Home > Analyses > Communication Services > News Corporation

News Corporation shapes the way millions access information and entertainment daily, influencing public discourse and market dynamics worldwide. As a dominant force in communication services, it commands a diverse portfolio, from iconic newspapers like The Wall Street Journal to subscription video and digital real estate platforms. Renowned for its innovative content distribution and market influence, News Corp continues to evolve. The key question for investors is whether its solid fundamentals and strategic positioning still justify a compelling growth outlook in 2026.

Table of contents

Business Model & Company Overview

News Corporation, founded in 2012 and headquartered in New York City, stands as a dominant player in the entertainment and media industry. Its business weaves together a broad ecosystem of authoritative content and services spanning newspapers, digital real estate, subscription video, book publishing, and financial news, delivering a comprehensive media experience to consumers and businesses worldwide.

The company’s revenue engine balances recurring subscription services, advertising, and content licensing across the Americas, Europe, and Asia. By integrating digital platforms with traditional media, News Corp effectively monetizes its extensive portfolio including premium brands like The Wall Street Journal and Dow Jones. This diversified model creates a strong economic moat, reinforcing its influential role in shaping the future of global media.

Financial Performance & Fundamental Metrics

In this section, I analyze News Corporation’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

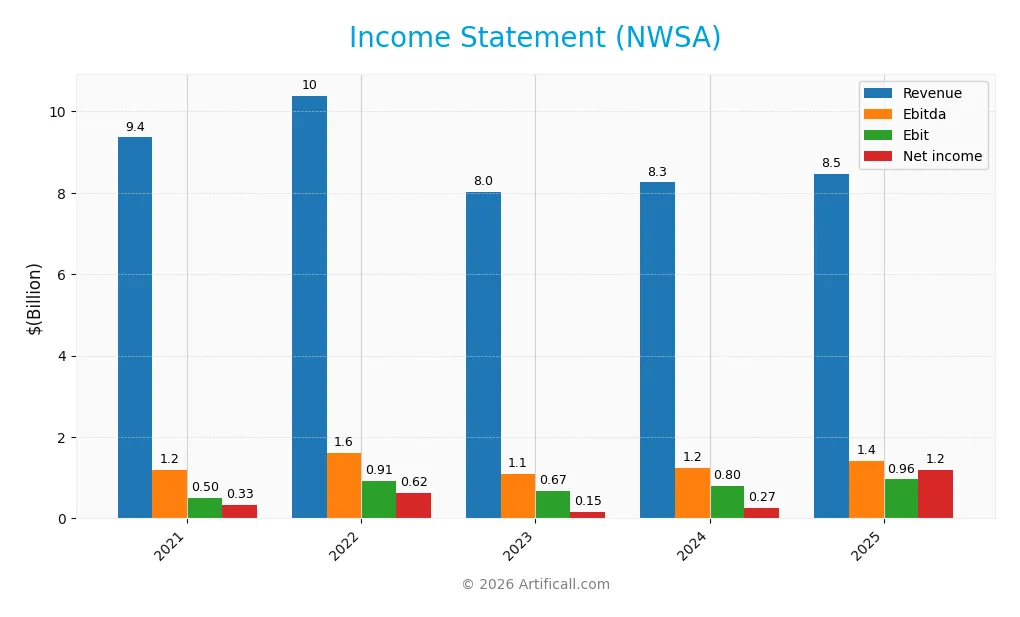

Below is News Corporation’s Income Statement for fiscal years 2021 through 2025, showing key financial figures in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 9.36B | 10.39B | 8.01B | 8.25B | 8.45B |

