Home > Analyses > Consumer Defensive > Molson Coors Beverage Company

Molson Coors Beverage Company shapes the way millions enjoy social moments by crafting iconic beer and malt beverages across the globe. As a powerhouse in the alcoholic beverages sector, it commands a strong portfolio of well-known brands and continuously innovates to meet evolving consumer tastes. With a rich heritage dating back to 1774, Molson Coors blends tradition with modern market strategies. Yet, as the competitive landscape shifts, the key question remains: does its current valuation reflect sustainable growth and operational strength?

Table of contents

Business Model & Company Overview

Molson Coors Beverage Company, founded in 1774 and headquartered in Golden, Colorado, stands as a dominant player in the alcoholic beverages industry. It operates a cohesive ecosystem of beer, flavored malt beverages, craft, and ready-to-drink products, serving markets across the Americas, Europe, Middle East, Africa, and Asia Pacific. This broad portfolio reflects a core mission to cater to diverse consumer tastes worldwide while maintaining a storied legacy.

The company’s revenue engine balances product sales with a strategic global footprint, generating value through its extensive brand offerings in established and emerging markets. With a market capitalization near 9.8B USD and a workforce of 16,800, Molson Coors leverages its presence across continents to sustain growth. Its competitive advantage lies in this expansive reach and brand diversity, creating a robust economic moat shaping the future of the beverage sector.

Financial Performance & Fundamental Metrics

I will analyze Molson Coors Beverage Company’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

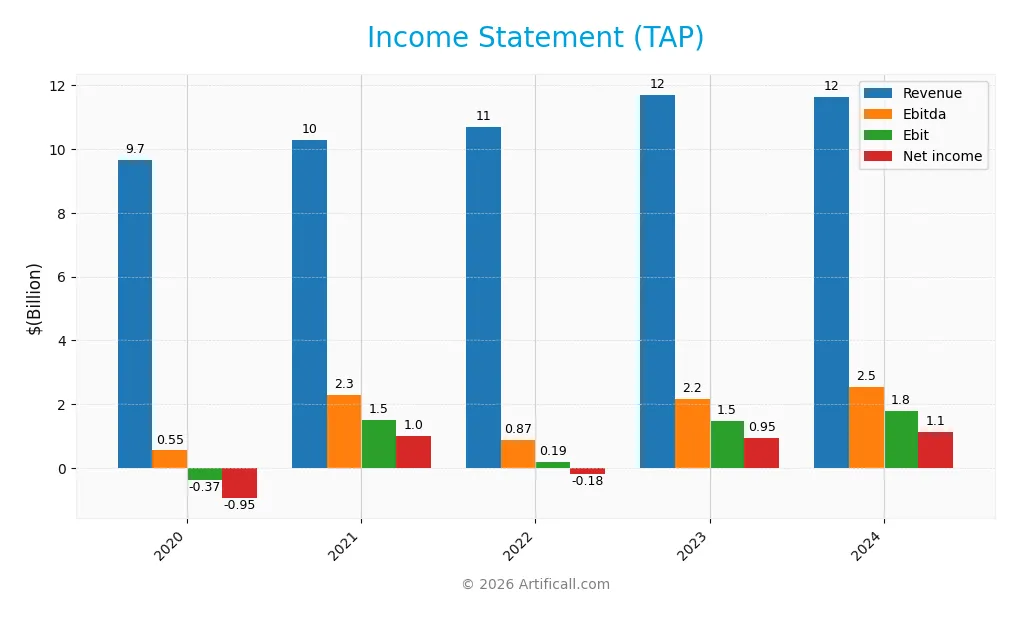

The table below summarizes Molson Coors Beverage Company’s key income statement items for the fiscal years 2020 through 2024, reflecting revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.65B | 10.28B | 10.70B | 11.70B | 11.63B |

