Home > Analyses > Technology > Marvell Technology, Inc.

Marvell Technology, Inc. powers the backbone of modern digital communication, shaping the way data flows through networks and storage systems worldwide. As a key player in the semiconductor industry, Marvell delivers cutting-edge Ethernet solutions, processors, and storage controllers that drive innovation across cloud, 5G, and enterprise markets. Renowned for its technological prowess and broad product portfolio, Marvell stands at a crossroads: do its solid fundamentals and growth prospects still warrant its current valuation?

Table of contents

Business Model & Company Overview

Marvell Technology, Inc., founded in 1995 and headquartered in Wilmington, Delaware, stands as a dominant force in the semiconductor industry. The company designs and develops an integrated ecosystem of analog, mixed-signal, and digital signal processing circuits, alongside embedded and standalone ICs. Its portfolio spans Ethernet solutions, multi-core processors, ASICs, and storage controllers, creating a comprehensive technology platform that serves diverse computing and networking needs worldwide.

Marvell’s revenue engine integrates hardware innovation with software-driven storage and connectivity solutions, balancing product sales with recurring service opportunities. Its strategic footprint covers major global markets, including the Americas, Europe, and Asia, with operations in key countries like China, India, and Taiwan. This expansive presence, combined with its broad product range, cements Marvell’s economic moat and positions it as a pivotal player shaping the future of semiconductor technology.

Financial Performance & Fundamental Metrics

In this section, I analyze Marvell Technology, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

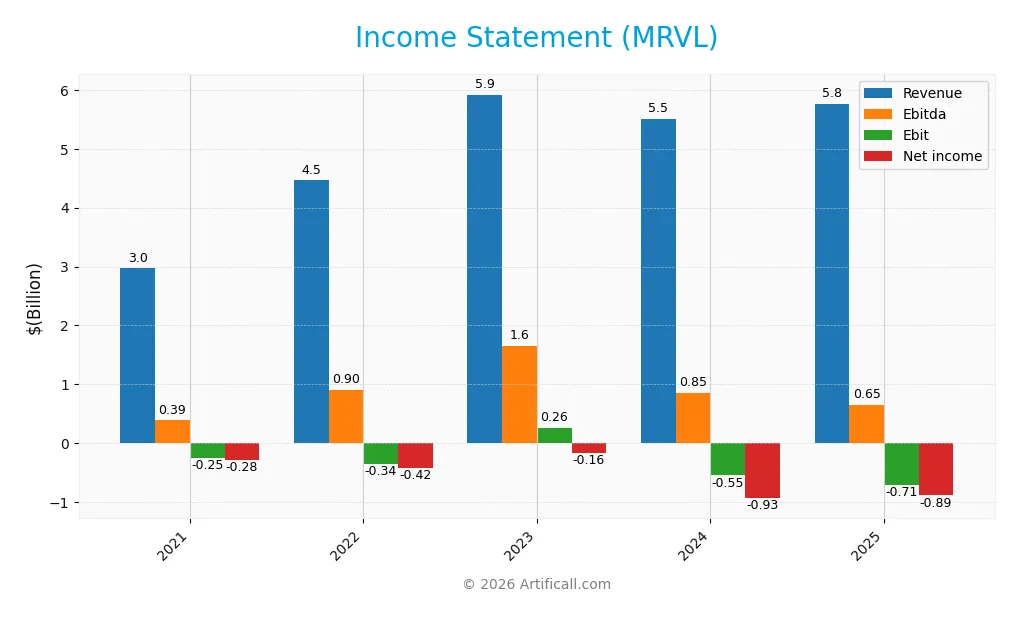

Income Statement

The table below presents Marvell Technology, Inc.’s annual income statement figures from fiscal years 2021 to 2025, highlighting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.97B | 4.46B | 5.92B | 5.51B | 5.77B |

