Home > Analyses > Utilities > NRG Energy, Inc.

NRG Energy, Inc. powers the daily lives of millions across the United States, delivering electricity generated from a diverse mix of natural gas, solar, nuclear, and other sources. As a key player in the independent power production sector, NRG stands out for its integrated approach, combining traditional and renewable energy solutions with innovative services like energy storage and carbon management. As the energy landscape evolves rapidly, I explore whether NRG’s solid market presence and strategic initiatives can sustain its growth and support its current valuation.

Table of contents

Business Model & Company Overview

NRG Energy, Inc., founded in 1989 and headquartered in Houston, Texas, stands as a major player in the independent power producers sector. With a diverse portfolio generating approximately 18,000 MW across 25 plants, its ecosystem integrates electricity production, delivery, and energy solutions spanning natural gas, coal, solar, nuclear, and battery storage. Serving around 6M residential, commercial, industrial, and wholesale customers, NRG’s mission extends beyond power generation to include advisory and carbon management services.

The company’s revenue engine balances physical and service offerings, from traditional power sales to renewable products and demand response services. Its footprint spans key U.S. regions and leverages multiple retail brands like Reliant and Direct Energy to engage varied markets. NRG’s integrated approach and scale create a robust economic moat, positioning it to shape the future of energy provision in a transitioning industry.

Financial Performance & Fundamental Metrics

This section analyzes NRG Energy, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

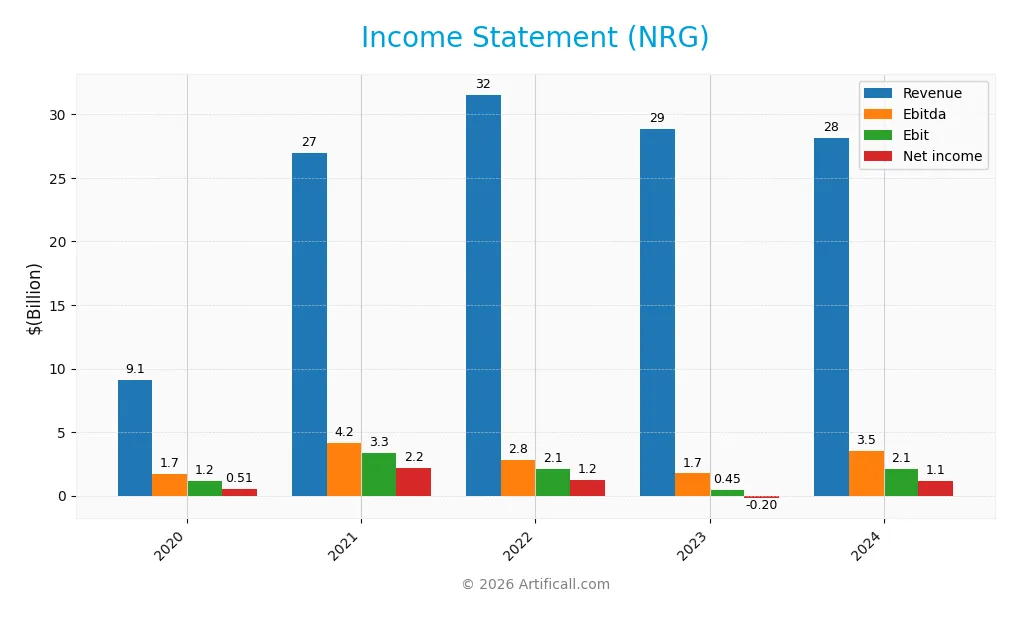

Below is the Income Statement for NRG Energy, Inc. covering fiscal years 2020 through 2024, highlighting key financial metrics reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.1B | 27B | 31.5B | 28.8B | 28.1B |

