Home > Analyses > Consumer Cyclical > Norwegian Cruise Line Holdings Ltd.

Norwegian Cruise Line Holdings Ltd. transforms the way millions experience travel by delivering memorable journeys across the globe’s most captivating destinations. As a dominant player in the travel services industry, it commands a fleet of renowned cruise brands known for luxury, innovation, and diverse itineraries spanning from brief escapes to extended voyages. With a strong market presence and ambitious growth plans, the key question for investors is whether Norwegian Cruise Line’s current fundamentals support its valuation and future expansion potential.

Table of contents

Business Model & Company Overview

Norwegian Cruise Line Holdings Ltd., founded in 1966 and headquartered in Miami, Florida, stands as a leading force in the travel services industry. It operates a cohesive ecosystem of cruise brands including Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. With a fleet of 28 ships offering over 59,000 berths, the company delivers diverse itineraries spanning from brief three-day trips to extensive 180-day voyages across key global destinations.

The company’s revenue engine balances onboard service sales, retail travel advisor distribution, and large-scale meetings and charters, creating multiple streams of income. Its strategic presence spans the Americas, Europe, and Asia-Pacific, allowing it to capitalize on varied regional demand. This multi-channel approach, combined with a robust fleet and global footprint, reinforces its competitive moat and positions it to shape the future of luxury and experiential travel.

Financial Performance & Fundamental Metrics

I will analyze Norwegian Cruise Line Holdings Ltd.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

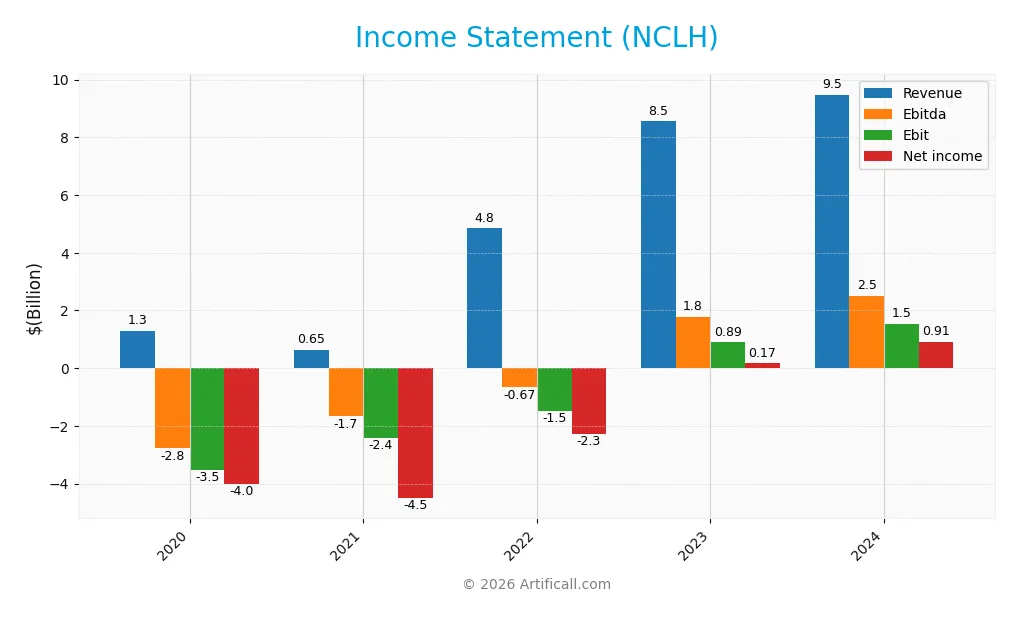

The table below summarizes Norwegian Cruise Line Holdings Ltd.’s key income statement figures over the past five fiscal years, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.28B | 648M | 4.84B | 8.55B | 9.48B |

