Home > Analyses > Technology > Nokia Oyj

Nokia Oyj powers the global communication backbone, enabling seamless connectivity that shapes how billions interact daily. As a pioneering force in communication equipment, Nokia leads with cutting-edge mobile and fixed network solutions spanning 2G to 5G technologies, cloud services, and advanced optical networks. Renowned for its innovation and robust market presence, Nokia continues to influence the telecom landscape profoundly. The key question for investors today is whether Nokia’s solid fundamentals and strategic vision justify its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

Nokia Oyj, founded in 1865 and headquartered in Espoo, Finland, stands as a dominant player in the Communication Equipment sector. Its integrated ecosystem spans mobile, fixed, and cloud network solutions, delivering technologies from 2G through 5G. Nokia’s comprehensive portfolio includes radio access networks, fiber and copper-based infrastructure, and advanced optical and submarine networks, positioning the company at the forefront of global connectivity innovation.

The company’s revenue engine balances hardware, software, and recurring services, serving a diverse client base across the Americas, Europe, and Asia. Its offerings include cloud and cognitive services, IP routing solutions, and enterprise software, supported by intellectual property licensing. This robust mix underpins Nokia’s competitive advantage, reinforcing its economic moat and shaping the future of global network infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze Nokia Oyj’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

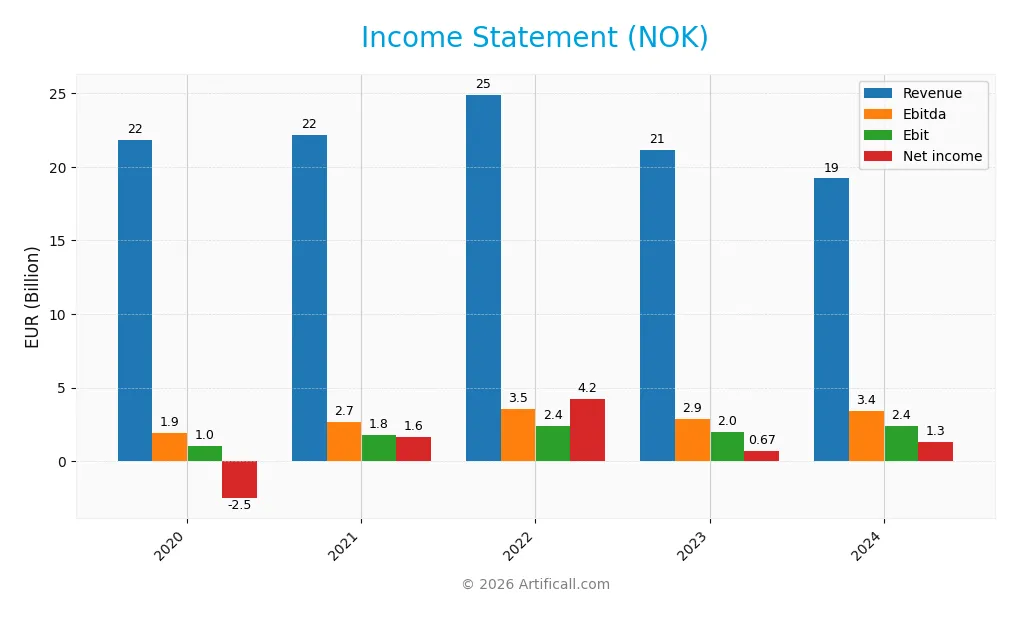

Income Statement

The table below presents Nokia Oyj’s key income statement figures for fiscal years 2020 through 2024, reported in EUR.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 21.9B | 22.2B | 24.9B | 21.1B | 19.2B |

