Home > Analyses > Technology > Okta, Inc.

Okta, Inc. transforms how organizations secure and manage digital identities, impacting millions of users daily across enterprises and public institutions. As a pioneer in identity infrastructure, Okta leads with its Identity Cloud platform, offering seamless access and robust security solutions that define modern authentication standards. Renowned for innovation and reliability, the company shapes the future of cybersecurity. But as competition intensifies, does Okta’s growth narrative still justify its current market valuation?

Table of contents

Business Model & Company Overview

Okta, Inc., founded in 2009 and headquartered in San Francisco, is a leading player in the Software – Infrastructure industry, delivering a comprehensive identity solutions ecosystem. Its Okta Identity Cloud integrates products like Single Sign-On, Adaptive Multi-Factor Authentication, and Lifecycle Management, forming a unified platform that serves enterprises, SMBs, universities, and government agencies globally.

The company’s revenue engine balances cloud-based software offerings with recurring services, including customer support and professional training. Okta capitalizes on a strategic presence across the Americas, Europe, and Asia, leveraging its scalable platform to secure user identities and APIs worldwide. This robust competitive advantage positions Okta as a pivotal force shaping the future of digital identity management.

Financial Performance & Fundamental Metrics

In this section, I analyze Okta, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

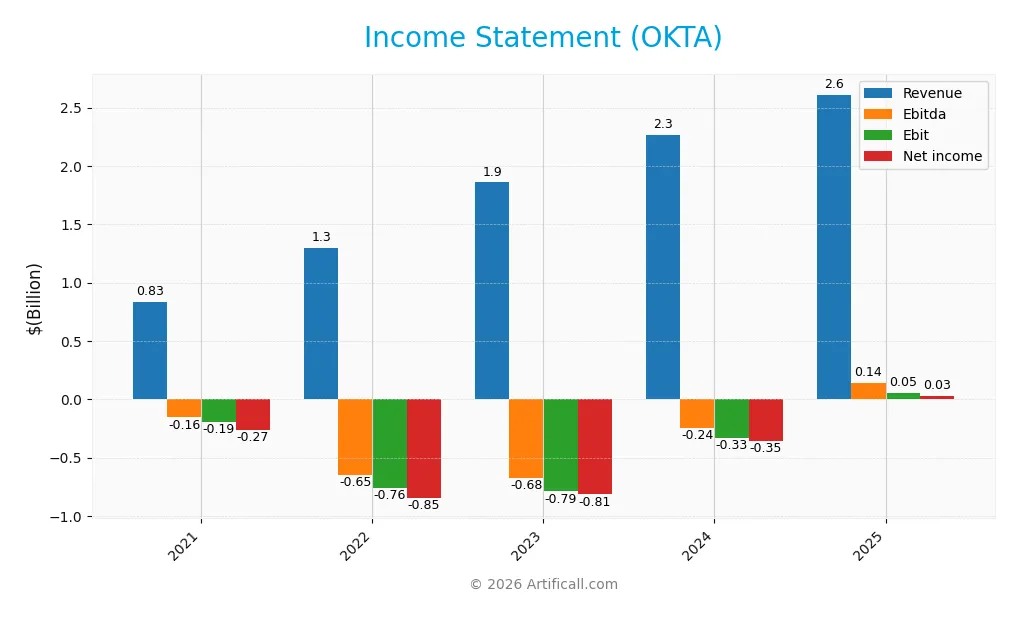

Income Statement

The following table presents Okta, Inc.’s key income statement figures for fiscal years 2021 through 2025, expressed in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 835M | 1.3B | 1.86B | 2.26B | 2.61B |

