Home > Analyses > Technology > NXP Semiconductors N.V.

NXP Semiconductors powers the invisible connections in billions of devices worldwide. Its microcontrollers, application processors, and wireless solutions drive innovation in automotive safety, industrial automation, and IoT ecosystems. Renowned for blending cutting-edge technology with reliability, NXP shapes how people interact with smart environments daily. As semiconductor competition intensifies, I ask whether NXP’s strong industry position and diverse portfolio continue to support its premium valuation and long-term growth potential.

Table of contents

Business Model & Company Overview

NXP Semiconductors N.V., founded in 2006 and headquartered in Eindhoven, the Netherlands, stands as a leading semiconductor supplier. It delivers a cohesive ecosystem of microcontrollers, application and communication processors, wireless connectivity, analog and interface devices, and advanced sensors. These products power diverse applications across automotive, industrial IoT, mobile, and communication infrastructure sectors, reflecting a broad and integrated technological mission.

The company’s revenue engine balances robust hardware sales with strategic software and security solutions, targeting OEMs, contract manufacturers, and distributors worldwide. NXP holds a strong footprint across the Americas, Europe, and Asia, including China, the U.S., and South Korea. Its competitive advantage lies in specialized semiconductor innovation that underpins critical industries, securing a durable economic moat in global technology markets.

Financial Performance & Fundamental Metrics

I analyze NXP Semiconductors’ income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

The table below presents NXP Semiconductors N.V.’s key income statement figures for fiscal years 2021 through 2025, showing trends in profitability and expenses.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 11.1B | 13.2B | 13.3B | 12.6B | 12.3B |

| Cost of Revenue | 5.0B | 5.7B | 5.7B | 5.5B | 5.6B |

| Operating Expenses | 3.5B | 3.7B | 3.9B | 3.7B | 3.4B |

| Gross Profit | 6.1B | 7.5B | 7.6B | 7.1B | 6.7B |

| EBITDA | 3.8B | 5.0B | 4.9B | 4.4B | 3.9B |

| EBIT | 2.5B | 3.8B | 3.8B | 3.5B | 3.1B |

| Interest Expense | 0.4B | 0.4B | 0.4B | 0.4B | 0.4B |

| Net Income | 1.9B | 2.8B | 2.8B | 2.5B | 2.0B |

| EPS | 6.91 | 10.64 | 10.83 | 9.84 | 8.00 |

| Filing Date | 2022-02-24 | 2023-03-01 | 2024-02-22 | 2025-02-20 | 2026-02-03 |

Income Statement Evolution

NXP Semiconductors’ revenue grew 10.9% from 2021 to 2025 but declined 2.74% in 2025 alone. Net income increased 8.02% over the five years but fell 17.22% in 2025. Gross margins remain strong at 54.43%, though slightly compressed year-over-year. Operating expenses grew slower than revenue, supporting margin stability despite weaker top-line growth.

Is the Income Statement Favorable?

In 2025, NXP reported $12.3B revenue and $2.0B net income, yielding a 16.47% net margin, considered favorable versus industry peers. EBIT margin stands at 24.95%, reflecting efficient operations. Interest expense at 3.13% of revenue is manageable. Declines in revenue and net income growth present caution, but overall fundamentals remain positive with solid profitability and controlled costs.

Financial Ratios

The following table summarizes NXP Semiconductors N.V.’s key financial ratios from 2021 to 2025, illustrating profitability, liquidity, leverage, valuation, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 17% | 21% | 21% | 20% | 16% |

