Home > Analyses > Energy > NexGen Energy Ltd.

NexGen Energy Ltd. is at the forefront of shaping the future of clean energy through its groundbreaking uranium exploration and development in Canada’s Athabasca Basin. Renowned for its flagship Rook I project, the company combines innovative exploration techniques with a commitment to quality, positioning itself as a key player in the uranium sector. As global demand for sustainable energy grows, I explore whether NexGen’s strong fundamentals and strategic assets continue to justify its growth prospects and market valuation.

Table of contents

Business Model & Company Overview

NexGen Energy Ltd., founded in 2013 and headquartered in Vancouver, Canada, operates as a key player in the uranium industry. The company’s core mission centers on the acquisition, exploration, and development of uranium properties, anchored by its flagship Rook I project spanning 35,065 hectares in the Athabasca Basin. This expansive asset base forms a cohesive ecosystem dedicated to unlocking uranium’s potential as a critical energy resource.

The company’s revenue engine is primarily driven by its exploration and development activities within Canada, focusing on advancing its mineral claims toward production. Though still in the development stage, NexGen’s strategic positioning in the uranium sector places it at the heart of global energy supply chains, with prospects to influence markets across the Americas, Europe, and Asia. Its competitive advantage lies in its extensive landholdings and technical expertise, setting a robust foundation for long-term value creation.

Financial Performance & Fundamental Metrics

I will analyze NexGen Energy Ltd.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

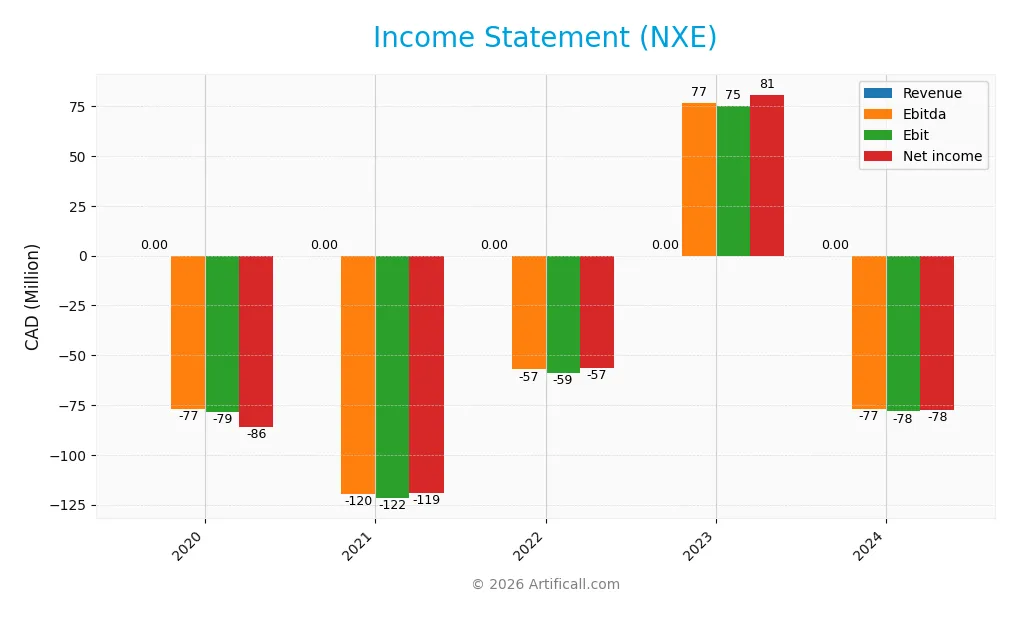

The table below presents NexGen Energy Ltd.’s key Income Statement figures for fiscal years 2020 through 2024, reported in CAD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 0 | 0 | 0 | 0 | 0 |

