Home > Analyses > Technology > Novanta Inc.

Novanta Inc. powers breakthroughs in medical and industrial technology through its advanced photonics, vision, and precision motion solutions. From enabling cutting-edge DNA sequencing to enhancing surgical imaging and industrial laser processing, Novanta shapes critical applications that impact daily life and innovation worldwide. As a recognized leader with a diverse portfolio and strong market presence, it stands at the crossroads of technology and healthcare. The key question for investors is whether Novanta’s innovation and market position translate into sustainable growth and justify its current valuation.

Table of contents

Business Model & Company Overview

Novanta Inc., founded in 1968 and headquartered in Bedford, Massachusetts, stands as a leader in photonics, vision, and precision motion components. Its comprehensive ecosystem integrates laser scanning, medical-grade visualization, and precision motion control, serving medical and industrial markets globally. With 3,000 employees and a broad brand portfolio, Novanta delivers advanced subsystems that enable critical applications from DNA sequencing to robotic automation.

The company’s revenue engine balances hardware innovation with software-driven and recurring service elements across Americas, Europe, and Asia. Novanta markets through direct sales, distributors, and system integrators, leveraging its diverse product range for stability and growth. This strategic global footprint and technology integration form a robust economic moat, positioning Novanta as a pivotal force shaping future industrial and medical technologies.

Financial Performance & Fundamental Metrics

This section provides a comprehensive review of Novanta Inc.’s income statement, key financial ratios, and dividend payout policy to inform investment decisions.

Income Statement

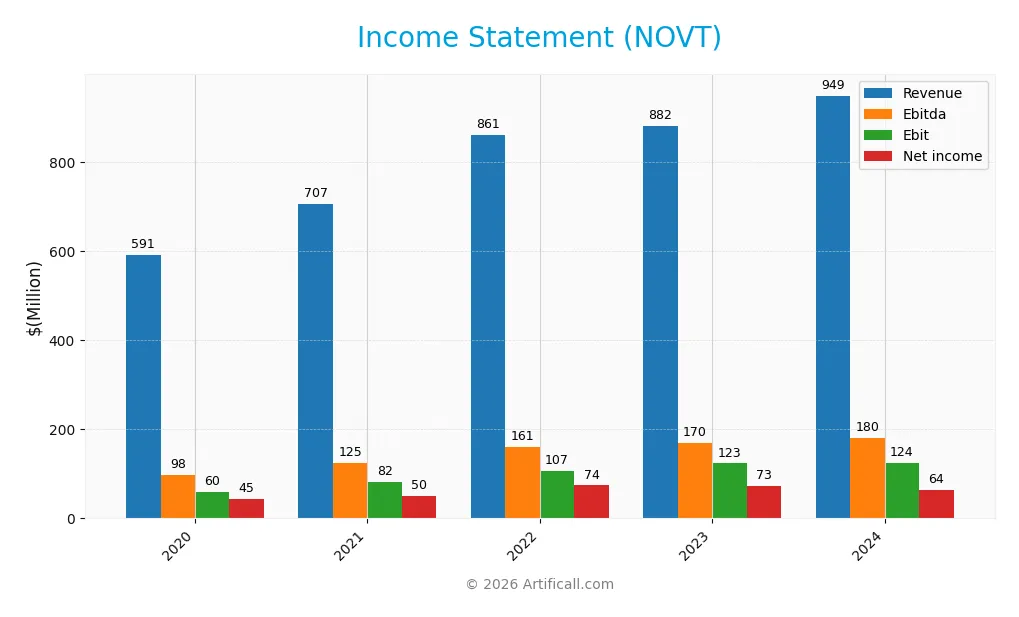

The following table presents Novanta Inc.’s income statement figures for the fiscal years 2020 through 2024, reflecting key profitability and expense metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 591M | 707M | 861M | 882M | 949M |

| Cost of Revenue | 346M | 406M | 482M | 482M | 528M |

| Operating Expenses | 189M | 236M | 275M | 289M | 311M |

| Gross Profit | 245M | 300M | 378M | 400M | 422M |

| EBITDA | 98M | 125M | 161M | 170M | 180M |

| EBIT | 60M | 82M | 107M | 123M | 124M |

| Interest Expense | 7M | 7M | 16M | 26M | 31M |

| Net Income | 45M | 50M | 74M | 73M | 64M |

| EPS | 1.27 | 1.42 | 2.08 | 2.03 | 1.78 |

| Filing Date | 2021-03-01 | 2022-03-01 | 2023-03-01 | 2024-02-28 | 2025-02-25 |

Income Statement Evolution

Novanta Inc. reported a 7.67% revenue increase from 2023 to 2024, continuing a favorable 60.72% growth over five years. Gross profit rose 5.41% last year, supporting stable gross margins near 44.4%. EBIT growth was modest at 0.8%, while net income declined by 18.3%, reflecting a contraction in net margins despite overall favorable margin levels.