| Cost of Revenue | 1.69B | 1.61B | 4.27B | 5.47B | 5.69B |

| Operating Expenses | 3.07B | 1.59B | 2.13B | 2.15B | 2.33B |

| Gross Profit | -413M | -960M | 577M | 3.08B | 3.79B |

| EBITDA | -2.78B | -1.67B | -665M | 1.77B | 2.49B |

| EBIT | -3.52B | -2.43B | -1.48B | 891M | 1.52B |

| Interest Expense | 482M | 2.07B | 802M | 728M | 747M |

| Net Income | -4.01B | -4.51B | -2.27B | 166M | 910M |

| EPS | -15.75 | -12.33 | -5.41 | 0.39 | 2.09 |

| Filing Date | 2021-02-26 | 2022-03-01 | 2023-02-28 | 2024-02-28 | 2025-02-27 |

Income Statement Evolution

Norwegian Cruise Line Holdings Ltd. demonstrated strong revenue growth from 2020 to 2024, rising from 1.28B to 9.48B, with a notable acceleration of 10.87% in the last year. Net income followed a positive trend, improving from a significant loss of -4.01B in 2020 to a profit of 910M in 2024. Margins improved substantially, with the gross margin reaching nearly 40% and net margin nearing 10%, signaling enhanced profitability and operational efficiency.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals, supported by a gross margin of 39.99% and an EBIT margin of 16.04%. Net margin expanded significantly to 9.6%, reflecting higher profitability. Despite a neutral interest expense ratio of 7.88%, the company achieved a 70.67% EBIT growth and a remarkable 394.04% increase in net margin year-over-year, indicating strong operational leverage and improved bottom-line performance.

Financial Ratios

The table below presents key financial ratios for Norwegian Cruise Line Holdings Ltd. (NCLH) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -313% | -695% | -469% | 2.0% | 9.6% |

| ROE | -92% | -185% | -3310% | 55% | 64% |

| ROIC | -21% | -16% | -11% | 6.1% | 9.4% |

| P/E | -1.61 | -1.68 | -2.26 | 51.2 | 12.3 |

| P/B | 1.49 | 3.12 | 74.9 | 28.3 | 7.86 |

| Current Ratio | 1.86 | 0.89 | 0.37 | 0.22 | 0.17 |

| Quick Ratio | 1.82 | 0.85 | 0.34 | 0.19 | 0.15 |

| D/E | 2.71 | 5.12 | 199.0 | 46.7 | 9.76 |

| Debt-to-Assets | 0.64 | 0.66 | 0.73 | 0.72 | 0.70 |

| Interest Coverage | -7.22 | -1.23 | -1.94 | 1.28 | 1.96 |

| Asset Turnover | 0.07 | 0.03 | 0.26 | 0.44 | 0.47 |

| Fixed Asset Turnover | 0.10 | 0.05 | 0.33 | 0.52 | 0.56 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Norwegian Cruise Line Holdings Ltd. saw its Return on Equity (ROE) improve significantly, reaching 63.86% in 2024, indicating stronger profitability compared to prior years. However, liquidity ratios such as the Current Ratio declined to 0.17, reflecting tighter short-term financial flexibility. The Debt-to-Equity Ratio remained high at 9.76, signaling sustained leverage and financial risk, while profitability margins showed overall improvement but with mixed stability.

Are the Financial Ratios Favorable?

In 2024, profitability indicators like ROE (63.86%) and Price-to-Earnings ratio (12.3) were favorable, suggesting efficient earnings generation and reasonable valuation. Conversely, liquidity ratios (Current Ratio 0.17, Quick Ratio 0.15) and leverage metrics including Debt-to-Equity (9.76) and Debt-to-Assets (69.69%) were unfavorable, highlighting potential solvency concerns. Efficiency ratios such as Asset Turnover (0.47) and Fixed Asset Turnover (0.56) were also weak, and the absence of dividends added to the neutral to negative market value perception. Overall, the ratio evaluation leans toward unfavorable.

Shareholder Return Policy

Norwegian Cruise Line Holdings Ltd. (NCLH) has not paid dividends from 2020 through 2024, reflecting a focus on reinvestment and managing high leverage, with a dividend payout ratio and yield at zero. There is no evidence of share buyback programs during this period.

This no-distribution policy aligns with the company’s need to prioritize debt reduction and operational recovery, supporting sustainable long-term value creation. The absence of dividends and buybacks indicates a cautious approach to capital allocation amid financial constraints.

