Home > Analyses > Technology > Match Group, Inc.

Match Group, Inc. transforms how millions connect and form relationships worldwide. Its portfolio boasts iconic brands like Tinder, Match, and Hinge, each revolutionizing online dating with innovative features and user engagement. The company commands a leading position in the software application sector, blending technology with social interaction. As digital dating evolves, I question whether Match Group’s current fundamentals justify its valuation and support sustainable growth ahead.

Table of contents

Business Model & Company Overview

Match Group, Inc., founded in 1986 and headquartered in Dallas, Texas, dominates the global online dating industry. Its portfolio integrates leading brands like Tinder, Match, OkCupid, and Hinge into a unified ecosystem that connects millions worldwide. This cohesive platform addresses diverse demographics, fueling its stronghold in digital social interaction.

The company’s revenue engine balances subscription-based services and in-app purchases across Americas, Europe, and Asia. Its scalable software products generate recurring income, complemented by targeted monetization strategies. Match Group’s competitive advantage lies in its expansive user base and brand diversification, securing its role as a key innovator shaping the future of digital relationships.

Financial Performance & Fundamental Metrics

I analyze Match Group, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value creation.

Income Statement

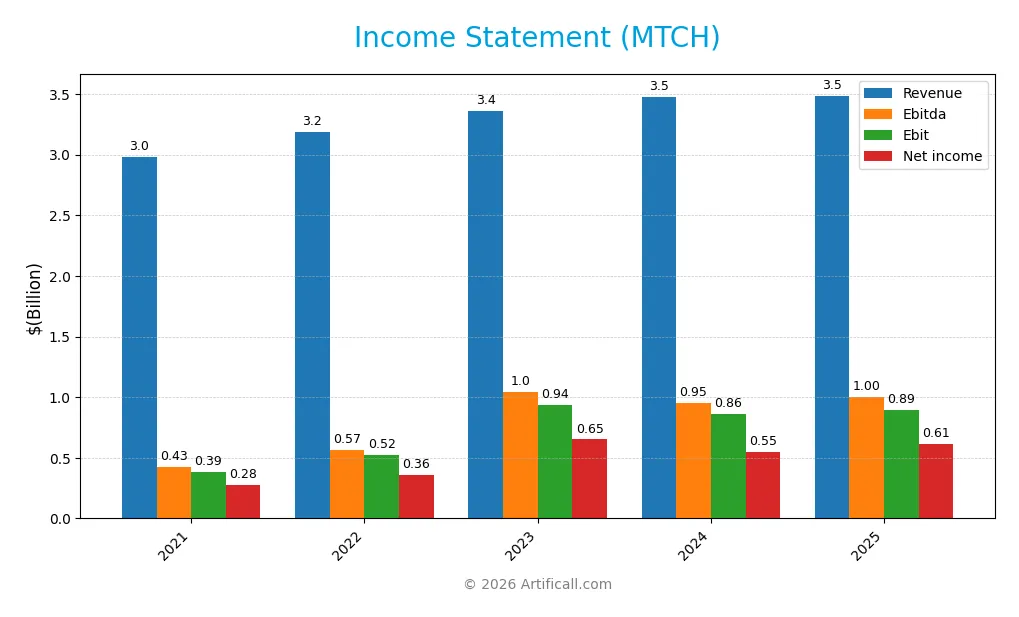

The table below summarizes Match Group, Inc.’s key income statement metrics for fiscal years 2021 through 2025, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.98B | 3.19B | 3.36B | 3.48B | 3.49B |

| Cost of Revenue | 839M | 960M | 954M | 991M | 948M |

| Operating Expenses | 1.29B | 1.71B | 1.49B | 1.66B | 1.67B |

| Gross Profit | 2.14B | 2.23B | 2.41B | 2.49B | 2.54B |

| EBITDA | 428M | 567M | 1.05B | 952M | 999M |

| EBIT | 387M | 523M | 937M | 864M | 894M |

| Interest Expense | 130M | 146M | 160M | 160M | 148M |

| Net Income | 278M | 362M | 651M | 564M | 613M |

| EPS | 1.01 | 1.28 | 2.36 | 2.12 | 2.53 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-27 | 2026-02-03 |

Income Statement Evolution

Match Group’s revenue rose 17% from 2021 to 2025, though growth slowed to 0.2% in 2025. Net income surged 121% over the period, supported by a strong net margin increasing nearly 89%. Gross margin remained stable around 73%, while EBIT margin improved to 25.6%, reflecting disciplined cost control despite slight rises in operating expenses.

