Home > Analyses > Healthcare > Moderna, Inc.

Moderna, Inc. revolutionizes healthcare by pioneering messenger RNA technology that transforms how we prevent and treat infectious diseases and cancer. As a biotechnology powerhouse, Moderna leads with innovative vaccines against COVID-19, flu, and other respiratory viruses, backed by strategic collaborations with industry giants. Renowned for its cutting-edge research and rapid development capabilities, the company stands at the forefront of medical innovation. The key question now is whether Moderna’s current fundamentals and growth prospects justify its market valuation in a rapidly evolving biotech landscape.

Table of contents

Business Model & Company Overview

Moderna, Inc., founded in 2010 and headquartered in Cambridge, Massachusetts, operates as a leading force in biotechnology. It has built a comprehensive ecosystem centered on messenger RNA therapeutics and vaccines targeting infectious diseases, immuno-oncology, and rare conditions. This core mission integrates a diverse portfolio, including vaccines for COVID-19, flu, and other respiratory and latent infections, positioning Moderna at the forefront of medical innovation globally.

The company’s revenue engine balances product sales and strategic collaborations across the Americas, Europe, and Asia. Moderna leverages its expertise in mRNA technology through partnerships with industry giants and government agencies, enhancing its pipeline of vaccines and therapeutics. This blend of proprietary innovation and global reach underpins its robust economic moat, shaping the future landscape of biotechnology and healthcare.

Financial Performance & Fundamental Metrics

In this section, I analyze Moderna, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

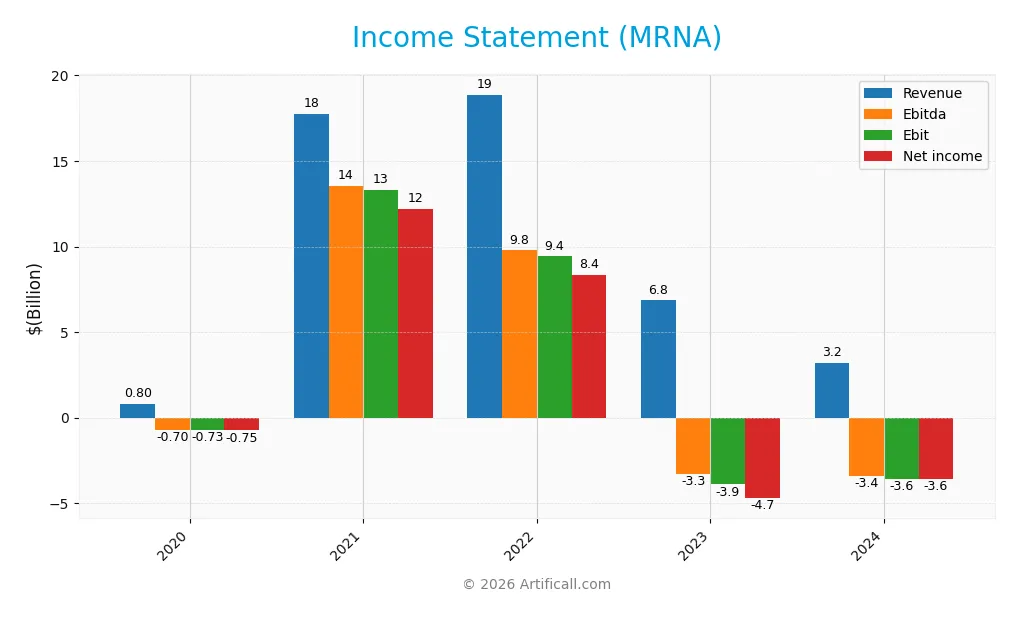

The table below presents Moderna, Inc.’s key income statement items for fiscal years 2020 through 2024, showing revenue, expenses, profits, and earnings per share in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 803M | 17.7B | 18.9B | 6.8B | 3.2B |

| Cost of Revenue | 39M | 2.6B | 5.4B | 4.7B | 1.5B |

| Operating Expenses | 1.53B | 1.82B | 4.04B | 6.39B | 5.68B |

| Gross Profit | 764M | 15.1B | 13.5B | 2.2B | 1.7B |

| EBITDA | -703M | 13.5B | 9.8B | -3.3B | -3.4B |

| EBIT | -735M | 13.3B | 9.4B | -3.9B | -3.6B |

| Interest Expense | 9.9M | 18M | 29M | 38M | 24M |

| Net Income | -747M | 12.2B | 8.4B | -4.7B | -3.6B |

| EPS | -1.96 | 30.31 | 21.26 | -12.34 | -9.27 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, Moderna’s revenue showed strong overall growth of 298%, although it declined sharply by 53% in the latest year. Gross profit followed a similar pattern, dropping nearly 20% year-over-year but maintaining a favorable gross margin of 54%. Operating expenses contracted in line with revenue, but negative EBIT and net income margins persisted, reflecting ongoing profitability challenges.

