Home > Analyses > Financial Services > Morgan Stanley

Morgan Stanley shapes the global financial landscape by delivering sophisticated capital markets solutions and wealth management services that touch millions of lives daily. As a powerhouse in financial advisory, investment management, and institutional securities, it has earned a reputation for innovation and trusted expertise since 1924. With a strong market presence and diversified offerings, the pressing question for investors is whether Morgan Stanley’s solid fundamentals still support its current valuation and growth prospects in an evolving economic environment.

Table of contents

Business Model & Company Overview

Morgan Stanley, founded in 1924 and headquartered in New York City, stands as a dominant player in the financial capital markets industry. It delivers a cohesive ecosystem of financial services spanning Institutional Securities, Wealth Management, and Investment Management. This integrated platform serves a diverse clientele, including corporations, governments, financial institutions, and individuals across the Americas, Europe, the Middle East, Africa, and Asia.

The company’s revenue engine balances capital raising, advisory, sales and trading services with wealth and investment management, blending transactional and recurring income streams. Its strategic global footprint enables access to multiple markets, driving a diversified revenue base. Morgan Stanley’s competitive advantage lies in its broad service offering and deep market penetration, securing its economic moat and influence in shaping the future of financial services worldwide.

Financial Performance & Fundamental Metrics

This section provides a fundamental analysis of Morgan Stanley, focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

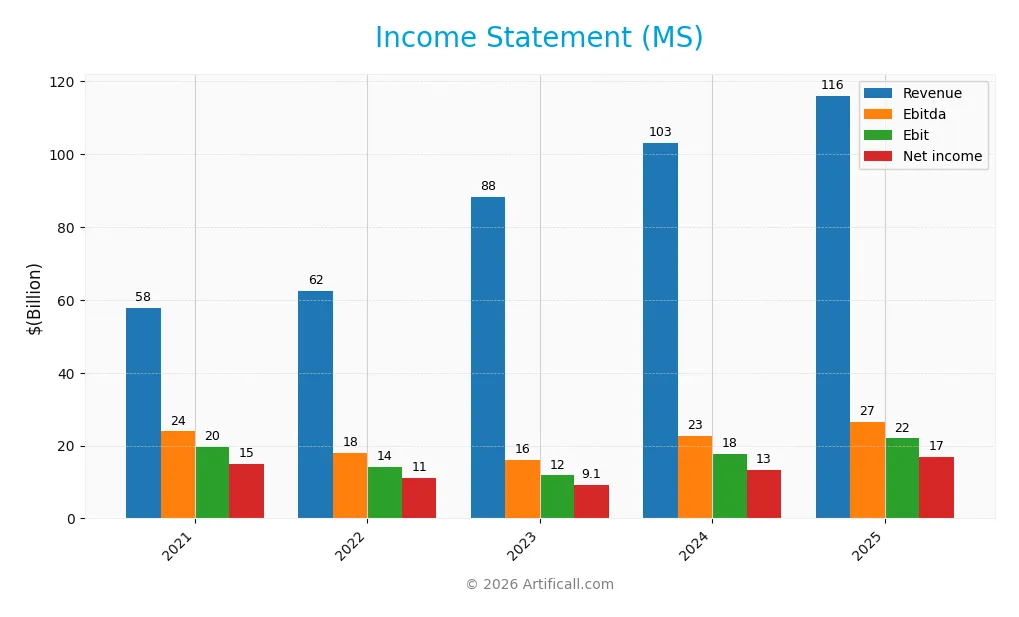

The following table presents Morgan Stanley’s key income statement figures for the fiscal years 2021 through 2025, highlighting revenue, expenses, profits, earnings per share, and filing dates.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 57.8B | 62.5B | 88.3B | 103.1B | 116.1B |

| Cost of Revenue | 1.4B | 12.5B | 38.2B | 45.8B | 49.4B |

| Operating Expenses | 36.7B | 35.8B | 38.3B | 39.8B | 44.8B |

| Gross Profit | 56.4B | 49.9B | 50.1B | 57.4B | 66.7B |

| EBITDA | 23.9B | 18.1B | 16.1B | 22.8B | 26.6B |

| EBIT | 19.7B | 14.1B | 11.8B | 17.6B | 21.9B |

| Interest Expense | 1.4B | 12.3B | 37.6B | 45.5B | 49.0B |

| Net Income | 15.0B | 11.0B | 9.1B | 13.4B | 16.9B |

| EPS | 8.16 | 6.23 | 5.24 | 8.04 | 10.34 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-22 | 2025-02-21 | 2026-01-15 |