| Cost of Revenue | 1.48B | 2.40B | 2.93B | 3.21B | 3.39B |

| Operating Expenses | 1.75B | 2.41B | 2.75B | 2.86B | 3.10B |

| Gross Profit | 1.49B | 2.06B | 2.99B | 2.29B | 2.38B |

| EBITDA | 389M | 901M | 1.65B | 851M | 652M |

| EBIT | -253M | -344M | 256M | -547M | -705M |

| Interest Expense | 69.3M | 139.3M | 170.6M | 211.7M | 189.4M |

| Net Income | -277M | -421M | -164M | -933M | -885M |

| EPS | -0.41 | -0.53 | -0.19 | -1.08 | -1.02 |

| Filing Date | 2021-01-31 | 2022-03-10 | 2023-03-09 | 2024-03-13 | 2025-03-12 |

Income Statement Evolution

Marvell Technology’s revenue nearly doubled from 2021 to 2025, showing favorable overall growth of 94.26%, though the one-year growth to 2025 was a modest 4.71%, classified as neutral. Gross profit and margin remained relatively stable with a slight positive trend, while operating expenses grew at the same pace as revenue in the last year, negatively impacting operating income. Net income declined sharply over the period, with persistent negative margins despite a recent slight improvement.

Is the Income Statement Favorable?

The 2025 income statement reveals mixed fundamentals. Gross margin stands at a favorable 41.31%, but the company reported an unfavorable negative EBIT margin of -12.23% and a net margin of -15.35%. Interest expenses are well managed, marked as favorable at 3.28% of revenue. Net income remains negative at -885M USD, though net margin and EPS showed modest improvement in the last year. Overall, the income statement is assessed as unfavorable given the sustained losses and declining profitability metrics.

Financial Ratios

The following table summarizes key financial ratios for Marvell Technology, Inc. over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -9.3% | -9.4% | -2.8% | -17.0% | -15.3% |

| ROE | -3.3% | -2.7% | -1.0% | -6.3% | -6.6% |

| ROIC | -2.2% | -1.5% | -2.2% | -2.9% | -3.9% |

| P/E | -127.5 | -135.1 | -224.7 | -62.5 | -110.4 |

| P/B | 4.19 | 3.62 | 2.35 | 3.93 | 7.27 |

| Current Ratio | 1.50 | 1.80 | 1.37 | 1.69 | 1.54 |

| Quick Ratio | 1.25 | 1.28 | 0.93 | 1.21 | 1.03 |

| D/E | 0.16 | 0.30 | 0.30 | 0.30 | 0.32 |

| Debt-to-Assets | 12.4% | 21.3% | 21.0% | 20.7% | 21.5% |

| Interest Coverage | -3.7 | -2.5 | 1.4 | -2.7 | -3.8 |

| Asset Turnover | 0.28 | 0.20 | 0.26 | 0.26 | 0.29 |

| Fixed Asset Turnover | 6.94 | 7.38 | 7.51 | 5.74 | 5.56 |

| Dividend Yield | 0.45% | 0.34% | 0.56% | 0.35% | 0.21% |

Evolution of Financial Ratios

Over the period, Marvell Technology’s Return on Equity (ROE) remained negative, showing slight fluctuations but no significant improvement, ending at -6.59% in 2025. The Current Ratio demonstrated moderate stability, ranging around 1.5 to 1.8, indicating consistent liquidity. The Debt-to-Equity Ratio stayed relatively low and stable near 0.3, reflecting controlled leverage. Profitability margins declined, with net margin deteriorating to -15.35% in 2025, signaling weakened earnings performance.

Are the Financial Ratios Favorable?

In 2025, Marvell shows mixed financial signals. Liquidity ratios such as Current Ratio (1.54) and Quick Ratio (1.03) are favorable, supporting short-term financial health. Leverage metrics, including Debt-to-Equity (0.32) and Debt-to-Assets (21.5%), are also viewed positively, suggesting conservative debt levels. However, profitability indicators like ROE (-6.59%), Net Margin (-15.35%), and Interest Coverage (-3.72) are unfavorable, indicating challenges in generating earnings and covering interest expenses. Efficiency is weak with Asset Turnover at 0.29, while Fixed Asset Turnover (5.56) remains favorable. Overall, the global evaluation rates the ratios as unfavorable.

Shareholder Return Policy

Marvell Technology, Inc. pays a modest dividend of approximately $0.24 per share with a low dividend yield around 0.2% to 0.5%. However, the company reports negative net profit margins and payout ratios are negative, indicating dividends might be funded by non-operating sources.

There is no explicit mention of share buybacks. Given ongoing net losses and negative earnings, the current dividend distribution may not be sustainable long term. This cautious approach suggests prioritization of reinvestment over shareholder returns to support future value creation.

