In an era where sustainable energy solutions are paramount, NuScale Power Corporation is revolutionizing the nuclear energy landscape. By developing modular light water reactor technology, NuScale is not only providing efficient energy generation but also addressing critical global challenges like district heating and hydrogen production. With a reputation for innovation and quality, this company stands at the forefront of the renewable utilities sector. As we delve into the investment analysis, I’ll explore whether NuScale’s fundamentals still support its current market valuation and growth trajectory.

Table of contents

Company Description

NuScale Power Corporation, founded in 2007 and headquartered in Portland, Oregon, is a pioneering player in the Renewable Utilities sector. The company specializes in developing and selling modular light water reactor nuclear power plants, which provide energy for various applications, including electrical generation and hydrogen production. Its flagship offerings include the NuScale Power Module, capable of generating 77 megawatts of electricity, and larger configurations such as the VOYGR-12 power plant, which generates 924 MWe. As a subsidiary of Fluor Enterprises, Inc., NuScale is positioned as a leader in nuclear innovation, striving to shape a sustainable future through advanced energy solutions that address global energy demands.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of NuScale Power Corporation, focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

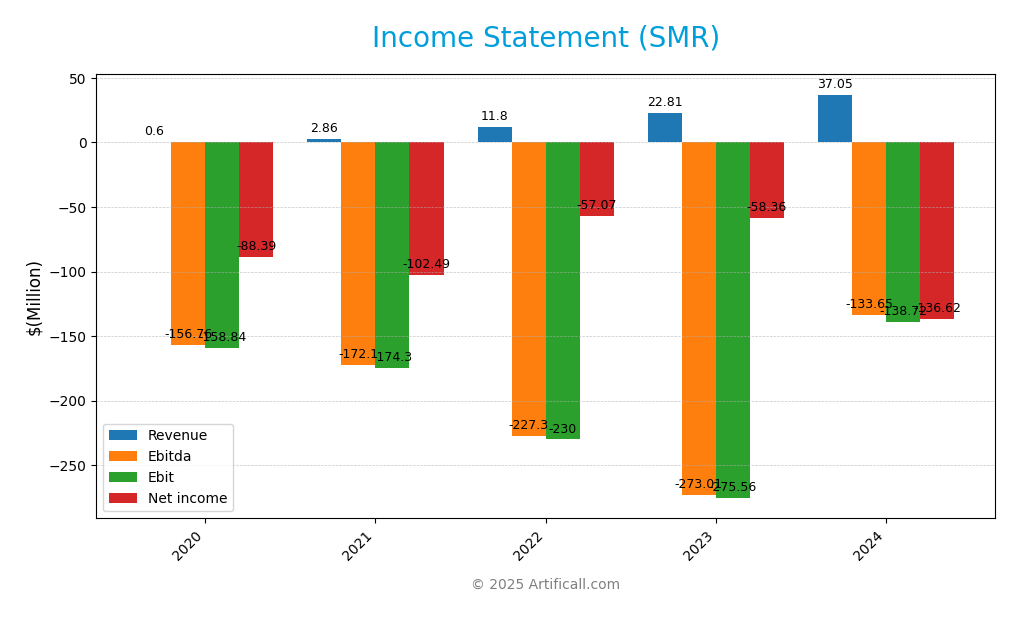

Below is the income statement for NuScale Power Corporation, providing a comprehensive overview of the company’s financial performance over the last five fiscal years.