| Cost of Revenue | 6.5B | 20.5B | 27.4B | 26.5B | 22.1B |

| Operating Expenses | 1.4B | 3.2B | 2.1B | 1.9B | 3.6B |

| Gross Profit | 2.6B | 6.5B | 4.1B | 2.3B | 6.0B |

| EBITDA | 1.7B | 4.2B | 2.8B | 1.7B | 3.5B |

| EBIT | 1.2B | 3.3B | 2.1B | 0.5B | 2.1B |

| Interest Expense | 0.4B | 0.5B | 0.4B | 0.7B | 0.7B |

| Net Income | 0.5B | 2.2B | 1.2B | -0.2B | 1.1B |

| EPS | 2.08 | 8.93 | 5.17 | -1.12 | 5.14 |

| Filing Date | 2021-03-01 | 2022-02-24 | 2023-02-23 | 2024-02-28 | 2025-02-26 |

Income Statement Evolution

From 2020 to 2024, NRG Energy’s revenue grew significantly by 209.36%, although it dipped by 2.4% in the last year. Net income increased by 120.59% over the period, with a sharp recovery in 2024 after a loss in 2023. Gross margins remained favorable at 21.44%, while EBIT and net margins showed neutrality, reflecting some volatility in profitability ratios despite improved earnings.

Is the Income Statement Favorable?

In 2024, NRG Energy reported revenue of $28.13B and net income of $1.13B, marking a strong turnaround from the previous year’s loss. The company’s gross profit surged 162.52%, and EBIT grew by 362.33%, supporting a neutral EBIT margin of 7.46%. Interest expenses remained favorable at 2.31% of revenue. Overall, the fundamentals appear favorable with solid profitability improvements, despite a slight revenue decline.

Financial Ratios

The following table presents key financial ratios for NRG Energy, Inc. over the fiscal years 2020 to 2024, providing a snapshot of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 5.6% | 8.1% | 3.9% | -0.7% | 4.0% |

| ROE | 30.4% | 60.8% | 31.9% | -7.0% | 45.4% |

| ROIC | 5.7% | 16.6% | 9.1% | 2.1% | 11.6% |

| P/E | 18.0 | 4.8 | 6.2 | -58.4 | 16.5 |

| P/B | 5.5 | 2.9 | 2.0 | 4.1 | 7.5 |

| Current Ratio | 3.1 | 1.4 | 1.3 | 1.0 | 1.0 |

| Quick Ratio | 3.0 | 1.3 | 1.2 | 1.0 | 1.0 |

| D/E | 5.4 | 2.3 | 2.2 | 3.8 | 4.4 |

| Debt-to-Assets | 61% | 36% | 28% | 42% | 46% |

| Interest Coverage | 2.8 | 6.9 | 4.8 | 0.6 | 3.7 |

| Asset Turnover | 0.61 | 1.16 | 1.08 | 1.11 | 1.17 |

| Fixed Asset Turnover | 3.2 | 13.8 | 16.5 | 14.8 | 13.0 |

| Dividend Yield | 3.2% | 3.0% | 4.4% | 3.2% | 2.2% |

Evolution of Financial Ratios

NRG Energy’s Return on Equity (ROE) showed significant improvement, reaching 45.4% in 2024 compared to negative values in 2023, indicating a rebound in profitability. The Current Ratio remained relatively stable around 1.0, suggesting consistent short-term liquidity. However, the Debt-to-Equity ratio increased to 4.44 in 2024, reflecting higher leverage and increased reliance on debt financing.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as ROE (45.4%) and Return on Invested Capital (11.6%) are favorable, while net profit margin at 4.0% is considered unfavorable. Liquidity ratios like the Current Ratio (1.02) and Quick Ratio (0.96) are neutral, neither indicating strong nor weak liquidity. The Debt-to-Equity ratio (4.44) is unfavorable due to elevated leverage. Market value ratios show mixed signals with a neutral P/E of 16.5 but an unfavorable Price to Book at 7.5. Overall, the ratios are slightly favorable for investors.

Shareholder Return Policy

NRG Energy, Inc. maintains a dividend payout ratio around 36% in 2024, with a dividend yield near 2.18% and a dividend per share rising to $1.97. The payout is supported by approximately 80% coverage from free cash flow, while the company also engages in share buybacks.

