Home > Analyses > Industrials > Nano Nuclear Energy Inc

Nano Nuclear Energy Inc is revolutionizing the energy landscape with its cutting-edge microreactor technologies, promising safer and more efficient power solutions. As a pioneering force in industrial machinery, its flagship projects—ZEUS solid-core battery reactor and ODIN low-pressure coolant reactor—highlight its commitment to innovation and sustainable energy. With a strategic focus on fuel fabrication and nuclear consultation, the company stands at a crossroads: can its bold advancements translate into sustained growth and justify its current market valuation?

Table of contents

Business Model & Company Overview

Nano Nuclear Energy Inc, founded in 2021 and headquartered in New York City, stands at the forefront of the microreactor technology sector within the industrial machinery industry. Its core mission revolves around pioneering an integrated ecosystem of advanced nuclear solutions, including the ZEUS solid-core battery reactor and the ODIN low-pressure coolant reactor, alongside fuel fabrication and nuclear consultation services. This cohesive approach positions the company as a cutting-edge innovator shaping the future of small-scale nuclear power.

The company’s revenue engine balances cutting-edge hardware development with specialized services, such as fuel supply and transport consultation, creating multiple value streams. Nano Nuclear Energy’s strategic presence in the US market underpins its growth potential, with ongoing initiatives likely to impact global nuclear power trends. Its competitive advantage lies in its unique technology portfolio and early positioning in a niche yet critical energy segment, granting it a durable economic moat in the evolving nuclear landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze Nano Nuclear Energy Inc’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

The table below summarizes Nano Nuclear Energy Inc’s key income statement figures for fiscal years 2022 through 2025, reflecting its financial performance and earnings per share.

| 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|

| Revenue | 0 | 0 | 0 | 0 |

| Cost of Revenue | 0 | 0 | 107K | 0 |

| Operating Expenses | 1.06M | 6.28M | 10.47M | 45.01M |

| Gross Profit | 0 | 0 | -107K | 0 |

| EBITDA | -1.03M | -6.25M | -10.04M | -46.22M |

| EBIT | -1.03M | -6.25M | -10.15M | 0 |

| Interest Expense | 0 | 0 | 0 | 0 |

| Net Income | -1.03M | -6.25M | -10.15M | -40.07M |

| EPS | -0.0361 | -0.22 | -387.13 | -1.06 |

| Filing Date | 2022-09-30 | 2023-09-30 | 2024-12-30 | 2025-12-18 |

Income Statement Evolution

From 2022 to 2025, Nano Nuclear Energy Inc reported zero revenue, reflecting no sales activity. Net income deteriorated significantly, with losses growing from -1M in 2022 to -40M in 2025. Gross and EBIT margins remained at 0%, indicating no profitability, while net margin stayed unfavorable throughout. Despite a 100% growth in gross profit and EBIT in the last year, overall margins show persistent weakness.

Is the Income Statement Favorable?

The 2025 income statement shows a substantial net loss of -40M and an EPS of -1.06, confirming ongoing negative profitability. Operating expenses surged to 45M, driven by R&D and administrative costs, with no revenue to offset them. Interest expenses are negligible, which is favorable, but the absence of income and high losses lead to an unfavorable fundamental assessment for the period.

Financial Ratios

The following table presents key financial ratios for Nano Nuclear Energy Inc (NNE) over the fiscal years 2022 to 2025, providing insight into liquidity, profitability, valuation, and leverage metrics:

| Ratios | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Net Margin | 0 | 0 | 0 | 0 |

| ROE | -49% | -89% | -32% | 0% |

| ROIC | -50% | -90% | -31% | 0% |

| P/E | -144 | -24 | -37 | -36 |

| P/B | 70.3 | 21.2 | 11.9 | 0.007 |

| Current Ratio | 16.3 | 31.8 | 16.0 | 53.5 |

| Quick Ratio | 16.3 | 31.8 | 16.0 | 53.5 |

| D/E | 0 | 0 | 0.061 | 0.013 |

| Debt-to-Assets | 0 | 0 | 0.055 | 0.012 |

| Interest Coverage | 0 | 0 | 0 | 0 |

| Asset Turnover | 0 | 0 | 0 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 |

| Dividend Yield | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

From 2022 to 2025, Nano Nuclear Energy Inc’s current ratio exhibited a rising trend, increasing significantly from 16.31 to 53.48, indicating improved liquidity. The debt-to-equity ratio remained consistently low around 0.01, reflecting minimal leverage. However, profitability measures such as Return on Equity (ROE) stayed negative and stable, signaling ongoing challenges in generating profit.

