Home > Analyses > Consumer Cyclical > NVR, Inc.

NVR, Inc. transforms how Americans build and buy homes, shaping communities across multiple states. Its brands—Ryan Homes, NVHomes, and Heartland Homes—serve a spectrum from first-time buyers to luxury seekers. Known for operational efficiency and innovation in residential construction, NVR combines building expertise with mortgage services to streamline the homebuying process. As the housing market evolves, I ask: does NVR’s robust model still support its lofty valuation and growth outlook?

Table of contents

Business Model & Company Overview

NVR, Inc., founded in 1980 and based in Reston, Virginia, stands as a dominant force in the U.S. residential construction sector. It operates a cohesive ecosystem by building single-family homes, townhomes, and condominiums under Ryan Homes, NVHomes, and Heartland Homes. These brands target a broad buyer spectrum from first-time purchasers to luxury market clients. NVR’s scale and diversified product lines create a robust platform in key Eastern and Midwestern states.

The company’s revenue engine combines homebuilding with mortgage banking, offering title insurance and loan services that enhance customer value and streamline sales. NVR’s presence spans critical U.S. regions, including Maryland, Florida, and New York, supporting steady demand cycles. Its economic moat lies in integrated services and regional expertise, shaping the residential construction industry’s future amid evolving market dynamics.

Financial Performance & Fundamental Metrics

I will analyze NVR, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value proposition.

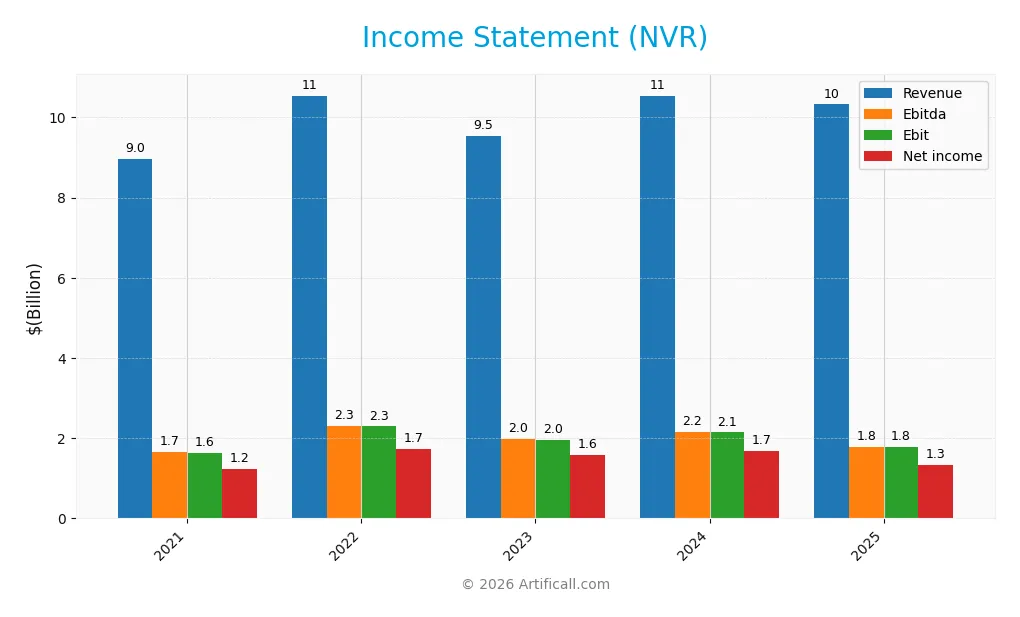

Income Statement

Below is NVR, Inc.’s income statement summary for fiscal years 2021 through 2025 in USD, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 8.96B | 10.54B | 9.53B | 10.54B | 10.32B |

| Cost of Revenue | 6.76B | 7.66B | 7.05B | 7.85B | 7.95B |

| Operating Expenses | 726M | 707M | 661M | 705M | 699M |

| Gross Profit | 2.20B | 2.88B | 2.48B | 2.69B | 2.37B |

| EBITDA | 1.66B | 2.31B | 1.97B | 2.16B | 1.79B |

| EBIT | 1.64B | 2.29B | 1.96B | 2.14B | 1.79B |

| Interest Expense | 53M | 40M | 28M | 28M | 29M |

| Net Income | 1.24B | 1.73B | 1.59B | 1.68B | 1.34B |

| EPS | 3.45 | 5.25 | 4.92 | 5.41 | 4.62 |

| Filing Date | 2022-02-16 | 2023-02-15 | 2024-02-14 | 2025-02-12 | 2026-02-11 |

Income Statement Evolution

From 2021 to 2025, NVR’s revenue increased 15.2%, yet declined 2.1% in 2025 alone. Net income grew 8.3% over the period but dropped 18.7% last year. Margins remained generally favorable, with gross margin near 23% and net margin around 13%, though net margin contracted slightly overall.