Is the Income Statement Favorable?

In 2025, Match Group reported $3.49B revenue and $613M net income, yielding a 17.6% net margin, signaling solid profitability. EBIT margin of 25.6% and controlled interest expense at 4.2% further strengthen fundamentals. Earnings per share grew sharply 18% year-over-year. Overall, the income statement shows favorable trends with efficient cost management and robust margin expansion.

Financial Ratios

The following table summarizes key financial ratios for Match Group, Inc. from 2021 to 2025, highlighting profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.3% | 11.4% | 19.4% | 15.8% | 17.6% |

| ROE | -1.4% | -1.0% | -33.3% | -8.7% | -2.4% |

| ROIC | 21.3% | 13.6% | 19.3% | 16.4% | 22.5% |

| P/E | 131 | 32.4 | 15.4 | 15.4 | 12.8 |

| P/B | -179 | -33 | -515 | -134 | -31 |

| Current Ratio | 1.04 | 1.59 | 2.39 | 2.54 | 1.42 |

| Quick Ratio | 1.04 | 1.59 | 2.39 | 2.54 | 1.42 |

| D/E | -19.3 | -10.7 | -196.6 | -62.1 | -15.7 |

| Debt-to-Assets | 78% | 92% | 85% | 89% | 89% |

| Interest Coverage | 6.53 | 3.54 | 5.73 | 5.14 | 5.91 |

| Asset Turnover | 0.59 | 0.76 | 0.75 | 0.78 | 0.78 |

| Fixed Asset Turnover | 18.3 | 18.1 | 17.3 | 22.0 | 26.6 |

| Dividend Yield | 0% | 0% | 0% | 0% | 2.4% |

Evolution of Financial Ratios

From 2021 to 2025, Match Group’s ROE remained negative, deteriorating sharply to -242% in 2025. The Current Ratio fluctuated, peaking above 2.5 in 2024 before declining to 1.42 in 2025, indicating reduced short-term liquidity. Debt-to-Equity ratio stayed negative, improving to -15.67 in 2025, reflecting high leverage but some deleveraging. Profitability margins generally improved, with net margin rising to 17.6%.

Are the Financial Ratios Favorable?

In 2025, Match Group’s profitability shows strength with a favorable net margin of 17.6% and ROIC of 22.5%, well above the 7.8% WACC. Liquidity ratios are mixed: the quick ratio is favorable at 1.42, but current ratio is neutral. Leverage is high, evidenced by an 89% debt-to-assets ratio flagged unfavorable, though debt-to-equity is favorable due to negative equity. Market valuation metrics like P/E (12.77) and dividend yield (2.38%) are favorable, supporting a generally positive ratio outlook.

Shareholder Return Policy

Match Group, Inc. initiated dividend payments in 2025 with a 30% payout ratio and a 2.38% yield, supported by robust free cash flow coverage. The company also conducts share buybacks, balancing distributions with capital reinvestment.

This policy aligns with sustainable value creation given solid profit margins and cash flow, but investors should monitor payout consistency and repurchase levels to avoid excessive capital strain.

