Home > Analyses > Consumer Cyclical > Packaging Corporation of America

Packaging Corporation of America transforms everyday commerce by delivering essential containerboard and corrugated packaging solutions that protect and showcase products across diverse industries. As a recognized leader in packaging and paper manufacturing, the company blends innovation with quality to meet evolving market demands. With a strong industry presence and a heritage dating back over 150 years, the question remains: does Packaging Corporation of America’s current financial health and strategic positioning support sustainable growth for investors today?

Table of contents

Business Model & Company Overview

Packaging Corporation of America, founded in 1867 and headquartered in Lake Forest, Illinois, stands as a dominant player in the Packaging & Containers industry. It operates through a cohesive ecosystem spanning containerboard manufacturing and corrugated packaging products tailored for diverse sectors like food, beverages, and industrial goods. Its dual-segment approach integrates Packaging and Paper, delivering solutions from shipping containers to specialty papers, all designed to protect and promote products efficiently.

The company’s revenue engine balances direct sales of containerboard and corrugated packaging with its Paper segment’s commodity and specialty paper offerings. Packaging Corporation of America leverages strategic distribution via direct sales, brokers, and partners across the US, reinforcing its stronghold in the Americas. This blend of hardware and recurring paper sales underpins its robust cash flow and cultivates a resilient economic moat, positioning it as a key shaper of the packaging industry’s future.

Financial Performance & Fundamental Metrics

I will analyze Packaging Corporation of America’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

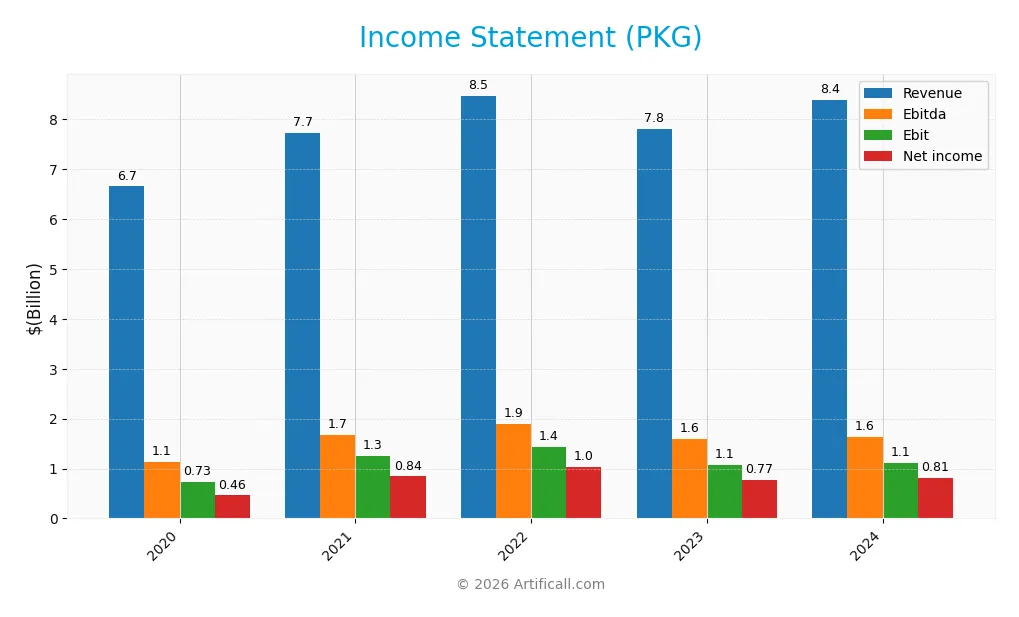

The table below summarizes the annual income statement data for Packaging Corporation of America (PKG) from 2020 to 2024, reflecting key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 6.66B | 7.73B | 8.48B | 7.80B | 8.38B |