This balanced approach to dividends and buybacks appears structured to sustain distributions without excessive financial strain. Given consistent profitability and cash flow coverage, the policy supports a reasonable framework for long-term shareholder value creation.

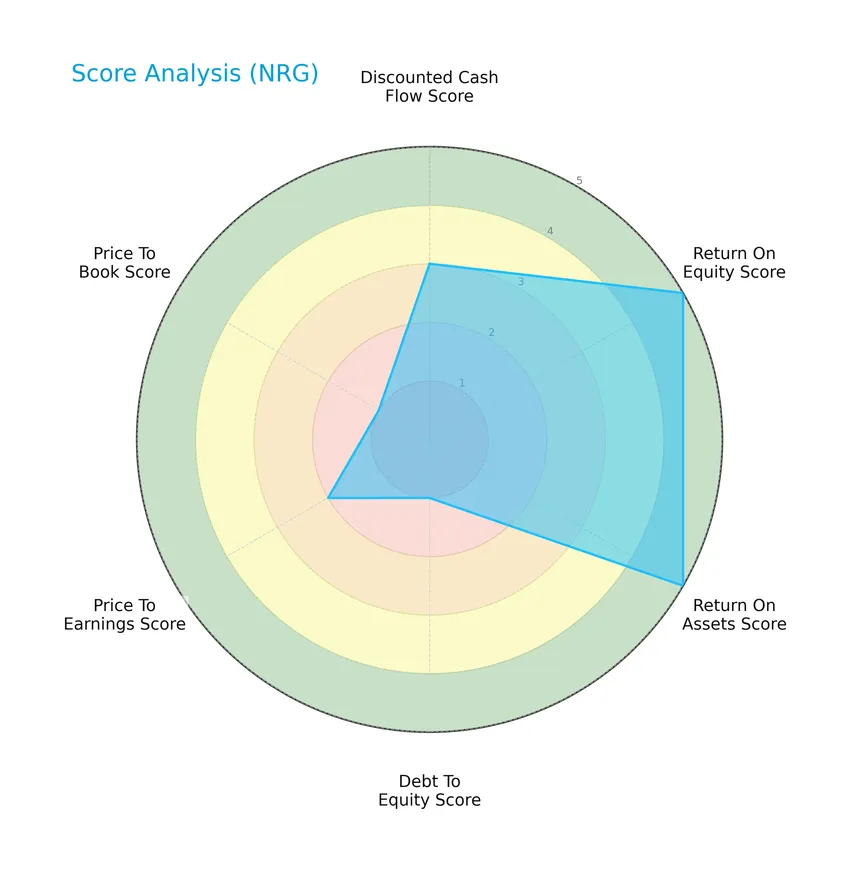

Score analysis

The following radar chart presents a comprehensive view of NRG Energy, Inc.’s key financial scores:

NRG Energy shows strong profitability with very favorable return on equity and return on assets scores at 5 each. However, its debt to equity and price to book scores are very unfavorable at 1, indicating leverage and valuation concerns, while discounted cash flow and price to earnings scores remain moderate.

Analysis of the company’s bankruptcy risk

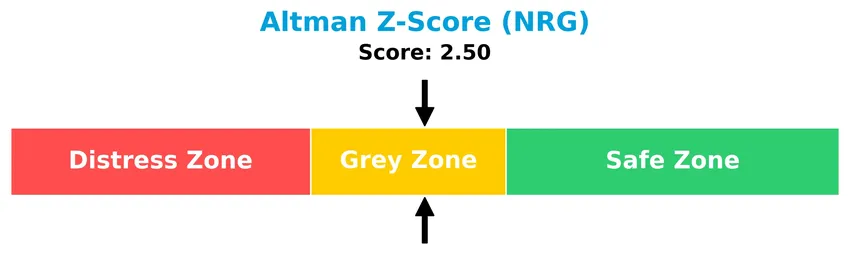

The Altman Z-Score places NRG Energy in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

Is the company in good financial health?