| ROE | 29% | 37% | 32% | 27% | 20% |

| ROIC | 12% | 16% | 15% | 13% | 11% |

| P/E | 33x | 15x | 21x | 21x | 27x |

| P/B | 9.4x | 5.6x | 6.9x | 5.8x | 5.5x |

| Current Ratio | 2.13 | 2.12 | 1.91 | 2.36 | 2.05 |

| Quick Ratio | 1.65 | 1.58 | 1.39 | 1.60 | 1.38 |

| D/E | 1.62 | 1.50 | 1.29 | 1.18 | 1.22 |

| Debt-to-Assets | 51% | 48% | 46% | 45% | 46% |

| Interest Coverage | 7.0x | 8.9x | 8.4x | 8.6x | 8.6x |

| Asset Turnover | 0.53 | 0.57 | 0.55 | 0.52 | 0.46 |

| Fixed Asset Turnover | 4.20 | 4.25 | 4.00 | 3.86 | 4.12 |

| Dividend Yield | 0.9% | 2.0% | 1.7% | 2.0% | 1.9% |

Evolution of Financial Ratios

From 2021 to 2025, NXP Semiconductors’ Return on Equity (ROE) exhibited volatility, peaking around 37% in 2022 before settling near 20% in 2025. The Current Ratio remained relatively stable, fluctuating between 1.9 and 2.3, indicating consistent liquidity. The Debt-to-Equity Ratio showed a slight decline from about 1.62 in 2021 to 1.22 in 2025, reflecting a modest deleveraging trend amid stable profitability margins.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin (16.5%) and ROE (20.1%) appear favorable, supported by a solid return on invested capital (11%). Liquidity is robust with a current ratio of 2.05 and quick ratio of 1.38. However, leverage remains relatively high with a debt-to-equity ratio of 1.22, which is unfavorable. Market valuation ratios such as P/E (27.1) and P/B (5.45) are also unfavorable, while efficiency indicated by asset turnover (0.46) is weak. Overall, the ratio profile is slightly favorable but mixed.

Shareholder Return Policy

NXP Semiconductors maintains a consistent dividend policy, with a payout ratio near 50% and an annual yield around 1.9%. Dividends have steadily increased, supported by robust free cash flow coverage and moderate capital expenditures. The company also engages in share buybacks, enhancing shareholder value.

This balanced approach aligns with sustainable long-term value creation. The dividend distribution remains prudent given NXPI’s solid profitability and cash flow metrics. However, investors should monitor debt levels and leverage as potential risks that could pressure future payouts or repurchase activity.