| Income Statement Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 600K | 2.86M | 11.80M | 22.81M | 37.05M |

| Cost of Revenue | 355K | 1.77M | 7.32M | 18.96M | 4.94M |

| Operating Expenses | 159M | 175M | 234M | 279M | 170M |

| Gross Profit | 245K | 1.09M | 4.49M | 3.85M | 32.11M |

| EBITDA | -156M | -172M | -227M | -273M | -134M |

| EBIT | -159M | -174M | -230M | -276M | -135M |

| Interest Expense | 653K | 1.72M | 0 | 0 | 0 |

| Net Income | -88.39M | -102.49M | -57.07M | -58.36M | -136.62M |

| EPS | -2.03 | -2.35 | -0.51 | -0.80 | -1.47 |

| Filing Date | 2021-03-31 | 2022-03-10 | 2023-03-16 | 2024-03-15 | 2025-03-03 |

Interpretation of Income Statement

Over the last five years, NuScale Power Corporation has shown a notable increase in revenue, rising from 600K in 2020 to 37.05M in 2024, indicating a strong growth trajectory. However, net income has not followed suit, worsening from -88.39M in 2020 to -136.62M in 2024. The company’s gross profit margin has improved, reflecting better cost management despite high operating expenses. In the most recent year, although revenue grew significantly, the deepening net loss suggests that increased costs and heavy investments in R&D continue to weigh heavily on profitability. It’s crucial to monitor how these expenses evolve in relation to revenue growth moving forward.

Financial Ratios

Here are the financial ratios for NuScale Power Corporation (SMR) over the last few fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -14731.17% | -3581.17% | -483.47% | -255.86% | -368.80% |

| ROE | 303.33% | -52.33% | -49.76% | -62.45% | -22.08% |

| ROIC | -1323.03% | -1974.62% | -738.00% | -1983.98% | -30.66% |

| P/E | -1689.11 | -4.27 | -9.13 | -4.14 | -12.24 |

| P/B | -15.15 | 2.23 | 4.54 | 2.58 | 2.70 |

| Current Ratio | 0.16 | 1.78 | 7.38 | 1.77 | 5.25 |

| Quick Ratio | 0.16 | 1.78 | 7.38 | 1.77 | 5.25 |

| D/E | -1.22 | 0.08 | 0.01 | 0.03 | 0 |

| Debt-to-Assets | 75.43% | 12.77% | 0.45% | 1.31% | 0% |

| Interest Coverage | -243.25 | -101.63 | 0 | 0 | 0 |

| Asset Turnover | 0.01 | 0.02 | 0.03 | 0.10 | 0.07 |

| Fixed Asset Turnover | 0.12 | 0.58 | 2.47 | 3.41 | 15.30 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

NuScale Power Corporation (ticker: SMR) displays a mixed financial profile based on its 2024 ratios. The liquidity ratios are notably strong, with a current ratio of 5.25 and a quick ratio also at 5.25, indicating robust short-term financial health and the ability to cover immediate obligations. However, the solvency ratio is concerning at -1.47, suggesting potential long-term financial instability. Profitability ratios are predominantly negative, with a net profit margin of -3.69%, indicating challenges in generating profit. Efficiency ratios, such as the asset turnover at 0.068, are weak, reflecting underutilization of assets. Overall, while liquidity appears strong, the company faces significant profitability and solvency challenges.

Evolution of Financial Ratios

Over the past five years, NuScale Power has experienced fluctuating financial health. The current ratio improved significantly from 0.16 in 2020 to 5.25 in 2024, demonstrating enhanced liquidity, while profitability ratios have consistently remained negative, indicating ongoing operational struggles.

Distribution Policy

NuScale Power Corporation (SMR) does not currently pay dividends, reflecting its focus on reinvestment strategies during its high-growth phase. The company is prioritizing research and development to enhance its technological offerings, which may align with long-term shareholder value creation. Additionally, NuScale engages in share buybacks, indicating a commitment to returning capital to shareholders. However, the lack of dividends and the negative net income suggest potential risks, emphasizing the need for careful monitoring of the company’s financial health moving forward.

Sector Analysis

NuScale Power Corporation operates in the Renewable Utilities sector, focusing on modular nuclear power plants with innovative technology. Its competitive advantages include unique reactor designs and strategic partnerships.

