Home > Analyses > Consumer Defensive > Monster Beverage Corporation

Monster Beverage Corporation energizes daily life with its dynamic portfolio of energy drinks and innovative beverages that redefine refreshment across the globe. As a dominant force in the non-alcoholic beverage industry, Monster commands a strong market presence with iconic brands like Monster Energy, Java Monster, and Reign, known for their bold flavors and quality. With consumer trends continually evolving, I explore whether Monster’s robust fundamentals and innovation pipeline still support its premium valuation and growth potential.

Table of contents

Business Model & Company Overview

Monster Beverage Corporation, founded in 1985 and headquartered in Corona, California, stands as a dominant force in the non-alcoholic beverage industry. Its core mission revolves around delivering a diverse ecosystem of energy drinks, ready-to-drink teas, juices, and sparkling beverages under globally recognized brands like Monster Energy and Reign. This comprehensive portfolio caters to a broad consumer base, blending innovation with lifestyle appeal in a competitive market.

The company’s revenue engine thrives on a balanced mix of product sales spanning carbonated and non-carbonated drinks, distributed through a vast network of bottlers, retailers, and e-commerce channels across the Americas, Europe, and Asia. By leveraging its extensive global footprint and strong brand equity, Monster secures recurring demand and robust market penetration. Its enduring competitive advantage lies in shaping energy drink consumption trends, reinforcing a resilient economic moat.

Financial Performance & Fundamental Metrics

In this section, I analyze Monster Beverage Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

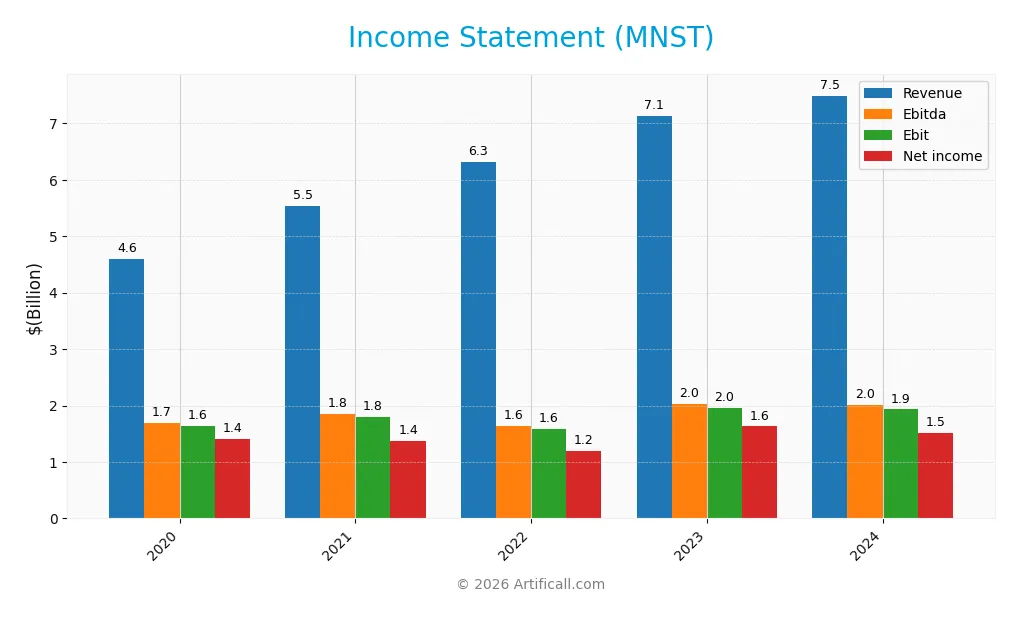

Below is the Income Statement for Monster Beverage Corporation (MNST) over the last five fiscal years, showing key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.60B | 5.54B | 6.31B | 7.14B | 7.49B |