Income Statement Evolution

From 2021 to 2025, Morgan Stanley’s revenue doubled, reaching $116B in 2025, with a 12.6% increase from 2024 alone. Net income showed a more modest 12.2% growth over the entire period but rose 11.9% year-on-year to $16.2B. Gross and EBIT margins remained favorable at 57.5% and 18.9%, respectively, though net margin declined overall despite a recent 14.5% level.

Is the Income Statement Favorable?

The 2025 income statement displays solid fundamentals, highlighted by a 24.8% EBIT growth and a 28.3% EPS increase, signaling operational efficiency and shareholder value gains. Interest expense ratio at 42.2% is unfavorable, reflecting significant borrowing costs. However, overall, 78.6% of income metrics are positive, leading to a generally favorable evaluation of the company’s profitability and growth trajectory.

Financial Ratios

The following table presents key financial ratios for Morgan Stanley (MS) over the fiscal years 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 26.0% | 17.7% | 10.3% | 13.0% | 14.5% |

| ROE | 14.3% | 11.0% | 9.2% | 12.8% | 0 |

| ROIC | 3.1% | 2.3% | 1.8% | 2.5% | 0 |

| P/E | 11.7 | 13.0 | 16.7 | 14.9 | 16.5 |

| P/B | 1.66 | 1.44 | 1.53 | 1.91 | 0 |

| Current Ratio | 0.77 | 0.72 | 0.72 | 0.66 | 0 |

| Quick Ratio | 0.77 | 0.72 | 0.72 | 0.66 | 0 |

| D/E | 2.90 | 3.08 | 3.42 | 3.45 | 0 |

| Debt-to-Assets | 25.7% | 26.2% | 28.4% | 29.7% | 0 |

| Interest Coverage | 14.4 | 1.15 | 0.31 | 0.39 | 0.45 |

| Asset Turnover | 0.049 | 0.053 | 0.074 | 0.085 | 0 |

| Fixed Asset Turnover | 3611 | 15620 | 3839 | 4485 | 0 |

| Dividend Yield | 2.38% | 3.76% | 3.80% | 3.07% | 2.17% |

Evolution of Financial Ratios

From 2021 to 2025, Morgan Stanley’s profitability margins, including net and EBIT margins, show a general decline, with net profit margin dropping from 26.0% in 2021 to 14.5% in 2025. The current ratio exhibits some volatility but trends downward, reaching zero in 2025, indicating liquidity concerns. Debt-to-equity ratio data is incomplete for 2025 but was notably high in previous years, suggesting a leveraged position with some improvement.

Are the Financial Ratios Favorable?

In 2025, Morgan Stanley’s net margin at 14.5% and dividend yield of 2.17% are favorable, reflecting decent profitability and shareholder returns. However, the absence of key liquidity ratios, low interest coverage at 0.45, and unfavorable asset turnover ratios signal operational and financial risks. The market valuation via a P/E of 16.54 is neutral, while debt-related ratios suggest a favorable stance, leading to an overall slightly unfavorable financial ratio profile.

Shareholder Return Policy

Morgan Stanley has consistently paid dividends, with a payout ratio around 36-63% and a dividend per share rising from $2.34 in 2021 to about $3.85 in 2025. Dividend yields varied from roughly 2.4% to 3.8%, supported by moderate payout coverage relative to net income.

The company also conducts share buybacks, reflecting its approach to returning capital to shareholders. While the dividend policy shows a balanced distribution, free cash flow coverage appears volatile, suggesting potential risks if cash flows weaken. Overall, the policy aims to sustain long-term shareholder value through dividends and buybacks but requires monitoring of cash flow adequacy.