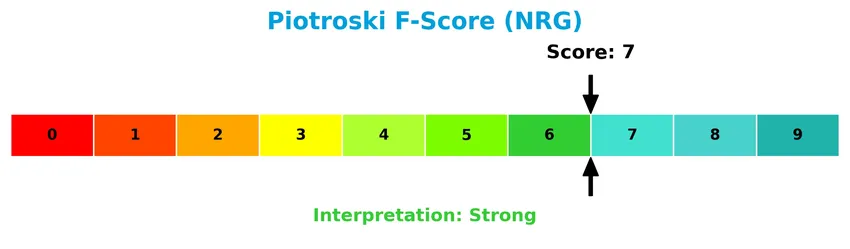

This Piotroski diagram illustrates the company’s financial strength based on nine accounting criteria:

With a Piotroski Score of 7, NRG Energy is considered to be in strong financial health, reflecting overall solid fundamentals and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore NRG Energy, Inc.’s strategic positioning, revenue segments, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether NRG Energy holds a competitive advantage over its industry peers.

Strategic Positioning

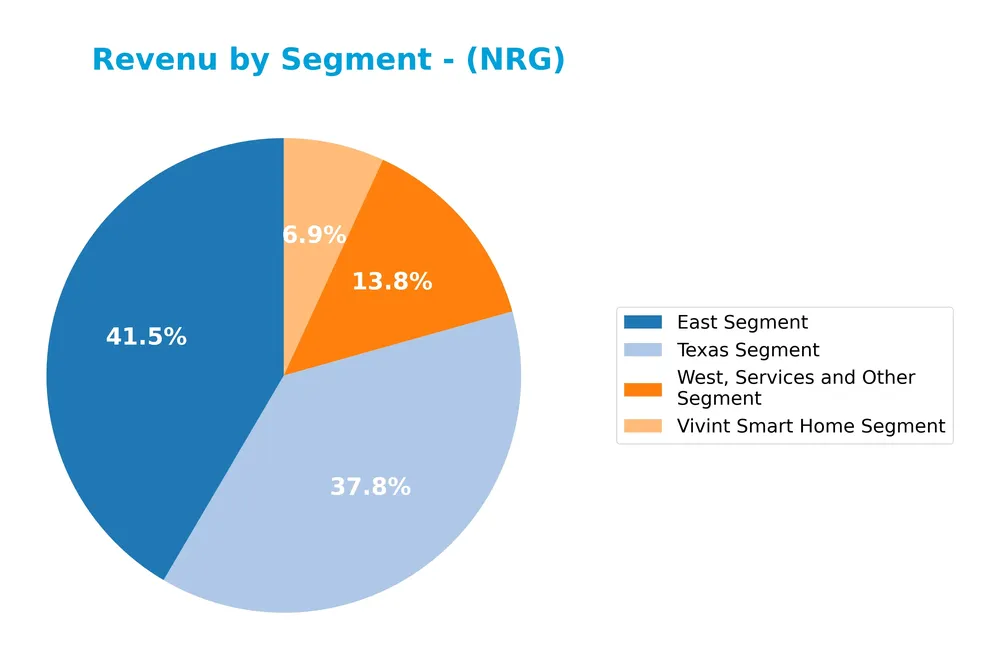

NRG Energy operates a diversified portfolio across geographic segments—East (11.7B in 2024), Texas (10.7B), West, Services & Other (3.9B), and Vivint Smart Home (1.9B)—reflecting a broad product and service range in electricity generation, retail, and energy solutions across the US.

Revenue by Segment

This pie chart displays NRG Energy, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting how each business unit contributes to the company’s total income.

In 2024, the East Segment remains the largest revenue driver at 11.7B, followed closely by the Texas Segment at 10.7B, showing a slight shift from previous years where the East Segment had a higher lead. The West, Services and Other Segment contributes 3.9B, while the Vivint Smart Home Segment accounts for 1.9B, reflecting its growing role since 2023. Overall, the revenue mix shows moderate concentration in two main segments with a noticeable increase in the smart home business.

