Home > Analyses > Communication Services > Omnicom Group Inc.

Omnicom Group Inc. drives how brands connect with consumers worldwide, shaping daily experiences through innovative advertising and marketing solutions. As a top player in the communication services sector, Omnicom excels with a diverse portfolio spanning advertising, public relations, digital marketing, and data analytics. Renowned for its creativity and global reach, the company continually adapts to evolving market demands. The key question for investors now is whether Omnicom’s solid fundamentals and innovation pipeline justify its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

Omnicom Group Inc., founded in 1944 and headquartered in New York City, stands as a dominant leader in the advertising agencies industry. Its comprehensive ecosystem integrates advertising, marketing, corporate communications, and digital transformation services, creating a unified platform that addresses diverse client needs. With a workforce of 74,900 employees, Omnicom’s mission centers on delivering innovative branding, public relations, and healthcare marketing solutions globally.

The company’s revenue engine balances a robust mix of service offerings including advertising, data analytics, media planning, and digital marketing across the Americas, Europe, and Asia. This diverse portfolio fuels recurring client engagements and cross-market synergies. Omnicom’s expansive global footprint and integrated capabilities form a resilient economic moat, positioning it to shape the future trajectory of communication services worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Omnicom Group Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

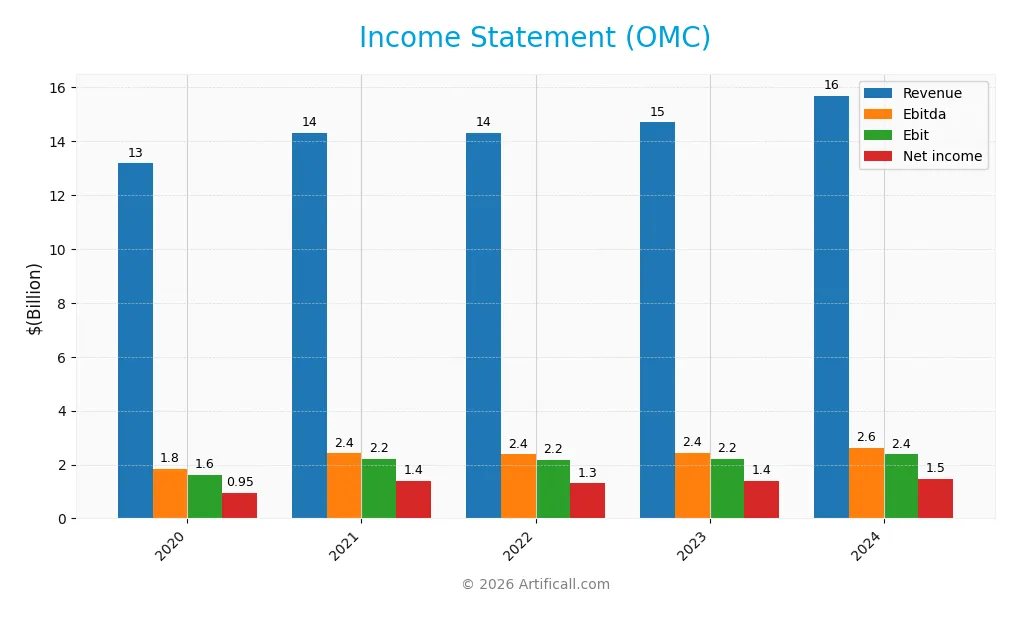

The table below summarizes Omnicom Group Inc.’s key income statement figures for the fiscal years 2020 through 2024, showing revenues, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 13.2B | 14.3B | 14.3B | 14.7B | 15.7B |

