Home > Analyses > Technology > monday.com Ltd.

monday.com Ltd. transforms how teams collaborate and manage work across industries by providing a highly customizable cloud-based Work OS. Renowned for its innovative modular platform, monday.com empowers organizations worldwide with tools spanning project management, CRM, marketing, and software development. With a strong reputation for quality and market influence since its 2012 inception, the company continues to push the boundaries of digital workflow solutions. As we analyze its current fundamentals, the key question remains: does monday.com’s valuation reflect its growth potential in an evolving software landscape?

Table of contents

Business Model & Company Overview

monday.com Ltd., founded in 2012 and headquartered in Tel Aviv-Yafo, Israel, has established itself as a leading provider in the software application industry. Its core offering, Work OS, is a cloud-based visual operating system designed as a modular ecosystem that enables organizations to customize workflows across marketing, CRM, project management, and software development. This flexible platform serves diverse clients, including educational and government institutions, reinforcing its broad market appeal.

The company drives revenue primarily through its subscription-based software services, supplemented by customer success and business development solutions, creating a balanced model with strong recurring income. monday.com maintains a strategic global footprint across the Americas, Europe, and Asia, enhancing its growth potential. Its competitive advantage lies in the seamless integration and adaptability of its Work OS, positioning the company as a pivotal force shaping the future of digital work management.

Financial Performance & Fundamental Metrics

In this section, I analyze monday.com Ltd.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

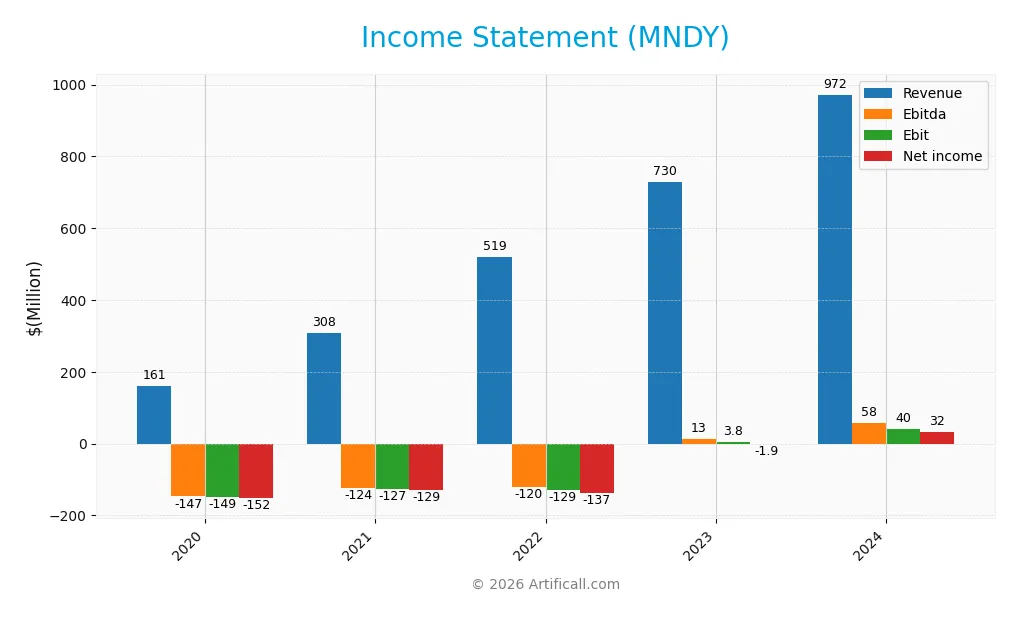

Income Statement

The table below presents monday.com Ltd.’s key income statement figures for the fiscal years 2020 through 2024, showing revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 161M | 308M | 519M | 730M | 972M |

| Cost of Revenue | 22M | 39M | 67M | 81M | 104M |

| Operating Expenses | 289M | 395M | 605M | 688M | 889M |

| Gross Profit | 139M | 269M | 453M | 649M | 868M |

| EBITDA | -147M | -124M | -120M | 13M | 58M |

| EBIT | -149M | -127M | -129M | 4M | 40M |

| Interest Expense | 1M | 1M | 1M | 0.4M | 0M |

| Net Income | -152M | -129M | -137M | -2M | 32M |

| EPS | -3.92 | -3.09 | -2.99 | -0.039 | 0.65 |

| Filing Date | 2020-12-31 | 2022-03-16 | 2023-03-14 | 2024-03-14 | 2025-03-17 |

Income Statement Evolution

Between 2020 and 2024, monday.com Ltd. exhibited strong revenue growth, surging over 500% to reach $972M in 2024. Net income turned positive in 2024 at $32M after several years of losses, reflecting a significant margin improvement. Gross margin remained favorable at 89.3%, while EBIT and net margins showed more modest, neutral trends, indicating operational efficiency gains but ongoing cost pressures.

