Home > Analyses > Technology > NVIDIA Corporation

NVIDIA Corporation revolutionizes how we experience digital worlds, powering everything from immersive gaming to cutting-edge AI and autonomous vehicles. As a dominant force in the semiconductor industry, NVIDIA’s flagship GeForce GPUs and advanced data center solutions have established it as a beacon of innovation and quality. With its expanding footprint across diverse high-growth sectors, I explore whether NVIDIA’s robust fundamentals still support its lofty market valuation and future growth prospects.

Table of contents

Business Model & Company Overview

NVIDIA Corporation, founded in 1993 and headquartered in Santa Clara, California, stands as a dominant force in the semiconductor industry. Its ecosystem integrates cutting-edge graphics, compute, and networking solutions that power gaming, professional visualization, data centers, and automotive markets. From GeForce GPUs and cloud gaming services to AI-driven autonomous vehicle platforms, NVIDIA’s core mission revolves around advancing computing performance and immersive experiences globally.

The company’s revenue engine balances hardware sales—GPUs and automotive platforms—with software and recurring services like vGPU and AI Enterprise software. NVIDIA strategically serves diverse global markets across the Americas, Europe, and Asia, selling to OEMs, cloud providers, and automotive manufacturers. This diversified model underpins a robust economic moat, enabling NVIDIA to shape the future of multiple high-growth technology sectors.

Financial Performance & Fundamental Metrics

This section analyzes NVIDIA Corporation’s income statement, key financial ratios, and dividend payout policy to provide a comprehensive view of its financial health.

Income Statement

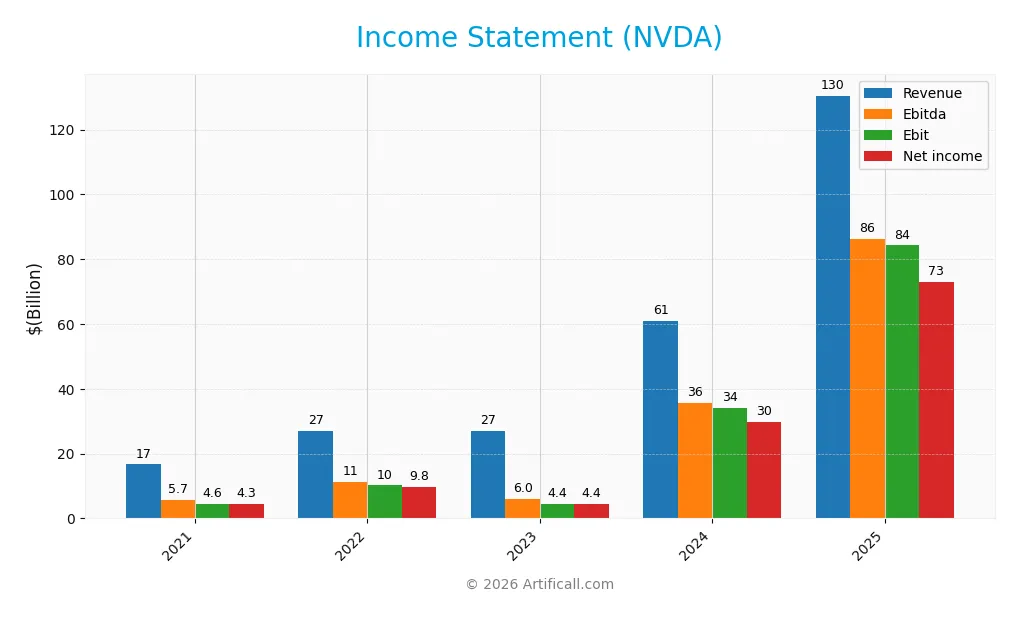

The following table summarizes NVIDIA Corporation’s key income statement figures over the fiscal years 2021 to 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 16.7B | 26.9B | 27.0B | 60.9B | 130.5B |

