Home > Analyses > Consumer Cyclical > McDonald’s Corporation

McDonald’s shapes global dining habits, serving millions daily with its iconic menu and swift service. It dominates the restaurant industry through relentless innovation and a vast footprint exceeding 40,000 locations worldwide. The brand’s blend of consistency, convenience, and evolving menu options cements its market influence. As competition intensifies, I question whether McDonald’s fundamentals still support its premium valuation and future growth trajectory.

Table of contents

Business Model & Company Overview

McDonald’s Corporation, founded in 1940 and headquartered in Chicago, Illinois, commands a dominant position in the global restaurant industry. With a network of over 40,000 restaurants, it delivers a cohesive ecosystem of quick-service dining, spanning burgers, chicken, breakfast items, and beverages. The brand’s scale and recognition form the backbone of its competitive edge in the consumer cyclical sector.

The company generates value through a balance of franchised and company-operated restaurants, leveraging consistent menu innovation and operational efficiency. Its strategic footprint spans the Americas, Europe, and Asia, capturing diverse markets with scalable offerings. McDonald’s robust economic moat stems from its iconic brand, extensive global presence, and efficient capital allocation shaping the fast-food industry’s future.

Financial Performance & Fundamental Metrics

I will analyze McDonald’s Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

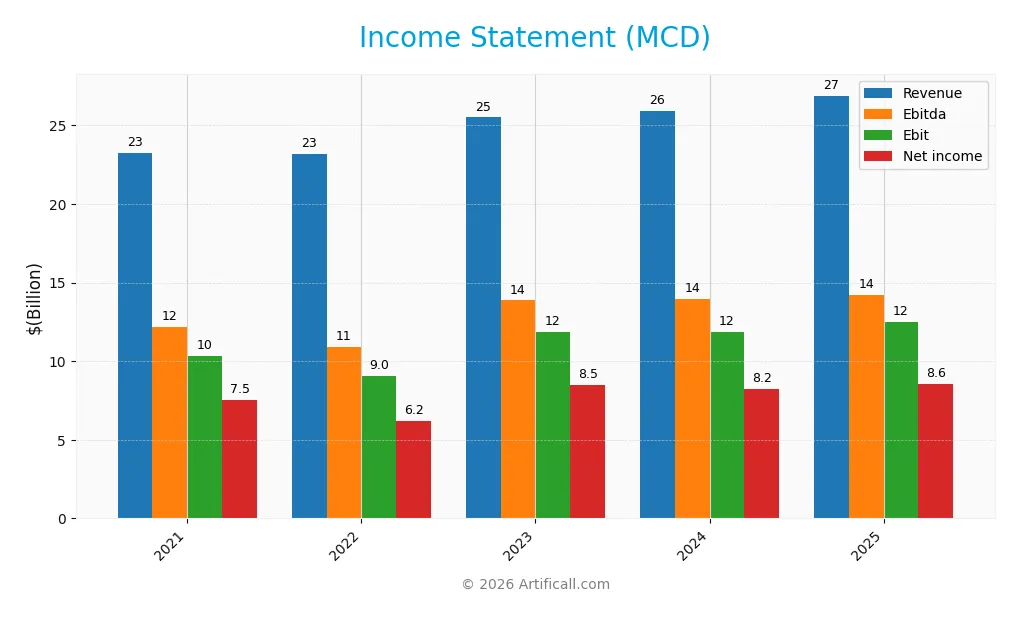

The table below presents McDonald’s Corporation’s key income statement figures for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 23.2B | 23.2B | 25.5B | 25.9B | 26.9B |

| Cost of Revenue | 10.6B | 10.0B | 10.9B | 11.2B | 11.6B |

| Operating Expenses | 2.2B | 3.8B | 2.9B | 3.0B | 2.9B |

| Gross Profit | 12.6B | 13.2B | 14.6B | 14.7B | 15.3B |

| EBITDA | 12.2B | 10.9B | 13.9B | 13.9B | 14.2B |

| EBIT | 10.3B | 9.0B | 11.9B | 11.9B | 12.5B |

| Interest Expense | 1.2B | 1.2B | 1.4B | 1.5B | 1.6B |

| Net Income | 7.5B | 6.2B | 8.5B | 8.2B | 8.6B |

| EPS | 10.11 | 8.39 | 11.63 | 11.45 | 11.99 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-22 | 2025-02-25 | 2026-02-11 |

