Home > Analyses > Healthcare > Merck & Co., Inc.

Merck & Co., Inc. profoundly influences global health by delivering groundbreaking pharmaceutical and animal health solutions that touch millions of lives daily. As a leading player in the pharmaceutical industry, Merck is renowned for its innovative oncology treatments, vaccines, and comprehensive health management products. Its reputation for quality and strategic collaborations underscores its market leadership. Yet, as the healthcare landscape evolves rapidly, the critical question remains: do Merck’s current fundamentals and growth prospects justify its substantial market valuation in 2026?

Table of contents

Business Model & Company Overview

Merck & Co., Inc., founded in 1891 and headquartered in Kenilworth, New Jersey, stands as a leading healthcare company with a diverse portfolio spanning human pharmaceuticals and animal health. Its integrated ecosystem addresses critical needs in oncology, immunology, vaccines, and veterinary solutions, connecting patients, healthcare providers, and animal producers globally. This cohesive approach underpins its dominant position in the drug manufacturing sector.

Merck generates value through a balanced revenue engine combining pharmaceutical sales and innovative animal health products, alongside strategic collaborations with major industry players. Its global footprint spans the Americas, Europe, and Asia, serving a broad client base including hospitals, government agencies, and veterinarians. This robust model creates a formidable economic moat, positioning Merck as a pivotal force shaping the future of healthcare worldwide.

Financial Performance & Fundamental Metrics

I will analyze Merck & Co., Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strengths and risks.

Income Statement

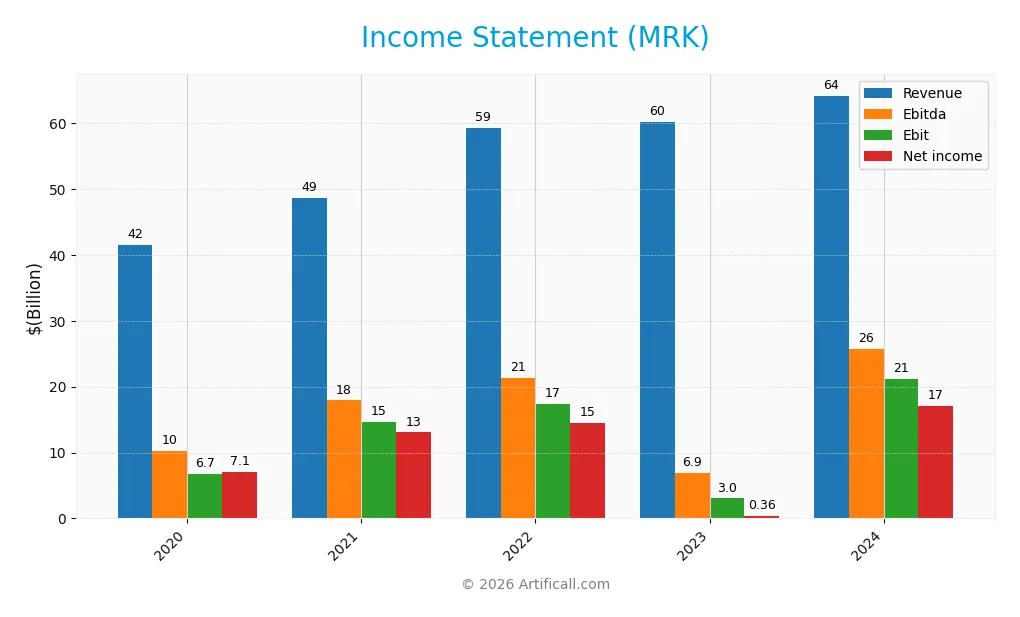

The table below summarizes Merck & Co., Inc.’s key financial figures for the fiscal years 2020 through 2024, providing a clear view of revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 41.5B | 48.7B | 59.3B | 60.1B | 64.2B |

