Home > Analyses > Utilities > Oklo Inc.

Oklo Inc. is revolutionizing the energy landscape by designing advanced fission power plants that promise reliable, commercial-scale electricity with a focus on sustainability and innovation. As a pioneering force in the regulated electric utilities sector, Oklo combines cutting-edge technology with nuclear fuel recycling services to address the growing demand for clean energy in the United States. With its solid market presence and visionary leadership, the key question for investors is whether Oklo’s fundamentals continue to support its ambitious growth trajectory and market valuation.

Table of contents

Business Model & Company Overview

Oklo Inc., founded in 2013 and headquartered in Santa Clara, California, stands as a pioneering force in the regulated electric industry. Specializing in designing and developing fission power plants, Oklo delivers a cohesive energy ecosystem aimed at providing reliable, commercial-scale power across the United States. The company’s mission integrates advanced nuclear technology with innovative recycling of used nuclear fuel, positioning it uniquely within the utilities sector.

Oklo’s revenue engine is built on a blend of hardware—the fission power plants themselves—and value-added services such as nuclear fuel recycling. This dual approach enables consistent revenue streams while supporting sustainable energy solutions. Though primarily focused on the U.S. market, the company’s strategic innovations hint at broader implications for global energy infrastructure. Its competitive advantage lies in shaping the future of clean, reliable power generation through proprietary technology and a closed-loop fuel cycle.

Financial Performance & Fundamental Metrics

In this section, I analyze Oklo Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

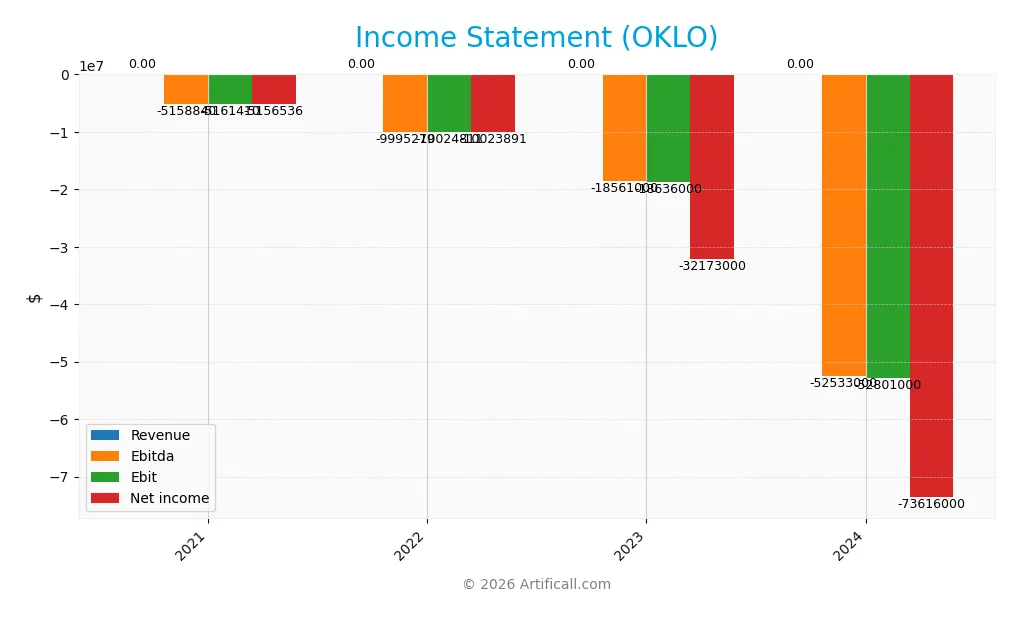

The table below presents Oklo Inc.’s income statement figures for fiscal years 2021 through 2024, reflecting their financial performance over this period.