| Cost of Revenue | 13.7B | 13.4B | 14.7B | 12.4B | 10.4B |

| Operating Expenses | 7.3B | 6.7B | 7.9B | 7.0B | 6.9B |

| Gross Profit | 8.2B | 8.8B | 10.2B | 8.7B | 8.9B |

| EBITDA | 1.9B | 2.7B | 3.5B | 2.9B | 3.4B |

| EBIT | 1.0B | 1.8B | 2.4B | 2.0B | 2.4B |

| Interest Expense | 244M | 281M | 270M | 304M | 360M |

| Net Income | -2.5B | 1.6B | 4.3B | 665M | 1.3B |

| EPS | -0.45 | 0.29 | 0.76 | 0.12 | 0.23 |

| Filing Date | 2021-03-04 | 2022-03-03 | 2023-03-02 | 2024-02-29 | 2025-03-13 |

Income Statement Evolution

Nokia’s revenue declined by 9.07% in 2024 and by 12.04% over 2020-2024, signaling a challenging sales environment. Despite this, net income rose sharply, with a 111.19% increase in 2024 and 150.61% over the period, reflecting improved net margins. Gross profit grew modestly by 2.04% in 2024, while operating expenses fell proportionally with revenue, maintaining margin stability.

Is the Income Statement Favorable?

The 2024 income statement reveals favorable fundamentals with a gross margin of 46.12%, EBIT margin of 12.58%, and net margin of 6.64%, all deemed positive. EBIT grew 21.2% year-on-year, supported by controlled interest expenses at 1.87% of revenue. Earnings per share nearly doubled, underscoring strong profitability despite lower revenues. Overall, 71.43% of income statement metrics are favorable, supporting a positive earnings quality assessment.

Financial Ratios

The following table presents key financial ratios for Nokia Oyj over the last five fiscal years, offering insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -11.5% | 7.3% | 17.1% | 3.1% | 6.6% |

| ROE | -16.5% | 9.3% | 19.9% | 3.2% | 6.2% |

| ROIC | -9.1% | 6.6% | 7.6% | 2.5% | 5.7% |

| P/E | -7.1 | 19.0 | 5.7 | 25.8 | 18.3 |

| P/B | 1.18 | 1.77 | 1.14 | 0.84 | 1.13 |

| Current Ratio | 1.55 | 1.62 | 1.59 | 1.66 | 1.58 |

| Quick Ratio | 1.36 | 1.42 | 1.33 | 1.41 | 1.39 |

| D/E | 0.52 | 0.33 | 0.26 | 0.25 | 0.23 |

| Debt-to-Assets | 17.1% | 14.1% | 12.9% | 13.0% | 12.1% |

| Interest Coverage | 3.6 | 7.7 | 8.6 | 5.5 | 5.5 |

| Asset Turnover | 0.47 | 0.55 | 0.58 | 0.53 | 0.49 |

| Fixed Asset Turnover | 6.9 | 7.9 | 8.5 | 7.4 | 9.1 |

| Dividend Yield | 0.83% | 0.03% | 1.45% | 3.56% | 3.09% |

Evolution of Financial Ratios

Over the analyzed period, Nokia’s Return on Equity (ROE) showed a decline, reaching 6.18% in 2024, indicating reduced profitability. The Current Ratio remained relatively stable and favorable around 1.58, reflecting consistent liquidity. The Debt-to-Equity Ratio improved from higher levels, settling at 0.23 in 2024, suggesting better leverage management. Overall, profitability margins exhibited moderate stability with some fluctuations.

Are the Financial Ratios Favorable?

In 2024, Nokia’s financial ratios present a generally favorable profile, with 64.29% of key ratios assessed positively. Liquidity ratios such as Current and Quick Ratios are favorable at 1.58 and 1.39 respectively, while leverage metrics including Debt-to-Equity (0.23) and Debt-to-Assets (12.13%) also stand favorably. Profitability shows mixed signals: Net Margin at 6.64% is neutral, ROE is unfavorable, but fixed asset turnover (9.07) and interest coverage (6.71) are favorable. Market valuation ratios like Price-to-Book (1.13) and Dividend Yield (3.09%) further support a positive outlook.