Is the Income Statement Favorable?

In 2024, Moderna reported revenue of $3.2B with a gross margin of 54.2%, indicating efficiency in production costs. However, the company recorded an EBIT margin of -112% and a net margin of -111%, signaling heavy losses. While EPS improved 25% year-over-year, the overall income statement remains unfavorable due to significant net losses despite a low interest expense burden.

Financial Ratios

The table below presents Moderna, Inc.’s key financial ratios for the fiscal years 2020 through 2024, providing a clear view of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -93% | 69% | 44% | -69% | -111% |

| ROE | -29% | 86% | 44% | -34% | -33% |

| ROIC | -26% | 78% | 39% | -27% | -33% |

| P/E | -53.3 | 8.4 | 8.5 | -8.1 | -4.5 |

| P/B | 15.6 | 7.2 | 3.7 | 2.7 | 1.5 |

| Current Ratio | 1.43 | 1.76 | 2.73 | 3.42 | 3.67 |

| Quick Ratio | 1.42 | 1.60 | 2.54 | 3.36 | 3.62 |

| D/E | 0.09 | 0.06 | 0.06 | 0.09 | 0.07 |

| Debt-to-Assets | 3.2% | 3.7% | 4.6% | 6.7% | 5.3% |

| Interest Coverage | -77.2 | 739 | 325 | -112 | -164 |

| Asset Turnover | 0.11 | 0.72 | 0.73 | 0.37 | 0.23 |

| Fixed Asset Turnover | 2.08 | 12.8 | 8.82 | 2.58 | 1.08 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

From 2020 to 2024, Moderna, Inc. (MRNA) saw a marked decline in Return on Equity (ROE), dropping from positive territory in 2021 and 2022 to -32.67% in 2024. The Current Ratio increased steadily, peaking at 3.67 in 2024, indicating improved short-term liquidity. Meanwhile, the Debt-to-Equity Ratio remained low and stable around 0.07, reflecting consistent leverage management despite profitability challenges.

Are the Financial Ratios Favorable?

In 2024, Moderna’s profitability ratios, including net margin (-111.32%) and ROE (-32.67%), were unfavorable, highlighting significant losses. Liquidity showed mixed signals: the Current Ratio (3.67) was unfavorable, possibly due to excess current assets, while the Quick Ratio (3.62) was favorable. Leverage ratios such as Debt-to-Equity (0.07) and Debt-to-Assets (5.28%) were favorable, indicating low financial risk. However, efficiency ratios like Asset Turnover (0.23) and Interest Coverage (-149.29) were unfavorable. Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

Moderna, Inc. has not paid dividends from 2020 to 2024, reflecting negative net income in recent years and a reinvestment focus amid fluctuating profitability. The company does not currently engage in share buybacks, consistent with its strategy prioritizing growth and operational stabilization.

This policy aligns with Moderna’s ongoing investment in R&D and capacity building, supporting long-term shareholder value creation despite short-term earnings challenges. The absence of distributions and buybacks suggests a cautious approach to capital allocation amid volatile financial performance.