| Cost of Revenue | 1.87B | 2.43B | 3.14B | 3.35B | 3.44B |

| Operating Expenses | 1.09B | 1.31B | 1.59B | 1.84B | 2.12B |

| Gross Profit | 2.72B | 3.11B | 3.17B | 3.79B | 4.05B |

| EBITDA | 1.69B | 1.85B | 1.65B | 2.02B | 2.01B |

| EBIT | 1.63B | 1.80B | 1.58B | 1.95B | 1.93B |

| Interest Expense | 0 | 0 | 0 | 0 | 28M |

| Net Income | 1.41B | 1.38B | 1.19B | 1.63B | 1.51B |

| EPS | 1.33 | 1.30 | 1.13 | 1.56 | 1.50 |

| Filing Date | 2021-03-01 | 2022-02-28 | 2023-03-01 | 2024-02-29 | 2025-02-28 |

Income Statement Evolution

From 2020 to 2024, Monster Beverage Corporation’s revenue grew by 62.93% to $7.49B, indicating strong top-line expansion. Net income increased modestly by 7.06% over the same period, reaching $1.51B, while net margin declined by 34.29%, reflecting margin pressure. Gross margin remained favorable at 54.04%, though operating expenses grew in line with revenue, slightly compressing EBIT and net margins.

Is the Income Statement Favorable?

In 2024, fundamentals appear generally favorable despite some margin contraction. Gross profit rose 6.71% year-over-year, supporting a solid 25.76% EBIT margin. However, net margin decreased 11.83% to 20.14%, and EPS fell by 3.25%, signaling some profit margin challenges. Interest expense remains minimal at 0.37% of revenue. Overall, 57.14% of income statement metrics are positive, indicating a predominantly favorable financial condition.

Financial Ratios

The table below presents key financial ratios for Monster Beverage Corporation (MNST) over the past five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 31% | 25% | 19% | 23% | 20% |

| ROE | 27% | 21% | 17% | 20% | 25% |

| ROIC | 26% | 20% | 16% | 18% | 22% |

| P/E | 35.0 | 36.9 | 44.9 | 36.9 | 35.0 |

| P/B | 9.5 | 7.7 | 7.6 | 7.3 | 8.9 |

| Current Ratio | 4.2 | 4.9 | 4.8 | 4.8 | 3.3 |

| Quick Ratio | 3.7 | 4.2 | 3.8 | 4.0 | 2.6 |

| D/E | 0 | 0 | 0 | 0.06 | 0.06 |

| Debt-to-Assets | 0 | 0 | 0 | 0.05 | 0.05 |

| Interest Coverage | 0 | 0 | 0 | 69.2 | 69.2 |

| Asset Turnover | 0.74 | 0.71 | 0.76 | 0.74 | 0.97 |

| Fixed Asset Turnover | 14.6 | 17.7 | 12.2 | 8.0 | 7.2 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Monster Beverage Corporation’s Return on Equity (ROE) experienced a decline from 27.31% to 25.33%, indicating a slight decrease in profitability efficiency. The Current Ratio fell notably from around 4.19 in 2020 to 3.32 in 2024, reflecting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased marginally to 0.06 in 2024, remaining low and stable, suggesting minimal reliance on debt financing.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (20.14%) and ROE (25.33%) are rated favorable, supported by a strong interest coverage ratio of 69.19. Liquidity shows mixed signals: the quick ratio is favorable at 2.65, yet the current ratio is unfavorable at 3.32. Leverage remains low and favorable, with a debt-to-assets ratio of 4.84%. Market valuation ratios like P/E (34.99) and P/B (8.86) are unfavorable, while asset turnover is neutral. Overall, 64.29% of ratios are favorable, indicating a generally positive financial position.

Shareholder Return Policy

Monster Beverage Corporation (MNST) does not pay dividends, reflecting a strategic choice likely aimed at reinvestment or growth priorities. The absence of dividend payouts over recent years is complemented by no reported share buyback programs in the available data.

This approach suggests a focus on capital allocation towards operational efficiency and growth rather than immediate shareholder distributions. Without dividends or buybacks, the policy appears geared towards sustaining long-term value creation through reinvestment rather than direct returns to shareholders.

