Home > Analyses > Technology > MongoDB, Inc.

MongoDB, Inc. revolutionizes how data drives modern applications, empowering enterprises and developers with flexible, scalable database solutions that underpin daily digital experiences worldwide. As the industry leader in general-purpose database platforms, MongoDB is renowned for its flagship Atlas cloud service and robust enterprise offerings, setting the standard for innovation and reliability in software infrastructure. In this analysis, I explore whether MongoDB’s strong market position and growth prospects continue to justify its premium valuation amid evolving industry dynamics.

Table of contents

Business Model & Company Overview

MongoDB, Inc., founded in 2007 and headquartered in New York City, stands as a leader in the software infrastructure industry. Its ecosystem centers around a versatile database platform, including MongoDB Enterprise Advanced for enterprises, MongoDB Atlas as a multi-cloud database-as-a-service, and a free Community Server for developers. This cohesive suite empowers businesses to manage data seamlessly across cloud, on-premise, or hybrid environments, reflecting its core mission to simplify and modernize data management worldwide.

The company’s revenue engine balances subscription-based services from MongoDB Atlas and Enterprise Advanced with professional consulting and training offerings. Its footprint spans major global markets across the Americas, Europe, and Asia, fueling steady growth. MongoDB’s competitive advantage lies in its flexible, scalable platform that shapes the future of data infrastructure, creating a durable economic moat in an evolving industry.

Financial Performance & Fundamental Metrics

This section presents a clear analysis of MongoDB, Inc.’s income statement, key financial ratios, and dividend payout policy to guide informed investment decisions.

Income Statement

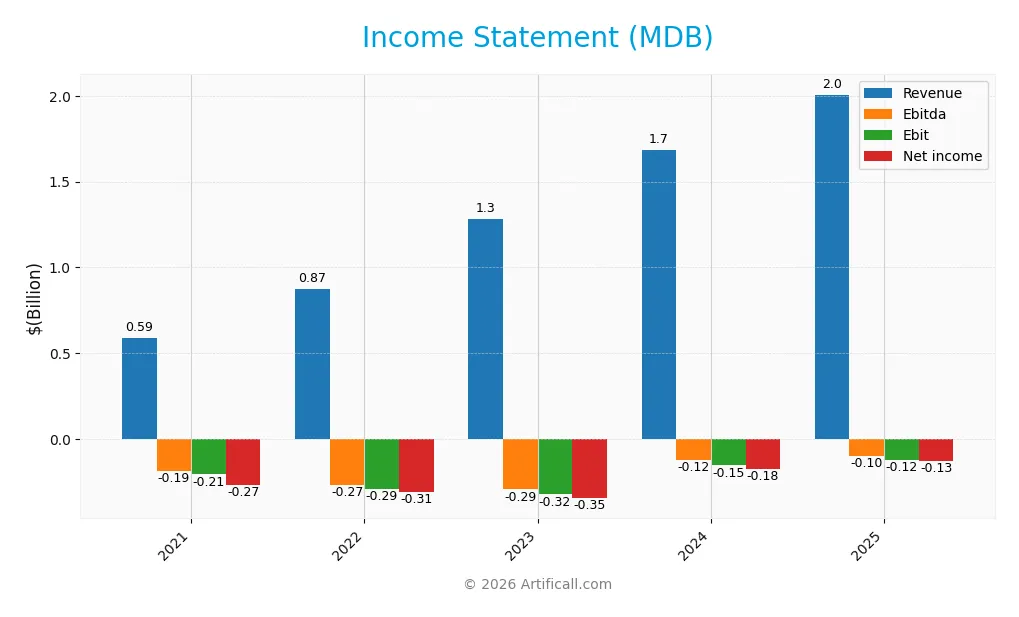

The table below presents MongoDB, Inc.’s annual income statement figures from 2021 to 2025, reflecting key financial results in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 590M | 874M | 1.28B | 1.68B | 2.01B |