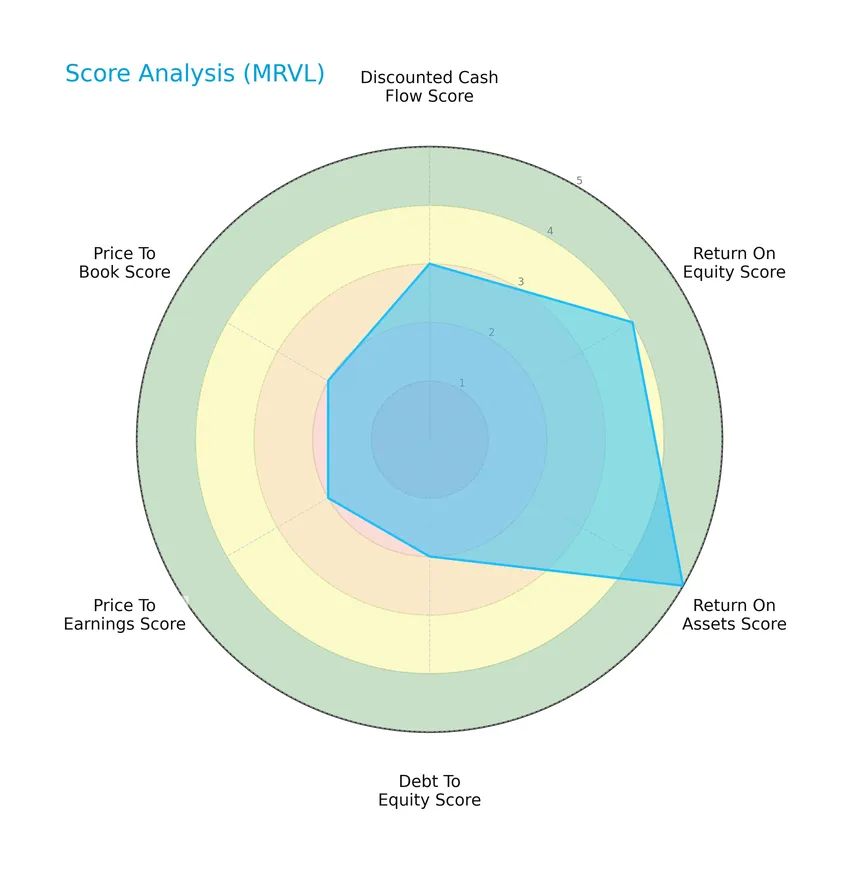

Score analysis

The following radar chart illustrates Marvell Technology, Inc.’s key financial scores across valuation and profitability metrics:

Marvell Technology shows a very favorable return on assets score of 5 and a favorable return on equity score of 4. Valuation metrics such as price to earnings and price to book scores are moderate at 2, alongside moderate scores for discounted cash flow and debt to equity ratios.

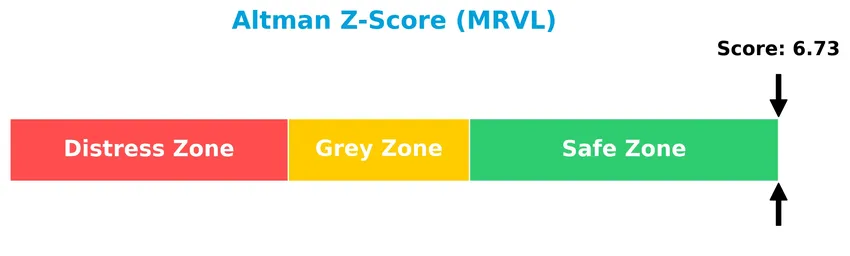

Analysis of the company’s bankruptcy risk

Marvell Technology, Inc. is positioned well within the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy:

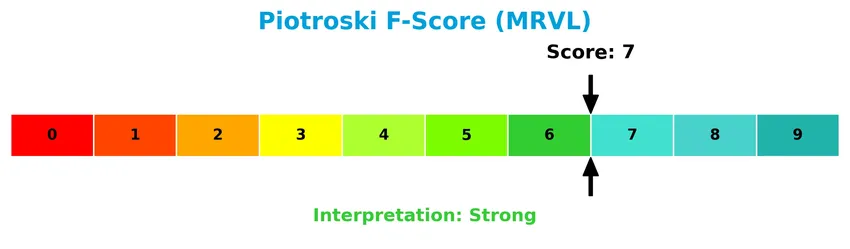

Is the company in good financial health?

