Home > Analyses > Utilities > NuScale Power Corporation

NuScale Power Corporation transforms the energy landscape by pioneering modular nuclear reactors that redefine clean power generation. Its flagship NuScale Power Module delivers scalable, safe, and reliable nuclear energy for electricity, heating, and industrial uses. Renowned for innovation and engineering excellence, NuScale challenges traditional utilities with flexible, carbon-free solutions. As the energy sector evolves, I ask: does NuScale’s technology and market position justify its current valuation and growth expectations?

Table of contents

Business Model & Company Overview

NuScale Power Corporation, founded in 2007 and headquartered in Portland, Oregon, leads the Renewable Utilities sector with its innovative modular light water reactor technology. Its core mission integrates scalable nuclear power solutions designed for electricity generation, district heating, desalination, and hydrogen production. This cohesive ecosystem centers on adaptable reactor modules such as the 77 MWe NuScale Power Module and the VOYGR series, tailored for diverse energy demands.

The company’s revenue engine balances hardware sales of reactor modules with long-term service contracts, positioning it strategically across the Americas, Europe, and Asia. This blend of equipment and recurring revenue underpins its competitive edge. I recognize NuScale’s economic moat lies in its pioneering modular design that reshapes nuclear power’s future by offering flexible, clean energy at scale.

Financial Performance & Fundamental Metrics

I will analyze NuScale Power Corporation’s income statement, key financial ratios, and dividend payout policy to assess its underlying financial health and shareholder value creation.

Income Statement

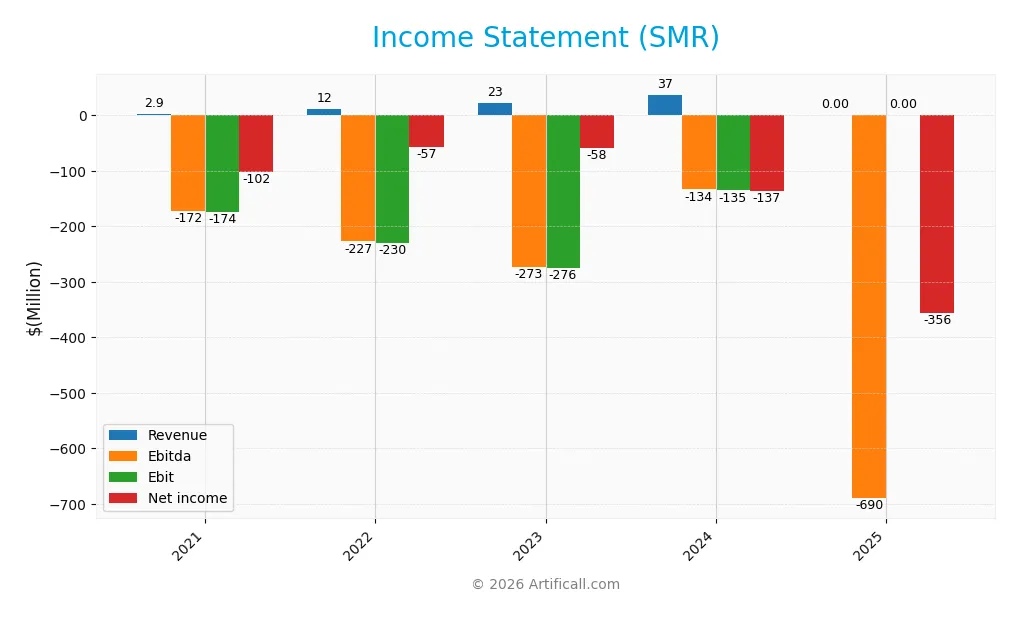

This table summarizes NuScale Power Corporation’s key income statement figures from fiscal years 2021 to 2025, reflecting their financial performance and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.9M | 11.8M | 22.8M | 37.0M | 0 |

| Cost of Revenue | 1.8M | 7.3M | 19.0M | 4.9M | 0 |

| Operating Expenses | 175.4M | 234.5M | 279.4M | 170.8M | 655.4M |

| Gross Profit | 1.1M | 4.5M | 3.8M | 32.1M | 11.4M |

| EBITDA | -172.1M | -227.3M | -273.0M | -133.6M | -689.6M |

| EBIT | -174.3M | -230.0M | -275.6M | -135.5M | 0 |

| Interest Expense | 1.7M | 0 | 0 | 0 | 0 |

| Net Income | -102.5M | -57.1M | -58.4M | -136.6M | -355.8M |

| EPS | -2.35 | -0.51 | -0.80 | -1.47 | -2.17 |

| Filing Date | 2022-03-10 | 2023-03-16 | 2024-03-15 | 2025-03-03 | 2026-02-26 |

Income Statement Evolution

NuScale Power’s revenue declined sharply to zero in 2025 from $37M in 2024, marking a 100% drop. Gross profit followed suit, falling 64% year-over-year. Operating expenses surged drastically in 2025, pushing margins further into the red. Despite a 100% improvement in EBIT growth, margins remain deeply unfavorable across the period.

