Home > Analyses > Consumer Cyclical > MercadoLibre, Inc.

MercadoLibre, Inc. transforms everyday commerce across Latin America by seamlessly connecting millions of buyers and sellers through its innovative online marketplace. As the region’s dominant e-commerce and fintech platform, it offers a comprehensive suite of services—from digital payments and credit solutions to logistics and advertising—that empower businesses and consumers alike. With a reputation for pioneering digital commerce in emerging markets, MercadoLibre stands at a crossroads: does its robust growth trajectory still justify its premium valuation for savvy investors seeking long-term opportunities?

Table of contents

Business Model & Company Overview

MercadoLibre, Inc., founded in 1999 and headquartered in Montevideo, Uruguay, stands as a dominant player in Latin America’s specialty retail sector. Its integrated ecosystem combines online commerce, fintech, logistics, and advertising platforms, creating a seamless experience for businesses, merchants, and consumers. This cohesive approach enables MercadoLibre to serve diverse market needs—from e-commerce transactions and digital payments to credit and logistics solutions—positioning it at the heart of Latin America’s digital economy.

The company’s revenue engine balances its marketplace transactions with recurring fintech services like Mercado Pago and Mercado Credito, while logistics and advertising add multiple layers of monetization. Its strategic presence spans the Americas, with growing influence in key markets across Latin America. This multifaceted model not only drives substantial cash flow but also establishes a robust economic moat, reinforcing MercadoLibre’s role as a transformative force shaping the future of online commerce in the region.

Financial Performance & Fundamental Metrics

In this section, I analyze MercadoLibre, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

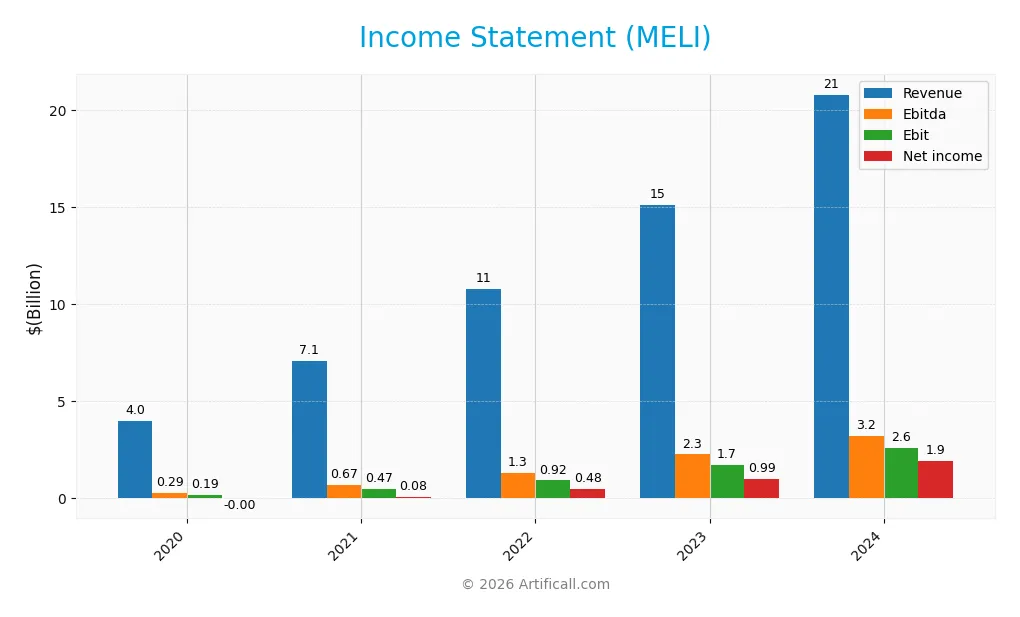

The table below summarizes MercadoLibre, Inc.’s key income statement figures from 2020 through 2024, reflecting the company’s financial performance over these fiscal years.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.97B | 7.07B | 10.78B | 15.11B | 20.78B |