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Revenue | 0 | 0 | 0 | 0 |

| Cost of Revenue | 0 | 0 | 0 | 0 |

| Operating Expenses | 5.16M | 10.02M | 18.64M | 52.80M |

| Gross Profit | 0 | 0 | 0 | 0 |

| EBITDA | -5.16M | -10.00M | -18.56M | -52.53M |

| EBIT | -5.16M | -10.02M | -18.64M | -52.80M |

| Interest Expense | 0 | 0 | 0 | 0 |

| Net Income | -5.16M | -10.02M | -32.17M | -73.62M |

| EPS | -0.02 | 0.06 | -0.47 | -0.74 |

| Filing Date | 2022-03-31 | 2023-03-31 | 2024-03-29 | 2025-03-24 |

Income Statement Evolution

From 2021 to 2024, Oklo Inc. reported zero revenue consistently, with no gross profit generated. Operating expenses rose sharply from 5.2M in 2021 to 52.8M in 2024, driving EBIT deeper into negative territory, worsening from -5.2M to -52.8M. Margins remained unfavorable throughout, with no improvement in gross, EBIT, or net margins over the period.

Is the Income Statement Favorable?

In 2024, Oklo’s fundamentals remain unfavorable, marked by a net loss of 73.6M and an EPS of -0.7443. Despite zero interest expense, significant rises in R&D and administrative expenses intensified losses. The absence of revenue and sustained negative margins reflect ongoing challenges, contributing to a largely unfavorable income statement profile for the latest fiscal year.

Financial Ratios

The following table presents key financial ratios for Oklo Inc. over the last five fiscal years, offering a snapshot of the company’s profitability, leverage, liquidity, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 0 | 0 | 0 | 0 |

| ROE | -82% | 36% | 94% | -29% |

| ROIC | -48.0% | -95% | -156% | -19% |

| P/E | -184 | -95 | -32 | -29 |

| P/B | 151 | -34 | -30 | 8.4 |

| Current Ratio | 23.9 | 16.5 | 4.43 | 43.5 |

| Quick Ratio | 23.9 | 16.5 | 4.43 | 43.5 |

| D/E | 7.8% | -1.1% | -0.7% | 0.5% |

| Debt-to-Assets | 4.5% | 2.8% | 1.7% | 0.5% |

| Interest Coverage | 0 | 0 | 0 | 0 |

| Asset Turnover | 0 | 0 | 0 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 |

| Dividend Yield | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Oklo Inc.’s Return on Equity (ROE) has shown volatility, ending at -29.35% in 2024, reflecting deteriorated profitability. The Current Ratio improved dramatically to 43.47 in 2024, indicating stronger liquidity compared to prior years. The Debt-to-Equity Ratio remained low and stable near 0.01, signaling minimal leverage use. Profitability has generally been weak or negative throughout the period.

Are the Financial Ratios Favorable?

In 2024, Oklo displays unfavorable profitability with negative ROE and zero net margin. Liquidity is mixed: the Current Ratio is overly high (unfavorable), but the Quick Ratio is favorable at 43.47. Leverage remains low and favorable. Efficiency ratios such as asset turnover are zero, indicating operational inefficiency. Market valuation ratios present a mixed picture, with a high Price-to-Book ratio deemed unfavorable. Overall, the financial ratios are mostly unfavorable, with only about 36% favorable metrics.

Shareholder Return Policy

Oklo Inc. does not pay dividends, reflecting its consistent net losses and reinvestment focus typical for a high-growth or development-stage company. The absence of dividend payout aligns with ongoing negative free cash flow and operating cash flow per share, indicating limited distributable cash.

The company does not engage in share buybacks either, which suggests a prioritization of capital for growth and operational needs rather than returning cash to shareholders. This approach appears consistent with sustainable long-term value creation given Oklo’s financial profile and early-stage status.