| Cost of Revenue | 5.27B | 5.86B | 6.39B | 6.10B | 6.60B |

| Operating Expenses | 545M | 590M | 670M | 624M | 682M |

| Gross Profit | 1.39B | 1.87B | 2.09B | 1.70B | 1.78B |

| EBITDA | 1.14B | 1.68B | 1.89B | 1.59B | 1.63B |

| EBIT | 726M | 1.26B | 1.44B | 1.07B | 1.11B |

| Interest Expense | 94M | 152M | 70M | 53M | 41M |

| Net Income | 461M | 841M | 1.03B | 765M | 805M |

| EPS | 4.86 | 8.87 | 11.07 | 8.52 | 8.97 |

| Filing Date | 2021-02-24 | 2022-02-24 | 2023-02-23 | 2024-02-29 | 2025-02-27 |

Income Statement Evolution

Between 2020 and 2024, Packaging Corporation of America (PKG) experienced a favorable revenue growth of 25.91%, with net income rising 74.64% over the same period. Despite a 7.45% revenue increase in the last year being neutral, net margin growth slowed, declining by 2.08%, indicating some pressure on profitability. Key margins such as gross margin and EBIT margin remained favorable, reflecting stable operational efficiency.

Is the Income Statement Favorable?

In 2024, PKG reported revenue of 8.38B USD and net income of 805M USD, with a net margin of 9.6%, classified as favorable. EBIT margin stood at 13.19%, supported by controlled interest expenses at 0.49% of revenue. However, operating expenses rose in line with revenue growth, marking an unfavorable trend. Overall, 64.29% of income statement metrics were favorable, indicating generally positive financial fundamentals for the year.

Financial Ratios

The table below presents key financial ratios for Packaging Corporation of America (PKG) over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7% | 11% | 12% | 10% | 10% |

| ROE | 14% | 23% | 28% | 19% | 18% |

| ROIC | 9% | 14% | 15% | 10% | 11% |

| P/E | 28.2 | 15.2 | 11.5 | 19.0 | 24.9 |

| P/B | 4.00 | 3.55 | 3.22 | 3.63 | 4.55 |

| Current Ratio | 3.51 | 3.09 | 2.86 | 2.57 | 3.23 |

| Quick Ratio | 2.51 | 2.07 | 1.75 | 1.77 | 2.10 |

| D/E | 0.84 | 0.76 | 0.76 | 0.79 | 0.63 |

| Debt-to-Assets | 37% | 35% | 35% | 37% | 31% |

| Interest Coverage | 9.0 | 8.4 | 20.2 | 20.2 | 26.6 |

| Asset Turnover | 0.90 | 0.99 | 1.06 | 0.90 | 0.95 |

| Fixed Asset Turnover | 1.94 | 2.05 | 2.02 | 1.88 | 1.94 |

| Dividend Yield | 2.3% | 3.0% | 3.6% | 3.1% | 2.2% |

Evolution of Financial Ratios

From 2020 to 2024, Packaging Corporation of America’s Return on Equity (ROE) showed an overall upward trend, peaking at 28.08% in 2022 before moderating to 18.28% in 2024. The Current Ratio fluctuated but remained above 2.5, rising to 3.23 in 2024, indicating strong short-term liquidity. The Debt-to-Equity Ratio steadily declined from 0.84 in 2020 to 0.63 in 2024, reflecting a gradual reduction in leverage and improved capital structure stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as ROE (18.28%) and Return on Invested Capital (10.53%) were favorable, while net margin (9.6%) was neutral. Liquidity presented mixed signals with a strong quick ratio (2.1, favorable) but an unfavorable current ratio (3.23). Leverage ratios including debt-to-equity (0.63) and debt-to-assets (31.38%) were neutral. Market valuation showed a neutral price-to-earnings ratio (24.92) but an unfavorable price-to-book ratio (4.55). Overall, the financial ratios suggest a slightly favorable profile.

Shareholder Return Policy

Packaging Corporation of America (PKG) pays consistent dividends, with a payout ratio around 55-65% over recent years and a dividend yield near 2.2-3.6%. Dividend payments are supported by free cash flow coverage exceeding 100%, complemented by share buyback programs enhancing shareholder returns.

