Home > Analyses > Technology > MKS Inc.

MKS Inc. powers the precision and control behind critical manufacturing processes that shape the technology and industrial landscapes worldwide. As a leader in hardware and equipment for semiconductor, industrial, and life sciences sectors, MKS delivers cutting-edge vacuum, laser, and photonics solutions that drive innovation and quality in complex production environments. With a reputation for technological excellence and market influence, the key question for investors is whether MKS’s robust fundamentals continue to support its premium valuation and long-term growth prospects.

Table of contents

Business Model & Company Overview

MKS Inc., founded in 1961 and headquartered in Andover, Massachusetts, stands as a dominant player in the hardware and equipment industry. It delivers a cohesive ecosystem of instruments, systems, and subsystems designed to measure, monitor, and control critical manufacturing processes worldwide. Its core mission revolves around precision and innovation, serving diverse markets including semiconductors, industrial technologies, and life sciences.

The company generates value through a balanced revenue engine combining advanced hardware, integrated software, and recurring services. Its Vacuum & Analysis, Light & Motion, and Equipment & Solutions segments offer specialized products such as pressure control, laser technology, and laser-based PCB manufacturing systems. With a robust presence across the Americas, Europe, and Asia, MKS Inc. leverages its strong economic moat to shape the future of process control and manufacturing precision.

Financial Performance & Fundamental Metrics

I will analyze MKS Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

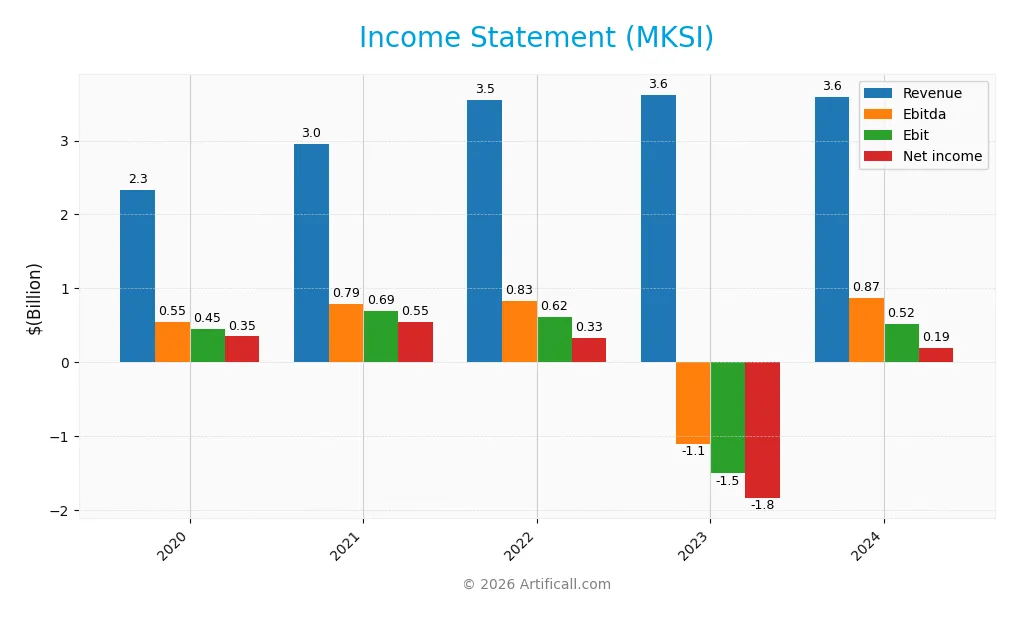

The table below summarizes MKS Inc.’s key income statement metrics over the past five fiscal years, illustrating revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.33B | 2.95B | 3.55B | 3.62B | 3.59B |

| Cost of Revenue | 1.28B | 1.57B | 2.00B | 1.98B | 1.88B |

| Operating Expenses | 595M | 681M | 930M | 3.20B | 1.21B |

| Gross Profit | 1.05B | 1.38B | 1.55B | 1.64B | 1.71B |

| EBITDA | 551M | 794M | 832M | -1.11B | 870M |

| EBIT | 452M | 690M | 616M | -1.51B | 522M |

| Interest Expense | 29M | 25M | 177M | 422M | 345M |

| Net Income | 350M | 551M | 333M | -1.84B | 190M |

| EPS | 6.35 | 9.95 | 5.58 | -27.56 | 2.82 |

| Filing Date | 2021-02-23 | 2022-02-28 | 2023-03-14 | 2024-02-27 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, MKS Inc. showed a 53.9% increase in revenue, indicating solid top-line growth. However, net income declined by 45.7% over the same period, reflecting pressure on profitability. Gross margin remained stable and favorable at 47.6%, while net margin contracted by 64.7%, signaling a deterioration in bottom-line efficiency despite revenue gains.