| Cost of Revenue | 11.1B | 11.8B | 11.7B | 12.2B | 12.9B |

| Operating Expenses | 361M | 380M | 379M | 394M | 394M |

| Gross Profit | 2.1B | 2.5B | 2.6B | 2.5B | 2.7B |

| EBITDA | 1.8B | 2.4B | 2.4B | 2.4B | 2.6B |

| EBIT | 1.6B | 2.2B | 2.2B | 2.2B | 2.4B |

| Interest Expense | 214M | 210M | 209M | 219M | 248M |

| Net Income | 945M | 1.4B | 1.3B | 1.4B | 1.5B |

| EPS | 4.39 | 6.57 | 6.40 | 6.98 | 7.54 |

| Filing Date | 2021-02-18 | 2022-02-09 | 2023-02-08 | 2024-02-07 | 2025-02-05 |

Income Statement Evolution

From 2020 to 2024, Omnicom Group Inc. saw revenue grow by 19.12% to $15.7B, with net income increasing 55.66% to $1.48B. Gross margin remained stable and neutral at 17.47%, while EBIT and net margins showed favorable improvements, reaching 15.14% and 9.44%, respectively. Operating expenses grew in line with revenue, supporting margin stability.

Is the Income Statement Favorable?

The 2024 income statement reflects generally favorable fundamentals: revenue rose 6.79% year-over-year to $15.7B, gross profit grew 9.69%, and EBIT increased 7.42%, indicating operational efficiency. Despite a slight net margin decline of 0.35%, EPS grew 7.96% to $7.54. Interest expense remained low relative to revenue, supporting profitability. Overall, 78.57% of income metrics are favorable, suggesting solid financial health.

Financial Ratios

The table below presents key financial ratios for Omnicom Group Inc. (OMC) over the fiscal years 2020 to 2024, providing an overview of profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.2% | 9.8% | 9.1% | 9.5% | 9.4% |

| ROE | 30.8% | 42.7% | 40.0% | 38.5% | 35.3% |

| ROIC | 10.3% | 13.0% | 13.0% | 12.4% | 13.0% |

| P/E | 14.1 | 11.3 | 12.9 | 12.4 | 11.4 |

| P/B | 4.4 | 4.8 | 5.2 | 4.8 | 4.0 |

| Current Ratio | 1.00 | 0.98 | 0.97 | 0.95 | 1.00 |

| Quick Ratio | 0.93 | 0.91 | 0.89 | 0.86 | 0.90 |

| D/E | 2.25 | 2.10 | 2.06 | 1.80 | 1.64 |

| Debt-to-Assets | 25.0% | 24.2% | 24.8% | 23.2% | 23.2% |

| Interest Coverage | 8.0 | 10.2 | 10.5 | 9.6 | 9.5 |

| Asset Turnover | 0.48 | 0.50 | 0.53 | 0.52 | 0.53 |

| Fixed Asset Turnover | 7.3 | 6.5 | 6.9 | 7.6 | 8.4 |

| Dividend Yield | 4.2% | 3.8% | 3.5% | 3.3% | 3.3% |

Evolution of Financial Ratios

From 2020 to 2024, Omnicom Group Inc. showed an overall improvement in Return on Equity (ROE), rising from 30.8% to 35.3%, indicating enhanced profitability. The Current Ratio remained relatively stable but below 1.0, reflecting consistent liquidity challenges. The Debt-to-Equity Ratio decreased from about 2.25 in 2020 to 1.64 in 2024, signaling a moderate reduction in financial leverage.

Are the Financial Ratios Favorable?

In 2024, Omnicom’s profitability metrics like ROE (35.3%) and Return on Invested Capital (13.0%) were favorable, supported by a net margin rated neutral at 9.4%. Liquidity ratios were mixed; the Current Ratio at 1.0 was unfavorable, while the Quick Ratio at 0.9 was neutral. Leverage indicators showed some concern with a Debt-to-Equity Ratio of 1.64 deemed unfavorable, yet the Debt-to-Assets Ratio at 23.2% was favorable. Market valuation was positive with a PE ratio of 11.4 but a high Price-to-Book ratio of 4.03 was unfavorable. Overall, 57% of ratios were favorable, indicating a generally positive financial profile.

Shareholder Return Policy

Omnicom Group Inc. maintains a consistent dividend payout ratio around 37-59%, with a dividend yield near 3.3% in 2024 and stable dividends per share around $2.81. The dividend payments are well covered by free cash flow, supporting a balanced return approach.

The company also engages in share buybacks, complementing its dividend distributions. This combined strategy appears aligned with sustainable long-term shareholder value creation, given the coverage by operating cash flow and manageable leverage ratios.