Is the Income Statement Favorable?

In 2024, Novanta’s income statement shows generally favorable fundamentals with a 44.41% gross margin and 13.09% EBIT margin, indicating operational efficiency. Interest expense remained well-controlled at 3.32% of revenue. However, net margin fell by 10.44% over the period and 18.3% last year, impacting net income and EPS growth negatively. Overall, the income statement is assessed as favorable but with caution due to recent net margin pressure.

Financial Ratios

The table below presents key financial ratios for Novanta Inc. (NOVT) over the last five fiscal years, providing insight into profitability, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.5% | 7.1% | 8.6% | 8.3% | 6.8% |

| ROE | 9.3% | 9.7% | 12.8% | 10.8% | 8.6% |

| ROIC | 6.7% | 5.4% | 8.0% | 8.7% | 7.3% |

| P/E | 93.3 | 124.0 | 65.4 | 82.8 | 85.7 |

| P/B | 8.7 | 12.0 | 8.4 | 9.0 | 7.4 |

| Current Ratio | 2.7 | 2.0 | 2.6 | 3.0 | 2.6 |

| Quick Ratio | 1.9 | 1.3 | 1.5 | 1.9 | 1.7 |

| D/E | 0.53 | 0.95 | 0.85 | 0.60 | 0.63 |

| Debt-to-Assets | 29.5% | 40.2% | 39.4% | 33.0% | 33.9% |

| Interest Coverage | 8.5 | 8.7 | 6.6 | 4.3 | 3.5 |

| Asset Turnover | 0.68 | 0.58 | 0.69 | 0.72 | 0.68 |

| Fixed Asset Turnover | 5.2 | 5.2 | 5.9 | 6.0 | 6.1 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Novanta Inc.’s Return on Equity (ROE) declined from 12.8% in 2022 to 8.6% in 2024, indicating weakening profitability. The Current Ratio showed some fluctuation, peaking at 2.98 in 2023 before slightly easing to 2.58 in 2024 but remaining above 2.5 overall, signaling consistent liquidity. Debt-to-Equity Ratio decreased from 0.85 in 2022 to 0.63 in 2024, reflecting a moderate reduction in leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (6.75%) and ROIC (7.25%) are neutral, while ROE (8.59%) and WACC (10.92%) are unfavorable, hinting at challenges in generating returns above cost of capital. Liquidity ratios, including Current (2.58) and Quick (1.72) ratios, are favorable, supporting short-term financial stability. Leverage and efficiency metrics like Debt-to-Equity (0.63) and Fixed Asset Turnover (6.08) are neutral to favorable. Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

Novanta Inc. does not pay dividends, reflecting a strategy likely focused on reinvestment or growth rather than immediate shareholder income. No share buyback programs are reported, indicating retention of capital within the business.

This approach aligns with the absence of dividend payouts, suggesting emphasis on long-term value creation through operational reinvestment rather than cash distributions. The policy appears consistent with sustainable shareholder value growth given the company’s financial metrics and absence of capital return programs.