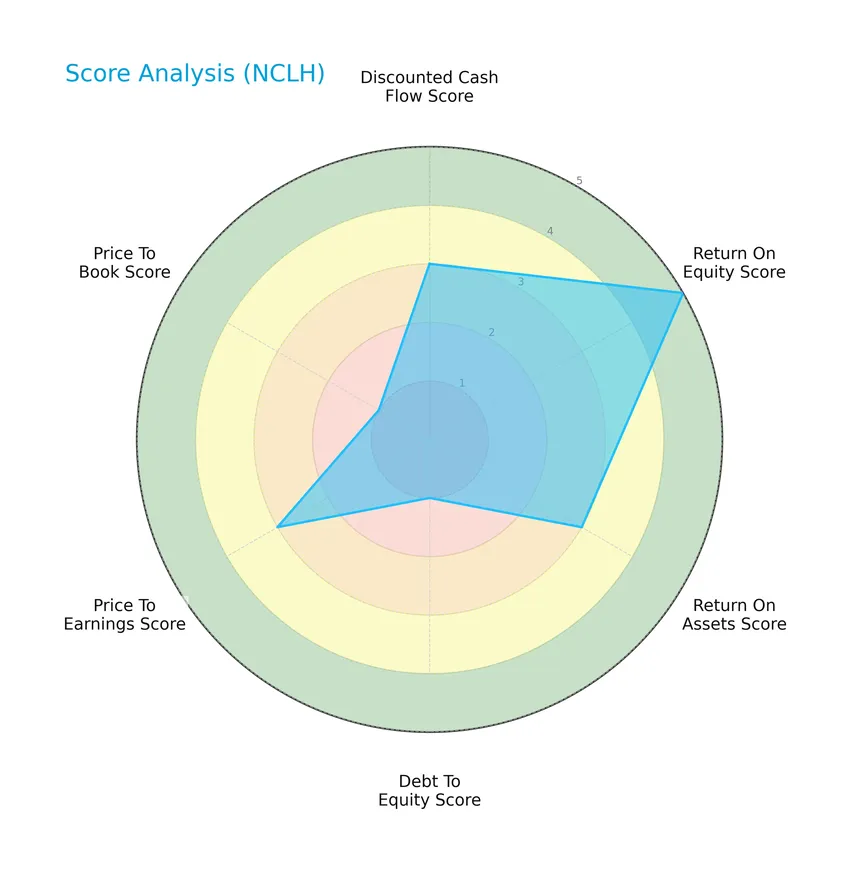

Score analysis

The following radar chart presents a comprehensive overview of key financial scores for Norwegian Cruise Line Holdings Ltd.:

The company shows a very favorable return on equity score of 5, indicating strong profitability relative to shareholder equity. However, debt-to-equity and price-to-book scores are very unfavorable at 1, reflecting concerns on leverage and valuation metrics. Other scores like discounted cash flow, return on assets, and price-to-earnings hold moderate levels at 3, suggesting mixed financial signals.

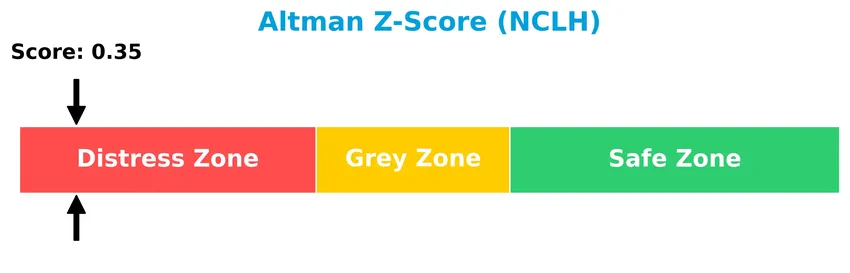

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Norwegian Cruise Line Holdings Ltd. in the distress zone, highlighting a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

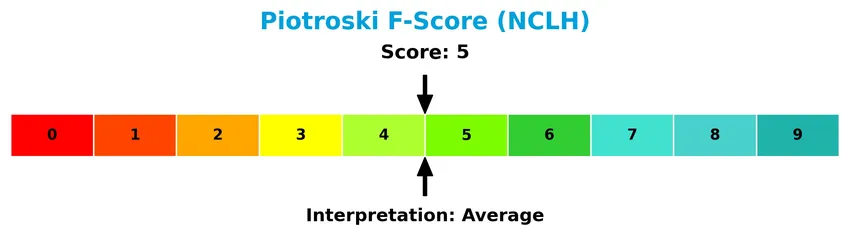

The Piotroski diagram below illustrates the company’s current financial health status based on its Piotroski Score:

With a Piotroski Score of 5, the company is classified as having average financial health. This score suggests moderate strength in profitability, leverage, liquidity, and operational efficiency, indicating neither strong nor weak financial fundamentals at this time.