Shareholder Return Policy

Nokia Oyj maintains a consistent dividend policy with a payout ratio around 57% in 2024 and a dividend yield near 3.1%. The dividend per share has grown steadily from €0.027 in 2020 to €0.132 in 2024. Share buybacks are not explicitly reported.

The dividend payments are well-covered by free cash flow, supporting sustainable distributions without excessive financial strain. This prudent payout approach, combined with operational profitability, indicates a balanced strategy aimed at long-term shareholder value preservation.

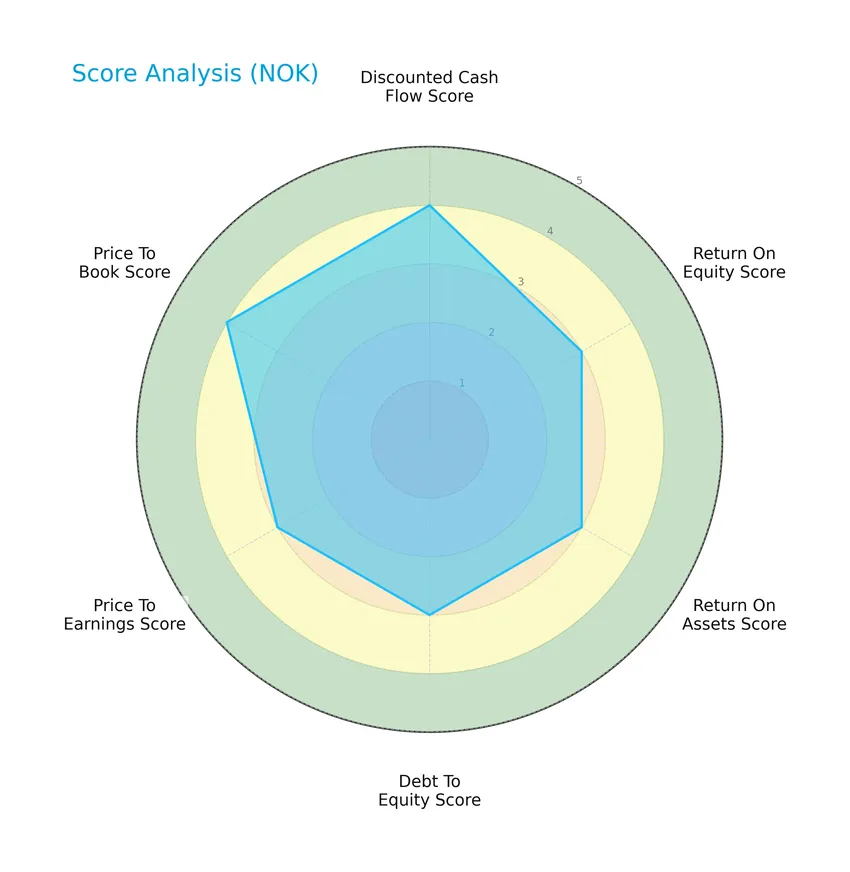

Score analysis

This radar chart presents a comprehensive overview of Nokia Oyj’s key financial scores to evaluate its investment appeal:

Nokia shows favorable discounted cash flow and price-to-book valuations at score 4, while its return on equity, return on assets, debt-to-equity, and price-to-earnings scores register moderate values of 3, indicating balanced financial performance with room for improvement.

Analysis of the company’s bankruptcy risk

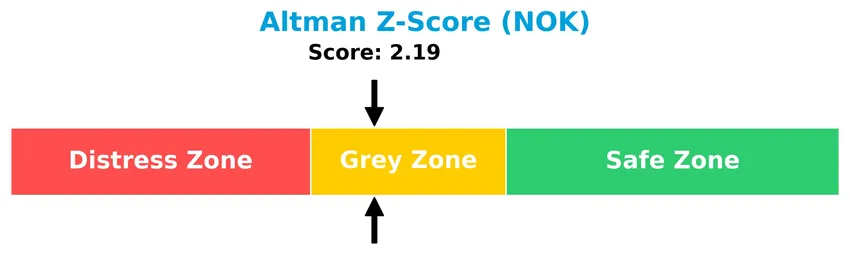

The Altman Z-Score places Nokia in the grey zone, suggesting a moderate risk of financial distress and bankruptcy:

Is the company in good financial health?