Score analysis

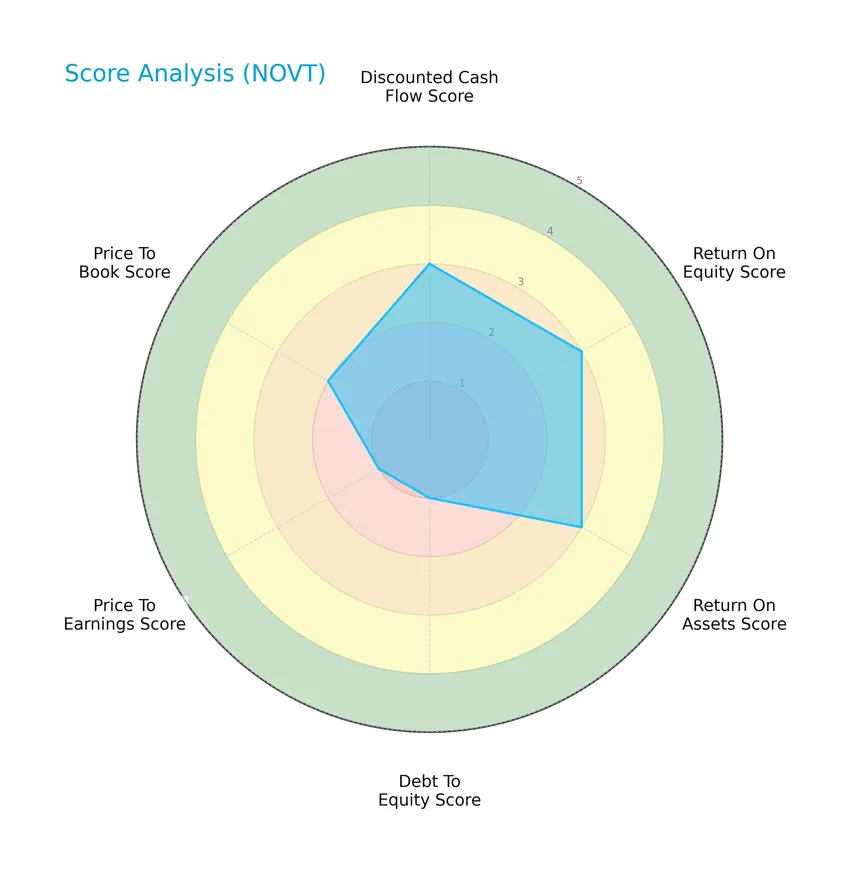

The following radar chart presents a comprehensive overview of Novanta Inc.’s key financial scores:

Novanta Inc. displays moderate scores in discounted cash flow, return on equity, and return on assets, each rated at 3. However, debt to equity and price to earnings scores are very unfavorable at 1, while price to book is moderate at 2, reflecting mixed financial metrics.

Analysis of the company’s bankruptcy risk

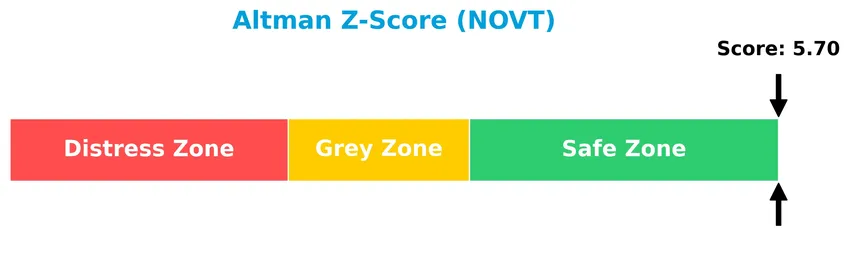

Novanta Inc.’s Altman Z-Score indicates it is well within the safe zone, suggesting a low risk of bankruptcy:

Is the company in good financial health?

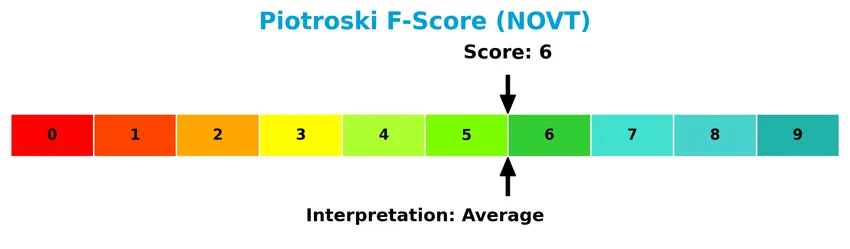

The Piotroski Score diagram below illustrates Novanta Inc.’s financial health assessment:

With a Piotroski Score of 6, Novanta Inc. is positioned in the average category, indicating a moderate level of financial strength based on profitability, leverage, liquidity, and efficiency criteria.

Competitive Landscape & Sector Positioning

This sector analysis will cover Novanta Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and a SWOT analysis. I will also examine whether Novanta holds a competitive advantage over its industry peers.