Score analysis

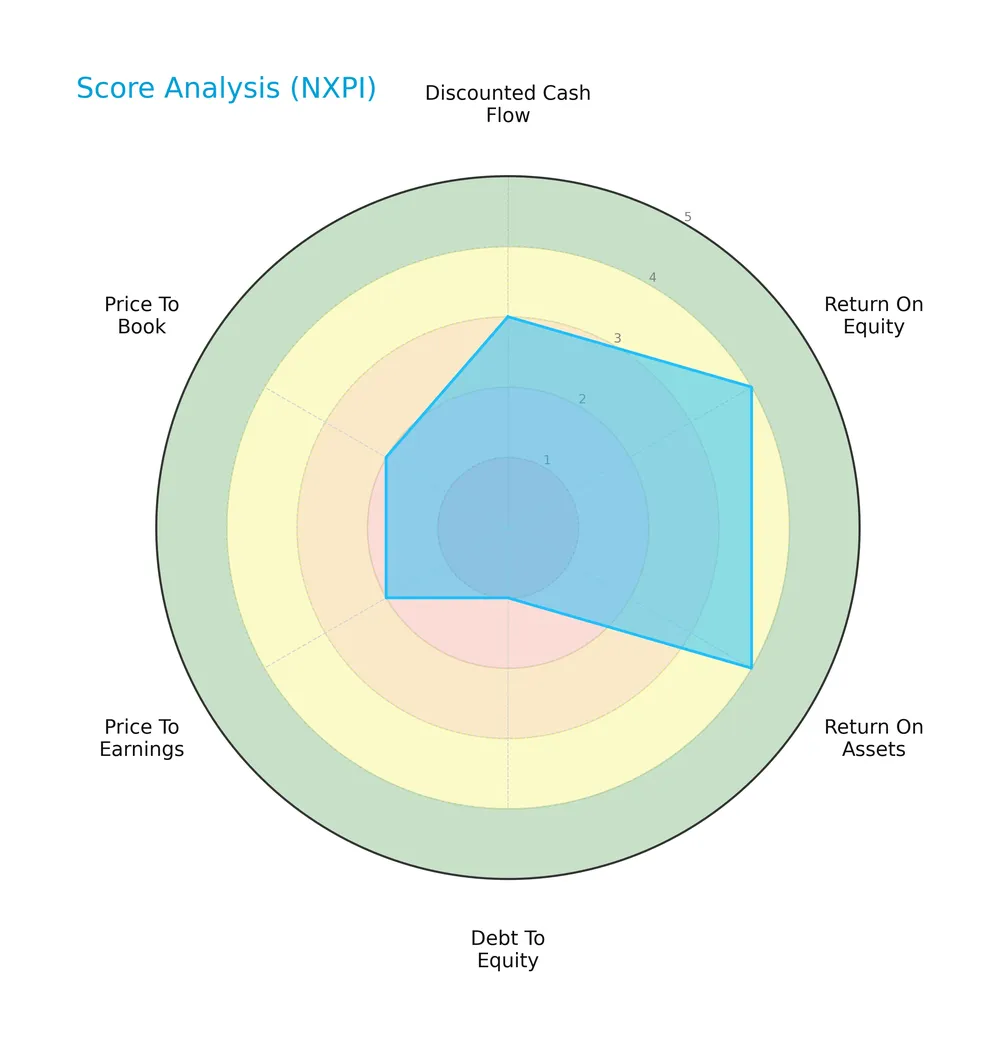

The radar chart below presents a detailed view of the company’s key financial scores:

The company shows favorable returns on equity and assets, signaling effective profitability. However, its debt-to-equity score is very unfavorable, indicating high leverage risk. Valuation metrics and discounted cash flow scores remain moderate.

Analysis of the company’s bankruptcy risk

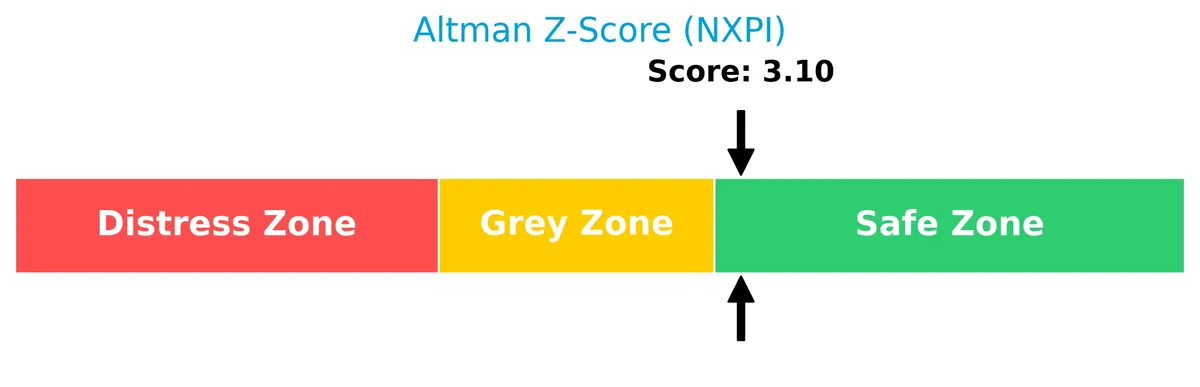

The Altman Z-Score places the company in the safe zone, suggesting a low bankruptcy risk based on its financial ratios:

Is the company in good financial health?

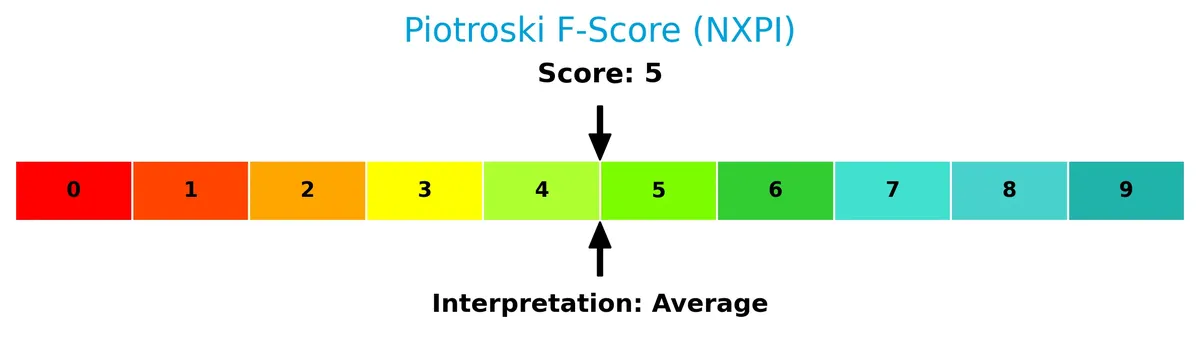

The Piotroski diagram reflects the company’s average financial health score:

A score of 5 indicates moderate financial strength. The company shows neither strong nor weak fundamentals, implying a balanced but cautious outlook.