Are the Financial Ratios Favorable?

In 2025, the company showed mixed financial health: liquidity ratios like quick ratio (53.48) were favorable, while the current ratio was deemed unfavorable despite its high level. Profitability ratios, including ROE (-0.02) and net margin (0%), were unfavorable, reflecting losses. Low debt ratios (debt-to-equity 0.01, debt-to-assets 1.22%) were favorable, but asset turnover and interest coverage were unfavorable, resulting in an overall unfavorable financial ratio assessment.

Shareholder Return Policy

Nano Nuclear Energy Inc does not pay dividends, reflecting its negative net income and high investment in growth and development. The company has no dividend payout, with net losses per share and no dividend yield, indicating a reinvestment strategy prioritizing long-term value creation.

Despite the absence of dividends, the firm does not engage in share buybacks. This approach, common for companies in early or capital-intensive stages, suggests a focus on preserving cash and funding operations, which may support sustainable shareholder value over time if growth materializes.

Score analysis

The following radar chart displays the company’s key financial scores to provide a comprehensive performance overview:

Nano Nuclear Energy Inc shows a mixed profile with very unfavorable returns on equity and assets, as well as poor valuation metrics. However, its debt-to-equity ratio is very favorable, indicating strong leverage management despite other weaknesses.

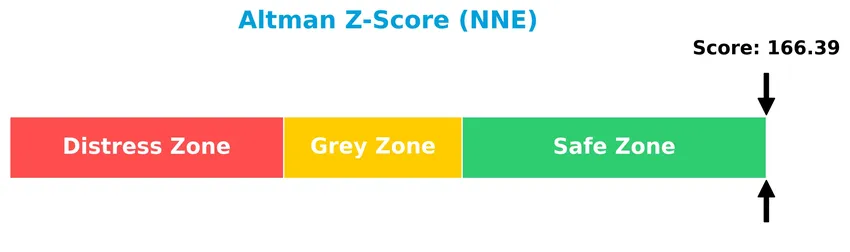

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that the company is situated well within the safe zone, suggesting a very low risk of bankruptcy at this time:

Is the company in good financial health?

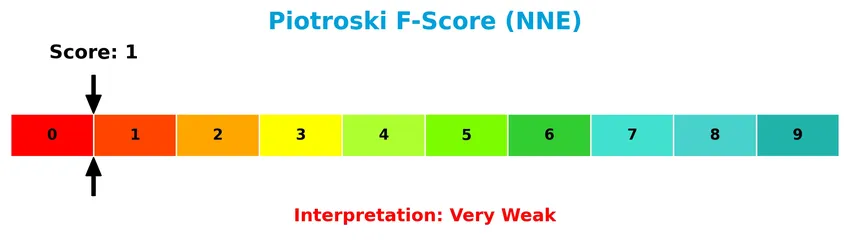

This diagram illustrates the Piotroski Score to assess the company’s financial strength:

With a Piotroski Score of 1, Nano Nuclear Energy Inc is classified as very weak in financial health, reflecting significant challenges in profitability and operational efficiency despite other financial indicators.

Competitive Landscape & Sector Positioning

This sector analysis will examine Nano Nuclear Energy Inc’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company possesses a competitive advantage relative to its industry peers.

Strategic Positioning

Nano Nuclear Energy Inc (NNE) concentrates on microreactor technology with two main products, ZEUS and ODIN, alongside fuel fabrication and consultation services, operating solely from the US with a small workforce of 5 employees, indicating a focused product portfolio and geographic exposure.

