Home > Analyses > Technology > Ouster, Inc.

Ouster, Inc. is transforming how machines perceive the world by delivering cutting-edge 3D vision through its high-resolution digital lidar sensors. As a pioneer in the hardware and technology sector, Ouster’s flagship OS and DF sensors empower autonomous vehicles, robotics, and infrastructure with precise spatial awareness. Renowned for innovation and quality, the company shapes the future of smart mobility and automation. Yet, the question remains: does Ouster’s current valuation fully reflect its growth potential in this fast-evolving market?

Table of contents

Business Model & Company Overview

Ouster, Inc., founded in 2020 and headquartered in San Francisco, CA, stands as a prominent player in the hardware and equipment industry. The company specializes in designing and manufacturing high-resolution digital lidar sensors, integrating them with enabling software to deliver precise 3D vision solutions across machinery, vehicles, robots, and fixed infrastructure. Its product ecosystem, including the OS scanning sensor and DF solid-state flash sensor, reflects a focused mission to enhance spatial awareness through advanced sensing technology.

The company’s revenue engine capitalizes on a blend of cutting-edge hardware and proprietary software that drives recurring value through continuous innovation and deployment. Ouster’s strategic outreach spans major global markets including the Americas, Europe, and Asia, positioning it to meet diverse industrial needs worldwide. Its robust technological foundation and cross-sector applications create a formidable economic moat, shaping the future of autonomous sensing and smart infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze Ouster, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

The table below presents Ouster, Inc.’s key income statement figures over the last five fiscal years, reflecting trends in revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 18.9M | 33.6M | 41.0M | 83.3M | 111.1M |

| Cost of Revenue | 17.4M | 24.5M | 30.1M | 73.6M | 70.6M |

| Operating Expenses | 53.3M | 108.8M | 156.4M | 382.9M | 144.6M |

| Gross Profit | 1.5M | 9.1M | 10.9M | 9.7M | 40.5M |

| EBITDA | -98.3M | -88.7M | -123.4M | -342.6M | -79.9M |

| EBIT | -103.9M | -96.3M | -135.6M | -364.3M | -94.7M |

| Interest Expense | 2.5M | 0.5M | 2.7M | 9.3M | 1.8M |

| Net Income | -106.8M | -93.9M | -138.6M | -374.1M | -97.0M |

| EPS | -59.79 | -7.02 | -7.79 | -10.1 | -2.08 |

| Filing Date | 2021-03-09 | 2022-02-28 | 2023-03-24 | 2024-03-28 | 2025-03-21 |

Income Statement Evolution

From 2020 to 2024, Ouster, Inc. exhibited strong revenue growth, rising nearly 488%, with a notable 33.4% increase between 2023 and 2024. Gross profit surged by 318.1% in the last year, reflecting improved cost efficiency, and gross margin stands favorably at 36.42%. Despite this, EBIT and net margins remain negative but show marked improvement in 2024 with EBIT margin at -85.22% and net margin at -87.35%.

Is the Income Statement Favorable?

The 2024 income statement reveals meaningful progress with revenue at $111M and a significantly smaller net loss of $97M compared to prior years. Operating expenses grew proportionally with revenue, supporting sustainable growth. Interest expense remains low at 1.64% of revenue, a positive sign for financial health. Overall, 85.7% of evaluated income statement metrics are favorable, indicating generally positive fundamentals despite ongoing net losses and negative profitability margins.

Financial Ratios

The table below presents key financial ratios for Ouster, Inc. over the fiscal years 2020 to 2024, providing a snapshot of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -5.65 | -2.80 | -3.38 | -4.49 | -0.87 |

