Every day, countless devices we rely on—from smartphones to electric vehicles—are powered by the cutting-edge semiconductor solutions from Monolithic Power Systems, Inc. This company is not just a participant in the semiconductor industry; it is a trailblazer, known for its innovative power electronics that enhance efficiency and performance across various sectors. With a reputation for quality and market influence, I find myself questioning whether Monolithic Power’s current fundamentals still justify its impressive market valuation and continued growth potential.

Table of contents

Company Description

Monolithic Power Systems, Inc. (MPWR) is a prominent player in the semiconductor industry, specializing in the design and sale of power electronics solutions across multiple markets, including computing, automotive, industrial, and consumer electronics. Founded in 1997 and headquartered in Kirkland, Washington, the company has established a strong presence in key geographic markets such as China, Taiwan, Europe, South Korea, and the United States. MPWR’s product portfolio includes integrated circuits for DC to DC conversion and lighting control, catering to a diverse array of applications from portable devices to medical equipment. With its commitment to innovation and quality, Monolithic Power Systems continues to shape the power management landscape, driving efficiency and performance across the electronics ecosystem.

Fundamental Analysis

In this section, I will analyze Monolithic Power Systems, Inc. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

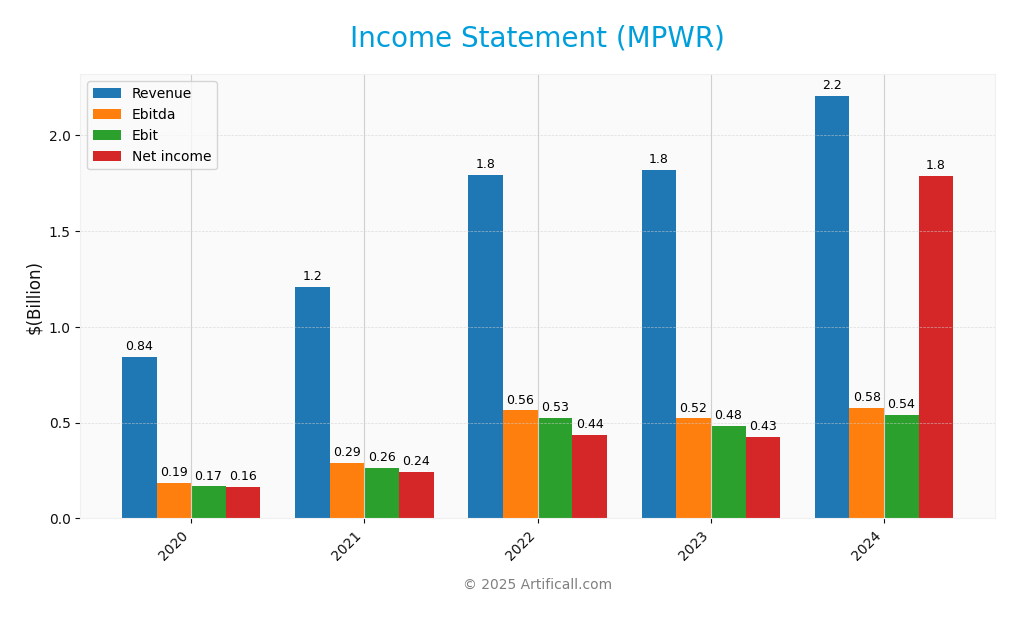

Below is the Income Statement for Monolithic Power Systems, Inc. (MPWR) over the last five fiscal years, showcasing key financial metrics.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 844M | 1.21B | 1.79B | 1.82B | 2.21B |

| Cost of Revenue | 378M | 522M | 746M | 800M | 986M |

| Operating Expenses | 307M | 423M | 522M | 539M | 682M |

| Gross Profit | 466M | 685M | 1.05B | 1.02B | 1.22B |

| EBITDA | 186M | 291M | 564M | 522M | 576M |

| EBIT | 167M | 262M | 527M | 482M | 539M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 164M | 242M | 438M | 427M | 1.79B |

| EPS | 3.67 | 5.28 | 9.37 | 8.98 | 36.76 |

| Filing Date | 2021-03-01 | 2022-02-25 | 2023-02-24 | 2024-02-29 | 2025-03-03 |

Interpretation of Income Statement

Examining the trends from 2020 to 2024, we see a robust increase in Revenue, rising from 844M to 2.21B, indicating strong market demand. Net Income surged significantly in 2024 to 1.79B, driven by efficient cost management and improved margins. The Gross Profit margin has remained stable, reflecting consistent pricing power and operational efficiency. However, the recent year showed remarkable growth in EPS, suggesting that the company effectively utilized its resources to maximize shareholder value, despite the rise in operating expenses. This positions MPWR favorably for future growth amidst a competitive landscape.