Score analysis

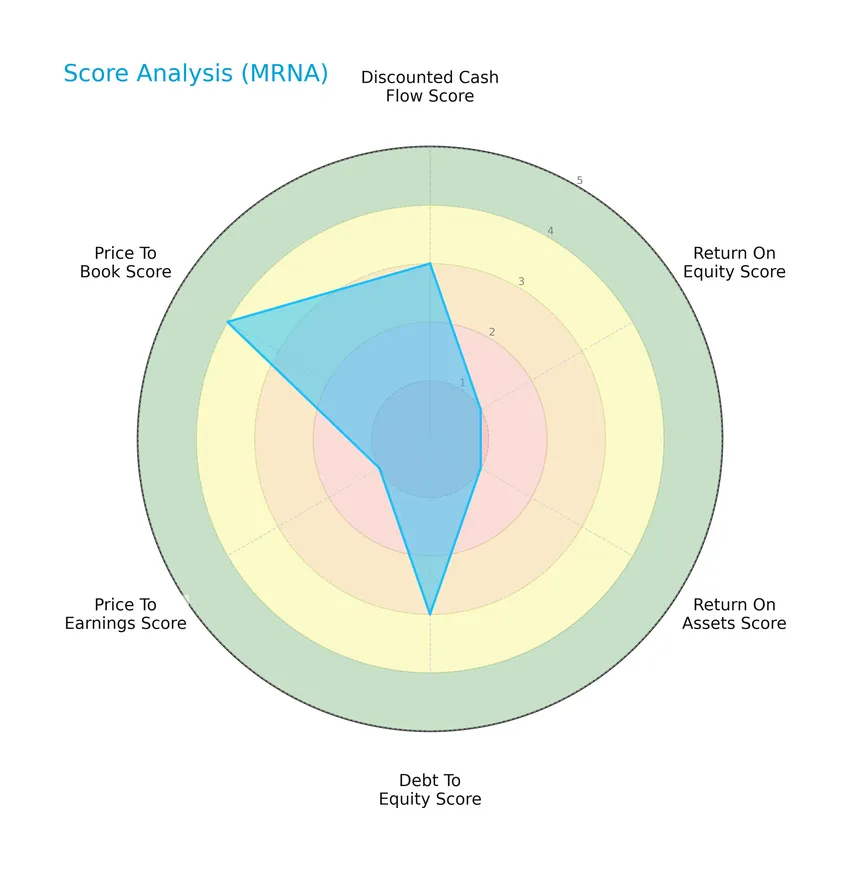

The following radar chart presents a detailed overview of Moderna, Inc.’s key financial scores:

Moderna’s discounted cash flow and debt-to-equity scores are moderate at 3, while price-to-book is favorable at 4. However, return on equity, return on assets, and price-to-earnings scores are very unfavorable, indicating areas of concern in profitability and valuation metrics.

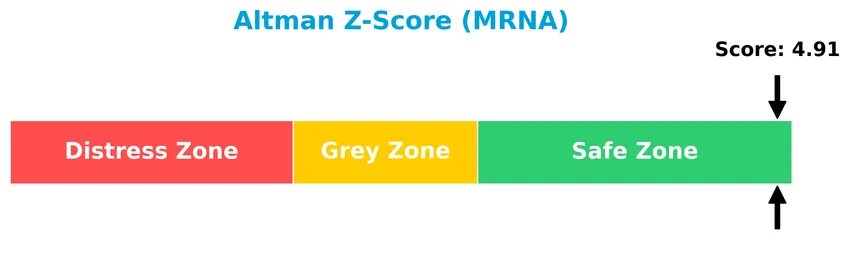

Analysis of the company’s bankruptcy risk

Moderna’s Altman Z-Score indicates a safe zone status, suggesting a low risk of bankruptcy and financial stability over the near term:

Is the company in good financial health?

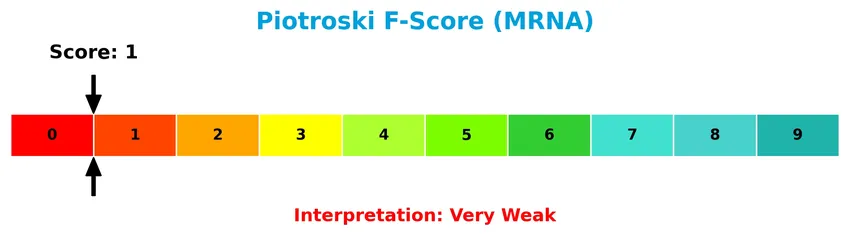

The Piotroski diagram below illustrates Moderna’s financial strength based on the Piotroski Score criteria:

With a Piotroski Score of 1, Moderna is assessed as very weak in financial health, reflecting potential issues in profitability, leverage, liquidity, or operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Moderna, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Moderna holds a competitive advantage over its peers in the biotechnology industry.