The policy balances distributions with capital expenditures, maintaining coverage ratios above 1, indicating prudent financial management. This approach appears to support sustainable long-term value creation by aligning dividend payments and buybacks with operating cash flow and investment needs.

Score analysis

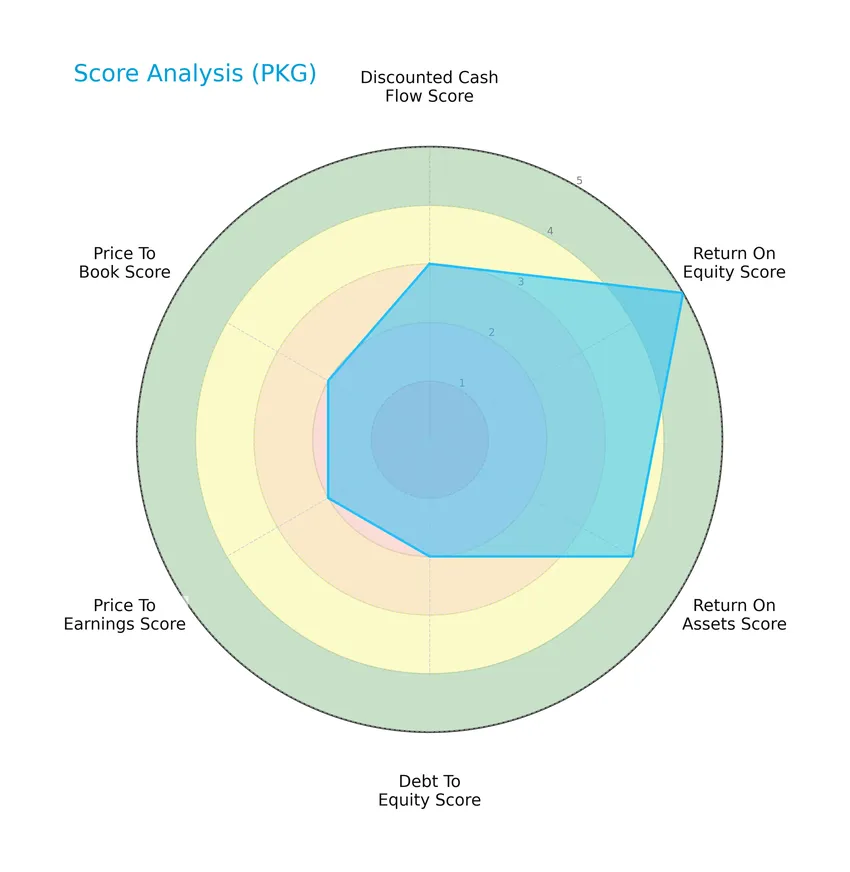

The following radar chart illustrates the company’s performance across key financial metrics and valuation ratios:

Packaging Corporation of America shows a very favorable return on equity score of 5 and a favorable return on assets score of 4. Other metrics such as discounted cash flow, debt to equity, price to earnings, and price to book ratios are moderate, indicating balanced financial and valuation metrics overall.

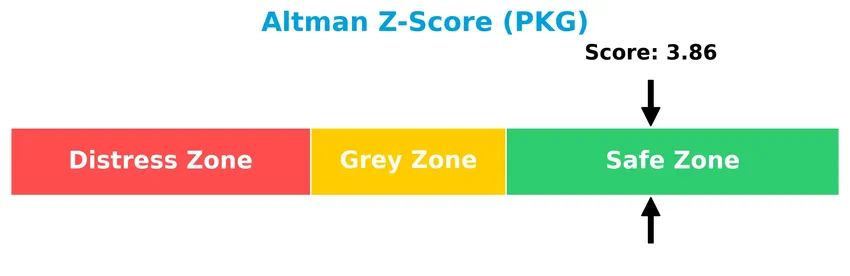

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company confidently in the safe zone, indicating a low risk of bankruptcy and financial distress:

Is the company in good financial health?