Is the Income Statement Favorable?

In 2025, the company reported zero revenue but a gross profit of $11.4M, which signals accounting adjustments rather than core profitability. Operating expenses ballooned to $655M, driving a net loss of $356M, with a negative EPS of $-2.17. Interest expense is negligible, a rare positive, but overall fundamentals are unfavorable due to absent revenue and heavy losses.

Financial Ratios

The table below summarizes NuScale Power Corporation’s key financial ratios over the past five fiscal years to provide insight into its operational efficiency and financial health:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -35.81% | -4.83% | -2.56% | -3.69% | 0% |

| ROE | -154.69% | -49.76% | -62.45% | -22.08% | -30.44% |

| ROIC | -198.02% | -73.80% | -198.40% | -30.49% | -33.09% |

| P/E | -4.27 | -9.13 | -4.14 | -12.24 | -6.52 |

| P/B | 6.60 | 4.54 | 2.58 | 2.70 | 1.98 |

| Current Ratio | 1.78 | 7.38 | 1.77 | 5.25 | 4.30 |

| Quick Ratio | 1.78 | 7.38 | 1.77 | 5.25 | 4.30 |

| D/E | 0.23 | 0.04 | 0.03 | 0 | 0 |

| Debt-to-Assets | 13% | 1.25% | 1.31% | 0 | 0 |

| Interest Coverage | -101.63 | 0.62 | 0.65 | 0 | 0 |

| Asset Turnover | 0.02 | 0.03 | 0.10 | 0.07 | 0 |

| Fixed Asset Turnover | 0.46 | 1.37 | 3.41 | 15.30 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

NuScale Power Corporation’s Return on Equity (ROE) has remained negative, declining further to -30.44% in 2025, signaling persistent unprofitability. The Current Ratio, while high at 4.3 in 2025, has decreased from a peak of 7.38 in 2022, indicating reduced but still strong liquidity. The Debt-to-Equity Ratio stayed at zero, reflecting no leverage.

Are the Financial Ratios Fovorable?

Profitability ratios are unfavorable, with ROE and Return on Invested Capital (ROIC) deeply negative, while net margin stands at zero. Liquidity ratios show mixed signals: the Current Ratio is high but unfavorable due to excess idle assets, whereas the Quick Ratio is favorable at 4.3. Leverage ratios remain favorable with no debt. Efficiency and market value ratios, such as asset turnover and price-to-book, are mostly unfavorable or neutral. Overall, 64% of the ratios are unfavorable.

Shareholder Return Policy

NuScale Power Corporation (SMR) does not pay dividends, reflecting its negative net income and ongoing investment phase. The company maintains significant cash reserves and does not engage in share buybacks, indicating a focus on reinvestment and growth rather than immediate shareholder payouts.

This approach aligns with long-term value creation by prioritizing capital allocation toward development over distributions. However, shareholders should monitor future profitability and cash flow trends to assess when a return policy shift might support sustainable returns.