Is the Income Statement Favorable?

In 2024, revenue slightly decreased by 1%, but gross profit grew by 4%, showing improved cost management. Operating expenses scaled favorably relative to revenue, supporting a strong 135% rise in EBIT and a net margin of 5.3%, classified as favorable. Despite interest expenses remaining neutral, the overall fundamentals in 2024 present a favorable income statement profile with improved profitability metrics compared to the prior year.

Financial Ratios

The following table presents key financial ratios for MKS Inc. over the fiscal years 2020 to 2024, illustrating the company’s profitability, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 19% | 9% | -51% | 5% |

| ROE | 15% | 19% | 7% | -74% | 8% |

| ROIC | 11% | 14% | 4% | -18% | 6% |

| P/E | 23.7 | 17.5 | 15.2 | -3.7 | 37.0 |

| P/B | 3.51 | 3.34 | 1.13 | 2.78 | 3.03 |

| Current Ratio | 4.83 | 4.67 | 2.93 | 3.18 | 3.19 |

| Quick Ratio | 3.48 | 3.41 | 1.91 | 2.01 | 2.04 |

| D/E | 0.44 | 0.36 | 1.15 | 2.03 | 2.06 |

| Debt-to-Assets | 26% | 23% | 45% | 55% | 56% |

| Interest Coverage | 15.7 | 28.0 | 3.5 | -3.7 | 1.4 |

| Asset Turnover | 0.60 | 0.65 | 0.31 | 0.40 | 0.42 |

| Fixed Asset Turnover | 5.0 | 5.8 | 3.4 | 3.6 | 3.6 |

| Dividend Yield | 0.53% | 0.49% | 1.03% | 0.86% | 0.84% |

All values are based on reported fiscal year data in USD. Percentages are rounded to nearest whole number for margins and ratios expressed as decimals are shown with two decimal places. Negative values indicate losses or unfavorable financial conditions in those years.

Evolution of Financial Ratios

From 2021 to 2024, MKS Inc.’s Return on Equity (ROE) showed a marked decline from 19.1% in 2021 to 8.18% in 2024, indicating diminished profitability. The Current Ratio remained relatively stable around 3.1 to 3.2, suggesting consistent short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased sharply from 0.36 in 2021 to 2.06 in 2024, reflecting a significant rise in leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (5.3%) and return on invested capital (6.31%) are neutral, while ROE at 8.18% and WACC at 11.28% are unfavorable. Liquidity shows mixed signals: a high current ratio of 3.19 is unfavorable, yet the quick ratio of 2.04 is favorable. Leverage ratios, including debt-to-equity at 2.06 and debt-to-assets at 55.65%, are unfavorable, as is the interest coverage at 1.51. Efficiency ratios show asset turnover at 0.42 (unfavorable) but fixed asset turnover at 3.55 (favorable). Overall, the majority of ratios are unfavorable.

Shareholder Return Policy

MKS Inc. pays dividends with a payout ratio of approximately 31% in 2024 and a dividend yield near 0.84%. The dividend per share has remained stable around $0.87, supported by free cash flow coverage of about 78%. The company also engages in share buybacks, balancing distributions with financial prudence.

This approach suggests a moderate and sustainable shareholder return strategy, avoiding excessive payouts or repurchases. The stable dividend, combined with free cash flow backing and buybacks, indicates a focus on long-term shareholder value without risking financial strain.