| Cost of Revenue | 0 | 0 | 0 | 0 | 0 |

| Operating Expenses | 8.77B | 9.40B | 7.34B | 7.45B | 7.50B |

| Gross Profit | 9.36B | 10.39B | 8.01B | 8.25B | 8.45B |

| EBITDA | 1.18B | 1.60B | 1.09B | 1.24B | 1.42B |

| EBIT | 503M | 911M | 674M | 801M | 956M |

| Interest Expense | 53M | 99M | 84M | 35M | 10M |

| Net Income | 330M | 623M | 149M | 266M | 1.18B |

| EPS | 0.56 | 1.06 | 0.26 | 0.47 | 2.08 |

| Filing Date | 2021-08-10 | 2022-08-12 | 2023-08-15 | 2024-08-13 | 2025-08-06 |

Income Statement Evolution

From 2021 to 2025, News Corporation’s revenue showed a declining trend overall, dropping by 9.68%, although there was a slight 2.42% increase in the last year. Net income, however, increased substantially by 257.58%, with net margin improving significantly by 295.91%. Margins, particularly gross and EBIT margins, remained stable and favorable, reflecting controlled operating expenses relative to revenue growth.

Is the Income Statement Favorable?

In 2025, News Corporation reported $8.45B in revenue with an EBITDA of $1.42B and EBIT of $956M, resulting in a net income of $1.18B. The net margin was a favorable 13.96%, supported by a low interest expense ratio of 0.12%. Earnings per share rose sharply by 350% year-over-year. Overall, the income statement fundamentals are assessed as favorable, driven by strong profitability and margin improvements despite modest revenue growth.

Financial Ratios

The table below presents key financial ratios for News Corporation (NWSA) over the fiscal years 2021 to 2025, offering insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.5% | 6.0% | 1.9% | 3.2% | 14.0% |

| ROE | 4.0% | 7.6% | 1.8% | 3.3% | 13.4% |

| ROIC | 3.7% | 6.5% | 2.9% | 3.8% | 5.2% |

| P/E | 46.1 | 14.8 | 75.4 | 58.6 | 14.3 |

| P/B | 1.85 | 1.12 | 1.39 | 1.92 | 1.92 |

| Current Ratio | 1.38 | 1.16 | 1.28 | 1.43 | 1.84 |

| Quick Ratio | 1.30 | 1.07 | 1.18 | 1.33 | 1.72 |

| D/E | 0.44 | 0.51 | 0.52 | 0.50 | 0.34 |

| Debt-to-Assets | 21.5% | 24.1% | 24.9% | 24.3% | 18.9% |

| Interest Coverage | 11.2 | 9.9 | 8.0 | 22.9 | 95.6 |

| Asset Turnover | 0.56 | 0.60 | 0.47 | 0.49 | 0.55 |

| Fixed Asset Turnover | 2.83 | 3.47 | 2.60 | 2.87 | 3.99 |

| Dividend Yield | 1.1% | 1.9% | 1.5% | 1.1% | 1.1% |

Evolution of Financial Ratios

From 2021 to 2025, News Corporation’s Return on Equity (ROE) showed a clear upward trend, improving from 4.0% to 13.4%, indicating enhanced profitability. The Current Ratio steadily increased from 1.38 in 2021 to 1.84 in 2025, reflecting stronger short-term liquidity. Meanwhile, the Debt-to-Equity Ratio declined from 0.44 to 0.34, suggesting a more conservative leverage position over the period.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin (13.96%) are favorable, though ROE (13.45%) and ROIC (5.16%) remain neutral. Liquidity ratios, including a current ratio of 1.84 and quick ratio of 1.72, are favorable, supporting short-term financial stability. Leverage is conservative, with a debt-to-equity of 0.34 and debt-to-assets at 19%, both favorable. Market valuation shows a moderate P/E of 14.3 (favorable) and a price-to-book of 1.92 (neutral). Overall, 64% of key ratios are favorable, indicating a generally positive financial profile.

Shareholder Return Policy

News Corporation maintains a modest dividend payout ratio of around 15.7% in 2025, with a dividend yield near 1.1% and a rising dividend per share over recent years. The company’s dividend payments are comfortably covered by free cash flow, and it also engages in share repurchases, supporting shareholder returns.