Key Products & Brands

The following table outlines the key products and brands offered by Nano Nuclear Energy Inc:

| Product | Description |

|---|---|

| ZEUS | A solid-core battery microreactor under development by Nano Nuclear Energy Inc. |

| ODIN | A low-pressure coolant microreactor designed for advanced nuclear applications. |

| High-Assay Low-Enriched Uranium Fabrication Facility | A facility being developed to supply nuclear reactor fuel, focusing on advanced uranium processing. |

| Fuel Transportation and Nuclear Consultation Services | Services related to the transport of nuclear fuel and consulting within the nuclear industry. |

Nano Nuclear Energy Inc focuses on innovative microreactor technologies and nuclear fuel supply solutions, combining hardware development with specialized services in the nuclear sector.

Main Competitors

There are 24 competitors in the Industrials sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127.1B |

| Parker-Hannifin Corporation | 114.2B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73.0B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

Nano Nuclear Energy Inc ranks 24th among 24 competitors, with a market cap only 1.14% of the leader Eaton Corporation plc. The company is positioned well below both the average market cap of the top 10 (72.4B) and the sector median (32.4B). Its market cap is 86.55% lower than the next closest competitor above, highlighting a significant gap in scale.

Does NNE have a competitive advantage?

Nano Nuclear Energy Inc currently does not present a clear competitive advantage, as it is shedding value with a ROIC significantly below its WACC and an overall unfavorable income statement evaluation. Despite some growth in gross profit and EBIT, the company’s net margin and revenue growth remain stagnant or negative.

Looking ahead, NNE is developing innovative microreactor technologies such as the ZEUS solid-core battery reactor and the ODIN low-pressure coolant reactor, alongside plans for a uranium fuel fabrication facility. These initiatives could offer new market opportunities and support future profitability improvements.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis provides a clear snapshot of Nano Nuclear Energy Inc’s key internal and external factors to guide investment decisions.

Strengths

- innovative microreactor technology

- strong liquidity position

- low debt levels

Weaknesses

- negative profitability metrics

- high stock price volatility (beta 7.49)

- very weak Piotroski score

Opportunities

- growing demand for clean energy solutions

- expansion in nuclear fuel fabrication

- potential market leadership in microreactors

Threats

- regulatory hurdles in nuclear industry

- technological risks and delays

- intense competition from alternative energy

Overall, Nano Nuclear Energy shows promise with its cutting-edge technology and strong balance sheet, but it faces significant profitability challenges and market risks. Investors should weigh the growth potential against operational uncertainties and high volatility when considering this stock.

Stock Price Action Analysis

The following weekly chart illustrates Nano Nuclear Energy Inc’s stock price performance over the past 100 weeks, highlighting key fluctuations and trend movements:

Trend Analysis

Over the past 12 months, Nano Nuclear Energy Inc’s stock price increased by 670.07%, indicating a strong bullish trend overall, despite a recent deceleration in momentum. The stock reached a high of 47.84 and a low of 3.92, with a standard deviation of 10.76, reflecting considerable volatility in price movements.

Volume Analysis

In the last three months, trading volume has been decreasing, with seller dominance at 69% of recent activity. Buyer volume dropped to 34.8M versus seller volume at 77.3M, suggesting a shift toward selling pressure and cautious investor sentiment during this period.

Target Prices

The target consensus for Nano Nuclear Energy Inc (NNE) indicates a stable outlook with a unified price expectation.

| Target High | Target Low | Consensus |

|---|---|---|

| 50 | 50 | 50 |

Analysts show a consistent target price of 50, suggesting a clear and steady valuation expectation for NNE.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Nano Nuclear Energy Inc (NNE).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table presents recent grades from recognized financial analysts for Nano Nuclear Energy Inc (NNE):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

The overall trend shows a stable preference for a Buy rating from HC Wainwright & Co. and Benchmark, with a single notable Sell downgrade from Ladenburg Thalmann in August 2025. Consensus remains positive with a Buy rating despite this dissent.

Consumer Opinions

Consumers express a mix of enthusiasm and caution regarding Nano Nuclear Energy Inc, reflecting its innovative potential alongside some operational concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressed by the company’s cutting-edge nuclear tech and commitment to sustainability.” | “Concerns about the timeline for commercial viability remain a bit frustrating.” |

| “Strong leadership team and promising partnerships in the nuclear sector.” | “Customer service response times could be improved.” |

| “Clear focus on reducing carbon footprint, which aligns with my investment values.” | “Stock volatility makes it challenging for risk-averse investors.” |

Overall, consumer feedback highlights Nano Nuclear Energy’s innovation and eco-friendly approach as key strengths, while some express unease about execution timelines and customer support.