Strategic Positioning

NuScale Power Corporation (SMR) operates within the Renewable Utilities sector, focusing on modular nuclear power solutions. Currently, its market cap stands at approximately 6.1B, reflecting a significant presence in a niche market. The company’s flagship product, the NuScale Power Module, delivers 77 MWe, catering to various energy needs. However, competitive pressure remains high from alternative renewable technologies and traditional energy sources. With advancements in technology and growing environmental concerns, NuScale must navigate potential disruptions while maintaining its market share effectively.

Revenue by Segment

The pie chart illustrates the revenue distribution by segment for NuScale Power Corporation for the fiscal year ending December 31, 2024.

In the fiscal year 2024, the only reported revenue segment is “Other,” which generated 411K. This limited segmentation indicates a potential concentration risk, as there are no diverse revenue streams contributing to the overall financial health of the company. The lack of significant revenue from other segments may pose challenges for growth moving forward, and investors should remain cautious about the dependency on this singular source.

Key Products

NuScale Power Corporation specializes in modular light water reactor technology for various energy applications. Below is a table summarizing its key products:

| Product | Description |

|---|---|

| NuScale Power Module | A modular reactor that generates 77 megawatts of electricity (MWe), designed for scalable energy production. |

| VOYGR-12 | A power plant configuration that delivers 924 MWe, suitable for larger energy demands and grid integration. |

| VOYGR-4 | A four-module plant configuration offering flexibility for energy generation, tailored to client specifications. |

| VOYGR-6 | A six-module variant designed for higher output, accommodating various industrial and municipal energy needs. |

| Process Heat Solutions | Customizable solutions for district heating, desalination, and hydrogen production, leveraging nuclear technology. |

These products reflect NuScale’s commitment to providing innovative and sustainable energy solutions in the renewable utilities sector.

Main Competitors

Currently, I have not identified any reliable competitors for NuScale Power Corporation (ticker: SMR) based on the available data. This analysis indicates a lack of verified competitor names, which limits my ability to provide a comparative market landscape.

However, I can assess that NuScale Power Corporation operates in the Renewable Utilities sector and has a market capitalization of approximately 6.1B. Given its niche in developing modular light water reactor nuclear power plants, it appears to hold a competitive position focused on innovative energy solutions, though the absence of verified competitors makes it challenging to evaluate its relative market share and competitive dynamics accurately.

Competitive Advantages

NuScale Power Corporation (SMR) holds a strong competitive edge in the renewable utilities sector through its innovative modular nuclear technology, which offers scalable energy solutions. The NuScale Power Module is designed to generate 77 MWe, enabling flexible applications across various industries, including electrical generation and hydrogen production. Looking ahead, the company is well-positioned to capitalize on growing demand for clean energy solutions, with potential expansion into new markets and the introduction of advanced reactor designs. This strategic focus on modularity and adaptability provides significant growth opportunities in an evolving energy landscape.

SWOT Analysis

This SWOT analysis aims to evaluate NuScale Power Corporation’s strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Innovative technology

- Strong market demand for clean energy

- Strategic partnerships

Weaknesses

- High operational costs

- Limited market presence

- Regulatory challenges

Opportunities

- Growing renewable energy market

- Expansion into international markets

- Government incentives for nuclear energy

Threats

- Intense competition in renewable sector

- Regulatory hurdles

- Economic downturns affecting funding

The overall SWOT assessment indicates that while NuScale Power has significant strengths and opportunities, it must address its weaknesses and prepare for external threats. A strategic focus on innovation and market expansion, while managing regulatory challenges, will be essential for sustainable growth.