Is the Income Statement Favorable?

In 2025, NVR posted $10.3B revenue and $1.34B net income, reflecting a 13% net margin. EBIT margin held at a solid 17.4%, and interest expense was minimal at 0.28% of revenue. Despite recent declines in revenue and profit, the company maintains strong operational efficiency, resulting in a neutral overall assessment of fundamentals.

Financial Ratios

The table below presents key financial ratios for NVR, Inc. over the past five fiscal years, illustrating profitability, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 14% | 16% | 17% | 16% | 13% |

| ROE | 41% | 49% | 36% | 40% | 35% |

| ROIC | 25% | 37% | 28% | 30% | 26% |

| P/E | 17.1 | 8.8 | 14.2 | 15.1 | 15.8 |

| P/B | 7.0 | 4.3 | 5.2 | 6.0 | 5.5 |

| Current Ratio | 4.4 | 4.5 | 4.9 | 5.1 | 4.0 |

| Quick Ratio | 2.8 | 3.0 | 3.3 | 3.3 | 2.1 |

| D/E | 0.53 | 0.29 | 0.23 | 0.24 | 0.31 |

| Debt-to-Assets | 27% | 18% | 15% | 16% | 20% |

| Interest Coverage | 28 | 55 | 66 | 72 | 58 |

| Asset Turnover | 1.54 | 1.86 | 1.44 | 1.65 | 1.76 |

| Fixed Asset Turnover | 124 | 116 | 95 | 97 | 42 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Return on Equity (ROE) showed volatility, peaking at 49.2% in 2022 before settling at 34.7% in 2025. The Current Ratio declined from 5.07 in 2024 to 3.95 in 2025, indicating reduced liquidity. Debt-to-Equity Ratio improved from 0.53 in 2021 to 0.31 in 2025, reflecting enhanced leverage management. Profitability margins softened slightly in 2025.

Are the Financial Ratios Fovorable?

In 2025, profitability is strong with a 12.98% net margin and 34.67% ROE, both favorable. Liquidity shows mixed signals: a high quick ratio (2.12) is favorable, but the current ratio (3.95) is flagged unfavorable. Leverage remains conservative with a debt-to-equity of 0.31, favorable. Market valuation metrics like price-to-book are unfavorable, while price-to-earnings is neutral. Overall, 64% of ratios are favorable.

Shareholder Return Policy

NVR, Inc. does not pay dividends, reflecting its strategy to reinvest earnings in growth and operations. The company does not currently engage in share buybacks either, focusing instead on capital preservation and expansion.

This approach aligns with sustaining long-term shareholder value by prioritizing reinvestment over immediate cash returns. The lack of distributions suggests a focus on strengthening the balance sheet and supporting operational cash flow, which may benefit shareholders over time.