Risk Analysis

Below is a summary table outlining the key risks facing Nano Nuclear Energy Inc, highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Negative profitability metrics and weak returns on equity/assets indicate financial fragility. | High | High |

| Market Volatility | High beta (7.49) implies significant stock price volatility, increasing market risk. | High | Medium |

| Technological Risk | Developing novel microreactor technologies involves R&D uncertainties and regulatory hurdles. | Medium | High |

| Liquidity Risk | Extremely high current and quick ratios may indicate inefficient asset use affecting liquidity. | Medium | Medium |

| Bankruptcy Risk | Despite weak financial scores, a very high Altman Z-Score suggests low bankruptcy probability. | Low | High |

| Valuation Concerns | Extremely low price-to-book and price-to-earnings ratios reflect market skepticism on value. | High | Medium |

The most pressing risks are the company’s poor profitability and negative returns, combined with high stock volatility. Investors should exercise caution due to these financial weaknesses amid ongoing technology development challenges. However, the very high Altman Z-Score implies bankruptcy risk remains low for now.

Should You Buy Nano Nuclear Energy Inc?

Nano Nuclear Energy Inc appears to be navigating a challenging profitability landscape with improving operational efficiency but a slightly unfavorable moat as value is still being shed. Despite a very favorable leverage profile, the overall investment rating could be seen as moderate to low, suggesting cautious analytical interpretation.

Strength & Efficiency Pillars

Nano Nuclear Energy Inc exhibits a strong financial safety net as evidenced by an Altman Z-Score of 166.39, placing it firmly in the safe zone against bankruptcy risk. The company shows very favorable leverage metrics, including a low debt-to-equity ratio of 0.01 and a debt-to-assets ratio of 1.22%, indicating prudent financial management. Despite these strengths, profitability metrics such as ROE (-2%) and ROIC (-2%) are negative, and the company is currently shedding value relative to its WACC of 15.16%. The Piotroski score of 1 further highlights weak operational fundamentals.

Weaknesses and Drawbacks

Nano Nuclear Energy faces significant profitability challenges, with net, gross, and EBIT margins all at 0%, reflecting operational inefficiencies. Its valuation signals mixed interpretations: a negative P/E ratio of -36.49 and an ultra-low P/B of 0.01 suggest market skepticism or distress rather than premium positioning. Liquidity is distorted, with a current ratio at an unusually high 53.48, which may indicate inefficiencies in working capital management. Market sentiment is currently unfavorable—seller dominance at 68.95% in the recent period points to short-term selling pressure that could weigh on share performance.

Our Verdict about Nano Nuclear Energy Inc

The company’s long-term fundamental profile appears unfavorable due to weak profitability and value destruction despite strong solvency signals. While the overall stock trend remains bullish with a 670.07% price increase over the longer term, the recent seller-dominant phase and decelerating momentum suggest caution. Despite its financial safety and low leverage, Nano Nuclear Energy might appear risky for immediate entry and could benefit from a wait-and-see approach to gauge improvement in operational performance and market sentiment.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Can Nano Nuclear Energy Stock Beat the Market in 2026? – Yahoo Finance (Jan 24, 2026)

- NANO Nuclear Energy: Timeline Ambiguity Hurts Speculative Bulls (NASDAQ:NNE) – Seeking Alpha (Jan 22, 2026)

- NANO Nuclear Energy Issues Request for Information Soliciting Potential Commercial Partner Input in Support of U.S. Department of Energy and NASA Lunar Surface Reactor Program – NANO Nuclear Energy Inc. (Jan 15, 2026)

- Nano Nuclear Energy (NASDAQ:NNE) Shares Gap Up – Here’s What Happened – MarketBeat (Jan 21, 2026)

- Nano Nuclear Energy Inc (NNE) Shares Gap Down to $34.8 on Jan 20 – GuruFocus (Jan 20, 2026)

For more information about Nano Nuclear Energy Inc, please visit the official website: nanonuclearenergy.com