Income Statement Evolution

Between 2021 and 2025, McDonald’s revenue rose 15.8%, showing steady growth. Net income increased 13.5%, though net margin declined slightly by 2%. Gross margin held favorably at 57%, while EBIT margin improved to 46%. One-year growth rates reveal moderate revenue and gross profit gains, with EBIT and EPS growth notably favorable.

Is the Income Statement Favorable?

In 2025, McDonald’s fundamentals remain solid, supported by a 31.9% net margin and a 46.4% EBIT margin, both rated favorable. Interest expense weighs moderately at 5.9% of revenue, marked neutral. Operating expenses grew proportionally with revenue, reflecting disciplined cost control. Overall, income statement metrics indicate a favorable financial position entering 2026.

Financial Ratios

The table below summarizes key financial ratios for McDonald’s Corporation over the past five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 32% | 27% | 33% | 32% | 32% |

| ROE | -1.6% | -1.0% | -1.8% | -2.2% | 0% |

| ROIC | 17% | 16% | 18% | 18% | 0% |

| P/E | 26.5 | 31.4 | 25.5 | 25.3 | 25.5 |

| P/B | -43.5 | -32.3 | -45.9 | -54.9 | 0 |

| Current Ratio | 1.78 | 1.43 | 1.16 | 1.19 | 0 |

| Quick Ratio | 1.76 | 1.41 | 1.16 | 1.18 | 0 |

| D/E | -10.7 | -8.1 | -11.3 | -13.7 | 0 |

| Debt-to-Assets | 92% | 97% | 95% | 94% | 0% |

| Interest Coverage | 8.73 | 7.76 | 8.56 | 7.78 | 7.84 |

| Asset Turnover | 0.43 | 0.46 | 0.45 | 0.47 | 0 |

| Fixed Asset Turnover | 0.61 | 0.64 | 0.66 | 0.67 | 0 |

| Dividend Yield | 2.0% | 2.1% | 2.1% | 2.3% | 2.3% |

Evolution of Financial Ratios

McDonald’s return on equity (ROE) remained at zero in 2025, indicating no improvement in shareholder profitability. The current ratio dropped to zero, reflecting a lack of available liquidity data or a possible liquidity concern. Debt-to-equity ratio stood at zero, marked as favorable, suggesting stable leverage despite incomplete data. Profit margins showed consistent strength, with net profit margin steady around 31.85%.

Are the Financial Ratios Favorable?

In 2025, McDonald’s reported a solid net margin of 31.85% and a favorable debt-to-equity ratio, indicating controlled leverage. However, ROE and ROIC were zero, which is unfavorable for assessing profitability efficiency. Liquidity ratios were unavailable or zero, signaling potential red flags. Interest coverage at 7.88 and dividend yield at 2.35% were favorable. Overall, 42.86% of ratios were positive, but 50% were unfavorable, rendering the financial ratio profile slightly unfavorable.

Shareholder Return Policy

McDonald’s maintains a consistent dividend payout ratio near 60%, with a dividend per share rising from $5.25 in 2021 to $7.17 in 2025. The dividend yield hovers around 2.3%, supported by stable earnings and free cash flow coverage, indicating a balanced distribution approach.

The company also implements share buybacks, complementing its dividend policy. This dual strategy reflects prudent capital allocation aimed at sustainable shareholder value. However, the relatively high payout ratio warrants monitoring to avoid pressure on future cash flow flexibility.