Key Products & Brands

The table below outlines NRG Energy, Inc.’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Electricity Generation | Produces electricity using natural gas, coal, oil, solar, nuclear, and battery storage across 25 plants with ~18,000 MW capacity. |

| Retail Energy Brands | Provides energy and services to retail customers under NRG, Reliant, Direct Energy, Green Mountain Energy, Stream, and XOOM Energy. |

| Regional Segments | Operates through Texas, East, and West segments offering electricity and related services to residential, commercial, industrial, and wholesale customers. |

| Vivint Smart Home Segment | Offers smart home energy services and solutions, contributing to diversified revenue streams. |

| Energy Trading & Commodities | Trades electric power, natural gas, environmental and weather products, and financial products including forwards, futures, options, and swaps. |

| System and On-site Solutions | Provides system power, distributed generation, backup generation, storage, distributed solar, demand response, energy efficiency, and advisory services. |

| Carbon Management & Specialty Services | Offers carbon management and other specialty energy-related services to enhance sustainability and operational efficiency. |

NRG Energy’s product portfolio is broad, covering electricity generation from diverse sources, retail energy services through multiple brands, and advanced energy solutions including smart home and carbon management services. This diversification supports its position in the independent power producer industry.

Main Competitors

There are 2 main competitors in the Utilities sector; below is a table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Vistra Corp. | 56B |

| NRG Energy, Inc. | 32B |

NRG Energy, Inc. ranks 2nd among its competitors with a market cap approximately 51% of the leader, Vistra Corp. The company is positioned below both the average market cap of the top 10 and the median market cap of the Utilities sector. It maintains a significant 95.67% gap from its nearest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NRG have a competitive advantage?

NRG Energy, Inc. presents a competitive advantage, as evidenced by its ROIC exceeding WACC by over 3%, alongside a growing ROIC trend, indicating efficient capital use and value creation over 2020-2024. The company’s integrated power generation and diverse energy portfolio support this favorable position in the utilities sector.

Looking ahead, NRG’s future outlook includes expanding renewable products, energy storage, carbon management, and advisory services, targeting growing markets in distributed generation and energy efficiency. These opportunities align with evolving customer needs and regulatory trends in the U.S. energy landscape.

SWOT Analysis

This SWOT analysis highlights NRG Energy, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- diversified energy portfolio

- strong ROE at 45.4%

- growing ROIC indicates value creation

Weaknesses

- high debt-to-equity ratio at 4.44

- unfavorable net margin at 4.0%

- elevated price-to-book ratio at 7.5

Opportunities

- expansion in renewable energy demand

- increasing profitability trends

- growing market for energy efficiency services

Threats

- regulatory risks in utilities sector

- volatile commodity prices

- competitive pressure from alternative energy providers

NRG’s strengths in profitability and value creation are tempered by leverage and margin challenges. Strategic focus on renewables and operational efficiency is essential to mitigate threats and capitalize on growth opportunities.