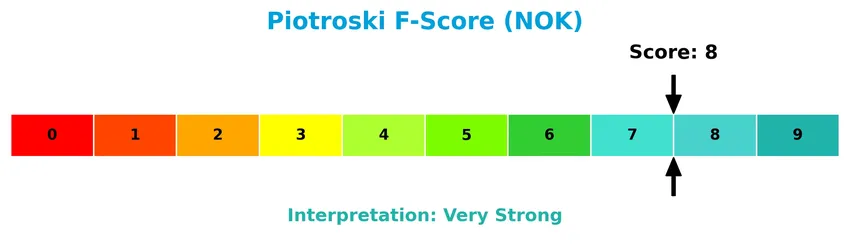

The Piotroski diagram highlights the company’s financial strength based on nine key criteria:

With a Piotroski Score of 8, Nokia demonstrates very strong financial health, reflecting robust profitability, liquidity, and operational efficiency, which supports its status as a fundamentally sound company.

Competitive Landscape & Sector Positioning

This section provides an overview of Nokia Oyj’s position within the communication equipment sector, highlighting its business segments and market dynamics. I will assess the company’s competitive advantages relative to its main industry peers.

Strategic Positioning

Nokia Oyj maintains a diversified product portfolio across Mobile Networks, Network Infrastructure, Cloud and Network Services, and Technologies, serving global markets. Its revenue is geographically balanced, with significant exposure in North America (€8.4B), Europe (€6.7B), Asia Pacific (€2.6B), and other regions, evidencing broad international reach.

Key Products & Brands

The following table outlines Nokia Oyj’s main products and brand categories with their descriptions:

| Product | Description |

|---|---|

| Mobile Networks | Radio access network products covering 2G to 5G technologies and microwave radio links for transport networks. |

| Network Infrastructure | Fixed networking solutions including fiber and copper-based access infrastructure. |

| Cloud and Network Services | Cloud and virtualization services, Wi-Fi portfolio with mesh solutions and cloud-based controllers. |

| IP Routing Solutions | IP aggregation, edge and core applications for residential, business, mobile, and industrial services. |

| Optical Networks | Coherent optical transponders, optical transport network switchers, WDM, ROADM solutions, and optical line systems. |

| Submarine Networks | Solutions for underwater communication networks. |

| Business Applications Software | Software for business applications, cloud and cognitive services, core networks software, and enterprise solutions. |

| Nokia Technologies | Hardware, software, services, and licensing of intellectual property including patents and the Nokia brand. |

Nokia Oyj offers a comprehensive range of products and services spanning mobile, fixed, cloud, and optical networking sectors, serving diverse customers from communication service providers to government entities.

Main Competitors

There are 7 competitors in the Communication Equipment industry, with the table listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cisco Systems, Inc. | 300B |

| Motorola Solutions, Inc. | 63.5B |

| Nokia Oyj | 34.9B |

| Hewlett Packard Enterprise Company | 32B |

| Credo Technology Group Holding Ltd | 24.7B |

| Zebra Technologies Corporation | 12.6B |

| AudioCodes Ltd. | 255M |

Nokia Oyj ranks 3rd among its competitors with a market cap approximately 12.17% that of the leader, Cisco Systems. The company is positioned below the average market cap of the top 10 competitors (67B) but remains above the sector median (32B). It holds a significant 73.56% gap above its closest competitor, Motorola Solutions, indicating a solid lead in its tier.

Does NOK have a competitive advantage?

Nokia Oyj currently does not demonstrate a strong competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite improving profitability. The company’s income statement shows favorable margins and net income growth, but overall revenue has declined in recent years, reflecting operational challenges.