| Cost of Revenue | 6.3B | 9.4B | 11.6B | 16.6B | 32.6B |

| Operating Expenses | 5.9B | 7.4B | 11.1B | 11.3B | 16.4B |

| Gross Profit | 10.4B | 17.5B | 15.4B | 44.3B | 97.9B |

| EBITDA | 5.7B | 11.4B | 6.0B | 35.6B | 86.1B |

| EBIT | 4.6B | 10.2B | 4.4B | 34.1B | 84.3B |

| Interest Expense | 184M | 236M | 262M | 257M | 247M |

| Net Income | 4.3B | 9.8B | 4.4B | 29.8B | 72.9B |

| EPS | 0.18 | 0.39 | 0.18 | 1.21 | 2.97 |

| Filing Date | 2021-02-26 | 2022-03-18 | 2023-02-24 | 2024-02-21 | 2025-02-26 |

Income Statement Evolution

NVIDIA’s revenue grew substantially from $16.7B in 2021 to $130.5B in 2025, representing a strong overall growth of 683%. Net income surged even more dramatically, by 1582% over the same period, reaching $72.9B in 2025. Margins improved notably, with the gross margin at 74.99% and net margin at 55.85%, reflecting enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement shows robust fundamentals with revenue doubling compared to 2024 and net income increasing by 145%. Operating expenses grew proportionally, maintaining a high EBIT margin of 64.58%. Interest expenses remain minimal at 0.19% of revenue, supporting strong net margins. Overall, all key metrics and margin growth rates are evaluated as favorable, indicating a solid financial position.

Financial Ratios

The following table presents key financial ratios for NVIDIA Corporation over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26% | 36% | 16% | 49% | 56% |

| ROE | 26% | 37% | 20% | 69% | 92% |

| ROIC | 17% | 25% | 12% | 51% | 75% |

| P/E | 75.4 | 62.7 | 109.1 | 51.8 | 39.9 |

| P/B | 19.3 | 23.0 | 21.6 | 35.9 | 36.7 |

| Current Ratio | 4.09 | 6.65 | 3.52 | 4.17 | 4.44 |

| Quick Ratio | 3.63 | 6.05 | 2.73 | 3.67 | 3.88 |

| D/E | 0.46 | 0.44 | 0.54 | 0.26 | 0.13 |

| Debt-to-Assets | 27% | 27% | 29% | 17% | 9% |

| Interest Coverage | 24.6 | 42.5 | 16.1 | 128.3 | 329.8 |

| Asset Turnover | 0.58 | 0.61 | 0.65 | 0.93 | 1.17 |

| Fixed Asset Turnover | 5.84 | 7.46 | 5.57 | 11.58 | 16.16 |

| Dividend Yield | 0.12% | 0.07% | 0.08% | 0.03% | 0.03% |

Evolution of Financial Ratios

NVIDIA’s Return on Equity (ROE) has shown a robust upward trend, reaching 91.87% in 2025, indicating increased profitability. The Current Ratio, reflecting liquidity, rose from 3.52 in 2023 to 4.44 in 2025, suggesting improved short-term financial strength. Meanwhile, the Debt-to-Equity Ratio significantly decreased to 0.13 in 2025, highlighting a reduction in leverage and a stronger equity base.

Are the Financial Ratios Favorable?

In 2025, NVIDIA demonstrates strong profitability with a net margin of 55.85% and high returns on equity and invested capital, all marked favorable. Liquidity ratios show mixed signals: the quick ratio is favorable at 3.88, but the current ratio is deemed unfavorable at 4.44. Leverage metrics, including a low debt-to-equity ratio of 0.13 and high interest coverage above 340, are favorable. Market valuation ratios such as P/E and P/B remain unfavorable, reflecting a high valuation. Overall, 64.29% of key ratios are favorable, supporting a generally positive financial profile.

Shareholder Return Policy

NVIDIA Corporation maintains a very low dividend payout ratio near 1.1%, with dividend per share gradually increasing to $0.034 in fiscal 2025. The annual dividend yield remains minimal at 0.03%, while share buybacks are part of the capital return strategy, supported by strong free cash flow coverage.

This conservative dividend approach, combined with share repurchases, suggests NVIDIA prioritizes retaining earnings for reinvestment while providing modest cash returns. The policy appears aligned with sustainable long-term value creation, given robust profitability and cash flow metrics supporting balanced distributions.