Score analysis

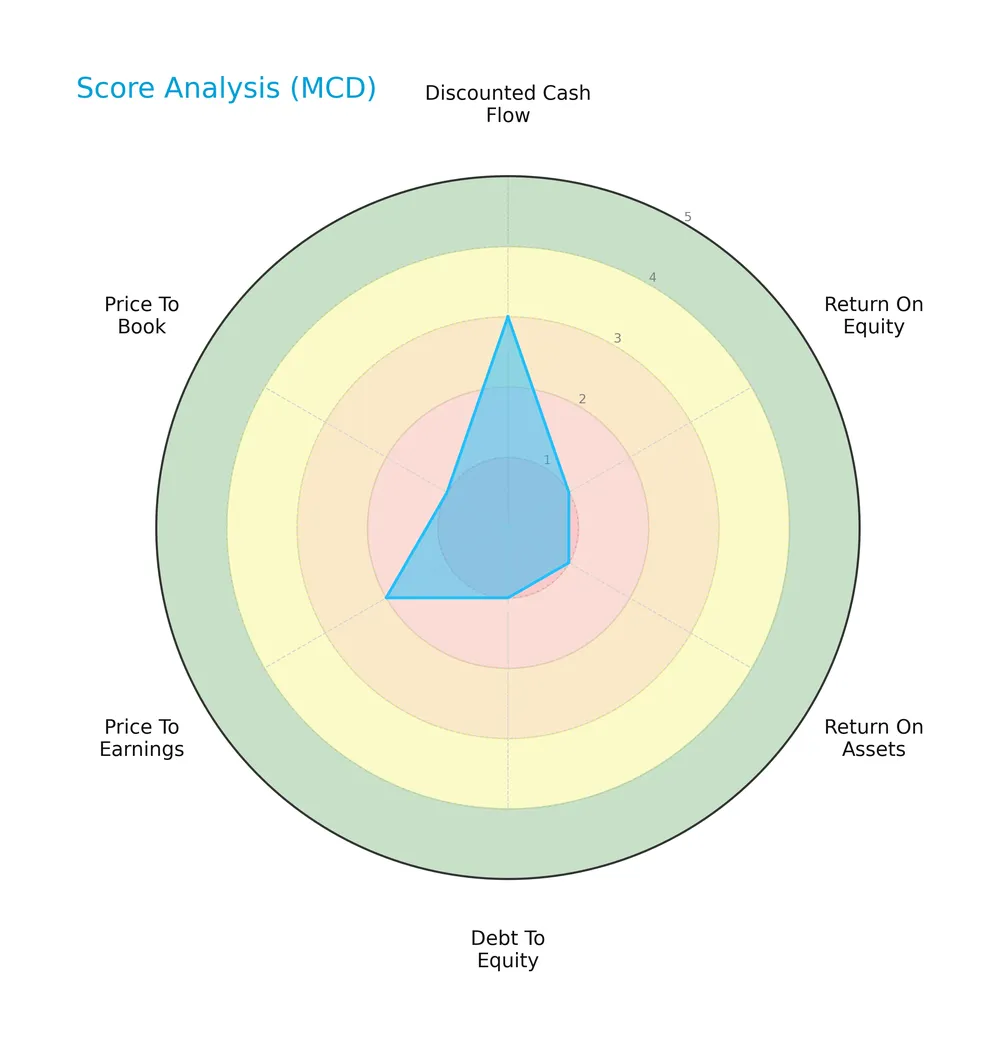

Below is a radar chart illustrating McDonald’s Corporation’s key financial scores across valuation, profitability, and leverage metrics:

McDonald’s shows a moderate discounted cash flow score of 3 but scores very unfavorably on return on equity, return on assets, debt to equity, and price to book ratios. The price to earnings score is also unfavorable, indicating valuation and profitability challenges.

