Meta Platforms, Inc. is a leading player in the technology sector, primarily known for its social media platforms and innovations in virtual reality. As the parent company of Facebook, Instagram, WhatsApp, and Oculus, Meta has a significant influence on how people connect and communicate globally. This article will help you determine if investing in Meta Platforms is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Table of Contents

Company Description

Meta Platforms, Inc. engages in developing products that enable people to connect and share through mobile devices, personal computers, virtual reality headsets, and wearables. The company operates in two segments: Family of Apps, which includes Facebook, Instagram, Messenger, and WhatsApp, and Reality Labs, which focuses on augmented and virtual reality products. Headquartered in Menlo Park, California, Meta has a global reach, with significant market presence in North America, Europe, and Asia. The company aims to enhance user experiences and foster connections through innovative technology and social platforms.

Key Products of Meta Platforms

| Product |

Description |

| Facebook |

A social networking platform for sharing and connecting with friends and family. |

| Instagram |

A photo and video sharing platform that allows users to share visual content. |

| WhatsApp |

A messaging application for private communication between users. |

| Messenger |

A messaging service integrated with Facebook for real-time communication. |

| Oculus |

A virtual reality platform offering immersive experiences through hardware and software. |

Revenue Evolution

The following table illustrates the revenue evolution of Meta Platforms from 2021 to 2025, highlighting key financial metrics.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

117,929 |

55,274 |

46,753 |

39,370 |

13.99 |

| 2022 |

116,609 |

37,690 |

28,944 |

23,200 |

8.63 |

| 2023 |

134,902 |

59,052 |

46,751 |

39,098 |

15.19 |

| 2024 |

164,501 |

86,876 |

69,380 |

62,360 |

24.61 |

| 2025 (est.) |

Projected |

Projected |

Projected |

Projected |

Projected |

The revenue and net income have shown a positive trend, particularly from 2023 to 2024, indicating strong growth potential. The EPS has also increased significantly, reflecting improved profitability.

Financial Ratios Analysis

The following table presents key financial ratios for Meta Platforms, providing insights into its financial health and operational efficiency.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

33.38% |

31.53% |

32.28% |

24.05 |

7.58 |

3.15 |

0.11 |

| 2022 |

19.90% |

18.45% |

18.24% |

13.94 |

2.57 |

2.20 |

0.21 |

| 2023 |

28.98% |

25.53% |

23.65% |

23.30 |

5.95 |

2.67 |

0.24 |

| 2024 |

37.91% |

34.14% |

28.61% |

23.79 |

8.12 |

2.98 |

0.27 |

Interpretation of Financial Ratios

In 2024, Meta Platforms is expected to achieve a net margin of 37.91%, indicating strong profitability. The return on equity (ROE) is projected at 34.14%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is also favorable at 28.61%, suggesting efficient use of capital. The price-to-earnings (P/E) ratio of 23.79 indicates that the stock is reasonably valued relative to its earnings, while the price-to-book (P/B) ratio of 8.12 suggests a premium valuation compared to its book value. The current ratio of 2.98 indicates strong liquidity, and the debt-to-equity (D/E) ratio of 0.27 shows a conservative approach to leverage.

Evolution of Financial Ratios

The financial ratios have shown a generally favorable trend over the past few years. The net margin has increased significantly, indicating improved profitability. The ROE and ROIC have also risen, reflecting better capital efficiency. The current ratio remains strong, suggesting that Meta Platforms is well-positioned to meet its short-term obligations. Overall, the latest year’s ratios are favorable for investors.

Distribution Policy

Meta Platforms has a modest payout ratio of 8.13%, indicating that it retains a significant portion of its earnings for reinvestment. The annual dividend yield is approximately 0.34%, which is relatively low compared to other companies in the sector. The company has engaged in share buybacks, which can enhance shareholder value, but it is essential to monitor if these buybacks are sustainable in the long term. Overall, the distribution policy appears to favor growth over immediate returns to shareholders.

Sector Analysis

Meta Platforms operates in the highly competitive technology sector, particularly in social media and virtual reality. The company holds a significant market share in social networking, with Facebook and Instagram being among the most widely used platforms globally. However, it faces intense competition from other tech giants like Google, TikTok, and Snapchat, which continuously innovate and capture user attention. The sector is also subject to rapid technological changes and evolving consumer preferences, which can disrupt established players.

Main Competitors

The following table outlines the main competitors of Meta Platforms and their respective market shares.

| Company |

Market Share |

| Meta Platforms (Facebook, Instagram) |

60% |

| Google (YouTube) |

20% |

| TikTok |

15% |

| Snapchat |

5% |

Meta Platforms dominates the social media landscape, particularly in North America and Europe, while competitors like Google and TikTok are gaining traction, especially among younger demographics.

Competitive Advantages

Meta Platforms benefits from a vast user base, extensive data analytics capabilities, and a strong brand presence. Its investment in augmented and virtual reality through Reality Labs positions it well for future growth in emerging technologies. The company’s ability to innovate and adapt to changing market conditions will be crucial in maintaining its competitive edge.