| Cost of Revenue | 218M | 396M | 546M | 581M | 618M |

| Operating Expenses | 821M | 1.67B | 2.12B | 2.20B | 2.07B |

| Gross Profit | 617M | 904M | 1.31B | 1.68B | 1.99B |

| EBITDA | -156M | -651M | -676M | -245M | 139M |

| EBIT | -193M | -759M | -790M | -329M | 51M |

| Interest Expense | 73M | 91M | 11M | 8M | 5M |

| Net Income | -266M | -848M | -815M | -355M | 28M |

| EPS | -2.09 | -5.73 | -5.16 | -2.17 | 0.17 |

| Filing Date | 2021-03-04 | 2022-03-07 | 2023-03-03 | 2024-03-01 | 2025-03-05 |

Income Statement Evolution

From 2021 to 2025, Okta, Inc. demonstrated strong revenue growth, rising from $835M to $2.61B, a 213% increase over the period. Net income turned positive in 2025 after years of losses, reaching $28M. Gross margins improved to 76.3%, while EBIT and net margins remained modest but showed marked enhancements, reflecting better cost control and operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement reveals generally favorable fundamentals. Revenue grew 15.3% year-over-year, with gross profit up 18.4%, supporting stable operating expenses relative to revenue. EBIT margin was positive at 1.95%, and net margin improved to 1.07%, indicating progress toward profitability. Interest expenses remain low at 0.19% of revenue, contributing to a positive overall income statement evaluation with 85.7% of metrics favorable.

Financial Ratios

The table below presents key financial ratios for Okta, Inc. over the last five fiscal years, providing insight into profitability, leverage, liquidity, valuation, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -31.9% | -65.2% | -43.9% | -15.7% | 1.1% |

| ROE | -38.3% | -14.3% | -14.9% | -6.0% | 0.4% |

| ROIC | -7.6% | -9.6% | -10.3% | -7.1% | -0.6% |

| P/E | -127.4 | -34.5 | -14.3 | -38.1 | 570.6 |

| P/B | 48.8 | 4.9 | 2.1 | 2.3 | 2.5 |

| Current Ratio | 1.86 | 2.45 | 2.20 | 1.67 | 1.35 |

| Quick Ratio | 1.86 | 2.45 | 2.20 | 1.67 | 1.35 |

| D/E | 2.84 | 0.34 | 0.43 | 0.22 | 0.15 |

| Debt-to-Assets | 59.7% | 22.1% | 25.4% | 14.4% | 10.1% |

| Interest Coverage | -2.8 | -8.4 | -73.8 | -64.5 | -14.8 |

| Asset Turnover | 0.25 | 0.14 | 0.20 | 0.25 | 0.28 |

| Fixed Asset Turnover | 3.93 | 6.10 | 10.3 | 17.3 | 22.3 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Okta’s Return on Equity (ROE) has shown gradual improvement from deeply negative figures in earlier years to a modest positive 0.44% in 2025, indicating a slow recovery in profitability. The Current Ratio declined from 2.45 in 2022 to 1.35 in 2025, suggesting reduced short-term liquidity but remaining above 1. The Debt-to-Equity Ratio decreased significantly from 2.84 in 2021 to 0.15 in 2025, reflecting a substantial deleveraging trend.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin and ROE remain unfavorable at 1.07% and 0.44% respectively, while return on invested capital (ROIC) is negative, indicating weak earnings performance. Liquidity ratios are mixed: the current ratio is neutral at 1.35, but the quick ratio is favorable, suggesting adequate liquid assets. Leverage ratios, including debt-to-equity (0.15) and debt-to-assets (10.09%), are favorable, indicating low financial risk. Market valuation metrics present a high price-to-earnings ratio of 570.6 (unfavorable) and a neutral price-to-book ratio of 2.49. Overall, the financial ratios present a neutral outlook with balanced favorable and unfavorable indicators.

Shareholder Return Policy

Okta, Inc. does not pay dividends, reflecting its ongoing reinvestment strategy typical of high-growth technology firms. No dividend payout has been recorded in recent fiscal years, and there is no indication of share buyback programs to return capital to shareholders.

This approach prioritizes funding growth and innovation over immediate shareholder distributions. While it may limit short-term income for investors, it aligns with long-term value creation by focusing resources on expanding the business and enhancing competitive positioning.