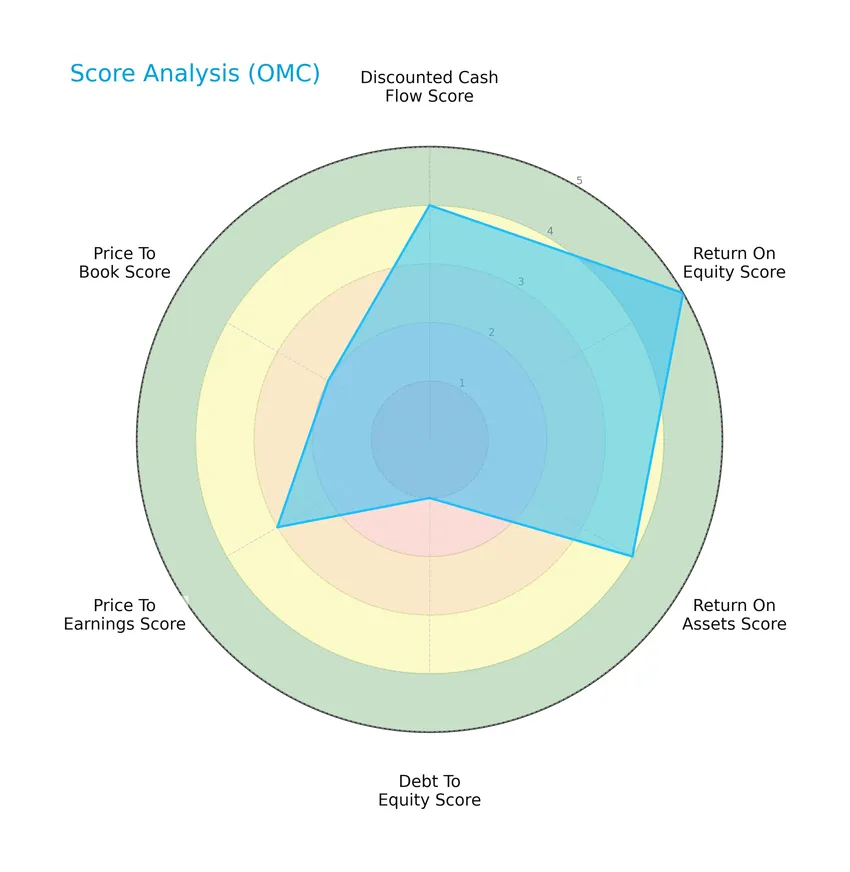

Score analysis

The following radar chart provides an overview of Omnicom Group Inc.’s key financial scores across multiple valuation and performance metrics:

Omnicom Group shows strong returns with a very favorable return on equity score of 5 and a favorable return on assets score of 4. Its discounted cash flow score is also favorable at 4. However, the debt to equity score is very unfavorable at 1, indicating higher leverage risk. Price-to-earnings and price-to-book scores stand at moderate levels of 3 and 2 respectively.

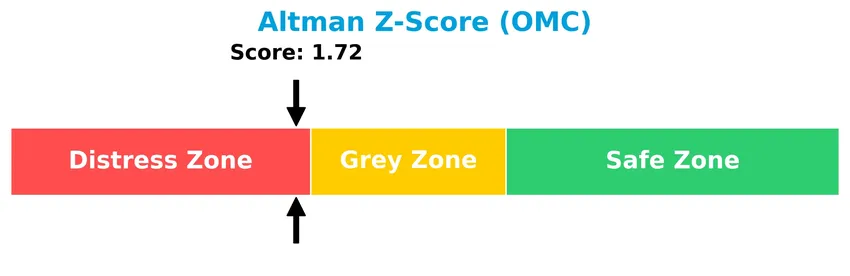

Analysis of the company’s bankruptcy risk

Omnicom Group’s Altman Z-Score places it in the distress zone, signaling a higher risk of financial distress and potential bankruptcy:

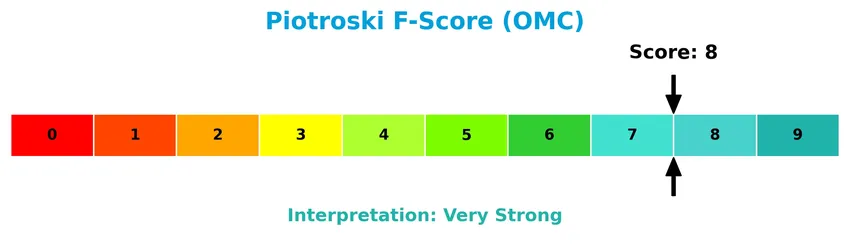

Is the company in good financial health?

The Piotroski F-Score diagram illustrates Omnicom Group’s financial strength based on profitability, leverage, and efficiency criteria:

With a very strong Piotroski score of 8, Omnicom Group demonstrates solid financial health and robust fundamentals, suggesting resilience despite other risk factors.

Competitive Landscape & Sector Positioning

This sector analysis will review Omnicom Group Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Omnicom Group holds a competitive advantage over its peers in the advertising agencies industry.

Strategic Positioning

Omnicom Group Inc. operates a diversified portfolio across advertising, healthcare, public relations, and experiential services, generating $10.4B from non-advertising segments in 2024. Geographically, it maintains broad exposure with $8.7B in North America, $4.4B in Europe, and $1.8B in Asia Pacific, reflecting a balanced global footprint.

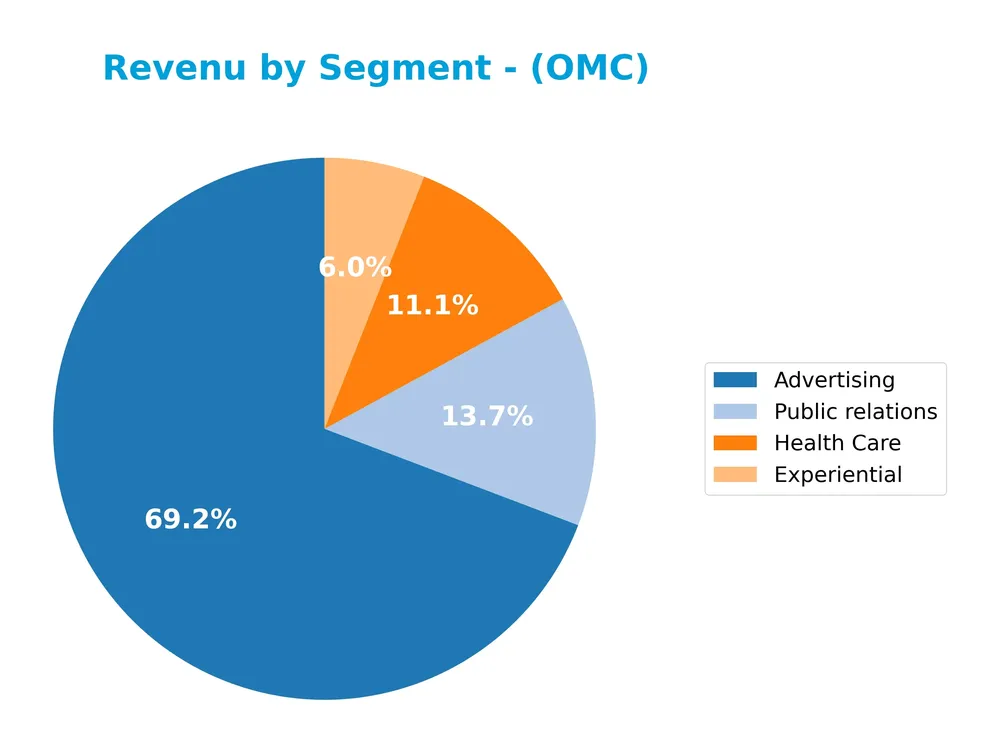

Revenue by Segment

The pie chart displays Omnicom Group Inc.’s revenue distribution by segment for the fiscal year 2024, illustrating the company’s income sources across its main business areas.