| Cost of Revenue | 2.27B | 4.06B | 5.58B | 7.52B | 11.20B |

| Operating Expenses | 1.58B | 2.56B | 4.13B | 5.38B | 6.95B |

| Gross Profit | 1.71B | 3.01B | 5.20B | 7.59B | 9.58B |

| EBITDA | 293M | 674M | 1.32B | 2.25B | 3.21B |

| EBIT | 188M | 470M | 915M | 1.73B | 2.60B |

| Interest Expense | 107M | 229M | 272M | 176M | 153M |

| Net Income | -4M | 83M | 489M | 993M | 1.91B |

| EPS | -0.01 | 1.67 | 9.57 | 19.64 | 37.69 |

| Filing Date | 2021-03-01 | 2022-02-23 | 2023-02-24 | 2024-02-23 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, MercadoLibre, Inc. (MELI) exhibited strong revenue growth, surging 423% overall and 37.5% in the last year. Net income followed an even more pronounced upward trend, increasing by 191,200% over the period with a 41% rise in the last year alone. Margins improved consistently, with the gross margin at 46.1% and net margin reaching 9.2%, reflecting enhanced profitability alongside expanding sales.

Is the Income Statement Favorable?

In 2024, MELI’s fundamentals appear favorable, supported by a 12.5% EBIT margin and manageable interest expenses at 0.74% of revenue. Operating expenses grew proportionally with revenue, preserving operational leverage. The company’s net income of $1.91B and EPS of $37.69 underline strong earnings power. Overall, all key metrics, including margin expansions and profitability growth, contribute to a positive income statement evaluation.

Financial Ratios

The table below summarizes key financial ratios for MercadoLibre, Inc. (MELI) over the last five fiscal years, providing insight into profitability, liquidity, valuation, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -0.0003 | 0.0117 | 0.0447 | 0.0653 | 0.0920 |

| ROE | -0.0006 | 0.0542 | 0.2638 | 0.3214 | 0.4392 |

| ROIC | -0.0005 | 0.0280 | 0.0887 | 0.1590 | 0.1773 |

| P/E | -83326 | 809 | 88 | 80 | 45 |

| P/B | 50.5 | 43.9 | 23.3 | 25.7 | 19.8 |

| Current Ratio | 1.47 | 1.40 | 1.28 | 1.27 | 1.21 |

| Quick Ratio | 1.44 | 1.36 | 1.26 | 1.24 | 1.20 |

| D/E | 1.03 | 2.60 | 2.96 | 1.74 | 1.57 |

| Debt-to-Assets | 0.26 | 0.39 | 0.39 | 0.30 | 0.27 |

| Interest Coverage | 1.20 | 1.93 | 3.93 | 12.54 | 17.20 |

| Asset Turnover | 0.61 | 0.70 | 0.78 | 0.86 | 0.82 |

| Fixed Asset Turnover | 5.72 | 5.57 | 6.54 | 7.03 | 8.38 |

| Dividend Yield | 0.00004% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

MercadoLibre’s Return on Equity (ROE) increased substantially from near zero in 2020 to 43.9% in 2024, reflecting improved profitability. The Current Ratio declined moderately from 1.47 in 2020 to about 1.21 in 2024, indicating slightly reduced liquidity but still above 1. The Debt-to-Equity Ratio peaked near 2.96 in 2022 and then decreased to 1.57 by 2024, showing a trend toward lower leverage.

Are the Financial Ratios Favorable?

In 2024, profitability metrics such as ROE (43.9%) and Return on Invested Capital (17.7%) are favorable, while the net margin of 9.2% is neutral. Liquidity ratios show mixed signals: the Current Ratio is neutral at 1.21, but the Quick Ratio is favorable at 1.20. The Debt-to-Equity Ratio of 1.57 and high Price-to-Earnings ratio of 45.1 are unfavorable, while debt to assets and interest coverage ratios are favorable. Overall, 42.9% of ratios are favorable, 35.7% unfavorable, and 21.4% neutral, leading to a slightly favorable global assessment.

Shareholder Return Policy

MercadoLibre, Inc. (MELI) does not pay dividends, reflecting a reinvestment strategy consistent with its high growth profile. No dividend payouts have been recorded from 2021 to 2024, and the dividend payout ratio remains at zero. The company does not engage in share buybacks either.