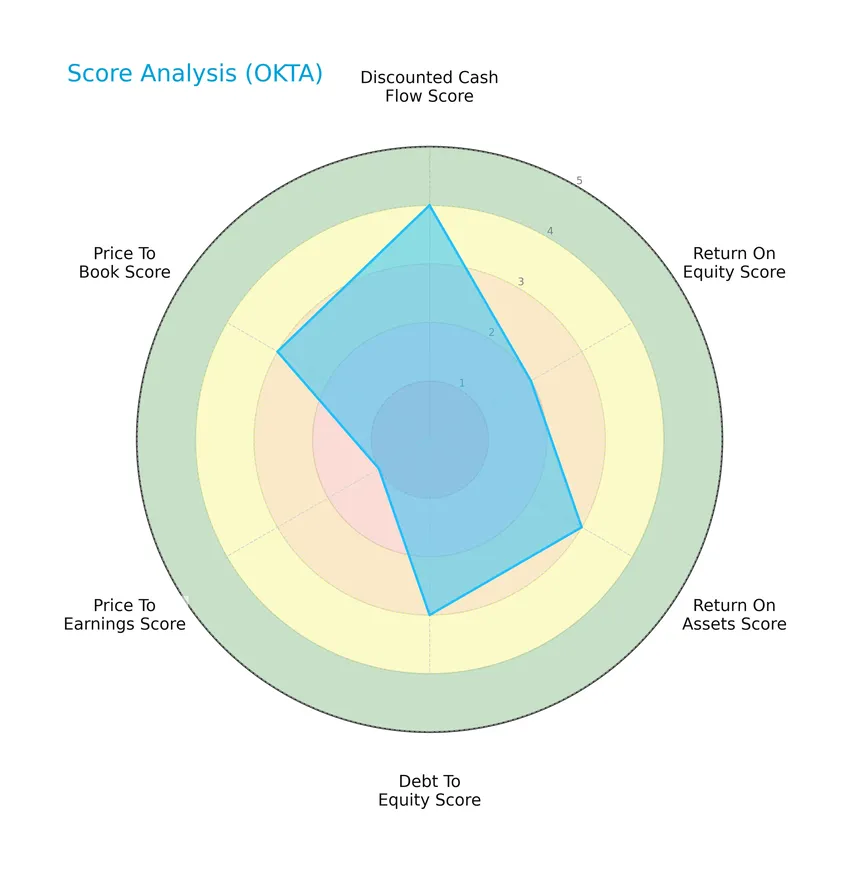

Score analysis

The following radar chart presents a comprehensive view of Okta, Inc.’s key financial scores, illustrating various fundamental and valuation metrics:

Okta displays a favorable discounted cash flow score of 4, while profitability measures such as return on equity and return on assets are moderate at 2 and 3 respectively. The debt-to-equity and price-to-book scores also stand at a moderate level of 3, whereas the price-to-earnings score is notably very unfavorable at 1.

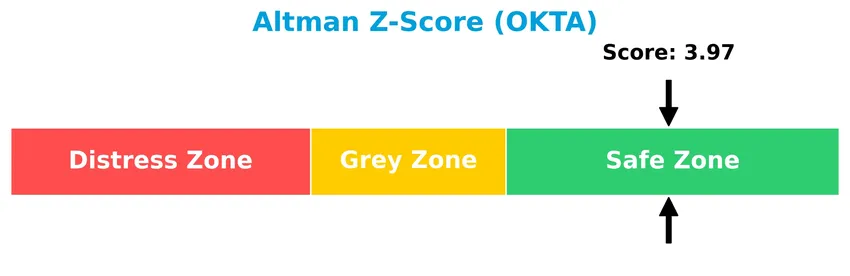

Analysis of the company’s bankruptcy risk

Okta’s Altman Z-Score indicates that the company is in the safe zone, suggesting a low risk of bankruptcy and financial distress:

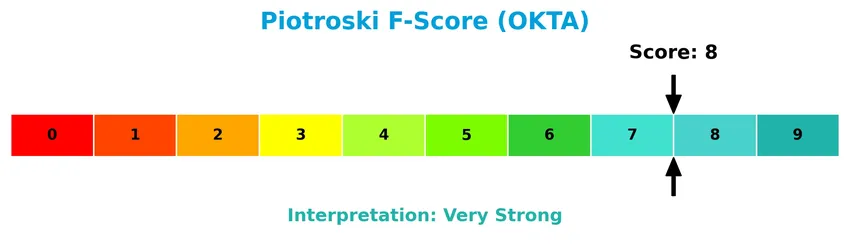

Is the company in good financial health?

The Piotroski Score diagram below reflects Okta’s strong financial health and operational efficiency:

With a Piotroski Score of 8, Okta ranks in the very strong category, indicating robust financial strength and solid fundamentals supporting its investment profile.

Competitive Landscape & Sector Positioning

This sector analysis will explore the strategic positioning, revenue segments, key products, and main competitors of Okta, Inc. I will assess whether Okta holds a competitive advantage within the software infrastructure industry.

Strategic Positioning

Okta, Inc. maintains a concentrated product portfolio focused on identity solutions, with subscription revenues of $2.56B in 2025 and modest technology services at $54M. Geographically, it predominantly serves the US market, generating $2.06B of $2.61B total revenue, showing steady international expansion.

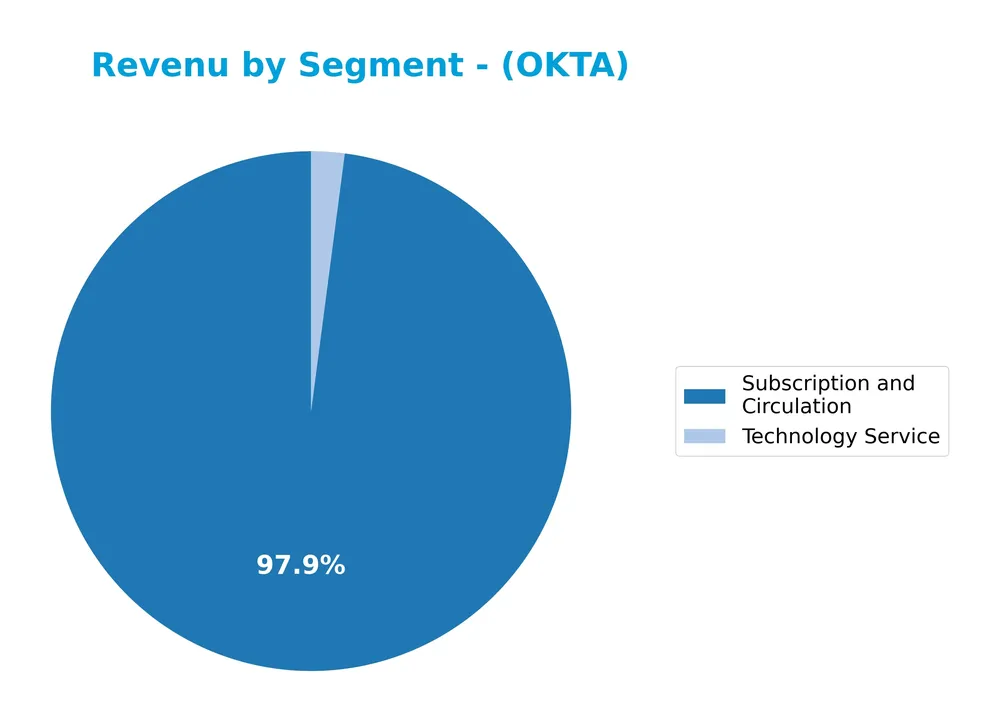

Revenue by Segment

This pie chart illustrates Okta, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the contributions of Subscription and Circulation versus Technology Service.