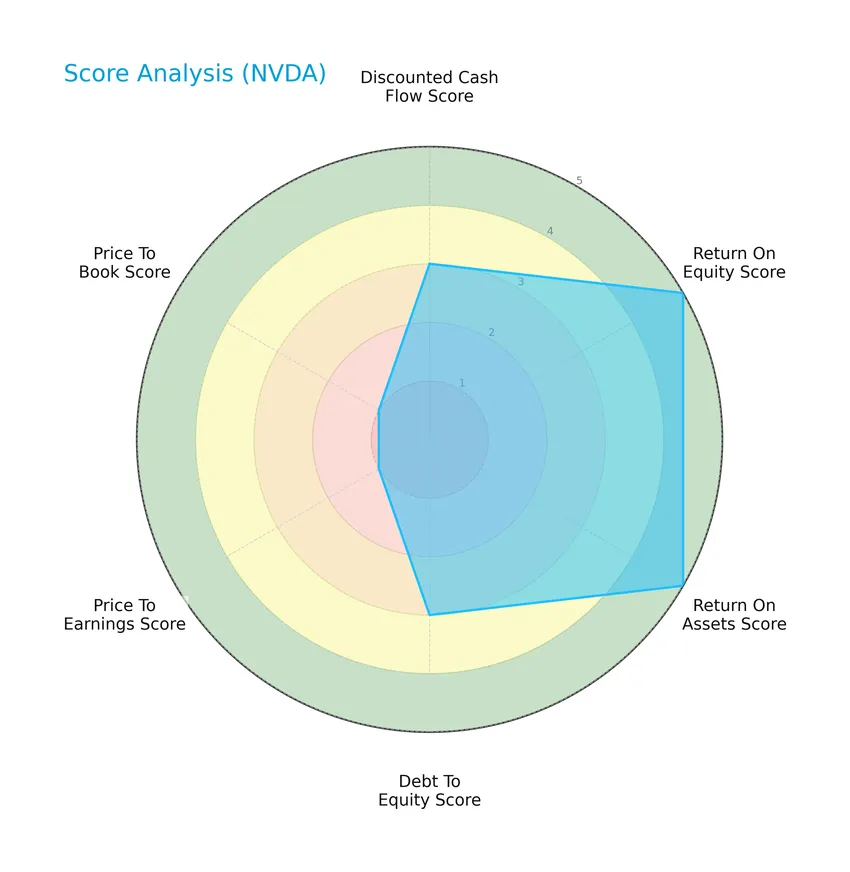

Score analysis

Here is an overview of NVIDIA Corporation’s key financial scores presented in the upcoming radar chart:

The company shows very favorable returns on equity and assets, both scoring 5, while discounted cash flow and debt-to-equity ratios hold moderate scores of 3. However, valuation metrics such as price-to-earnings and price-to-book scores are very unfavorable at 1 each.

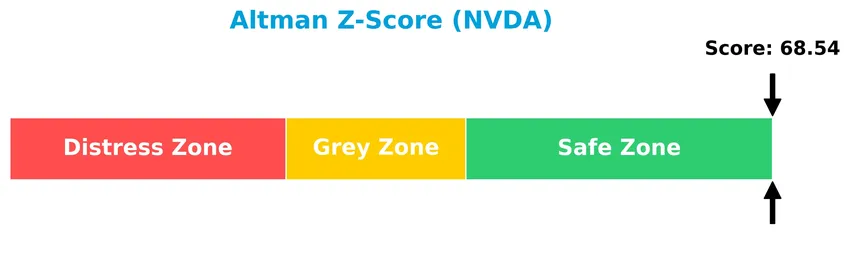

Analysis of the company’s bankruptcy risk

NVIDIA’s Altman Z-Score indicates its position well within the safe zone, reflecting a very low risk of bankruptcy:

Is the company in good financial health?