This approach prioritizes capital allocation toward business expansion and innovation. Given MELI’s strong free cash flow and improving profitability margins, the absence of direct shareholder returns aligns with a focus on sustainable long-term value creation through reinvestment rather than immediate distributions.

Score analysis

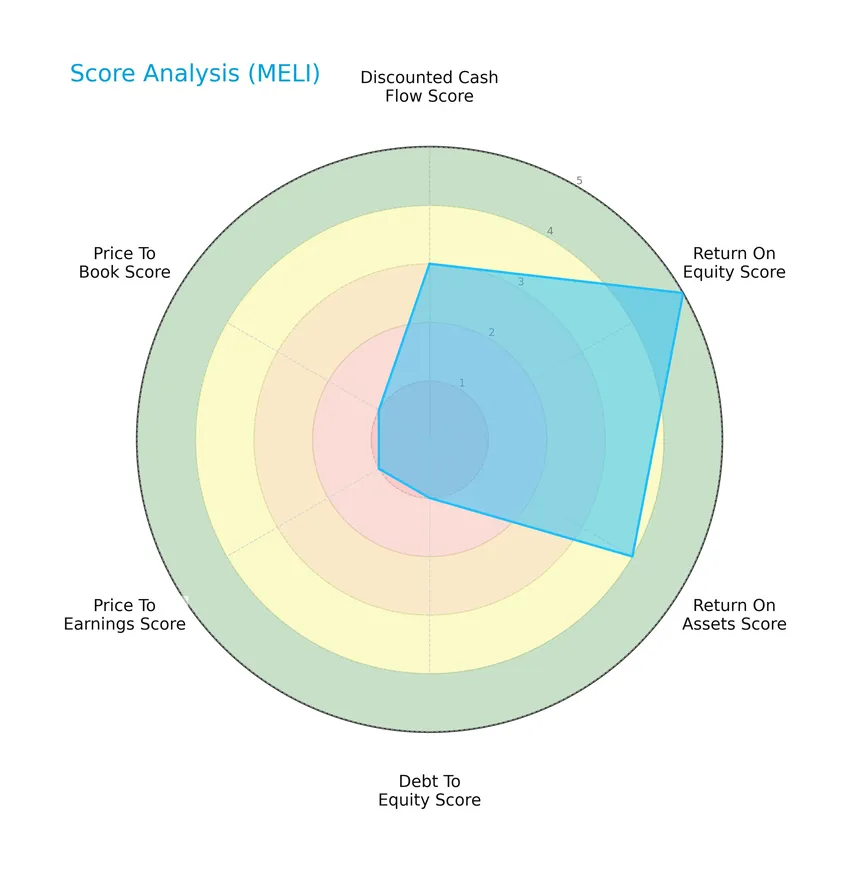

The following radar chart presents an overview of MercadoLibre, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

MercadoLibre shows a very favorable return on equity score of 5 and a favorable return on assets score of 4, indicating strong profitability. However, the debt-to-equity, price-to-earnings, and price-to-book scores are very unfavorable at 1, reflecting concerns in leverage and valuation. The discounted cash flow score is moderate at 3.

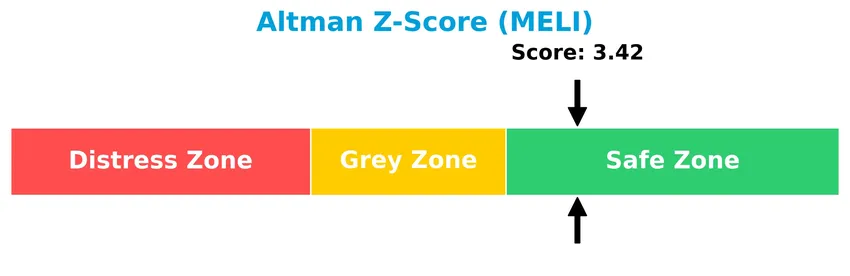

Analysis of the company’s bankruptcy risk

MercadoLibre’s Altman Z-Score places the company in the safe zone, suggesting a low risk of bankruptcy and financial distress:

Is the company in good financial health?