Looking ahead, Nokia’s diverse portfolio across mobile networks, cloud services, and optical networks positions it to explore growth opportunities in emerging technologies and new markets. Continued focus on innovation in 5G and cloud infrastructure could support future expansion, although the company must address revenue headwinds to strengthen its competitive position.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Nokia Oyj’s key strategic factors to assist investors in evaluating its investment potential.

Strengths

- Strong global presence in communication equipment

- Diversified product portfolio spanning mobile, fixed, cloud, and network services

- Favorable financial ratios including solid liquidity and low debt

Weaknesses

- Declining revenue trend over recent years

- Moderate return on equity indicating efficiency challenges

- Slightly unfavorable moat due to value destruction despite improving profitability

Opportunities

- Growing demand for 5G and cloud network solutions

- Expansion in emerging markets like India and Latin America

- Increasing digital transformation and network virtualization needs

Threats

- Intense competition in telecom infrastructure

- Rapid technological changes requiring constant innovation

- Regulatory risks and geopolitical tensions affecting supply chains

Overall, Nokia demonstrates robust strengths in technology and market reach but faces revenue decline and operational efficiency challenges. Strategic focus on innovation and emerging markets is crucial to capitalize on growth opportunities and mitigate competitive and geopolitical risks.

Stock Price Action Analysis

The following weekly stock chart illustrates Nokia Oyj’s price movements over the past 12 months, highlighting key fluctuations and overall trajectory:

Trend Analysis

Over the past 12 months, Nokia’s stock price increased by 90.17%, indicating a strong bullish trend. The price ranged from a low of 3.33 to a high of 6.91. Despite this significant rise, the trend shows deceleration, with a standard deviation of 0.89 reflecting moderate volatility.

Volume Analysis

In the last three months, trading volume has been increasing overall, with sellers dominating 61.24% of activity. Buyer volume declined to 656M while seller volume rose to 1.04B, suggesting bearish pressure and weakening investor confidence during this recent period.

Target Prices

The consensus target prices for Nokia Oyj indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 8.5 | 5 | 6.69 |

Analysts expect Nokia’s stock price to trade between 5 and 8.5, with an average consensus target of 6.69, suggesting cautious optimism in the near term.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Nokia Oyj (NOK) to provide insight.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is a summary of recent verified stock grades assigned to Nokia Oyj by reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-01 |

| Jefferies | Upgrade | Buy | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-24 |

| JP Morgan | Maintain | Overweight | 2025-07-29 |

| JP Morgan | Maintain | Overweight | 2025-02-21 |

| Craig-Hallum | Maintain | Buy | 2025-01-06 |

| JP Morgan | Upgrade | Overweight | 2024-12-09 |

| JP Morgan | Maintain | Neutral | 2024-10-21 |

| Northland Capital Markets | Maintain | Outperform | 2024-10-18 |

| Northland Capital Markets | Maintain | Outperform | 2024-09-04 |

The overall trend shows a consistent positive outlook with multiple upgrades and stable overweight or buy recommendations. Notably, JP Morgan has shifted from neutral to overweight, while Jefferies upgraded to buy, indicating growing confidence among key analysts.

Consumer Opinions

Consumer sentiment about Nokia Oyj reflects a mix of appreciation for its technological reliability and concerns over recent product innovation.

| Positive Reviews | Negative Reviews |

|---|---|

| “Nokia’s network equipment is highly reliable and efficient, ensuring stable connectivity.” | “Product updates feel slow compared to competitors, leading to outdated features.” |

| “Strong customer service with knowledgeable representatives ready to assist.” | “Some mobile devices lack the cutting-edge specs expected in 2026.” |

| “Good value for enterprise solutions, particularly in 5G infrastructure deployment.” | “Limited variety in consumer electronics limits options for tech enthusiasts.” |

Overall, consumers praise Nokia’s dependable network technology and customer support but note a need for faster innovation and broader device offerings to stay competitive in the evolving tech market.