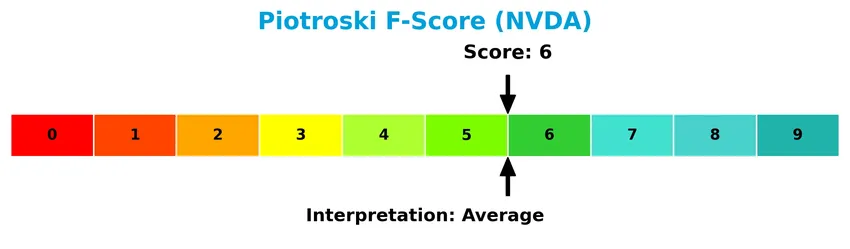

The Piotroski Score chart below illustrates NVIDIA’s financial health assessment based on key profitability and efficiency criteria:

With a Piotroski Score of 6, the company is considered to be in average financial health, suggesting moderate strength but room for improvement in its fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis will examine NVIDIA Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT aspects. I will also assess whether NVIDIA holds a competitive advantage over its industry peers.

Strategic Positioning

NVIDIA has diversified its product portfolio across Gaming, Data Center, Automotive, and Professional Visualization segments, with Data Center leading at $115B in FY2025. Geographically, it maintains broad exposure, generating significant revenue in the US ($61B), Taiwan ($20.5B), Singapore ($23.7B), and China ($17.1B).

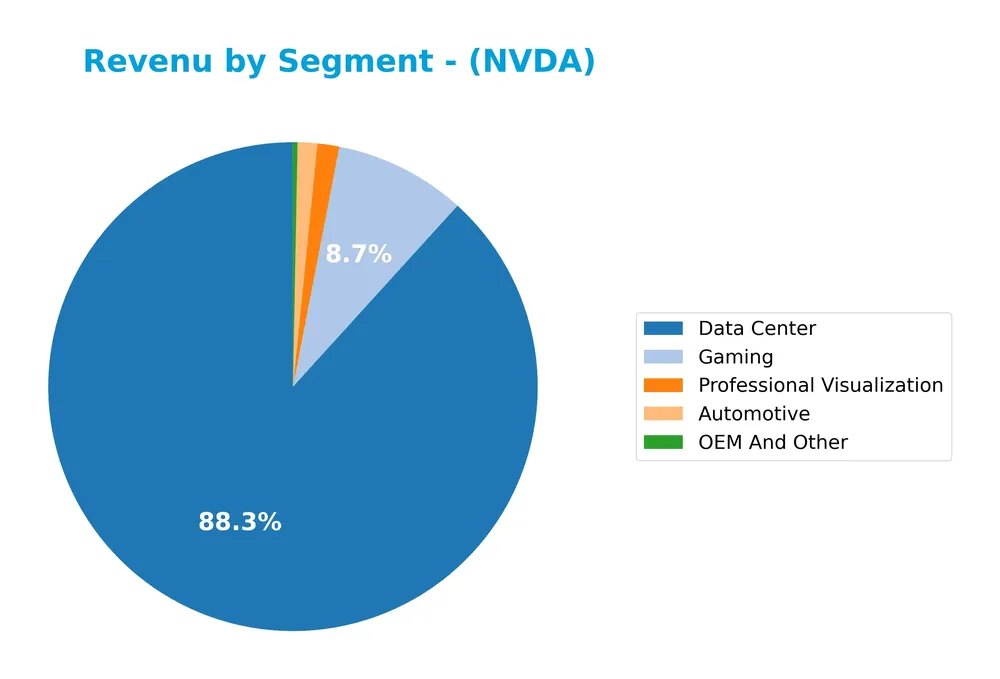

Revenue by Segment

The pie chart illustrates NVIDIA Corporation’s revenue distribution by product segments for the fiscal year 2025, highlighting the company’s diverse business areas.

In 2025, NVIDIA’s revenue was heavily driven by the Data Center segment, reaching $115B, showing substantial growth from $47.5B in 2024. Gaming remains a key contributor at $11.4B, a moderate increase from the previous year. Automotive and Professional Visualization also grew to $1.7B and $1.9B respectively, reflecting steady expansion. OEM and Other segments contribute minimally, indicating a concentrated revenue base with increasing reliance on Data Center growth.