| Cost of Revenue | 1.8M | 0 | 0 | 0 | 0 |

| Operating Expenses | 16.7M | 51.2M | 59.8M | 84.7M | 76.0M |

| Gross Profit | -1.8M | 0 | 0 | 0 | 0 |

| EBITDA | -76.8M | -119.7M | -57.1M | 76.8M | -76.8M |

| EBIT | -78.6M | -121.8M | -58.9M | 75.0M | -78.2M |

| Interest Expense | 13.6M | 4.0M | 2.4M | 6.3M | 32.6M |

| Net Income | -86.2M | -119.1M | -56.6M | 80.8M | -77.6M |

| EPS | -0.30 | -0.26 | -0.12 | 0.16 | -0.14 |

| Filing Date | 2021-03-19 | 2022-02-25 | 2023-02-24 | 2024-03-07 | 2025-03-04 |

Income Statement Evolution

NexGen Energy Ltd. reported zero revenue consistently from 2020 to 2024, resulting in no gross profit or margin improvement. Net income fluctuated significantly, with a notable positive spike in 2023 at CAD 81M before dropping to a loss of CAD 77.6M in 2024. Operating expenses remained high and largely stable, contributing to consistently unfavorable gross, EBIT, and net margins over the period.

Is the Income Statement Favorable?

The 2024 income statement reveals a loss of CAD 77.6M and negative EBITDA and EBIT, reflecting ongoing operational challenges. Despite a favorable interest expense ratio, the absence of revenue and persistent high operating costs weigh heavily. Overall, fundamentals remain unfavorable, with limited margin growth and a negative net margin trend, underscoring financial strain for investors to consider.

Financial Ratios

The following table presents key financial ratios for NexGen Energy Ltd. (NXE) over the fiscal years 2020 to 2024, providing insight into profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0 | 0 | 0 | 0 | 0 |

| ROE | -91% | -27% | -14% | 10% | -7% |

| ROIC | -5% | -9% | -11% | -9% | -4% |

| P/E | -15 | -21 | -50 | 58 | -68 |

| P/B | 13.7 | 5.9 | 6.8 | 5.7 | 4.5 |

| Current Ratio | 10.2 | 26.0 | 1.5 | 1.6 | 1.0 |

| Quick Ratio | 10.2 | 26.0 | 1.5 | 1.6 | 1.0 |

| D/E | 2.45 | 0.17 | 0.39 | 0.39 | 0.39 |

| Debt-to-Assets | 65% | 14% | 29% | 32% | 28% |

| Interest Coverage | -1.4 | -12.8 | -25.1 | -13.6 | -2.3 |

| Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Over the period from 2020 to 2024, NexGen Energy Ltd. experienced a significant decline in Return on Equity (ROE), dropping from a deeply negative level in 2020 to -6.58% in 2024, reflecting persistent unprofitability. The Current Ratio decreased sharply from an exceptionally high 25.99 in 2021 to a more moderate 1.03 by 2024, indicating reduced liquidity. The Debt-to-Equity Ratio improved substantially, falling from 2.45 in 2020 to 0.39 in 2024, suggesting better leverage management.

Are the Financial Ratios Favorable?

In 2024, NexGen Energy’s financial ratios present a mixed picture. Profitability ratios such as ROE (-6.58%) and net margin (0%) are unfavorable, highlighting ongoing losses. Liquidity ratios show a neutral to favorable stance, with the current ratio at 1.03 (neutral) and quick ratio at 1.03 (favorable). Leverage is managed well, with debt-to-equity at 0.39 and debt-to-assets at 27.56%, both favorable. Market valuation ratios are mostly unfavorable, except for a favorable price-to-earnings ratio of -67.8, reflecting complex valuation dynamics. Overall, 64.29% of ratios are unfavorable, indicating caution.

Shareholder Return Policy

NexGen Energy Ltd. (NXE) does not pay dividends, reflecting its negative net income per share in recent years and ongoing reinvestment in operations. The company also does not engage in share buybacks, focusing instead on preserving cash and funding growth initiatives.

This approach aligns with a high-growth strategy prioritizing capital expenditure over immediate shareholder returns. While this supports long-term value creation, shareholders should monitor cash flow and profitability trends to assess sustainability.