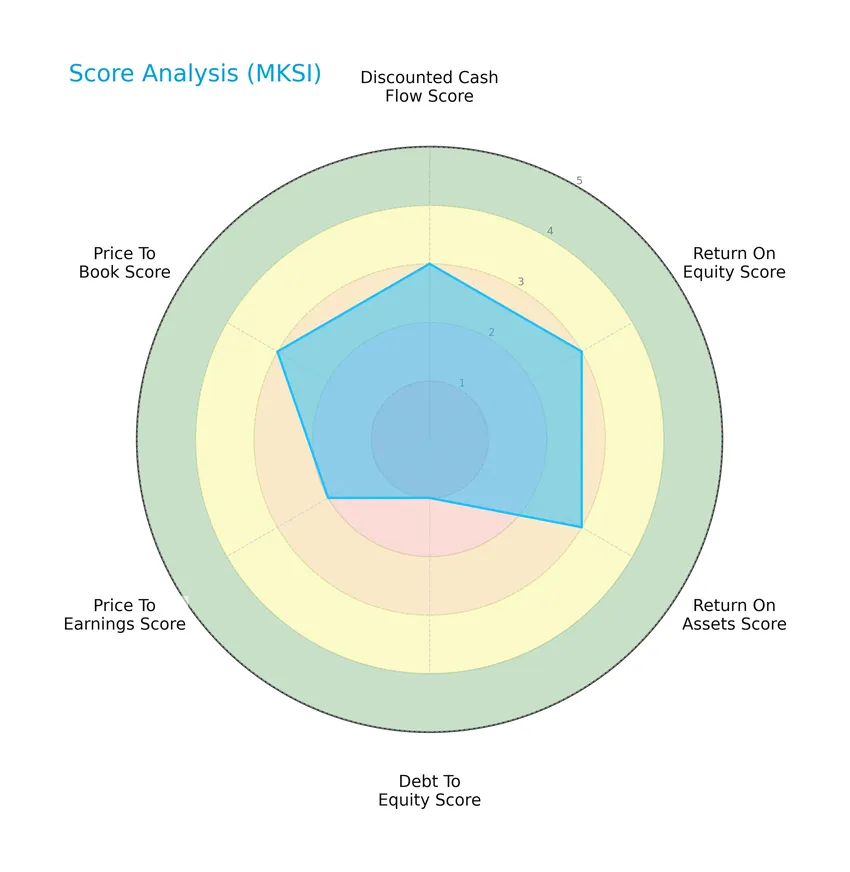

Score analysis

The following radar chart presents a comprehensive overview of the company’s key financial scores across valuation, profitability, and leverage metrics:

MKS Inc. shows moderate scores in discounted cash flow, return on equity, return on assets, price-to-earnings, and price-to-book ratios. However, its debt-to-equity score is very unfavorable, indicating higher leverage risk relative to peers.

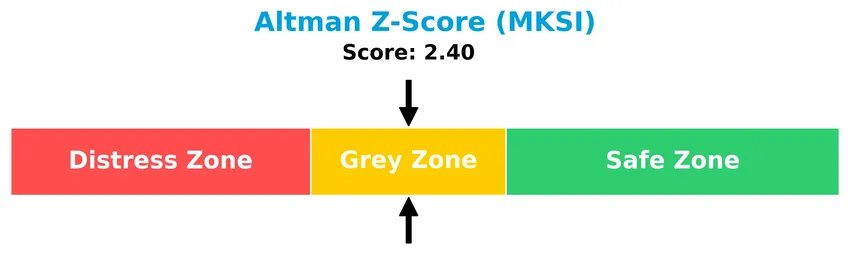

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the grey zone, suggesting a moderate risk of financial distress and potential bankruptcy:

Is the company in good financial health?

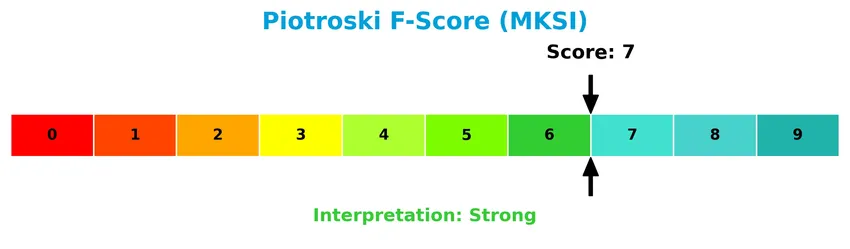

The Piotroski Score diagram illustrates the company’s financial strength across nine criteria used to evaluate profitability, leverage, liquidity, and efficiency:

With a Piotroski Score of 7, MKS Inc. is considered to be in strong financial health, reflecting solid fundamentals despite some risks indicated by other metrics.