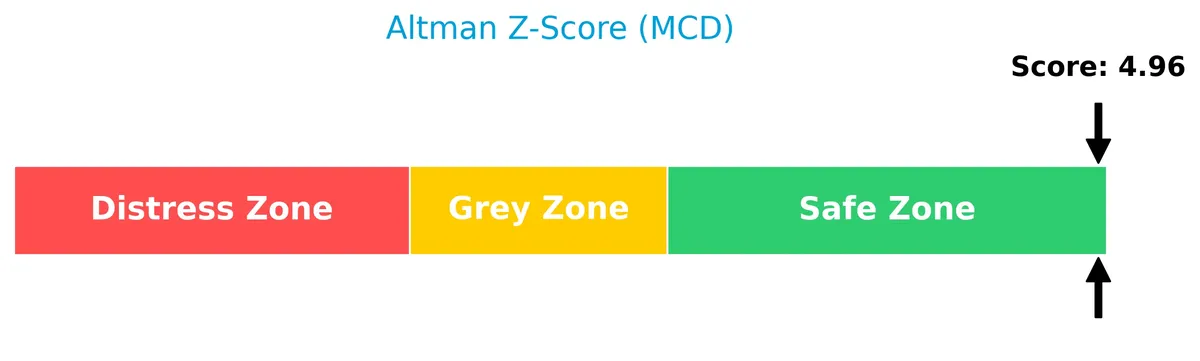

Analysis of the company’s bankruptcy risk

The Altman Z-Score places McDonald’s firmly in the safe zone, signaling a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

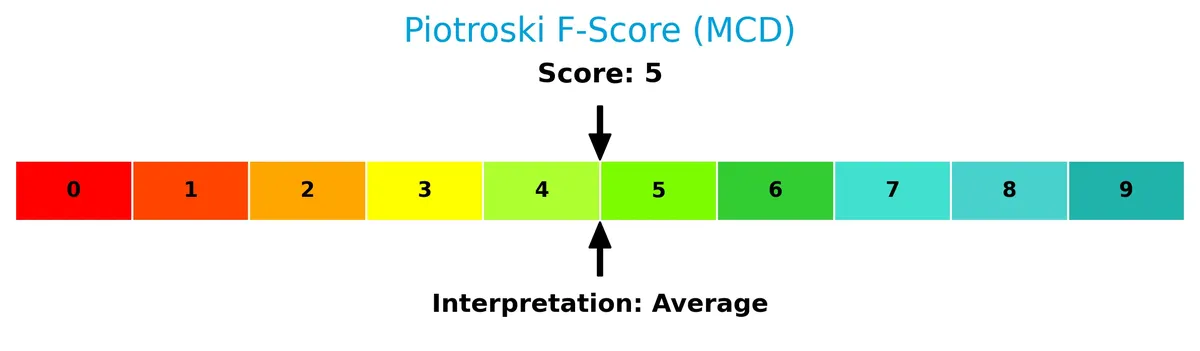

The Piotroski Score diagram below reflects McDonald’s average financial health, based on a score of 5, which suggests moderate strength without clear robustness:

With a Piotroski Score of 5, McDonald’s shows average financial condition, indicating neither strong nor weak operational and financial performance. This middle-ground score advises cautious interpretation of its financial health.

Competitive Landscape & Sector Positioning

This analysis explores McDonald’s strategic positioning within the restaurants sector, focusing on segment revenues and key products. I will assess whether McDonald’s holds a competitive advantage relative to its main competitors.

Strategic Positioning

McDonald’s maintains a geographically diversified revenue base, with significant exposure to the United States (10.6B) and international operated markets (12.6B) in 2024. Its product portfolio spans core fast-food offerings and breakfast menus, supporting consistent global franchise growth.