Competitive Landscape & Sector Positioning

This section analyzes NXP Semiconductors N.V.’s strategic positioning, revenue segments, key products, and main competitors. I will examine whether NXP holds a competitive advantage in the semiconductor industry.

Strategic Positioning

NXP Semiconductors concentrates its revenue in High Performance Mixed Signal products, exceeding $9B in 2018, while Standard Products declined to zero. Geographically, it diversifies broadly, with significant exposure to China ($4.5B in 2024), the US, and various Asian and European markets, balancing global risk.

Revenue by Segment

This pie chart displays NXP Semiconductors’ revenue breakdown by product segment, covering fiscal year 2018. It highlights how different segments contributed to the overall top line.

In 2018, High Performance Mixed Signal dominated with $9B, driving NXP’s growth consistently since 2013. Corporate and Other remained a minor segment at $385M. Standard Products, negligible at zero in 2018, suggests a strategic shift or product phase-out. The concentration in High Performance Mixed Signal signals reliance on this core segment, which could amplify risk if market dynamics shift.

Key Products & Brands

The following table outlines NXP Semiconductors’ primary products and their descriptions:

| Product | Description |

|---|---|

| Microcontrollers | Embedded computing units used in automotive, industrial, and IoT applications for control and automation tasks. |

| Application Processors | Includes i.MX family (i.MX 8 and 9), powering multimedia, display, and communication functions in diverse devices. |

| Communication Processors | Processors designed for managing data and signal transmission in communication infrastructure and mobile devices. |

| Wireless Connectivity Solutions | Technologies such as NFC, ultra-wideband, Bluetooth low-energy, Zigbee, Wi-Fi, and integrated Wi-Fi/Bluetooth SoCs. |

| Analog and Interface Devices | Components facilitating signal conversion and interface between analog and digital circuits. |

| Radio Frequency Power Amplifiers | Amplify radio signals, critical for wireless communication performance in mobile and infrastructure equipment. |

| Security Controllers | Semiconductor-based controllers ensuring device and data security across applications. |

| Environmental and Inertial Sensors | Sensors measuring pressure, inertial movement, magnetic fields, and gyroscopic data for automotive and industrial use. |

NXP’s product lineup centers on high-performance mixed signal semiconductors, dominating its revenue stream. These solutions address critical needs in automotive, industrial, IoT, mobile, and communication sectors globally.

Main Competitors

There are 38 competitors in total, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

NXP Semiconductors ranks 16th among 38 competitors. Its market cap is just 1.22% of the leader NVIDIA’s massive 4.6T valuation. The company trades below the average top 10 market cap of 975B but remains above the sector median of 31B. It enjoys a 31% market cap premium over its closest higher-ranked competitor, indicating a notable gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NXP Semiconductors have a competitive advantage?

NXP Semiconductors shows a slightly unfavorable moat with ROIC falling below WACC by 1.75%, indicating it currently sheds value and faces declining profitability. Despite solid gross (54.4%) and EBIT (24.9%) margins, the company’s decreasing return on invested capital signals weakening competitive strength.

Looking ahead, NXP leverages a diverse product portfolio across automotive, industrial, IoT, and communication sectors internationally. Expansion opportunities exist in emerging markets and new semiconductor technologies, which could help reverse recent profitability declines if executed effectively.

SWOT Analysis

This SWOT analysis distills NXP Semiconductors’ key factors to clarify strategic priorities and risks.

Strengths

- strong gross margin at 54%

- solid ROE of 20%

- diversified global market presence

Weaknesses

- declining revenue and EPS growth in short term

- high debt-to-equity ratio of 1.22

- asset turnover below industry average

Opportunities

- rising demand in automotive and IoT sectors

- expansion in emerging markets like China

- innovation in wireless connectivity solutions

Threats

- intense semiconductor industry competition

- geopolitical tensions impacting China sales

- cyclical demand fluctuations in technology sector

NXP’s strengths in profitability and global reach underpin its competitive edge. However, recent growth slowdowns and leverage pose caution. The company must leverage emerging technology trends and geographic expansion to offset market volatility and geopolitical risks.