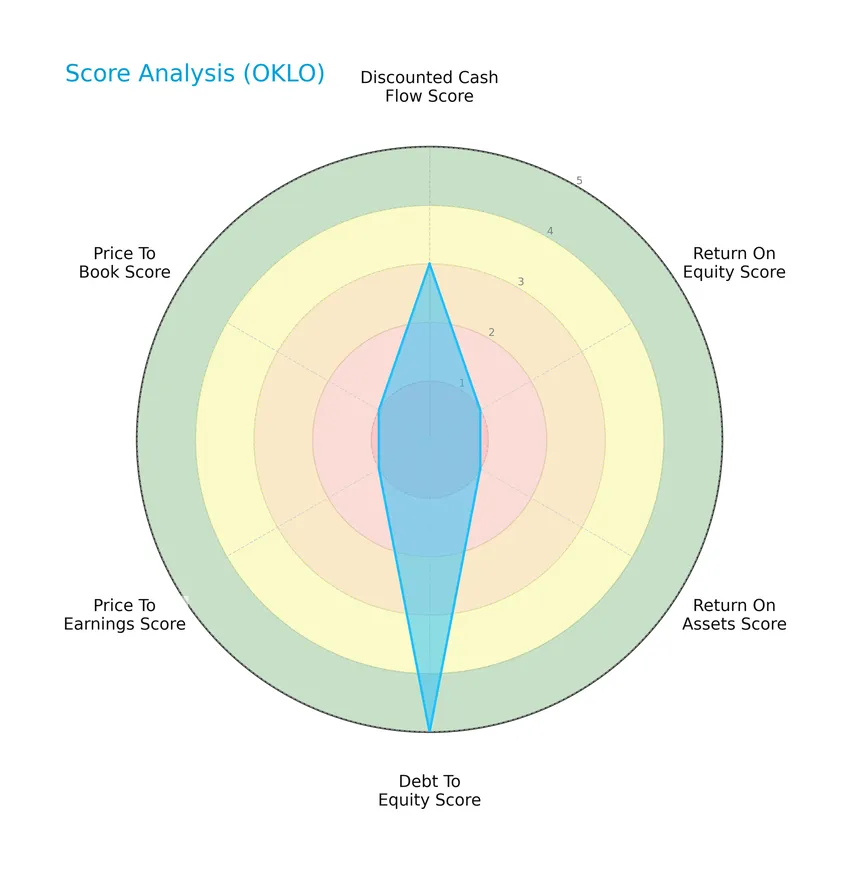

Score analysis

The following radar chart illustrates Oklo Inc.’s key financial scores, highlighting strengths and weaknesses across valuation and performance metrics:

Oklo Inc. shows a moderate discounted cash flow score of 3 and a very favorable debt-to-equity score at 5, indicating strong leverage management. However, profitability and valuation metrics, including return on equity, return on assets, price-to-earnings, and price-to-book scores, are all very unfavorable at 1, reflecting challenges in earnings generation and market valuation.

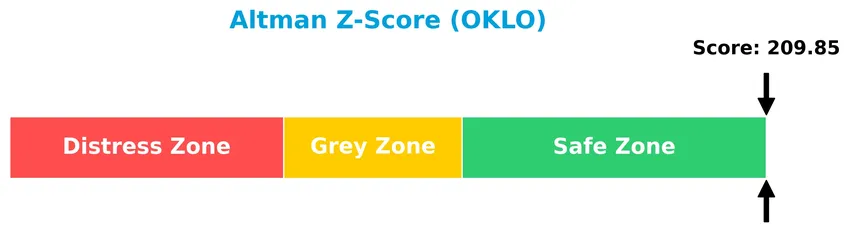

Analysis of the company’s bankruptcy risk

Oklo Inc.’s Altman Z-Score places it firmly in the safe zone, indicating a low risk of bankruptcy based on its financial ratios and stability:

Is the company in good financial health?

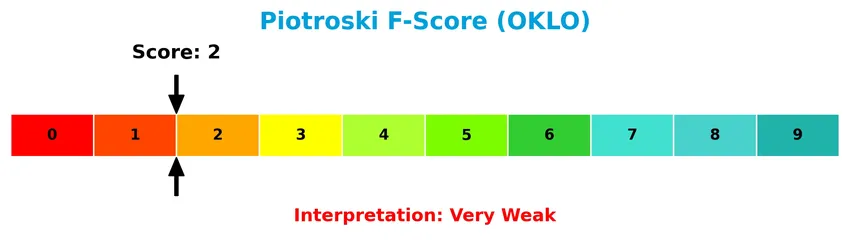

This Piotroski diagram presents a view of Oklo Inc.’s financial strength as measured by the Piotroski Score:

With a Piotroski Score of 2, Oklo Inc. falls into the very weak category, suggesting limited financial strength and potential concerns regarding profitability, leverage, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Oklo Inc.’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will assess whether Oklo holds a competitive advantage within the regulated electric utilities sector.