Is the Income Statement Favorable?

The 2024 income statement reflects fundamentally favorable performance with a 33.2% revenue increase and a 1395% rise in net margin compared to 2023. EBIT improved nearly tenfold to $40M, supporting a neutral EBIT margin of 4.1%. Interest expense was negligible, enhancing profitability. Overall, the income statement demonstrates strong top-line growth, improving profitability, and controlled expenses, contributing to a largely favorable financial position.

Financial Ratios

The table below presents key financial ratios for monday.com Ltd. (MNDY) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -94% | -42% | -26% | -0.3% | 3.3% |

| ROE | 70% | -18% | -20% | -0.2% | 3.1% |

| ROIC | -395% | -18% | -20% | 2.5% | -1.7% |

| P/E | -46 | -106 | -41 | -4840 | 363 |

| P/B | -32 | 20 | 8.2 | 11.2 | 11.4 |

| Current Ratio | 1.1 | 4.0 | 3.1 | 2.8 | 2.7 |

| Quick Ratio | 1.1 | 4.0 | 3.1 | 2.8 | 2.7 |

| D/E | -0.10 | 0.0001 | 0.11 | 0.075 | 0.10 |

| Debt-to-Assets | 13% | 0.009% | 7.5% | 4.8% | 6.3% |

| Interest Coverage | -149 | -130 | -192 | -87 | 0 |

| Asset Turnover | 1.02 | 0.33 | 0.50 | 0.57 | 0.58 |

| Fixed Asset Turnover | 22.4 | 15.7 | 4.5 | 7.3 | 7.1 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, monday.com Ltd. showed improving trends in its key ratios. The Return on Equity (ROE) recovered from deeply negative levels, reaching 3.14% in 2024, indicating a move toward profitability though still weak. The Current Ratio remained strong and stable above 2.6, signaling solid liquidity. The Debt-to-Equity Ratio was consistently low, around 0.1, reflecting cautious leverage management.

Are the Financial Ratios Favorable?

In 2024, monday.com’s profitability ratios such as net margin (3.33%) and ROE (3.14%) are considered unfavorable, while liquidity ratios like current and quick ratios (2.66 each) are favorable. Leverage is low with debt-to-equity at 0.1 and debt-to-assets at 6.29%, both favorable. Efficiency ratios show mixed signals: fixed asset turnover is favorable at 7.13, but asset turnover is neutral at 0.58. Market valuation ratios, including a high P/E of 363 and P/B of 11.41, are unfavorable. Overall, the financial ratios present a neutral stance.

Shareholder Return Policy

monday.com Ltd. (MNDY) does not pay dividends, reflecting a strategic focus on reinvestment and growth rather than immediate shareholder payouts. The absence of dividend distributions is consistent with its positive net profit margin in 2024 and ongoing investments, supported by solid free cash flow generation.

The company does not engage in share buybacks either, indicating a preference to allocate capital towards expanding operations or innovation. This approach aligns with sustaining long-term shareholder value creation by prioritizing growth and operational strength over short-term returns.