Strategic Positioning

Novanta Inc. operates a diversified product portfolio spanning photonics, vision, and precision motion segments, serving medical and industrial markets globally. Its 2024 revenues reflect balanced contributions from Precision Manufacturing (202M), Robotics and Automation (288M), Advanced Surgery (209M), and Precision Medicine (250M), with geographic exposure spread across the US (487M), Germany (123M), China (85M), and Asia-Pacific regions.

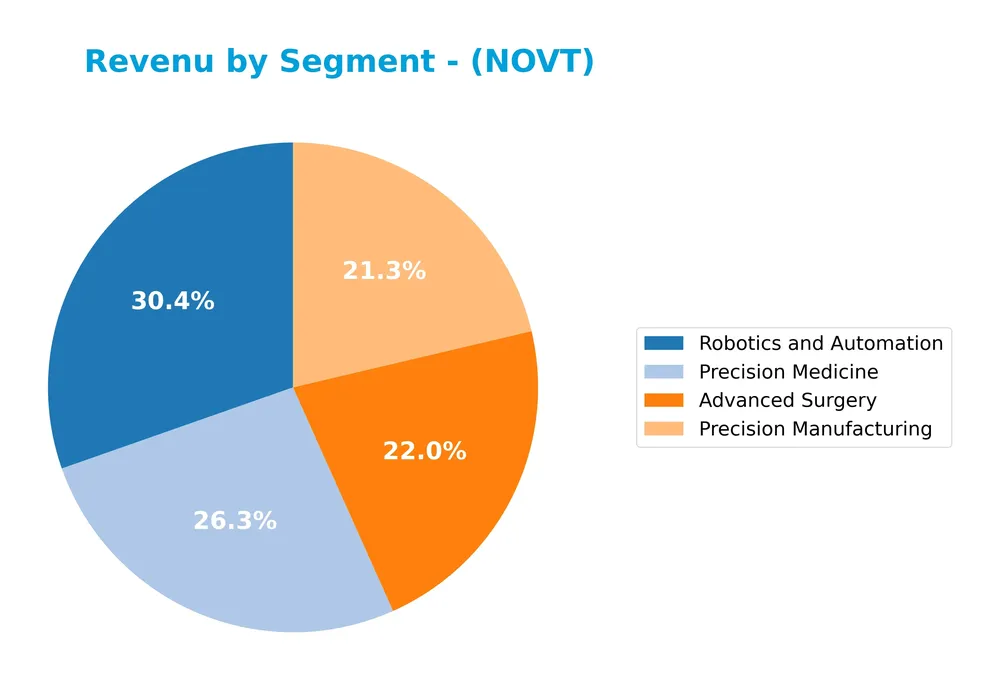

Revenue by Segment

This pie chart displays Novanta Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s key business areas and their relative contributions.

In 2024, Novanta’s revenue was driven primarily by Robotics and Automation at $288M and Precision Medicine at $250M, followed by Advanced Surgery and Precision Manufacturing with $209M and $202M respectively. This marks a shift from previous years where segments like Medical Solutions and Precision Medicine and Manufacturing dominated. The diversification into specialized medical and automation technologies suggests a strategic focus on high-growth, innovation-driven markets, though the company should monitor segment concentration closely.

Key Products & Brands

The following table outlines Novanta Inc.’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| Photonics | Photonics-based solutions including laser scanning and beam delivery, CO2 laser, solid state laser, ultrafast laser, and optical light engines for industrial processing, metrology, medical imaging, DNA sequencing, and medical laser procedures. |

| Vision | Medical-grade technologies such as medical insufflators, pumps, visualization and wireless solutions, video recorders, operating room integration technologies, optical data collection, machine vision, RFID, thermal chart recorders, spectrometry, and embedded touch screens. |

| Precision Motion | Optical and inductive encoders, precision motors, servo drives, motion control solutions, integrated stepper motors, robotic end-of-arm technology, air bearings, and air bearing spindles. |

| Robotics and Automation | Robotics and automation components and systems designed to enhance manufacturing precision and efficiency (reported revenue of $288M in 2024). |

| Advanced Surgery | Products supporting advanced surgical procedures, contributing $209M in revenue in 2024. |

| Precision Medicine | Solutions for precision medicine, including technologies to improve medical diagnostics and treatment, with $250M revenue in 2024. |

| Medical Solutions | Medical-related product offerings generating $325M revenue in 2023, part of the company’s diversified healthcare technology portfolio. |

Novanta Inc. markets its products under various brand names including Cambridge Technology, Synrad, Laser Quantum, ARGES, WOM, NDS, Med X Change, JADAK, ThingMagic, Photo Research, Celera Motion, MicroE, Zettlex, Applimotion, Ingenia, and Westwind. The company’s product range spans photonics, vision, and precision motion technologies, serving medical and industrial markets globally.