| ROE | 2.91 | -0.36 | -0.81 | -2.08 | -0.54 |

| ROIC | -1.46 | -0.34 | -0.63 | -1.46 | -0.51 |

| P/E | -2.26 | -7.41 | -1.11 | -0.76 | -5.87 |

| P/B | -6.57 | 2.67 | 0.89 | 1.58 | 3.15 |

| Current Ratio | 1.01 | 9.38 | 5.51 | 3.22 | 2.80 |

| Quick Ratio | 0.78 | 9.04 | 4.85 | 2.94 | 2.59 |

| D/E | -0.59 | 0.07 | 0.33 | 0.39 | 0.11 |

| Debt-to-Assets | 0.47 | 0.06 | 0.22 | 0.21 | 0.07 |

| Interest Coverage | -20.56 | -198.0 | -53.98 | -40.12 | -57.15 |

| Asset Turnover | 0.41 | 0.11 | 0.16 | 0.25 | 0.40 |

| Fixed Asset Turnover | 0.91 | 1.33 | 1.81 | 2.89 | 4.54 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Between 2020 and 2024, Ouster, Inc. experienced a decline in Return on Equity (ROE), reaching -53.64% in 2024, indicating worsening profitability. The Current Ratio decreased from 9.38 in 2021 to 2.80 in 2024 but remained above 1, signaling maintained liquidity. The Debt-to-Equity Ratio improved significantly, falling from 0.39 in 2023 to 0.11 in 2024, reflecting reduced leverage risk.

Are the Financial Ratios Favorable?

In 2024, Ouster’s profitability ratios, including net margin (-87.35%) and ROE (-53.64%), were unfavorable, alongside a negative interest coverage ratio (-51.94), indicating financial stress. Liquidity metrics such as the Current Ratio (2.8) and Quick Ratio (2.59) were favorable, as was low leverage with a Debt-to-Equity of 0.11. Efficiency showed mixed signals: asset turnover was unfavorable at 0.4, but fixed asset turnover was favorable at 4.54. Overall, 57% of ratios were unfavorable, suggesting a cautious financial position.

Shareholder Return Policy

Ouster, Inc. has not paid dividends from 2020 through 2024, reflecting consistent net losses and negative free cash flow per share. This absence of dividend distribution aligns with its reinvestment strategy during its high-growth phase, prioritizing operational and capital expenditures over shareholder payouts.

The company does not engage in share buybacks either, likely due to its ongoing financial challenges and negative operating margins. This approach, focusing on reinvestment rather than immediate returns, aims to support sustainable long-term value creation, although it inherently carries risks associated with prolonged unprofitability.