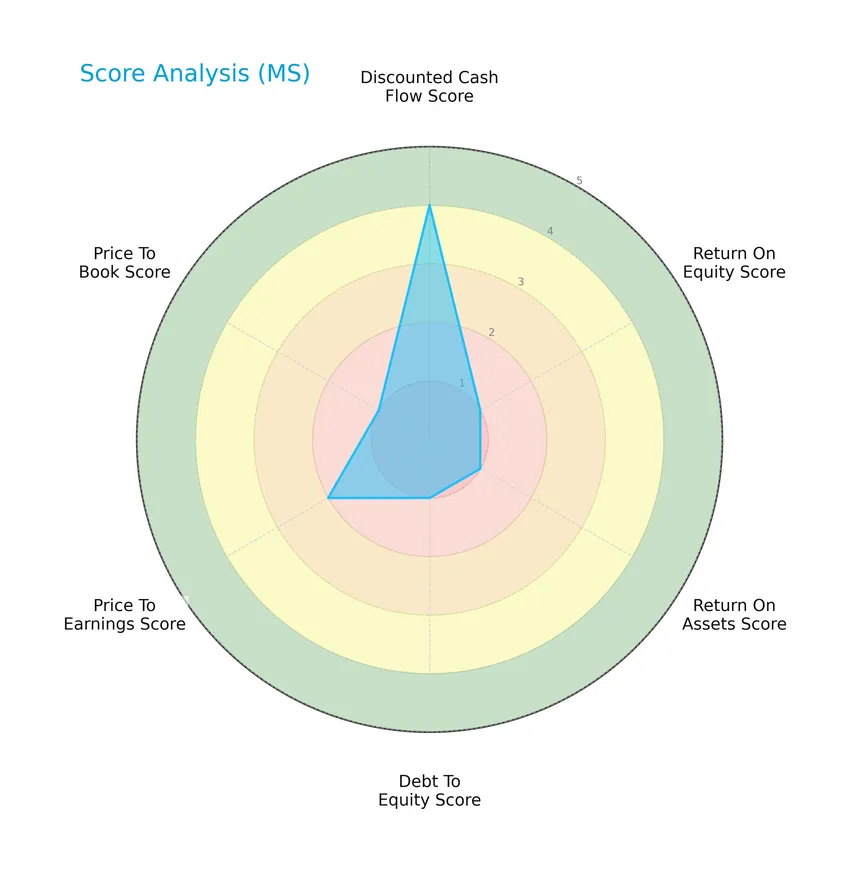

Score analysis

The radar chart below presents Morgan Stanley’s key financial scores, highlighting valuation, profitability, and leverage metrics:

Morgan Stanley’s discounted cash flow score is favorable at 4, but profitability scores such as return on equity and return on assets are very unfavorable at 1. The debt to equity and price to book scores also rate very unfavorable, while price to earnings is moderate at 2, indicating mixed financial health signals.

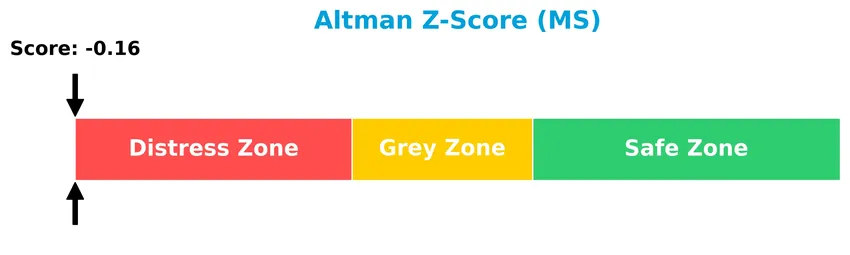

Analysis of the company’s bankruptcy risk

Morgan Stanley’s Altman Z-Score places it in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

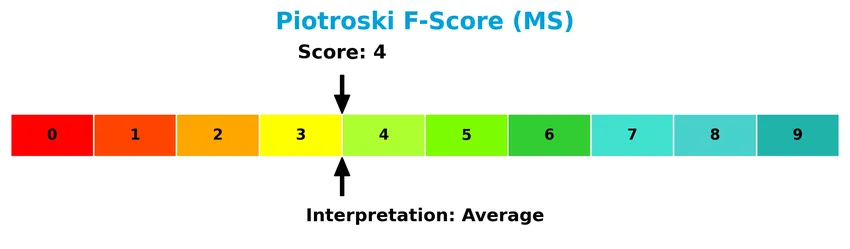

Is the company in good financial health?