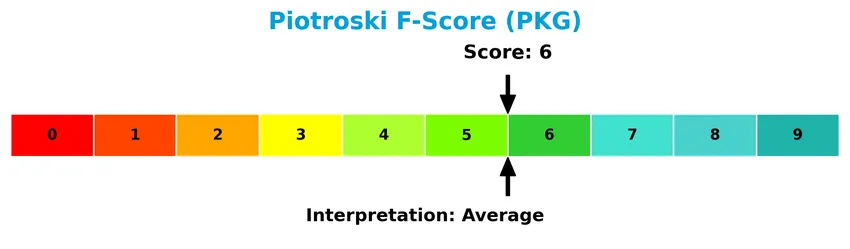

This Piotroski diagram provides insight into the company’s financial strength based on nine key criteria:

With a Piotroski score of 6, the company is in the average range, suggesting moderate financial health but not among the strongest performers in terms of profitability, leverage, liquidity, and efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Packaging Corporation of America’s strategic positioning, revenue segments, key products, and main competitors. I will also assess whether the company holds a competitive advantage within the packaging and containers industry.

Strategic Positioning

Packaging Corporation of America maintains a concentrated product portfolio focused on containerboard and corrugated packaging within the US market. Its revenue predominantly stems from the Packaging segment, with a smaller Paper segment contribution, indicating limited geographic and product diversification.

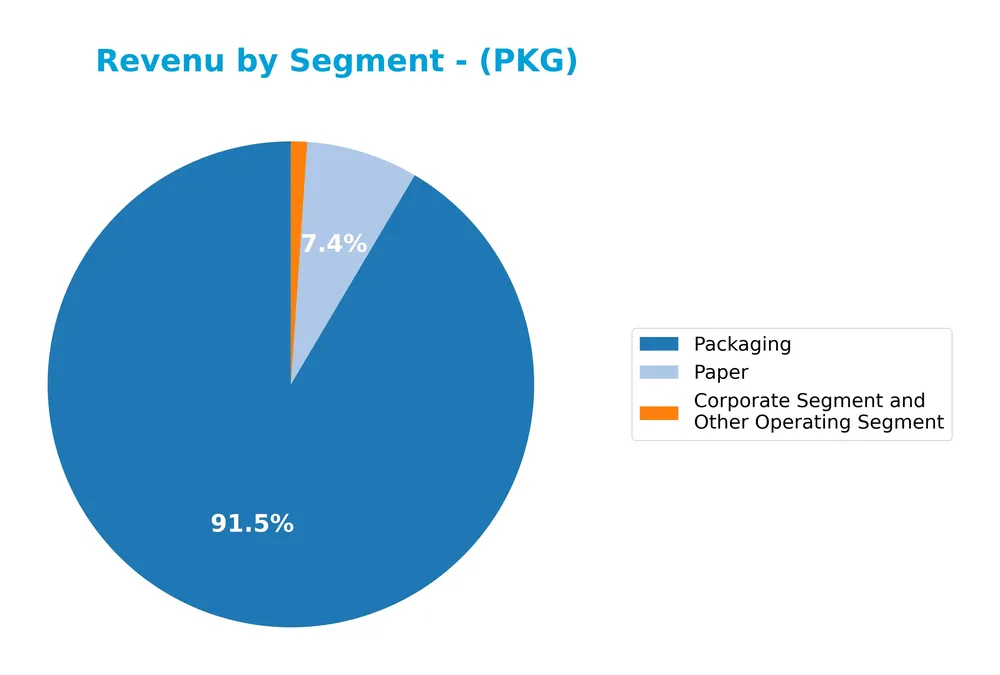

Revenue by Segment

This pie chart illustrates Packaging Corporation of America’s revenue distribution by segment for the fiscal year 2024, highlighting the latest available breakdown of its business lines.