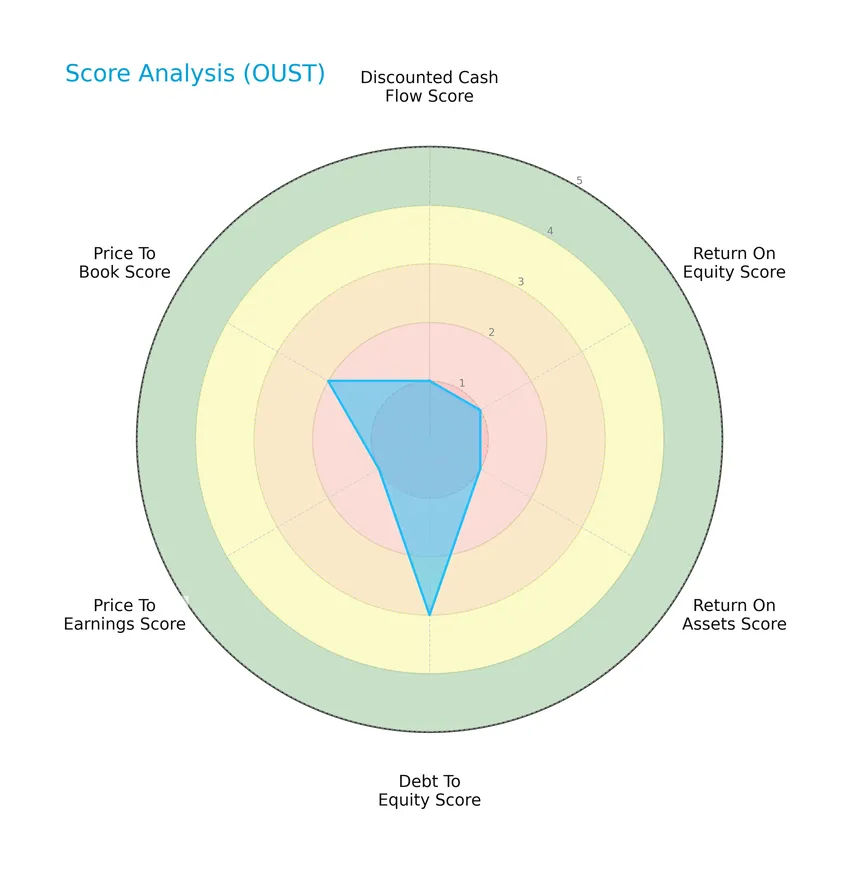

Score analysis

Here is an overview of Ouster, Inc.’s key financial scores represented in the radar chart for a comprehensive view of its valuation and performance metrics:

The scores reveal very unfavorable ratings in discounted cash flow, return on equity, return on assets, and price-to-earnings, while debt-to-equity and price-to-book ratios show moderate standing, indicating mixed financial signals.

Analysis of the company’s bankruptcy risk

Ouster, Inc.’s Altman Z-Score places it securely in the safe zone, suggesting a low probability of bankruptcy and strong financial stability:

Is the company in good financial health?

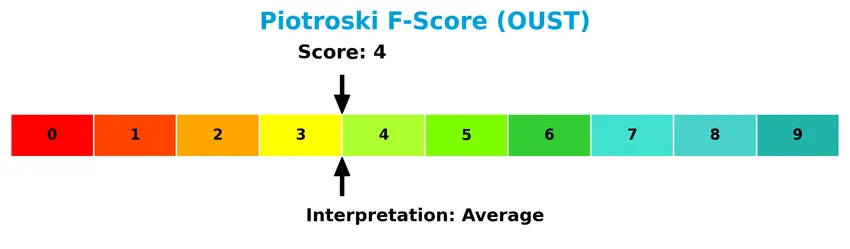

The Piotroski Score diagram illustrates the company’s moderate financial health status based on nine fundamental criteria:

With a score of 4, Ouster, Inc. falls into the average category, indicating neither strong nor weak financial health, reflecting a balanced but cautious outlook.

Competitive Landscape & Sector Positioning

This sector analysis will examine Ouster, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Ouster holds a competitive advantage over its industry peers.

Strategic Positioning

Ouster, Inc. focuses on a concentrated product portfolio of high-resolution digital lidar sensors and related software, generating $111M in 2024 revenue primarily from hardware. Geographically, it maintains diversified exposure across Americas ($58M), EMEA ($33M), and Asia Pacific ($20M), reflecting a balanced global footprint.

Revenue by Segment

This pie chart illustrates Ouster, Inc.’s revenue distribution across product segments for the fiscal year 2024, highlighting the evolution of its income sources over recent years.

Ouster’s revenue is primarily driven by its product segment, which reached $111.1M in 2024, marking a significant increase from $30.1M in 2022 and $33.6M in 2021. The data shows a strong upward trend in product sales, with no revenue recorded from services. The 2024 figures indicate acceleration in product revenue, reflecting growing market demand but also a concentration risk due to reliance on a single segment.

Key Products & Brands

The table below outlines Ouster, Inc.’s main products and their descriptions:

| Product | Description |

|---|---|

| OS Scanning Sensor | High-resolution digital lidar sensor providing 3D vision, designed for machinery and vehicles. |

| DF Flash Sensor | True solid-state flash lidar sensor offering detailed 3D spatial data for robotics and infrastructure assets. |

| Enabling Software | Software solutions that support and enhance the functionality of Ouster’s lidar sensors. |

Ouster, Inc. specializes in high-resolution digital lidar sensors and software, serving applications in machinery, vehicles, robotics, and fixed infrastructure. Their key products include the OS scanning sensor and DF flash sensor, which provide advanced 3D vision capabilities.

Main Competitors

There are 20 competitors in the Hardware, Equipment & Parts industry; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40B |

| Garmin Ltd. | 39B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Ouster, Inc. ranks 18th among 20 competitors, with a market cap just 0.87% of the leader’s (Amphenol Corporation). It sits well below both the average market cap of the top 10 competitors (54.5B) and the sector median (21.6B). The company has a significant 187% market cap gap to its next closest competitor above, highlighting its smaller scale within the sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Ouster have a competitive advantage?

