Home > Analyses > Industrials > Old Dominion Freight Line, Inc.

Old Dominion Freight Line moves the backbone of North America’s commerce with unmatched precision and speed. As a premier less-than-truckload carrier, it commands respect for its extensive network and innovative logistics solutions. The company’s reputation for reliability and operational excellence sets industry standards. Yet, in a market facing evolving supply chain challenges, I ask: do Old Dominion’s fundamentals still justify its premium valuation and growth trajectory?

Table of contents

Business Model & Company Overview

Old Dominion Freight Line, Inc., founded in 1934 and based in Thomasville, North Carolina, commands a leading position in the U.S. less-than-truckload (LTL) trucking industry. The company’s network forms a cohesive ecosystem of regional, inter-regional, and national LTL services, complemented by expedited transportation and value-added offerings like container drayage and supply chain consulting. This integrated approach underpins its operational strength across North America.

The company’s revenue engine balances fleet-intensive hardware—over 10K tractors and nearly 41K trailers—with sophisticated logistics and brokerage software services. Its extensive footprint spans the Americas, supported by 251 service centers and three maintenance hubs. This blend of assets and services creates a durable economic moat, positioning Old Dominion as a pivotal force shaping freight transportation’s future.

Financial Performance & Fundamental Metrics

I analyze Old Dominion Freight Line’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

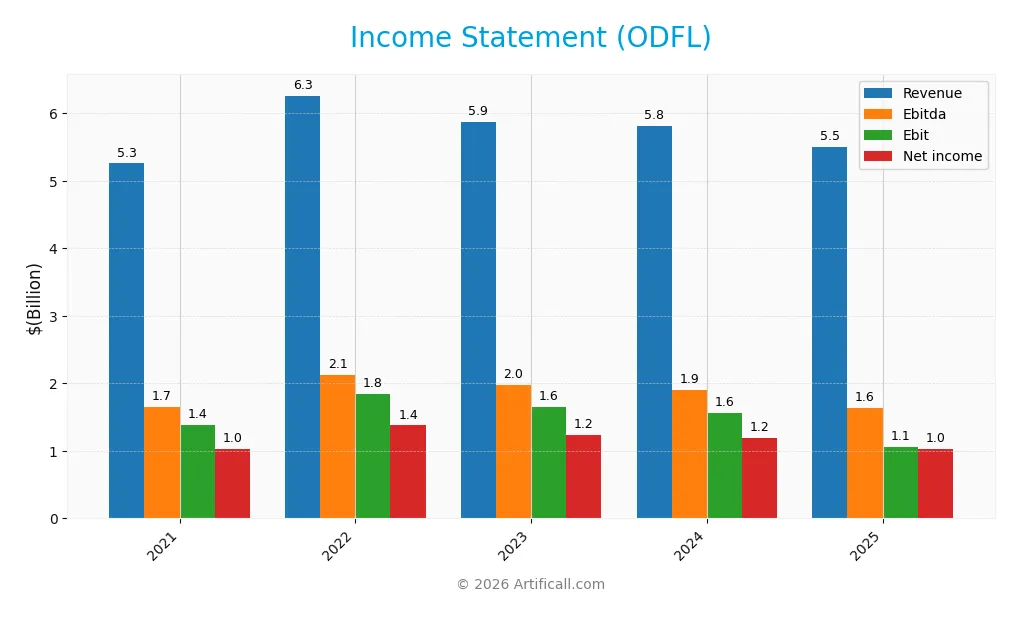

The table below presents Old Dominion Freight Line, Inc.’s key income statement figures for fiscal years 2021 through 2025, showing revenue trends, profitability, and earnings metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.26B | 6.26B | 5.87B | 5.81B | 5.50B |

| Cost of Revenue | 3.48B | 4.00B | 3.79B | 3.79B | 2.81B |

| Operating Expenses | 383M | 415M | 432M | 479M | 317M |

| Gross Profit | 1.78B | 2.26B | 2.07B | 2.02B | 1.37B |

| EBITDA | 1.65B | 2.12B | 1.97B | 1.90B | 1.63B |

| EBIT | 1.39B | 1.84B | 1.65B | 1.56B | 1.06B |

| Interest Expense | 1.73M | 1.56M | 464K | 212K | 12K |

| Net Income | 1.03B | 1.38B | 1.24B | 1.19B | 1.02B |

| EPS | 4.47 | 6.13 | 5.66 | 5.51 | 4.85 |

| Filing Date | 2022-02-23 | 2023-02-22 | 2024-02-26 | 2025-02-25 | 2026-02-04 |

Income Statement Evolution

Old Dominion Freight Line’s revenue declined by 5.5% from 2024 to 2025, reversing a modest 4.6% growth over 2021-2025. Gross profit contracted sharply by 32%, dragging down the EBIT by a similar margin. Margins weakened overall, with net margin falling by 8.7% year-over-year, indicating pressure on profitability despite some operational expense control.