Competitive Landscape & Sector Positioning

This sector analysis will explore MKS Inc.’s strategic positioning, revenue breakdown, key products, main competitors, and competitive advantages. I will assess whether MKS Inc. holds a meaningful competitive advantage over its peers in the hardware, equipment, and parts industry.

Strategic Positioning

MKS Inc. maintains a diversified product portfolio across Vacuum & Analysis, Light & Motion, and Equipment & Solutions segments, serving semiconductor, industrial, life sciences, and defense markets. Geographically, it has broad exposure, with significant revenue from the US (804M), China (775M), Korea (358M), and other Asia-Pacific and global regions, reflecting a balanced global footprint.

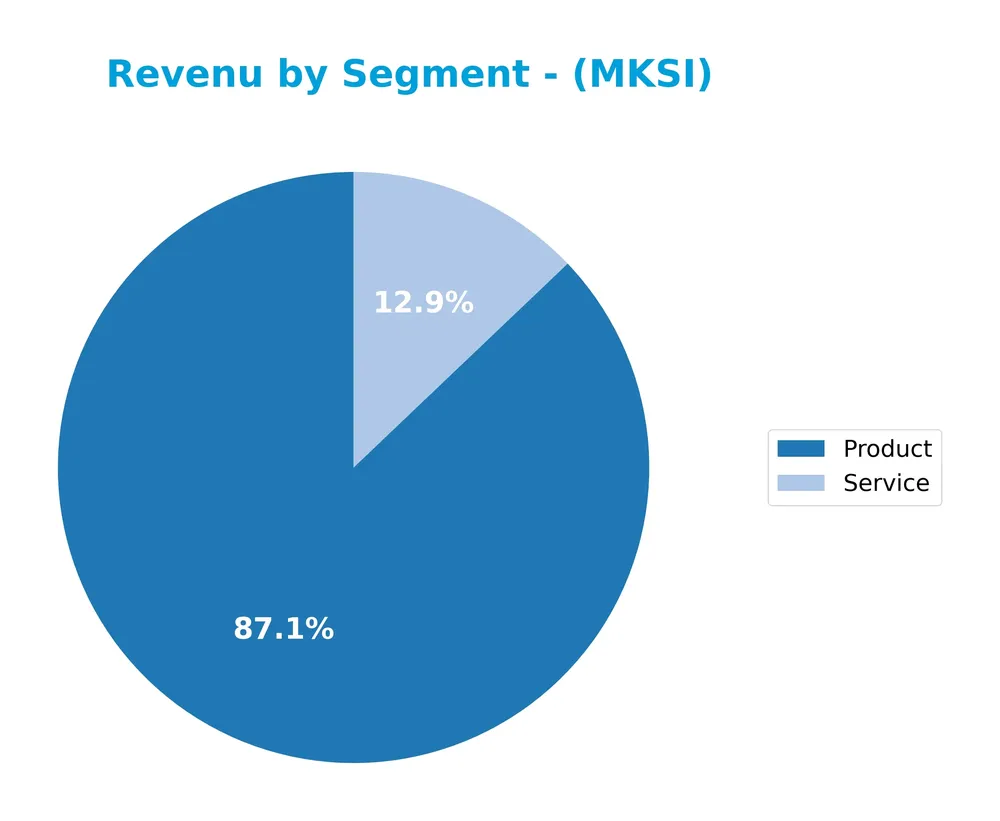

Revenue by Segment

This pie chart illustrates MKS Inc.’s revenue distribution by segment for the fiscal year 2024, showing the relative contributions of product and service lines.

In 2024, MKS Inc. generated $3.12B from product sales and $462M from services, indicating a strong reliance on product revenue. Compared to 2023, product revenue slightly decreased from $3.20B, while service revenue grew from $422M, suggesting a modest shift towards service offerings. The overall trend reflects stability in product sales with a gradual increase in service contributions, highlighting a potential diversification of revenue sources but still concentrated primarily in product segments.