Stock Analysis

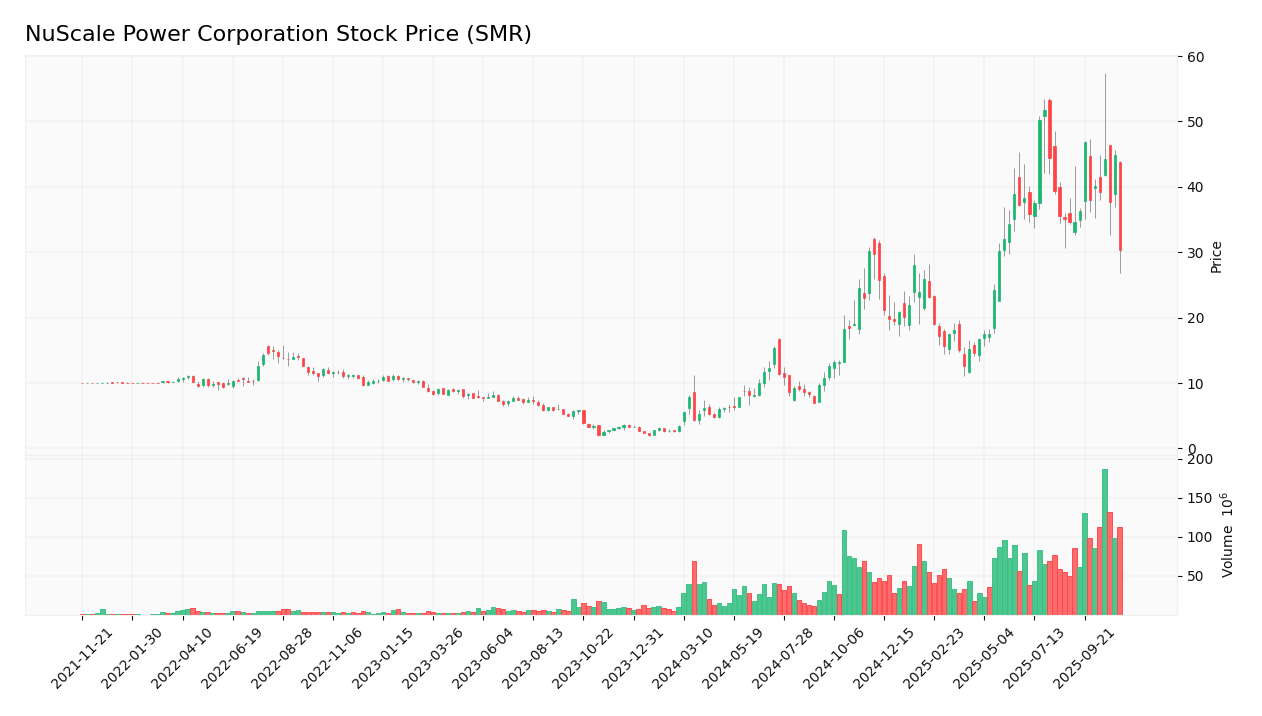

Over the past year, NuScale Power Corporation (SMR) has experienced significant price movements, culminating in a staggering 529.18% increase. This performance reflects a dynamic trading environment, underpinned by investor interest and market fluctuations.

Trend Analysis

Analyzing the stock’s performance over the last two years, the percentage change of 529.18% indicates a clear bullish trend. However, more recently, from September 7, 2025, to November 23, 2025, the stock has seen a decline of 40.05%. This recent trend exhibits a deceleration, with a standard deviation of 7.9, suggesting less volatility compared to the overall price movement. Notably, the stock reached a high of 51.67 and a low of 1.99 during this period.

Volume Analysis

In examining trading volumes over the last three months, total volume reached approximately 5B, with buyer volume accounting for 54.02% of the total at around 2.73B. Currently, the volume trend is increasing, although recent activity shows a slight seller dominance with buyer volume at 563M against seller volume of 729M. This suggests mixed investor sentiment, with cautious market participation as buyers are slightly outpaced by sellers.

Analyst Opinions

Recent analyst recommendations for NuScale Power Corporation (SMR) indicate a consensus rating of “sell.” Analysts have expressed concerns regarding the company’s financial metrics, particularly highlighting a poor discounted cash flow score and low return on equity. The rating from analysts reflects significant skepticism about the company’s current valuation and growth potential. These views are echoed by multiple analysts, leading to a cautious outlook for investors considering adding SMR to their portfolios in 2025.