Okta’s revenue is overwhelmingly driven by its Subscription and Circulation segment, which reached $2.56B in 2025, showing consistent growth from $371M in 2019. Technology Service revenue is comparatively minor at $54M in 2025 and has slightly decreased since 2023. The concentration in Subscription and Circulation suggests robust customer demand for recurring services, though it also implies some concentration risk if this segment slows down.

Key Products & Brands

The following table summarizes Okta, Inc.’s key products and brands with their descriptions:

| Product | Description |

|---|---|

| Okta Identity Cloud | Platform offering Universal Directory, Single Sign-On, Adaptive Multi-Factor Authentication, Lifecycle Management, API Access Management, Access Gateway, and Advanced Server Access. |

| Auth0 Products | Includes Universal Login, Attack Protection, Adaptive Multi-Factor Authentication, Passwordless authentication, Machine to Machine, private Cloud, and Organizations features. |

| Subscription and Circulation | Revenue stream primarily from subscription-based access to Okta’s identity solutions and related services. |

| Technology Service | Revenue from technology-related services supporting Okta’s product offerings. |

Okta’s portfolio centers on identity and access management solutions, combining cloud-based platforms and security features to serve enterprises, government agencies, and other organizations globally. Subscription revenues dominate, reflecting the company’s SaaS business model.

Main Competitors

There are 32 competitors in the Technology sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Okta, Inc. ranks 21st among 32 competitors in the Software – Infrastructure industry. Its market cap is about 0.44% that of the leader, Microsoft Corporation, placing it well below both the average market cap of the top 10 competitors (508B) and the sector median (18.8B). The company is positioned just 3.38% below its nearest competitor above, indicating a relatively narrow gap in this segment.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does OKTA have a competitive advantage?

Okta, Inc. currently does not present a strong competitive advantage as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating value destruction despite improving profitability. Its income statement shows favorable growth and margins, but the overall moat status is slightly unfavorable due to negative excess returns.

Looking ahead, Okta’s broad suite of identity solutions and expanding presence in both U.S. and international markets offer growth opportunities. Continued innovation in cloud-based security products and increasing adoption of its platform could support further improvements in financial performance and competitive positioning.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Okta, Inc.’s strategic position in the market.

Strengths

- strong revenue growth (15.33% YoY)

- robust gross margin (76.32%)

- very strong Piotroski score (8)

Weaknesses

- low net margin (1.07%)

- high P/E ratio (570.6)

- negative ROIC vs WACC (-7.8)

Opportunities

- expanding international sales

- rising demand for cloud identity solutions

- increasing adoption of passwordless authentication

Threats

- intense competition in identity security

- rapid technology changes

- regulatory and data privacy challenges

Overall, Okta demonstrates solid growth and profitability potential but faces challenges in efficiency and valuation metrics. The company’s strategy should focus on improving operational margins and leveraging global expansion while mitigating competitive and regulatory risks.