Score analysis

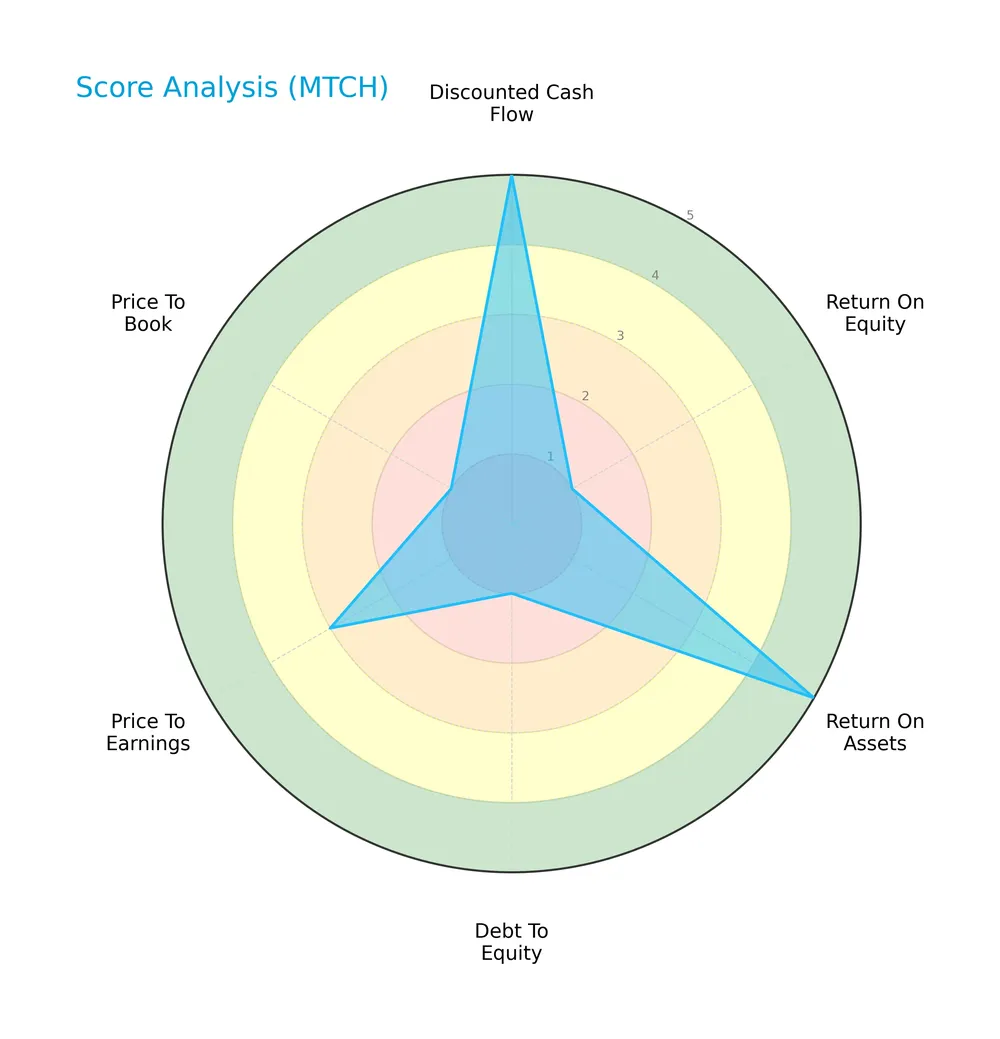

The following radar chart illustrates Match Group, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Match Group shows a very favorable discounted cash flow and return on assets scores at 5 each. However, return on equity, debt to equity, and price to book scores are very unfavorable at 1, indicating profitability and capital structure challenges. The price to earnings score is moderate at 3.

Analysis of the company’s bankruptcy risk

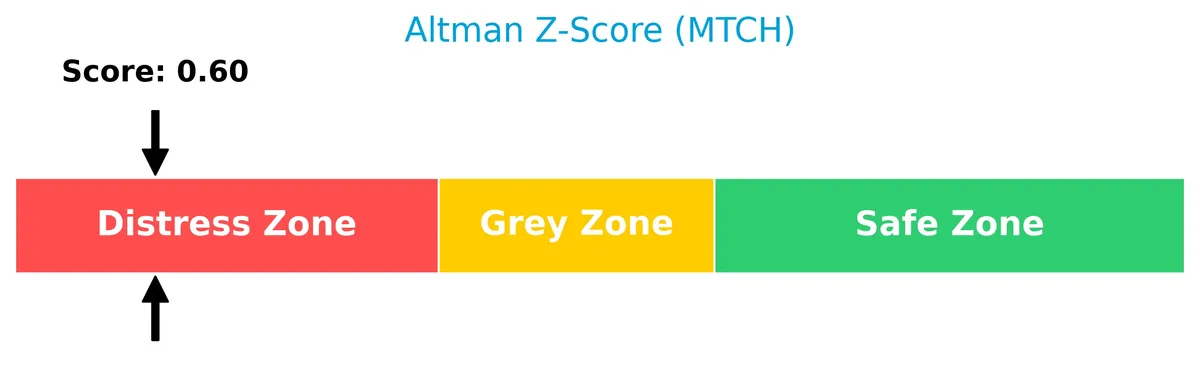

Match Group’s Altman Z-Score places it in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