| Cost of Revenue | 13.6B | 13.6B | 17.4B | 16.1B | 15.2B |

| Operating Expenses | 22.4B | 21.9B | 23.6B | 41.0B | 28.8B |

| Gross Profit | 27.9B | 35.1B | 41.9B | 43.9B | 49.0B |

| EBITDA | 10.2B | 17.9B | 21.3B | 6.9B | 25.7B |

| EBIT | 6.7B | 14.7B | 17.4B | 3.0B | 21.2B |

| Interest Expense | 831M | 806M | 962M | 1.1B | 1.3B |

| Net Income | 7.1B | 13.0B | 14.5B | 365M | 17.1B |

| EPS | 2.79 | 5.16 | 5.73 | 0.14 | 6.76 |

| Filing Date | 2021-02-25 | 2022-02-25 | 2023-02-24 | 2024-02-26 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Merck & Co., Inc. showed steady revenue growth of 54.55%, with a 6.74% increase in the most recent year, categorized as neutral. Net income surged 142.21% overall, with a remarkable 4293.38% rise in net margin last year, indicating significantly improved profitability. Margins also strengthened, with gross margin at 76.32% and net margin at 26.68%, both marked as favorable.

Is the Income Statement Favorable?

The 2024 income statement reveals robust fundamentals, with revenue of $64.2B and net income of $17.1B, supporting an EPS of $6.76. Operating expenses grew moderately relative to revenue, aiding an EBITDA margin above 40%. Interest expense remains low at 1.98% of revenue. The overall evaluation rates 92.86% of income statement metrics as favorable, reflecting solid profitability and efficient cost management.

Financial Ratios

The following table summarizes key financial ratios for Merck & Co., Inc. over the last five fiscal years, providing a clear view of its profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 17% | 27% | 24% | 1% | 27% |

| ROE | 28% | 34% | 32% | 1% | 37% |

| ROIC | 6% | 14% | 19% | 1% | 19% |

| P/E | 28 | 15 | 19 | 779 | 15 |

| P/B | 7.8 | 5.1 | 6.1 | 7.6 | 5.4 |

| Current Ratio | 1.02 | 1.27 | 1.47 | 1.25 | 1.36 |

| Quick Ratio | 0.81 | 1.02 | 1.23 | 1.00 | 1.15 |

| D/E | 1.32 | 0.91 | 0.70 | 0.97 | 0.83 |

| Debt-to-Assets | 36% | 33% | 29% | 34% | 33% |

| Interest Coverage | 6.7 | 16.4 | 19.0 | 2.6 | 15.9 |

| Asset Turnover | 0.45 | 0.46 | 0.54 | 0.56 | 0.55 |

| Fixed Asset Turnover | 2.44 | 2.53 | 2.77 | 2.61 | 2.70 |

| Dividend Yield | 3.15% | 3.41% | 2.50% | 2.62% | 3.11% |

Evolution of Financial Ratios

Merck & Co., Inc. experienced a significant rebound in Return on Equity (ROE), increasing from 0.97% in 2023 to 36.96% in 2024, indicating a strong recovery in profitability. The Current Ratio showed a modest improvement from 1.25 to 1.36, reflecting slightly better liquidity. The Debt-to-Equity Ratio declined from 0.97 to 0.83, suggesting reduced leverage and improved financial stability.

Are the Financial Ratios Favorable?

In 2024, Merck’s profitability ratios, including net margin at 26.68% and ROE at 36.96%, were favorable, supported by an interest coverage ratio of 16.69. Liquidity is neutral to favorable with a current ratio of 1.36 and quick ratio of 1.15. Leverage ratios remain neutral, with a debt-to-equity ratio of 0.83 and debt-to-assets at 32.68%. Market valuation shows a favorable P/E of 14.72 but an unfavorable price-to-book ratio of 5.44. Overall, 57.14% of key ratios are favorable, indicating solid financial health.

Shareholder Return Policy

Merck & Co., Inc. maintains a consistent dividend policy with a payout ratio around 46%, supported by a steady dividend per share growth reaching 3.10 USD in 2024 and an annual yield of approximately 3.1%. The company also engages in share buybacks, balancing distributions with strong free cash flow coverage to avoid unsustainable payouts.

This approach aligns well with long-term shareholder value creation by combining reliable income with capital return flexibility. The dividend and repurchase strategy, backed by solid profitability and cash flow metrics, suggests a prudent policy aimed at sustaining shareholder returns without compromising financial stability.