| Cost of Revenue | 177M | 259M | 349M | 424M | 535M |

| Operating Expenses | 623M | 904M | 1.28B | 1.49B | 1.69B |

| Gross Profit | 413M | 614M | 935M | 1.26B | 1.47B |

| EBITDA | -186M | -267M | -294M | -122M | -97M |

| EBIT | -207M | -292M | -323M | -154M | -124M |

| Interest Expense | 56M | 11M | 10M | 9M | 8M |

| Net Income | -267M | -307M | -345M | -177M | -129M |

| EPS | -4.53 | -4.75 | -5.03 | -2.48 | -1.73 |

| Filing Date | 2021-03-22 | 2022-03-18 | 2023-03-17 | 2024-03-15 | 2025-03-21 |

Income Statement Evolution

From 2021 to 2025, MongoDB, Inc. experienced significant revenue growth of 240%, reaching $2.01B in 2025. Net income losses narrowed by 52%, though the company remained unprofitable with a net margin of -6.43%. Gross margin was stable and favorable at 73.3%, while EBIT margin improved but stayed negative at -6.16%, reflecting ongoing investment in operations.

Is the Income Statement Favorable?

In 2025, MongoDB showed favorable fundamentals with 19.2% revenue growth and a 16.9% increase in gross profit. Operating expenses scaled in line with revenue, supporting a nearly 20% EBIT growth. Despite net losses, margin improvements and a 38.7% net margin growth indicate positive momentum. Overall, 86% of income statement metrics are favorable, signaling solid operational progress.

Financial Ratios

The following table summarizes key financial ratios for MongoDB, Inc. over the last five fiscal years, presenting a clear view of the company’s profitability, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -45% | -35% | -27% | -10% | -6% |

| ROE | 53.0% | -46.0% | -47.0% | -16.5% | -4.6% |

| ROIC | -20% | -15.0% | -17.3% | -10.1% | -7.4% |

| P/E | -82.8 | -85.2 | -42.6 | -161.6 | -157.9 |

| P/B | -4393 | 39.2 | 19.9 | 26.7 | 7.3 |

| Current Ratio | 3.22 | 4.02 | 3.80 | 4.40 | 5.20 |

| Quick Ratio | 3.22 | 4.02 | 3.80 | 4.40 | 5.20 |

| D/E | -195 | 1.77 | 1.60 | 1.11 | 0.01 |

| Debt-to-Assets | 70% | 48% | 46% | 41% | 1.1% |

| Interest Coverage | -3.73 | -25.6 | -35.4 | -24.9 | -26.7 |

| Asset Turnover | 0.42 | 0.36 | 0.50 | 0.59 | 0.58 |

| Fixed Asset Turnover | 6.09 | 8.37 | 12.97 | 18.62 | 24.78 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, MongoDB, Inc. saw a gradual improvement in key financial ratios. The Return on Equity (ROE) increased from a deeply negative level (-452%) to a less negative -4.64% in 2025, indicating some recovery in profitability. The Current Ratio steadily rose from 3.22 to 5.2, reflecting stronger liquidity. Meanwhile, the Debt-to-Equity Ratio markedly decreased from negative and volatile values to a very low 0.01, signaling a significant reduction in leverage.

Are the Financial Ratios Favorable?

In 2025, MongoDB’s financial ratios present a mixed picture. Profitability metrics such as net margin (-6.43%) and ROE (-4.64%) are unfavorable, while the price-to-earnings ratio is surprisingly favorable despite being negative. Liquidity shows contrasting signals: the Current Ratio is unfavorable at 5.2, but the Quick Ratio is favorable at the same level. Leverage indicators, including debt-to-equity (0.01) and debt-to-assets (1.06%), are favorable, suggesting low financial risk. Efficiency is neutral with an asset turnover of 0.58, but interest coverage remains unfavorable at -15.26. Overall, the global ratio evaluation is unfavorable.

Shareholder Return Policy

MongoDB, Inc. does not pay dividends, reflecting its negative net income and reinvestment focus. The company prioritizes growth and development over immediate shareholder payouts, with no dividend yield or payout ratio reported.

No share buyback programs are indicated, aligning with its emphasis on capital preservation and expansion. This policy supports long-term value creation, though it may not satisfy investors seeking regular income from their investment.