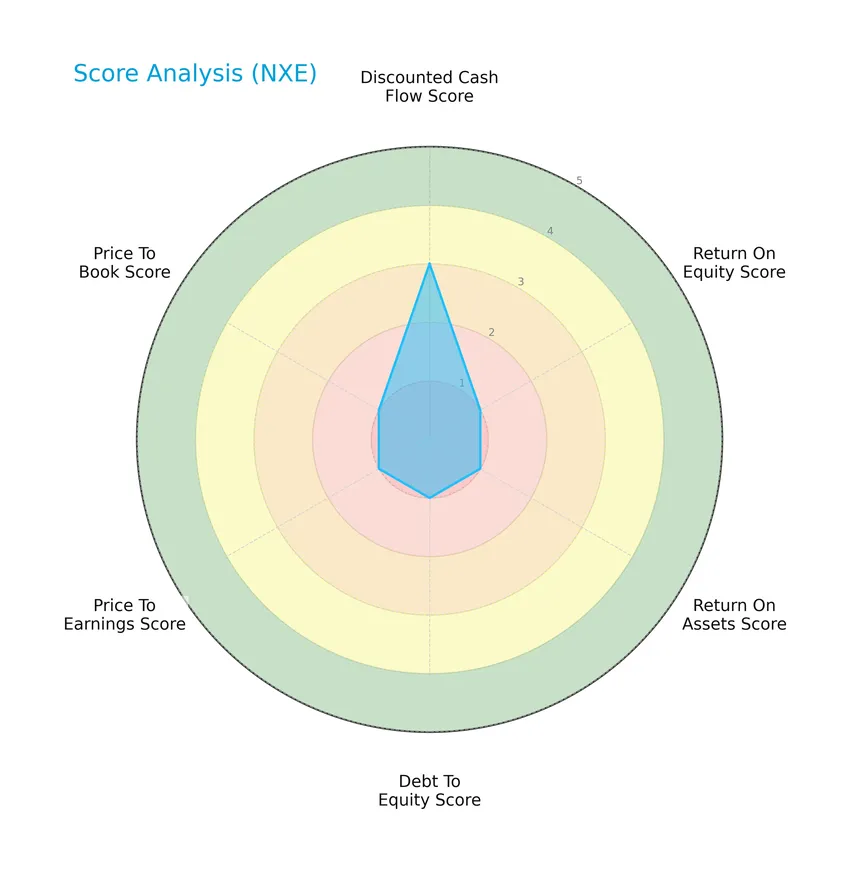

Score analysis

The following radar chart presents an overview of key financial scores for NexGen Energy Ltd.:

NexGen Energy Ltd. scores moderately on discounted cash flow with a 3, but all other metrics including return on equity, return on assets, debt to equity, price to earnings, and price to book are very unfavorable at 1, indicating overall weak financial performance.

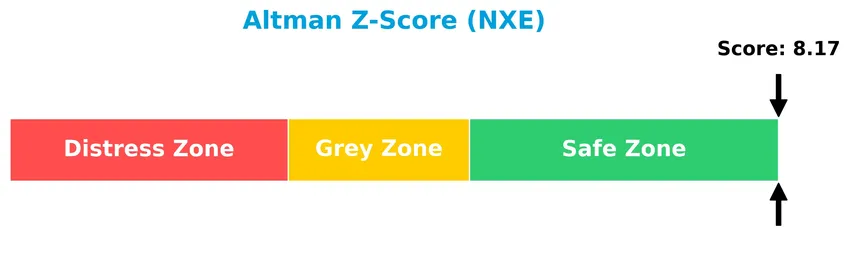

Analysis of the company’s bankruptcy risk

The Altman Z-Score places NexGen Energy Ltd. firmly in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