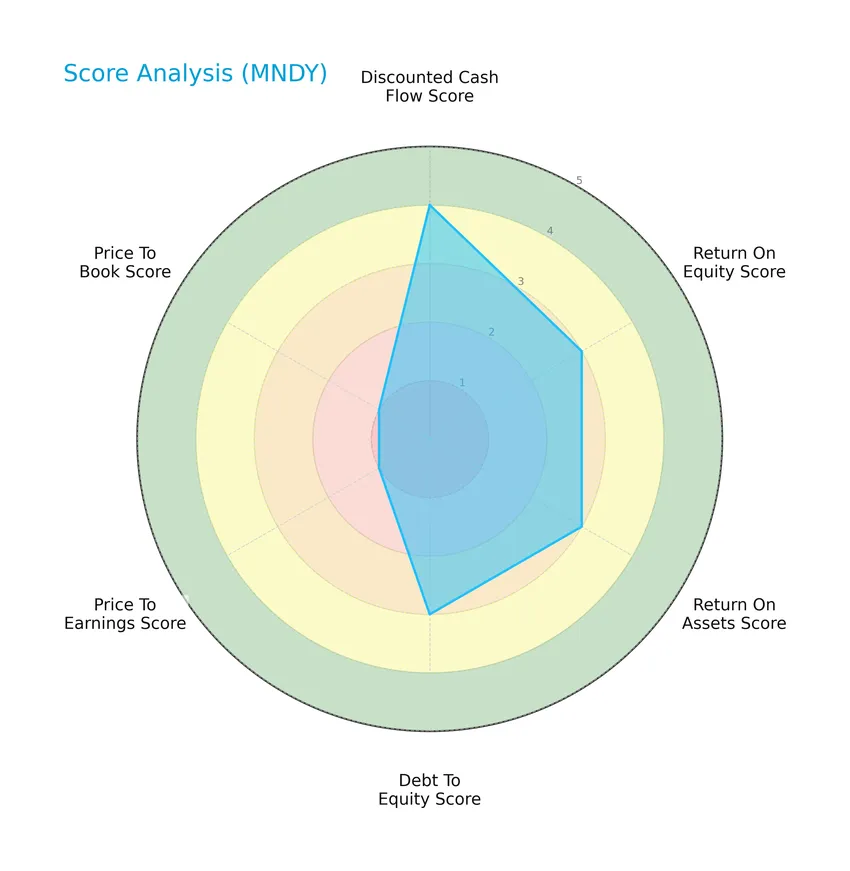

Score analysis

The following radar chart displays an overview of monday.com Ltd.’s key financial scores, highlighting strengths and weaknesses across valuation and profitability metrics:

monday.com Ltd. shows a favorable discounted cash flow score (4) and moderate scores in return on equity (3), return on assets (3), and debt to equity (3). However, valuation metrics like price to earnings (1) and price to book (1) remain very unfavorable, reflecting potential market pricing concerns.

Analysis of the company’s bankruptcy risk

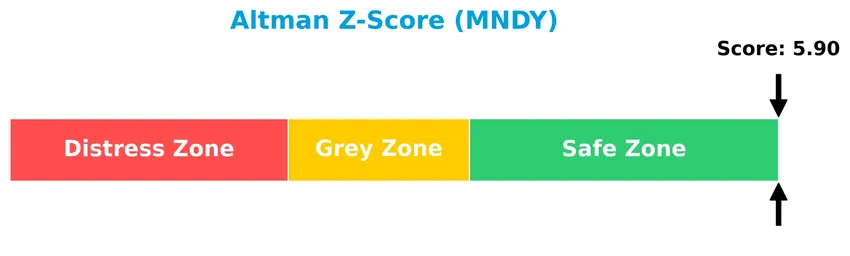

The Altman Z-Score indicates that monday.com Ltd. is in the safe zone, suggesting a low risk of bankruptcy given its current financial ratios:

Is the company in good financial health?

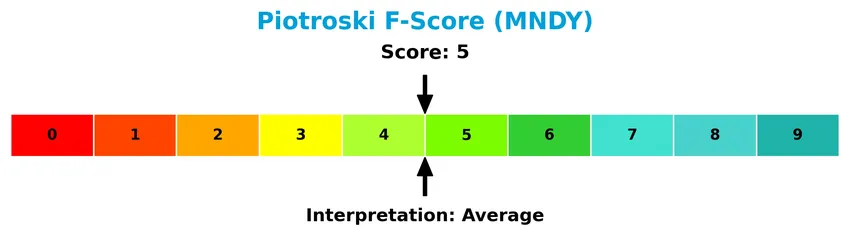

The Piotroski diagram provides insight into monday.com Ltd.’s financial strength based on multiple accounting criteria:

With a Piotroski Score of 5, the company falls into an average category, indicating moderate financial health but leaving room for improvement in profitability, liquidity, or operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore monday.com Ltd.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether monday.com Ltd. holds a competitive advantage over its rivals in the software application industry.