In 2024, the Packaging segment dominates with $7.69B in revenue, significantly outpacing Paper at $625M and Corporate Segment and Other Operating Segment at $90M. The data reflects a strong concentration in Packaging, which has grown steadily over the years, while Paper remains a smaller contributor. The Corporate and other segment revenue is minimal, indicating limited diversification outside core operations. Overall, the recent year confirms Packaging as the primary driver of growth and revenue stability.

Key Products & Brands

The following table outlines the main products and brands of Packaging Corporation of America:

| Product | Description |

|---|---|

| Containerboard and Corrugated Packaging | Includes conventional shipping containers, multi-color boxes, displays, honeycomb protective packaging, and packaging for meat, fresh produce, processed food, beverages, and other industrial and consumer goods. |

| Commodity and Specialty Papers | Consists of commodity and specialty papers, communication papers, cut-size office papers, and printing and converting papers sold through a dedicated sales organization. |

Packaging Corporation of America generates most of its revenue from containerboard and corrugated packaging products, complemented by its paper segment offering various specialty and office papers.

Main Competitors

In the Packaging & Containers industry, there are 5 main competitors; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Paper Company | 21.3B |

| Smurfit Westrock Plc | 20.7B |

| Amcor plc | 19.4B |

| Packaging Corporation of America | 19.0B |

| Ball Corporation | 14.3B |

Packaging Corporation of America ranks 4th among its 5 competitors with a market cap at 95.4% of the leader, International Paper Company. It stands above both the average market cap of the top 10 and the median market cap of the sector. Its market cap is approximately 4.27% below its closest rival, Amcor plc, showing a relatively tight gap at the upper end of the ranking.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PKG have a competitive advantage?

Packaging Corporation of America (PKG) presents a clear competitive advantage, evidenced by its very favorable moat status, with ROIC exceeding WACC by over 3%, and a growing ROIC trend of 15.4%, indicating efficient capital use and value creation. The company’s favorable income metrics, including gross margin of 21.3% and net margin of 9.6%, support its strong market position in packaging and paper products.

Looking ahead, PKG is well-positioned to capitalize on opportunities in both its Packaging and Paper segments, leveraging diverse product offerings such as corrugated containers and specialty papers. Its established presence in the US market and ongoing profitability improvement suggest potential for sustained growth and expansion in packaging solutions aligned with evolving customer needs.

SWOT Analysis

This SWOT analysis highlights key internal and external factors influencing Packaging Corporation of America’s strategic positioning.

Strengths

- strong market position in packaging

- favorable profitability with 21.27% gross margin

- durable competitive advantage with growing ROIC

Weaknesses

- moderate net margin growth recently declined

- unfavorable opex growth compared to revenue

- relatively high price-to-book ratio at 4.55

Opportunities

- expanding demand for sustainable packaging

- growth in e-commerce boosting containerboard needs

- potential to improve operational efficiency

Threats

- raw material cost volatility

- rising competition in packaging industry

- economic downturn impacting consumer goods shipments

Packaging Corporation of America benefits from solid profitability and a strong competitive moat, but recent margin pressures and cost challenges warrant caution. The company’s strategy should focus on leveraging market growth opportunities while managing operational efficiency and cost risks.