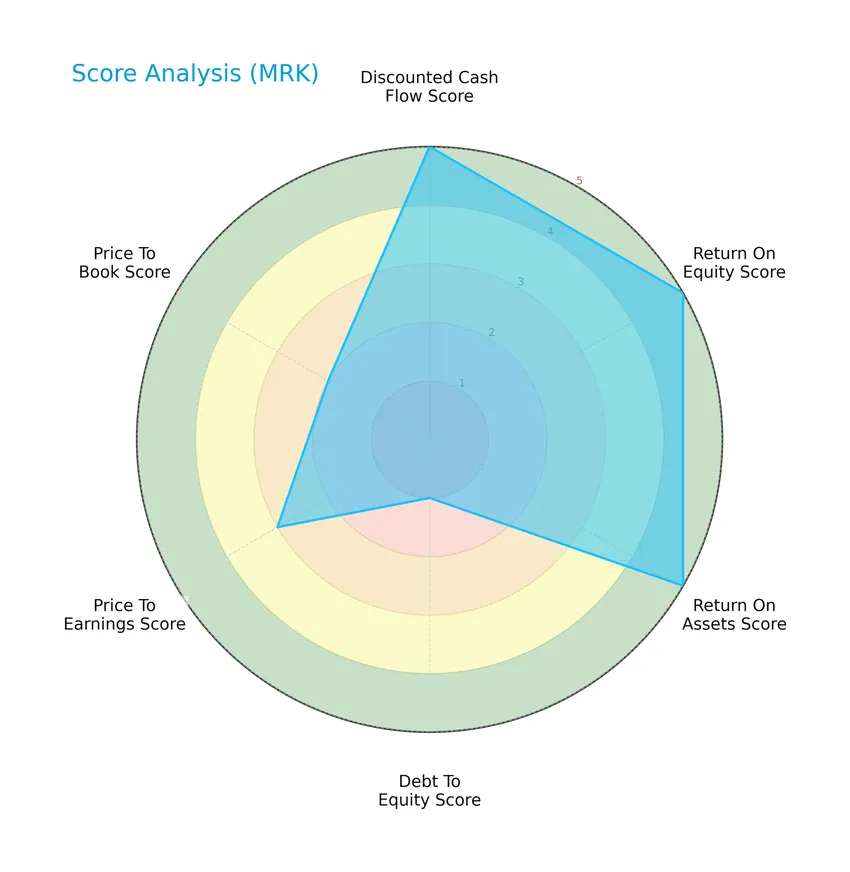

Score analysis

Here is a radar chart presenting the evaluation of key financial ratios and valuation metrics for Merck & Co., Inc.:

The company scores very favorably in discounted cash flow, return on equity, and return on assets, each rated 5, indicating strong profitability and value generation. Debt-to-equity is rated very unfavorably at 1, reflecting higher leverage risk. Price-to-earnings and price-to-book ratios have moderate scores of 3 and 2, respectively.

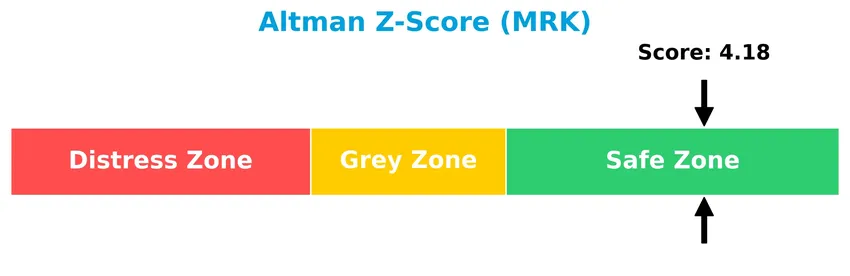

Analysis of the company’s bankruptcy risk

Merck & Co., Inc. has an Altman Z-Score of 4.18, placing it securely in the safe zone and indicating a low risk of bankruptcy:

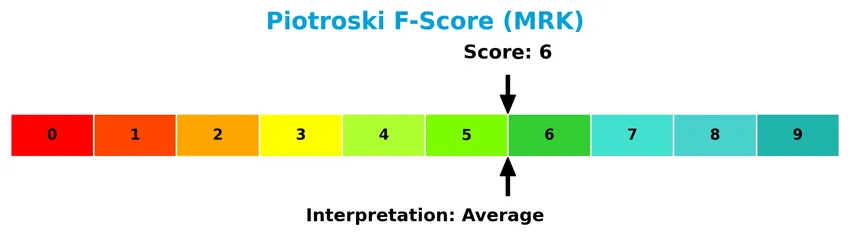

Is the company in good financial health?