In 2024, Advertising remains the dominant segment, generating $8.47B, followed by Public Relations at $1.68B, Health Care at $1.35B, and Experiential at $731M. Advertising shows steady growth over recent years, indicating it as the core revenue driver. The Health Care and Public Relations segments demonstrate moderate increases, while Experiential also grows but remains the smallest contributor, reflecting a stable yet concentrated revenue structure with limited diversification risk.

Key Products & Brands

The table below summarizes Omnicom Group Inc.’s key products and brands with their respective service descriptions:

| Product | Description |

|---|---|

| Advertising | Comprehensive advertising services including branding, digital/direct marketing, and media buying. |

| Experiential | Marketing services focused on entertainment, experiential, and event marketing strategies. |

| Health Care | Specialized healthcare marketing and communications services. |

| Public relations | Services including corporate communications, crisis communications, investor relations, and public affairs. |

Omnicom Group’s product portfolio spans advertising, experiential marketing, healthcare communications, and public relations, reflecting its broad scope in marketing and corporate communications services worldwide.

Main Competitors

Omnicom Group Inc. faces competition from 18 companies, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| T-Mobile US, Inc. | 223.3B |

| AT&T Inc. | 174.0B |

| Verizon Communications Inc. | 170.8B |

| Comcast Corporation | 107.6B |

| DoorDash, Inc. | 94.7B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Baidu, Inc. | 44.3B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

Omnicom Group Inc. ranks 15th among 18 competitors, with a market cap roughly 4.0% that of the leader, Netflix. It is positioned below both the average market cap of the top 10 (134B) and the sector median (33.5B). The company maintains a 7.81% market cap gap to the next competitor above it, highlighting a moderate distance in scale within its peer group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does OMC have a competitive advantage?

Omnicom Group Inc. demonstrates a very favorable competitive advantage, evidenced by a ROIC exceeding its WACC by 7.0% and a 26.1% growth trend, signaling strong value creation and efficient capital use. The company’s favorable EBIT margin of 15.14% and overall positive income statement evaluation further support its durable competitive position in the advertising industry.

Looking ahead, Omnicom’s extensive service portfolio across global markets, including North America, Europe, and Asia Pacific, positions it well for growth opportunities in digital transformation and marketing analytics. Its presence in diverse regions and expanding service offerings suggest potential for continued profitability and market share expansion.

SWOT Analysis

This SWOT analysis highlights Omnicom Group Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- strong global presence with diversified geographic revenue

- favorable EBIT margin of 15.14%

- very strong Piotroski Score of 8

Weaknesses

- current ratio at 1.0 indicates tight liquidity

- debt-to-equity ratio of 1.64 signals higher leverage

- slight net margin decline in last year (-0.35%)

Opportunities

- expanding digital marketing and data analytics services

- growing demand in Asia Pacific and emerging markets

- increasing ROIC trend indicating value creation

Threats

- intense competition in advertising and marketing sector

- economic downturns impacting client ad budgets

- regulatory risks in multiple international markets

Omnicom demonstrates a robust competitive position with solid profitability and a durable moat. However, its leverage and liquidity warrant caution. The company’s strategic focus on digital growth and emerging markets could drive future gains, but investors should monitor sector competition and macroeconomic risks closely.