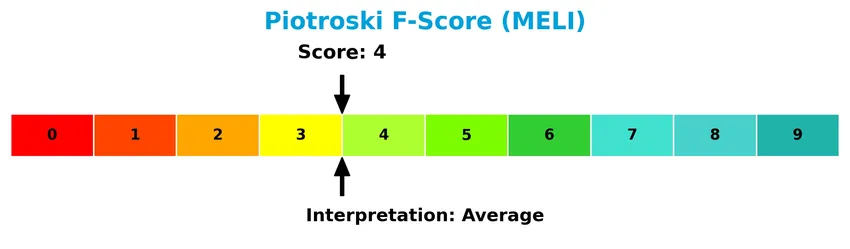

The Piotroski Score diagram below illustrates MercadoLibre’s financial health assessment based on nine key criteria:

With a Piotroski Score of 4, MercadoLibre is classified as having average financial strength, indicating mixed signals on profitability, leverage, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine MercadoLibre, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether MercadoLibre holds a competitive advantage over its industry peers in the consumer cyclical sector.

Strategic Positioning

MercadoLibre, Inc. has diversified its product portfolio by expanding from marketplace commerce to a broad fintech ecosystem including payments, credit, logistics, classifieds, and advertising services. Geographically, it concentrates primarily in Latin America with significant revenue from Brazil (11.4B USD), Mexico (4.7B USD), and Argentina (3.8B USD), reflecting a regional specialization.

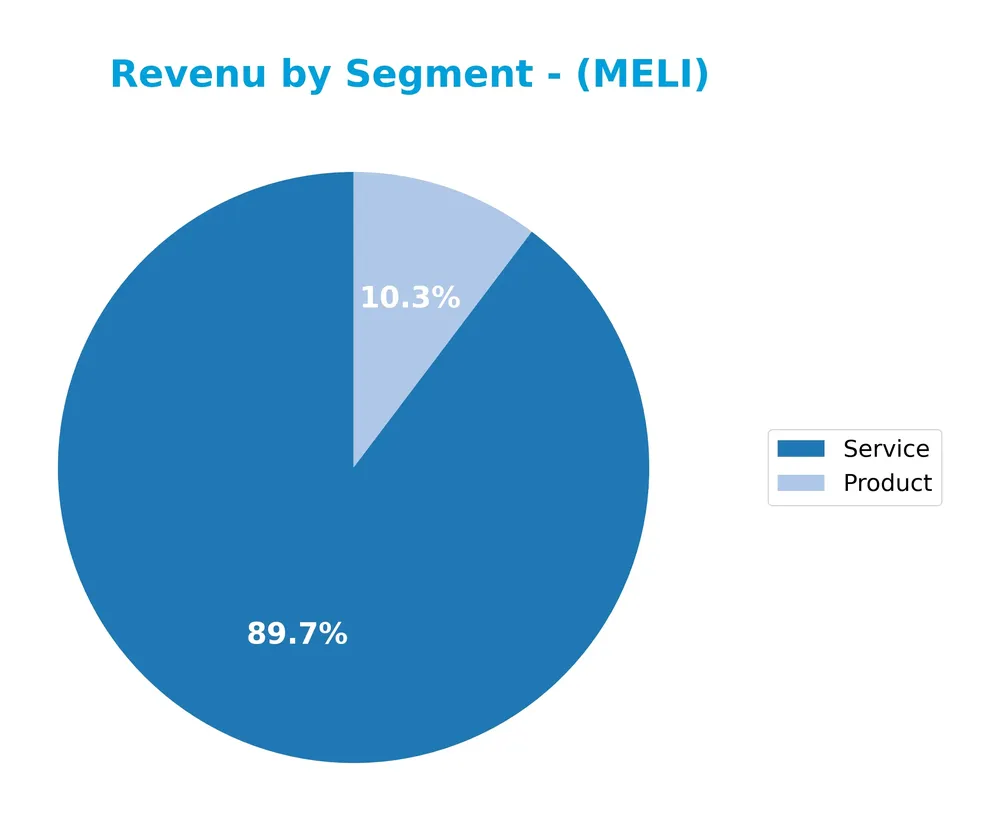

Revenue by Segment

This pie chart displays MercadoLibre, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting contributions from Product and Service divisions.