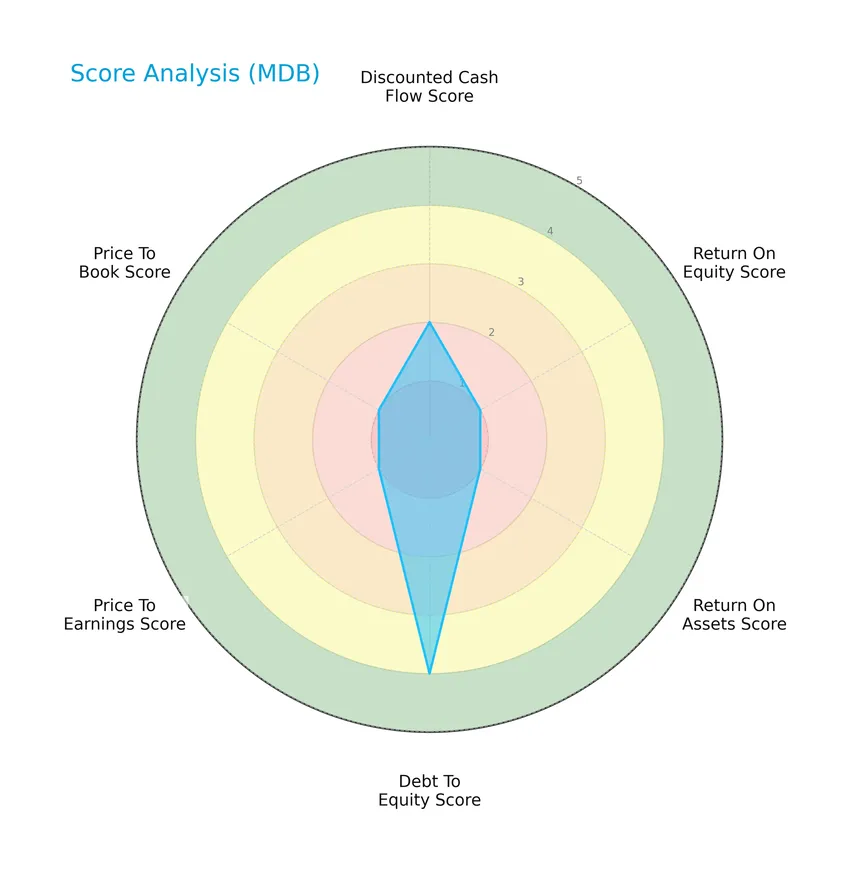

Score analysis

The following radar chart presents a comprehensive view of MongoDB, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

MongoDB shows moderate performance in discounted cash flow but very unfavorable scores in return on equity, return on assets, price-to-earnings, and price-to-book ratios. Its debt-to-equity score is favorable, indicating relatively prudent leverage management.

Analysis of the company’s bankruptcy risk

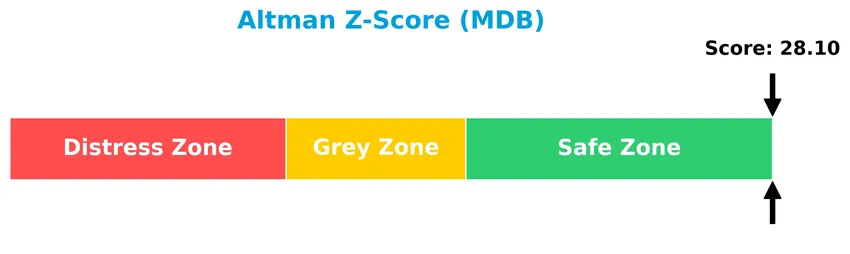

MongoDB’s Altman Z-Score indicates a very low risk of bankruptcy, placing the company firmly within the safe zone:

Is the company in good financial health?