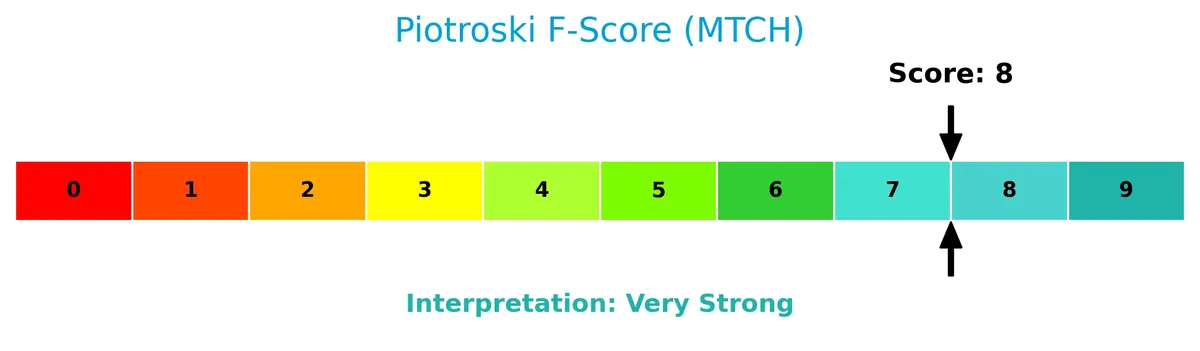

The Piotroski Score diagram below highlights the company’s strong financial health based on nine fundamental criteria:

With a Piotroski Score of 8, Match Group ranks very strong, reflecting robust profitability, liquidity, and operational efficiency despite some other financial strain signals.

Competitive Landscape & Sector Positioning

This analysis reviews Match Group, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Match Group holds a competitive advantage over its peers.

Strategic Positioning

Match Group concentrates on dating products, owning multiple brands like Tinder and OkCupid. Its revenue streams focus on subscription and service models. Geographically, it balances exposure between the US and international markets, with non-US revenue steadily rising to $1.89B in 2024.