The following Piotroski diagram illustrates Merck & Co., Inc.’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 6, the company is assessed as having average financial health, suggesting moderate strength in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an overview of Merck & Co., Inc.’s position within the healthcare sector, focusing on its strategic and operational dimensions. I will assess whether Merck holds a competitive advantage relative to its key competitors in the pharmaceutical and animal health markets.

Strategic Positioning

Merck & Co., Inc. maintains a diversified product portfolio with significant revenue from its Pharmaceutical segment ($57.4B in 2024) and a growing Animal Health segment ($5.9B). Geographically, it generates over half of its revenue from the United States ($32.3B), complemented by substantial exposure in EMEA ($14B), China ($5.5B), and other international markets.

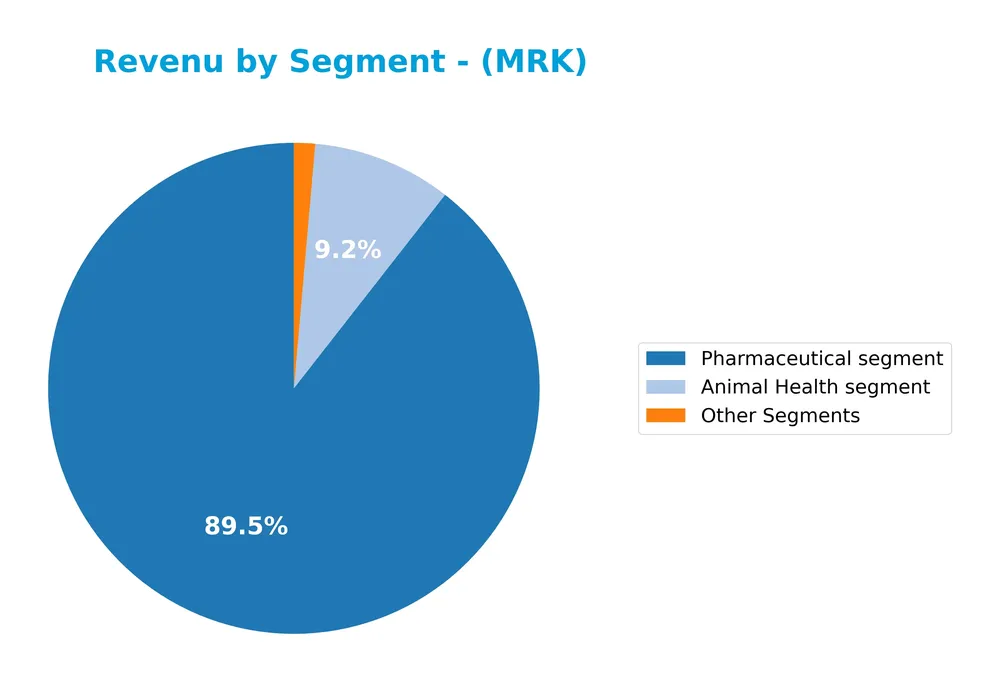

Revenue by Segment

This pie chart illustrates Merck & Co., Inc.’s revenue distribution across its main business segments for the fiscal year 2024.

In 2024, the Pharmaceutical segment remains the dominant revenue driver with $57.4B, showing steady growth from $53.6B in 2023. The Animal Health segment also increased to $5.9B, reflecting moderate expansion. Other Segments contribute a smaller share at $891M, down slightly from the previous year. Overall, the company’s revenue growth is concentrated in pharmaceuticals, indicating a focus on its core business with manageable exposure to other segments.

Key Products & Brands

The following table outlines Merck & Co., Inc.’s primary products and brands across its main business segments:

| Product | Description |

|---|---|

| Pharmaceutical Segment | Human health pharmaceutical products in oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, diabetes, plus preventive vaccines for pediatric, adolescent, and adult populations. |

| Animal Health Segment | Veterinary pharmaceuticals, vaccines, health management solutions, and digitally connected products for identification, traceability, and monitoring in animals. |

| Other Segments | Additional unspecified business activities contributing to the company’s revenue beyond Pharmaceuticals and Animal Health. |

Merck’s portfolio spans human pharmaceuticals and animal health products, emphasizing oncology and vaccines in pharmaceuticals, alongside veterinary care solutions in animal health. Other segments represent smaller, varied operations.