In 2024, MercadoLibre’s revenue was predominantly driven by the Service segment, generating 18.6B USD, significantly outpacing the Product segment at 2.1B USD. This reflects a strong reliance on service-based offerings, with the Product segment showing steady growth but remaining a smaller portion of total revenue. The concentration in Services suggests a continuing focus on expanding digital and fintech solutions.

Key Products & Brands

The following table summarizes MercadoLibre, Inc.’s main products and platforms with their descriptions:

| Product | Description |

|---|---|

| Mercado Libre Marketplace | An automated online commerce platform allowing businesses, merchants, and individuals to list, buy, and sell merchandise. |

| Mercado Pago | A FinTech platform facilitating online and offline payments, money transfers, and transaction processing. |

| Mercado Fondo | Investment service enabling users to invest funds deposited in Mercado Pago accounts. |

| Mercado Crédito | Lending service providing loans to select merchants and consumers. |

| Mercado Envios | Logistics solution offering third-party carrier services, fulfillment, and warehousing for sellers on the marketplace. |

| Mercado Libre Classifieds | Online classified listings for motor vehicles, real estate, and services. |

| Mercado Libre Ads | Advertising platform for large retailers and brands to promote products and services on the internet. |

| Mercado Shops | Online storefront solution allowing users to create, manage, and promote digital stores. |

MercadoLibre’s core offerings combine e-commerce and financial technology services, supported by logistics, advertising, and classified platforms, forming an integrated ecosystem across Latin America.

Main Competitors

MercadoLibre, Inc. faces competition from a total of 10 major players, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

MercadoLibre ranks 4th among its competitors, with a market cap at 4.48% of the leader, Amazon.com. It is positioned below the average market capitalization of the top 10 competitors (317B) but remains above the sector median (33.6B). The company enjoys a significant 46.43% market cap premium over its nearest rival above, highlighting a solid gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MELI have a competitive advantage?

MercadoLibre, Inc. shows a very favorable competitive advantage, with a ROIC exceeding its WACC by 7.7%, indicating efficient capital use and value creation. Its growing ROIC trend highlights a durable competitive moat and increasing profitability over 2020-2024. The company’s consistently favorable income statement metrics, including a 46.1% gross margin and 9.2% net margin, support its strong market position in Latin America’s specialty retail sector.

Looking ahead, MercadoLibre continues to expand its product and service offerings, including Mercado Pago’s FinTech solutions, Mercado Credito loans, and logistics services through Mercado Envios. Growth opportunities remain in further geographic penetration and enhancement of digital storefronts and advertising platforms, positioning it to capitalize on rising e-commerce and online financial services demand across Latin America.

SWOT Analysis

This SWOT analysis highlights MercadoLibre, Inc.’s key internal and external factors to guide informed investment decisions.

Strengths

- Strong revenue growth with 422% increase over 5 years

- High ROE at 44% indicating efficient capital use

- Durable competitive advantage with growing ROIC

- Diverse service offerings including fintech, logistics, and ads

Weaknesses

- High valuation multiples (PE 45, PB 20) may limit upside

- Elevated debt-to-equity ratio at 1.57 increases financial risk

- No dividend yield limits income appeal

Opportunities

- Expansion in Latin American e-commerce markets with rising internet penetration

- Growth in fintech services and credit offerings

- Increasing demand for digital storefront and logistics solutions

Threats

- Intense competition from global and local e-commerce players

- Economic instability and currency volatility in key markets

- Regulatory changes impacting fintech and online commerce

MercadoLibre demonstrates robust growth and a strong competitive moat, supported by efficient capital returns. However, elevated leverage and valuation suggest caution. Strategic focus on fintech expansion and market penetration will be crucial to mitigate regional risks and competition.