Strategic Positioning

Moderna, Inc. focuses on messenger RNA therapeutics and vaccines, with a diverse product portfolio addressing infectious, immuno-oncology, and rare diseases. Geographically, its revenue spans the US (1.79B in 2024), Europe (598M), and Rest of World (810M), reflecting a balanced international exposure.

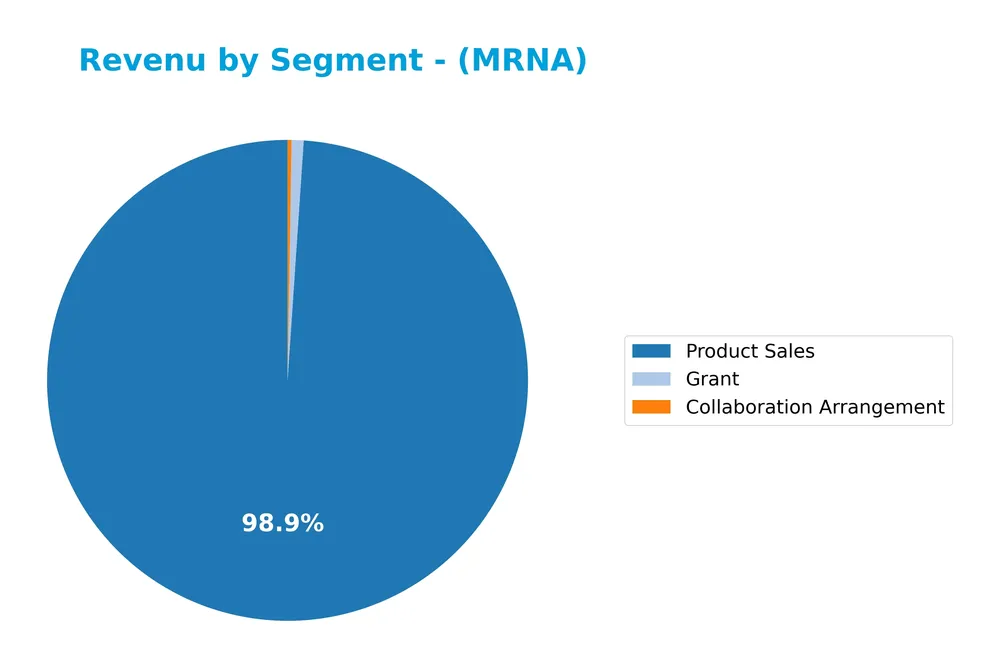

Revenue by Segment

This pie chart illustrates Moderna, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting contributions from product sales, collaborations, and grants.

In 2024, Moderna’s revenue was primarily driven by product sales totaling 4.5B USD, with collaboration arrangements and grants contributing 12M and 37M USD respectively. This marks a notable shift from prior years where the “Messenger RNA (mRNA) Medicines” segment dominated with revenues peaking at 19.3B USD in 2022 before a sharp decline. The 2024 figures suggest a concentration in product sales but also a slowdown compared to the mRNA medicines boom in earlier years.

Key Products & Brands

The following table outlines Moderna, Inc.’s principal products and brand categories:

| Product | Description |

|---|---|

| Messenger RNA (mRNA) Medicines | Therapeutics and vaccines based on messenger RNA technology targeting infectious diseases, cancer, and rare diseases. |

| Respiratory Vaccines | Vaccines for COVID-19, flu, respiratory syncytial virus, Endemic HCoV, and hMPV+PIV3. |

| Latent Vaccines | Vaccines targeting cytomegalovirus, Epstein-Barr virus, HIV, herpes simplex virus, and varicella-zoster virus. |

| Public Health Vaccines | Vaccines for Zika and Nipah viruses. |

| Cancer Vaccines | Personalized cancer vaccines, KRAS, and checkpoint vaccines. |

| Immuno-oncology Products | Intratumoral therapeutics aimed at cancer treatment. |

| Systemic and Localized Therapeutics | Includes systemic secreted and cell surface therapeutics, localized regenerative, systemic intracellular, and inhaled pulmonary treatments. |

Moderna’s product portfolio is centered on innovative mRNA technology with a diverse range of vaccines and therapeutics targeting infectious diseases, oncology, and rare conditions, supported by strategic alliances in the biotech sector.

