Home > Analyses > Technology > Oddity Tech Ltd.

Oddity Tech Ltd. is reshaping the beauty and wellness landscape with its innovative PowerMatch technology, transforming how consumers discover and engage with personalized products. As a frontrunner in the software-infrastructure sector, Oddity Tech drives growth through its digital-first brands IL MAKIAGE and SpoiledChild, challenging traditional offline markets. With a strong reputation for innovation and rapid expansion, the key question remains: do Oddity Tech’s fundamentals justify its current valuation and promising growth trajectory?

Table of contents

Business Model & Company Overview

Oddity Tech Ltd., founded in 2013 and headquartered in Tel Aviv-Jaffa, Israel, stands out as a consumer-tech leader in the beauty and wellness sectors. Through its innovative PowerMatch technology, the company delivers a seamless ecosystem of digital-first brands—IL MAKIAGE and SpoiledChild—that redefine traditional, offline-dominated markets with targeted products for face, complexion, hair, and skin care. This cohesive approach drives its mission to disrupt and innovate within the global beauty and wellness industries.

The company’s revenue engine blends product sales with digital engagement, leveraging its software-driven PowerMatch platform alongside recurring customer demand for personalized beauty solutions. Oddity Tech maintains a strategic global footprint, serving diverse markets across the Americas, Europe, and Asia. Its significant market cap of $2B and rapidly growing digital brands underpin a resilient economic moat, positioning it to shape the future of beauty tech with scalable, data-driven consumer experiences.

Financial Performance & Fundamental Metrics

I will analyze Oddity Tech Ltd.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

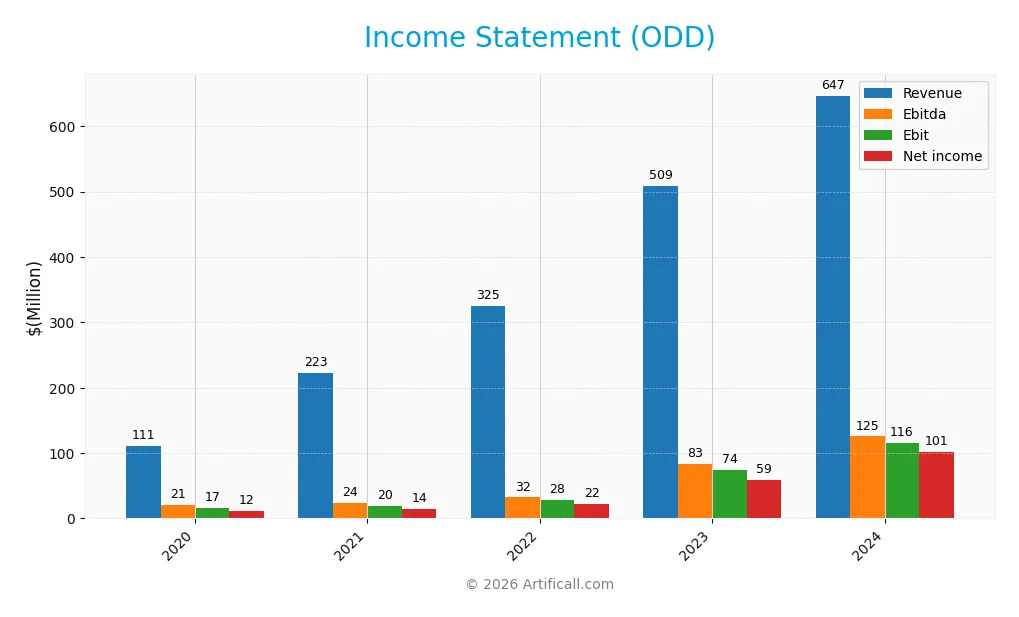

Below is the income statement summary for Oddity Tech Ltd. over the last five fiscal years.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 111M | 223M | 325M | 509M | 647M |

| Cost of Revenue | 33M | 69M | 106M | 150M | 179M |

| Operating Expenses | 61M | 134M | 190M | 284M | 353M |

| Gross Profit | 78M | 153M | 218M | 358M | 468M |

| EBITDA | 21M | 24M | 32M | 83M | 125M |

| EBIT | 17M | 20M | 28M | 74M | 116M |

| Interest Expense | 1.3M | 0.9M | 0 | 0 | 0.08M |

| Net Income | 12M | 14M | 22M | 59M | 101M |

| EPS | 0.0602 | 0.0762 | 0.11 | 1.03 | 1.78 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-02-25 |

Income Statement Evolution

Between 2020 and 2024, Oddity Tech Ltd. demonstrated strong revenue growth, increasing from 110.6M to 647M, a rise of nearly 485%. Net income surged even more sharply, growing over 766% to 101.5M in 2024. Margins improved consistently, with the gross margin reaching 72.4% and net margin 15.7%, reflecting enhanced profitability and operational efficiency over the period.