Ouster currently does not present a strong competitive advantage as it is shedding value with a ROIC well below its WACC, though its profitability is improving. The company shows a slightly unfavorable moat status despite a growing ROIC trend from 2020 to 2024.

Looking ahead, Ouster’s product portfolio of high-resolution digital lidar sensors and expanding geographic revenues across Americas, Asia Pacific, and EMEA offer growth opportunities. Continued innovation in scanning and solid-state flash sensors could support further market penetration and revenue expansion.

SWOT Analysis

This SWOT analysis highlights Ouster, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong revenue growth of 33.4% in 2024

- favorable gross margin at 36.4%

- solid liquidity ratios with current ratio 2.8 and quick ratio 2.59

Weaknesses

- negative net margin at -87.4%

- unfavorable return on equity at -53.6%

- high beta of 2.935 indicating volatility

Opportunities

- expanding markets in Americas and EMEA with growing sales

- increasing profitability trend with 74% EBIT growth

- rising demand for lidar in autonomous and industrial applications

Threats

- intense competition in lidar and sensor technology

- high operating losses risk cash burn

- technological obsolescence in fast-evolving sector

Overall, Ouster shows promising growth and improving profitability but remains unprofitable with financial risks. Investors should weigh growth potential against operational challenges and market volatility when considering this stock.

Stock Price Action Analysis

The weekly stock chart below illustrates Ouster, Inc.’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Ouster, Inc. (OUST) stock price increased by 346.76%, indicating a strong bullish trend with acceleration. The price ranged from a low of 4.82 to a high of 35.8, with an 8.61 standard deviation, reflecting significant volatility. However, in the recent period from November 2025 to January 2026, the price declined by 3.38%, showing a slight bearish trend and mild deceleration.

Volume Analysis

In the last three months, trading volume for OUST has been increasing overall, with total volume at 952M shares and buyer volume at 56.17%. However, during the recent period from November 2025 to January 2026, seller volume dominated at 72%, suggesting a seller-driven market and potential cautious investor sentiment amid price weakness.

Target Prices

Analysts present a moderately optimistic target consensus for Ouster, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 39 | 33 | 36.67 |

The target prices suggest a potential upside, with analysts expecting the stock to trade around 36.67 on average, reflecting moderate confidence in its near-term prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback to provide insights into Ouster, Inc.’s market perception.

Stock Grades

Here is the recent summary of Ouster, Inc.’s analyst grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-07 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-05 |

| WestPark Capital | Maintain | Buy | 2025-11-05 |

| WestPark Capital | Upgrade | Buy | 2025-08-13 |

| Oppenheimer | Maintain | Outperform | 2025-07-16 |

| WestPark Capital | Downgrade | Hold | 2025-06-12 |

| WestPark Capital | Upgrade | Buy | 2025-05-09 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-21 |

| WestPark Capital | Maintain | Hold | 2025-03-21 |

The overall trend shows a predominance of Buy and Overweight grades with multiple upgrades from Hold to Buy during 2025, indicating improving analyst sentiment. There are no Sell or Strong Sell ratings, and consensus remains positive.

Consumer Opinions

Ouster, Inc. has sparked a mix of enthusiasm and concerns among its user base, reflecting a diverse consumer experience.

| Positive Reviews | Negative Reviews |

|---|---|

| “Ouster’s lidar technology delivers exceptional precision and reliability in autonomous systems.” | “The pricing structure feels steep for smaller businesses and startups.” |

| “Customer support is responsive and knowledgeable, helping solve technical issues quickly.” | “Some users reported occasional software glitches affecting data processing speed.” |

| “The product’s durability in harsh environments exceeds expectations, ideal for industrial use.” | “Limited integration options with certain legacy platforms slow down deployment.” |

Overall, consumers praise Ouster’s advanced lidar accuracy and robust customer service, while noting concerns about cost and occasional software integration challenges. Addressing these could enhance user satisfaction further.