| Cost of Revenue | 5.89B | 6.23B | 7.05B | 7.33B | 7.09B |

| Operating Expenses | 4.18B | 2.60B | 3.50B | 2.93B | 2.78B |

| Gross Profit | 3.77B | 4.05B | 3.66B | 4.37B | 4.53B |

| EBITDA | 553M | 2.29B | 873M | 2.17B | 2.55B |

| EBIT | -369M | 1.50B | 188M | 1.49B | 1.79B |

| Interest Expense | 286M | 262M | 236M | 229M | 279M |

| Net Income | -946M | 1.01B | -175M | 949M | 1.12B |

| EPS | -4.36 | 4.63 | -0.86 | 4.39 | 5.38 |

| Filing Date | 2021-02-11 | 2022-02-23 | 2023-02-21 | 2024-02-20 | 2025-02-18 |

Income Statement Evolution

From 2020 to 2024, Molson Coors Beverage Company (TAP) experienced a 20.44% revenue increase, though revenue slightly declined by 0.64% from 2023 to 2024. Net income showed strong growth over the period, surging 218.68%, with a 19.05% rise in net margin in the last year. Margins improved overall, with gross margin steady around 39% and EBIT margin at 15.36%.

Is the Income Statement Favorable?

In 2024, TAP reported $11.6B revenue and $1.12B net income, reflecting a 9.65% net margin, which is considered favorable. EBIT grew 20.13% year-over-year, signaling operational efficiency gains. Interest expense remained low at 2.4% of revenue, supporting profitability. Overall, the income statement fundamentals for 2024 are favorable, with strong earnings growth and margin stability despite a slight revenue dip.

Financial Ratios

The following table presents key financial ratios for Molson Coors Beverage Company (TAP) over the fiscal years 2022 to 2024, providing a snapshot of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2022 | 2023 | 2024 |

|---|---|---|---|

| Net Margin | -1.6% | 8.1% | 9.7% |

| ROE | -1.4% | 7.2% | 8.6% |

| ROIC | 0.7% | 4.7% | 5.8% |

| P/E | -63.7 | 13.9 | 10.7 |

| P/B | 0.88 | 1.00 | 0.91 |

| Current Ratio | 0.78 | 0.70 | 0.94 |

| Quick Ratio | 0.55 | 0.50 | 0.70 |

| D/E | 0.52 | 0.48 | 0.47 |

| Debt-to-Assets | 25.5% | 23.8% | 23.8% |

| Interest Coverage | 0.7 | 6.3 | 6.3 |

| Asset Turnover | 0.41 | 0.44 | 0.45 |

| Fixed Asset Turnover | 2.53 | 2.63 | 2.61 |

| Dividend Yield | 2.9% | 2.7% | 3.1% |

Evolution of Financial Ratios

Molson Coors Beverage Company’s Return on Equity (ROE) showed improvement from negative territory in 2022 to 8.57% in 2024, although still rated unfavorable. The Current Ratio increased from 0.70 in 2023 to 0.94 in 2024 but remains below 1, indicating ongoing liquidity constraints. Debt-to-Equity Ratio improved slightly to 0.47 in 2024, signaling a more balanced leverage position with favorable assessment.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like net margin (9.65%) and return on invested capital (5.85%) are neutral, while ROE is unfavorable at 8.57%. Liquidity ratios remain below 1, with current ratio at 0.94 and quick ratio at 0.7, both unfavorable. Leverage metrics such as debt-to-equity (0.47) and debt-to-assets (23.76%) are favorable, supported by a strong interest coverage ratio of 6.39. Market valuation ratios including price-to-earnings (10.66) and price-to-book (0.91) are favorable, resulting in an overall slightly favorable financial ratio profile.

Shareholder Return Policy

Molson Coors Beverage Company (TAP) maintains a consistent dividend policy with a payout ratio around 33%, a dividend per share increasing from $0.58 in 2020 to $1.77 in 2024, and a dividend yield near 3.1%. The dividend is well covered by free cash flow, indicating prudent distribution.

The data does not explicitly mention share buybacks. The dividend policy appears sustainable, balancing shareholder returns with operational cash flow, supporting long-term value creation without signs of excessive risk from distributions or repurchases.