Competitive Landscape & Sector Positioning

This sector analysis explores Norwegian Cruise Line Holdings Ltd.’s strategic positioning, revenue segments, key products, main competitors, competitive advantages, and SWOT profile. I will examine whether the company holds a competitive advantage within the travel services industry.

Strategic Positioning

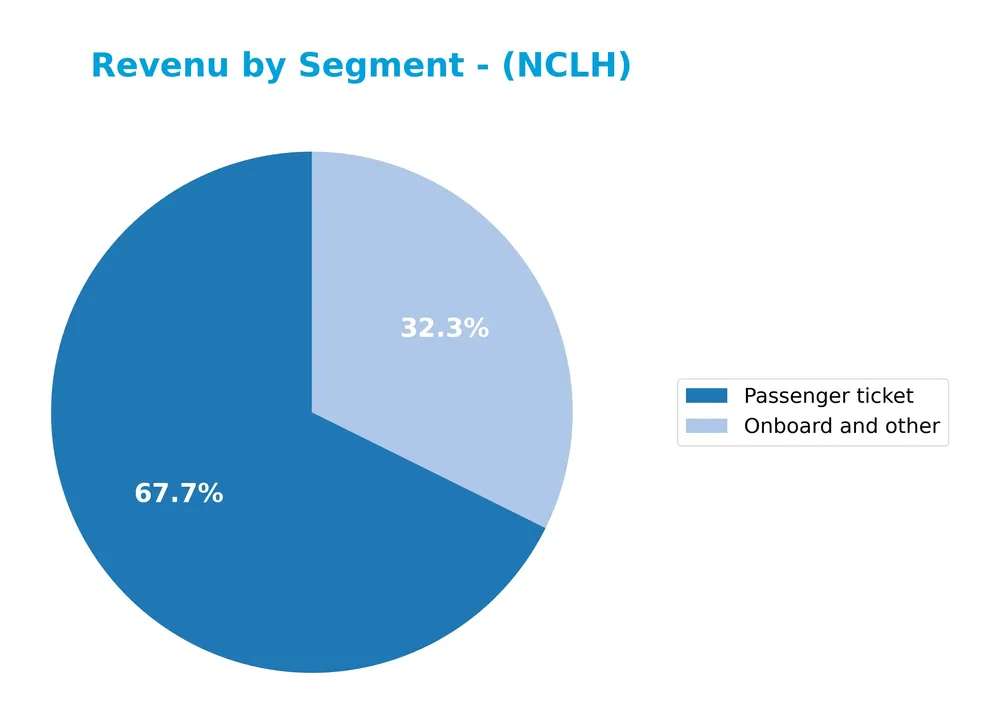

Norwegian Cruise Line Holdings Ltd. operates a diversified product portfolio with three cruise brands offering itineraries from 3 to 180 days across multiple regions, including North America, Europe, Asia-Pacific, and other international markets. Its revenue is balanced between passenger tickets (6.4B in 2024) and onboard services (3.1B in 2024), reflecting broad geographic and product exposure.

Revenue by Segment

This pie chart illustrates the revenue distribution between the “Passenger ticket” and “Onboard and other” segments for Norwegian Cruise Line Holdings Ltd. during the fiscal year 2024.

In 2024, the “Passenger ticket” segment remains the dominant revenue driver with $6.4B, showing continued growth from $5.8B in 2023. The “Onboard and other” segment also increased to $3.1B, reflecting a steady recovery and expansion after pandemic lows. Overall, the business shows strong momentum in both core segments, with passenger tickets accounting for a larger share, indicating a concentration in primary cruise sales while onboard services steadily enhance revenue diversification.