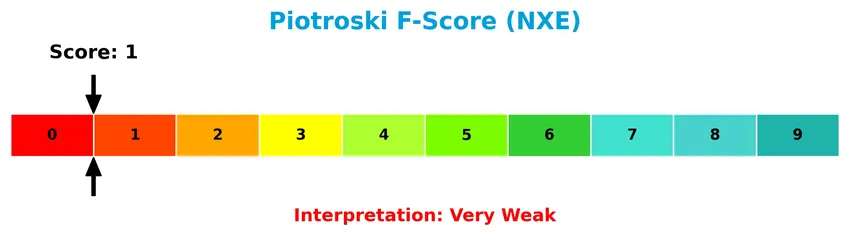

This Piotroski diagram illustrates the financial health of NexGen Energy Ltd. based on its Piotroski Score:

With a Piotroski Score of 1, NexGen Energy Ltd. is classified as very weak financially, suggesting significant challenges in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine NexGen Energy Ltd.’s strategic positioning, revenue segments, key products, main competitors, competitive advantages, and SWOT factors within the uranium industry. I will assess whether NexGen Energy holds a competitive advantage over its peers.

Strategic Positioning

NexGen Energy Ltd. maintains a concentrated strategic position, focusing exclusively on uranium exploration and development within Canada, primarily through its Rook I project covering 35,065 hectares in Saskatchewan’s Athabasca Basin, reflecting a specialized geographic and product portfolio.

Key Products & Brands

The following table presents NexGen Energy Ltd.’s principal products and assets related to uranium exploration and development:

| Product | Description |

|---|---|

| Rook I Project | A uranium exploration and development asset comprising 32 contiguous mineral claims over 35,065 hectares in the southwestern Athabasca Basin, Saskatchewan, Canada. |

NexGen Energy Ltd. focuses on uranium exploration and development, with its main asset being the extensive Rook I project in Canada’s Athabasca Basin, a region known for high-grade uranium deposits.

Main Competitors

There are 10 main competitors in the uranium industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cameco Corporation | 39.8B |

| NexGen Energy Ltd. | 6.0B |

| Uranium Energy Corp. | 5.6B |

| Centrus Energy Corp. | 4.2B |

| Energy Fuels Inc. | 3.5B |

| Denison Mines Corp. | 2.4B |

| Ur-Energy Inc. | 507M |

| IsoEnergy Ltd. | 499M |

| Uranium Royalty Corp. | 471M |

| enCore Energy Corp. | 464M |

NexGen Energy Ltd. ranks 2nd among its peers, holding about 20.7% of the market cap of the sector leader Cameco Corporation. It is positioned above both the average market cap of the top 10 competitors (6.35B) and the median market cap of the uranium sector (2.9B). The company enjoys a significant gap of +383.77% above its closest competitor.

Does NXE have a competitive advantage?

NexGen Energy Ltd. does not currently present a strong competitive advantage, as it is shedding value with a ROIC significantly below its WACC, despite a growing ROIC trend. The company’s income statement shows mostly unfavorable margins and no revenue growth over the recent period.

Looking ahead, NexGen’s principal asset, the Rook I uranium project in Canada, offers potential opportunities for development and value creation in the energy sector. Continued exploration and evaluation in this resource-rich area could support future growth and improved profitability.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting NexGen Energy Ltd., aiding investors in understanding its strategic position.

Strengths

- Strong market presence in uranium exploration

- Significant landholding in Athabasca Basin

- Low debt-to-equity ratio (0.39)

Weaknesses

- Unfavorable profitability metrics

- Negative return on equity (-6.58%)

- Weak financial strength (Piotroski score 1)

Opportunities

- Growing demand for nuclear energy

- Potential for resource expansion at Rook I project

- Increasing ROIC trend despite current value destruction

Threats

- High beta indicating stock volatility

- Price-to-book ratio elevated at 4.46

- Regulatory and environmental risks in uranium sector

Overall, NexGen Energy demonstrates solid asset positioning but suffers from poor profitability and financial strength. The company should focus on operational improvements and capitalize on the rising demand for nuclear energy while managing sector-specific risks carefully.