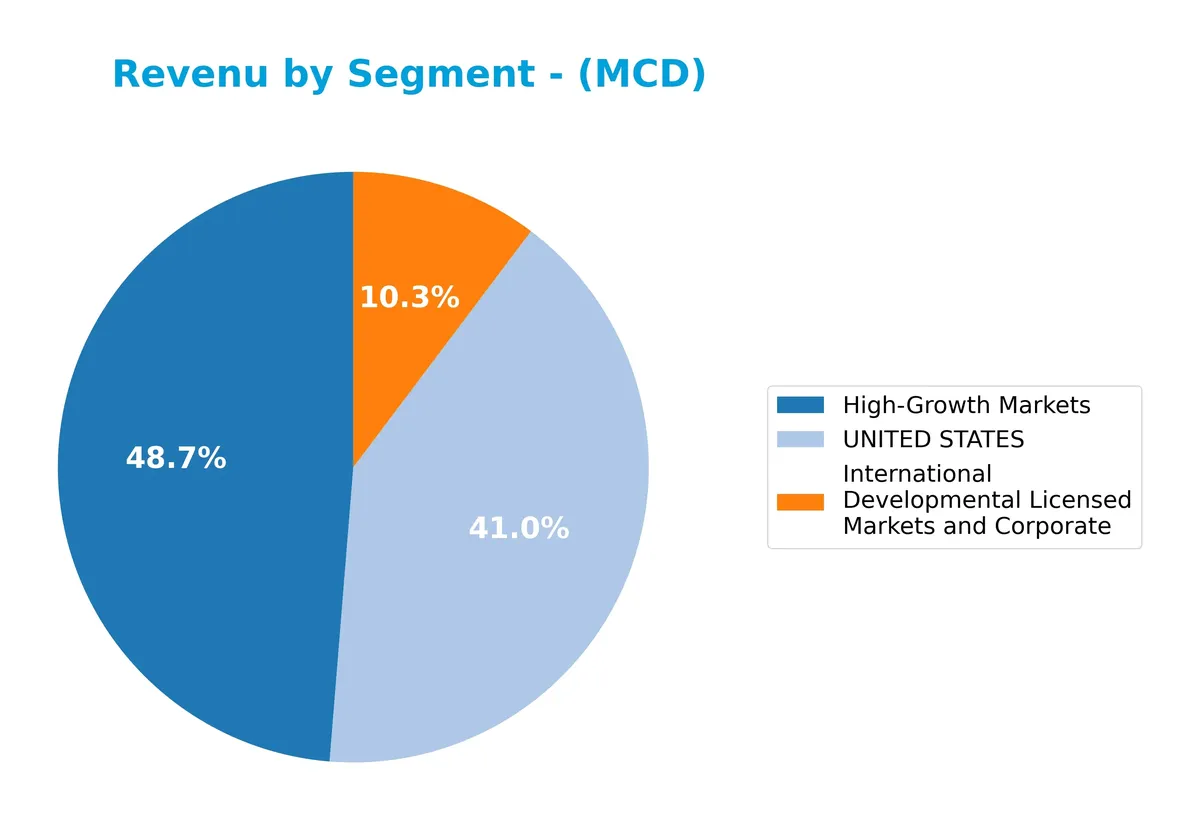

Revenue by Segment

This pie chart illustrates McDonald’s revenue distribution across its key segments for the fiscal year 2024, highlighting contributions from the United States, High-Growth Markets, and International Developmental Licensed Markets.

McDonald’s revenue remains heavily driven by High-Growth Markets at $12.6B, followed by the United States at $10.6B, and International Developmental Licensed Markets at $2.7B. The steady growth in international licensed markets signals expanding global footprint. The U.S. segment shows moderate gains, maintaining its role as a core revenue pillar. Overall, the 2024 data reflects balanced geographic diversification with controlled concentration risk.