Key Products & Brands

The following table summarizes Norwegian Cruise Line Holdings Ltd.’s main products and brands offered to customers:

| Product | Description |

|---|---|

| Norwegian Cruise Line | A leading cruise brand offering itineraries ranging from 3 to 180 days across destinations including Scandinavia, Caribbean, and Asia-Pacific. |

| Oceania Cruises | Premium cruise line focusing on destination-rich voyages with immersive experiences in regions such as the Mediterranean and South America. |

| Regent Seven Seas Cruises | Luxury cruise brand providing all-inclusive voyages with upscale amenities to destinations worldwide including Africa and India. |

| Passenger Ticket | Revenue generated from the sale of cruise tickets, representing the core product for access to voyages. |

| Onboard and Other | Revenue from onboard spending such as dining, excursions, retail, and other services provided during cruises. |

Norwegian Cruise Line Holdings Ltd. operates three distinct cruise brands targeting different market segments. The company’s revenues primarily derive from passenger ticket sales and onboard services, reflecting a diversified cruise experience portfolio.

Main Competitors

There are 5 competitors in total, and the table below lists the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Booking Holdings Inc. | 172B |

| Airbnb, Inc. | 82.3B |

| Royal Caribbean Cruises Ltd. | 77.2B |

| Expedia Group, Inc. | 33.1B |

| Norwegian Cruise Line Holdings Ltd. | 10.4B |

Norwegian Cruise Line Holdings Ltd. ranks 5th among its competitors, with a market cap just 5.55% of the top player, Booking Holdings Inc. The company’s market capitalization is below both the average of the top 10 competitors (75B) and the sector median (77.2B). It maintains a significant gap of +247.45% below the next closest competitor, Expedia Group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does NCLH have a competitive advantage?

Norwegian Cruise Line Holdings Ltd. does not currently demonstrate a strong competitive advantage, as its ROIC is below WACC, indicating value shedding. However, its profitability is improving, supported by favorable income statement margins and strong revenue growth.

Looking ahead, NCLH’s diverse geographic footprint across North America, Europe, and Asia-Pacific offers opportunities for expansion. The company’s portfolio of cruise brands and wide range of itineraries position it to capitalize on growing demand in international travel markets.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Norwegian Cruise Line Holdings Ltd.’s strategic position and investment potential.

Strengths

- Strong brand portfolio with Norwegian, Oceania, and Regent Seven Seas

- Robust revenue growth of 10.87% in 2024

- High ROE of 63.86% indicating efficient capital use

Weaknesses

- High debt-to-equity ratio of 9.76 signaling heavy leverage

- Low liquidity ratios with current ratio at 0.17

- Altman Z-score in distress zone at 0.35 indicating financial risk

Opportunities

- Expansion into Asia-Pacific market with revenue growth to $779M

- Growing profitability and EBIT margin at 16.04%

- Increasing demand for premium and diverse cruise itineraries

Threats

- Economic downturns impacting discretionary travel spending

- Rising fuel and operational costs pressure margins

- Competitive pressures from other cruise lines and travel alternatives

Norwegian Cruise Line Holdings shows solid growth and profitability, supported by strong brands and expanding markets. However, its high leverage and liquidity constraints suggest caution. The company should focus on debt reduction and operational efficiency to mitigate financial risks while capitalizing on emerging market opportunities.