Stock Price Action Analysis

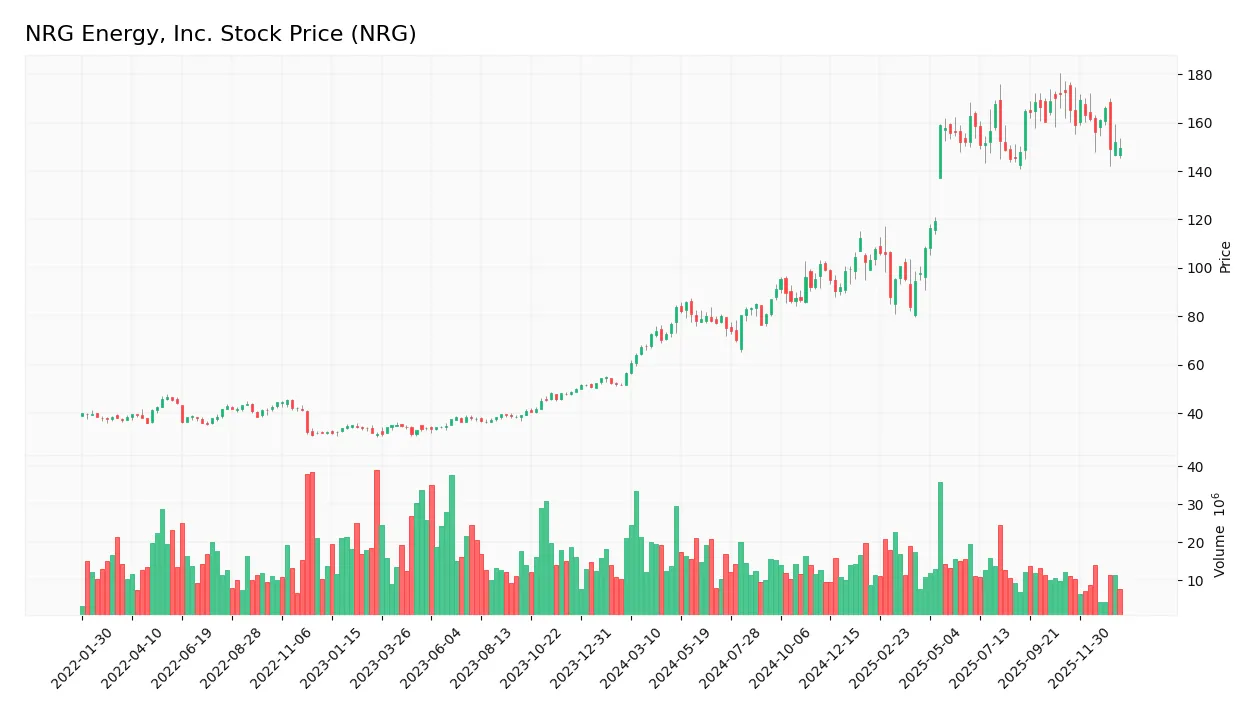

The weekly stock chart for NRG Energy, Inc. displays price movements and trends over the past 12 months:

Trend Analysis

Over the past 12 months, NRG stock price increased by 163.27%, indicating a bullish trend. The highest price reached 172.5 and the lowest was 56.71, with volatility reflected by a standard deviation of 36.39. The upward trend shows deceleration, suggesting slower momentum in recent periods.

Volume Analysis

In the last three months, trading volume has been decreasing with seller dominance at 64.71%, reflecting bearish investor sentiment. Buyer activity is subdued at 35.29%, indicating cautious market participation and a lack of strong buying pressure during this period.

Target Prices

Analysts present a moderately bullish consensus target for NRG Energy, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 211 | 144 | 192.2 |

The target prices indicate expectations of potential upside, with a consensus around 192.2, reflecting cautious optimism among analysts for NRG’s stock performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest grades and consumer feedback concerning NRG Energy, Inc. to inform investors.

Stock Grades

Below is a summary of the latest verified stock grades for NRG Energy, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| BMO Capital | Maintain | Market Perform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-28 |

| Seaport Global | Maintain | Buy | 2025-10-08 |

| Barclays | Maintain | Overweight | 2025-08-07 |

| BMO Capital | Maintain | Market Perform | 2025-08-06 |

| Citigroup | Maintain | Buy | 2025-07-17 |

| BMO Capital | Maintain | Market Perform | 2025-05-14 |

| Guggenheim | Maintain | Buy | 2025-05-13 |

| Wells Fargo | Maintain | Overweight | 2025-05-13 |

The consensus among these firms remains generally positive with a majority maintaining buy or overweight ratings, while a notable portion assigns market perform or hold grades. This indicates a stable outlook with cautious optimism prevailing among analysts.