Stock Price Action Analysis

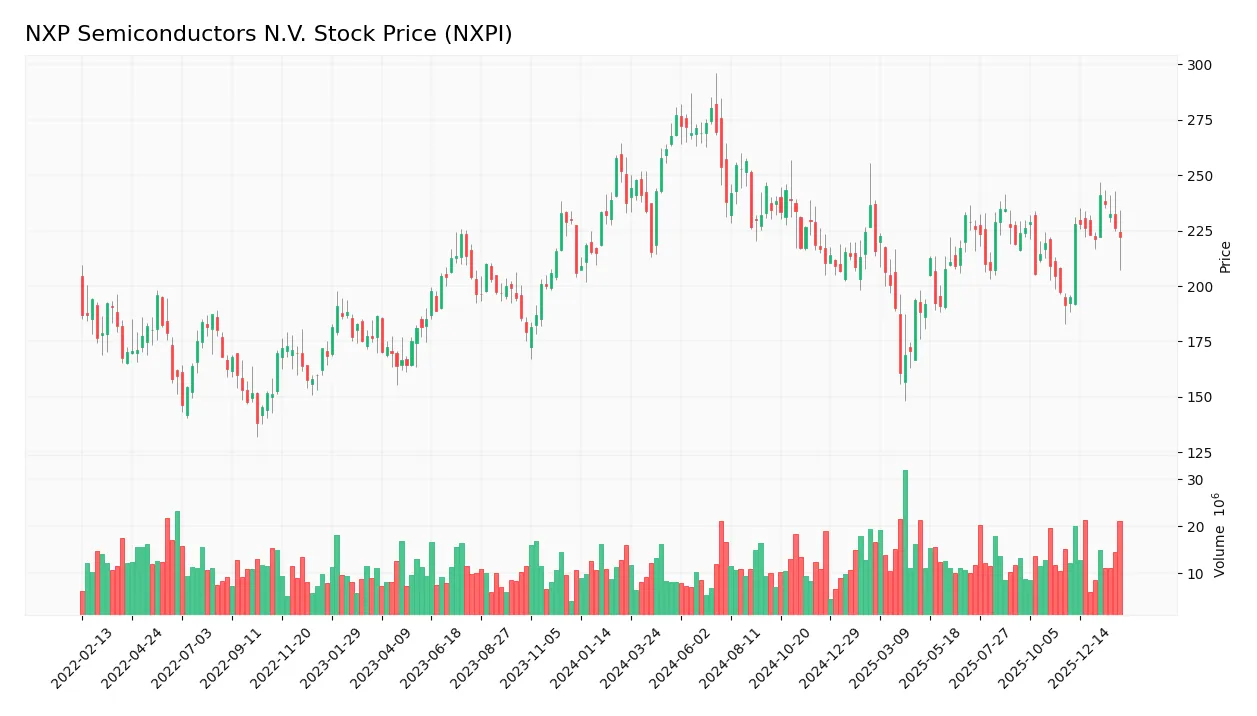

The weekly stock chart below illustrates NXP Semiconductors N.V. (NXPI) price movements over the last 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, NXPI’s stock price declined by 6.49%, indicating a bearish trend with accelerating downward momentum. The stock fluctuated between a high of 280.19 and a low of 160.81, showing significant volatility with a standard deviation of 24.1.

Volume Analysis

Trading volume has been increasing overall, with sellers dominating 64.52% of recent trades from late November 2025 to early February 2026. This seller-driven activity suggests cautious investor sentiment and elevated market participation amid downward price pressure.

Target Prices

Analysts set a robust target consensus for NXP Semiconductors, reflecting confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 215 | 280 | 250 |

The target range from 215 to 280 indicates optimism, with a consensus at 250 signaling solid upside potential relative to current prices.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a balanced view of NXP Semiconductors N.V.’s market perception.

Stock Grades

The following table presents recent verified analyst grades for NXP Semiconductors N.V., reflecting the consensus view as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-02-04 |

| Mizuho | Maintain | Outperform | 2026-02-04 |

| B of A Securities | Maintain | Buy | 2026-02-04 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-04 |

| Citigroup | Maintain | Buy | 2026-02-04 |

| Needham | Maintain | Buy | 2026-02-03 |

| Wells Fargo | Maintain | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

The grades show a strong bias toward positive ratings, with most firms maintaining Buy or Outperform status. JP Morgan’s Neutral stance provides some balance, but the consensus clearly favors a bullish outlook.