Stock Price Action Analysis

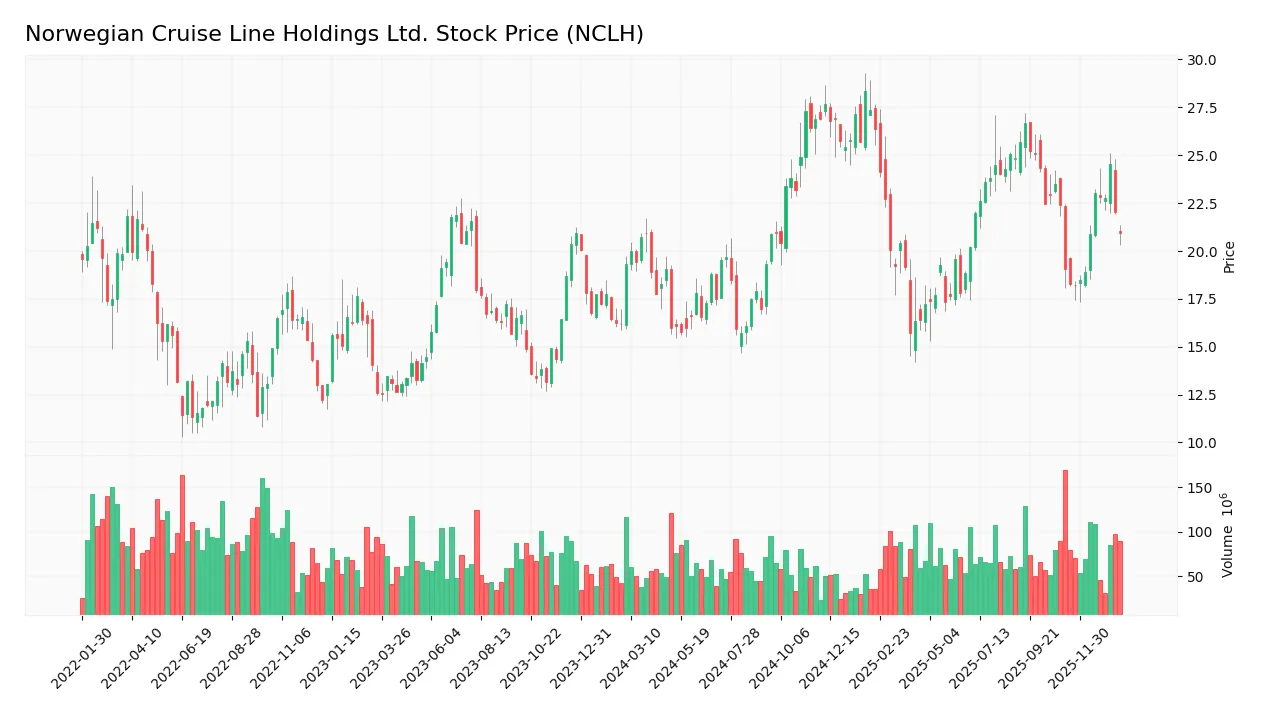

The following weekly stock chart illustrates Norwegian Cruise Line Holdings Ltd.’s price movements over the last 100 weeks:

Trend Analysis

Over the past 12 months, NCLH’s stock price increased by 8.5%, indicating a bullish trend with price acceleration. The price fluctuated between a low of 15.69 and a high of 28.35, with a standard deviation of 3.6, reflecting moderate volatility during this period.

Volume Analysis

In the last three months, trading volumes show a slight seller dominance with buyer volume at 429M versus seller volume at 585M, representing 42.32% buyer activity. Despite overall increasing volume trends, recent activity suggests cautious investor sentiment and moderate market participation skewed toward selling pressure.

Target Prices

Analysts present a cautious consensus on Norwegian Cruise Line Holdings Ltd. with a moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 38 | 20 | 26.78 |

The target prices suggest that analysts expect the stock to trade between $20 and $38, with an average forecast near $27, indicating moderate growth prospects amid some uncertainty.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback regarding Norwegian Cruise Line Holdings Ltd. (NCLH).

Stock Grades

The following table presents the latest verified grades from recognized financial institutions for Norwegian Cruise Line Holdings Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-20 |

| Citigroup | Maintain | Buy | 2026-01-14 |

| Wells Fargo | Maintain | Overweight | 2026-01-13 |

| TD Cowen | Maintain | Buy | 2026-01-13 |

| B of A Securities | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2025-12-17 |

| Jefferies | Downgrade | Hold | 2025-12-15 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| Goldman Sachs | Downgrade | Neutral | 2025-12-09 |

| Truist Securities | Maintain | Buy | 2025-12-02 |

Overall, the grades reflect a predominantly positive outlook with a consensus “Buy” rating, though some recent downgrades to Hold and Neutral indicate caution among certain analysts, suggesting mixed sentiment within the sector.

Consumer Opinions

Consumer sentiment around Norwegian Cruise Line Holdings Ltd. (NCLH) reflects a mix of enthusiasm for its unique cruise experiences and concerns over service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent itineraries with diverse destinations.” | “Customer service can be slow and unresponsive.” |

| “Good value for money compared to competitors.” | “Cabin maintenance was below expectations.” |

| “Friendly and professional onboard staff.” | “Delays in embarkation process were frustrating.” |

Overall, consumers appreciate NCLH’s attractive cruise routes and staff friendliness, but recurring complaints about service delays and cabin upkeep suggest areas needing improvement.