Strategic Positioning

Oklo Inc. operates in the regulated electric sector, focusing on designing and developing fission power plants and used nuclear fuel recycling, primarily serving the US market. Its product portfolio is concentrated on advanced nuclear technology, with geographic exposure limited to the United States.

Key Products & Brands

The following table outlines Oklo Inc.’s main products and services currently offered:

| Product | Description |

|---|---|

| Fission Power Plants | Design and development of commercial-scale fission power plants delivering reliable energy. |

| Used Nuclear Fuel Recycling | Services focused on recycling used nuclear fuel to support sustainable energy production. |

Oklo Inc. specializes in advanced nuclear energy solutions, including innovative fission power plants and fuel recycling services, aimed at providing reliable and sustainable power within the US market.

Main Competitors

There are 23 competitors in total; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Oklo Inc. ranks 22nd among 23 competitors, with a market cap at 8.12% of the sector leader, NextEra Energy. The company is positioned below both the average market cap of the top 10 (67.5B) and the median market cap in the sector (34B). It maintains a 22.88% market cap gap to the nearest competitor above, indicating a notable distance from higher-tier players.

Does OKLO have a competitive advantage?

Oklo Inc. currently does not present a strong competitive advantage, as it is shedding value with a ROIC significantly below its WACC and unfavorable income statement metrics. Despite this, the company shows a growing ROIC trend, indicating improving profitability.

Looking ahead, Oklo’s focus on designing and developing fission power plants and providing used nuclear fuel recycling services positions it in a specialized market with potential for future opportunities. Its development of reliable, commercial-scale energy solutions in the regulated electric industry may offer avenues for growth.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Oklo Inc.’s current strategic position by evaluating its internal capabilities and external environment.

Strengths

- innovative fission power technology

- strong balance sheet with low debt

- favorable WACC and interest expense

- high current and quick ratios

- NYSE-listed with $13.7B market cap

Weaknesses

- negative profitability and margins

- declining earnings and EPS

- weak ROE and ROIC

- unfavorable valuation multiples

- very weak Piotroski score

Opportunities

- growing demand for clean, reliable energy

- potential expansion in US energy market

- advancements in nuclear fuel recycling

Threats

- regulatory hurdles in nuclear industry

- high R&D and operational costs

- market volatility and competitive pressure

Oklo shows strong financial stability and promising technology but suffers from poor profitability and weak financial performance metrics. Its strategy should focus on improving operational efficiency and leveraging growth opportunities while managing regulatory and cost risks carefully.

Stock Price Action Analysis

The following weekly chart illustrates Oklo Inc. (OKLO) stock price movements over the last 100 weeks, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, OKLO’s stock price increased by 490.9%, indicating a strong bullish trend. However, recent data from November 2025 to January 2026 shows a -22.21% decline, reflecting a short-term bearish trend with a slope of -1.17. The overall trend exhibits deceleration despite high volatility (std deviation 39.17). The highest recorded price was 163.39, and the lowest was 5.59.

Volume Analysis

In the last three months, trading volume has been increasing overall, with total buyer volume at 3.58B and seller volume at 2.59B historically. Recently, seller volume dominated at 466M versus buyer volume of 243M, indicating a seller-driven market. This shift suggests growing investor caution and heightened market participation on the sell side.

Target Prices

Analysts present a clear target consensus for Oklo Inc., reflecting optimistic expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 150 | 95 | 125.67 |

The target prices indicate a positive outlook, with a consensus suggesting substantial upside potential from current levels.

Analyst & Consumer Opinions

This section examines the latest grades and consumer feedback regarding Oklo Inc. to provide balanced insights.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table presents the latest verified analyst grades for Oklo Inc. from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Upgrade | Buy | 2026-01-21 |

| Seaport Global | Upgrade | Buy | 2025-12-08 |

| UBS | Maintain | Neutral | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

Overall, the trend shows a recent improvement in sentiment with upgrades to Buy from B of A Securities and Seaport Global after previous neutral stances, while Wedbush consistently maintains an Outperform rating. The consensus remains positive with six Buy and two Hold ratings.