Score analysis

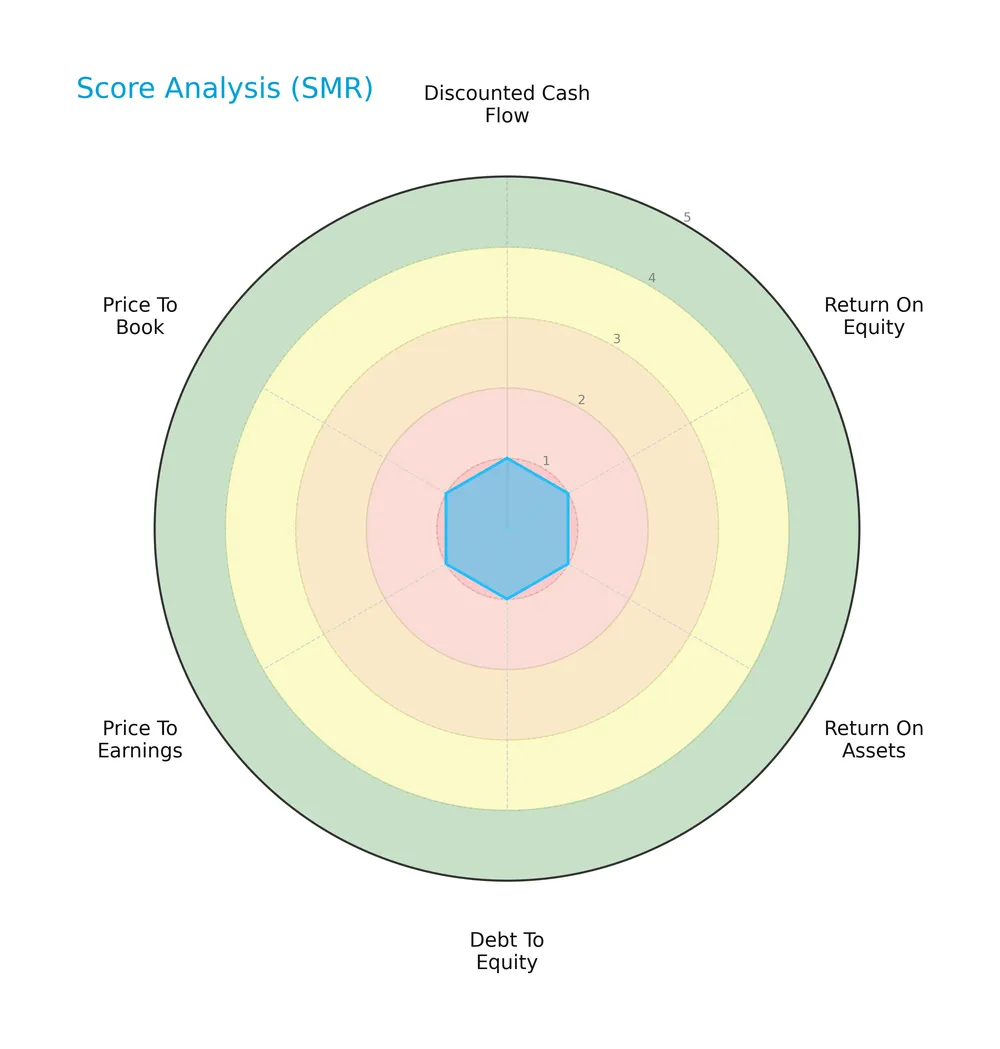

The following radar chart presents NuScale Power Corporation’s key financial metric scores for a comprehensive view:

All six scores—DCF, ROE, ROA, Debt/Equity, PE, and PB—register at 1, indicating a very unfavorable position across valuation, profitability, and leverage metrics.

Analysis of the company’s bankruptcy risk

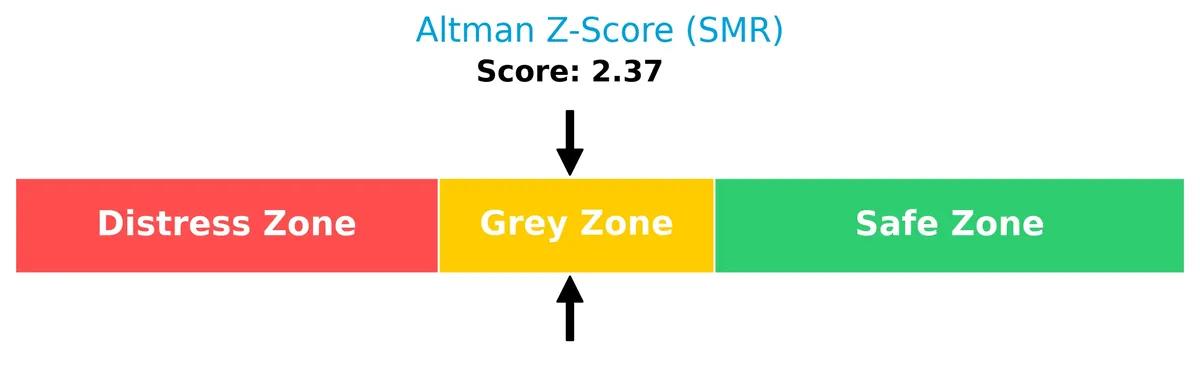

NuScale Power’s Altman Z-Score places it in the grey zone, signaling a moderate risk of financial distress and potential bankruptcy:

Is the company in good financial health?