Risk Analysis

Below is a summary table highlighting the primary risks Norwegian Cruise Line Holdings Ltd. faces, focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Risk | High debt-to-equity ratio (9.76) and debt to assets (69.69%) raise solvency concerns. | High | High |

| Liquidity Risk | Very low current (0.17) and quick (0.15) ratios suggest weak short-term liquidity. | High | High |

| Market Volatility | Elevated beta of 2.083 indicates strong sensitivity to market swings. | Moderate | Moderate |

| Operational Risk | Dependence on global travel demand, vulnerable to pandemics or geopolitical events. | Moderate | High |

| Profitability Risk | Neutral net margin (9.6%) and moderate interest coverage (2.03) may constrain earnings. | Moderate | Moderate |

| Valuation Risk | Unfavorable price-to-book (7.86) ratio suggests potential overvaluation. | Moderate | Moderate |

| Bankruptcy Risk | Altman Z-Score at 0.35 places the company in distress zone, indicating bankruptcy risk. | High | Very High |

The most pressing risks for NCLH are its financial distress signals, notably the very low Altman Z-Score and heavy leverage, which significantly increase bankruptcy probability. Weak liquidity and high debt amplify these concerns. Operational risks linked to global travel uncertainties remain impactful as well. Investors must weigh these carefully against the company’s moderate profitability and valuation metrics.

Should You Buy Norwegian Cruise Line Holdings Ltd.?

Norwegian Cruise Line Holdings Ltd. appears to be exhibiting improving profitability and operational efficiency, supported by a slightly favorable competitive moat with growing ROIC. Despite a substantial leverage profile and distress-zone Altman Z-score, its overall rating suggests a moderate investment profile.

Strength & Efficiency Pillars

Norwegian Cruise Line Holdings Ltd. demonstrates solid profitability with a return on equity (ROE) of 63.86%, signaling strong shareholder returns. The net margin stands at a respectable 9.6%, complemented by an EBIT margin of 16.04%, reflecting operational efficiency. Importantly, the company’s return on invested capital (ROIC) of 9.43% slightly exceeds its weighted average cost of capital (WACC) at 8.99%, positioning NCLH as a value creator. However, the Altman Z-Score of 0.35 places it in the distress zone, indicating financial stability concerns, while a Piotroski score of 5 suggests average financial strength.

Weaknesses and Drawbacks

NCLH faces significant challenges in valuation and leverage metrics. A price-to-book ratio of 7.86 signals an expensive valuation relative to its book value, while the debt-to-equity ratio at 9.76 is alarmingly high, exposing the company to elevated financial risk. Liquidity ratios such as the current ratio (0.17) and quick ratio (0.15) are deeply unfavorable, highlighting potential short-term solvency issues. Additionally, seller dominance in the recent trading period, with buyers comprising only 42.32%, suggests near-term market pressure that could weigh on price momentum.

Our Verdict about Norwegian Cruise Line Holdings Ltd.

The long-term fundamental profile of NCLH might appear favorable due to strong profitability and value creation signals. However, recent market dynamics indicate a slightly seller-dominant environment despite an overall bullish trend. This contrast suggests that, despite underlying strengths, investors could adopt a cautious stance and await more favorable market conditions before increasing exposure to this high-leverage cruise operator.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Norwegian Cruise Line Holdings Ltd. $NCLH Stock Position Reduced by Patient Capital Management LLC – MarketBeat (Jan 21, 2026)

- What you need to know ahead of Norwegian Cruise Line’s earnings release – MSN (Jan 23, 2026)

- Norwegian Cruise Line (NCLH) Laps the Stock Market: Here’s Why – Yahoo Finance (Jan 21, 2026)

- Norwegian Cruise Line Holdings Ltd (NCLH) Shares Down 4.13% on J – GuruFocus (Jan 20, 2026)

- Norwegian Cruise Line Set for Potential Growth Surge – StocksToTrade (Jan 20, 2026)

For more information about Norwegian Cruise Line Holdings Ltd., please visit the official website: nclhltd.com