Key Products & Brands

McDonald’s offers a diverse menu of food and beverage products globally, segmented by key markets:

| Product | Description |

|---|---|

| Hamburgers and Cheeseburgers | Core menu items including signature burgers served worldwide. |

| Chicken Sandwiches and Nuggets | Popular poultry offerings complementing the beef menu. |

| Wraps and Salads | Health-conscious options featuring fresh ingredients. |

| Breakfast Menu | Includes biscuit and bagel sandwiches, breakfast burritos, hotcakes, and other morning items. |

| Fries, Oatmeal, and Bakery Items | Classic side dishes and baked goods enhancing meal variety. |

| Shakes, Desserts, and Sundaes | Sweet treats and beverages appealing to a broad customer base. |

| Soft Drinks, Coffee, and Other Beverages | Beverage lineup supporting all-day dining occasions. |

| United States Market Segment | Largest revenue source, generating $10.6B in 2024, reflecting McDonald’s strong domestic presence. |

| High-Growth Markets Segment | Fastest-growing international segment with $12.6B revenue in 2024, emphasizing expansion in emerging regions. |

| International Developmental Licensed Markets and Corporate | Smaller segment at $2.7B in 2024, covering licensed and corporate-operated restaurants globally. |

McDonald’s product portfolio is broad and balanced, with significant revenue contributions from the United States and international high-growth markets. This geographic diversification supports stable global operations.

Main Competitors

McDonald’s Corporation operates in a competitive landscape with 6 key players; the table below lists the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| McDonald’s Corporation | 217B |

| Starbucks Corporation | 95.5B |

| Chipotle Mexican Grill, Inc. | 50.6B |

| Yum! Brands, Inc. | 41.8B |

| Darden Restaurants, Inc. | 21.8B |

| Domino’s Pizza, Inc. | 14.4B |

McDonald’s ranks 1st among its competitors with a market cap 8% above the top leader benchmark. It sits well above the average market cap of 73.5B and the sector median of 46.2B. The gap to the next competitor, Starbucks, is significant, reinforcing McDonald’s dominant scale in the restaurant sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does McDonald’s have a competitive advantage?

McDonald’s presents competitive advantages through its strong brand recognition and global footprint, operating over 40K restaurants worldwide. Its favorable margins and consistent revenue growth underscore operational efficiency in the competitive restaurant sector.

Looking ahead, McDonald’s opportunities include expanding its international developmental licensed markets and innovating its menu offerings. Continued growth in operated markets and product diversification support potential future revenue streams.

SWOT Analysis

This SWOT analysis highlights McDonald’s core strategic factors to guide investment decisions.

Strengths

- Strong global brand recognition

- High net margin of 31.85%

- Robust dividend yield at 2.35%

Weaknesses

- Declining ROIC trend

- Unfavorable ROE and asset turnover

- Price-to-earnings ratio above sector average

Opportunities

- Expansion in emerging markets

- Menu innovation and digital ordering

- Growth in international operated markets

Threats

- Intense industry competition

- Rising commodity costs

- Regulatory pressures on fast food

McDonald’s benefits from a resilient brand and solid profitability, but declining efficiency metrics signal caution. Growth hinges on international expansion and innovation, while cost and competitive risks require vigilant management.