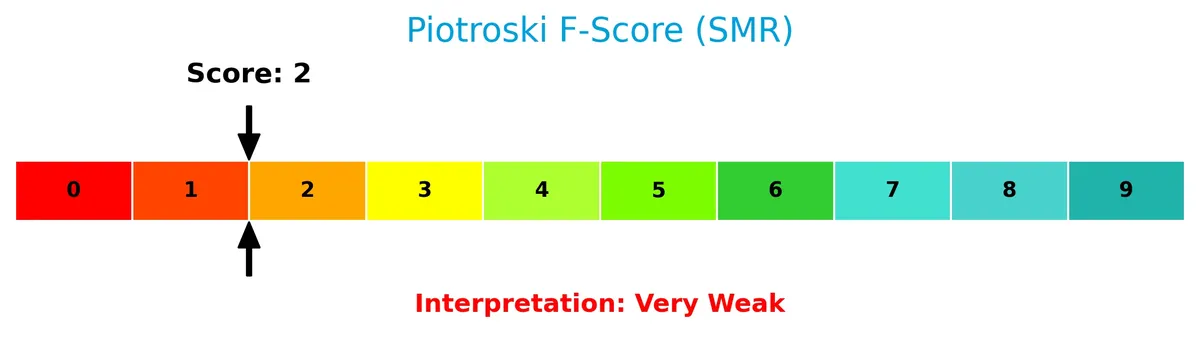

Here is the Piotroski Score diagram reflecting the company’s financial strength:

With a Piotroski Score of 2, NuScale Power shows very weak financial health, suggesting significant weaknesses in profitability, efficiency, and leverage measures.

Competitive Landscape & Sector Positioning

This analysis examines NuScale Power Corporation’s position within the renewable utilities sector, focusing on its strategic and operational dimensions. I will assess whether NuScale holds a competitive advantage compared to its main industry peers.

Strategic Positioning

NuScale Power focuses on modular nuclear power plants, offering scalable solutions from single modules to multi-module plants tailored to customer needs. Its product portfolio is concentrated within advanced nuclear technology, with operations centered in the US and no disclosed geographic diversification.

Revenue by Segment

This pie chart illustrates NuScale Power Corporation’s revenue distribution by segment for fiscal years 2024 and 2025, highlighting the company’s segment contributions and trends.

The “Other” segment remains the sole revenue contributor, showing a decline from 411K in 2024 to 134K in 2025. This contraction signals a slowdown and potential concentration risk, as the company lacks diversification across segments. Investors should monitor for new segment development to mitigate reliance on this shrinking revenue source.

Key Products & Brands

NuScale Power Corporation focuses on modular nuclear reactors and related power plant configurations:

| Product | Description |

|---|---|

| NuScale Power Module | Modular light water reactor generating 77 megawatts of electricity (MWe). |

| VOYGR-12 Power Plant | Large-scale nuclear plant capable of producing 924 MWe. |

| VOYGR-4 Power Plant | Four-module configuration tailored to customer specifications for power generation. |

| VOYGR-6 Power Plant | Six-module configuration designed to meet diverse energy needs. |

| Other Applications | Solutions for district heating, desalination, hydrogen production, and process heat applications. |

NuScale’s product suite centers on scalable nuclear technology. Its modular reactors offer flexible capacity to serve electricity and industrial heat demands.

Main Competitors

NuScale Power Corporation faces 3 main competitors, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Vernova Inc. | 184B |

| Constellation Energy Corporation | 114B |

| NuScale Power Corporation | 4.2B |

NuScale ranks 3rd among its competitors with a market cap just 2.16% of the leader, GE Vernova Inc. It sits well below both the average market cap of the top 10 competitors (100.9B) and the sector median (114.4B). The company’s market cap trails its closest rival by over 2700%, highlighting a significant scale gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NuScale Power Corporation have a competitive advantage?

NuScale Power Corporation currently lacks a clear competitive advantage, as it is shedding value with an ROIC significantly below its WACC. Despite this, its profitability shows a growing trend, suggesting improving operational efficiency over time.

Looking ahead, NuScale focuses on modular light water reactors with scalable power solutions ranging from 77 MWe to 924 MWe. These technologies target diverse applications, including electrical generation, district heating, desalination, and hydrogen production, offering potential expansion across multiple energy markets.

SWOT Analysis

This SWOT analysis highlights NuScale Power Corporation’s core strategic position and risks.