Stock Price Action Analysis

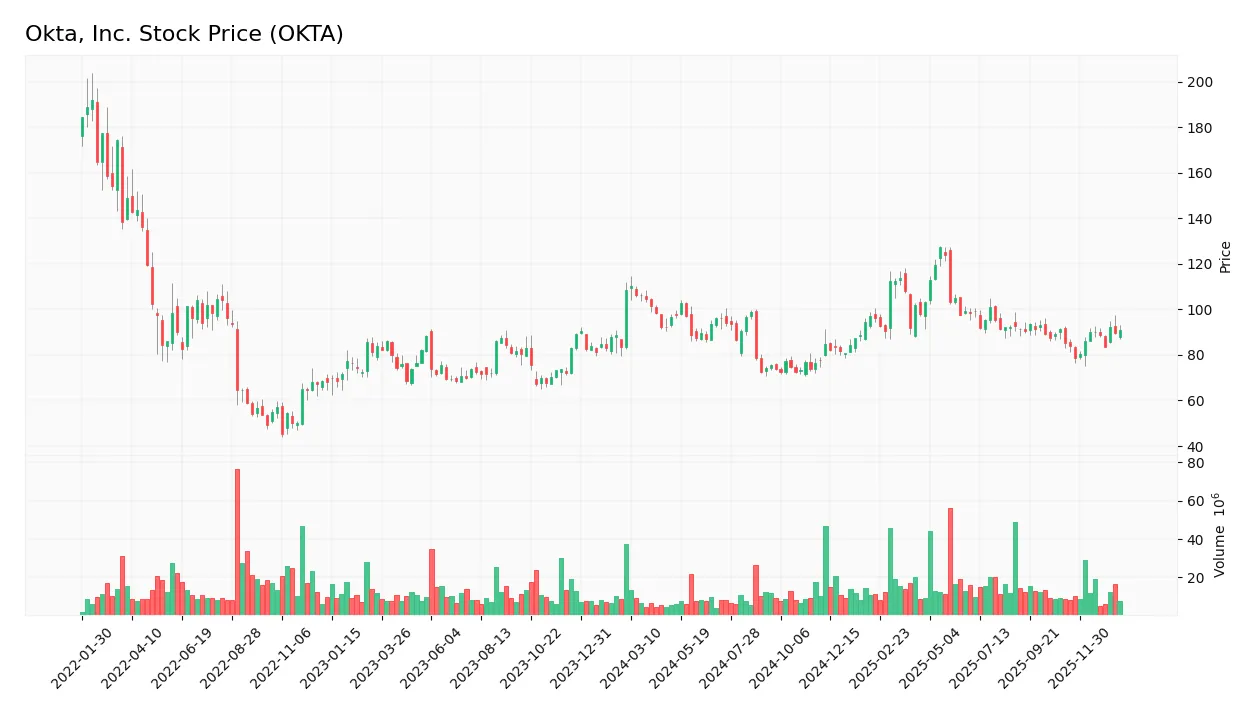

The following weekly stock chart illustrates Okta, Inc.’s price movements and key levels over the observed period:

Trend Analysis

Over the past 12 months, Okta’s stock price declined by 16.34%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 127.3 and a low of 72.24, accompanied by notable volatility with a standard deviation of 11.34. However, a recent 6.51% price increase since November 2025 suggests a short-term uptrend.

Volume Analysis

Trading volumes over the last three months show increasing activity, driven predominantly by buyers who accounted for 61.77% of volume. This buyer dominance, with 89.4M shares traded versus 55.3M seller shares, reflects growing investor interest and potentially improving sentiment toward Okta’s shares.

Target Prices

The consensus target prices for Okta, Inc. indicate a moderately optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 140 | 60 | 110.67 |

Analysts expect Okta’s stock price to range broadly, with a consensus near 111, reflecting cautious confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of analyst ratings and consumer feedback related to Okta, Inc.’s market performance.

Stock Grades

The latest stock grades for Okta, Inc. from respected analysts are detailed in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Upgrade | Overweight | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-16 |

| Needham | Maintain | Buy | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-04 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| Guggenheim | Maintain | Buy | 2025-12-03 |

| Susquehanna | Maintain | Neutral | 2025-12-03 |

Overall, the grades indicate a positive bias toward Okta, with upgrades and a majority of buy and overweight ratings, while a smaller portion remain neutral or hold, reflecting cautious optimism among analysts.

Consumer Opinions

Consumers of Okta, Inc. express a mix of appreciation and concerns, reflecting the company’s impact in identity management solutions.

| Positive Reviews | Negative Reviews |

|---|---|

| “Okta’s integration capabilities have streamlined our IT operations significantly.” | “Customer support response times can be slow during critical issues.” |

| “The platform’s security features give us confidence in protecting user data.” | “Pricing is on the higher side for small to mid-sized businesses.” |

| “User-friendly interface makes onboarding and management straightforward.” | “Occasional downtime affects business continuity.” |

Overall, consumers praise Okta for its robust security and ease of use, while criticisms mainly focus on pricing and customer support responsiveness.