Main Competitors

There are 20 competitors in the Technology sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40B |

| Garmin Ltd. | 39B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Novanta Inc. ranks 17th among 20 competitors, with a market capitalization approximately 2.9% of the sector leader, Amphenol Corporation. The company is positioned below both the average market cap of the top 10 competitors (54.5B) and the median market cap of the sector (21.6B). Novanta has a 21.57% market cap gap compared to its closest competitor above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NOVT have a competitive advantage?

Novanta Inc. currently does not present a strong competitive advantage, as it is shedding value with a ROIC below its WACC, indicating value destruction despite an improving profitability trend. The company’s overall moat status is slightly unfavorable, reflecting challenges in consistently generating excess returns above its cost of capital.

Looking ahead, Novanta’s diverse product portfolio in photonics, vision, and precision motion components serves expanding medical and industrial markets worldwide, offering opportunities for growth. Continued innovation and geographic expansion, notably in the U.S. and Asia Pacific regions, may support future revenue increases and enhance competitive positioning.

SWOT Analysis

This analysis highlights Novanta Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- Diverse product portfolio across photonics, vision, and precision motion

- Strong gross margin at 44.4%

- Established global presence with growing US and Asia revenue

Weaknesses

- High valuation with PE of 85.7 and PB of 7.37

- Negative recent net margin and EPS growth

- Moderate return on equity at 8.6%, below WACC

Opportunities

- Expansion in medical and industrial photonics markets

- Increasing demand for precision motion controls in automation

- Growth potential in emerging markets like China and Asia Pacific

Threats

- Intense competition in technology hardware sector

- Economic fluctuations impacting industrial demand

- High beta (1.6) indicating stock volatility risk

Novanta demonstrates solid fundamentals with favorable margins and diversified offerings but faces valuation concerns and margin pressure. Strategic focus should leverage growth in medical and industrial segments while managing financial efficiency and market volatility risks.

Stock Price Action Analysis

The weekly stock chart for Novanta Inc. (NOVT) highlights price movements and volume patterns over the last 12 months:

Trend Analysis

Over the past 12 months, NOVT’s stock price declined by 21.33%, indicating a bearish trend with accelerating downward momentum. The price ranged from a high of 185.16 to a low of 99.96, accompanied by high volatility reflected in a standard deviation of 24.99. A recent short-term recovery shows a 30.76% gain since November 2025.

Volume Analysis

Trading volume for NOVT has been increasing, with a slight buyer dominance at 51.28% overall and 53.84% in the recent period. This buyer-driven activity suggests growing investor interest and participation, supporting the recent upward price movement observed since late 2025.

Target Prices

The consensus target price for Novanta Inc. indicates a unified outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 160 | 160 | 160 |

Analysts uniformly expect Novanta’s stock to reach $160, reflecting a strong and consistent forecast.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide insight into Novanta Inc.’s market perception.

Stock Grades

Here is the summary of recent verified analyst grades for Novanta Inc., highlighting stability and occasional upgrades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Neutral | 2025-08-11 |

| Baird | Maintain | Neutral | 2025-03-03 |

| Baird | Maintain | Neutral | 2024-11-06 |

| Baird | Maintain | Neutral | 2024-08-07 |

| Baird | Maintain | Neutral | 2023-05-11 |

| Baird | Maintain | Neutral | 2023-05-10 |

| William Blair | Upgrade | Outperform | 2022-05-11 |

| William Blair | Upgrade | Outperform | 2022-05-10 |

| Berenberg | Maintain | Hold | 2020-11-13 |

| Baird | Maintain | Neutral | 2020-05-13 |

The overall trend shows a predominance of Neutral or Hold ratings, with William Blair’s notable upgrade to Outperform in 2022. The consensus currently stands at Hold, reflecting cautious investor sentiment.