Revenue by Segment

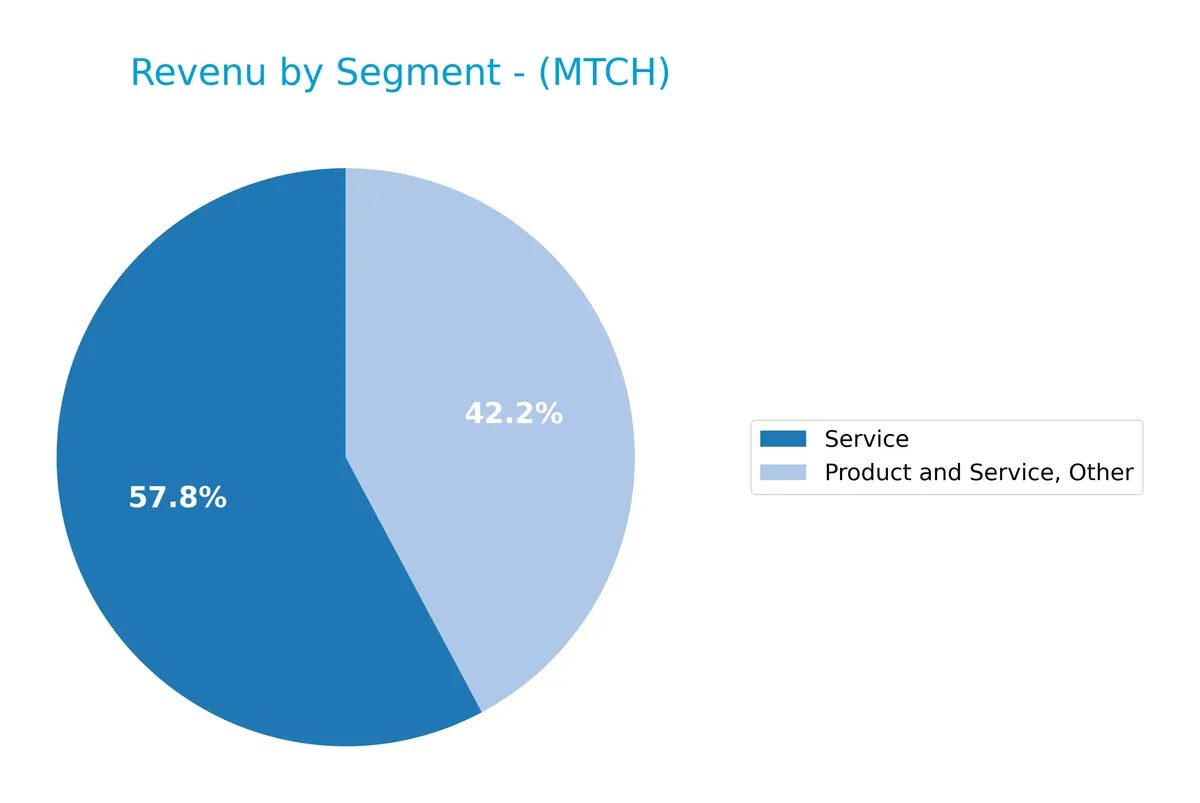

This pie chart illustrates Match Group, Inc.’s revenue distribution by segment across selected fiscal years, highlighting evolving contributions from various business lines.

Historically, Match Group’s revenue has concentrated around key segments like Match and Service. In 2019, Match Group alone generated $2B, showing dominance. Earlier years reveal diversification with segments like Dating, eCommerce, and Search contributing variably. The latest available data (2020) shifts focus toward Service at $1.35B and Product and Service, Other at $989M, signaling a gradual pivot toward service-driven revenue streams and potential concentration risks in those areas.

Key Products & Brands

Match Group’s portfolio includes leading dating brands and various related services worldwide:

| Product | Description |

|---|---|

| Tinder | A flagship dating app known for its swipe-based matching and large global user base. |

| Match | The original dating platform targeting long-term relationships with a broad demographic appeal. |

| Meetic | European dating service focused on serious relationships and local matchmaking. |

| OkCupid | A data-driven dating app offering detailed profiles and compatibility algorithms. |

| Hinge | A relationship-focused app that promotes meaningful connections through prompts and profiles. |

| Pairs | A popular dating platform in Japan emphasizing serious dating and marriage prospects. |

| PlentyOfFish | A well-established dating site with a broad user base and diverse communication features. |

| OurTime | A dating site tailored for singles aged 50 and over, focusing on mature relationships. |

| Other Brands | Various additional dating services and niche platforms expanding Match Group’s market coverage. |

Match Group dominates the online dating sector through a diversified brand portfolio. Each brand targets distinct user segments, enhancing market reach and resilience. This multi-brand strategy supports revenue diversification and competitive moat in the evolving digital dating industry.

Main Competitors

Match Group, Inc. faces competition from 33 companies in its sector; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Match Group, Inc. ranks 28th among 33 competitors, with a market cap just 3.1% of the sector leader Salesforce. It sits below both the top 10 average market cap of 144B and the sector median of 18.8B. The company’s market cap exceeds its closest competitor above by only 0.78%, signaling a narrow gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MTCH have a competitive advantage?

Match Group demonstrates a very favorable competitive advantage, consistently creating value with a ROIC exceeding WACC by 14.7%. The company shows a growing ROIC trend, reflecting efficient capital use and increasing profitability.

Looking ahead, Match Group’s portfolio of dating brands positions it to capture new markets and expand product offerings worldwide. Its global revenue growth signals opportunities to leverage brand strength and scale in international segments.

SWOT Analysis

This SWOT analysis highlights Match Group’s core strategic factors shaping its market position and growth prospects.

Strengths

- strong portfolio of leading dating brands

- very favorable moat with growing ROIC

- solid net margin of 17.6%

Weaknesses

- high debt-to-assets ratio at 89%

- negative ROE signaling equity inefficiency

- Altman Z-score in distress zone

Opportunities

- expanding international revenue base

- rising net margin and EPS growth

- potential to leverage technology for new products

Threats

- intense competition in dating apps

- regulatory risks in global markets

- reliance on user engagement trends

Match Group’s sustainable competitive advantage and profitable growth underpin a robust strategy. However, its high leverage and equity returns warrant cautious capital management.

Stock Price Action Analysis

The weekly stock chart of Match Group, Inc. (MTCH) over the past 12 months reveals notable price fluctuations and key support and resistance levels:

Trend Analysis

Over the past 12 months, MTCH’s stock price declined by 5.39%, indicating a bearish trend. The price range varied between 27.18 and 38.51, with volatility measured by a 2.61 standard deviation. The downward momentum shows deceleration, suggesting a slowing pace of decline.

Volume Analysis

In the last three months, trading volume decreased, with sellers slightly outnumbering buyers at 49.22% buyer dominance. This neutral buyer behavior paired with declining volume suggests subdued market participation and cautious investor sentiment.