Score analysis

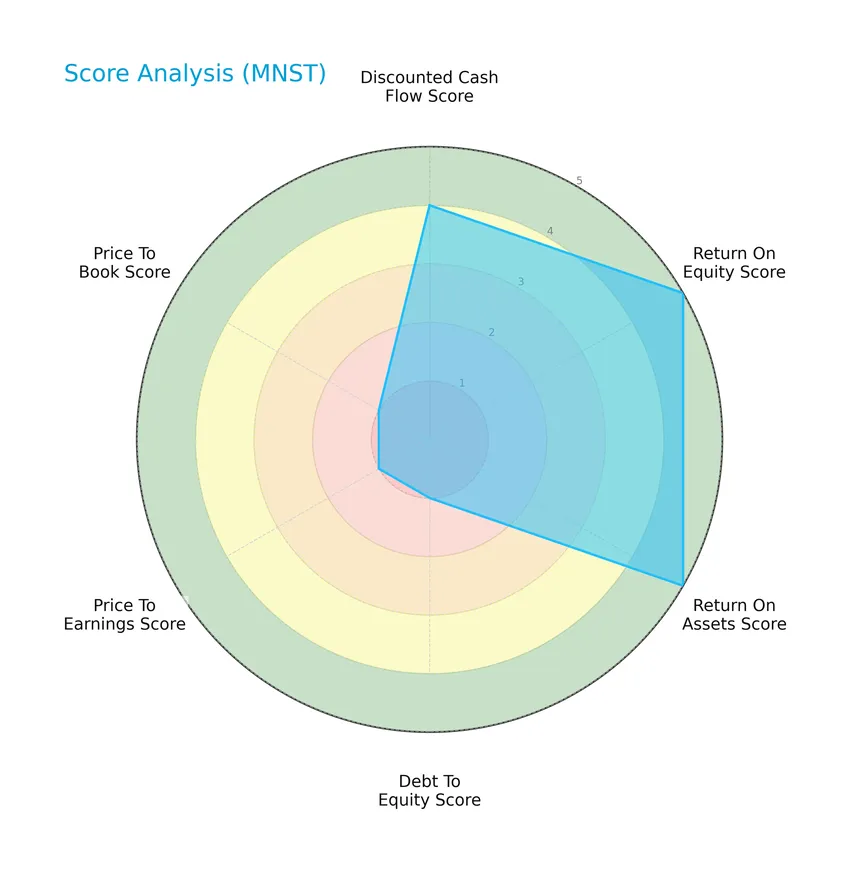

The following radar chart displays key financial scores assessing Monster Beverage Corporation’s valuation, profitability, and leverage metrics:

The company shows very favorable profitability with top scores in return on equity and assets (5 each) and a favorable discounted cash flow score (4). However, valuation and leverage metrics are very unfavorable, with debt-to-equity, price-to-earnings, and price-to-book scores all at 1, indicating potential concerns in these areas.

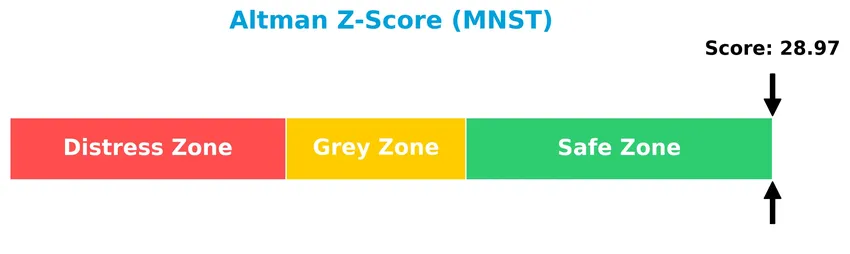

Analysis of the company’s bankruptcy risk

Monster Beverage Corporation’s Altman Z-Score places it well within the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

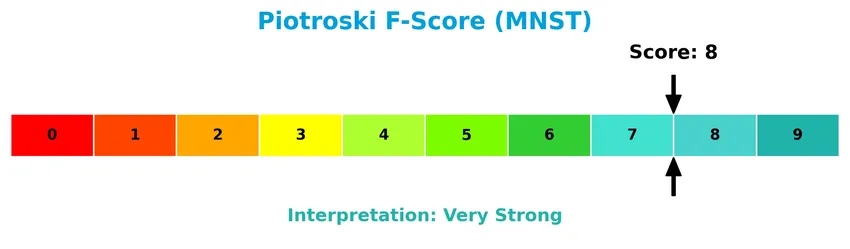

This Piotroski diagram illustrates the company’s strong financial health based on multiple criteria:

With a Piotroski Score of 8, Monster Beverage Corporation demonstrates very strong financial health, reflecting solid profitability, efficiency, and balance sheet strength.