This balanced distribution approach, combining dividends and buybacks, appears aligned with sustainable long-term value creation. The relatively low payout ratio and coverage by operating cash flow suggest prudent risk management, avoiding excessive distributions or repurchase risks.

Score analysis

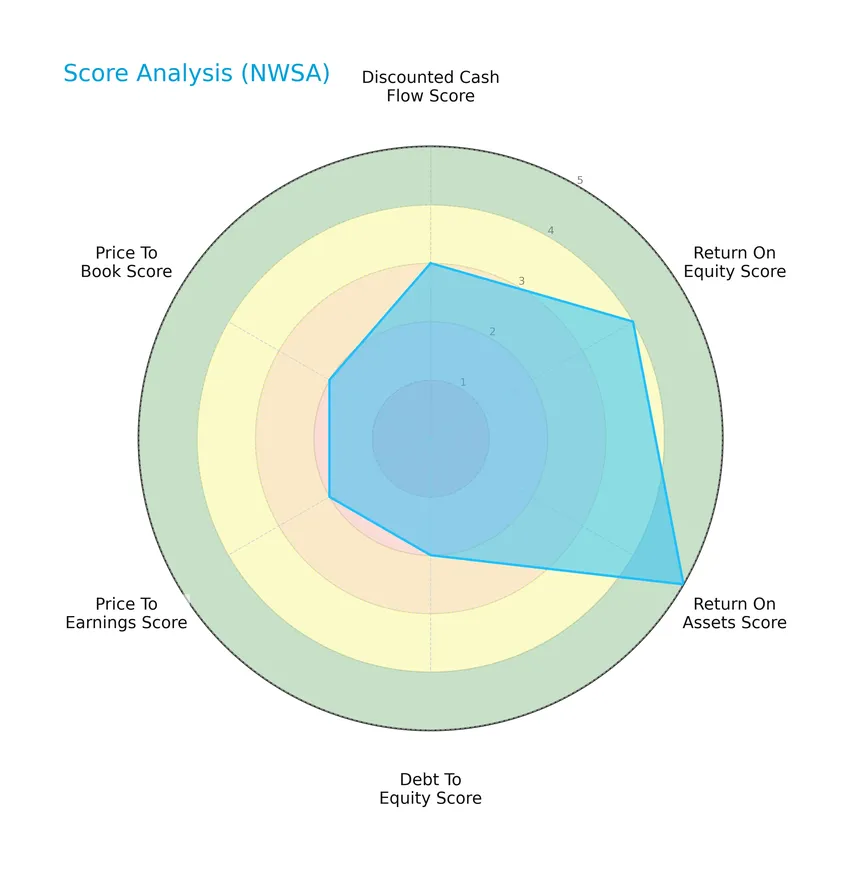

Here is a radar chart summarizing the key financial scores for News Corporation:

The company shows a very favorable return on assets score of 5 and a favorable return on equity score of 4. Moderate scores appear for discounted cash flow (3), debt to equity (2), price to earnings (2), and price to book ratios (2), indicating mixed valuation and leverage metrics.

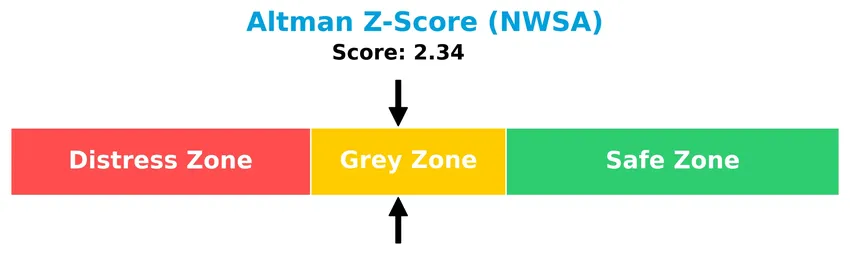

Analysis of the company’s bankruptcy risk

The Altman Z-Score places News Corporation in the grey zone, indicating a moderate risk of bankruptcy that investors should monitor carefully:

Is the company in good financial health?