Stock Price Action Analysis

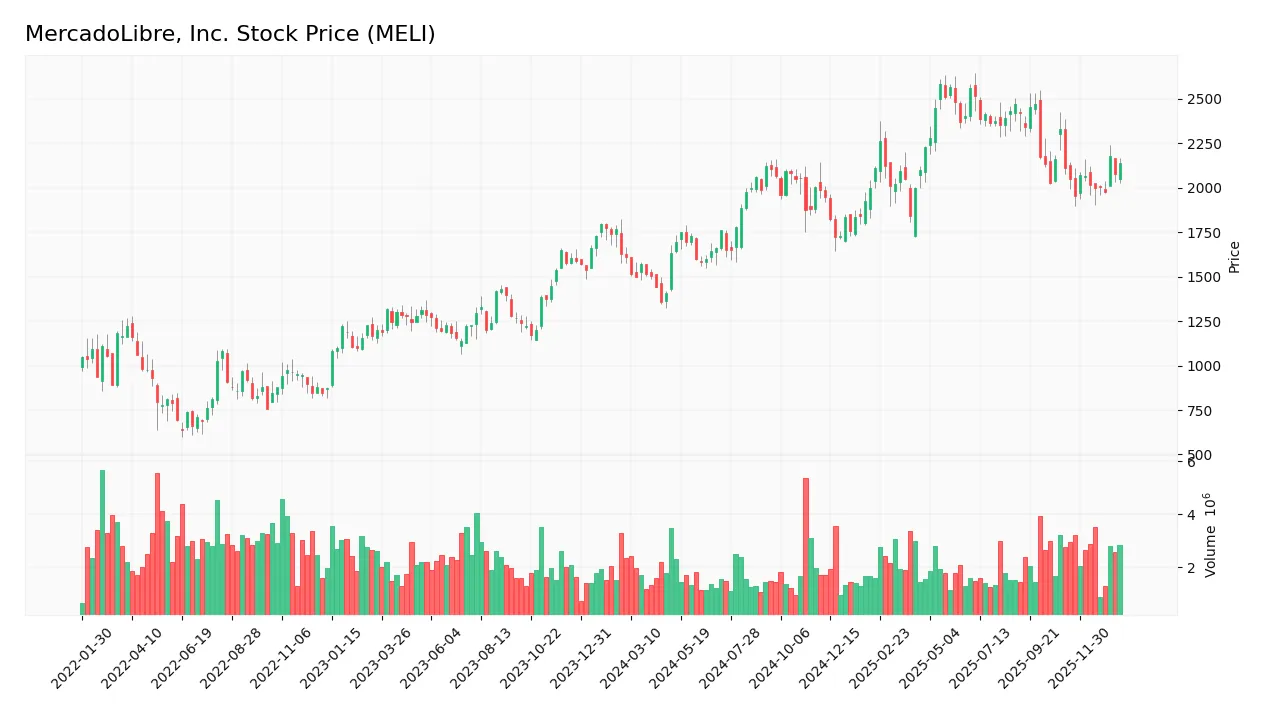

The following weekly chart illustrates MercadoLibre, Inc. (MELI) stock price movements over the past 12 months, highlighting key fluctuations and trend changes:

Trend Analysis

Over the past 12 months, MELI’s stock price increased by 32.52%, indicating a bullish trend. The price ranged between 1356.43 and 2584.92, showing considerable volatility with a standard deviation of 301.88. However, the recent trend from November 2025 to January 2026 shows a modest 1.36% rise, reflecting a neutral trend with deceleration in momentum.

Volume Analysis

In the last three months, trading volume has been increasing but is seller-dominant, with buyers accounting for only 28.09%. This suggests cautious investor sentiment, as selling pressure outweighs buying interest despite rising market participation.

Target Prices

Analysts present a bullish consensus for MercadoLibre, Inc., with promising upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 2900 | 2700 | 2830 |

The target prices indicate a generally optimistic outlook, suggesting the stock could trade between 2700 and 2900, with a consensus near 2830.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback concerning MercadoLibre, Inc. (MELI).

Stock Grades

Here is a summary of recent verified analyst grades for MercadoLibre, Inc. (MELI) from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

The consensus among analysts remains generally positive, with a majority rating MELI as Buy or better, while a smaller number maintain Neutral ratings. No recent downgrades or Sell ratings were recorded, indicating stable confidence in the stock’s outlook.