Stock Price Action Analysis

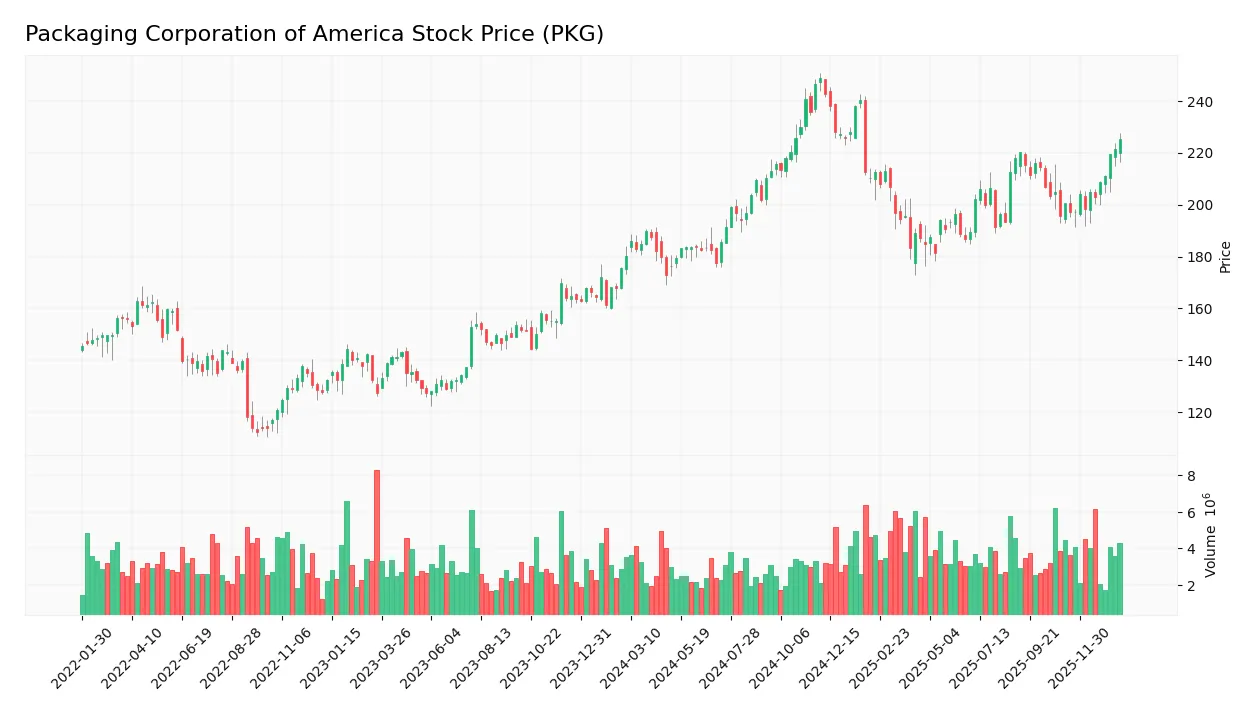

The following weekly stock chart for Packaging Corporation of America (PKG) illustrates price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 100 weeks, PKG’s stock price increased by 25.08%, indicating a bullish trend with acceleration. The price ranged between a low of 172.85 and a high of 248.85, with a high volatility reflected by a standard deviation of 17.84. Recent weeks show a 12.39% rise, confirming continued upward momentum.

Volume Analysis

Trading volumes over the last three months reveal a buyer-dominant market, with buyers accounting for 67.97% of volume. Volume is increasing, suggesting heightened investor interest and positive market participation supporting the upward price trend.

Target Prices

The consensus target prices for Packaging Corporation of America indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 273 | 233 | 247 |

Analysts expect the stock price to trade between 233 and 273, with an average consensus price of 247, reflecting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Packaging Corporation of America (PKG).

Stock Grades

Here is a summary of recent stock grades for Packaging Corporation of America from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-12 |

| Citigroup | Maintain | Neutral | 2026-01-06 |

| Wells Fargo | Upgrade | Overweight | 2026-01-06 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| JP Morgan | Maintain | Overweight | 2025-12-05 |

The consensus among analysts leans toward a Hold rating, with most institutions maintaining neutral or buy positions and Wells Fargo recently upgrading to Overweight, indicating some cautious optimism balanced by prevailing caution.

Consumer Opinions

Consumers of Packaging Corporation of America (PKG) express a mix of satisfaction and concerns, reflecting diverse experiences with the company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality packaging materials that enhance product safety and presentation. | Occasional delays in delivery affecting supply chain schedules. |

| Strong customer service with responsive and helpful support teams. | Pricing can be higher compared to some competitors. |

| Sustainable packaging options that align with environmental values. | Limited customization options for certain packaging needs. |

Overall, consumer feedback highlights PKG’s commitment to quality and sustainability as key strengths, while delivery timeliness and pricing remain areas for improvement.