Strengths

- innovative modular nuclear technology

- strong backing from Fluor Enterprises

- zero debt position

Weaknesses

- negative ROIC vs. WACC indicates value destruction

- declining revenue and profit margins

- weak financial scores and high beta

Opportunities

- rising demand for clean energy

- potential government support for nuclear power

- expansion into hydrogen and desalination markets

Threats

- high market volatility and beta risk

- regulatory hurdles in nuclear sector

- fierce competition from renewable utilities

NuScale’s technology and financial backing form a solid foundation. However, persistent losses and valuation concerns demand cautious capital allocation. Strategic focus on emerging clean energy applications could unlock growth, but regulatory and market risks require vigilant risk management.

Stock Price Action Analysis

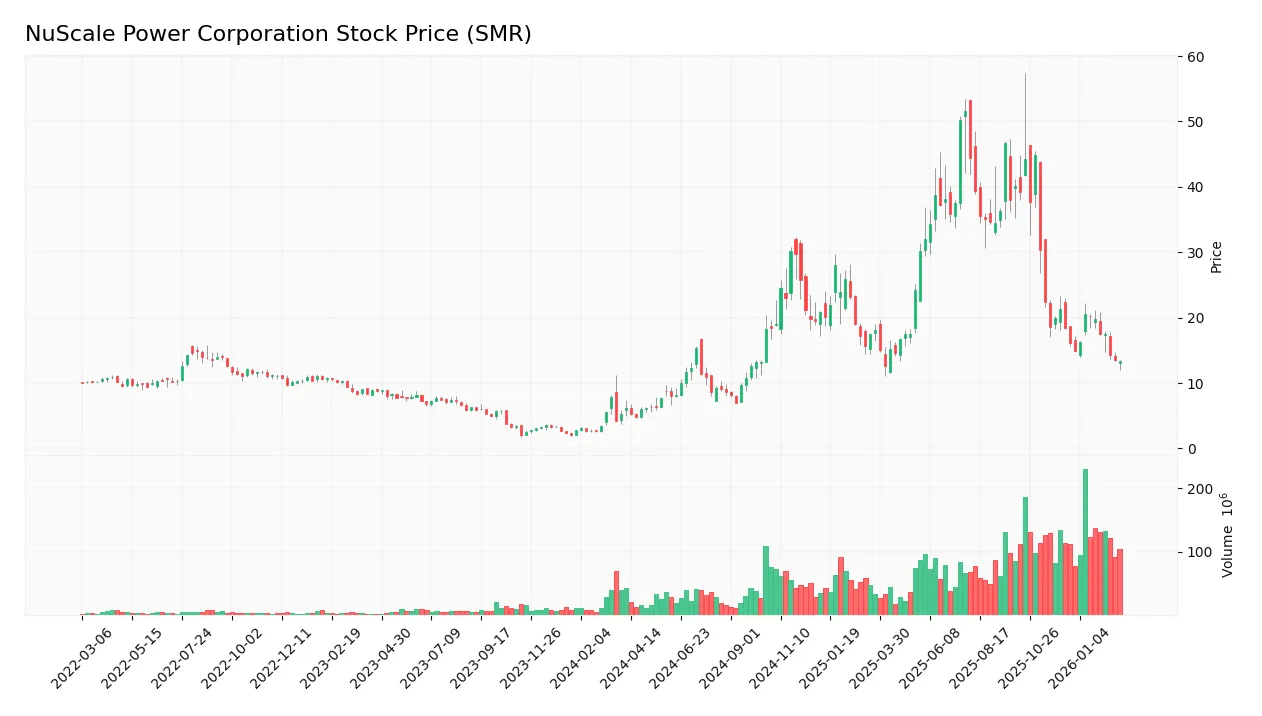

The weekly stock chart displays NuScale Power Corporation’s price movements over the past 100 weeks, highlighting key volatility and trend shifts:

Trend Analysis

Over the past 12 months, SMR’s stock price surged 118.52%, confirming a bullish trend despite notable deceleration. The price ranged from a low of 4.85 to a high of 51.67, with an 11.66 standard deviation signaling elevated volatility.

Volume Analysis

Trading volume shows an increasing trend with a total of 6.67B shares traded. Recently, seller volume dominates at 69%, indicating bearish sentiment and higher market participation by sellers from December 2025 to March 2026.

Target Prices

Analysts project a moderate upside with a consensus target price of $20.17.

| Target Low | Target High | Consensus |

|---|---|---|

| 15 | 25 | 20.17 |

The target range between $15 and $25 reflects cautious optimism, indicating room for growth balanced by sector headwinds.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines NuScale Power Corporation’s analyst grades and consumer feedback to provide balanced market insights.