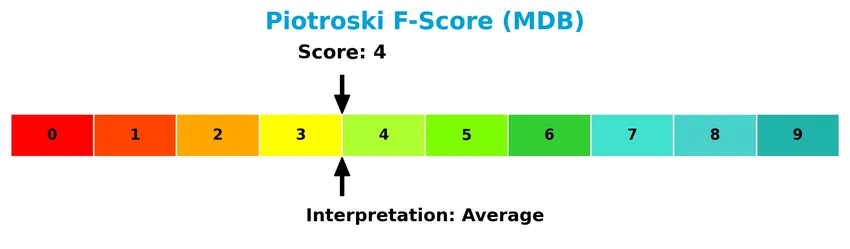

The Piotroski Score diagram below illustrates MongoDB’s financial health based on profitability, leverage, liquidity, and operational efficiency factors:

With a Piotroski Score of 4, MongoDB is assessed to have average financial health, reflecting moderate strength but room for improvement in key financial criteria.

Competitive Landscape & Sector Positioning

This sector analysis will examine MongoDB, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether MongoDB holds a competitive advantage over its industry peers in the software infrastructure sector.

Strategic Positioning

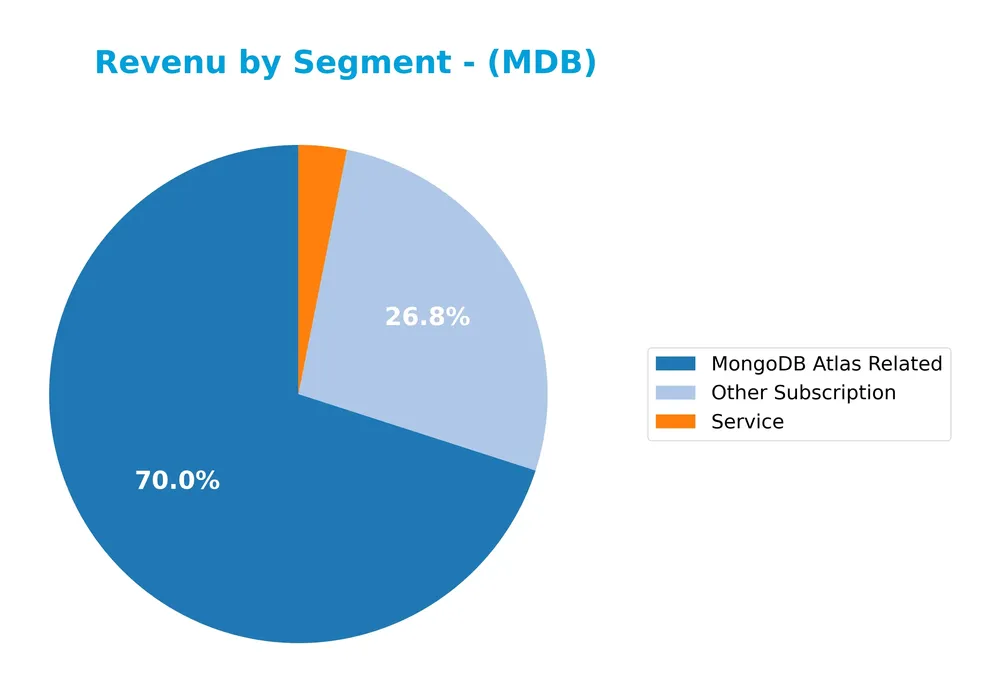

MongoDB, Inc. concentrates its product portfolio around its core database offerings, notably MongoDB Atlas, which generated $1.4B in 2025, complemented by Other Subscription and Service revenues. Geographically, it maintains diversified exposure with the Americas leading at $1.21B, followed by EMEA at $553M and Asia Pacific at $240M in 2025.

Revenue by Segment

The pie chart illustrates MongoDB, Inc.’s revenue distribution by segment for fiscal year 2025, highlighting the contributions of MongoDB Atlas Related, Other Subscription, and Service revenues.

In 2025, MongoDB Atlas Related revenue reached $1.41B, clearly dominating the business and showing strong growth compared to previous years. Other Subscription revenue also increased to $539M, reinforcing the company’s subscription-based model. Service revenue remains a minor contributor at $63M. The trend indicates a steady shift towards cloud-based offerings, with Atlas accelerating its share, underscoring both growth potential and some concentration risk in this key segment.