Consumer Opinions

NXP Semiconductors N.V. enjoys a generally favorable reputation among its customers, who appreciate its innovation and product quality.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent chip performance and reliability.” | “Customer support response times can lag.” |

| “Strong product lineup in automotive semiconductors.” | “Pricing is on the higher side compared to competitors.” |

| “Consistent quality with robust supply chain management.” | “Occasional delays in product availability reported.” |

Overall, consumers praise NXP for its cutting-edge technology and dependable products. However, some highlight slower customer service and pricing as areas needing attention.

Risk Analysis

Below is a summary table presenting key risks for NXP Semiconductors N.V. and their estimated probabilities and impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuates with sector beta of 1.46, amplifying swings | High | Medium |

| Valuation Concerns | Elevated P/E (27.14) and P/B (5.45) ratios may limit upside | Medium | High |

| Leverage Risk | Debt-to-equity ratio of 1.22 signals high leverage burden | Medium | High |

| Supply Chain | Global semiconductor supply disruptions affect production | Medium | Medium |

| Geopolitical Tensions | Operations in China and other regions exposed to trade conflicts | Medium | High |

| Competitive Pressure | Intense competition in semiconductors may erode margins | Medium | Medium |

Leverage and valuation present the most critical risks for NXP. The firm’s debt load is above industry comfort levels, increasing financial strain during downturns. Meanwhile, premium multiples constrain further price appreciation. Market volatility remains elevated due to sector cyclicality. Recent geopolitical tensions in Asia pose a persistent threat to supply chains and sales. Investors must weigh these risks carefully against the company’s solid profitability and safe Altman Z-score.

Should You Buy NXP Semiconductors N.V.?

NXP Semiconductors appears to be a moderately profitable company with a slightly unfavorable moat as its ROIC trends downward and underperforms WACC. Despite a manageable leverage profile, the overall rating of B suggests a very favorable but cautious investment profile.

Strength & Efficiency Pillars

NXP Semiconductors N.V. demonstrates solid profitability with a net margin of 16.47% and a return on equity (ROE) of 20.1%. The return on invested capital (ROIC) stands at 11.03%, surpassing the weighted average cost of capital (WACC) of 9.28%, confirming the company as a value creator. Financial health indicators reinforce stability: an Altman Z-score of 3.10 places NXPI in the safe zone, while a Piotroski score of 5 reflects average operational strength. These metrics underscore efficient capital allocation and robust profitability.

Weaknesses and Drawbacks

NXPI faces valuation headwinds, with a high price-to-earnings ratio of 27.14 and a price-to-book ratio of 5.45, suggesting premium pricing that could limit upside. Leverage remains a concern; the debt-to-equity ratio at 1.22 is unfavorable, indicating elevated financial risk. Although liquidity ratios such as a 2.05 current ratio are favorable, market pressure is evident. Recent seller dominance (35.48% buyer share) and a 6.49% overall price decline signal short-term bearish sentiment, raising caution for immediate entry.

Our Verdict about NXP Semiconductors N.V.

The long-term fundamental profile appears favorable, supported by strong profitability and value creation. However, the current bearish trend and seller dominance during the recent period suggest caution. Despite its solid financial footing, NXPI might appear more suitable for investors seeking a better entry point amid ongoing market pressure. Patience could prove prudent before committing to a position in this semiconductor heavyweight.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Machina Capital S.A.S. Invests $1.75 Million in NXP Semiconductors N.V. $NXPI – MarketBeat (Feb 05, 2026)

- NXP Semiconductors forecasts upbeat quarter, signaling industrial market bottom – Reuters (Feb 02, 2026)

- NXP Semiconductors’ Q4 Earnings and Revenues Beat Estimates – Yahoo Finance (Feb 03, 2026)

- NXP Semiconductors: Undervalued Leverage To An Eventual Recovery (Upgrade) (NASDAQ:NXPI) – Seeking Alpha (Feb 03, 2026)

- NXP Semiconductors Q4 Earnings Summary & Key Takeaways – Benzinga (Feb 02, 2026)

For more information about NXP Semiconductors N.V., please visit the official website: nxp.com