Competitive Landscape & Sector Positioning

This sector analysis will explore Monster Beverage Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive edge within the non-alcoholic beverages industry.

Strategic Positioning

Monster Beverage Corporation primarily concentrates on energy drinks, generating $6.86B in 2024, with smaller contributions from Strategic Brands ($432M) and Alcohol Brands ($172M). Geographically, it maintains strong exposure to the U.S. and Canada ($4.72B), complemented by significant sales in EMEA ($1.56B), Latin America ($666M), and Asia Pacific ($541M).

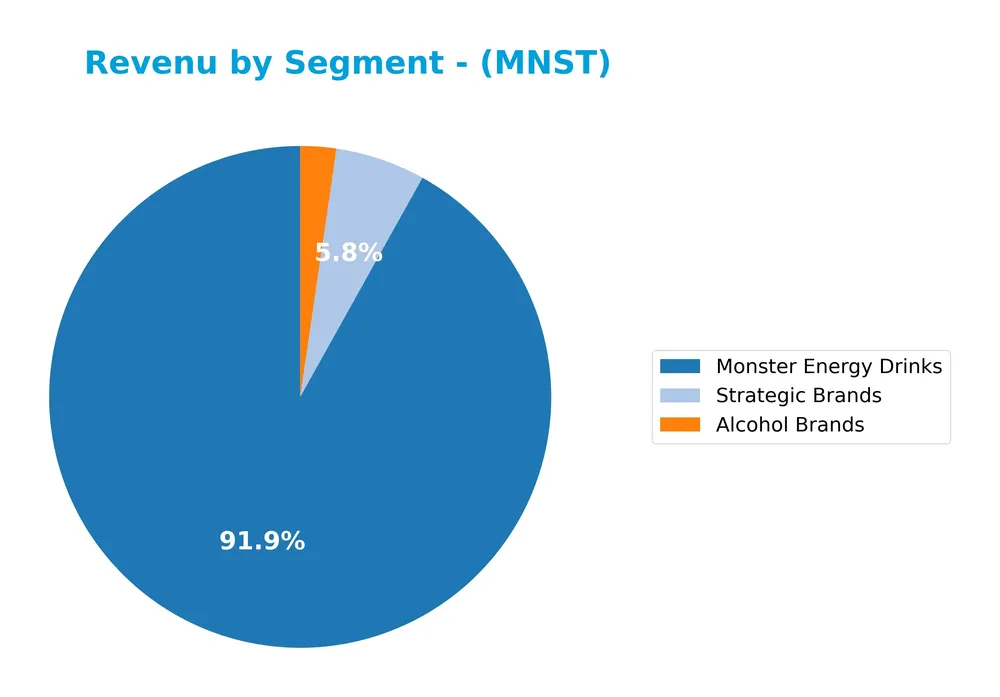

Revenue by Segment

The pie chart illustrates Monster Beverage Corporation’s revenue distribution by product segments for the fiscal year 2024.

In 2024, Monster Energy Drinks overwhelmingly dominate revenue with $6.9B, showing steady growth from $5.2B in 2021. Strategic Brands contribute $432M, reflecting moderate expansion, while Alcohol Brands represent a smaller but notable segment at $172M. The data indicates a clear concentration in energy drinks, with other segments growing but remaining relatively minor, suggesting some concentration risk despite diversification efforts.