Consumer Opinions

Consumer sentiment around NRG Energy, Inc. reflects a mix of appreciation for its service reliability and concern over pricing and customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply even during peak times | Customer service response times can be slow |

| Competitive pricing compared to local peers | Occasional billing errors reported by customers |

| User-friendly online account management | Limited renewable energy options in some regions |

Overall, consumers praise NRG Energy for dependable service and competitive rates. However, recurring issues include customer support delays and the desire for expanded renewable energy availability.

Risk Analysis

Below is a summary table presenting key risks for NRG Energy, Inc., including their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (4.44) increases financial risk and potential vulnerability to rate hikes or credit tightening. | High | High |

| Market Volatility | Beta of 1.24 indicates above-average stock volatility, exposing investors to market fluctuations. | Medium | Medium |

| Profitability | Unfavorable net margin (4.0%) signals tight profit margins amid operational costs and energy price shifts. | Medium | Medium |

| Regulatory Risk | Exposure to evolving environmental regulations may increase compliance costs and operational constraints. | Medium | High |

| Energy Commodity Prices | Dependence on natural gas, coal, and oil prices creates earnings volatility. | High | High |

| Dividend Stability | Dividend yield of 2.18% is supported but could be pressured by earnings variability and leverage. | Medium | Medium |

The most pressing risks for NRG are its high financial leverage and sensitivity to energy commodity prices, both of which can significantly affect profitability and stock stability. The company’s Altman Z-score of 2.5 places it in the grey zone, indicating moderate bankruptcy risk mainly driven by leverage concerns. Investors should closely monitor debt levels and commodity market trends when considering NRG.

Should You Buy NRG Energy, Inc.?

NRG Energy, Inc. appears to be delivering improving profitability with a durable competitive moat supported by growing ROIC, suggesting strong value creation. While its leverage profile could be seen as substantial, the overall rating of B indicates a very favorable financial health profile with moderate risk factors.

Strength & Efficiency Pillars

NRG Energy, Inc. demonstrates solid profitability with a return on equity (ROE) of 45.4% and a return on invested capital (ROIC) of 11.57%, both signaling efficient capital use. The company is a clear value creator as its ROIC of 11.57% comfortably exceeds its weighted average cost of capital (WACC) at 8.39%. Financial health is supported by a Piotroski score of 7, indicating strong operational fundamentals, while the Altman Z-score of 2.5 places NRG in the grey zone, suggesting moderate financial stability. Favorable margins and a dividend yield of 2.18% add to its efficiency profile.

Weaknesses and Drawbacks

NRG’s valuation metrics raise concerns; a price-to-book ratio of 7.5 is very unfavorable, indicating the stock may be overvalued relative to its book value. The debt-to-equity ratio stands at a high 4.44, reflecting significant leverage and potential financial risk. While its price-to-earnings ratio at 16.52 is moderate, the company’s recent period shows seller dominance with only 35.29% buyer volume, creating short-term bearish pressure. The current ratio of 1.02 and quick ratio of 0.96 suggest neutral liquidity but do not alleviate concerns about leverage and valuation.

Our Verdict about NRG Energy, Inc.

NRG Energy’s long-term fundamental profile is favorable due to strong profitability and value creation, but recent market activity is seller-dominant, signaling caution. Despite the company’s durable competitive advantage and improving ROIC, recent market pressure suggests a wait-and-see approach may be prudent before increasing exposure. The profile might appear attractive for investors prioritizing operational strength balanced against current valuation and leverage risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NRG Energy, Inc. Announces Quarterly Dividend – Business Wire (Jan 23, 2026)

- About Us – NRG Energy (Dec 18, 2025)

- What to expect from NRG Energy’s Q4 2025 earnings report – MSN (Jan 23, 2026)

- NRG Energy increases quarterly dividend by 8% to $0.475 per share – Investing.com Nigeria (Jan 24, 2026)

- NRG Energy Controls Both Power Generation and Distribution as AI Data Centers Reshape the Grid – 24/7 Wall St. (Jan 23, 2026)

For more information about NRG Energy, Inc., please visit the official website: nrg.com