Is the Income Statement Favorable?

In 2024, Oddity Tech posted a revenue growth of 27.2% and a substantial 55.6% increase in EBIT, driving a net income margin of 15.7%. Interest expenses were minimal at 0.01% of revenue, supporting strong bottom-line results. EPS rose 66% year-on-year to 1.78, indicating robust earnings growth. Overall, all key income statement metrics and their growth rates for 2024 are rated favorable, signaling solid financial health.

Financial Ratios

The following table presents key financial ratios for Oddity Tech Ltd. (ODD) over the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11% | 6% | 7% | 12% | 16% |

| ROE | 22% | 20% | 22% | 21% | 36% |

| ROIC | 21% | 16% | 16% | 18% | 29% |

| P/E | 229 | 193 | 124 | 45 | 24 |

| P/B | 51 | 39 | 27 | 9 | 9 |

| Current Ratio | 2.43 | 1.67 | 1.61 | 2.05 | 1.79 |

| Quick Ratio | 1.83 | 0.74 | 0.84 | 1.28 | 0.99 |

| D/E | 0.10 | 0.08 | 0.16 | 0.04 | 0.08 |

| Debt-to-Assets | 7% | 4% | 7% | 3% | 5% |

| Interest Coverage | 13 | 22 | 0 | 0 | 1521 |

| Asset Turnover | 1.35 | 1.56 | 1.50 | 1.26 | 1.47 |

| Fixed Asset Turnover | 11 | 23 | 14 | 22 | 19 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Oddity Tech Ltd. (ODD) has experienced a notable improvement in Return on Equity (ROE), rising from 20.28% in 2021 to 35.95% in 2024, indicating enhanced profitability. The Current Ratio showed some fluctuation, peaking at 2.43 in 2020 before stabilizing around 1.79 in 2024, reflecting solid liquidity. The Debt-to-Equity Ratio steadily declined from 0.16 in 2022 to 0.08 in 2024, signaling reduced leverage and financial risk.

Are the Financial Ratios Favorable?

In 2024, ODD’s profitability ratios such as net margin (15.69%) and ROE (35.95%) are favorable, complemented by strong returns on invested capital. Liquidity is supportive with a current ratio of 1.79, while the quick ratio is neutral at 0.99. Low debt levels, indicated by a debt-to-equity ratio of 0.08 and a debt-to-assets ratio of 5.17%, enhance financial stability. Market valuation ratios present a mixed picture: the price-to-earnings ratio is neutral at 23.75, but the price-to-book ratio is unfavorable at 8.54. Overall, 64% of the ratios are favorable, indicating a generally positive financial profile.

Shareholder Return Policy

Oddity Tech Ltd. does not pay dividends, reflecting a reinvestment strategy likely aimed at supporting growth and innovation. The company has maintained a zero dividend payout ratio and yield across recent years, with no indication of share buyback programs.

This approach suggests a focus on long-term value creation through capital retention rather than immediate shareholder distributions. Without buybacks or dividends, the policy emphasizes sustainable growth potential, assuming that reinvested earnings will enhance future returns.