Risk Analysis

Below is a summary table presenting key risks associated with Ouster, Inc., highlighting their likelihood and potential impact on investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative profitability metrics with net margin at -87.35% and ROE at -53.64% indicate losses. | High | High |

| Market Volatility | High beta of 2.935 suggests significant stock price fluctuations compared to the market. | High | Medium |

| Liquidity Risk | Strong current (2.8) and quick ratios (2.59) reduce risk of short-term liquidity problems. | Low | Low |

| Leverage Risk | Low debt-to-equity ratio (0.11) and debt-to-assets (7.33%) indicate conservative leverage. | Low | Low |

| Bankruptcy Risk | Altman Z-Score of 4.95 places Ouster in the safe zone, indicating low bankruptcy risk. | Low | High |

| Profitability Risk | Unfavorable interest coverage (-51.94) signals difficulty covering interest expenses. | Medium | High |

| Valuation Risk | Price-to-book ratio of 3.15 may imply overvaluation relative to book value. | Medium | Medium |

| Dividend Risk | No dividend yield, limiting income for dividend-focused investors. | High | Low |

The most critical risks are Ouster’s consistent losses and weak profitability metrics, which pose high impact and high probability concerns. Despite a strong Altman Z-Score indicating low bankruptcy risk, the high beta reflects substantial market volatility. Recent financials show ongoing challenges in achieving profitability, warranting cautious position sizing and close monitoring.

Should You Buy Ouster, Inc.?

Ouster, Inc. appears to have a slightly unfavorable moat profile with value destruction despite improving profitability. Its leverage profile seems moderate, supported by a safe-zone Altman Z-Score, though profitability metrics remain weak. Overall, the C- rating suggests a cautious analytical interpretation.

Strength & Efficiency Pillars

Ouster, Inc. exhibits solid financial resilience as evidenced by its Altman Z-Score of 4.95, placing it firmly in the safe zone, which indicates a low risk of bankruptcy. The company maintains a healthy balance sheet with a debt-to-equity ratio of 0.11 and a current ratio of 2.8, underscoring strong liquidity and low leverage. While profitability metrics such as ROE at -53.64% and ROIC at -50.84% are negative, the company’s revenue growth of 33.41% over the past year and gross margin of 36.42% reflect operational progress. The Piotroski score of 4 suggests average financial strength, highlighting areas for improvement.

Weaknesses and Drawbacks

Despite favorable liquidity, Ouster faces significant profitability challenges, with a net margin of -87.35% and an EBIT margin of -85.22%, signaling persistent losses. The price-to-book ratio of 3.15 suggests a premium valuation relative to book value, which may deter value-oriented investors. Interest coverage is deeply negative at -51.94, indicating difficulties in meeting interest obligations from operating earnings, raising concerns about financial sustainability. Recent market activity shows a seller dominance with buyers representing only 28.28%, creating short-term downward pressure on the stock price.

Our Verdict about Ouster, Inc.

Ouster presents an unfavorable long-term fundamental profile due to ongoing unprofitability and value destruction, as ROIC remains below WACC. However, the overall stock trend is bullish with strong volume growth and price appreciation of 346.76% over the longer term. Despite this, recent seller-dominant behavior suggests caution. Therefore, while the company might appear attractive to those focused on growth potential, a wait-and-see approach could be prudent to identify a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Ouster, Inc. (OUST) The Best Hardware Stock To Buy? – Yahoo Finance (Dec 10, 2025)

- Ouster (NYSE:OUST) Stock Price Down 5.9% – What’s Next? – MarketBeat (Jan 23, 2026)

- Ouster, Inc. (OUST) Stock Dips While Market Gains: Key Facts – sharewise.com (Jan 24, 2026)

- Ouster, Inc. (NASDAQ:OUST) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable – simplywall.st (Jan 15, 2026)

- Ouster: Strong Growth Should Lead To Further Upside (NASDAQ:OUST) – Seeking Alpha (Dec 16, 2025)

For more information about Ouster, Inc., please visit the official website: ouster.com