The Piotroski Score diagram below highlights the company’s financial strength and operational efficiency:

With a Piotroski Score of 7, Marvell Technology demonstrates strong financial health, reflecting solid profitability, liquidity, and leverage conditions that support its investment quality.

Competitive Landscape & Sector Positioning

This sector analysis will explore Marvell Technology, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Marvell holds a competitive advantage over its industry peers in the semiconductors sector.

Strategic Positioning

Marvell Technology, Inc. maintains a diversified product portfolio spanning data center (4.16B in 2025), enterprise networking, carrier infrastructure, automotive, industrial, and consumer segments. Geographically, it operates globally with significant exposure in China (2.51B), the US (957M), Taiwan, and Southeast Asia, reflecting broad market coverage across technology and industrial sectors.

Revenue by Segment

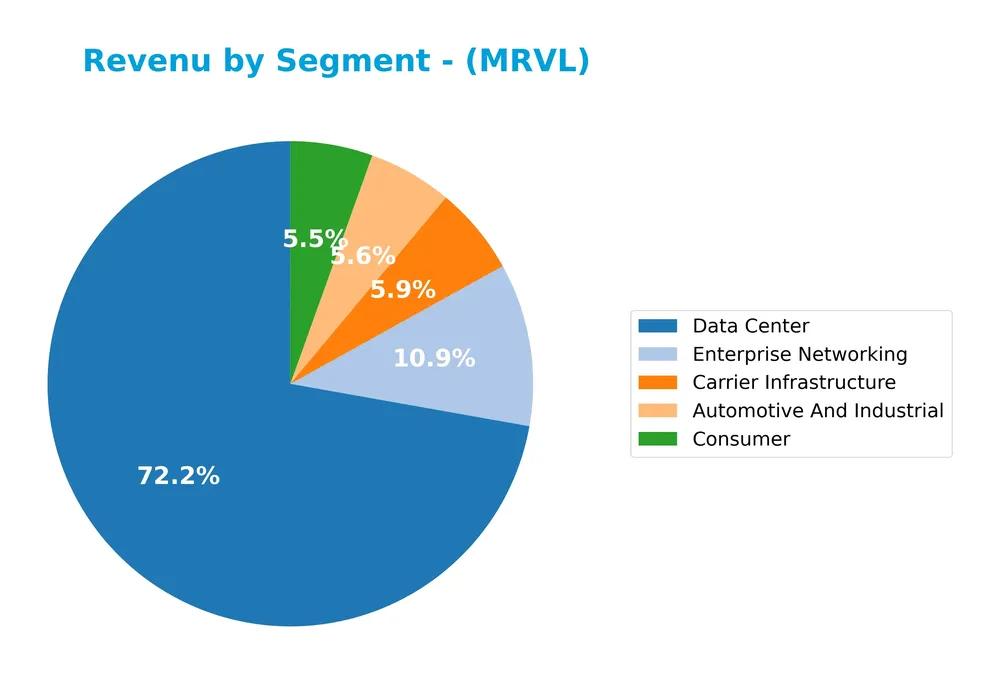

This pie chart illustrates Marvell Technology, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the relative contribution of each business area.

In 2025, the Data Center segment dominates with $4.16B in revenue, showing a strong growth trend compared to prior years. Enterprise Networking follows at $626M, while Carrier Infrastructure and Consumer segments have seen significant declines to $338M and $316M respectively. Automotive and Industrial remains modest at $322M. The concentration in Data Center revenue suggests increasing reliance on this segment, which could imply both growth potential and concentration risk.