Main Competitors

In the Biotechnology sector, there are 5 main competitors, with the table below listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Vertex Pharmaceuticals Incorporated | 116B |

| Regeneron Pharmaceuticals, Inc. | 80.2B |

| Incyte Corporation | 19.9B |

| Moderna, Inc. | 12.1B |

| Bio-Techne Corporation | 9.35B |

Moderna, Inc. ranks 4th among its competitors with a market cap at 16.4% of the top player, Vertex Pharmaceuticals. The company’s market cap is below both the average of 47.5B for the top 10 and the sector median of 19.9B. It maintains a 4.62% lead over its closest competitor above, indicating a modest gap in scale within this competitive group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MRNA have a competitive advantage?

Moderna, Inc. currently does not present a competitive advantage as it is shedding value with a very unfavorable moat status, showing declining profitability and a negative spread between ROIC and WACC. Its income statement reveals unfavorable margins and significant declines in revenue and net income growth despite some favorable trends in EBIT and EPS growth.

Looking ahead, Moderna’s future outlook includes development across a broad pipeline of messenger RNA therapeutics and vaccines targeting infectious diseases, immuno-oncology, rare and cardiovascular diseases, and auto-immune disorders. Strategic alliances with major pharmaceutical companies and global health organizations offer opportunities for market expansion and innovation in emerging vaccines and therapeutics.

SWOT Analysis

This SWOT analysis highlights Moderna, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic decisions.

Strengths

- strong mRNA technology platform

- diversified vaccine pipeline

- strategic alliances with major pharma

Weaknesses

- negative net margin and EBIT margin

- declining revenue growth

- weak financial health scores

Opportunities

- expanding global vaccine markets

- growing demand for infectious disease vaccines

- potential in rare and autoimmune diseases

Threats

- intense biotech competition

- regulatory hurdles

- market volatility and pricing pressures

Overall, Moderna’s robust technological base and partnerships present significant growth potential, but current profitability challenges and financial instability require cautious risk management. Strategic focus should balance innovation with operational efficiency to capitalize on market opportunities while mitigating threats.

Stock Price Action Analysis

The weekly stock chart below illustrates Moderna, Inc.’s price movements over the past 12 months, highlighting key highs, lows, and trend shifts:

Trend Analysis

Over the past 12 months, Moderna’s stock price declined by 48.76%, indicating a bearish trend with accelerating downside momentum. The price ranged between a high of 166.61 and a low of 23.51, showing significant volatility with a standard deviation of 37.85. Recent weeks show a strong rebound, with a 98.49% increase since November 2025.

Volume Analysis

Trading volume has been increasing, with total volume surpassing 4.5B shares traded over the year. Buyer dominance stands at 54.35%, rising to 71.37% in the recent period, reflecting strongly buyer-driven activity. This suggests heightened investor interest and positive market participation since November 2025.

Target Prices

Analysts present a moderate target consensus for Moderna, Inc., reflecting a range of expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 63 | 15 | 30.73 |

The target prices suggest that while some analysts see significant upside potential, the consensus leans toward a cautious outlook around the low 30s.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews expert evaluations and customer feedback related to Moderna, Inc. (MRNA) to inform investors.

Stock Grades

Here is the latest summary of stock grades for Moderna, Inc. from recognized financial institutions and analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-12 |

| Leerink Partners | Maintain | Underperform | 2025-11-21 |

| Piper Sandler | Maintain | Overweight | 2025-11-21 |

| RBC Capital | Maintain | Sector Perform | 2025-11-21 |

| B of A Securities | Maintain | Underperform | 2025-11-10 |

| Barclays | Maintain | Equal Weight | 2025-11-07 |

| UBS | Maintain | Buy | 2025-10-23 |

| Citigroup | Maintain | Neutral | 2025-10-23 |

| JP Morgan | Maintain | Underweight | 2025-10-23 |

| Needham | Maintain | Hold | 2025-10-20 |

The consensus indicates a predominantly cautious stance, with the majority of ratings clustered around hold and equal weight, reflecting tempered investor confidence and a balanced risk outlook. Few strong buy or sell recommendations are present, underscoring a stable but guarded market sentiment.