Target Prices

Analysts set a target consensus reflecting moderate upside potential for Match Group, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 33 | 43 | 36 |

The target range spans from $33 to $43, with a consensus at $36, indicating cautious optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Match Group, Inc.’s analyst ratings and consumer feedback to assess market sentiment and brand perception.

Stock Grades

The following table shows recent verified analyst grades for Match Group, Inc. from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Truist Securities | Maintain | Hold | 2026-02-04 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | In Line | 2025-11-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-20 |

| Susquehanna | Maintain | Positive | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-06 |

Overall, grades for MTCH show a consistent pattern of moderate optimism with no recent upgrades or downgrades. Most analysts maintain neutral to hold stances, reflecting cautious confidence amid stable market conditions.

Consumer Opinions

Match Group, Inc. sparks strong emotions among users, reflecting its powerful grip on online dating.

| Positive Reviews | Negative Reviews |

|---|---|

| “Intuitive interface makes swiping effortless.” | “Subscription costs feel too high for casual users.” |

| “Wide user base increases chances of matches.” | “Customer support is slow to respond.” |

| “Frequent app updates improve experience.” | “Some profiles seem fake or inactive.” |

Consumers praise Match Group’s user-friendly design and extensive network. However, complaints about pricing and support signal areas demanding urgent attention.

Risk Analysis

Below is a table outlining key risks facing Match Group, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 0.6 signals high bankruptcy risk, indicating distress zone. | High | Severe |

| Leverage | Debt-to-assets ratio at 89.06% signals heavy leverage, raising solvency risks. | High | High |

| Profitability | Negative ROE (-242%) despite favorable ROIC suggests uneven capital returns. | Moderate | Moderate |

| Market Volatility | Beta of 1.315 implies higher sensitivity to market swings. | Moderate | Moderate |

| Operational Risks | Current ratio of 1.42 is borderline, limiting cushion against short-term shocks. | Moderate | Moderate |

The most alarming risk is financial distress, highlighted by the Altman Z-Score well below 1.8 and heavy leverage at 89%. This raises red flags about solvency despite strong operational metrics like a 22.5% ROIC and robust Piotroski Score of 8. Investors must weigh these conflicting signals carefully. Recent market volatility also compounds risk given the stock’s beta over 1.3.

Should You Buy Match Group, Inc.?

Match Group appears to be in a very favorable moat position with growing value creation and operational efficiency. Despite a manageable leverage profile, its Altman Z-score suggests financial distress, while the overall rating of B reflects moderate investment appeal with significant risk considerations.

Strength & Efficiency Pillars

Match Group, Inc. delivers solid operational efficiency with a gross margin of 72.8% and an EBIT margin of 25.62%. Its net margin stands at 17.59%, reflecting strong profitability. The company’s ROIC of 22.5% comfortably exceeds its WACC of 7.8%, marking it as a clear value creator. Additionally, a rising ROIC trend confirms a sustainable competitive advantage, underscoring the firm’s ability to generate returns above its cost of capital.

Weaknesses and Drawbacks

Match Group is currently in financial distress, signaled by an Altman Z-Score of 0.60, well below the 1.8 distress threshold, indicating a heightened bankruptcy risk. Despite operational strengths, the company’s high debt-to-assets ratio of 89.06% raises leverage concerns. Market pressure also weighs on the stock, with a bearish overall trend and nearly balanced buyer-seller volumes around 49.4% buyers, limiting near-term upside momentum.

Our Final Verdict about Match Group, Inc.

Despite operational efficiency and a strong moat, Match Group’s Altman Z-Score in the distress zone makes its investment profile highly speculative. The solvency risk overshadows profitability metrics. Investors seeking stability might view this as too risky for conservative capital. Caution is warranted until financial health shows meaningful improvement.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Match Group Q4 Earnings Call Highlights – Yahoo Finance (Feb 04, 2026)

- Match Group: Tinder Is Bleeding Users, And Hinge Has Stopped Growing (NASDAQ:MTCH) – Seeking Alpha (Feb 04, 2026)

- Match Group (NASDAQ: MTCH) unveils 2025 results and $0.20 per share dividend – stocktitan.net (Feb 03, 2026)

- Match Group Q4 Beat And Dividend Hike Support Tinder Reset Story – Sahm (Feb 05, 2026)

- Match Group, Inc. (NASDAQ:MTCH) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 04, 2026)

For more information about Match Group, Inc., please visit the official website: mtch.com