Key Products & Brands

The table below outlines Marvell Technology, Inc.’s key products and brand categories with their respective descriptions:

| Product | Description |

|---|---|

| Ethernet Solutions | Controllers, network adapters, physical transceivers, and switches for networking purposes. |

| Processors & ASICs | Single or multiple core processors, application processors, and custom ASIC products. |

| Storage Products | Controllers for HDDs and SSDs supporting SAS, SATA, PCIe, NVMe, and NVMe over Fabrics. |

| Fiber Channel Products | Host bus adapters and controllers for server and storage system connectivity. |

| Automotive and Industrial | Semiconductor solutions tailored for automotive and industrial applications. |

| Carrier Infrastructure | Products serving telecommunications infrastructure needs. |

| Consumer Products | Semiconductor components targeting consumer electronics markets. |

| Data Center Solutions | Integrated circuits and systems designed for data center applications. |

| Enterprise Networking | Networking products for enterprise environments, including switches and controllers. |

Marvell Technology’s product portfolio spans a wide range of semiconductor solutions across multiple sectors, including data center, networking, storage, automotive, and consumer electronics, reflecting its diversified industry presence.

Main Competitors

There are 38 competitors in the semiconductors industry, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

Marvell Technology, Inc. ranks 15th among 38 semiconductor companies, with a market cap representing 1.5% of the leader’s (NVIDIA). It is positioned below the average market cap of the top 10 competitors (974.8B) but remains above the sector median (30.7B). The distance to the next competitor above Marvell is a significant +66.89%, indicating a notable gap to its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MRVL have a competitive advantage?

Marvell Technology, Inc. currently does not present a competitive advantage as it is shedding value with a ROIC significantly below its WACC and a strongly declining ROIC trend over 2021-2025. Its financial performance shows unfavorable EBIT and net margins despite a favorable gross margin, indicating challenges in profitability and value creation.

Looking ahead, Marvell’s diverse portfolio in Ethernet, storage, and application processors, combined with its presence in key global markets like China, the US, and Southeast Asia, offers opportunities to enhance its competitive position. However, continued focus on operational efficiency and innovation will be critical to reversing its value destruction trend.

SWOT Analysis

This SWOT analysis highlights Marvell Technology, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- strong market presence in semiconductors

- diverse product portfolio including Ethernet and storage controllers

- solid geographic revenue diversification

Weaknesses

- negative net and EBIT margins

- declining ROIC and value destruction

- unfavorable asset turnover and interest coverage

Opportunities

- expanding demand for data center and cloud infrastructure

- growth potential in emerging markets like China and Southeast Asia

- innovation in advanced integrated circuits and processors

Threats

- intense semiconductor industry competition

- geopolitical risks affecting supply chains

- macroeconomic volatility impacting tech spending

Overall, Marvell shows robust market positioning but faces profitability challenges and declining returns. Strategic focus on operational efficiency and innovation is critical to capitalize on growth opportunities while managing sector risks.

Stock Price Action Analysis

The weekly stock chart for Marvell Technology, Inc. (MRVL) illustrates price movements and key levels over the recent trading period:

Trend Analysis

Over the past 12 months, MRVL’s stock price increased by 3.38%, indicating a bullish trend with deceleration in momentum. The price ranged between a low of 49.43 and a high of 124.76, with notable volatility reflected by a 16.42 standard deviation. However, the recent 11-week period from November 2025 to January 2026 shows an 11.76% decline, signaling short-term bearishness.

Volume Analysis

Trading volumes over the last three months reveal a seller-dominant market with buyer participation at 30.31%. Volume has been increasing overall, suggesting heightened market activity but prevailing selling pressure, which may reflect cautious or negative investor sentiment towards MRVL in the recent period.

Target Prices

Analysts present a clear target consensus for Marvell Technology, Inc. (MRVL).

| Target High | Target Low | Consensus |

|---|---|---|

| 156 | 80 | 117 |

The target prices suggest a moderately optimistic outlook, with a consensus price of 117 indicating potential upside from current levels while acknowledging some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Marvell Technology, Inc. (MRVL).

Stock Grades

Here is the latest overview of Marvell Technology, Inc. stock grades from recognized financial analysts and grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| Melius Research | Upgrade | Buy | 2026-01-05 |

| Benchmark | Downgrade | Hold | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Stifel | Maintain | Buy | 2025-12-03 |

| Susquehanna | Maintain | Positive | 2025-12-03 |

| Goldman Sachs | Maintain | Neutral | 2025-12-03 |

| Jefferies | Maintain | Buy | 2025-12-03 |

The consensus remains generally positive with a majority of buy and overweight ratings, despite a few hold and neutral assessments. Recent upgrades suggest cautious optimism among analysts, reflecting a balanced but favorable market view.