Stock Price Action Analysis

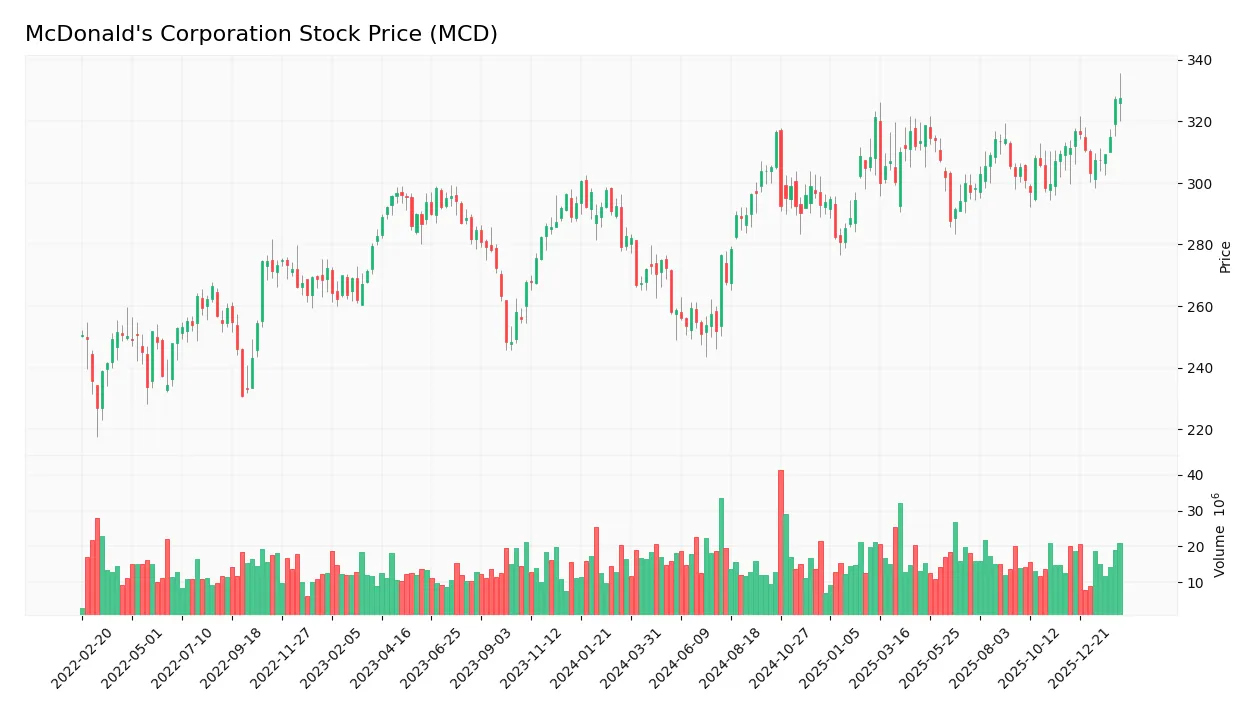

The weekly stock chart displays McDonald’s price movements over the last 12 months, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 12 months, McDonald’s stock rose 15.9%, indicating a bullish trend with acceleration. The price ranged from a low of 251.09 to a high of 327.58. Volatility is moderate with an 18.62 standard deviation, reflecting notable swings but sustained upward momentum.

Volume Analysis

Trading volumes increased recently, driven by buyer dominance at 69.51% from late 2025 to early 2026. This rising volume suggests strong investor interest and confidence, reinforcing the positive price trend and indicating active market participation.

Target Prices

Analysts set a firm price consensus for McDonald’s Corporation, reflecting confidence in growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 315 | 380 | 347.65 |

The target range spans from 315 to 380, with a consensus around 348, signaling moderate upside potential and broad analyst agreement.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines McDonald’s Corporation’s recent analyst grades alongside consumer feedback to provide balanced insight.

Stock Grades

Here are the latest verified grades from reputable analysts for McDonald’s Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Neutral | 2026-02-13 |

| Argus Research | Upgrade | Buy | 2026-02-13 |

| BTIG | Maintain | Buy | 2026-02-12 |

| Truist Securities | Maintain | Buy | 2026-02-12 |

| UBS | Maintain | Buy | 2026-02-12 |

| Jefferies | Maintain | Buy | 2026-02-12 |

| Citigroup | Maintain | Buy | 2026-02-12 |

| RBC Capital | Maintain | Sector Perform | 2026-02-12 |

| Piper Sandler | Maintain | Neutral | 2026-02-12 |

| Barclays | Maintain | Overweight | 2026-02-12 |

The majority of analysts maintain a Buy rating, indicating confidence in McDonald’s outlook. A few hold Neutral or Sector Perform grades, reflecting some caution but overall positive consensus.