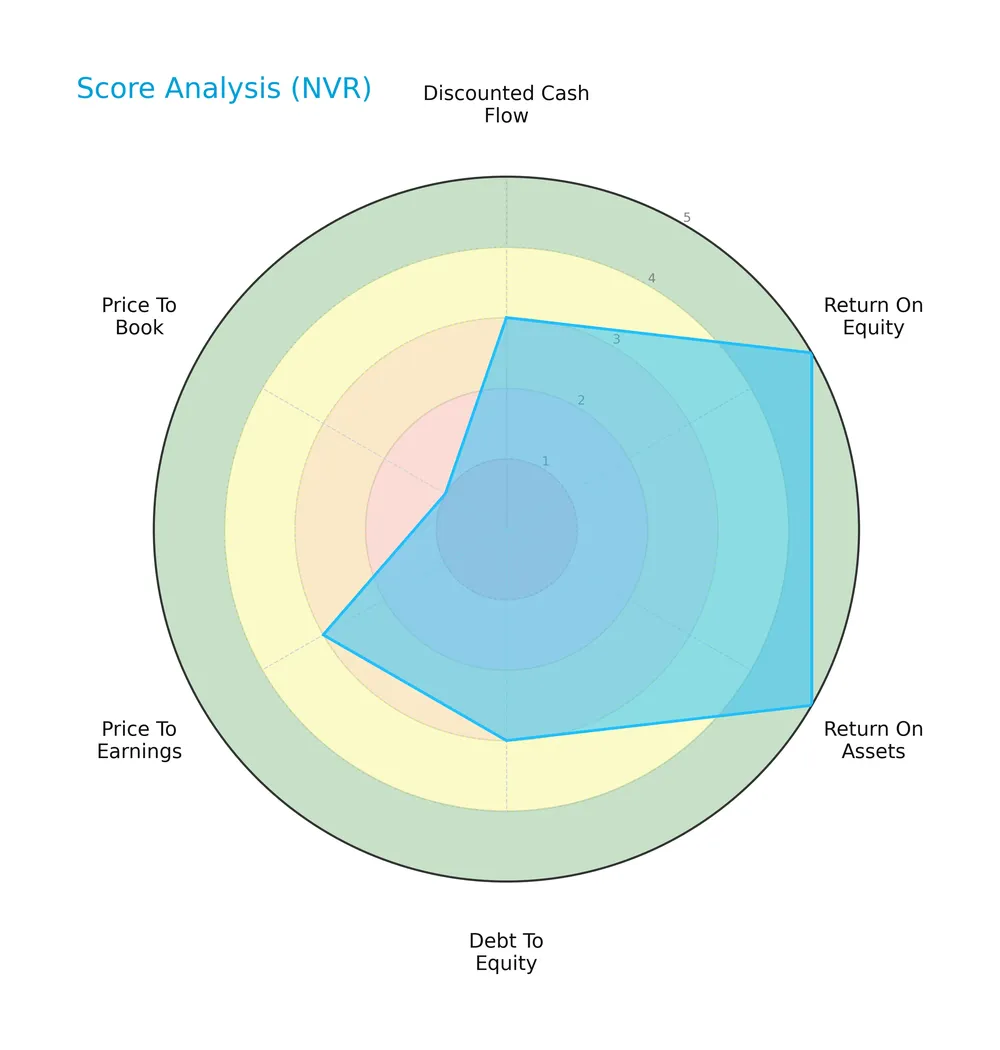

Score analysis

Below is a radar chart illustrating NVR, Inc.’s key financial scores across six valuation and performance metrics:

NVR scores very favorably on return on equity and assets, indicating strong profitability. Debt-to-equity and price-to-earnings scores are moderate. The discounted cash flow score is also moderate, while the price-to-book score is notably weak.

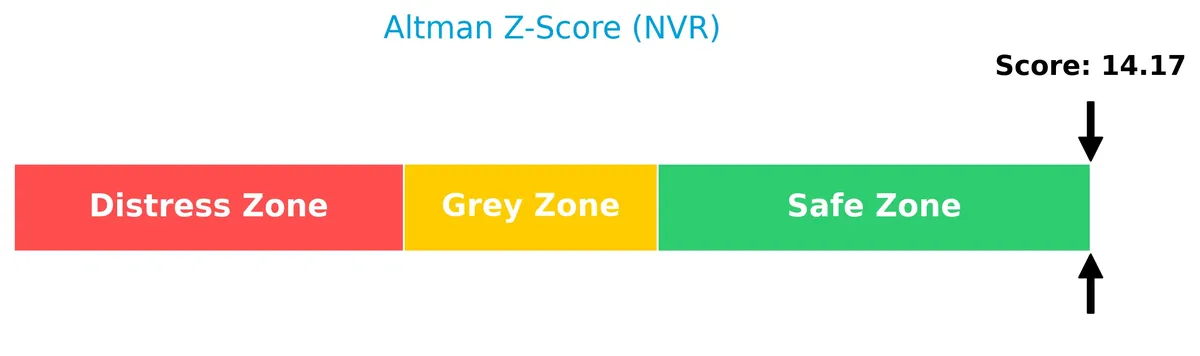

Analysis of the company’s bankruptcy risk

The Altman Z-Score places NVR, Inc. well within the safe zone, signaling very low risk of bankruptcy:

Is the company in good financial health?