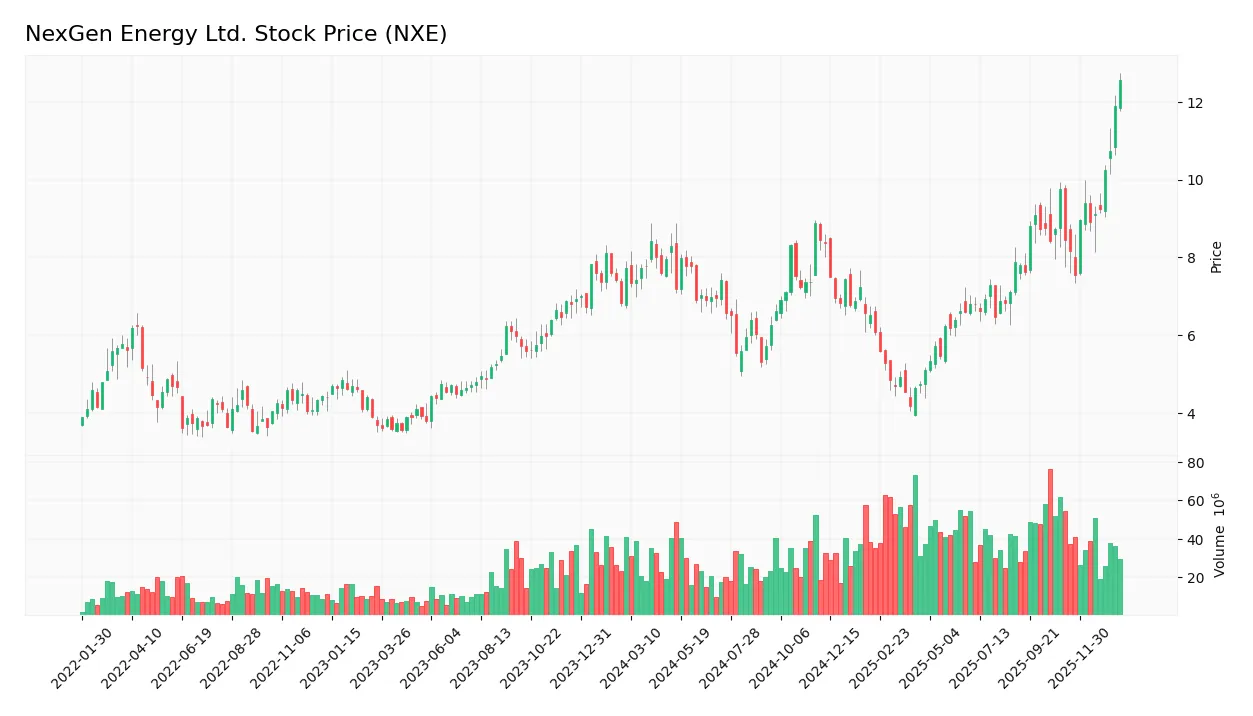

Stock Price Action Analysis

The weekly stock chart of NexGen Energy Ltd. (NXE) over the past 12 months highlights significant price movements and volatility patterns:

Trend Analysis

Over the past 12 months, NXE’s stock price increased by 62.95%, indicating a bullish trend. The price showed acceleration, rising from a low of 4.18 to a high of 12.58. The standard deviation of 1.48 suggests moderate volatility during this period.

Volume Analysis

Trading volumes over the last three months demonstrate buyer dominance with 60.35% buyer volume. The total volume trend is increasing, reflecting heightened market participation and positive investor sentiment toward NXE shares.

Target Prices

No verified target price data is available from recognized analysts for NexGen Energy Ltd. Market sentiment appears cautious due to sector volatility and commodity price fluctuations.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to NexGen Energy Ltd. (NXE).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

No verified stock grades were available from recognized analysts for NexGen Energy Ltd. However, the consensus based on available data indicates a general “Buy” sentiment with four buy ratings and no holds or sells.