Strategic Positioning

monday.com Ltd. focuses on a diversified geographic presence across the US, Europe, the Middle East, Africa, and other international markets. Its product portfolio centers on a modular, cloud-based Work OS with applications spanning marketing, CRM, project management, and software development, serving various organizational sectors.

Key Products & Brands

The following table outlines the main products and brand offerings of monday.com Ltd.:

| Product | Description |

|---|---|

| Work OS | A cloud-based visual work operating system with modular building blocks to create software applications and tools. |

| Marketing Solutions | Product solutions designed to support marketing activities and campaigns. |

| CRM Solutions | Tools aimed at customer relationship management to enhance client interactions. |

| Project Management | Software applications that facilitate planning, executing, and monitoring projects. |

| Software Development | Solutions tailored for software development teams to improve workflows and collaboration. |

| Business Services | Includes business development, presale, and customer success services to support organizational growth and retention. |

monday.com Ltd. primarily offers a versatile Work OS platform complemented by specialized solutions across marketing, CRM, project management, software development, and business services, serving a broad range of industries and organizational units globally.

Main Competitors

There are 33 competitors in the Technology Software – Application sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

monday.com Ltd. ranks 27th among 33 competitors, with a market cap at 2.75% of the sector leader Salesforce, Inc. It sits below both the average market cap of the top 10 (143.6B) and the sector median (18.8B). The company is 19.29% smaller than its closest competitor above, indicating a notable gap in scale within this competitive landscape.

Does monday.com have a competitive advantage?

monday.com currently shows a slightly unfavorable competitive advantage as it is shedding value, with ROIC below WACC, indicating value destruction despite growing profitability. Its income statement reflects strong revenue growth and favorable margins supporting operational efficiency.

Looking ahead, monday.com’s cloud-based Work OS and modular software solutions targeting diverse sectors provide opportunities for market expansion and product innovation. Continued improvements in profitability and scaling across international markets may influence its competitive position over time.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights monday.com Ltd.’s current strategic position to assist investors in making informed decisions.

Strengths

- Strong revenue growth at 33.21% YoY

- High gross margin of 89.33%

- Robust liquidity with current and quick ratios at 2.66

Weaknesses

- Low net margin at 3.33%

- High valuation multiples (PE 363, PB 11.41)

- Negative ROIC indicating value destruction

Opportunities

- Expanding demand for cloud-based work management tools

- Growth in international markets

- Increasing adoption of modular software platforms

Threats

- Intense competition in SaaS market

- Market volatility impacting high-PE stocks

- Potential margin pressure from rising operating costs

Overall, monday.com shows strong growth and solid liquidity but faces profitability challenges and high valuation risks. The company’s strategy should focus on improving operational efficiency and margin expansion while leveraging growth opportunities in global SaaS adoption.

Stock Price Action Analysis

The weekly stock chart for monday.com Ltd. (MNDY) reveals significant price movements and volatility during the past 12 months:

Trend Analysis

Over the past year, MNDY’s stock price declined by 43.51%, indicating a bearish trend. The trend shows deceleration despite high volatility with a standard deviation of 48.42. The stock reached a high of 324.31 and a low of 126.7, confirming substantial price swings.

Volume Analysis

Trading volume has been increasing overall, with a nearly balanced total buyer-to-seller volume ratio of about 50%. However, in the recent period (Nov 2025 to Jan 2026), sellers dominated with just 25.13% buyer volume, suggesting bearish investor sentiment and stronger selling pressure.

Target Prices

The current analyst consensus for monday.com Ltd. (MNDY) reflects a positive outlook with a broad range of expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 310 | 194 | 255.25 |

Analysts anticipate the stock price to fluctuate between 194 and 310, with a consensus target near 255, indicating moderate growth potential.

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback related to monday.com Ltd. (MNDY).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is a summary of the latest verified stock grades for monday.com Ltd. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-22 |

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| JP Morgan | Maintain | Overweight | 2025-11-11 |

| UBS | Maintain | Neutral | 2025-11-11 |

The overall trend indicates a strong consensus toward positive outlooks, with the majority of analysts maintaining Buy or Overweight ratings and only one Neutral rating noted, reflecting stable confidence in the stock.