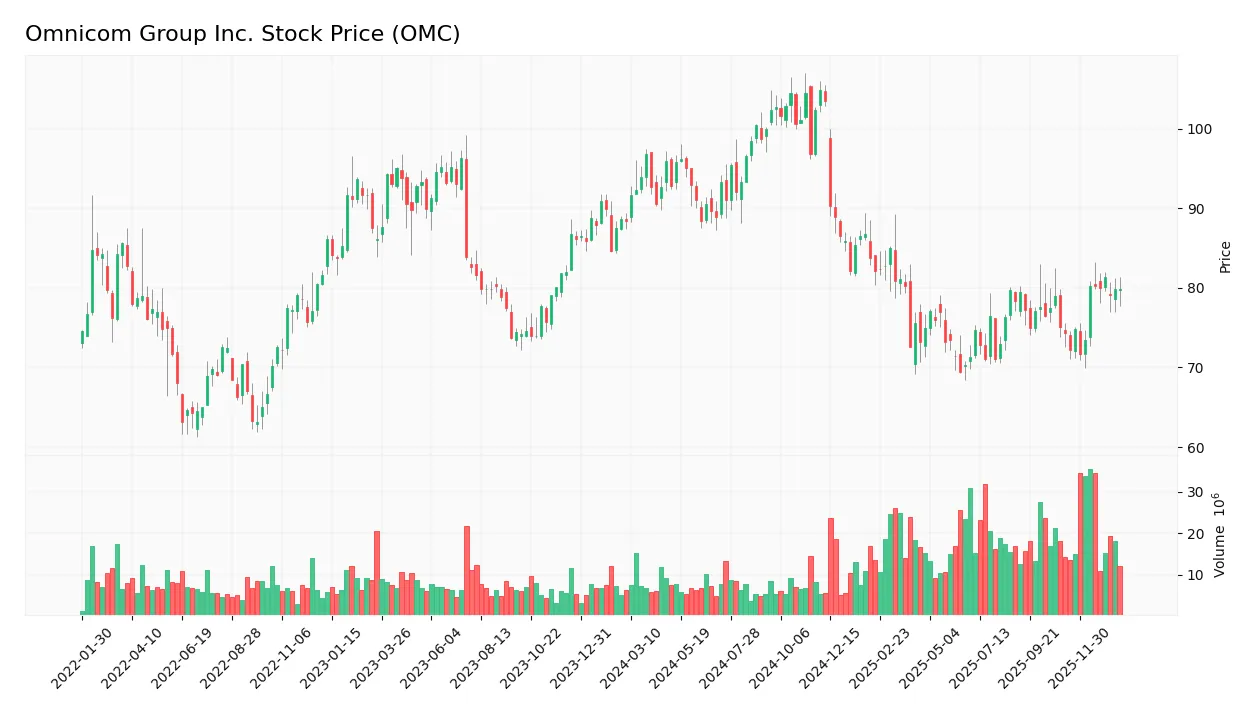

Stock Price Action Analysis

The weekly stock chart for Omnicom Group Inc. (OMC) illustrates price movements over the past 100 weeks, highlighting key highs, lows, and recent momentum:

Trend Analysis

Over the past 12 months, Omnicom Group Inc. experienced a -9.78% price change, indicating a bearish trend with accelerating decline. The stock ranged between a high of 104.82 and a low of 69.48, showing significant volatility with a standard deviation of 10.23. However, from November 2025 to January 2026, a 7.42% price increase suggests a short-term reversal with moderate volatility.

Volume Analysis

In the last three months, trading volumes have been increasing overall, with total volume exceeding 1.5B shares. Buyer volume slightly declined to 48.04%, indicating neutral buyer behavior and a slight seller dominance. This suggests cautious investor sentiment with balanced market participation between buyers and sellers.

Target Prices

The consensus target prices for Omnicom Group Inc. indicate a moderate upside potential with some room for downside risk.

| Target High | Target Low | Consensus |

|---|---|---|

| 108 | 82 | 92.25 |

Analysts expect Omnicom’s stock to trade between 82 and 108, with an average consensus price of 92.25, reflecting cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Omnicom Group Inc. (OMC).

Stock Grades

Here is the latest overview of Omnicom Group Inc. stock grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Downgrade | Underperform | 2026-01-05 |

| UBS | Maintain | Buy | 2025-12-05 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Wells Fargo | Upgrade | Overweight | 2025-09-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-16 |

| JP Morgan | Maintain | Overweight | 2025-07-10 |

| Barclays | Downgrade | Equal Weight | 2025-06-25 |

| B of A Securities | Upgrade | Neutral | 2025-06-23 |

| Barclays | Maintain | Overweight | 2025-04-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-16 |

The grading trend for Omnicom Group shows a mixed stance with recent shifts including a downgrade to underperform by B of A Securities, contrasting with stable or improved ratings like Wells Fargo’s upgrade to overweight. The consensus remains cautious with a “Hold” rating supported by 20 hold recommendations and 10 buys.