Key Products & Brands

The table below summarizes NVIDIA Corporation’s key products and brands and their business focus:

| Product | Description |

|---|---|

| GeForce GPUs | Graphics processing units for gaming and PCs, including the GeForce NOW game streaming service and related infrastructure. |

| Quadro/NVIDIA RTX GPUs | Enterprise workstation graphics solutions designed for professional visualization and design applications. |

| vGPU Software | Cloud-based visual and virtual computing software enabling virtual GPU capabilities. |

| Automotive Platforms | Infotainment systems, AI Cockpit, autonomous driving development, and autonomous vehicle solutions. |

| Omniverse Software | Platform for building 3D designs and virtual worlds, targeting professional visualization markets. |

| Data Center Platforms | Systems for AI, high-performance computing (HPC), and accelerated computing, including NVIDIA AI Enterprise software. |

| Mellanox Networking | Networking and interconnect solutions supporting data center and cloud infrastructure. |

| Cryptocurrency Mining | Specialized processors designed for cryptocurrency mining activities. |

| Jetson | Embedded platforms for robotics and other AI-driven applications. |

NVIDIA’s product portfolio spans gaming, professional visualization, data center, and automotive markets, with strong emphasis on GPUs, AI computing, and networking solutions. The company serves a diverse clientele including OEMs, system builders, cloud providers, and automotive manufacturers.

Main Competitors

In the Semiconductor industry, there are 38 competitors, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

NVIDIA Corporation ranks 1st among 38 competitors, with a market cap nearly equal to the sector leader at 0.9938 times its size. It stands significantly above both the average market cap of the top 10 (975B) and the median market cap in the sector (31B). The distance to the next closest competitor below NVIDIA is substantial at -178.95%, highlighting its dominant position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NVIDIA have a competitive advantage?

NVIDIA Corporation presents a strong competitive advantage, demonstrated by a very favorable moat status, with ROIC exceeding WACC by over 60% and a growing ROIC trend of 339%, indicating efficient capital use and value creation. The company’s profitability margins are consistently favorable, supported by robust revenue and net income growth over recent years.

Looking ahead, NVIDIA’s diverse product offerings across gaming, data center AI, automotive, and virtual computing markets position it well for future growth opportunities. Expansion into new geographic markets and continued innovation in AI and autonomous vehicle technologies further underpin its potential for sustained competitive strength.

SWOT Analysis

This SWOT analysis highlights NVIDIA Corporation’s key strategic factors to guide investors in assessing its investment potential.

Strengths

- Leading AI and GPU technology

- Strong revenue and net income growth

- Durable competitive moat with high ROIC

Weaknesses

- High valuation multiples (PE and PB)

- Elevated beta indicating volatility

- Low dividend yield

Opportunities

- Expansion in AI and data center markets

- Growing automotive AI and autonomous driving

- Increasing global demand for gaming GPUs

Threats

- Intense semiconductor competition

- Geopolitical risks in China and Taiwan

- Supply chain disruptions and chip shortages

NVIDIA demonstrates robust growth and a durable competitive advantage, making it a compelling long-term investment. However, elevated valuation and geopolitical exposure require cautious risk management in portfolio allocation.