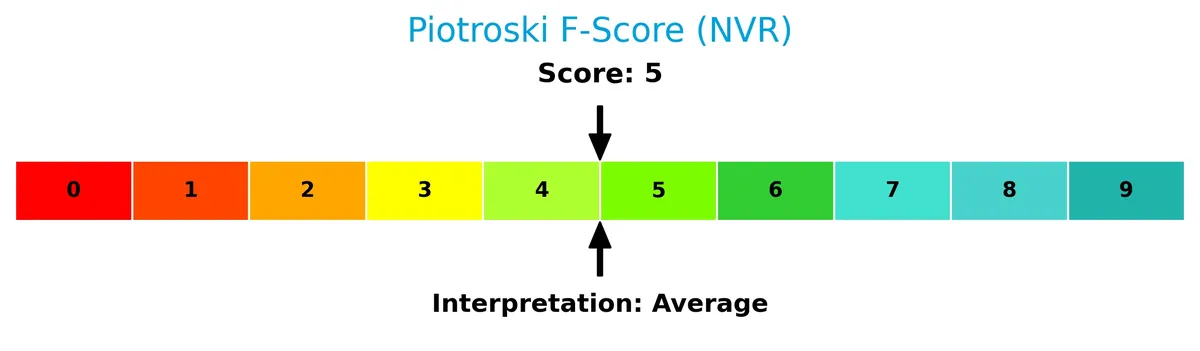

The Piotroski Score diagram below provides insight into NVR’s financial health based on nine fundamental criteria:

With a Piotroski Score of 5, NVR shows average financial strength. This middling score suggests moderate health but leaves room for improvement in profitability, leverage, and efficiency metrics.

Competitive Landscape & Sector Positioning

This section examines NVR, Inc.’s strategic role within the residential construction sector. It covers revenue distribution, key products, and main competitors. I will assess whether NVR holds a competitive advantage over its peers.

Strategic Positioning

NVR, Inc. focuses on residential construction with two core segments: homebuilding (≈$10B) and mortgage banking (~$230M). Its geographic exposure concentrates in the US Mid Atlantic, Mid East, North East, and South East regions, maintaining a targeted portfolio across diverse buyer segments and price points.