Is the Income Statement Favorable?

In 2025, ODFL reported a gross margin of 25% and an EBIT margin of 19.2%, both marked favorable by benchmarks. Interest expense remained negligible, supporting clean financing costs. However, revenue and net income trends are unfavorable, with net income slipping 1% over five years and EPS down nearly 12% last year. The overall income statement stance is cautious, reflecting mixed fundamentals.

Financial Ratios

The table below presents key financial ratios for Old Dominion Freight Line, Inc. over the last five fiscal years to facilitate year-over-year comparison:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 19.7% | 22.0% | 21.1% | 20.4% | 18.6% |

| ROE | 28.1% | 37.7% | 29.1% | 27.9% | — |

| ROIC | 23.8% | 31.8% | 24.7% | 23.6% | — |

| P/E | 40.1 | 23.3 | 35.8 | 32.0 | 32.1 |

| P/B | 11.3 | 8.8 | 10.4 | 8.9 | 0 |

| Current Ratio | 2.98 | 1.76 | 2.10 | 1.33 | 0 |

| Quick Ratio | 2.98 | 1.76 | 2.10 | 1.33 | 0 |

| D/E | 0.03 | 0.03 | 0.02 | 0.04 | 0 |

| Debt-to-Assets | 2.1% | 2.1% | 1.5% | 3.1% | 0 |

| Interest Coverage | 806x | 1178x | 3536x | 7283x | 113420x |

| Asset Turnover | 1.09 | 1.29 | 1.06 | 1.06 | 0 |

| Fixed Asset Turnover | 1.63 | 1.70 | 1.43 | 1.29 | 0 |

| Dividend Yield | 0.22% | 0.42% | 0.39% | 0.59% | 0.71% |

Note: Some 2025 ratios are unavailable or reported as zero, reflecting incomplete data disclosure.

Evolution of Financial Ratios

Over the period, Return on Equity (ROE) and Current Ratio showed a declining trend, reaching zero in 2025. Debt-to-Equity Ratio remained consistently low, indicating stable leverage. Profitability margins, including net profit margin, decreased moderately, signaling a slowdown in earnings efficiency despite relatively strong operating margins in earlier years.

Are the Financial Ratios Fovorable?

In 2025, profitability is mixed: net margin at 18.63% is favorable, but ROE and ROIC are zero, marking concern. Liquidity ratios are unfavorable due to zero current and quick ratios, while leverage ratios remain favorable with low debt levels. Market valuation metrics like P/E are unfavorable at 32.15, suggesting high price relative to earnings. Overall, the majority of ratios tilt toward an unfavorable assessment.

Shareholder Return Policy

Old Dominion Freight Line, Inc. maintains a consistent dividend policy with a payout ratio rising from 8.9% in 2021 to 23% in 2025 and a dividend yield near 0.7%. The dividend per share increased steadily to $1.12 in 2025, supported by free cash flow coverage above 1.6 times.

The company also engages in share buybacks, reinforcing capital return alongside dividends. This balanced approach suggests a commitment to sustainable, long-term shareholder value creation, though investors should monitor payout growth relative to profit margins and cash flow stability.