This Piotroski diagram illustrates Morgan Stanley’s financial strength based on nine fundamental criteria:

With a Piotroski score of 4, Morgan Stanley falls into the average category, suggesting moderate financial health but not strong enough to be considered a robust value investment at this time.

Competitive Landscape & Sector Positioning

This sector analysis will examine Morgan Stanley’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also assess whether Morgan Stanley holds a competitive advantage over its rivals in the financial services industry.

Strategic Positioning

Morgan Stanley maintains a diversified product portfolio across Institutional Securities, Wealth Management, and Investment Management, generating $28.1B, $28.4B, and $5.9B in 2024 revenue respectively. Geographically, it operates globally with significant exposure in the Americas ($46.9B), Asia ($7.6B), and EMEA ($7.2B).

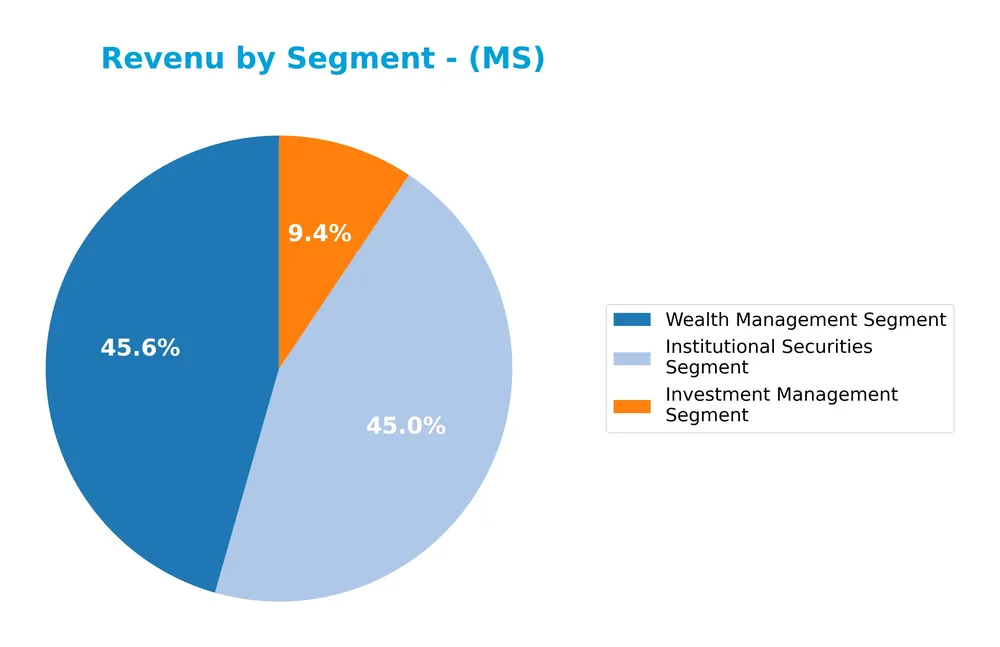

Revenue by Segment

This pie chart illustrates Morgan Stanley’s revenue distribution across its main business segments for the fiscal year 2024, highlighting the contribution of each segment to total revenue.

In 2024, Morgan Stanley’s Wealth Management and Institutional Securities segments remain the primary revenue drivers, generating $28.4B and $28.1B respectively, showing strong and nearly balanced growth. The Investment Management segment, while smaller at $5.9B, continues to grow steadily. The recent year indicates a stabilization with no severe concentration risk, as revenue is well diversified between wealth management and institutional activities.

Key Products & Brands

The following table summarizes Morgan Stanley’s main products and services across its key business segments:

| Product | Description |

|---|---|

| Institutional Securities | Capital raising, financial advisory, underwriting of debt and equity, mergers and acquisitions advice, sales and trading services including equities, fixed income, foreign exchange, and commodities, secured lending, and asset-backed and mortgage lending. |

| Wealth Management | Financial advisor-led brokerage, investment advisory, self-directed brokerage, wealth planning, stock plan administration, annuities, insurance products, securities-based lending, residential real estate loans, banking, and retirement plan services for individual investors and small to medium businesses. |

| Investment Management | Management of equity, fixed income, liquidity, and alternative products for benefit plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, and corporations via institutional and intermediary channels. |

Morgan Stanley operates through three main segments offering a broad range of financial services, with Institutional Securities and Wealth Management generating the largest revenue contributions in 2024.