Risk Analysis

Below is a summary table outlining key risks associated with Packaging Corporation of America (PKG), considering their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in demand for packaging products due to economic cycles affecting sales volumes. | Medium | High |

| Raw Material Costs | Rising prices of raw materials like pulp and paper can increase production costs. | High | Medium |

| Supply Chain Risk | Disruptions in logistics or supply of raw materials impacting delivery and production timelines. | Medium | High |

| Regulatory Changes | New environmental regulations on packaging materials could increase compliance costs. | Low | Medium |

| Competitive Pressure | Intense competition from packaging alternatives and new entrants may erode market share. | Medium | Medium |

| Financial Leverage | Moderate debt levels with a debt-to-equity ratio of 0.63 could affect financial flexibility. | Low | Medium |

| Dividend Sustainability | Dividend yield at 2.24% is favorable but could be pressured under adverse conditions. | Low | Low |

The most probable and impactful risks involve raw material cost increases and supply chain disruptions, which have recently affected the packaging industry due to global logistics challenges and commodity price volatility. PKG’s strong financial position, with an Altman Z-score in the safe zone and a moderate Piotroski score, helps mitigate bankruptcy risk but investors should monitor cost pressures closely.

Should You Buy Packaging Corporation of America?

Packaging Corporation of America appears to be a robust value creator with a durable competitive moat supported by growing ROIC. While the leverage profile is manageable, the overall rating suggests a very favorable yet moderate financial health, indicating cautious optimism.

Strength & Efficiency Pillars

Packaging Corporation of America (PKG) exhibits strong profitability and value creation attributes. The company reports a solid return on equity of 18.28% alongside a favorable net margin of 9.6%. Its return on invested capital (ROIC) stands at 10.53%, exceeding the weighted average cost of capital (WACC) at 7.43%, confirming PKG as a clear value creator. Financial health metrics further reinforce stability, with an Altman Z-score of 3.86 placing it firmly in the safe zone, and a Piotroski score of 6 indicating average but positive operational strength.

Weaknesses and Drawbacks

Despite these strengths, PKG faces valuation and liquidity concerns that warrant caution. The price-to-book ratio is elevated at 4.55, signaling a premium valuation that may limit upside potential. The current ratio is 3.23, marked as unfavorable, suggesting an unusual level of short-term assets relative to liabilities that could impact operational efficiency. Debt-to-equity is moderate at 0.63, which is manageable but not negligible. These factors, combined with a neutral price-to-earnings ratio of 24.92, imply that market expectations are high and could expose the stock to volatility under adverse conditions.

Our Verdict about Packaging Corporation of America

The fundamental profile of PKG appears favorable, supported by consistent profitability and strong value creation metrics. Coupled with a bullish overall market trend and recent buyer dominance of 67.97%, the stock may appear attractive for long-term exposure. However, the moderate valuation and liquidity signals suggest investors could benefit from a cautious approach, monitoring for potential entry points aligned with market dynamics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- UniSuper Management Pty Ltd Grows Stake in Packaging Corporation of America $PKG – MarketBeat (Jan 24, 2026)

- Packaging Corporation of America: Positives Are Priced In (Downgrade) (NYSE:PKG) – Seeking Alpha (Jan 20, 2026)

- Packaging Corp to Report Q4 Earnings: What’s in Store for the Stock? – Yahoo Finance (Jan 23, 2026)

- Packaging Corp to Report Q4 Earnings: What’s in Store for the Stock? – Zacks Investment Research (Jan 23, 2026)

- How PKG’s Shift Toward Cost Efficiency and Shareholder Returns Will Impact Packaging Corporation of America (PKG) Investors – simplywall.st (Jan 21, 2026)

For more information about Packaging Corporation of America, please visit the official website: packagingcorp.com