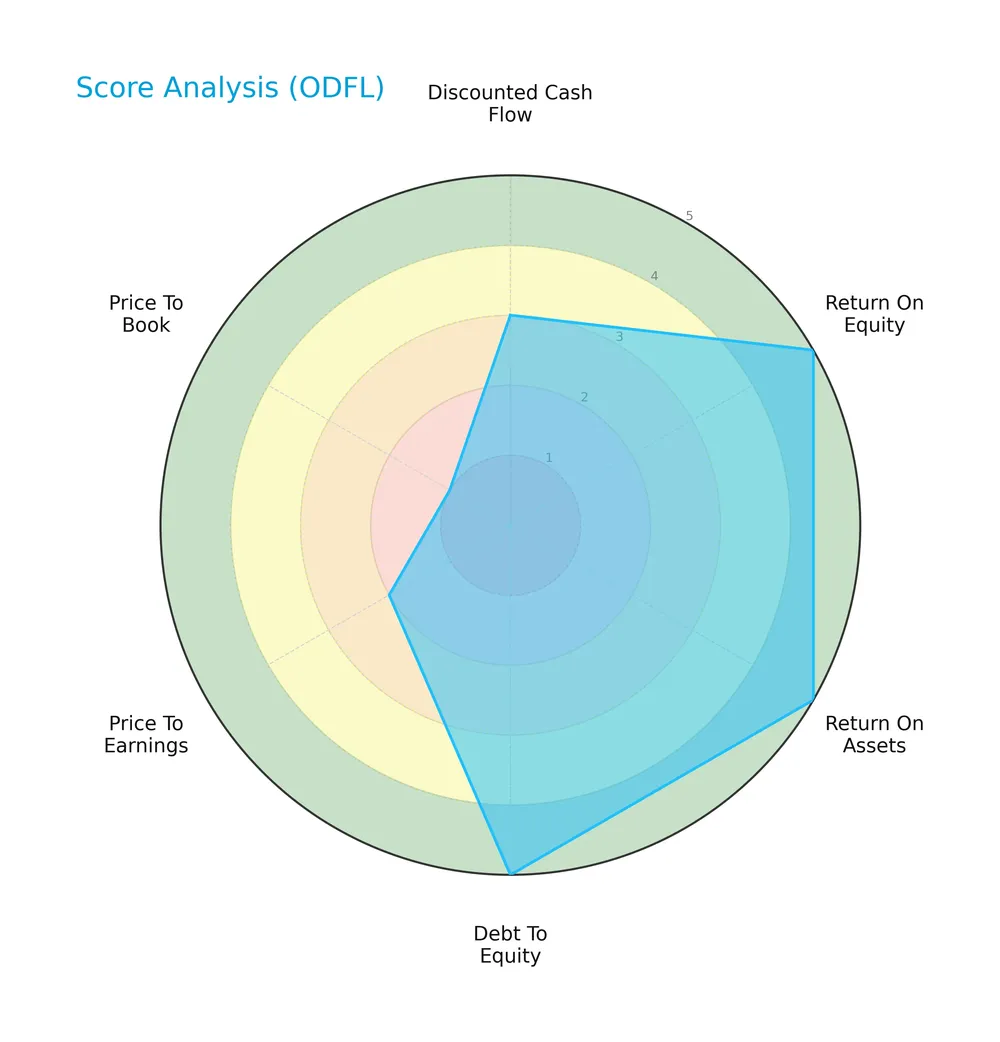

Score analysis

The radar chart below presents a detailed view of Old Dominion Freight Line’s key financial scores:

The company scores very favorably on return on equity, return on assets, and debt to equity, reflecting strong profitability and balance sheet management. Discounted cash flow and price to earnings scores are moderate, while price to book is notably low.

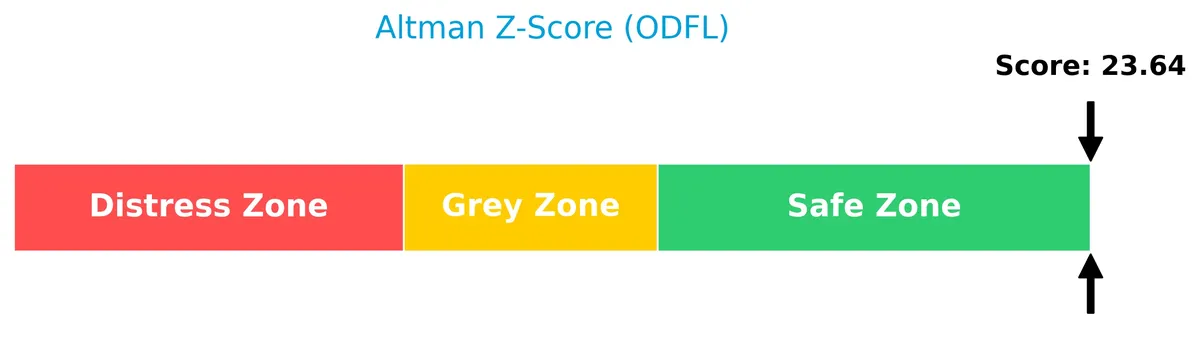

Analysis of the company’s bankruptcy risk

Old Dominion Freight Line’s Altman Z-Score strongly indicates it is in the safe zone, suggesting minimal bankruptcy risk at present:

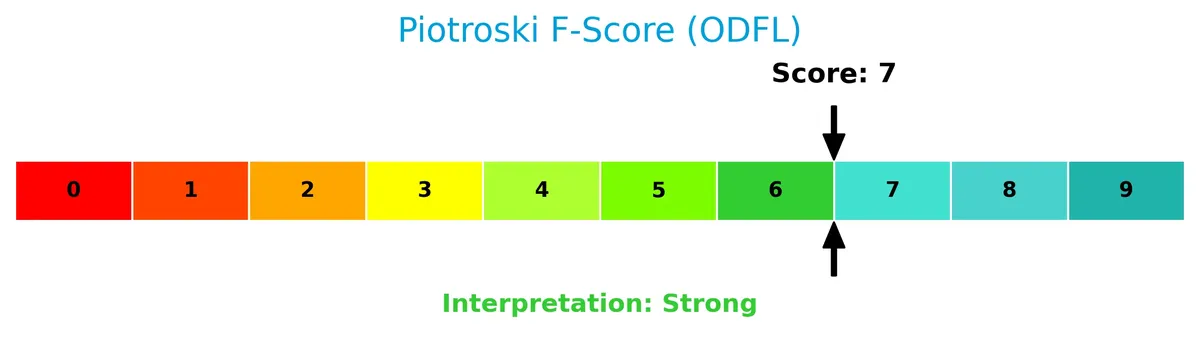

Is the company in good financial health?

The Piotroski diagram highlights Old Dominion Freight Line’s solid financial strength based on nine critical health indicators:

With a Piotroski score of 7, the company demonstrates strong financial health, indicating robust profitability, liquidity, and operating efficiency.

Competitive Landscape & Sector Positioning

This section analyzes Old Dominion Freight Line’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Old Dominion holds a competitive advantage over its industry peers.

Strategic Positioning

Old Dominion Freight Line focuses on less-than-truckload (LTL) services across the US and North America, with LTL revenue exceeding 5.7B in 2024. Its portfolio shows limited diversification, relying heavily on LTL services with minor contributions from ancillary offerings like truckload brokerage and supply chain consulting.