Key Products & Brands

The table below outlines Monster Beverage Corporation’s key products and brands with brief descriptions:

| Product | Description |

|---|---|

| Monster Energy Drinks | Carbonated and non-carbonated energy drinks including Monster Energy Ultra, Monster Rehab, Java Monster, and Muscle Monster. |

| Strategic Brands | Various beverage lines including ready-to-drink iced teas, lemonades, juice cocktails, coffee drinks, sports drinks, and flavored sparkling beverages. |

| Alcohol Brands | Alcoholic beverage products under various brand names. |

| Other Segments | Includes additional beverage products such as single-serve juices, waters, and sodas. |

| Key Brand Names | Monster Energy, Monster Energy Ultra, Monster Rehab, Monster Energy Nitro, Java Monster, Muscle Monster, Espresso Monster, Punch Monster, Juice Monster, Monster Hydro Energy Water, Reign Total Body Fuel, NOS, Full Throttle, Burn, Mother, Nalu, Ultra Energy, Play, Power Play, Relentless, BPM, BU, Gladiator, Samurai, Live+, Predator, Fury, True North. |

Monster Beverage’s portfolio is led by its flagship Monster Energy Drinks segment, complemented by Strategic Brands and a growing Alcohol Brands segment, supported by a diverse range of beverage names targeting different consumer preferences.

Main Competitors

There are 7 competitors in total, with the following table listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Coca-Cola Company | 297.5B |

| PepsiCo, Inc. | 194.5B |

| Monster Beverage Corporation | 74.4B |

| Coca-Cola Europacific Partners PLC | 41.7B |

| Keurig Dr Pepper Inc. | 37.7B |

| Coca-Cola Consolidated, Inc. | 13.3B |

| Celsius Holdings, Inc. | 11.8B |

Monster Beverage Corporation ranks 3rd among its 7 competitors, holding about 27% of the market cap of the sector leader, The Coca-Cola Company. It is positioned below the average market cap of the top 10 competitors (95.8B) but remains above the sector median (41.7B). The company enjoys a significant market cap gap of +142.75% above its nearest competitor.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MNST have a competitive advantage?

Monster Beverage Corporation presents a competitive advantage as it consistently creates value with a ROIC 16.1% above its WACC, supported by favorable gross and net margins around 54% and 20%, respectively. Despite a declining ROIC trend, the company maintains strong profitability with a diverse portfolio of energy and non-alcoholic beverages serving multiple global markets.

Looking ahead, Monster’s future opportunities include expanding its presence in Asia Pacific and Latin America, where revenue growth has been steady, alongside launching new product lines within its broad brand portfolio. These initiatives could support sustained revenue growth and help offset recent margin pressures, positioning the company to leverage evolving consumer preferences internationally.

SWOT Analysis

This SWOT analysis highlights Monster Beverage Corporation’s key strategic factors to aid investors in evaluating its market position and growth potential.

Strengths

- Strong brand portfolio with diverse energy drink products

- High profitability with 20% net margin

- Solid financial health with low debt and high Altman Z-Score

Weaknesses

- High valuation multiples (PE 35, PB 8.9)

- Declining ROIC trend

- No dividend yield for income investors

Opportunities

- Expanding international presence, especially in EMEA and Asia Pacific

- Growing global demand for energy and functional beverages

- Innovation in health-conscious and natural beverage lines

Threats

- Intense competition in energy drink market

- Regulatory scrutiny on energy drink ingredients

- Economic downturns impacting discretionary spending

Overall, Monster Beverage exhibits robust financial strength and brand equity, supported by favorable profitability and risk metrics. However, its high valuation and declining ROIC warrant caution. The company’s growth strategy should focus on geographic expansion and product innovation while managing competitive and regulatory risks.