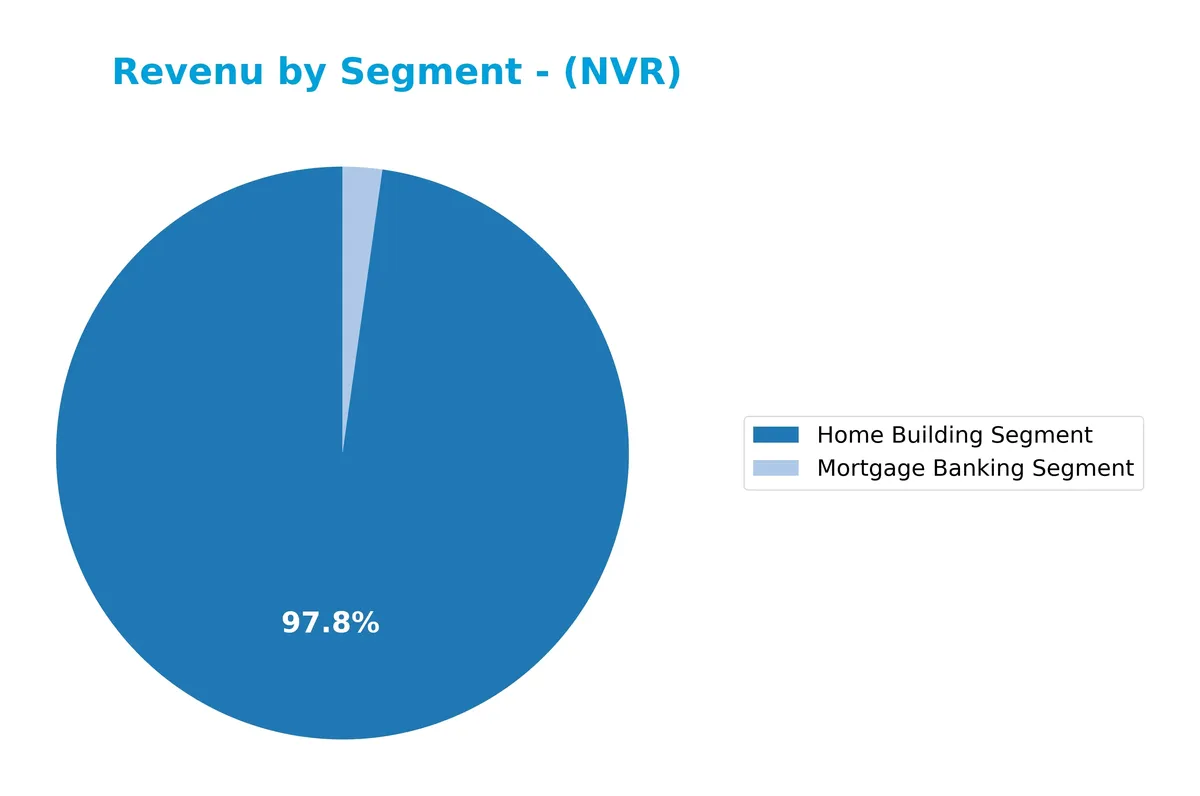

Revenue by Segment

The pie chart illustrates NVR, Inc.’s revenue distribution by segment for fiscal year 2025, highlighting primary business contributions and segment scale.

NVR’s revenue in 2025 centers overwhelmingly on the Home Building Segment, generating $10.1B, dwarfing the Mortgage Banking Segment’s $230M. Historically, Home Building dominates, reflecting consistent strength in core operations. The Mortgage Banking segment remains a minor contributor with stable but modest revenue. The slight decline in Home Building revenue from 2024’s $10.3B signals a mild slowdown, warranting close observation for potential market headwinds or margin pressures.

Key Products & Brands

NVR, Inc. generates revenue primarily through these key products and brands:

| Product | Description |

|---|---|

| Ryan Homes | Single-family detached homes targeting first-time and first-time move-up buyers. |

| NVHomes | Townhomes and condominiums marketed to move-up and luxury buyers. |

| Heartland Homes | Residential buildings aimed at move-up and luxury buyers. |

| Home Building Segment | Construction and sale of single-family homes, townhomes, and condominiums across multiple states. |

| Mortgage Banking Segment | Mortgage-related services including loan origination, title insurance, and loan sales to investors. |

NVR’s core business centers on residential construction under three brand names, serving a broad geographic area. The mortgage banking segment complements home sales with related financing services.

Main Competitors

There are 4 main competitors in the Residential Construction industry; the table lists the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| D.R. Horton, Inc. | 42.6B |

| Lennar Corporation | 26.3B |

| PulteGroup, Inc. | 23.2B |

| NVR, Inc. | 20.6B |

NVR, Inc. ranks 4th among these competitors. Its market cap is 54.1% of the leader, D.R. Horton. The company sits below both the average market cap of the top 10 (28.2B) and the sector median (24.8B). It is narrowly behind PulteGroup by just 0.82%, indicating a tight competition for third place.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NVR have a competitive advantage?

NVR presents a clear competitive advantage. It consistently earns a ROIC 17.5% above WACC with a growing trend, signaling strong value creation and efficient capital use.

Looking ahead, NVR’s diversified homebuilding brands and mortgage services position it well to capture opportunities in multiple U.S. regions. Expansion in luxury and first-time buyer markets may further enhance growth.

SWOT Analysis

This analysis highlights NVR, Inc.’s key internal and external factors affecting its competitive position.

Strengths

- strong ROIC well above WACC

- consistent profitability with 12.98% net margin

- dominant regional homebuilding presence

Weaknesses

- recent 1-year revenue decline of 2.08%

- unfavorable PB ratio at 5.47 signals stock premium

- no dividend yield limits income appeal

Opportunities

- expansion in growing US housing markets

- leveraging mortgage banking segment for cross-sales

- rising demand for luxury and move-up homes

Threats

- housing market cyclicality and economic downturns

- rising interest rates increasing mortgage costs

- supply chain disruptions impacting construction costs

NVR benefits from a robust moat and solid profitability but is facing near-term revenue softness. Its strategy should focus on geographic expansion and mortgage services while managing cyclical risks prudently.