Stock Price Action Analysis

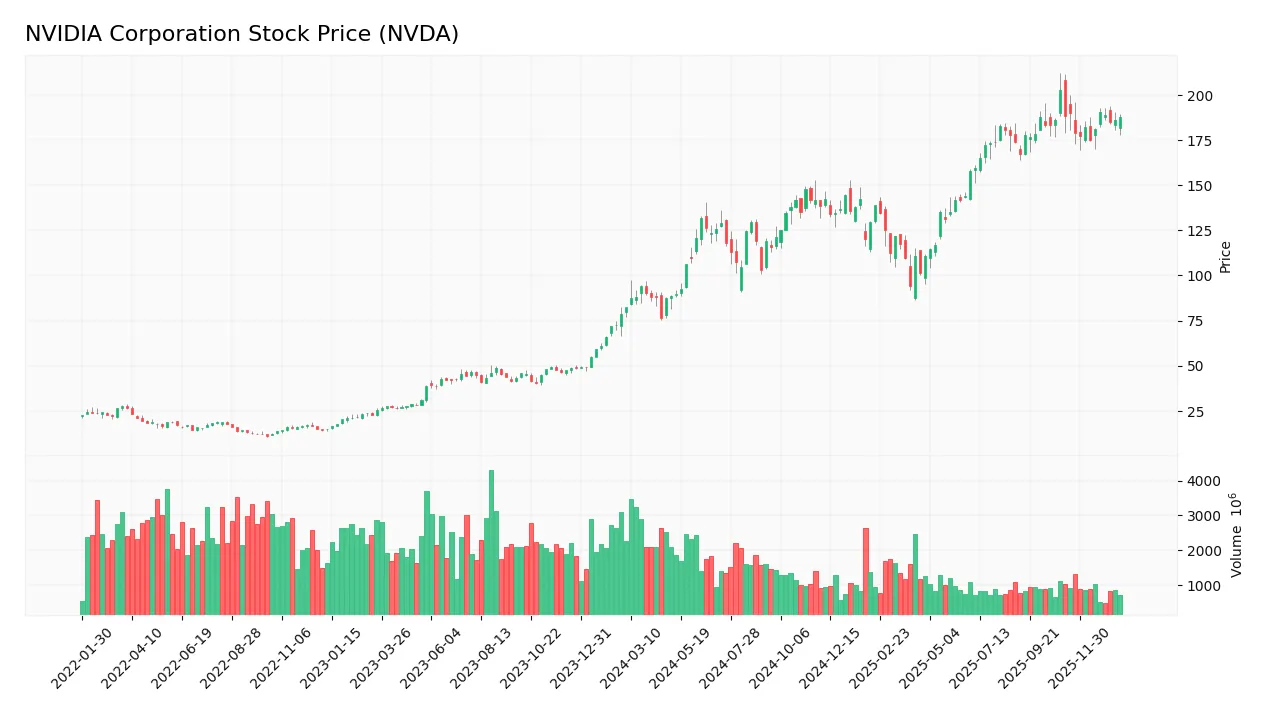

The weekly stock chart of NVIDIA Corporation (NVDA) highlights price movements and volume trends over the past 12 months with key support and resistance levels visible:

Trend Analysis

Over the past 12 months, NVDA’s stock price increased by 128.09%, indicating a strong bullish trend despite a recent deceleration in momentum. The price ranged from a low of 76.2 to a high of 202.49, with notable volatility reflected in a standard deviation of 32.36.

Volume Analysis

In the last three months, trading volume for NVDA has been decreasing overall with buyer volume at 4.88B and seller volume slightly higher at 5.44B. Buyer dominance slipped to 47.28%, suggesting a neutral buyer-seller balance and a cautious investor sentiment during this period.

Target Prices

The consensus target prices for NVIDIA Corporation indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 352 | 140 | 265.21 |

Analysts expect NVIDIA’s stock to trade between $140 and $352, with an average consensus target around $265, reflecting strong confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to NVIDIA Corporation’s market performance and products.

Stock Grades

The following table presents the latest verified stock grades for NVIDIA Corporation from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-16 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Stifel | Maintain | Buy | 2025-12-29 |

| Truist Securities | Maintain | Buy | 2025-12-29 |

| B of A Securities | Maintain | Buy | 2025-12-26 |

| Baird | Maintain | Outperform | 2025-12-26 |

| Bernstein | Maintain | Outperform | 2025-12-26 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Tigress Financial | Maintain | Strong Buy | 2025-12-18 |

| Morgan Stanley | Maintain | Overweight | 2025-12-01 |

The consensus among analysts leans strongly positive, with a majority maintaining Buy or Outperform ratings and few Hold or Sell recommendations. This consistency signals sustained confidence in NVIDIA’s market prospects.

Consumer Opinions

NVIDIA Corporation continues to evoke strong reactions from its user base, reflecting both high praise and areas of concern.

| Positive Reviews | Negative Reviews |

|---|---|

| Exceptional graphics performance that boosts gaming and AI projects. | High product prices can be a barrier for casual users. |

| Consistent innovation keeping NVIDIA ahead in GPU technology. | Occasional driver updates cause compatibility issues. |

| Strong customer support and detailed documentation. | Limited availability during product launches frustrates buyers. |

Overall, consumers admire NVIDIA’s cutting-edge technology and performance, though pricing and product availability remain common pain points. This balance is crucial for investors to consider when evaluating market sentiment.