Stock Price Action Analysis

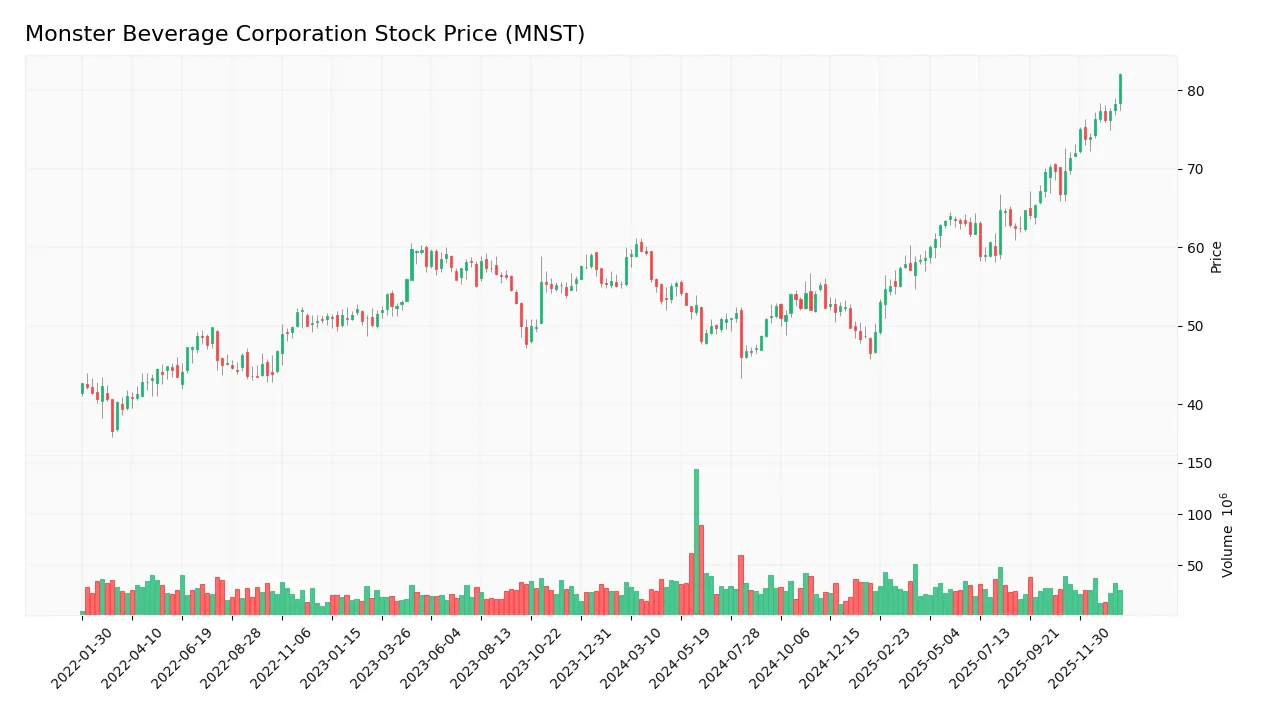

The weekly stock chart of Monster Beverage Corporation (MNST) over the past 12 months highlights significant price movements and volume shifts:

Trend Analysis

Over the past 12 months, MNST’s stock price increased by 39.48%, indicating a bullish trend with clear acceleration. The price ranged between a low of 46.06 and a high of 82.0, with volatility reflected in an 8.48 standard deviation. Recent weeks (Nov 2025–Jan 2026) show a 17.6% gain and a positive slope of 0.88, confirming sustained momentum.

Volume Analysis

In the last three months, trading volume has been decreasing overall, despite a strong buyer dominance at 87.4%. Buyers accounted for 274.6M shares versus 39.6M sellers, suggesting robust demand but waning market participation, which could imply cautious investor sentiment or reduced liquidity.

Target Prices

Analysts show a moderately bullish outlook on Monster Beverage Corporation with a clear target price consensus.

| Target High | Target Low | Consensus |

|---|---|---|

| 87 | 70 | 80.4 |

The target prices suggest a potential upside from current levels, reflecting confidence in Monster Beverage’s growth prospects while acknowledging some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Monster Beverage Corporation (MNST).

Stock Grades

Here are the latest verified grades for Monster Beverage Corporation from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-14 |

| Citigroup | Maintain | Buy | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-23 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-12-12 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| Wells Fargo | Maintain | Overweight | 2025-12-03 |

The overall trend in grades for MNST shows a predominance of Buy and Overweight ratings, indicating general confidence in the stock’s prospects, while Neutral and Hold grades suggest some caution among analysts.