Key Products & Brands

The table below outlines MKS Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Vacuum & Analysis | Pressure and vacuum control solutions including direct and indirect pressure measurement, materials delivery with flow and valve technologies, integrated pressure measurement and control subsystems, power solutions like microwave and RF matching networks, and plasma/reactive gas products. |

| Light & Motion | Laser products (continuous wave, pulsed nanosecond, diode, diode-pumped solid-state, fiber lasers) and photonics products such as motion control, optical tables, vibration isolation, photonic instruments, optics assemblies, opto-mechanical components, and laser/LED measurement devices. |

| Equipment & Solutions | Laser-based systems for PCB manufacturing (flexible interconnect PCB processing, high-density interconnect solutions for rigid PCB and substrate processing) and multi-layer ceramic capacitor test systems. |

| Products (FY 2024) | Instruments, systems, and subsystems that measure, monitor, deliver, analyze, power, and control critical manufacturing process parameters globally; generated revenue of $3.12B in 2024. |

| Services (FY 2024) | Service offerings related to the company’s product range; generated revenue of $462M in 2024. |

MKS Inc.’s product portfolio spans vacuum and pressure control, laser and photonic technologies, and laser-based manufacturing equipment. The company generated over $3.5B in combined product and service revenues in 2024, serving semiconductor, industrial, life sciences, research, and defense markets.

Main Competitors

There are 20 competitors in the Technology Hardware, Equipment & Parts sector; below is the list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40.0B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34.0B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

MKS Inc. ranks 14th among 20 competitors in this sector, with a market cap approximately 8.5% that of the leader, Amphenol Corporation. The company is positioned below both the average market cap of the top 10 (54.4B) and the sector median (21.6B). It maintains an 11.9% market cap distance above its closest competitor, indicating a moderate gap in scale relative to rivals directly above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MKSI have a competitive advantage?

MKS Inc. does not currently present a competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over 2020-2024 is strongly negative, signaling worsening efficiency in capital use.

Looking ahead, MKS Inc. operates in diverse markets including semiconductors, industrial technologies, and life sciences, with a broad product portfolio in vacuum, laser, and photonics systems. Continued innovation in laser-based systems and expansion into emerging geographic markets may offer future growth opportunities despite the current unfavorable value creation profile.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting MKS Inc. to guide investors in assessing its strategic position.

Strengths

- strong gross margin at 47.63%

- favorable EBIT margin of 14.56%

- diversified product portfolio across semiconductor and industrial sectors

Weaknesses

- declining ROIC and value destruction

- high debt-to-equity ratio at 2.06

- unfavorable liquidity ratios and interest coverage

Opportunities

- growth in Asian markets, especially China and Korea

- expanding semiconductor and advanced manufacturing demand

- innovation in laser and vacuum technologies

Threats

- high market volatility with beta near 1.92

- intense competition in tech hardware sector

- macroeconomic risks impacting global manufacturing

Overall, MKS Inc. shows solid operational strengths but faces financial challenges with leverage and declining returns. Strategic focus on innovation and expansion in emerging markets is crucial to offset risks and drive sustainable growth.

Stock Price Action Analysis

The weekly stock chart below illustrates MKS Inc.’s price movements and trading patterns over the past 12 months:

Trend Analysis

Over the past 12 months, MKS Inc.’s stock price increased by 71.55%, indicating a bullish trend with acceleration. The price ranged from a low of 60.29 to a high of 217.06, reflecting significant volatility with a standard deviation of 26.73. Recent weeks show a continued positive slope of 5.59%.

Volume Analysis

Trading volume over the last three months shows a strongly buyer-dominant pattern, with buyers accounting for 82.49% of activity. Volume is increasing, suggesting growing investor interest and confidence in the stock. This heightened market participation points to sustained demand pressure on the shares.

Target Prices

Analysts present a clear consensus on MKS Inc.’s target prices, indicating a bullish outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 265 | 151 | 216.57 |

The target prices suggest that analysts expect the stock to appreciate, with a consensus price notably above the current trading levels, reflecting positive market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of analyst ratings and consumer feedback concerning MKS Inc. (MKSI).

Stock Grades

Here is the latest summary of MKS Inc. stock grades from recognized financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-22 |

| TD Cowen | Maintain | Buy | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-22 |

| Morgan Stanley | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-22 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-20 |

| Keybanc | Maintain | Overweight | 2026-01-16 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-15 |

| Needham | Maintain | Buy | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2026-01-13 |

Overall, the grades show a predominantly positive outlook with multiple Buy and Overweight ratings, while Wells Fargo’s Equal Weight suggests a more neutral stance, reflecting some divergence among analysts.