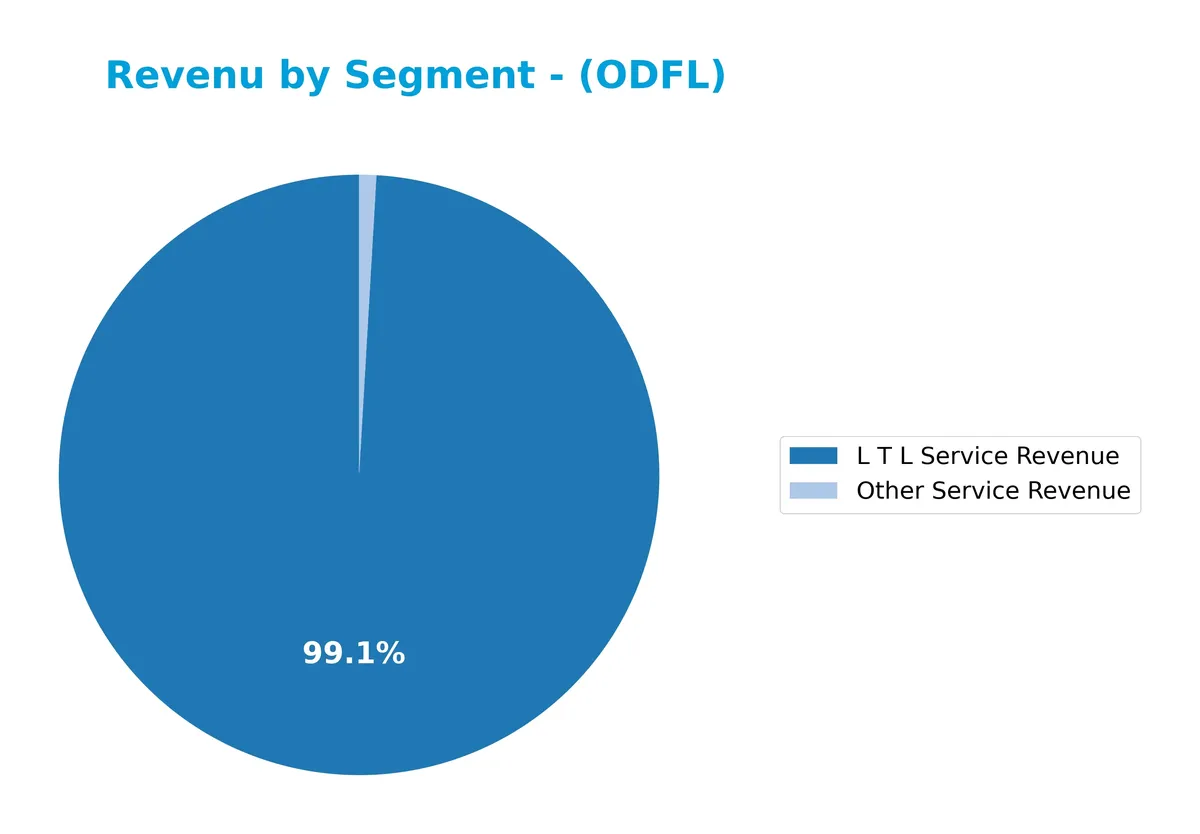

Revenue by Segment

This pie chart displays Old Dominion Freight Line’s revenue breakdown by segment for fiscal year 2024, highlighting the dominant sources of income and their relative scale.

Old Dominion’s revenue heavily relies on L T L Service, generating $5.76B in 2024, dwarfing Other Service Revenue at $54M. Historically, L T L Service consistently drives over 98% of total revenue, underscoring a concentrated business model. The slight decline from $6.18B in 2022 to $5.76B in 2024 signals a cautious slowdown, warranting attention to growth sustainability in its core segment.

Key Products & Brands

Old Dominion Freight Line’s core offerings and related services include:

| Product | Description |

|---|---|

| Less-Than-Truckload (LTL) Service | Regional, inter-regional, and national LTL freight transportation across the US and North America. |

| Expedited Transportation | Faster delivery options integrated within LTL services for time-sensitive shipments. |

| Container Drayage | Short-haul movement of containers between ports, terminals, and warehouses. |

| Truckload Brokerage | Facilitating the arrangement of full truckload shipments through third-party carriers. |

| Supply Chain Consulting | Advisory services to optimize clients’ logistics and transportation networks. |

Old Dominion’s revenue primarily derives from LTL services, reflecting its specialization in this segment. Complementary services enhance customer solutions but contribute a smaller revenue share.

Main Competitors

There are 89 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338B |

| Caterpillar Inc. | 280B |

| RTX Corporation | 251B |

| The Boeing Company | 171B |

| Union Pacific Corporation | 138B |

| Eaton Corporation plc | 127B |

| Deere & Company | 126B |

| Honeywell International Inc. | 124B |

| Lockheed Martin Corporation | 116B |

| Parker-Hannifin Corporation | 114B |

Old Dominion Freight Line, Inc. ranks 49th among 89 competitors. Its market cap is 12.49% of the sector leader, GE Aerospace. The company sits below the average market cap of the top 10 (178.7B) but above the sector median (36B). It maintains a 21.02% market cap gap to the next competitor above, indicating a moderate buffer.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ODFL have a competitive advantage?

Old Dominion Freight Line, Inc. shows several favorable margin metrics, indicating operational efficiency despite recent declines in revenue and profit growth. However, its ROIC trend is sharply declining, and ROIC versus WACC data is unavailable, limiting confirmation of a sustained moat.

Looking ahead, ODFL’s extensive asset base and service network support potential growth in regional and national less-than-truckload markets. The company’s value-added services could create new revenue streams, but recent financial headwinds highlight the need for cautious monitoring.

SWOT Analysis

This SWOT analysis highlights Old Dominion Freight Line’s key internal capabilities and external challenges to guide strategic decisions.

Strengths

- Strong net margin at 18.63%

- Extensive service network with 251 service centers

- Excellent interest coverage ratio at 88,060

Weaknesses

- Recent 5.5% revenue decline

- Declining gross profit growth at -32%

- Limited liquidity with low current and quick ratios

Opportunities

- Expansion in supply chain consulting

- Growth in expedited transportation demand

- Increasing inter-regional freight needs

Threats

- Intense competition in trucking industry

- Economic downturn risks reducing freight volume

- Rising fuel and labor costs impacting margins

Old Dominion’s solid profitability and service footprint provide a strong base. However, revenue contraction and liquidity concerns require cautious capital management. The firm must leverage growth in value-added services while mitigating sector headwinds.