Risk Analysis

Below is a summary table highlighting the key risks associated with investing in Okta, Inc., focusing on their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Extremely high P/E ratio of 570.6 indicates overvaluation risk and potential price correction. | High | High |

| Profitability | Low net margin (1.07%) and unfavorable ROE (0.44%) suggest weak profitability and operational risks. | Medium | Medium |

| Financial Stability | Despite favorable Altman Z-Score (3.97) and low debt (D/E 0.15), modest return on invested capital (-0.61%) signals efficiency concerns. | Low | Medium |

| Competitive Pressure | Rapid changes in tech and identity security markets may threaten Okta’s market share. | Medium | High |

| No Dividends | Absence of dividend yield may deter income-focused investors and affect stock attractiveness. | High | Low |

The most critical risks are the high valuation that could lead to price volatility and Okta’s limited profitability, which might pressure future earnings. However, the company’s strong financial health and low debt offer some cushion against distress. As always, I recommend cautious position sizing and ongoing monitoring of market conditions.

Should You Buy Okta, Inc.?

Okta, Inc. could be seen as exhibiting improving operational efficiency with a growing but still negative profitability profile, alongside a slightly unfavorable competitive moat due to value destruction. Despite a manageable leverage profile, the overall rating appears to be a solid B, suggesting moderate investment appeal.

Strength & Efficiency Pillars

Okta, Inc. presents a robust financial foundation underscored by a strong Altman Z-Score of 3.97, placing it securely in the safe zone, and a Piotroski Score of 8, indicating very strong financial health. The company maintains favorable debt metrics with a debt-to-equity ratio of 0.15 and debt-to-assets of 10.09%, complemented by an interest coverage ratio of 10.2, signaling solid financial stability. Although Okta’s ROIC is negative at -0.61%, it benefits from a favorable WACC of 7.21%, but this gap means Okta is currently not a value creator. Nonetheless, its fixed asset turnover is impressive at 22.31, reflecting operational efficiency in asset utilization.

Weaknesses and Drawbacks

Okta faces headwinds with an extremely elevated P/E ratio of 570.6, denoting a highly premium valuation that could deter risk-averse investors. The net margin is weak at 1.07%, paired with a return on equity of just 0.44%, highlighting profitability challenges. Additionally, the asset turnover ratio of 0.28 is unfavorable, suggesting inefficient asset use in generating revenue. The current ratio stands neutral at 1.35, offering moderate liquidity cushion, but the absence of dividend yield may be a drawback for income-focused investors. Market-wise, the overall stock trend is bearish with a 16.34% decline, although recent buyer dominance at 61.77% indicates some short-term optimism.

Our Verdict about Okta, Inc.

Okta’s long-term fundamental profile might appear moderately favorable given its strong financial health scores and stable capital structure but is tempered by weak profitability and an extreme valuation premium. Despite the overall bearish trend, the recent buyer dominance and upward price movement suggest renewed market interest. This profile could suggest a cautious stance, where investors might consider waiting for clearer signals before committing to a long-term position, balancing potential growth against valuation and profitability risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Buys New Position in Okta, Inc. $OKTA – MarketBeat (Jan 24, 2026)

- Okta, Inc. (OKTA) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Jan 21, 2026)

- Okta Vishing Campaign Allegedly Linked to ShinyHunters: What You Need to Know – SOCRadar® Cyber Intelligence Inc. (Jan 23, 2026)

- Okta’s Profits Are Up, But Its Credibility Still Hasn’t Recovered – 24/7 Wall St. (Jan 22, 2026)

- Okta, Inc. (OKTA) To Launch Local Data Centers in India – Insider Monkey (Jan 23, 2026)

For more information about Okta, Inc., please visit the official website: okta.com