Consumer Opinions

Consumer sentiment around Novanta Inc. (NOVT) reflects a mix of appreciation for product quality and concerns about customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “Novanta’s products are reliable and innovative, consistently meeting our operational needs.” | “Customer support can be slow to respond during critical times.” |

| “The technology offered by Novanta significantly improved our manufacturing efficiency.” | “Pricing seems a bit high compared to competitors with similar features.” |

| “Their solutions have strong integration capabilities, making deployment straightforward.” | “Occasional delays in delivery have caused scheduling challenges.” |

Overall, consumers praise Novanta for its advanced, dependable technologies and integration ease. However, recurring issues include slower customer service and premium pricing, which could impact satisfaction for cost-sensitive buyers.

Risk Analysis

The table below outlines key risks associated with investing in Novanta Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta of 1.603 indicates sensitivity to market swings, affecting share price stability. | High | Moderate |

| Valuation Risk | Elevated P/E ratio of 85.7 and P/B of 7.37 suggest possible overvaluation and correction risk. | Moderate | High |

| Financial Health | Moderate Altman Z-Score (5.7) indicates low bankruptcy risk but debt-to-equity weakness (0.63). | Low | Moderate |

| Profitability | Low ROE of 8.59% and net margin of 6.75% reflect modest profitability, limiting growth. | Moderate | Moderate |

| Dividend Policy | No dividend yield could reduce appeal for income-focused investors during downturns. | Moderate | Low |

Most significant risks involve valuation concerns given the steep P/E and P/B ratios, exposing investors to potential price corrections. Market volatility also poses a notable threat due to the company’s above-average beta. Despite a strong Altman Z-Score indicating financial stability, profitability and leverage metrics warrant cautious monitoring.

Should You Buy Novanta Inc.?

Novanta Inc. appears to be improving its operational efficiency with growing profitability, though its competitive moat might be slightly unfavorable due to value destruction versus WACC. Despite a manageable leverage profile, the overall rating suggests a moderate investment case with caution warranted.

Strength & Efficiency Pillars

Novanta Inc. exhibits solid financial health underscored by an Altman Z-Score of 5.70, placing it securely in the safe zone and indicating low bankruptcy risk. The company maintains a favorable gross margin of 44.41% and an EBIT margin of 13.09%, reflecting operational efficiency. A Piotroski score of 6 suggests average financial strength, while liquidity ratios such as a current ratio of 2.58 and quick ratio of 1.72 confirm robust short-term solvency. Despite a return on equity (ROE) of 8.59% and return on invested capital (ROIC) of 7.25% falling below the weighted average cost of capital (WACC) at 10.92%, the firm sustains moderate profitability and efficient asset use.

Weaknesses and Drawbacks

The valuation metrics for Novanta raise cautionary flags. The price-to-earnings (P/E) ratio stands at a steep 85.7, signaling a highly premium valuation that may limit upside potential. Similarly, a price-to-book (P/B) ratio of 7.37 suggests the stock is priced well above its net asset value. Though debt-to-equity is moderate at 0.63, the interest coverage ratio of 3.95 is only adequate, posing some risk if earnings weaken. The company’s bearish overall stock trend with a 21.33% price decline and moderate seller volume highlights short-term market pressures that could challenge near-term performance.

Our Verdict about Novanta Inc.

Novanta Inc.’s long-term fundamental profile appears moderately favorable, supported by strong liquidity and profitability metrics, albeit with some value destruction indicated by ROIC below WACC. Recent technical trends show a slight buyer dominance with a 30.76% price rebound since late 2025, suggesting potential recovery. While the overall stock trend has been bearish, the recent positive momentum might present cautious investors with an opportunity. Therefore, despite long-term strengths, the profile may appear best suited for investors adopting a wait-and-see approach to better time entry points.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Novanta Inc. Schedules Earnings Release and Conference Call for Tuesday, February 24, 2026 – Yahoo Finance (Jan 22, 2026)

- Novanta Inc (NOVT) Shares Up 5.85% on Jan 21 – GuruFocus (Jan 21, 2026)

- Insider Selling: Novanta (NASDAQ:NOVT) CFO Sells 1,423 Shares of Stock – MarketBeat (Jan 23, 2026)

- Novanta (NASDAQ:NOVT) CEO Matthijs Glastra Sells 7,500 Shares – MarketBeat (Jan 23, 2026)

- Tech supplier Novanta’s COO to appear at virtual investor event – Stock Titan (Dec 18, 2025)

For more information about Novanta Inc., please visit the official website: novanta.com