Risk Analysis

Below is an overview of key risk categories relevant to NVIDIA Corporation, including their likelihood and potential impact on investment returns:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (2.31) indicates sensitivity to market swings, potentially causing sharp price moves. | High | High |

| Valuation Risk | Elevated P/E (39.9) and P/B (36.66) ratios suggest the stock is expensive relative to earnings. | Medium | High |

| Competitive Risk | Intense competition in semiconductors, especially from global players and emerging AI startups. | Medium | Medium |

| Regulatory Risk | Geopolitical tensions and export restrictions on advanced chips could disrupt supply chains. | Medium | High |

| Technology Risk | Rapid innovation pace requires continuous R&D; failure to keep up can erode market share. | Medium | Medium |

| Financial Risk | Low debt (D/E 0.13) and strong interest coverage reduce default risk; liquidity ratios mixed. | Low | Low |

| Dividend Risk | Minimal dividend yield (0.03%) limits income appeal and may reflect reinvestment priorities. | Low | Low |

The most pressing risks for NVIDIA are market volatility and valuation pressures, given its high beta and rich valuation multiples. Recent global chip restrictions and competition in AI sectors also pose notable threats. Nonetheless, strong financial health and profitability ratios provide a buffer against downturns. Investors should weigh these risks carefully against growth potential.

Should You Buy NVIDIA Corporation?

NVIDIA appears to be a highly profitable company with robust value creation and a durable competitive moat supported by growing ROIC. Despite moderate leverage and some valuation concerns, its overall B+ rating suggests a generally very favorable financial profile, reflecting operational efficiency and strong equity returns.

Strength & Efficiency Pillars

NVIDIA Corporation exhibits robust profitability with a net margin of 55.85% and a return on equity (ROE) of 91.87%, underscoring its operational efficiency. Its return on invested capital (ROIC) stands at an impressive 75.28%, significantly exceeding the weighted average cost of capital (WACC) of 14.74%, confirming NVIDIA as a clear value creator. The company’s financial health is solid, supported by an Altman Z-Score of 68.54, placing it firmly in the safe zone against bankruptcy risk, while a Piotroski Score of 6 reflects average but stable financial strength.

Weaknesses and Drawbacks

Despite strong fundamentals, NVIDIA’s valuation metrics raise caution. A price-to-earnings ratio (P/E) of 39.9 and a price-to-book ratio (P/B) of 36.66 indicate a premium valuation that may signal overextension relative to earnings and book value. The current ratio of 4.44, flagged as unfavorable, suggests excess short-term liquidity that could be inefficiently deployed. Additionally, recent seller volume dominance at 52.72% could indicate short-term market pressure, while the dividend yield remains minimal at 0.03%, offering limited income appeal to investors.

Our Verdict about NVIDIA Corporation

NVIDIA’s long-term fundamental profile is favorable, supported by strong profitability and value creation metrics. However, recent market activity shows a slight seller dominance, suggesting that despite the company’s durable competitive advantages and bullish overall trend, investors might consider a cautious, wait-and-see approach before increasing exposure. This balanced view reflects the premium valuation and transient market pressures the stock currently faces.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NVIDIA (NVDA) CEO Jensen Huang Frames AI as the Largest Infrastructure Buildout in Human History – Yahoo Finance (Jan 24, 2026)

- Nvidia director Persis Drell departs after over a decade – Seeking Alpha (Jan 24, 2026)

- SLT Holdings LLC Sells 6,290 Shares of NVIDIA Corporation $NVDA – MarketBeat (Jan 24, 2026)

- Nvidia Chips Fetch Record Premiums On China’s Black Market – Benzinga (Jan 23, 2026)

- Nvidia Could Launch a New PC This Year. Should You Buy NVDA Stock First? – Barchart.com (Jan 21, 2026)

For more information about NVIDIA Corporation, please visit the official website: nvidia.com