Consumer Opinions

Consumers have shared mixed sentiments about MKS Inc., reflecting both appreciation for its product quality and concerns about customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “MKS Inc. products are reliable and high-performance.” | “Customer support takes too long to respond.” |

| “Strong innovation in their technology offerings.” | “Pricing is on the higher side compared to competitors.” |

| “Excellent technical specifications and durability.” | “Limited availability of some key components.” |

Overall, consumers consistently praise MKS Inc. for product quality and innovation but often highlight issues with customer service delays and pricing as areas needing improvement.

Risk Analysis

The table below summarizes key risks associated with MKS Inc., highlighting their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (2.06) increases financial risk and interest burden. | High | High |

| Profitability | Low return on equity (8.18%) and net margin (5.3%) signal modest profitability challenges. | Medium | Medium |

| Valuation | Elevated price-to-earnings (36.98) and price-to-book (3.03) ratios suggest overvaluation risk. | Medium | Medium |

| Liquidity | Current ratio (3.19) unfavorable despite strong quick ratio (2.04), indicating potential issues. | Medium | Medium |

| Market Volatility | Beta of 1.918 implies higher stock price volatility compared to market average. | High | Medium |

| Bankruptcy Risk | Altman Z-Score in grey zone (2.40) points to moderate bankruptcy risk. | Medium | High |

The most prominent risks are MKS Inc.’s elevated financial leverage and its moderate bankruptcy risk, as reflected by its Altman Z-Score in the grey zone. Combined with above-average market volatility, these factors warrant cautious consideration despite the company’s strong Piotroski score and moderate profitability.

Should You Buy MKS Inc.?

MKS Inc. appears to be navigating a challenging leverage profile with substantial net debt, while its profitability metrics suggest weak value creation and declining operational efficiency. Despite a very unfavorable moat due to eroding returns, the overall B- rating indicates moderate investment appeal.

Strength & Efficiency Pillars

MKS Inc. exhibits moderate profitability with a net margin of 5.3% and a return on equity of 8.18%, though these metrics suggest room for improvement. The company maintains a solid Piotroski score of 7, indicating strong financial health, while its Altman Z-score of 2.40 places it in the grey zone, reflecting moderate bankruptcy risk. However, MKS’s return on invested capital (6.31%) falls short of its weighted average cost of capital (11.28%), confirming it is currently a value destroyer rather than a value creator.

Weaknesses and Drawbacks

The firm faces significant headwinds from its financial structure and valuation. Its debt-to-equity ratio stands at 2.06, signaling very high leverage, compounded by a weak interest coverage ratio of 1.51, which raises concerns about debt servicing capacity. Valuation metrics also appear stretched, with a price-to-earnings ratio of 36.98 and price-to-book ratio of 3.03, both unfavorable and suggesting a premium valuation that may limit upside. Additionally, a current ratio of 3.19 is marked unfavorable, potentially reflecting inefficient capital allocation or liquidity management.

Our Verdict about MKS Inc.

MKS Inc. presents an unfavorable long-term fundamental profile due to its persistent value destruction and high leverage. However, its bullish overall stock trend and recent strong buyer dominance (82.49%) might suggest that the market anticipates improvement. Given this mixed picture, the investment case may appear speculative; despite long-term challenges, recent market momentum could offer opportunities, yet a cautious, wait-and-see approach may better suit risk-conscious investors.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- MKS Inc. (MKSI) Hit a 52 Week High, Can the Run Continue? – Yahoo Finance (Jan 23, 2026)

- MKS Inc. (NASDAQ:MKSI) Held Back By Insufficient Growth Even After Shares Climb 37% – Sahm (Jan 24, 2026)

- MKS increases Q4 guidance ahead of earnings; Needham hikes price target – Seeking Alpha (Jan 22, 2026)

- Morgan Stanley Maintains MKS Inc(MKSI.US) With Buy Rating, Raises Target Price to $258 – 富途资讯 (Jan 22, 2026)

- Mizuho Markets Americas LLC Increases Stock Position in MKS Inc. $MKSI – MarketBeat (Jan 19, 2026)

For more information about MKS Inc., please visit the official website: mksinst.com