US revenue growth

Weaknesses

- Negative net margin at -9.14%

- High debt-to-equity ratio at 3.57

- Low Altman Z-score indicating financial distress

Opportunities

- Increasing demand for digital operations management

- Growing adoption of AI and machine learning in IT operations

- Expansion into new industry verticals globally

Threats

- Intense competition in software application sector

- Rising operational costs impacting profitability

- Economic uncertainty affecting IT spending

PagerDuty shows robust growth and strong gross margins, but profitability challenges and high leverage present risks. Strategic focus should be on improving operational efficiency and leveraging AI-driven solutions to capitalize on market expansion while managing financial risks carefully.

Stock Price Action Analysis

The weekly stock chart below illustrates PagerDuty, Inc.’s price movement over the past 12 months, highlighting key price levels and volatility patterns:

Trend Analysis

Over the past 12 months, PagerDuty’s stock price declined by 54.69%, indicating a bearish trend. The price fell from a high of 24.66 to a low of 11.17, with a deceleration in the downtrend. Price volatility is moderate, with a standard deviation of 2.94, showing consistent downward pressure.

Volume Analysis

Trading volume has been increasing overall, with sellers dominating 56.58% of the total 856M shares traded over the year. In the recent period (Nov 2025–Jan 2026), seller dominance intensified to 76.7%, reflecting strong selling pressure and cautious investor sentiment.

Target Prices

The consensus target prices for PagerDuty, Inc. indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 19 | 15 | 16.2 |

Analysts expect PagerDuty’s stock to trade between $15 and $19, with a consensus target price around $16.2, suggesting cautious optimism.

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding PagerDuty, Inc. (PD).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is a summary of the latest verified stock grades for PagerDuty, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Baird | Maintain | Neutral | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

The overall trend shows a mix of buy and hold ratings with some recent downgrades, reflecting cautious sentiment among analysts. Several firms maintain positive views, while the consensus leans toward holding the stock.

Consumer Opinions

Consumers generally appreciate PagerDuty, Inc. for its reliability and effective incident management, though some users express concerns about pricing and complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “PagerDuty’s alert system is incredibly reliable.” | “Pricing is quite high for small businesses.” |

| “The platform integrates smoothly with our tools.” | “The learning curve can be steep for new users.” |

| “Customer support is responsive and helpful.” | “Occasional glitches during peak usage times.” |

| “Customizable notifications improve our workflow.” | “Some features feel overly complicated.” |

Overall, consumers praise PagerDuty for its robust performance and helpful support but note that cost and usability could be improved, especially for smaller teams.

Risk Analysis

Below is a table summarizing the key risks associated with investing in PagerDuty, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-9.14%) and return on equity (-32.92%) indicate ongoing profitability challenges. | High | High |

| Leverage & Debt | High debt-to-equity ratio (3.57) and 50% debt-to-assets increase financial vulnerability. | High | High |

| Liquidity | Current and quick ratios at 1.87 suggest adequate liquidity, but negative interest coverage (-3.51) raises concerns. | Moderate | Medium |

| Market Valuation | Elevated price-to-book ratio (13.12) may imply overvaluation risk despite a favorable P/E score. | Moderate | Medium |

| Bankruptcy Risk | Altman Z-Score of 1.16 places the company in the distress zone, signaling a heightened bankruptcy risk. | High | Very High |

| Profitability & Efficiency | Moderate asset turnover (0.5) and favorable fixed asset turnover (16.61) partially offset risks. | Moderate | Low |

The most pressing risks for PagerDuty stem from its financial distress signals, particularly the Altman Z-Score well below 1.8 and persistent negative profitability metrics. Despite solid liquidity ratios, elevated debt levels and weak interest coverage raise caution. Investors should weigh these factors carefully when considering PagerDuty for their portfolios in 2026.

Should You Buy PagerDuty, Inc.?

PagerDuty, Inc. appears to be navigating a challenging profitability landscape with a slightly unfavorable moat marked by value erosion despite improving returns. While leverage profile is very unfavorable, the overall A- rating and strong Piotroski score suggest a favorable value creation potential amid financial distress risks.

Strength & Efficiency Pillars

PagerDuty, Inc. exhibits mixed financial health with notable strengths in operational efficiency and financial robustness. Despite a net margin of -9.14% and negative returns on equity (-32.92%) and invested capital (-9.66%), the company maintains a favorable weighted average cost of capital (WACC) at 5.86%. Its Altman Z-Score, though in the distress zone at 1.16, is complemented by a strong Piotroski score of 7, indicating solid financial discipline. The current ratio of 1.87 reflects sound liquidity, while a high gross margin of 82.96% underlines pricing power and operational leverage.

Weaknesses and Drawbacks

Significant challenges cloud PagerDuty’s valuation and leverage profile. The debt-to-equity ratio at 3.57 and a debt-to-assets ratio of 50% signify elevated financial risk, compounded by an unfavorable interest coverage of -3.51, pointing to difficulty servicing debt. The high price-to-book ratio of 13.12 suggests a stretched valuation, which, along with moderate price-to-earnings metrics, could deter value-focused investors. Market sentiment remains bearish, with seller dominance at 76.7% in the recent period and a 27.89% price decline since November 2025, adding short-term pressure and volatility.

Our Verdict about PagerDuty, Inc.

PagerDuty’s long-term fundamental profile might appear unfavorable due to its negative profitability metrics and financial distress signals. However, the strong Piotroski score and improving operational metrics suggest potential resilience. Despite bearish technical trends and recent seller dominance, the company’s solid liquidity and operational margins could appeal to investors with a cautious risk appetite. Therefore, while the profile might suggest potential for recovery, a wait-and-see approach could be prudent before committing further capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Assessing PagerDuty (PD) Valuation After Recent Share Price Weakness And Undervaluation Signals – Yahoo Finance (Jan 25, 2026)

- PagerDuty: A Bigger Risk As Retention Wanes (Downgrade) (NYSE:PD) – Seeking Alpha (Jan 20, 2026)

- PagerDuty Appoints Scott Aronson to Board of Directors – Business Wire (Jan 20, 2026)

- PagerDuty (NYSE:PD) Receives Average Rating of “Hold” from Brokerages – MarketBeat (Jan 19, 2026)

- PagerDuty, Inc. (NYSE:PD) Q3 2026 Earnings Call Transcript – MSN (Nov 25, 2025)

For more information about PagerDuty, Inc., please visit the official website: pagerduty.com