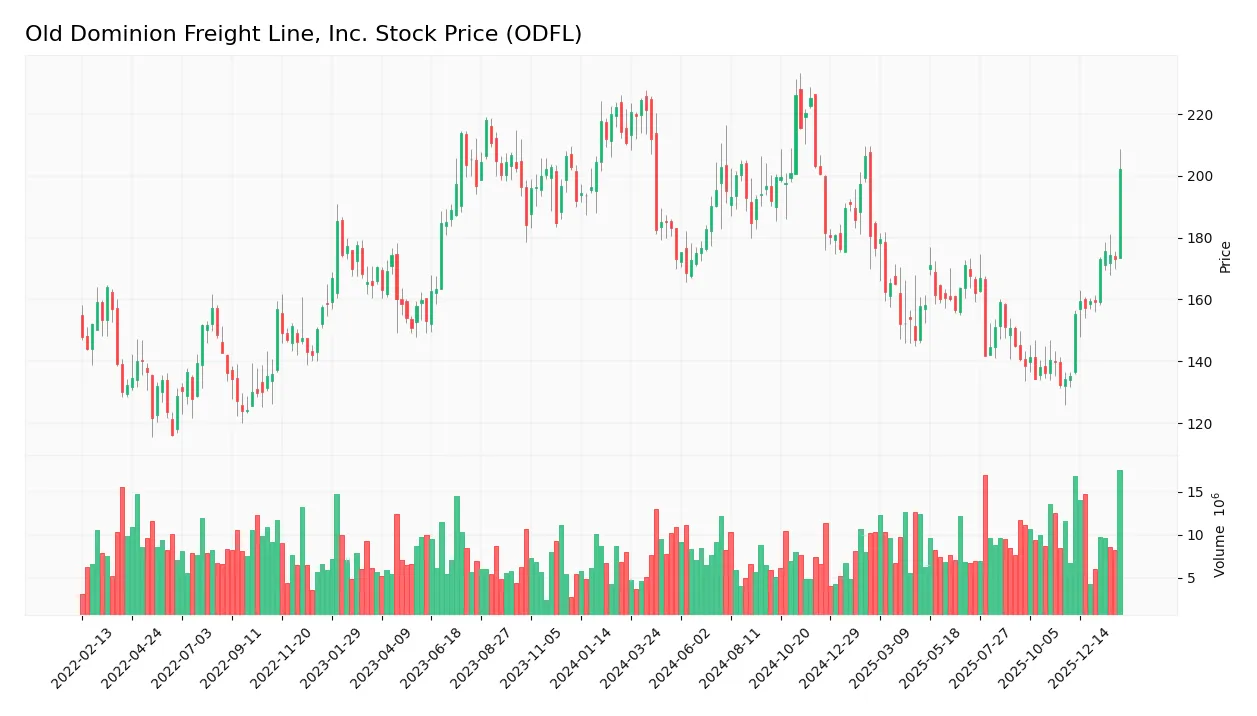

Stock Price Action Analysis

The following weekly chart shows Old Dominion Freight Line, Inc.’s stock price movements over the past 12 months, highlighting key price points and volatility:

Trend Analysis

Over the past 12 months, ODFL’s stock price declined by 4.0%, indicating a bearish trend. The price range spanned from a high of 226.11 to a low of 132.29, with volatility reflected by a 24.4 standard deviation. Notably, the downward trend is accelerating.

Volume Analysis

Trading volumes have been increasing, with buyers accounting for 53% overall and rising to 71% in recent months. This strong buyer dominance suggests growing market participation and positive investor sentiment despite the overall bearish price trend.

Target Prices

Analysts project a target price consensus that reflects confidence in Old Dominion Freight Line’s growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 138 | 232 | 187.79 |

The target prices indicate a broad valuation range but a strong midpoint near 188, suggesting optimism about the company’s long-term earnings power.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines grades and consumer feedback to provide insight into Old Dominion Freight Line, Inc.’s market perception.