Consumer Opinions

Consumers have voiced a mix of enthusiasm and concerns about monday.com Ltd., reflecting their experiences with the platform’s capabilities and support.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive interface that boosts team productivity | Occasional glitches during peak usage times |

| Excellent customization options for workflows | Customer support response can be slow |

| Strong integration with other popular tools | Pricing can be high for smaller teams |

Overall, users appreciate monday.com’s flexibility and ease of use, though some express frustration with occasional technical issues and customer support delays. Pricing remains a concern for smaller organizations seeking cost-effective solutions.

Risk Analysis

Below is a summary table presenting the key risk categories, their descriptions, probabilities, and potential impacts for monday.com Ltd.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Extremely high P/E ratio (363) and P/B ratio (11.41) signal overvaluation risk. | High | High |

| Profitability | Low net margin (3.33%) and negative ROIC (-1.73%) indicate weak profitability and efficiency. | Medium | Medium |

| Financial Health | Despite strong liquidity and low debt, moderate Piotroski score (5) suggests average strength. | Medium | Medium |

| Competitive Risk | Intense competition in cloud-based work OS and software solutions market. | Medium | High |

| Innovation Risk | Dependence on continuous product innovation to maintain market share and growth. | Medium | Medium |

The most significant risks for monday.com arise from its stretched market valuation combined with modest profitability, which could expose investors to price corrections. While financial stability is relatively sound, the company faces competitive and innovation pressures in a dynamic tech sector.

Should You Buy monday.com Ltd.?

monday.com Ltd. appears to be improving its profitability with growing operational efficiency, although it currently sheds value relative to its cost of capital, suggesting a slightly unfavorable competitive moat. Its leverage profile seems manageable, supported by a very favorable B- rating and a safe Altman Z-Score, indicating moderate financial health overall.

Strength & Efficiency Pillars

monday.com Ltd. exhibits solid financial health with an Altman Z-score of 5.90, placing it firmly in the safe zone, signaling low bankruptcy risk. The company maintains a conservative debt profile, reflected in a debt-to-equity ratio of 0.1 and a favorable current ratio of 2.66, indicating strong liquidity. Operational efficiency is supported by a high gross margin of 89.33%, although profitability metrics such as net margin (3.33%) and ROE (3.14%) remain modest. Despite a negative ROIC of -1.73% underperforming its WACC of 9.66%, suggesting value is currently being shed, the Piotroski score of 5 denotes average financial strength.

Weaknesses and Drawbacks

monday.com Ltd. faces significant valuation concerns, with an excessively high P/E ratio of 362.98 and a P/B ratio of 11.41, both rated very unfavorable. These elevated multiples imply the stock is priced for perfection, increasing risk if growth expectations falter. The bearish stock trend is corroborated by a steep overall price decline of -43.51% and recent seller dominance at 74.87%, which may continue to exert short-term downward pressure. Additionally, the company’s negative ROIC signals inefficiencies in generating returns above its cost of capital, a critical drawback for value-conscious investors.

Our Verdict about monday.com Ltd.

The long-term fundamental profile of monday.com Ltd. appears unfavorable due to value destruction and stretched valuation metrics. Despite this, the company’s robust liquidity and safe financial standing mitigate immediate solvency risks. Given the bearish technical trend and pronounced seller dominance in the recent period, despite a moderate volume increase, the profile suggests a cautious approach. Investors might consider waiting for signs of valuation normalization and a shift in market sentiment before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Monday.com in focus as KeyBanc cuts price target ahead of earnings (MNDY:NASDAQ) – Seeking Alpha (Jan 22, 2026)

- Assessing Monday.Com: Insights From 20 Financial Analysts – Benzinga (Jan 22, 2026)

- monday.com Ltd. $MNDY Stake Increased by Migdal Insurance & Financial Holdings Ltd. – MarketBeat (Jan 21, 2026)

- The Death Of Software Is Overstated: monday.com Is A Top Pick (NASDAQ:MNDY) – Seeking Alpha (Jan 12, 2026)

- Jefferies assigns buy rating to monday.com (MNDY) – MSN (Jan 22, 2026)

For more information about monday.com Ltd., please visit the official website: monday.com