Consumer Opinions

Consumers have mixed but insightful perspectives on MercadoLibre, Inc., reflecting both its market strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “MercadoLibre offers a seamless and user-friendly platform for buying and selling.” | “Customer service response times can be slow during peak periods.” |

| “Their payment system is secure and convenient, making transactions easy.” | “Shipping delays have been reported, especially in remote areas.” |

| “Wide product variety and competitive pricing attract me to shop here frequently.” | “Occasional issues with product quality control have affected trust.” |

Overall, consumers appreciate MercadoLibre’s ease of use and payment security, while recurring concerns focus on customer support responsiveness and delivery reliability. Addressing these weaknesses could enhance user satisfaction significantly.

Risk Analysis

The following table summarizes key risks for MercadoLibre, Inc., highlighting their probability and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (45.11) and P/B (19.81) ratios suggest overvaluation, risking price corrections. | High | High |

| Debt Levels | Elevated debt-to-equity ratio (1.57) could strain finances if cash flows weaken. | Moderate | Moderate |

| Competitive Pressure | Intense competition in Latin American e-commerce and fintech could erode market share. | High | High |

| Economic Conditions | Macroeconomic instability in Latin America may reduce consumer spending and loan repayments. | High | High |

| Dividend Absence | No dividend yield may deter income-focused investors, affecting stock demand in bearish phases. | Moderate | Low |

| Regulatory Risks | Changes in regional regulations for fintech and e-commerce could increase compliance costs. | Moderate | Moderate |

| Liquidity | Current ratio of 1.21 and quick ratio of 1.2 indicate moderate liquidity, possibly limiting flexibility during downturns. | Moderate | Moderate |

The most significant risks to monitor are MercadoLibre’s high valuation metrics and exposure to volatile Latin American markets, which could amplify the impact of economic downturns. Despite a solid Altman Z-Score placing the company in the safe zone, its high leverage and moderate liquidity warrant careful attention.

Should You Buy MercadoLibre, Inc.?

MercadoLibre appears to be a company with improving profitability and a durable competitive moat supported by a growing ROIC, suggesting strong value creation. Despite a challenging leverage profile, its overall rating is a moderate B-, reflecting cautious optimism.

Strength & Efficiency Pillars

MercadoLibre, Inc. exhibits robust profitability with a favorable return on equity of 43.92% and a solid net margin of 9.2%. The company is a clear value creator, as its return on invested capital (ROIC) stands at 17.73%, well above its weighted average cost of capital (WACC) of 10.03%. Financial stability is confirmed by an Altman Z-Score of 3.42, placing it firmly in the safe zone, though its Piotroski score of 4 suggests moderate financial strength. Overall, MercadoLibre demonstrates durable competitive advantages supported by growing profitability.

Weaknesses and Drawbacks

However, MercadoLibre faces significant valuation and leverage concerns. Its price-to-earnings ratio at 45.11 and price-to-book ratio of 19.81 indicate a premium valuation that may not align with risk-averse investors. The company’s debt-to-equity ratio of 1.57 is unfavorable, reflecting heightened leverage that could amplify financial risks. Recent market activity also signals seller dominance with only 28.09% buyer volume, creating short-term headwinds despite the broader bullish trend.

Our Verdict about MercadoLibre, Inc.

MercadoLibre’s long-term fundamental profile appears favorable due to strong profitability and value creation metrics. Yet, despite the overall bullish stock trend, recent seller dominance suggests a cautious stance. Investors might consider waiting for a more attractive entry point before increasing exposure, as current market pressures could temper near-term performance despite the company’s intrinsic strengths.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- MercadoLibre: Incredible Growth Acceleration Amid LatAm Fears (NASDAQ:MELI) – Seeking Alpha (Jan 24, 2026)

- Citi Maintains ‘Buy’ Rating on MercadoLibre, Inc. (MELI) – MSN (Jan 22, 2026)

- MELI Stock Price and Chart — NASDAQ:MELI – TradingView — Track All Markets (Jan 06, 2026)

- Rakuten Investment Management Inc. Takes Position in MercadoLibre, Inc. $MELI – MarketBeat (Jan 21, 2026)

- MercadoLibre (MELI) Stock Moves -1.94%: What You Should Know – Nasdaq (Jan 20, 2026)

For more information about MercadoLibre, Inc., please visit the official website: mercadolibre.com