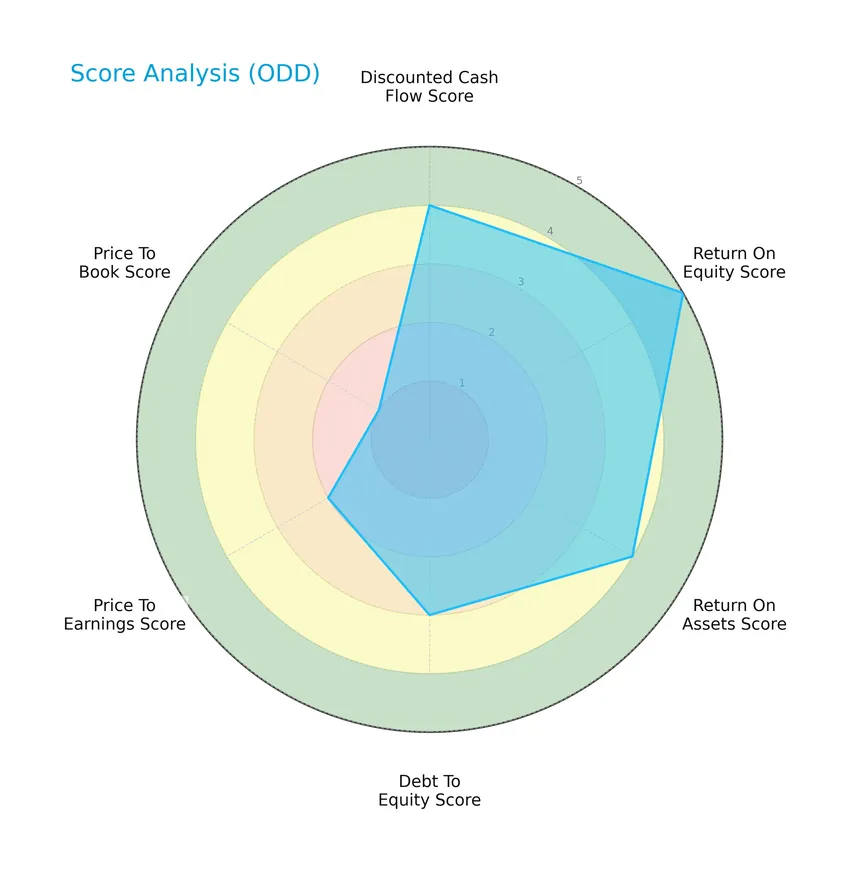

Score analysis

Here is a radar chart summarizing the key financial scores of Oddity Tech Ltd. for a quick overview:

The company exhibits strong profitability metrics with a very favorable return on equity score of 5 and a favorable return on assets score of 4. Its discounted cash flow score is also favorable at 4. However, leverage is moderate with a debt-to-equity score of 3. Valuation metrics show some weakness, with a moderate price-to-earnings score of 2 and a very unfavorable price-to-book score of 1.

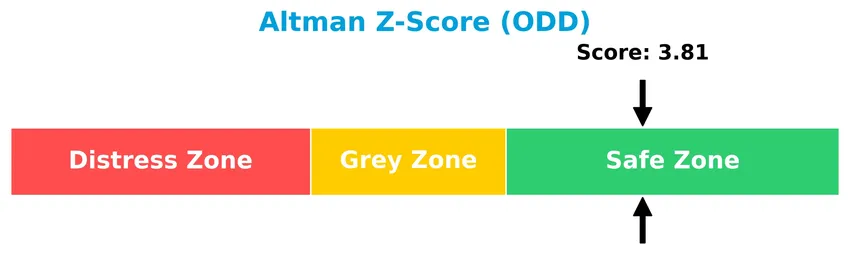

Analysis of the company’s bankruptcy risk

Oddity Tech Ltd.’s Altman Z-Score places it comfortably in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

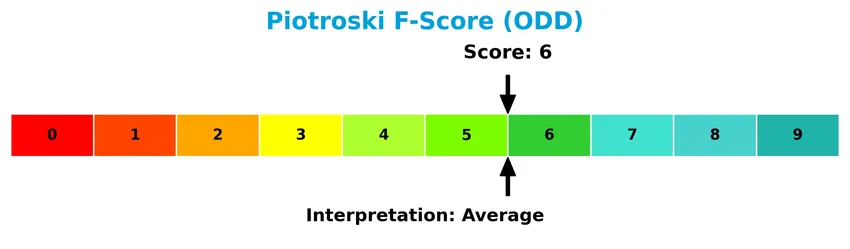

The following Piotroski diagram illustrates the company’s financial health based on its Piotroski Score:

With a Piotroski Score of 6, Oddity Tech Ltd. demonstrates average financial health. This score suggests the company has some strengths but does not rank among the strongest performers in financial robustness.

Competitive Landscape & Sector Positioning

This sector analysis will explore Oddity Tech Ltd.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Oddity Tech Ltd. maintains a competitive advantage in the software infrastructure and consumer-tech driven beauty and wellness market.