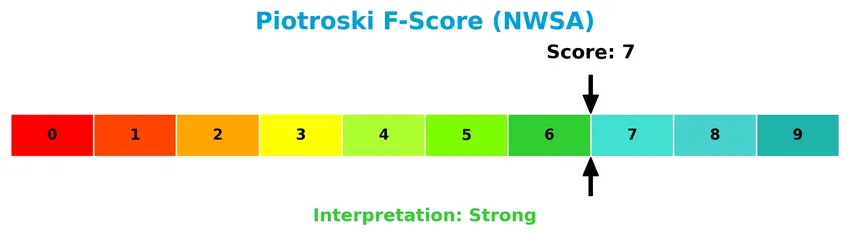

The Piotroski Score diagram highlights the company’s strong financial health status:

With a score of 7, News Corporation demonstrates strong financial strength, reflecting solid profitability, liquidity, and operational efficiency according to this metric.

Competitive Landscape & Sector Positioning

This sector analysis will examine News Corporation’s strategic positioning, revenue streams, key products, and main competitors within the communication services industry. I will explore whether News Corporation holds a competitive advantage relative to its peers.

Strategic Positioning

News Corporation maintains a diversified product portfolio across media, publishing, subscription video, and digital real estate services, generating balanced revenues from key segments like Dow Jones and News Media. Geographically, it leverages exposure in the US and Canada (4.1B in 2025) and Australasia (2.6B), supporting broad market reach.

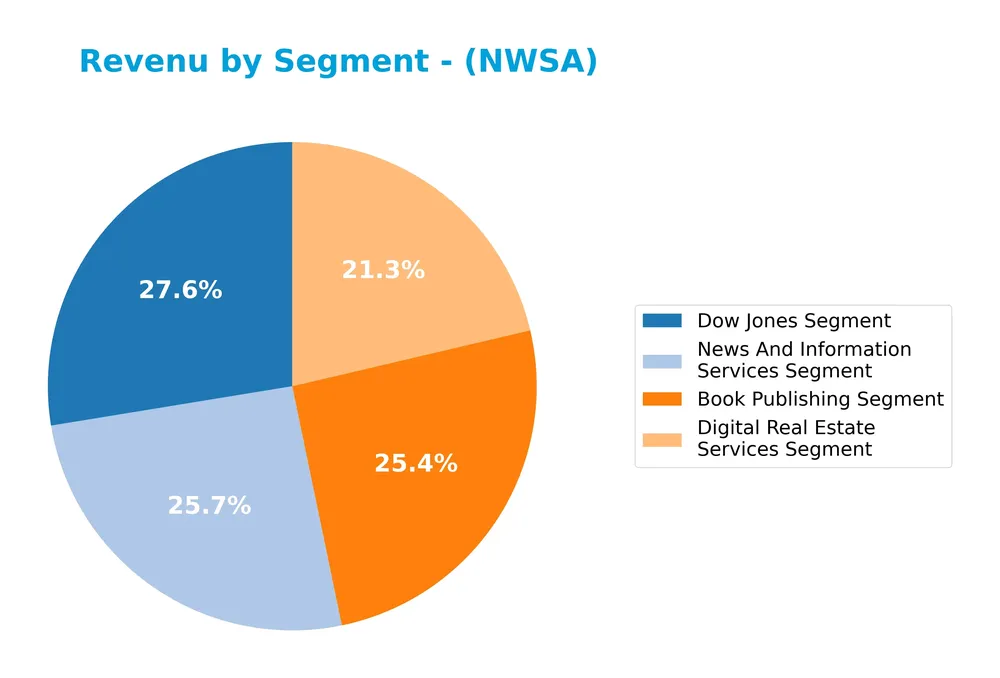

Revenue by Segment

The pie chart illustrates News Corporation’s revenue breakdown by segment for the fiscal year 2025, highlighting the contribution of each business area to the overall income.