Consumer Opinions

Consumers of Oklo Inc. show a mix of enthusiasm and caution, reflecting varied experiences with the company’s innovative energy solutions.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressed by Oklo’s cutting-edge microreactor tech and its potential for clean energy.” | “Initial costs are high, which could be a barrier for widespread adoption.” |

| “Customer support is responsive and knowledgeable, making the complex tech easier to understand.” | “Long development timelines create uncertainty about when products will reach the market.” |

| “Strong commitment to sustainability aligns with my investment values.” | “Limited operational experience leads to concerns about scalability and reliability.” |

Overall, consumer feedback highlights Oklo’s innovative technology and sustainability focus as key strengths, while concerns center on high costs and the early stage of commercial deployment.

Risk Analysis

Below is a summary table of key risks associated with investing in Oklo Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Performance | Persistent negative profitability and poor returns on equity and invested capital. | High | High |

| Market Volatility | Significant share price fluctuations with a wide trading range from $17.42 to $193.84. | High | Medium |

| Operational Risk | Challenges in scaling advanced nuclear technology and regulatory hurdles in the energy sector. | Medium | High |

| Liquidity Risk | Discrepancies in liquidity ratios despite strong quick ratio, potential cash flow constraints. | Medium | Medium |

| Valuation Risk | Elevated price-to-book ratio indicates possible overvaluation against fundamentals. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score indicates strong financial stability, minimizing bankruptcy concerns. | Low | Low |

The most critical risks are Oklo’s ongoing negative profitability and operational challenges in deploying innovative nuclear technology, which could impact long-term viability. Despite trading volatility, its strong Altman Z-Score suggests low bankruptcy risk, but valuation and liquidity concerns require careful monitoring.

Should You Buy Oklo Inc.?

Oklo Inc. appears to be in a very favorable overall rating category (C+), supported by a strong leverage profile despite very weak profitability metrics and a slightly unfavorable competitive moat. While operational efficiency shows some improvement, value creation remains challenged.

Strength & Efficiency Pillars

Oklo Inc. exhibits strong financial safety as evidenced by an Altman Z-Score of 209.85, placing it securely in the safe zone and indicating a very low bankruptcy risk. The company benefits from a highly favorable debt-to-equity ratio of 0.01, signaling prudent leverage management. Its weighted average cost of capital (WACC) stands at a favorable 7.49%, reflecting efficient capital structure. However, profitability metrics are under pressure with a negative ROE of -29.35% and ROIC of -19.05%, indicating that Oklo is currently not generating value and is shedding value relative to its cost of capital.

Weaknesses and Drawbacks

Oklo’s financial profile is challenged by multiple unfavorable metrics that pose risks to investors. The company’s price-to-book ratio is elevated at 8.37, suggesting an expensive valuation that may not be justified by fundamentals. Profitability is weak with a net margin at 0% and a severely negative EPS growth of -4410.91% over the overall period. Liquidity measures are mixed; while the quick ratio is favorable at 43.47, the current ratio is flagged as unfavorable at the same figure, potentially indicating asset structure issues. Recent market behavior is also concerning, with a seller-dominant sentiment reflected by only 34.32% buyer dominance between November 2025 and January 2026, contributing to a recent price decline of -22.21%.

Our Verdict about Oklo Inc.

Oklo’s long-term fundamental profile appears unfavorable due to persistent profitability weaknesses and value destruction despite solid financial health signals. While the overall stock trend remains bullish with a remarkable 490.9% price increase, recent seller dominance and declining price momentum suggest caution. Despite its safe zone credit status and low leverage, the company’s weak earnings and high valuation imply that investors might consider a wait-and-see approach for a more attractive entry point amid ongoing market pressure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Oklo, Meta Announce Agreement in Support of 1.2 GW Nuclear Energy Development in Southern Ohio – Oklo Inc. (Jan 09, 2026)

- Here’s What Barclays Has to Say About Oklo Inc (OKLO) – Yahoo Finance (Jan 23, 2026)

- Oklo Meta Nuclear Deal Links AI Power Needs To Long Term Execution – Sahm (Jan 24, 2026)

- Oklo Stock Upgraded to Buy. Meta Nuclear Deal Is a ‘Meaningful Step Forward.’ – Barron’s (Jan 21, 2026)

- Why Oklo Stock Sank Today – The Motley Fool (Jan 20, 2026)

For more information about Oklo Inc., please visit the official website: oklo.com