Financial Ratios

The table below presents the financial ratios for Monolithic Power Systems, Inc. (MPWR) over the most recent fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 20.04% | 24.39% | 23.47% | 80.95% |

| ROE | 19.46% | 26.23% | 20.85% | 56.80% |

| ROIC | 17.17% | 24.46% | 18.51% | 50.58% |

| P/E | 93.46 | 37.75 | 70.27 | 16.09 |

| P/B | 18.18 | 9.90 | 14.65 | 9.14 |

| Current Ratio | 4.96 | 5.36 | 7.74 | 5.31 |

| Quick Ratio | 3.81 | 3.66 | 6.11 | 3.89 |

| D/E | – | – | – | – |

| Debt-to-Assets | 0.00% | 0.08% | 0.23% | 0.44% |

| Interest Coverage | – | – | – | 0% |

| Asset Turnover | 0.76 | 0.87 | 0.75 | 0.61 |

| Fixed Asset Turnover | 3.33 | 5.02 | 4.94 | 4.17 |

| Dividend Yield | 0.48% | 0.83% | 0.62% | 0.84% |

Interpretation of Financial Ratios

Analyzing Monolithic Power Systems, Inc. (MPWR) as of December 31, 2024, the liquidity ratios present a robust picture, with a current ratio of 5.31 and a quick ratio of 3.89, indicating excellent short-term financial health. The solvency ratio stands at 3.87, reflecting strong capital structure and low debt levels, with a debt-to-equity ratio of just 0.005. Profitability metrics are impressive, with a net profit margin of 80.95%, suggesting highly efficient operations. However, the price-to-earnings (P/E) ratio of 16.09 may indicate the stock is reasonably priced, but a deeper analysis of the market context is necessary. Efficiency ratios, such as receivables turnover at 9.49, demonstrate effective management. Nevertheless, the high capital expenditure and its coverage ratios raise potential concerns about future cash flow sustainability.

Evolution of Financial Ratios

Over the past five years, Monolithic Power Systems, Inc. has shown strong growth in profitability and liquidity ratios, with notable improvements in both current and quick ratios, indicating enhanced financial stability. However, a slight decline in the net profit margin from 82.95% to 80.95% may warrant further observation.

Distribution Policy

Monolithic Power Systems, Inc. (MPWR) maintains a prudent distribution policy, with a dividend payout ratio of approximately 13.5% and a consistent annual dividend yield of around 0.84%. The company has shown a steady trend in dividend growth, paying $4.95 per share in 2024. Additionally, MPWR engages in share buyback programs, which further supports shareholder value. Overall, this balanced approach to capital returns is conducive to sustainable long-term value creation.

Sector Analysis

Monolithic Power Systems, Inc. (MPWR) is a key player in the semiconductor industry, specializing in power electronics solutions for diverse markets, facing competition from established tech firms.

Strategic Positioning

Monolithic Power Systems, Inc. (MPWR) currently holds a significant position in the semiconductor industry, with a market cap of approximately $46.1B. The company specializes in power electronics solutions, targeting diverse sectors including computing, automotive, and industrial markets. Competitive pressure remains intense, driven by rapid technological advancements and a growing number of market entrants. MPWR’s innovative DC to DC integrated circuits are crucial for many applications, but I must remain cautious, as the potential for technological disruption could impact future market share. As I evaluate MPWR, I will closely monitor these dynamics to inform my investment decisions.