In 2025, the Dow Jones Segment led revenues with $2.33B, closely followed by News and Information Services at $2.17B, and Book Publishing at $2.15B. Digital Real Estate Services showed steady growth, reaching $1.80B. Compared to 2024, there is a slight revenue increase in key segments, reflecting stable performance with moderate growth in digital services, though subscription video services were not reported in 2025, indicating a possible strategic shift or consolidation risk.

Key Products & Brands

The following table presents News Corporation’s key products and brands with brief descriptions:

| Product | Description |

|---|---|

| Digital Real Estate Services | Property and property-related advertising and services offered via websites and mobile applications. |

| Dow Jones | Financial and business news, data, and information services including The Wall Street Journal and Barron’s. |

| News And Information Services | Distribution of content and data products through newspapers, websites, apps, newsletters, podcasts, and video. |

| Book Publishing | Publishing of general fiction, nonfiction, children’s, and religious books. |

| Subscription Video Services | Sports, entertainment, and news services delivered to pay-TV and streaming subscribers via cable, satellite, and internet. |

News Corporation’s product portfolio spans diverse media and information services, including digital real estate platforms, renowned financial news brands, broad news distribution channels, book publishing, and subscription video offerings.

Main Competitors

There are 8 competitors in the Communication Services sector, with the table showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

| TKO Group Holdings, Inc. | 16.9B |

| News Corporation | 16.6B |

| News Corporation | 14.8B |

| Paramount Skydance Corporation Class B Common Stock | 14.1B |

News Corporation ranks 7th among its 8 competitors by market capitalization, with a market cap roughly 3.94% that of the top player, Netflix. It sits below both the average market cap of the top 10 competitors (73.2B) and the sector median (25.1B). The company has a 9.2% market cap gap below the next competitor above it, indicating a modest distance to its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does News Corporation have a competitive advantage?

News Corporation currently shows a slightly unfavorable competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite improving profitability. Its income statement is largely favorable, with strong net margin growth and efficient cost management supporting overall financial health.

Looking ahead, the company’s diverse media portfolio and multi-segment operations—including digital real estate, subscription video, and publishing—position it to leverage new content distribution channels and expanding markets. Continued growth in ROIC suggests potential for enhanced value creation as it adapts to evolving consumer preferences and technological opportunities.

SWOT Analysis

This SWOT analysis highlights News Corporation’s key internal and external factors to guide investors in understanding its strategic position.

Strengths

- diversified media segments

- strong net margin at 13.96%

- favorable financial ratios including low debt and high interest coverage

Weaknesses

- declining revenue trend overall (-9.68% over 5 years)

- slight value destruction as ROIC below WACC

- moderate Piotroski and Altman Z-score indicating financial risks

Opportunities

- growth in digital real estate and subscription video services

- expanding global digital content demand

- increasing ROIC trend signals improving profitability

Threats

- intense competition in media and entertainment

- regulatory risks in multiple regions

- disruption from changing consumer media habits

Overall, News Corporation shows solid profitability and financial health but faces challenges from declining revenue and value destruction. Strategic focus on digital growth and cost control is crucial to leverage opportunities and mitigate risks.