Main Competitors

There are 6 main competitors in the Financial – Capital Markets industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Morgan Stanley | 289B |

| The Goldman Sachs Group, Inc. | 287B |

| The Charles Schwab Corporation | 185B |

| Robinhood Markets, Inc. | 102B |

| Raymond James Financial, Inc. | 33B |

| Hut 8 Corp. | 5B |

Morgan Stanley ranks 1st among its 6 competitors, holding a market cap nearly equal to the leader benchmark (98.41%). It is positioned above both the average market cap of the top 10 (150B) and the median market cap of its sector (143B). The company maintains a very narrow margin over its closest competitor, Goldman Sachs, with a distance of -0.82%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MS have a competitive advantage?

Morgan Stanley demonstrates several favorable financial metrics, such as a strong gross margin of 57.48% and an EBIT margin of 18.91%, supporting efficient operations in the competitive financial capital markets industry. Despite a declining ROIC trend, the company’s consistent revenue growth (12.57% in the last year and over 100% across 2021-2025) and positive net margin growth indicate resilience and effective management in generating returns.

Looking ahead, Morgan Stanley’s diversified global presence across the Americas, Asia, and EMEA, along with its broad product offerings in Institutional Securities, Wealth Management, and Investment Management, position it to capture opportunities in expanding markets. Continued innovation in financial advisory, capital raising, and trading services, coupled with investment in new client segments, may further contribute to its future growth potential.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting Morgan Stanley to guide investors in their decision-making.

Strengths

- Strong global brand with diverse financial services

- Robust revenue growth of 12.57% in 2025

- Favorable gross margin at 57.48%

Weaknesses

- High interest expense ratio at 42.22%

- Declining ROIC trend

- Unfavorable liquidity ratios (current and quick)

Opportunities

- Expansion in Asia and EMEA markets with rising revenues

- Growth in wealth and investment management segments

- Digital transformation and fintech integration

Threats

- Market volatility impacting capital markets segment

- Intense competition in financial services

- Regulatory changes increasing compliance costs

Overall, Morgan Stanley’s strengths in brand and revenue growth provide a solid foundation, but its weaknesses in cost structure and declining returns warrant caution. Strategic focus on geographic expansion and technology adoption can capitalize on opportunities while managing evolving market and regulatory threats.

Stock Price Action Analysis

The weekly stock chart for Morgan Stanley (MS) illustrates price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 12 months, Morgan Stanley’s stock price increased by 106.94%, indicating a strong bullish trend with acceleration. The price ranged between a low of 86.19 and a high of 189.09, accompanied by significant volatility with a standard deviation of 27.23. Recent weeks also show a positive slope of 2.39 and a 10.22% gain.

Volume Analysis

In the last three months, trading volume has been decreasing overall, with buyers slightly dominant at 59.47%. This buyer-driven activity suggests moderate confidence among investors, though the declining volume may indicate cautious participation or consolidation phases in the market.

Target Prices

Analysts show a moderately optimistic consensus on Morgan Stanley’s future price.

| Target High | Target Low | Consensus |

|---|---|---|

| 220 | 165 | 196 |

The target prices suggest that Morgan Stanley could see upside potential, with a consensus around 196, reflecting balanced bullish and cautious views.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback related to Morgan Stanley’s recent performance and services.

Stock Grades

The following table presents the latest verified stock grades for Morgan Stanley from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-16 |

| JP Morgan | Maintain | Neutral | 2026-01-08 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

| Wolfe Research | Upgrade | Outperform | 2025-11-24 |

| JP Morgan | Maintain | Neutral | 2025-10-21 |

| Barclays | Maintain | Overweight | 2025-10-16 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-16 |

| Jefferies | Maintain | Buy | 2025-10-16 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-16 |

Overall, the grades for Morgan Stanley exhibit a consistent pattern of positive outlooks, with frequent “Outperform,” “Overweight,” and “Buy” ratings, while neutrality appears less common. The consensus from 50 analysts leans clearly toward a “Buy” recommendation.