Stock Price Action Analysis

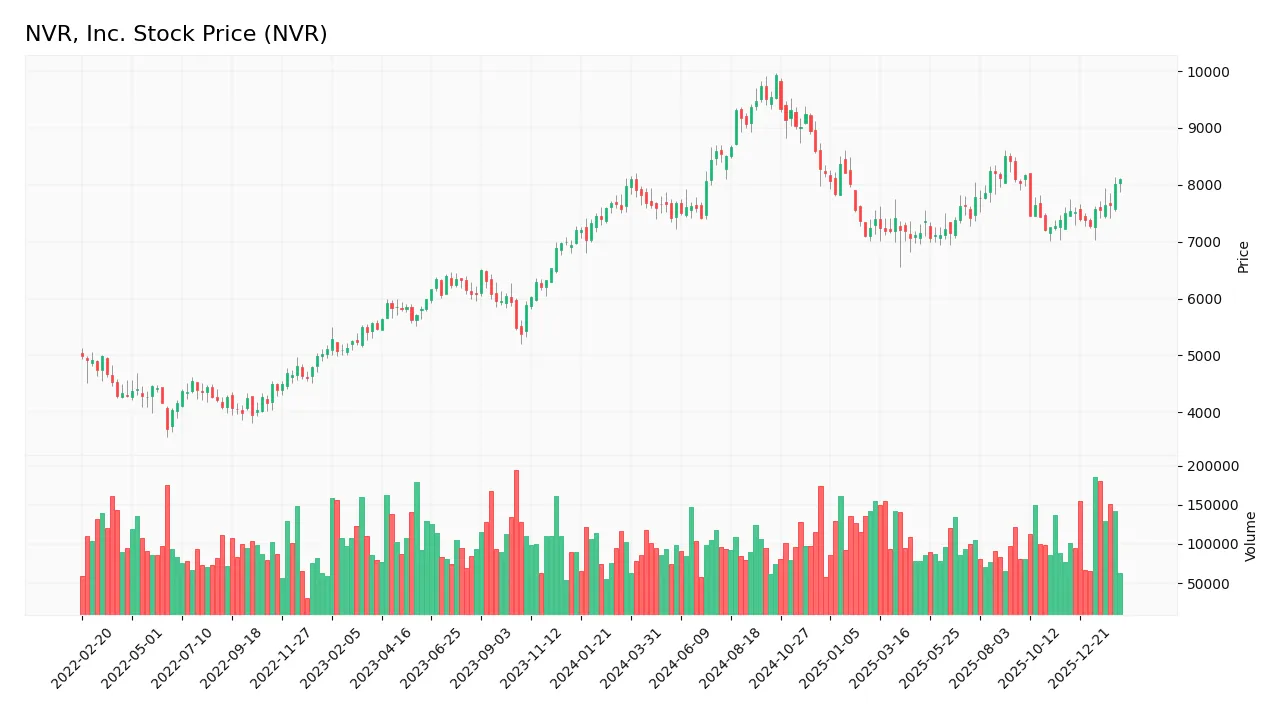

The weekly stock chart displays NVR, Inc.’s price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, NVR’s stock gained 1.57%, indicating a neutral trend by strict numeric standards despite acceleration and a high volatility of 725.18. The price ranged between 7,066 and 9,924, with recent momentum increasing notably since November 2025.

Volume Analysis

Trading volume has increased recently, totaling 12.3M shares with nearly balanced buyer (48.8%) and seller (51.2%) participation. The last three months show neutral buyer dominance at 49.4%, suggesting cautious investor sentiment without clear directional conviction.

Target Prices

Analysts present a strong consensus target price for NVR, Inc. at $8,686.

| Target Low | Target High | Consensus |

|---|---|---|

| 8,350 | 9,022 | 8,686 |

The target range indicates robust confidence in NVR’s growth prospects, with a narrow band reflecting steady analyst conviction.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines NVR, Inc.’s analyst ratings and consumer feedback, highlighting key perspectives and sentiment trends.