Consumer Opinions

Consumer sentiment around McDonald’s remains vibrant and mixed, reflecting its global presence and brand power.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently fast service worldwide. | Food quality can be inconsistent. |

| Affordable menu with good value. | Limited healthy options on the menu. |

| Friendly staff and clean locations. | Sometimes long wait times during peak hours. |

Overall, consumers praise McDonald’s for speed and value but frequently cite inconsistent food quality and limited healthy choices as notable drawbacks. These factors shape the brand’s ongoing challenge in balancing convenience with evolving customer expectations.

Risk Analysis

Below is a summary table of key risks facing McDonald’s Corporation, highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Weak ROE and ROIC signal potential inefficiencies in capital use. | Medium | High |

| Liquidity | Unfavorable current and quick ratios indicate liquidity stress risks. | Medium | Medium |

| Valuation | Elevated P/E ratio suggests overvaluation relative to earnings. | Medium | Medium |

| Operational Risk | Asset turnover metrics remain weak, affecting efficiency. | Medium | Medium |

| Market Volatility | Low beta (0.53) reduces market risk exposure but limits upside. | Low | Low |

| Debt Management | Favorable debt-to-equity and interest coverage ratios reduce default risk. | Low | Low |

The most pressing risks are McDonald’s mediocre capital efficiency and liquidity ratios, which historically can constrain growth during economic slowdowns. Despite a strong Altman Z-Score placing it in the safe zone, cautious monitoring is warranted as these financial weaknesses may pressure returns.

Should You Buy McDonald’s Corporation?

McDonald’s appears to be a company with robust value creation and operational efficiency, supported by a manageable leverage profile. While profitability metrics show some volatility, the firm’s financial health could be seen as stable, yet its rating suggests caution amid declining returns on invested capital.

Strength & Efficiency Pillars

McDonald’s Corporation demonstrates robust operational efficiency with a gross margin of 56.95% and an EBIT margin of 46.39%. Its net margin stands at a strong 31.85%, reflecting effective cost control and pricing power. Although return on equity (0%) and ROIC (0%) metrics are unfavorable and WACC data is unavailable, the company’s consistent profitability highlights solid operational fundamentals. Historically in this sector, such margins indicate resilience through economic cycles, supporting steady value generation despite ROIC data gaps.

Weaknesses and Drawbacks

McDonald’s faces valuation and leverage concerns that could weigh on investor sentiment. The price-to-earnings ratio of 25.49 signals a relatively elevated valuation compared to the S&P 500 average near 20. Additionally, liquidity ratios like current and quick ratios are marked unfavorable at zero, pointing to potential short-term solvency risks. Debt-to-equity scores, however, are favorable, suggesting manageable leverage. The absence of asset turnover metrics and a weak Piotroski score (5/9) further flags operational efficiency and financial strength as areas needing scrutiny.

Our Final Verdict about McDonald’s Corporation

The company’s profile might appear attractive given its strong operational margins and bullish market trend with 58.74% buyer dominance recently. However, mixed financial health metrics and an average Piotroski score suggest caution. Despite long-term strength, the valuation premium and liquidity concerns indicate investors might consider a wait-and-see approach for an improved risk-reward entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Mizuho lifts McDonald’s Corporation (MCD) PT to $325 but flags uncertain 2026 upside – MSN (Feb 13, 2026)

- Here’s what executives are saying about inflation and affordability (MCD:NYSE) – Seeking Alpha (Feb 13, 2026)

- McDonald’s – Britannica (Feb 09, 2026)

- McDonald’s Stock Edges Lower Ahead Of Q4 Earnings – Benzinga (Feb 11, 2026)

- Infographic: How McDonald’s (MCD) performed in Q4 2025 – AlphaStreet News (Feb 12, 2026)

For more information about McDonald’s Corporation, please visit the official website: corporate.mcdonalds.com