Consumer Opinions

NexGen Energy Ltd. has garnered mixed consumer sentiments, reflecting both enthusiasm for its innovation and concerns about operational challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressed by NexGen’s commitment to sustainable uranium mining.” | “Delays in project timelines have been frustrating.” |

| “Strong focus on environmental responsibility sets them apart.” | “Stock volatility makes it a risky investment.” |

| “Good communication from management on company progress.” | “High capital expenditure impacts short-term profitability.” |

Overall, consumers appreciate NexGen Energy’s environmental efforts and transparency but remain cautious due to project delays and financial risks. This feedback highlights the need for balanced risk management when investing.

Risk Analysis

The following table summarizes key risks associated with investing in NexGen Energy Ltd., highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative profitability metrics and weak return on equity increase financial distress risk. | High | High |

| Market Volatility | Stock exhibits a high beta (1.856), implying sensitivity to market swings. | High | Medium |

| Operational Risk | Exploration-stage uranium project with no commercial production yet. | Medium | High |

| Regulatory Risk | Uranium sector faces strict regulations and geopolitical uncertainties. | Medium | High |

| Liquidity Risk | Trading volume below average, potentially reducing ease of entry/exit. | Medium | Medium |

| Dividend Risk | No dividends paid, limiting income potential for investors. | High | Low |

NexGen’s most significant risks stem from its unfavorable financial ratios and very weak Piotroski score (1), indicating fragile financial strength. Despite a strong Altman Z-score placing it in a safe zone, the company’s exploration-stage status and sector regulatory challenges warrant caution. High market volatility further compounds risk for investors.

Should You Buy NexGen Energy Ltd.?

NexGen Energy Ltd. appears to be navigating a challenging profitability landscape with negative returns, while its leverage profile remains manageable. Despite a slightly unfavorable moat indicating value destruction, its improving operational efficiency suggests potential. The overall rating could be seen as C-, reflecting cautious sentiment.

Strength & Efficiency Pillars

NexGen Energy Ltd. exhibits solid financial stability, underscored by an Altman Z-score of 8.17, placing the company firmly in the safe zone and indicating a low bankruptcy risk. Its debt-to-equity ratio of 0.39 and debt-to-assets at 27.56% further demonstrate prudent leverage management. Although profitability metrics like ROE (-6.58%) and ROIC (-4.39%) are negative and below the 12.34% WACC, suggesting value erosion rather than creation, the company maintains a favorable quick ratio of 1.03, reflecting adequate short-term liquidity.

Weaknesses and Drawbacks

Profitability remains a critical concern, with zero net and EBIT margins and a steep 204.31% decline in EBIT growth over one year, signaling operational challenges. Valuation metrics are mixed: while the P/E ratio is negative (-67.8), reflecting losses and potentially undervalued shares, the price-to-book ratio at 4.46 suggests a premium valuation relative to book value. Interest coverage of -2.4 highlights difficulties in meeting debt obligations from earnings. These factors, combined with an unfavorable Piotroski score of 1, underscore significant financial weaknesses and operational risks.

Our Verdict about NexGen Energy Ltd.

NexGen Energy Ltd.’s long-term fundamental profile appears unfavorable due to persistent profitability and value destruction issues despite strong financial stability and liquidity. However, the bullish overall stock trend with increasing buyer dominance (60.35%) and recent acceleration might suggest potential market interest. Despite these technical positives, the fundamental weaknesses imply that investors might adopt a cautious stance, as the company may appear risky for long-term exposure at this stage.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NexGen Energy Ltd. (NXE): A Bull Case Theory – Yahoo Finance (Dec 04, 2025)

- NexGen Energy (TSE:NXE) Sets New 1-Year High – Here’s Why – MarketBeat (Jan 21, 2026)

- NexGen Energy (NYSE: NXE) backs Indigenous-led La Loche hotel – Stock Titan (Jan 22, 2026)

- (NXE) Strategic Market Analysis (NXE:CA) – Stock Traders Daily (Jan 24, 2026)

- NexGen Energy Accelerates Its Entry Into Uranium Mining (NYSE:NXE) – Seeking Alpha (Nov 11, 2025)

For more information about NexGen Energy Ltd., please visit the official website: nexgenenergy.ca