Stock Grades

Here are the latest verified grades from recognized analysts reflecting their views on NVR, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Zelman & Assoc | Upgrade | Hold | 2026-01-29 |

| UBS | Maintain | Neutral | 2026-01-06 |

| UBS | Maintain | Neutral | 2025-10-23 |

| B of A Securities | Maintain | Buy | 2025-10-10 |

| UBS | Maintain | Neutral | 2025-07-24 |

| JP Morgan | Maintain | Neutral | 2025-07-24 |

| UBS | Maintain | Neutral | 2025-04-23 |

| UBS | Maintain | Neutral | 2025-01-29 |

| JP Morgan | Maintain | Neutral | 2025-01-29 |

| UBS | Maintain | Neutral | 2025-01-08 |

The grades reveal a consistent neutral stance from UBS and JP Morgan, with B of A Securities maintaining a Buy rating. Zelman & Assoc’s recent upgrade from Sell to Hold marks a slight positive shift in sentiment.

Consumer Opinions

Consumers have a strong voice on NVR, Inc., reflecting both the company’s strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent build quality and attention to detail.” | “Customer service response times can be slow.” |

| “Smooth home buying process with knowledgeable staff.” | “Occasional delays in project completion.” |

| “High resale value on homes, showing strong market demand.” | “Pricing tends to be on the higher side.” |

Overall, buyers praise NVR for superior craftsmanship and a seamless purchasing experience. However, some express frustration with slower customer support and project timelines, signaling operational areas to watch.

Risk Analysis

Below is a summary table outlining key risks for NVR, Inc., focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated price-to-book ratio at 5.47 signals potential overvaluation | Medium | Medium |

| Market Cyclicality | Exposure to residential construction cycles and economic downturns | High | High |

| Interest Rate Risk | Rising mortgage rates could reduce homebuyer demand | High | High |

| Liquidity Risk | Current ratio at 3.95 flagged as unfavorable; may indicate overstocked inventory or working capital issues | Low | Medium |

| Dividend Risk | No dividend payout may deter income-focused investors | Medium | Low |

| Credit Risk | Low debt-to-equity ratio (0.31) supports financial stability | Low | Low |

The most pressing risks for NVR are cyclical market downturns and rising interest rates. Historically, the residential construction sector suffers sharp volume declines during recessions and rate hikes. Despite strong financials, overvaluation and liquidity concerns could amplify volatility in a downturn. Vigilant monitoring of housing market trends remains essential.

Should You Buy NVR, Inc.?

NVR, Inc. appears to be a robust value creator with a durable competitive moat supported by a growing ROIC well above WACC. While its leverage profile seems manageable, the overall A- rating suggests a very favorable financial health with moderate valuation risks.

Strength & Efficiency Pillars

NVR, Inc. demonstrates robust operational efficiency with a net margin of 12.98% and a strong return on equity at 34.67%. The return on invested capital (ROIC) stands at 25.85%, significantly exceeding the weighted average cost of capital (WACC) of 8.37%, confirming the company as a clear value creator. Its asset turnover ratio of 1.76 and fixed asset turnover of 41.97 further underscore efficient capital use. These metrics collectively reflect a sustainable competitive advantage and growing profitability.

Weaknesses and Drawbacks

The company’s valuation presents some concerns, notably a high price-to-book ratio of 5.47, which signals an expensive premium relative to book value. Although the price-to-earnings ratio is moderate at 15.79, the current ratio at 3.95 is marked unfavorable, suggesting potential liquidity inefficiencies despite ample short-term assets. Dividend yield remains at zero, which could dissuade income-focused investors. Market activity shows near parity between buyers (48.76%) and sellers (51.24%), indicating balanced but cautious investor sentiment.

Our Final Verdict about NVR, Inc.

NVR, Inc. offers a fundamentally strong profile with clear value creation and solid profitability. Despite a bullish long-term trend, recent market neutrality and valuation concerns suggest a wait-and-see stance might be prudent. The company could appeal to investors who prioritize operational excellence but may appear risky for those sensitive to premium valuation and liquidity nuances.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NVR, INC. ANNOUNCES SHARE REPURCHASE AUTHORIZATION – Yahoo Finance (Feb 11, 2026)

- NVR INC SEC 10-K Report – TradingView (Feb 11, 2026)

- $750M on the table: NVR gets green light to buy back its own stock – Stock Titan (Feb 11, 2026)

- MQS Management LLC Buys New Stake in NVR, Inc. $NVR – MarketBeat (Feb 11, 2026)

- NVR, INC. ANNOUNCES SHARE REPURCHASE AUTHORIZATION – marketscreener.com (Feb 11, 2026)

For more information about NVR, Inc., please visit the official website: nvrinc.com