Risk Analysis

Below is a summary table outlining key risks associated with investing in Nokia Oyj, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Price fluctuations influenced by global tech cycles and geopolitical tensions. | Medium | High |

| Competitive Pressure | Intense competition in 5G infrastructure and network solutions markets. | High | High |

| Financial Performance | Moderate ROE and asset turnover, with risk of profit margin pressure. | Medium | Medium |

| Technological Change | Rapid innovation demands continuous R&D investment and adaptation. | High | Medium |

| Regulatory Risk | Compliance with international telecom and data regulations, including export controls. | Medium | Medium |

| Supply Chain Disruptions | Potential delays or shortages affecting hardware components. | Medium | Medium |

| Currency Fluctuation | Exposure due to multinational operations and reporting in USD/EUR. | Medium | Low |

The most critical risks for Nokia are competitive pressure and technological change, driven by the fast-evolving 5G and cloud network sectors. Despite a favorable debt profile and liquidity, the company’s moderate ROE and asset turnover signal areas needing vigilance amid market uncertainties. The Altman Z-Score in the grey zone indicates moderate financial distress risk, urging cautious position sizing.

Should You Buy Nokia Oyj?

Nokia Oyj appears to be exhibiting improving profitability and operational efficiency, supported by a moderately favorable leverage profile despite a slightly unfavorable moat reflecting ongoing value shedding. Its overall A- rating suggests a generally favorable financial health, albeit within a grey zone risk context.

Strength & Efficiency Pillars

Nokia Oyj exhibits solid operational efficiency with a gross margin of 46.12% and an EBIT margin of 12.58%, highlighting effective cost management. The company maintains a favorable weighted average cost of capital (WACC) at 6.02%, but its return on invested capital (ROIC) sits slightly below at 5.66%, indicating value erosion despite a positive ROIC growth trend of 162.47%. Financial health is reinforced by a Piotroski score of 8, signaling very strong fundamentals, and an Altman Z-score of 2.19, placing Nokia in the grey zone but away from distress. Leverage ratios remain conservative with a debt-to-equity ratio of 0.23 and strong liquidity metrics.

Weaknesses and Drawbacks

Nokia faces several headwinds that temper its investment appeal. The return on equity (ROE) is a modest 6.18%, flagged as unfavorable, reflecting limited profitability for shareholders. Revenue declined by 9.07% over the last year, contributing to a 12.04% revenue contraction over the 2020-2024 period. The company has a moderate price-to-earnings ratio of 18.3, which suggests neither undervaluation nor a clear bargain. Market dynamics show seller dominance in the recent period with buyers comprising only 38.76%, which may exert short-term downward pressure on the stock despite the broader bullish trend.

Our Verdict about Nokia Oyj

Nokia’s long-term fundamental profile appears moderately favorable, supported by strong financial health and improving profitability metrics. However, the company is currently shedding value as ROIC lags behind WACC, and recent revenue declines raise concerns. Despite the overall bullish technical trend, the recent seller dominance suggests a cautious approach, and investors might consider waiting for more favorable market conditions before increasing exposure. Nokia may appear attractive for those prioritizing solid financial stability with a tolerance for cyclical volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Here’s What Wall Street Thinks About Nokia Oyj (NOK) – Yahoo Finance (Dec 31, 2025)

- Nokia Corporation $NOK Shares Sold by QRG Capital Management Inc. – MarketBeat (Jan 20, 2026)

- Defiance Launches LNOK: The First Daily 2X Long ETF for Nokia Oyj – GlobeNewswire (Jan 21, 2026)

- Nokia (NOK) Among Companies Eyeing Opportunities Amid EU’s Cyber – GuruFocus (Jan 21, 2026)

- What’s Driving the Market Sentiment Around Nokia Oyj? – Sahm (Jan 16, 2026)

For more information about Nokia Oyj, please visit the official website: nokia.com