Score analysis

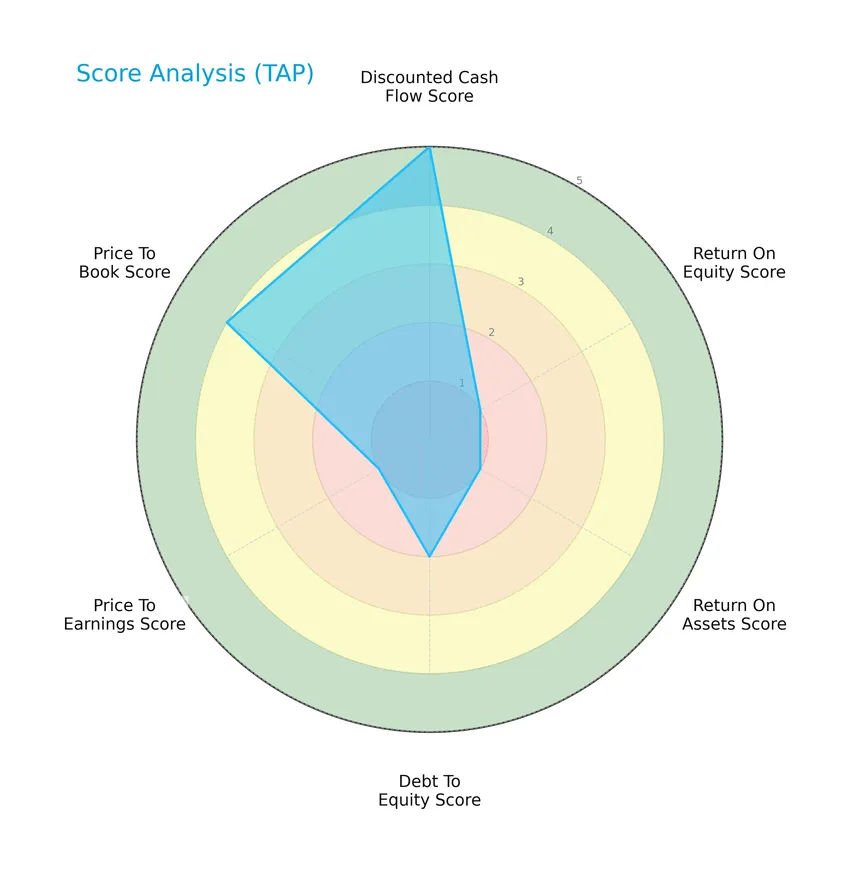

The following radar chart presents a comprehensive view of Molson Coors Beverage Company’s key financial scores:

Molson Coors Beverage Company shows a very favorable discounted cash flow score of 5, indicating strong intrinsic value. However, profitability metrics such as return on equity and return on assets are very unfavorable with scores of 1 each. Debt to equity is moderate at 2, while valuation metrics show a very unfavorable price to earnings score of 1 but a favorable price to book score of 4.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Molson Coors Beverage Company in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

The following diagram illustrates the company’s Piotroski Score:

With a Piotroski Score of 5, Molson Coors Beverage Company falls into the average range, suggesting moderate financial health without strong indications of either financial strength or weakness.

Competitive Landscape & Sector Positioning

This sector analysis will cover Molson Coors Beverage Company’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Molson Coors holds a competitive advantage over its rivals in the alcoholic beverages industry.

Strategic Positioning

Molson Coors Beverage Company maintains a geographically diversified portfolio, generating over 9.2B from the Americas and approximately 2.4B from Europe in 2024. Its product scope includes beer, malt beverages, craft, and ready-to-drink options, serving markets across the Americas, Europe, Middle East, Africa, and Asia Pacific.