Main Competitors

There are 10 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eli Lilly and Company | 970B |

| Johnson & Johnson | 500B |

| AbbVie Inc. | 405B |

| AstraZeneca PLC | 285B |

| Merck & Co., Inc. | 268B |

| Amgen Inc. | 176B |

| Gilead Sciences, Inc. | 151B |

| Pfizer Inc. | 143B |

| Bristol-Myers Squibb Company | 109B |

| Biogen Inc. | 26B |

Merck & Co., Inc. ranks 5th among its top competitors with a market cap 27.84% that of the leader, Eli Lilly and Company. It sits below the average market cap of the top 10 competitors (303B) but above the median market cap in the sector (222B). The company is 5.49% behind its next closest rival, AstraZeneca, highlighting a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MRK have a competitive advantage?

Merck & Co., Inc. demonstrates a clear competitive advantage, as evidenced by its very favorable moat status and a ROIC exceeding its WACC by nearly 14%, indicating strong value creation and efficient capital use. The company’s growing ROIC trend further confirms a durable competitive advantage with increasing profitability over the 2020-2024 period.

Looking ahead, Merck’s diversified pharmaceutical and animal health segments position it well to capitalize on opportunities across multiple therapeutic areas and global markets, including oncology, immunology, and vaccines. Collaborations with major industry players suggest potential expansion in long-acting HIV treatments, supporting future growth prospects.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors that impact Merck & Co., Inc.’s current strategic position and future potential.

Strengths

- strong global pharmaceutical portfolio

- favorable profit margins (net 26.7%, EBIT 33%)

- durable competitive advantage with growing ROIC

- robust revenue growth over 5 years (54.5%)

- solid dividend yield (3.1%)

Weaknesses

- moderate debt-to-equity ratio with low debt score

- price-to-book ratio considered high (5.44)

- average Piotroski score (6) indicating room for financial improvement

Opportunities

- expanding markets in China and emerging economies

- partnerships for innovative HIV treatments

- increasing demand for vaccines and animal health solutions

Threats

- intense competition in drug manufacturing

- regulatory risks and compliance costs

- pricing pressure from generics and healthcare reforms

Merck’s strengths in profitability and innovation provide a solid foundation, but high valuation metrics and moderate financial strength scores require cautious monitoring. Capitalizing on growth in emerging markets and strategic partnerships while managing competition and regulatory challenges should guide its strategy.

Stock Price Action Analysis

The weekly stock chart below illustrates Merck & Co., Inc.’s price movements and trends over the last 12 months:

Trend Analysis

Over the past 12 months, MRK’s stock price declined by 14.79%, indicating a bearish trend with acceleration. The price ranged between 75.97 and 131.95, showing high volatility with a standard deviation of 17.66. However, a recent shorter-term recovery of 25.38% occurred from November 2025 to January 2026, reflecting a strong rebound phase.

Volume Analysis

In the last three months, trading volume has been increasing, with buyers strongly dominating 74.02% of the activity. This buyer-driven volume surge suggests growing investor interest and higher market participation, potentially supporting the recent upward price momentum observed since November 2025.

Target Prices

Analysts present a moderately optimistic target consensus for Merck & Co., Inc. (MRK).

| Target High | Target Low | Consensus |

|---|---|---|

| 135 | 90 | 118.78 |

The target prices reflect expectations of potential upside, with a consensus price near 119, suggesting cautious confidence in MRK’s future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Merck & Co., Inc.’s market performance and products.

Stock Grades

Here is a summary of recent stock grades for Merck & Co., Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-20 |

| Wolfe Research | Upgrade | Outperform | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Citigroup | Maintain | Neutral | 2026-01-07 |

| BMO Capital | Upgrade | Outperform | 2025-12-18 |

| B of A Securities | Maintain | Buy | 2025-12-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-12 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-02 |

| Wells Fargo | Upgrade | Overweight | 2025-11-24 |

The consensus reflects a positive bias with multiple upgrades to outperform and overweight ratings, while several firms maintain buy or hold stances. Overall, analyst sentiment appears moderately favorable toward Merck stock.