Strategic Positioning

Oddity Tech Ltd. operates globally with a concentrated product portfolio focused on beauty and wellness under digital-first brands IL MAKIAGE and SpoiledChild. Its geographic exposure is primarily North America, generating $547M of $647M total revenue in 2024, reflecting a strategic emphasis on this market within the software-infrastructure sector.

Key Products & Brands

The following table outlines the main products and brands offered by Oddity Tech Ltd.:

| Product | Description |

|---|---|

| IL MAKIAGE | Beauty and wellness products for face and complexion, eyes and brows, lips, and skin care. |

| SpoiledChild | Hair and skin care products targeting the beauty and wellness market. |

| PowerMatch Technology | Proprietary technology used to personalize and enhance the consumer experience in beauty products. |

Oddity Tech Ltd. operates primarily through its digital-first brands IL MAKIAGE and SpoiledChild, leveraging its PowerMatch technology to innovate in the beauty and wellness sectors.

Main Competitors

There are 32 competitors in the Technology sector – Software Infrastructure industry, with the table showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Oddity Tech Ltd. ranks 30th among 32 competitors, with a market cap just 0.06% of the leader Microsoft Corporation. The company is positioned well below both the average market cap of the top 10 leaders (508B) and the sector median (19B). Oddity Tech also maintains a significant 44% market cap gap from its nearest competitor above.

Does ODD have a competitive advantage?

Oddity Tech Ltd. presents a clear competitive advantage, as evidenced by a very favorable moat status with ROIC exceeding WACC by nearly 10%, demonstrating value creation and a growing ROIC trend over 2020-2024. The company’s profitability metrics and income statement growth further support its strong operational efficiency and financial health.

Looking ahead, Oddity Tech Ltd. is positioned to leverage its PowerMatch technology in the beauty and wellness sectors, expanding its digital-first brands like IL MAKIAGE and SpoiledChild into new markets. This focus on innovation and digital disruption presents promising opportunities to capitalize on shifting consumer behaviors worldwide.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Oddity Tech Ltd. to support informed investment decisions.

Strengths

- Strong revenue growth with 27.2% YoY

- High profitability margins: 15.69% net margin

- Durable competitive advantage with growing ROIC

- Low debt levels and high interest coverage

- Diversified global presence with strong North America sales

Weaknesses

- High beta at 3.18 indicating high stock volatility

- Price-to-book ratio unfavorable at 8.54

- No dividend yield for income investors

- Quick ratio near 1, signaling liquidity could improve

Opportunities

- Expansion of digital-first beauty and wellness brands

- Increasing consumer demand for tech-driven wellness solutions

- Potential to scale PowerMatch technology in new markets

Threats

- Intense competition in beauty and wellness tech sector

- Market volatility impacting high-beta stock

- Rising costs could pressure margins

- Regulatory risks in international markets

Overall, Oddity Tech Ltd. shows robust growth and profitability, supported by a strong competitive moat. However, investors should be cautious about its stock volatility and valuation metrics. The company’s strategy should focus on leveraging technology and brand expansion while managing financial risks prudently.

Stock Price Action Analysis

The following weekly chart illustrates Oddity Tech Ltd. (ODD) stock price movements over the past 100 weeks, highlighting recent volatility and trend shifts:

Trend Analysis

Over the past year, Oddity Tech Ltd. experienced a -19.99% price decline, indicating a bearish trend with deceleration. The stock fluctuated significantly, with a high of 77.35 and a low of 32.19, reflecting elevated volatility at 11.78%. Recent months show a continued negative slope of -0.41 and a -9.11% drop.

Volume Analysis

Trading volume in the last three months is increasing, with total activity dominated by sellers who account for 74.3% of trades. Buyer participation is low at 25.7%, suggesting bearish investor sentiment and stronger selling pressure amid rising market engagement.

Target Prices

The consensus target prices for Oddity Tech Ltd. suggest a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 80 | 40 | 66.33 |

Analysts expect the stock to trade between 40 and 80, with an average target price around 66.33, indicating moderate confidence in growth potential.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Oddity Tech Ltd. (ODD) to provide balanced insights.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table summarizes the latest verified stock grades for Oddity Tech Ltd. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-08 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-11-21 |

| Barclays | Maintain | Equal Weight | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| Keybanc | Maintain | Overweight | 2025-10-08 |

| JMP Securities | Maintain | Market Outperform | 2025-09-23 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| JMP Securities | Maintain | Market Outperform | 2025-08-05 |

The overall trend shows a stable consensus with most firms maintaining positive ratings, predominantly “Overweight” and “Buy,” indicating moderate optimism among analysts, while a few maintain a more neutral “Equal Weight” stance.