Consumer Opinions

Consumers have mixed but insightful perspectives on Omnicom Group Inc., reflecting both its industry strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong creative output and innovative campaigns | Customer service response times can be slow |

| Reliable delivery of marketing solutions | High pricing compared to competitors |

| Experienced and knowledgeable account teams | Occasional misalignment with client expectations |

| Effective global reach and media buying power | Limited flexibility in contract terms |

Overall, consumer feedback praises Omnicom’s creative expertise and global capabilities while noting challenges with customer service and pricing. These recurring themes suggest strong operational competence tempered by areas needing better client engagement.

Risk Analysis

Below is a table summarizing the key risks associated with investing in Omnicom Group Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-score in distress zone (1.72) signals moderate bankruptcy risk despite strong Piotroski score. | Moderate | High |

| Leverage | High debt-to-equity ratio of 1.64 increases financial risk and interest obligations. | High | Moderate |

| Liquidity | Current ratio at 1.0 and quick ratio at 0.9 indicate tight liquidity, possibly limiting flexibility. | Moderate | Moderate |

| Valuation | Price-to-book ratio at 4.03 is unfavorable, possibly implying overvaluation risk. | Moderate | Moderate |

| Market Volatility | Beta of 0.755 suggests below-average volatility, reducing market risk exposure. | Low | Low |

| Industry Exposure | Advertising sector sensitive to economic cycles and digital transformation disruptions. | Moderate | High |

The most critical risks for Omnicom are its moderate bankruptcy risk indicated by the Altman Z-score and its high leverage, which could strain finances in downturns. Industry cyclicality and digital shifts remain important to monitor given their impact on advertising revenues. Overall, cautious risk management is advised despite favorable profitability metrics.

Should You Buy Omnicom Group Inc.?

Omnicom Group Inc. appears to be positioned with a durable competitive moat supported by growing ROIC, suggesting strong value creation and operational efficiency. Despite its moderate overall rating of B+ and manageable leverage profile, the distress zone Altman Z-score indicates cautious risk considerations.

Strength & Efficiency Pillars

Omnicom Group Inc. shows solid profitability with a return on equity of 35.31% and a net margin of 9.44%, underscoring efficient operational management. The company is a clear value creator, with its return on invested capital at 12.97% comfortably exceeding the weighted average cost of capital of 5.96%. Financial health signals are mixed: a very strong Piotroski score of 8 contrasts with an Altman Z-Score of 1.72, placing it in the distress zone, which warrants caution despite robust profitability metrics.

Weaknesses and Drawbacks

Valuation and leverage metrics pose notable risks. The price-to-book ratio stands at an elevated 4.03, indicating potential overvaluation relative to book value. The debt-to-equity ratio is high at 1.64, reflecting significant leverage that may constrain flexibility, while a current ratio of 1.0 suggests tight short-term liquidity. Moreover, recent market behavior is bearish, with a 9.78% price decline over the longer term and seller dominance at 51.96% in the last period, creating short-term headwinds for investors.

Our Verdict about Omnicom Group Inc.

Omnicom presents a favorable long-term fundamental profile driven by strong profitability and value creation. However, recent bearish technical trends and seller dominance might suggest a wait-and-see approach for a better entry point. The company’s financial leverage and liquidity concerns temper enthusiasm, though improving recent price momentum could signal a potential stabilization phase.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Invests $1.87 Million in Omnicom Group Inc. $OMC – MarketBeat (Jan 24, 2026)

- Is Omnicom Group (OMC) Pricing Reflect Recent Agency Model Shifts Accurately – Yahoo Finance (Jan 22, 2026)

- Universal Beteiligungs und Servicegesellschaft mbH Has $17.99 Million Holdings in Omnicom Group Inc. $OMC – MarketBeat (Jan 24, 2026)

- A Look At Omnicom Group (OMC) Valuation Following Recent Share Price Moves And Interpublic Acquisition Plans – Sahm (Jan 17, 2026)

- Omnicom Group (OMC) Stock Trades Up, Here Is Why – Yahoo Finance (Jan 14, 2026)

For more information about Omnicom Group Inc., please visit the official website: omnicomgroup.com