Key Products & Brands

Below is an overview of the key products and brands offered by Molson Coors Beverage Company:

| Product | Description |

|---|---|

| Beer | Manufactured, marketed, and sold under various brands across multiple global regions. |

| Flavored Malt Beverages | Includes a variety of flavored malt drinks catering to diverse consumer preferences. |

| Craft Beverages | Specialty craft beers targeting niche markets within the alcoholic beverage industry. |

| Ready to Drink Beverages | Convenient, pre-mixed alcoholic beverages designed for on-the-go consumption. |

Molson Coors Beverage Company’s portfolio spans traditional beers, flavored malt beverages, craft brews, and ready-to-drink options, serving customers across the Americas, Europe, Middle East, Africa, and Asia Pacific.

Main Competitors

There are 2 competitors in total; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Anheuser-Busch InBev SA/NV | 125B |

| Molson Coors Beverage Company | 9.6B |

Molson Coors Beverage Company ranks 2nd among its competitors, with a market cap approximately 7.8% that of the leader, Anheuser-Busch InBev SA/NV. It is positioned below both the average market cap of the top 10 companies (67.3B) and the median market cap in the sector. The company maintains a significant gap of +1181.45% below its closest rival.

Does TAP have a competitive advantage?

Molson Coors Beverage Company (TAP) currently does not demonstrate a definitive competitive advantage, as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating the company is shedding value. However, its ROIC trend shows significant growth, with favorable profitability metrics including a 15.36% EBIT margin and a 9.65% net margin, reflecting operational efficiency and improving returns.

Looking ahead, TAP’s diverse product portfolio across alcoholic beverages, including flavored malt and ready-to-drink options, positions it to capitalize on evolving consumer preferences. The company’s geographic presence in the Americas and Europe, combined with expanding revenue streams and positive earnings growth, suggests opportunities for future market penetration and product innovation that could strengthen its competitive standing.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Molson Coors Beverage Company to support informed investment decisions.

Strengths

- Strong brand portfolio across multiple regions

- Favorable profitability margins with growing net margin

- Solid dividend yield of 3.08%

Weaknesses

- Declining revenue growth in the last year

- Low current and quick ratios indicating liquidity challenges

- Altman Z-Score in distress zone signals financial risk

Opportunities

- Expanding craft and ready-to-drink segments

- Growth potential in Europe and emerging markets

- Improving operating efficiency and EBIT growth

Threats

- Intense competition in alcoholic beverages

- Regulatory pressures and changing consumer preferences

- Economic downturn affecting discretionary spending

Overall, Molson Coors shows solid profitability and improving operational metrics but faces short-term revenue and liquidity concerns. Strategic focus on innovation and geographic expansion, while managing financial risks, will be key to sustaining growth.

Stock Price Action Analysis

The weekly stock chart for Molson Coors Beverage Company (TAP) illustrates price movements and trends over the past 12 months:

Trend Analysis

Over the past 12 months, TAP’s stock price declined by 20.57%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 67.47 and a low of 43.72, with a standard deviation of 5.89 showing moderate volatility. However, a recent 2.5-month period shows a 6.52% price recovery, suggesting a mild short-term bullish correction.

Volume Analysis

In the last three months, trading volume has been increasing, driven strongly by buyers who account for 77.06% of activity. This buyer dominance contrasts with the nearly balanced overall yearly volume split. The rising volume and buyer control imply heightened investor interest and a potential shift in market participation dynamics.

Target Prices

The consensus target price for Molson Coors Beverage Company (TAP) reflects moderate upside potential based on current analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 65 | 40 | 50.67 |

Analysts expect the stock to trade between $40 and $65, with an average consensus target around $50.67, indicating cautious optimism about its near-term performance.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Molson Coors Beverage Company (TAP).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is an overview of the latest stock grades from recognized financial institutions for Molson Coors Beverage Company (TAP):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2025-11-21 |

| Wells Fargo | Downgrade | Equal Weight | 2025-11-19 |

| Barclays | Maintain | Underweight | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-11-05 |

| Jefferies | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

The consensus grade for TAP is “Hold,” supported by a majority of holds and buys among analysts. Recent changes show some cautious downgrades but also stability in neutral and hold ratings, indicating a mixed but generally moderate outlook.