Consumer Opinions

Morgan Stanley continues to evoke a mix of admiration and critique from its clients, reflecting its complex role in the financial sector.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent customer service with knowledgeable staff | High fees compared to competitors |

| Robust digital platform that simplifies investing | Occasional delays in transaction processing |

| Strong advisory support that helps in portfolio growth | Limited accessibility for smaller investors |

Overall, consumer feedback praises Morgan Stanley for its expert advisory and user-friendly digital tools, while concerns mainly focus on fees and occasional service delays. This highlights the importance of weighing cost against quality in financial services.

Risk Analysis

Below is a table summarizing the key risks associated with investing in Morgan Stanley, focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Altman Z-Score indicates distress zone, signaling high bankruptcy risk under adverse conditions. | High | High |

| Profitability | Unfavorable ROE and ROIC suggest weak returns on equity and invested capital. | Medium | Medium |

| Liquidity | Poor current and quick ratios raise concerns on short-term liquidity and operational flexibility. | Medium | Medium |

| Debt Management | Despite some favorable debt-to-equity metrics, very unfavorable interest coverage ratio signals risk in meeting interest obligations. | Medium | High |

| Market Volatility | Beta above 1.1 implies sensitivity to market swings, increasing share price volatility risk. | High | Medium |

| Valuation | Moderate P/E and unfavorable price-to-book ratios may affect investor perception and entry price. | Medium | Medium |

| Dividend Stability | Dividend yield is favorable but depends on sustained earnings amid financial pressures. | Medium | Low |

The most critical risks for Morgan Stanley involve financial stability and debt servicing capacity, as indicated by its Altman Z-Score in the distress zone and weak interest coverage. Coupled with market volatility and mediocre profitability metrics, these factors warrant cautious risk management for investors in 2026.

Should You Buy Morgan Stanley?

Morgan Stanley appears to be navigating a challenging profile with modest profitability and a declining return on invested capital, suggesting an eroding competitive moat. Despite substantial leverage and a distress-zone Altman Z-score, the company’s overall rating could be seen as moderate to unfavorable.

Strength & Efficiency Pillars

Morgan Stanley exhibits notable profitability with a gross margin of 57.48%, an EBIT margin of 18.91%, and a net margin of 14.52%, all marked as favorable. Despite the absence of ROE and ROIC data, the company maintains a favorable discounted cash flow score (4) and demonstrates solid revenue growth of 12.57% over the past year, with a strong EPS growth of 28.3%. The Piotroski score of 4 suggests average financial strength, while debt-to-equity and debt-to-assets ratios are favorable, indicating manageable leverage and financial stability.

Weaknesses and Drawbacks

There are several red flags that temper the investment case. The Altman Z-Score of -0.16 places Morgan Stanley firmly in the distress zone, signaling significant financial risk and potential bankruptcy concerns. Return on equity and assets scores are very unfavorable, suggesting operational inefficiencies. The interest coverage ratio is critically low at 0.45, reflecting difficulty in meeting interest obligations. Valuation metrics show moderate P/E (16.54), but a very unfavorable price-to-book ratio raises concerns about market perception. Liquidity is weak with unfavorable current and quick ratios, highlighting potential short-term solvency issues.

Our Verdict about Morgan Stanley

Morgan Stanley’s long-term fundamental profile appears mixed with favorable income statement metrics but serious caution flags in financial health and leverage. The bullish overall trend and recent slight buyer dominance (59.47%) could suggest some market confidence. However, the distress zone Altman Z-Score and poor leverage ratios indicate elevated risk. Despite long-term strength in profitability and growth, these financial vulnerabilities might suggest a wait-and-see approach for a more resilient entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Morgan Stanley says buy these 14 stocks to play the 4 themes that will define markets in 2026 – Business Insider (Jan 23, 2026)

- Assessing Morgan Stanley (MS) Valuation After Earnings Beat And Wealth Management Momentum – simplywall.st (Jan 23, 2026)

- Goldman Sachs, Morgan Stanley profits soar as Wall Street capitalizes on 2025 deal boom – Yahoo Finance (Jan 15, 2026)

- Morgan Stanley earnings top estimates driven by wealth management – CNBC (Jan 15, 2026)

- Is It Too Late To Consider Morgan Stanley (MS) After A 5-Year 214% Return? – Yahoo Finance (Jan 22, 2026)

For more information about Morgan Stanley, please visit the official website: morganstanley.com