Stock Grades

NuScale Power Corporation (SMR) has recently received updates from several reliable grading companies, reflecting a mix of sentiments towards its stock performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

| UBS | Maintain | Neutral | 2025-08-11 |

| BTIG | Downgrade | Neutral | 2025-06-25 |

| Canaccord Genuity | Maintain | Buy | 2025-05-29 |

| UBS | Maintain | Neutral | 2025-05-29 |

| CLSA | Maintain | Outperform | 2025-05-27 |

Overall, the trend in the grades for NuScale Power shows a notable shift, with recent downgrades from Citigroup and B of A Securities indicating growing caution among analysts, despite some firms maintaining a buy rating. This mixed sentiment suggests that while some see potential, others are wary of the stock’s performance moving forward.

Target Prices

The consensus target price for NuScale Power Corporation (SMR) reflects a promising outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 55 | 24 | 37.25 |

Overall, analysts anticipate a favorable trajectory for SMR, with a consensus target price indicating potential growth.

Consumer Opinions

Consumer sentiment about NuScale Power Corporation (ticker: SMR) reflects a blend of optimism and caution as stakeholders weigh the company’s innovative energy solutions against industry challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| “NuScale’s technology is a game changer for clean energy.” | “Customer service needs significant improvement.” |

| “I appreciate their commitment to sustainability.” | “Concerns about project timelines and delays.” |

| “The potential for small modular reactors is exciting.” | “High initial investment costs are a barrier.” |

Overall, consumer feedback highlights strengths in NuScale’s innovative approach to clean energy and sustainability, while concerns about customer service and project execution timelines persist.

Risk Analysis

In evaluating NuScale Power Corporation (SMR), it’s crucial to understand the associated risks that may affect its performance and investment potential. Below is a summary of key risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in government regulations affecting nuclear energy. | High | High |

| Market Risk | Fluctuations in energy prices impacting demand for services. | Medium | Medium |

| Technology Risk | Potential delays in technology development and deployment. | Medium | High |

| Competition Risk | Increasing competition from alternative energy sources. | High | Medium |

| Financial Risk | Exposure to financial market volatility affecting capital. | Medium | High |

Synthesizing these risks, regulatory and technological uncertainties stand out as the most likely and impactful, especially given the evolving landscape of energy policies and innovations in clean energy technologies.

Should You Buy NuScale Power Corporation?

NuScale Power Corporation has demonstrated significant challenges in profitability with a negative net margin of -3.69% and has not accumulated any debt, which could indicate a strategic decision to minimize financial risk. The company’s fundamentals have shown a negative trend with a current rating of D+, suggesting a need for improvement.

Favorable signals I haven’t found any favorable signals for this company.

Unfavorable signals The company is currently facing a negative net margin of -3.69%, indicating ongoing losses. Additionally, the rating of D+ suggests that there are considerable weaknesses in its financial performance. The overall trend analysis reveals a bullish stock trend, but a recent price change of -40.05% indicates significant volatility. Furthermore, recent seller volume exceeds buyer volume, suggesting a lack of investor confidence.

Conclusion Given the negative net margin and the unfavorable rating, it might be prudent to wait for improvements in the company’s financial health before considering an investment.

Additional Resources

- NuScale Power Corporation $SMR Shares Purchased by Intech Investment Management LLC – MarketBeat (Nov 19, 2025)

- NuScale Power Proudly Supports ENTRA1 Energy’s $25 Billion Agreement to Deploy Large-Scale Power Infrastructure Assets Across the United States – NuScale Power (Oct 29, 2025)

- A Look at NuScale Power’s (SMR) Valuation After a Recent Sharp Share Price Decline – Yahoo Finance (Nov 16, 2025)

- Troluce Capital Advisors Unloads Over One Million NuScale Power Shares – The Motley Fool (Nov 15, 2025)

- NuScale and ENTRA1 Expect $25 Billion from US/ Japan Trade Deal – Neutron Bytes (Oct 30, 2025)

For more information about NuScale Power Corporation, please visit the official website: nuscalepower.com