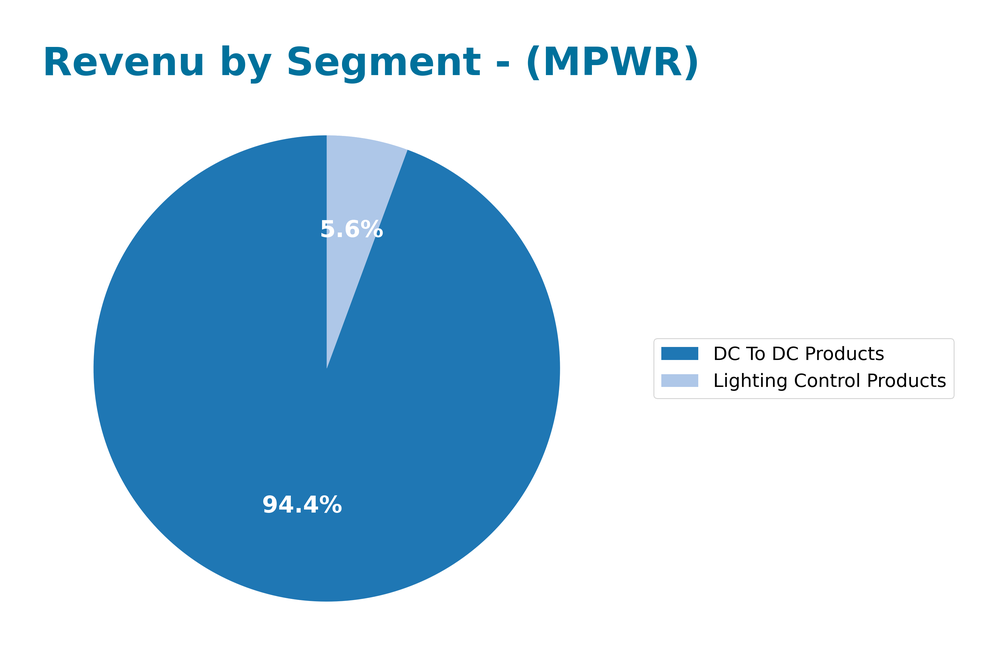

Revenue by Segment

The following chart illustrates the revenue breakdown by segment for Monolithic Power Systems, Inc. (MPWR) for the fiscal year 2023.

In 2023, MPWR’s revenue from “DC To DC Products” amounted to 1.72B, showing a steady increase from 1.70B in 2022, while “Lighting Control Products” generated 102.4M, up from 97.5M the previous year. The primary driver remains the DC To DC segment, which continues to expand its market presence. However, the growth rate appears to be slowing down, indicating potential margin pressures as competition intensifies. The Lighting Control segment, though smaller, is also contributing positively, suggesting diversification in revenue streams may be beneficial in the long term.

Key Products

Monolithic Power Systems, Inc. (MPWR) specializes in semiconductor-based power electronics solutions. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| DC-DC Integrated Circuits (ICs) | These ICs convert and control voltages for various electronic systems, including portable devices and computers. |

| Lighting Control ICs | Designed for backlighting applications, these ICs are used in LCD panels for monitors, laptops, and televisions. |

| Automotive Power Solutions | Power management systems specifically tailored for automotive applications, enhancing efficiency and performance. |

| Industrial Power Modules | Solutions aimed at industrial equipment, providing robust power management for demanding environments. |

| Communication Power ICs | Power management ICs that support wireless LAN access points and other communication devices for efficient performance. |

These products enable a wide range of applications across multiple sectors, reflecting the company’s commitment to innovation in power electronics.

Main Competitors

The competitive landscape for Monolithic Power Systems, Inc. (MPWR) is characterized by several key players in the semiconductor industry, each vying for market share in various sectors such as computing, automotive, and consumer electronics.

| Company | Market Cap |

|---|---|

| Western Digital Corporation (WDC) | 58.65B |

| Seagate Technology Holdings plc (STX) | 59.24B |

| NXP Semiconductors N.V. (NXPI) | 57.37B |

| Electronic Arts Inc. (EA) | 50.86B |

| Take-Two Interactive Software, Inc. (TTWO) | 45.80B |

| Monolithic Power Systems, Inc. (MPWR) | 46.15B |

| Atlassian Corporation (TEAM) | 41.81B |

| Garmin Ltd. (GRMN) | 39.17B |

| Block, Inc. (XYZ) | 37.13B |

| Ubiquiti Inc. (UI) | 34.96B |

| ASE Technology Holding Co., Ltd. (ASX) | 32.95B |

The semiconductor sector is highly competitive, with major players like Western Digital and Seagate Technology leading in market capitalization. The competition spans global markets, particularly in North America and Asia, reflecting the extensive demand for semiconductor solutions across various applications.