Consumer Opinions

Investor sentiment around Moderna, Inc. (MRNA) reflects a mix of optimism about its innovation and concerns about market volatility.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong leadership in mRNA technology and vaccine development. | High dependency on COVID-19 vaccine sales creates revenue uncertainty. |

| Impressive pipeline with promising new vaccines and therapeutics. | Stock price fluctuations driven by regulatory and competitive pressures. |

| Consistent R&D investment ensuring long-term growth potential. | Concerns about pricing strategies and accessibility in some markets. |

Overall, consumers appreciate Moderna’s innovative edge and robust pipeline, but remain cautious about its revenue concentration and market risks. Balancing these factors is key for investors considering MRNA.

Risk Analysis

Below is a summary table highlighting the key risks associated with investing in Moderna, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Despite a safe Altman Z-Score (4.91), Moderna shows very weak Piotroski (1) and negative profitability ratios. | Medium | High |

| Market Volatility | Beta of 1.174 indicates moderate sensitivity to market swings, with recent 6% price drop. | High | Medium |

| Product Pipeline | Reliance on mRNA vaccines and therapeutics innovation carries regulatory and development risks. | Medium | High |

| Competitive Pressure | Intense biotech competition and rapid technological changes may erode market share. | Medium | Medium |

| Dividend Policy | No dividend yield, which may deter income-focused investors. | Low | Low |

Financial risks are most notable, with Moderna suffering from unfavorable net margin (-111%) and return on equity (-32.7%), despite strong liquidity and low debt. The safe Altman Z-Score shows low bankruptcy risk, but the very weak Piotroski score signals operational and financial weakness. Market volatility remains a concern due to recent stock price fluctuations. Overall, investors should weigh Moderna’s innovative potential against these financial and market risks carefully.

Should You Buy Moderna, Inc.?

Moderna, Inc. appears to be facing significant challenges with declining profitability and a deteriorating competitive moat, suggesting value destruction. Despite a manageable leverage profile and a safe Altman Z-Score, its overall rating of C+ and very weak Piotroski score indicate cautious analytical interpretation.

Strength & Efficiency Pillars

Moderna, Inc. presents a mixed efficiency profile with a notably strong financial health indicator, reflected in an Altman Z-Score of 4.91, positioning the company safely away from bankruptcy risk. The firm maintains a favorable price-to-book ratio of 1.46, suggesting reasonable market valuation relative to its net assets. Its debt-to-equity ratio is exceptionally low at 0.07, signaling conservative leverage and sound capital structure. However, profitability metrics such as return on equity (-32.67%) and return on invested capital (-32.53%) are deeply negative, with ROIC well below the WACC of 9.16%, indicating Moderna is currently destroying rather than creating shareholder value.

Weaknesses and Drawbacks

Profitability challenges dominate Moderna’s risk profile, with a stark net margin of -111.32% and an EBIT margin of -112.0%, underscoring operational inefficiencies. The company’s current ratio stands at 3.67 but is deemed unfavorable, possibly indicating excessive current assets that could be underutilized. Negative interest coverage (-149.29) raises concerns about operating income sufficiency to cover interest expenses. Despite a favorable price-to-earnings score due to a negative P/E ratio (-4.48), this reflects losses rather than premium valuation. Market sentiment shows a recent strong buyer dominance (71.37%), yet the overall stock trend remains bearish with a -48.76% price decline, signaling persistent market pressure and volatility.

Our Verdict about Moderna, Inc.

The long-term fundamental profile of Moderna appears unfavorable due to its sustained negative profitability and value destruction. Nonetheless, recent technical trends demonstrate strong buyer dominance and a pronounced price rebound, suggesting potential market interest. Despite the current fundamental challenges, the recent positive momentum might indicate early signs of recovery. This profile may appear suitable for investors with high risk tolerance seeking entry points during a turnaround phase but warrants cautious monitoring given the enduring operational weaknesses.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Moderna (MRNA) Shares Skyrocket, What You Need To Know – Yahoo Finance (Jan 21, 2026)

- Moderna, Inc. $MRNA Shares Sold by Baillie Gifford & Co. – MarketBeat (Jan 24, 2026)

- What’s Happening With Moderna Stock? – Forbes (Jan 22, 2026)

- Moderna Is Curbing Investment in Vaccine Trials Due to US Backlash – Bloomberg (Jan 22, 2026)

- Moderna shares soar through the week, momentum data points toward caution (MRNA:NASDAQ) – Seeking Alpha (Jan 22, 2026)

For more information about Moderna, Inc., please visit the official website: modernatx.com