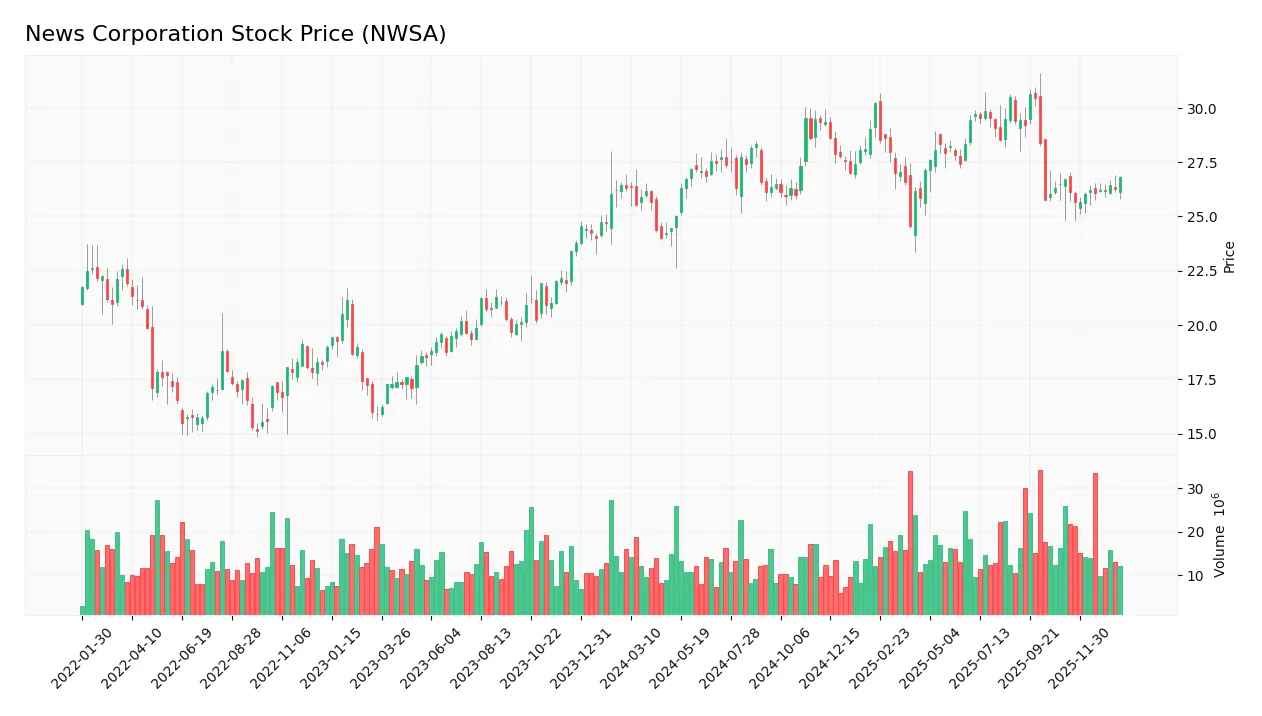

Stock Price Action Analysis

The following weekly chart illustrates News Corporation’s stock price movements over the past 12 months, highlighting key fluctuations and trend points:

Trend Analysis

Over the past 12 months, News Corporation’s stock price increased by 1.9%, indicating a bullish trend with acceleration. The price ranged between a low of 24.02 and a high of 30.62, with moderate volatility reflected by a standard deviation of 1.5. Recent months show a mild uptrend with a 0.41% gain and low volatility.

Volume Analysis

In the last three months, trading volume has been increasing overall, with a slight seller dominance at 44.11% buyer volume. This shift suggests cautious investor sentiment and heightened market participation, as sellers have marginally outpaced buyers despite the rising volume trend.

Target Prices

Analysts present a varied but optimistic target price consensus for News Corporation.

| Target High | Target Low | Consensus |

|---|---|---|

| 45 | 16 | 33.33 |

The target prices suggest expectations of moderate upside potential, with a consensus price notably above current levels, indicating cautious optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to News Corporation’s market performance.

Stock Grades

Here is a summary of recent verified grades from established financial institutions for News Corporation (NWSA):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

The overall trend reflects predominantly positive sentiment, with multiple “Buy” and “Overweight” ratings maintained or upgraded. Notably, Macquarie’s recent downgrade to “Neutral” stands out as a more cautious view amid otherwise favorable assessments.