Consumer Opinions

Consumer sentiment around Merck & Co., Inc. reflects a blend of appreciation for its innovation and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Merck’s commitment to breakthrough medicines is impressive and life-changing.” | “The cost of some key drugs is prohibitively high for many patients.” |

| “Customer service is responsive and knowledgeable, providing clear guidance.” | “Occasional delays in product availability have been frustrating.” |

| “Strong product efficacy and a robust pipeline give confidence in future growth.” | “Side effects reported for certain medications need better management.” |

Overall, consumers value Merck’s innovative treatments and service quality but express ongoing concerns about drug affordability and availability, highlighting areas for potential improvement.

Risk Analysis

The table below summarizes key risks associated with investing in Merck & Co., Inc., highlighting their likelihood and potential impact on investment returns:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in healthcare regulations or drug approvals could delay product launches or increase costs. | Medium | High |

| Market Competition | Intense competition in pharmaceuticals and animal health sectors may pressure pricing and margins. | High | Medium |

| Debt Risk | Elevated debt-to-equity ratio signals potential financial strain, despite strong interest coverage. | Medium | Medium |

| Product Pipeline | Dependence on successful R&D and collaborations for new treatments, especially in oncology and vaccines. | Medium | High |

| Patent Expiry | Loss of exclusivity on key drugs could reduce revenues due to generic competition. | Medium | High |

| Macroeconomic | Economic downturns can reduce healthcare spending and impact sales volume. | Low | Medium |

The most significant risks for Merck are regulatory changes, high market competition, and patent expirations, all with medium to high probability and impact. Despite a strong Altman Z-Score indicating financial stability, the debt-to-equity ratio remains a caution point for risk management.

Should You Buy Merck & Co., Inc.?

Merck & Co., Inc. appears to be exhibiting robust profitability and a durable competitive moat supported by growing ROIC, suggesting strong value creation. While its leverage profile could be seen as substantial, the overall rating of A- indicates a generally favorable financial health profile.

Strength & Efficiency Pillars

Merck & Co., Inc. exhibits robust profitability with a net margin of 26.68% and a return on equity (ROE) of 36.96%, reflecting efficient capital use. Its return on invested capital (ROIC) stands at 18.97%, comfortably exceeding the weighted average cost of capital (WACC) of 4.97%, confirming the company as a clear value creator. Financial health is solid, as evidenced by an Altman Z-Score of 4.18, placing Merck in the safe zone, and a Piotroski Score of 6, indicating average but stable financial strength. These metrics collectively underscore a durable competitive advantage and effective value creation.

Weaknesses and Drawbacks

Despite these strengths, Merck faces valuation and leverage concerns. The price-to-book (P/B) ratio at 5.44 is unfavorable, suggesting the stock may be overvalued relative to its book value, potentially limiting upside. While the price-to-earnings (P/E) ratio is moderate at 14.72, the debt-to-equity ratio of 0.83 is neutral but warrants monitoring, given the pharmaceutical sector’s capital intensity. The current ratio of 1.36 indicates moderate short-term liquidity, and the overall bearish stock trend with a price decline of 14.79% signals market pressure, though recent buyer dominance may temper this risk.

Our Verdict about Merck & Co., Inc.

Merck’s long-term fundamentals appear favorable, supported by strong profitability and value creation metrics. The recent trend shows a strongly buyer-dominant environment with a 74.02% buyer share over the last quarter, suggesting renewed market interest. Given the overall bearish trend but positive short-term momentum, Merck’s profile might appear attractive for long-term exposure, though investors could consider a cautious entry point amid valuation concerns and broader market volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- mRNA cancer vaccine shows protection at 5-year follow-up, Moderna and Merck say – Ars Technica (Jan 21, 2026)

- AbbVie Dodged a Patent Disaster, and Shares Gained 460%. Merck and Bristol Myers Are Next. – Barron’s (Jan 23, 2026)

- CEPI bankrolls $30M Ebola vaccine collaboration with Merck, SK Bioscience and others – Fierce Pharma (Jan 22, 2026)

- Moderna and Merck pop on cancer vaccine, Lucid-Rockwell partnership – Yahoo Finance (Jan 21, 2026)

- Merck added to BofA’s best ideas list—see all the names – Seeking Alpha (Jan 21, 2026)

For more information about Merck & Co., Inc., please visit the official website: merck.com