Stock Grades

The following table presents the latest verified grades from leading financial institutions for NuScale Power Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-02-24 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-24 |

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-11-25 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

Grades show a mixed consensus with a tilt toward buy and hold recommendations. Recent downgrades from Citigroup and B of A Securities highlight some caution amid generally stable or positive views.

Consumer Opinions

NuScale Power Corporation evokes strong feelings among its customers, reflecting the high stakes of its innovative energy solutions.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressed by NuScale’s cutting-edge modular reactor technology.” | “Project delays have been frustrating for investors.” |

| “Appreciate the company’s commitment to clean, safe nuclear power.” | “Communication about product timelines lacks clarity.” |

| “Strong potential for revolutionizing the energy sector.” | “High costs and regulatory hurdles remain significant risks.” |

Overall, consumers admire NuScale’s technological innovation and environmental focus. Yet, concerns about execution delays and regulatory challenges persist, tempering enthusiasm.

Risk Analysis

Below is a detailed table outlining key risks facing NuScale Power Corporation, with their likelihood and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative returns on equity and invested capital indicate ongoing losses and poor profitability. | High | High |

| Liquidity | Despite a high current ratio, zero interest coverage signals potential cash flow issues. | Medium | Medium |

| Market Volatility | A beta of 2.16 suggests stock price swings well above the market, adding investment risk. | High | Medium |

| Bankruptcy Risk | Altman Z-Score in grey zone signals moderate risk of financial distress over time. | Medium | High |

| Operational Risk | Zero asset turnover reflects ineffective use of assets, threatening future revenue growth. | High | High |

| Industry Dynamics | Nuclear modular reactors face regulatory and technological hurdles, slowing adoption pace. | Medium | High |

The most critical risks combine poor profitability, operational inefficiency, and moderate financial distress signals. NuScale’s negative ROIC (-33%) versus a 13.8% WACC confirms value destruction. The stock’s high beta amplifies market risk. Given the very weak Piotroski score (2), I see substantial caution warranted until operational metrics improve and regulatory clarity emerges.

Should You Buy NuScale Power Corporation?

NuScale Power appears to be in a grey zone with very weak financial strength. Despite growing operational efficiency, the company’s value creation remains negative, and its leverage profile suggests persistent financial challenges. Overall rating is D+, reflecting significant risks.

Strength & Efficiency Pillars

NuScale Power Corporation shows operational weakness with a net margin of 0% and negative returns on equity (-30.44%) and invested capital (-33.09%). Its ROIC at -33.09% falls well below the WACC of 13.76%, indicating the company is currently destroying value rather than creating it. However, the growing ROIC trend (up 83.29%) suggests some improvement in profitability. Interest expense remains favorable at 0%, supported by zero debt, which somewhat cushions financial pressures.

Weaknesses and Drawbacks

The company sits in the Altman Z-Score grey zone with a score of 2.37, reflecting moderate bankruptcy risk amid fragile financial health. Its very weak Piotroski score of 2 further signals poor fundamentals. Negative profitability metrics, including a 0% net margin and negative ROE, compound valuation concerns. The price-to-book ratio stands at 1.98, neutral but with a historical EPS decline of -47.62% last year. Recent seller dominance at 68.95% intensifies short-term market pressure, reducing near-term upside visibility.

Our Final Verdict about NuScale Power Corporation

Despite operational challenges and a bullish long-term stock trend, NuScale’s placement in the Altman Z-Score grey zone and very weak financial strength render the investment profile cautious. The recent seller dominance indicates heightened volatility and risk. While the growing ROIC trend may hint at future recovery, the current solvency and profitability risks suggest the stock might appear too speculative for conservative capital and calls for a wait-and-see stance.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NuScale Power Corporation (SMR) Reports Q4 Loss, Misses Revenue Estimates – Yahoo Finance (Feb 26, 2026)

- NuScale Power launches $1 billion at-the-market stock offering program – Investing.com (Feb 26, 2026)

- NuScale Power Corporation (SMR) Reports Q4 Loss, Misses Revenue Estimates – Nasdaq (Feb 26, 2026)

- NUSCALE POWER Corp SEC 10-K Report – TradingView (Feb 26, 2026)

- NUSCALE POWER CORPORATION (SMR) SHAREHOLDER ALERT Bernstein – GlobeNewswire (Feb 26, 2026)

For more information about NuScale Power Corporation, please visit the official website: nuscalepower.com