Consumer Opinions

Consumers express a mix of admiration and concern regarding News Corporation’s services and content, reflecting diverse expectations from a major media conglomerate.

| Positive Reviews | Negative Reviews |

|---|---|

| “News Corp provides comprehensive coverage with timely updates.” | “Sometimes biased reporting affects trust.” |

| “The variety of content across platforms is impressive.” | “Customer service can be slow to respond.” |

| “Innovative digital tools enhance the reading experience.” | “Subscription costs feel high compared to competitors.” |

| “Strong investigative journalism stands out.” | “Occasional technical glitches on the app.” |

Overall, consumers appreciate News Corporation’s extensive content and innovation but often cite concerns about editorial bias and service issues, suggesting areas for improvement in transparency and customer support.

Risk Analysis

Below is a summary table outlining key risks associated with investing in News Corporation (NWSA), focusing on their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Exposure to fluctuations in media and entertainment sector valuations and consumer demand. | Medium | High |

| Regulatory Risk | Potential changes in media regulations or antitrust policies affecting operations globally. | Medium | Medium |

| Technological | Risk of disruption from digital innovation and shifting consumer preferences in media consumption. | High | High |

| Financial Health | Moderate risk due to current Altman Z-Score in the grey zone indicating some bankruptcy risk. | Medium | High |

| Competition | Intense competition in digital content and subscription services could pressure margins. | High | Medium |

The most significant risks for News Corporation stem from technological disruption and financial health concerns. Although its Piotroski Score is strong at 7, the Altman Z-Score of 2.34 places it in a grey zone, signaling moderate bankruptcy risk, warranting careful monitoring.

Should You Buy News Corporation?

News Corporation appears to be improving its profitability with growing operational efficiency despite a slightly unfavorable moat that suggests value erosion. Supported by a manageable leverage profile and a very favorable B+ rating, its financial health could be seen as moderate but improving.

Strength & Efficiency Pillars

News Corporation exhibits solid profitability with a net margin of 13.96% and a return on equity measured at 13.45%, indicating stable earnings generation relative to shareholder equity. The company maintains a strong financial health profile, supported by an Altman Z-Score of 2.34, placing it in the grey zone but with a Piotroski Score of 7, reflecting robust internal financial strength. Its weighted average cost of capital (WACC) stands at 7.49%, which exceeds the return on invested capital (ROIC) of 5.16%, indicating that while operational efficiency is improving, the company currently does not create value over its capital costs.

Weaknesses and Drawbacks

Despite favorable profitability, News Corporation faces valuation and leverage concerns. The price-to-earnings ratio of 14.3 and price-to-book ratio of 1.92 suggest a moderate premium, which might limit upside potential. Leverage metrics remain conservative, with a debt-to-equity ratio of 0.34 and a healthy current ratio of 1.84, but recent market dynamics show seller dominance at 55.89% in the latest period, signaling short-term selling pressure that could weigh on the stock price. Additionally, revenue growth remains sluggish, with a 1-year growth rate of 2.42% and a negative overall period trend of -9.68%, suggesting challenges in top-line expansion.

Our Verdict about News Corporation

The long-term fundamental profile for News Corporation appears favorable, supported by strong profitability and financial health metrics. However, despite a bullish overall stock trend and increasing volume, recent seller dominance and modest revenue growth suggest a cautious stance. Investors might consider that despite underlying strengths, recent market pressure could warrant a wait-and-see approach for a more advantageous entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Assessing News Corp (NWSA) Valuation After A Recent Share Price Move – Yahoo Finance (Jan 22, 2026)

- Rakuten Investment Management Inc. Invests $4.38 Million in News Corporation $NWSA – MarketBeat (Jan 23, 2026)

- News Corporation (NWSA) Announces Updates on Stock Repurchase Pr – GuruFocus (Jan 20, 2026)

- Feb. 5: News Corp leaders to detail Q2 2026 results in live webcast – Stock Titan (Jan 20, 2026)

- News Corp outlines $1 billion 2025 share buyback – TipRanks (Jan 23, 2026)

For more information about News Corporation, please visit the official website: newscorp.com