Consumer Opinions

Consumers have mixed but insightful views on Oddity Tech Ltd., reflecting both its innovative edge and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cutting-edge technology with reliable performance.” | “Customer service response times are often slow.” |

| “User-friendly interface and intuitive design.” | “Pricing feels a bit high compared to competitors.” |

| “Regular software updates keep the product fresh.” | “Some features lack customization options.” |

Overall, consumers appreciate Oddity Tech’s innovation and product usability, though they frequently cite customer support delays and pricing as key concerns.

Risk Analysis

Below is a concise overview of key risks associated with Oddity Tech Ltd., highlighting probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (3.18) indicates significant stock price fluctuations. | High | High |

| Valuation Risk | Elevated price-to-book ratio (8.54) suggests possible overvaluation. | Medium | Medium |

| Competitive Risk | Operating in a disruptive beauty-tech market with strong incumbents. | Medium | High |

| Liquidity Risk | Average trading volume below typical levels may affect ease of trading. | Medium | Medium |

| Financial Leverage | Low debt-to-equity (0.08) reduces financial distress risk. | Low | Low |

| Dividend Policy | No dividend yield may deter income-focused investors. | Medium | Low |

| Economic Sensitivity | Exposure to global consumer trends and economic cycles in tech and wellness. | Medium | Medium |

The most significant risks for Oddity Tech Ltd. stem from its high market volatility and competitive pressures in the beauty and wellness tech space. Despite strong financial health indicators and a safe Altman Z-score, valuation concerns and trading liquidity warrant caution.

Should You Buy Oddity Tech Ltd.?

Oddity Tech Ltd. appears to be a company with improving profitability and a durable competitive moat supported by growing ROIC above WACC, suggesting strong value creation. Despite a manageable leverage profile and an overall B+ rating, some valuation metrics could warrant cautious interpretation.

Strength & Efficiency Pillars

Oddity Tech Ltd. demonstrates robust profitability and financial efficiency, underscored by a net margin of 15.69%, return on equity (ROE) of 35.95%, and return on invested capital (ROIC) of 28.56%. Importantly, the ROIC notably exceeds the weighted average cost of capital (WACC) of 18.7%, confirming the company as a value creator. The Altman Z-score of 3.81 places Oddity Tech firmly in the safe zone, indicating solid financial health, while a Piotroski score of 6 reflects average but stable operational strength. These metrics collectively suggest durable competitive advantages and efficient capital usage.

Weaknesses and Drawbacks

Despite strong fundamentals, Oddity Tech faces valuation and market pressure concerns. The price-to-book ratio at 8.54 is very unfavorable, signaling a significant premium over book value that could limit upside potential. The price-to-earnings ratio of 23.75 is neutral but suggests moderate market expectations. Leverage metrics are favorable with a low debt-to-equity ratio of 0.08 and a current ratio of 1.79; however, recent market conditions show seller dominance at 74.3% of trading volume since November 2025, exerting bearish pressure and contributing to a near 20% overall stock price decline over the past year.

Our Verdict about Oddity Tech Ltd.

Oddity Tech’s long-term fundamental profile appears favorable, supported by strong profitability and financial health. However, the bearish overall and recent technical trends, coupled with pronounced seller dominance, suggest caution. Despite the company’s value creation and efficient operations, recent market pressure may warrant a wait-and-see approach for a potentially more attractive entry point in the near term.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- ODDITY Tech is Now Oversold (ODD) – Nasdaq (Jan 21, 2026)

- Does Oddity Tech’s Expanded US$350 Million Credit Facility Reframe Its Capital Allocation Strategy (ODD)? – simplywall.st (Jan 23, 2026)

- Oddity Tech Ltd. (ODD): A Bear Case Theory – Yahoo Finance (Dec 09, 2025)

- Here is Why ODDITY Tech (ODD) is Highly Favored by Hedge Funds – Finviz (Jan 15, 2026)

- Oddity Tech: No Fundamental Weakness Seen; I Reiterate Buy (NASDAQ:ODD) – Seeking Alpha (Dec 19, 2025)

For more information about Oddity Tech Ltd., please visit the official website: oddity.com