Key Products & Brands

Below is a summary of MongoDB, Inc.’s key products and brands with their descriptions:

| Product | Description |

|---|---|

| MongoDB Enterprise Advanced | A commercial database server designed for enterprise clients, deployable on cloud, on-premise, or hybrid environments. |

| MongoDB Atlas | A hosted multi-cloud database-as-a-service platform providing scalable and managed database solutions. |

| Community Server | A free-to-download version of MongoDB’s database, offering essential functionality for developers starting with MongoDB. |

| Professional Services | Includes consulting and training services to support customers in database implementation and optimization. |

MongoDB, Inc. offers a range of database products targeting enterprise and developer needs, complemented by professional services to enhance customer experience and adoption.

Main Competitors

MongoDB, Inc. faces competition from 32 companies in its sector; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

MongoDB, Inc. ranks 13th among 32 competitors in the Software – Infrastructure industry. Its market cap is 0.92% that of the leader, Microsoft Corporation. The company is positioned below the average market cap of the top 10 competitors (508B) but above the sector median of 18.8B. MongoDB maintains an 8.07% market cap gap with the next competitor above it, indicating a moderate distance from its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MDB have a competitive advantage?

MongoDB, Inc. shows a slightly unfavorable competitive advantage as it is currently shedding value with an ROIC below its WACC, indicating value destruction despite growing profitability. The company’s gross margin remains strong at 73.32%, but negative EBIT and net margins reflect ongoing challenges in profitability.

Looking ahead, MongoDB’s expanding revenue across Americas, EMEA, and Asia Pacific markets, combined with its portfolio of products like MongoDB Atlas and Enterprise Advanced, suggests opportunities for growth. Continued investments in multi-cloud database services and geographic expansion could improve its competitive positioning over time.

SWOT Analysis

This analysis highlights MongoDB, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- Strong revenue growth of 239.86% over 5 years

- High gross margin at 73.32%

- Robust multi-cloud platform with global reach

Weaknesses

- Negative net margin of -6.43%

- Unfavorable ROE and ROIC indicating value destruction

- High price-to-book ratio at 7.32

Opportunities

- Expansion in emerging markets like Asia Pacific

- Increasing demand for cloud database solutions

- Growing adoption of hybrid and on-premise deployments

Threats

- Intense competition in cloud database market

- Economic uncertainty impacting IT budgets

- Risk of technology obsolescence

MongoDB’s solid revenue growth and scalable platform position it well for future expansion, but persistent profitability challenges and competitive pressures require cautious risk management. Strategic focus on efficiency and market diversification will be critical going forward.

Stock Price Action Analysis

The following weekly chart illustrates MongoDB, Inc. (MDB) stock price movements over the past 12 months, highlighting key fluctuations and trends:

Trend Analysis

Over the past 12 months, MDB stock price declined by 8.73%, indicating a bearish trend with accelerating downward momentum. The stock showed high volatility with a standard deviation of 71.44. Prices ranged from a low of 154.39 to a high of 436.84, reflecting significant price swings during this period.

Volume Analysis

In the last three months, trading volume has been increasing with buyer dominance at 66.51%, signaling a buyer-driven market. This rising volume alongside buyer strength suggests growing investor interest and participation, possibly supporting recent positive price momentum.

Target Prices

Analysts present a robust target consensus for MongoDB, Inc., reflecting strong confidence in its growth potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 500 | 375 | 445.2 |

The target prices suggest a bullish outlook, with analysts expecting the stock to trade significantly above current levels, indicating potential upside for investors.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback related to MongoDB, Inc. (MDB).

Stock Grades

Here is the latest available grading data for MongoDB, Inc. from recognized financial analysts and institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Guggenheim | Maintain | Buy | 2025-12-02 |

The overall trend reveals a strong consensus toward positive ratings, predominantly “Buy” and equivalent terms, with consistent maintenance of these grades over recent months. This pattern indicates steady analyst confidence in the stock’s outlook.

Consumer Opinions

Consumers express a mix of enthusiasm and concern about MongoDB, Inc., reflecting both its innovative strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “MongoDB’s flexible document model simplifies data management significantly.” | “Steep learning curve for beginners new to NoSQL databases.” |

| “Excellent scalability and performance for large datasets.” | “Pricing can be high for small businesses or startups.” |

| “Strong community support and comprehensive documentation.” | “Occasional issues with stability during major updates.” |

Overall, consumers appreciate MongoDB’s scalability, flexibility, and community support, while noting challenges with pricing and complexity for newcomers.