Stock Analysis

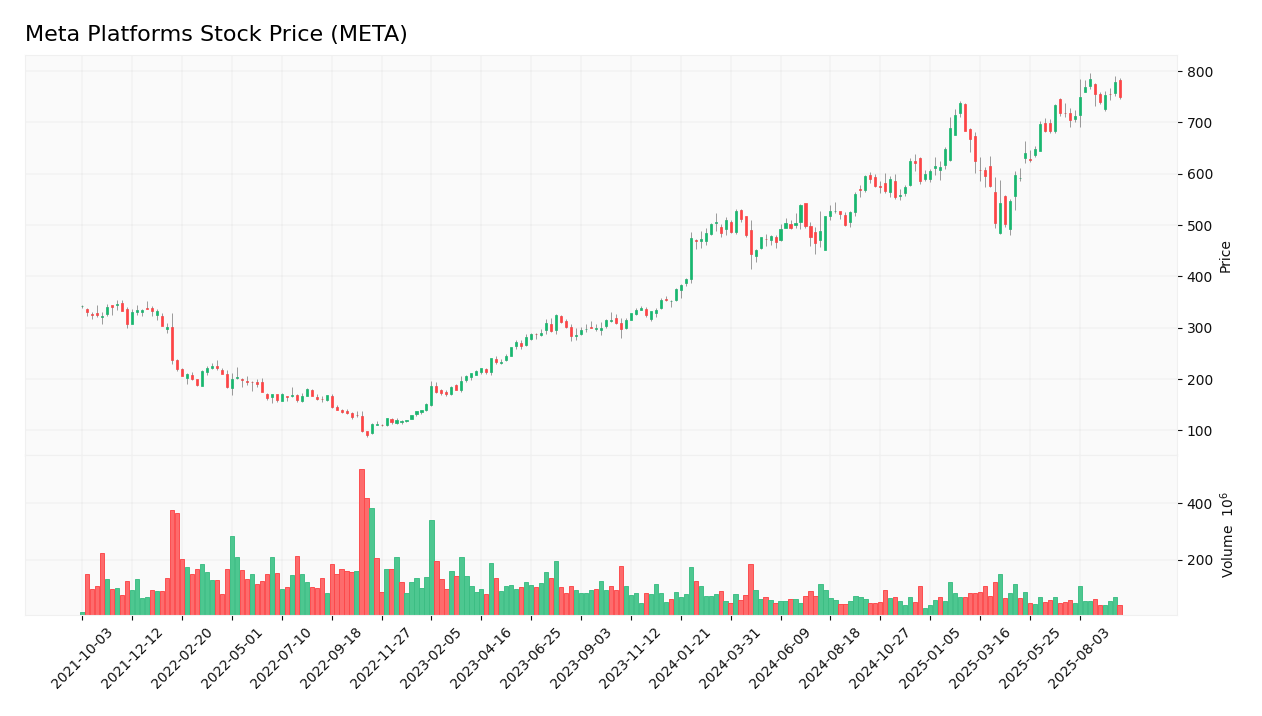

The following chart illustrates the weekly stock price trend of Meta Platforms.

Trend Analysis

The stock price of Meta Platforms has shown a bullish trend over the past year, with a significant increase from approximately $300 in early 2023 to around $750 in September 2025. This represents a percentage increase of approximately 150% over the period. The stock has experienced some volatility, with fluctuations in response to market conditions and company performance. The current price is within the 52-week range of $479.8 to $796.25, indicating a healthy trading range.

Volume Analysis

Over the last three months, the average trading volume for Meta Platforms has been approximately 11,657,653 shares per day. This indicates a strong interest from investors, with volumes trending upwards, suggesting a buyer-driven market. The increasing volume is a positive sign, indicating that more investors are willing to buy into the stock, which could support further price appreciation.

Analyst Opinions

Recent analyst recommendations for Meta Platforms have been predominantly positive, with many analysts rating the stock as a “buy.” The main arguments include the company’s strong revenue growth, robust profit margins, and significant investments in future technologies. The consensus among analysts is that Meta Platforms is well-positioned for long-term growth, making it a favorable investment opportunity in 2025.

Consumer Opinions

Consumer feedback on Meta Platforms has been mixed, with many praising the user experience and innovative features, while others express concerns about privacy and data security. The following table compares three positive and three negative reviews.

| Positive Reviews |

Negative Reviews |

| Great user interface and easy to navigate. |

Concerns about data privacy and security. |

| Innovative features keep the platform engaging. |

Frequent changes to algorithms affect visibility. |

| Strong community and networking opportunities. |

Ads can be intrusive and overwhelming. |

Risk Analysis

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Regulatory |

Increased scrutiny from regulators regarding data privacy. |

High |

High |

Ongoing investigations by the FTC. |

| Technological |

Rapid changes in technology may outpace Meta’s innovations. |

Medium |

High |

N/A |

| Operational |

Challenges in managing a large workforce and operational costs. |

Medium |

Moderate |

N/A |

| Geopolitical |

Impact of international relations on global operations. |

Medium |

High |

N/A |

The most critical risks for investors include regulatory scrutiny and technological disruption, which could significantly impact Meta’s operations and profitability.

Summary

Meta Platforms has established itself as a leader in the technology sector, with flagship products that dominate the social media landscape. The company’s financial ratios indicate strong profitability and efficient capital management. However, it faces significant risks, particularly from regulatory scrutiny and technological changes.

| Strengths |

Weaknesses |

| Strong brand recognition and user base. |

Regulatory challenges and scrutiny. |

| Innovative technology and product offerings. |

Concerns over data privacy. |

| Robust financial performance and growth potential. |

High competition in the tech sector. |

Should You Buy Meta Platforms?

Given the positive net margin, favorable long-term trend, and increasing buyer volumes, investing in Meta Platforms appears to be a favorable opportunity for long-term growth. However, investors should remain cautious of the regulatory risks and market volatility. It may be prudent to monitor the stock closely and consider the timing of any investment.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

For more information, visit the official website of Meta Platforms:

Meta Platforms Official Website.

Table of Contents

Table of Contents