Competitive Advantages

Monolithic Power Systems, Inc. (MPWR) boasts significant competitive advantages in the semiconductor industry, primarily through its innovative power electronics solutions. With a market cap of $46.1B, the company has established a strong foothold across various sectors, including computing, automotive, and consumer electronics. Looking ahead, MPWR is poised to capitalize on emerging markets and the growing demand for energy-efficient technologies. The introduction of new products tailored for advanced applications, such as electric vehicles and renewable energy systems, presents substantial growth opportunities, positioning the company favorably in a competitive landscape.

SWOT Analysis

The purpose of this analysis is to evaluate the key strengths, weaknesses, opportunities, and threats facing Monolithic Power Systems, Inc. (MPWR) to inform strategic decision-making.

Strengths

- Strong market position

- Innovative product offerings

- Diverse customer base

Weaknesses

- High dependency on semiconductor market

- Price volatility of raw materials

- Limited brand recognition compared to larger competitors

Opportunities

- Growing demand for power electronics

- Expansion into emerging markets

- Technological advancements in semiconductor solutions

Threats

- Intense competition in the semiconductor sector

- Economic downturn risks

- Regulatory challenges in global markets

The overall SWOT assessment indicates that while Monolithic Power Systems has significant strengths and opportunities to leverage, it must address its weaknesses and remain vigilant against external threats. This balanced approach is essential for sustainable growth and competitive advantage in the semiconductor market.

Stock Analysis

Over the past year, Monolithic Power Systems, Inc. (MPWR) has experienced significant price movements, reflecting strong trading dynamics. The stock has shown a robust bullish trend, highlighted by notable highs and lows.

Trend Analysis

The percentage change in MPWR’s stock price over the past year stands at +66.44%. This indicates a strong bullish trend. The stock has exhibited acceleration in its price movement, with a standard deviation of 129.88, signaling notable volatility. The highest price recorded was 1,074.91, while the lowest was 477.39, reinforcing the positive momentum in the stock’s performance.

Volume Analysis

In the last three months, trading volumes have totaled approximately 377.65M shares, with buyer-driven activity slightly leading at 51.42%. The volume trend is increasing, which suggests heightened investor participation and positive sentiment towards the stock. However, in the most recent period, buyer volume decreased to 16.14M shares against seller volume of 20.20M shares, indicating a slightly seller-dominant behavior, with buyer dominance at 44.42%. This shift may reflect a cautious sentiment among investors as they assess market conditions.

Analyst Opinions

Recent analyst recommendations for Monolithic Power Systems, Inc. (MPWR) indicate a consensus rating of “buy.” Analysts highlight the company’s strong return on equity (5) and return on assets (5), showcasing robust operational efficiency. The B+ rating reflects solid fundamentals despite a lower score in price-to-book (1). Analysts emphasize the potential for growth in the semiconductor market, considering MPWR’s innovative product offerings and strong market position. I consider these factors essential for investors looking to enhance their portfolios with promising technology stocks.

Stock Grades

Monolithic Power Systems, Inc. (MPWR) has garnered consistent attention from various reputable grading companies, reflecting a stable outlook among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-03 |

| Keybanc | maintain | Overweight | 2025-10-31 |

| Rosenblatt | maintain | Neutral | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Keybanc | maintain | Overweight | 2025-10-23 |

| Wells Fargo | maintain | Equal Weight | 2025-10-20 |

| Stifel | maintain | Buy | 2025-10-17 |

| Wolfe Research | upgrade | Outperform | 2025-10-14 |

| Citigroup | maintain | Buy | 2025-10-03 |

| Keybanc | maintain | Overweight | 2025-09-30 |

Overall, the trend indicates a solid stance on MPWR, with most analysts maintaining their ratings, while Wolfe Research recently upgraded its outlook to “Outperform”. This suggests a generally positive sentiment in the market regarding MPWR’s potential.