Consumer Opinions

Consumers have mixed but generally favorable sentiments about Monster Beverage Corporation, reflecting both appreciation for its product variety and concerns about health impacts.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great energy boost with a wide range of flavors.” | “Too much sugar and caffeine for daily consumption.” |

| “Consistently good taste and effective energy lift.” | “Packaging can be wasteful and not environmentally friendly.” |

| “Affordable pricing compared to other energy drinks.” | “Some flavors are overly sweet and artificial.” |

Overall, consumers praise Monster for its flavor diversity and energizing effects, but health-conscious buyers often cite concerns over sugar content and ingredient quality as drawbacks.

Risk Analysis

Below is a detailed table highlighting the key risk categories for Monster Beverage Corporation, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (34.99) and P/B (8.86) ratios indicate potentially overvalued stock, risking price correction. | Medium | High |

| Competitive Pressure | Intense competition in the energy drink and non-alcoholic beverage industry may affect market share. | Medium | Medium |

| Regulatory Risks | Health regulations and sugar taxes could impact product formulations and sales volume. | Low | Medium |

| Debt Management | Very low debt-to-equity (0.06) and strong interest coverage (69.19) reduce financial distress risk. | Low | Low |

| Dividend Policy | Absence of dividends may deter income-focused investors, impacting stock demand. | Medium | Low |

| Economic Sensitivity | Consumer discretionary spending could fluctuate with economic cycles, influencing sales. | Medium | Medium |

The most significant risks for MNST stem from its elevated valuation metrics, which suggest a correction risk, despite robust financial health shown by a very strong Piotroski score (8) and a safe Altman Z-Score (~29). Market competition and regulatory factors should also be monitored carefully.

Should You Buy Monster Beverage Corporation?

Monster Beverage Corporation appears to be generating strong value creation with robust profitability despite a declining return on invested capital trend, suggesting a slightly favorable competitive moat. While its leverage profile could be seen as challenging, the overall rating is very favorable at a B level.

Strength & Efficiency Pillars

Monster Beverage Corporation exhibits robust profitability and financial health, with a net margin of 20.14% and a return on equity (ROE) of 25.33%. Its return on invested capital (ROIC) stands at 22.11%, comfortably exceeding its weighted average cost of capital (WACC) of 6.01%, confirming the company as a clear value creator. The Altman Z-Score of 28.97 places it securely in the safe zone, while a Piotroski Score of 8 underscores very strong financial strength. These metrics collectively highlight Monster’s efficiency in generating returns and maintaining financial stability.

Weaknesses and Drawbacks

Despite solid fundamentals, Monster faces valuation and liquidity concerns. Its price-to-earnings ratio of 34.99 and price-to-book ratio of 8.86 indicate a premium valuation that may limit upside potential. The current ratio of 3.32, though typically seen as a liquidity buffer, is flagged unfavorable here, possibly suggesting excess current assets that are not efficiently deployed. Additionally, the absence of dividend yield could deter income-focused investors. These factors represent risks that could temper investor enthusiasm amid market fluctuations.

Our Verdict about Monster Beverage Corporation

Monster Beverage’s fundamental profile appears favorable, bolstered by strong profitability and financial health metrics. Coupled with a bullish overall stock trend and strong buyer dominance in the recent period, the profile may appear attractive for long-term exposure. However, the premium valuation and liquidity nuances suggest that investors could exercise caution, weighing potential entry points carefully against prevailing market conditions.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Oxbow Advisors LLC Acquires New Stake in Monster Beverage Corporation $MNST – MarketBeat (Jan 24, 2026)

- What to expect from Monster Beverage’s next quarterly earnings report – MSN (Jan 23, 2026)

- Wealth Enhancement Advisory Services LLC Grows Position in Monster Beverage Corporation $MNST – MarketBeat (Jan 24, 2026)

- Coca-Cola vs. Monster Beverage: Which Stock Stays Ahead of the Curve? – The Globe and Mail (Jan 22, 2026)

- The Zacks Analyst Blog Highlights Agnico Eagle Mines, Monster Beverage, General Motors, Kewaunee Scientific and CSP – Yahoo Finance (Jan 22, 2026)

For more information about Monster Beverage Corporation, please visit the official website: monsterbevcorp.com