Consumer Opinions

Molson Coors Beverage Company enjoys a solid reputation among its consumers, reflecting both loyalty and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great variety of beverages with consistent quality.” | “Pricing can be higher compared to competitors.” |

| “Strong brand presence and nostalgic flavors.” | “Some products have inconsistent taste batches.” |

| “Good availability in stores and bars.” | “Customer service response times could improve.” |

Overall, consumers appreciate Molson Coors’ diverse product range and brand heritage. However, pricing and occasional quality consistency issues remain common concerns that the company should address to enhance customer satisfaction.

Risk Analysis

Here is a summary table outlining the main risk categories affecting Molson Coors Beverage Company (TAP), their descriptions, probabilities, and potential impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (0.87) indicates risk of financial distress. | High | High |

| Profitability | Unfavorable ROE (8.57%) and low asset turnover may limit growth. | Medium | Medium |

| Liquidity | Current ratio (0.94) and quick ratio (0.7) below 1 signal tight liquidity. | Medium | Medium |

| Market Valuation | Favorable PE (10.66) and PB (0.91) ratios suggest undervaluation. | Low | Low |

| Debt Management | Favorable debt-to-equity (0.47) and interest coverage (6.39) ratios. | Low | Low |

| Dividend Stability | Dividend yield at 3.08% is favorable but depends on cash flow. | Medium | Medium |

The most pressing risk is the company’s position in the distress zone per the Altman Z-Score, signaling a high probability of financial difficulties. Coupled with unfavorable profitability and liquidity ratios, investors should approach with caution despite attractive valuation metrics.

Should You Buy Molson Coors Beverage Company?

Molson Coors appears to be improving profitability with a slightly favorable moat driven by growing ROIC, yet it sheds value relative to its WACC. Despite a manageable leverage profile, financial health signals remain mixed, suggesting a cautious B- rating overall.

Strength & Efficiency Pillars

Molson Coors Beverage Company exhibits solid profitability with a net margin of 9.65% and an EBIT margin standing at 15.36%, underscoring operational efficiency. Its weighted average cost of capital (WACC) at 5.19% is slightly below its return on invested capital (ROIC) of 5.85%, suggesting the company is marginally creating value, though this advantage remains limited. Financial health metrics, however, present mixed signals: an Altman Z-Score of 0.87 places the firm in the distress zone, while a Piotroski score of 5 indicates average financial strength.

Weaknesses and Drawbacks

The company faces notable challenges, particularly in liquidity and market perception. A current ratio of 0.94 and a quick ratio of 0.7 indicate tight short-term liquidity, raising concerns over financial flexibility. While leverage is moderate with a debt-to-equity ratio of 0.47, the stock’s recent bearish trend, with a 20.57% price decline, reflects market pressure. Despite a reasonable P/E of 10.66 and favorable P/B of 0.91, investor confidence could be tempered by the Altman Z-Score signaling financial distress risks.

Our Verdict about Molson Coors Beverage Company

Molson Coors presents a fundamentally mixed profile with moderate profitability and value creation offset by liquidity risks and financial distress concerns. Despite a recent strong buyer dominance of 77.06% and a positive short-term price trend, the overall bearish long-term trend and liquidity weaknesses suggest caution. The profile might appear attractive for investors with a tolerance for risk but could warrant a wait-and-see approach for those seeking greater stability.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Acquires New Stake in Molson Coors Beverage Company $TAP – MarketBeat (Jan 24, 2026)

- Feeling Political Or Recessionary Stress? Molson Coors May Benefit (NYSE:TAP) – Seeking Alpha (Jan 22, 2026)

- Did Strong Q4 Results and Lower Guidance Just Shift Molson Coors’ (TAP) Investment Narrative? – Sahm (Jan 21, 2026)

- 3 Reasons to Sell TAP and 1 Stock to Buy Instead – Finviz (Jan 22, 2026)

- Wall Street Remains Cautious on Molson Coors Beverage Company (TAP) – Yahoo Finance (Dec 09, 2025)

For more information about Molson Coors Beverage Company, please visit the official website: molsoncoors.com