Target Prices

The current consensus among analysts for Monolithic Power Systems, Inc. (MPWR) indicates a bullish outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 1300 | 970 | 1119 |

Overall, analysts expect MPWR to perform well, with a consensus target price reflecting confidence in the company’s future growth potential.

Consumer Opinions

Consumer sentiment about Monolithic Power Systems, Inc. (MPWR) reveals a mix of enthusiasm and concern, reflecting the company’s strong market presence and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent product reliability and performance.” | “Customer service could be more responsive.” |

| “Innovative solutions that meet our needs.” | “Pricing is on the higher side compared to competitors.” |

| “Great support and documentation provided.” | “Some products have a steep learning curve.” |

Overall, feedback indicates that while consumers appreciate the reliability and innovation of MPWR’s products, they express concerns regarding customer service responsiveness and pricing competitiveness.

Risk Analysis

In evaluating Monolithic Power Systems, Inc. (MPWR), it is essential to consider various risks that could impact its performance. The following table outlines key risk categories, descriptions, probabilities, and potential impacts.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand affecting sales. | Medium | High |

| Supply Chain Risk | Disruptions in supply chains due to geopolitical tensions. | High | Medium |

| Regulatory Risk | Changes in regulations impacting manufacturing processes. | Low | High |

| Technology Risk | Rapid technological advancements outpacing current products. | Medium | High |

| Competition Risk | Increased competition from new entrants in the market. | High | Medium |

The most significant risks for MPWR include market and supply chain risks, particularly given the ongoing semiconductor market volatility and global supply chain challenges.

Should You Buy Monolithic Power Systems, Inc.?

Monolithic Power Systems, Inc. (MPWR) has demonstrated strong profitability with a net income of 1.79B and an impressive net profit margin of 63.00%. The company appears to be creating value as its return on invested capital (ROIC) of 50.58% significantly exceeds its weighted average cost of capital (WACC) of 10.67%, indicating effective capital utilization. Furthermore, MPWR carries minimal debt, with a total debt of 15.79M against an equity of 47.04B, suggesting robust financial health. The recent rating of B+ implies a solid performance relative to industry standards.

Favorable signals

Monolithic Power Systems, Inc. (MPWR) exhibits several favorable elements in its income statement evaluation and ratios evaluation. The company shows strong revenue growth of 21.2% and a gross margin of 55.32%. Additionally, it has a notably high net margin of 80.95% and impressive earnings per share growth of 317.69%. Other positive indicators include a return on equity of 56.8% and a robust return on invested capital of 50.58%, which indicates value creation as it exceeds the weighted average cost of capital (WACC) of 10.67%.

Unfavorable signals

Despite the favorable aspects, there are some unfavorable signals present in the data. The operating expenses compared to revenue growth are unfavorable, reflecting a concern in managing costs. Additionally, the price-to-book ratio of 9.14 and the current ratio of 5.31 are indicators of potential valuation issues. Furthermore, a dividend yield of 0.84% might be perceived as low, potentially discouraging income-focused investors.

Conclusion

In summary, while Monolithic Power Systems, Inc. demonstrates strong income growth and favorable return metrics, the high valuation ratios and operating cost concerns warrant caution. Given the recent seller volume exceeding buyer volume, it might be more prudent to wait for buyers to return before making any investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Monolithic Power Systems, Inc. (MPWR): A Bull Case Theory – Finviz (Dec 05, 2025)

- Monolithic Power Systems, Inc. (MPWR): A Bull Case Theory – Insider Monkey (Dec 05, 2025)

- Brown Advisory Inc. Sells 69,316 Shares of Monolithic Power Systems, Inc. $MPWR – MarketBeat (Dec 05, 2025)

- $1000 Invested In Monolithic Power Systems 15 Years Ago Would Be Worth This Much Today – Sahm (Dec 03, 2025)

- $1000 Invested In Monolithic Power Systems 15 Years Ago Would Be Worth This Much Today – Benzinga (Dec 03, 2025)

For more information about Monolithic Power Systems, Inc., please visit the official website: monolithicpower.com