Stock Grades

The following table presents the latest verified stock grades from established financial firms for Old Dominion Freight Line, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-02-05 |

| Evercore ISI Group | Maintain | In Line | 2026-02-05 |

| Jefferies | Maintain | Hold | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| UBS | Maintain | Neutral | 2026-02-05 |

| Wells Fargo | Maintain | Underweight | 2026-02-05 |

| Baird | Downgrade | Underperform | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-01-21 |

| Truist Securities | Maintain | Buy | 2026-01-15 |

The consensus remains largely neutral with a Hold rating, reflecting cautious sentiment. Most firms maintained their prior grades, though Baird’s downgrade signals some emerging concerns among analysts.

Consumer Opinions

Old Dominion Freight Line, Inc. enjoys strong customer loyalty, but some operational challenges temper enthusiasm.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and timely delivery consistently. | Occasional delays during peak seasons. |

| Excellent customer service and communication. | Pricing can be higher than competitors. |

| Well-maintained fleet ensuring cargo safety. | Limited coverage in some rural areas. |

Overall, consumers praise Old Dominion’s dependability and service quality. However, pricing and occasional logistics hiccups remain notable concerns.

Risk Analysis

Below is a table summarizing key risks for Old Dominion Freight Line, Inc. with their probability and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to economic cycles affecting freight demand | High | High |

| Valuation Risk | Elevated P/E ratio at 32.15 indicating potential overvaluation | Moderate | Moderate |

| Liquidity Risk | Unfavorable current and quick ratios raise short-term liquidity concerns | Moderate | High |

| Operational Risk | Reliance on trucking infrastructure and fuel prices | High | Moderate |

| Competitive Risk | Intense competition in the LTL sector pressures margins | High | Moderate |

| Dividend Risk | Low dividend yield at 0.71% may deter income-focused investors | Low | Low |

I observe that market and operational risks dominate due to economic cycles and fuel price volatility. The elevated valuation warns of potential price corrections. Liquidity weaknesses merit caution despite a strong Altman Z-score confirming financial safety.

Should You Buy Old Dominion Freight Line, Inc.?

Old Dominion Freight Line, Inc. appears to be a highly profitable company with strong operational efficiency, supported by a very favorable leverage profile and a robust Altman Z-Score indicating financial safety. While its competitive moat’s status is unclear due to unavailable ROIC data, the firm’s overall A- rating suggests a favorable investment profile with prudent risk management.

Strength & Efficiency Pillars

Old Dominion Freight Line, Inc. demonstrates robust financial health with an Altman Z-Score of 23.64, placing it firmly in the safe zone against bankruptcy risk. The Piotroski Score of 7 signals strong operational and financial strength. The company’s net margin of 18.63% reflects efficient profitability. Despite unavailable ROIC and WACC data, a very favorable debt-to-equity score and extremely high interest coverage ratio of 88,060 indicate strong capital structure management and financial resilience.

Weaknesses and Drawbacks

The company faces valuation and liquidity concerns. Its price-to-earnings ratio stands at 32.15, suggesting a premium valuation that may pressure future returns. The price-to-book score is very unfavorable, raising red flags about market pricing relative to book value. Liquidity ratios, including current and quick ratios, are unavailable but marked unfavorable, implying potential short-term liquidity risks. Additionally, the stock shows a bearish overall trend with a 4.0% price decline, reflecting market caution despite strong recent buying dominance.

Our Verdict about Old Dominion Freight Line, Inc.

Old Dominion Freight Line presents a fundamentally favorable profile supported by solid financial health and profitability. The recent strong buyer dominance and accelerating price trend might suggest emerging momentum. However, the persistent bearish overall trend and valuation premiums could warrant a cautious, wait-and-see approach for investors seeking an optimal entry point. This balance of strengths and risks indicates the stock may appear suitable for long-term exposure with prudence.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why Old Dominion Freight Line (ODFL) Stock Is Trading Lower Today – Yahoo Finance (Feb 05, 2026)

- Old Dominion Freight Line (NASDAQ:ODFL) Given New $168.00 Price Target at JPMorgan Chase & Co. – MarketBeat (Feb 05, 2026)

- The Compounding King of Logistics: A Deep Dive into Old Dominion Freight Line (ODFL) – FinancialContent (Feb 05, 2026)

- Wells Fargo Raises Price Target for Old Dominion Freight Line (O – GuruFocus (Feb 05, 2026)

- Old Dominion Freight Line, Inc. (NASDAQ:ODFL) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 05, 2026)

For more information about Old Dominion Freight Line, Inc., please visit the official website: odfl.com