Risk Analysis

Below is a summary table presenting the key risks associated with investing in MongoDB, Inc., highlighting their probability and impact levels:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-6.43%), negative ROE (-4.64%), and negative ROIC (-7.36%) indicate losses | High | High |

| Valuation | High price-to-book ratio (7.32) and unfavorable price-to-earnings reflect potential overvaluation | Medium | Medium |

| Liquidity & Debt | Strong liquidity ratios (current and quick ratio ~5.2) but very low debt levels (D/E 0.01) | Low | Low |

| Profitability | Negative interest coverage (-15.26) signals difficulty covering interest expenses | Medium | High |

| Market Volatility | Stock beta of 1.38 suggests higher price volatility compared to the market | High | Medium |

| Dividend Policy | No dividend yield, indicating no income return for investors | High | Low |

The most significant risks lie in MongoDB’s continued unprofitable operations and negative returns on equity and capital, despite a strong balance sheet and low debt. Its stock price volatility and high valuation multiples add caution for investors. However, the company’s Altman Z-Score places it safely away from bankruptcy risk, while the Piotroski Score remains average, reflecting moderate financial strength.

Should You Buy MongoDB, Inc.?

MongoDB, Inc. appears to be in a very favorable financial position with a safe zone Altman Z-Score, yet it suggests a profile of value destruction despite improving profitability. While leverage is manageable, the overall rating could be seen as moderate C, reflecting mixed operational efficiency and financial health.

Strength & Efficiency Pillars

MongoDB, Inc. exhibits robust financial health, underscored by an Altman Z-score of 28.10, placing it firmly in the safe zone and indicating negligible bankruptcy risk. The company’s debt profile is particularly strong, with a debt-to-equity ratio of 0.01 and a debt-to-assets ratio of 1.06%, both favorable markers of low leverage. Despite a negative return on invested capital (ROIC) of -7.36% below its weighted average cost of capital (WACC) at 10.37%, MongoDB shows resilience through a growing ROIC trend of 62.87%, suggesting improving operational efficiency over time. The Piotroski score of 4 signals average financial strength, pointing to areas needing reinforcement.

Weaknesses and Drawbacks

There are notable profitability and valuation concerns that warrant caution. MongoDB posts a negative net margin of -6.43% and a return on equity (ROE) of -4.64%, reflecting ongoing challenges in generating profit from its equity base. Its price-to-book ratio stands elevated at 7.32, signaling a premium valuation that may not be justified by current earnings. Furthermore, the company’s current ratio of 5.2, although generally indicative of liquidity, is marked as unfavorable here, potentially hinting at inefficient asset utilization or excess cash not deployed effectively. Interest coverage is deeply negative at -15.26, indicating difficulties in covering interest expenses from operating earnings.

Our Verdict about MongoDB, Inc.

MongoDB’s long-term fundamental profile appears mixed but leans toward unfavorable given persistent profitability weaknesses and value destruction relative to its cost of capital. However, with a buyer-dominant recent period marked by a 66.51% buyer volume share and a positive price trend slope of 6.55%, the technical outlook may suggest emerging momentum. Despite these signs of market interest, the profile might suggest a cautious, wait-and-see approach as the company works through operational inefficiencies and valuation risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- MongoDB, Inc. $MDB Shares Purchased by Universal Beteiligungs und Servicegesellschaft mbH – MarketBeat (Jan 24, 2026)

- Truist Reiterates Buy on MongoDB (MDB) After Positive .local San Francisco Event – Finviz (Jan 21, 2026)

- Truist reiterates buy on MongoDB (MDB) after positive local San Francisco event – MSN (Jan 21, 2026)

- MongoDB, Inc. (MDB) Trading Close to 52-Week High, Here’s What Analysts Think About It – Yahoo Finance (Jan 01, 2026)

- Massachusetts Financial Services Co. MA Grows Stock Position in MongoDB, Inc. $MDB – MarketBeat (Jan 23, 2026)

For more information about MongoDB, Inc., please visit the official website: mongodb.com