Consumer Opinions

Marvell Technology, Inc. has garnered mixed but insightful feedback from its user base, reflecting both its technological strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Marvell’s chips deliver excellent performance and reliability.” | “Customer support response times can be slow during peak hours.” |

| “Great innovation in semiconductor technology, staying ahead of competitors.” | “Some products have higher price points compared to alternatives.” |

| “Consistent product quality with strong integration capabilities.” | “Limited software compatibility with certain legacy systems.” |

Overall, consumers praise Marvell for its innovation and product reliability, while concerns mainly focus on customer service responsiveness and pricing strategies.

Risk Analysis

Below is a summary table highlighting key risks associated with Marvell Technology, Inc. to guide your investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-15.35%) and unfavorable ROE (-6.59%) indicating losses | Moderate | High |

| Market Volatility | High beta (1.945) signals greater stock price fluctuations versus market | High | Medium |

| Valuation Risk | High price-to-book ratio (7.27) suggests potential overvaluation | Moderate | Medium |

| Debt & Liquidity | Favorable debt ratios but weak interest coverage (-3.72) | Low to Moderate | Medium |

| Dividend Yield | Very low yield (0.21%) limiting income potential | High | Low |

The most pressing risks for Marvell are its ongoing negative profitability metrics and elevated stock volatility. Despite a strong Altman Z-score (6.73) indicating low bankruptcy risk, investors should monitor earnings recovery closely. The stock’s high beta means market downturns could amplify losses, requiring cautious position sizing.

Should You Buy Marvell Technology, Inc.?

Marvell Technology, Inc. appears to have a challenging profitability profile with declining operational returns, suggesting value erosion and an unfavorable moat. Despite a manageable leverage profile, its B+ overall rating and strong Altman Z-Score indicate moderate financial resilience worth monitoring cautiously.

Strength & Efficiency Pillars

Marvell Technology, Inc. exhibits robust financial stability as evidenced by an Altman Z-Score of 6.73, positioning it firmly in the safe zone and indicating low bankruptcy risk. The company’s Piotroski Score of 7 reflects strong financial health, highlighting sound profitability and operational efficiency. Favorable debt metrics, including a debt-to-equity ratio of 0.32 and a current ratio of 1.54, underscore solid liquidity and conservative leverage. However, profitability remains challenged, with a negative ROIC of -3.88% well below its WACC of 12.44%, signaling that Marvell is currently not a value creator.

Weaknesses and Drawbacks

Marvell faces significant profitability headwinds, with a net margin of -15.35% and a negative return on equity of -6.59%, pointing to operational inefficiencies. The company’s valuation is stretched, reflected in a high price-to-book ratio of 7.27, which may deter value-conscious investors. Interest coverage is negative at -3.72, raising concerns about earnings sufficiency to cover debt costs. Market dynamics add pressure, as recent data shows a seller dominance with only 30.31% buyer volume, contributing to an 11.76% price decline in the near term, which could reflect investor caution.

Our Verdict about Marvell Technology, Inc.

The long-term fundamental profile of Marvell Technology appears unfavorable due to sustained value erosion and weak profitability metrics. Despite an overall bullish stock trend with a modest 3.38% price appreciation, recent seller dominance and short-term price deceleration suggest caution. Investors might consider a wait-and-see approach for a more attractive entry point, as the company’s current challenges could weigh on near-term performance even if some structural strengths remain.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Investors Heavily Search Marvell Technology, Inc. (MRVL): Here is What You Need to Know – Yahoo Finance (Jan 22, 2026)

- Rakuten Investment Management Inc. Makes New $2.55 Million Investment in Marvell Technology, Inc. $MRVL – MarketBeat (Jan 24, 2026)

- Marvell’s 2026 Story Looks Quiet Bullish (NASDAQ:MRVL) – Seeking Alpha (Jan 23, 2026)

- Marvell Technology, Western Digital, Photronics, FormFactor, and Amkor Shares Plummet, What You Need To Know – Finviz (Jan 23, 2026)

- Blackhawk Capital Partners LLC Invests $1.69 Million in Marvell Technology, Inc. $MRVL – MarketBeat (Jan 24, 2026)

For more information about Marvell Technology, Inc., please visit the official website: marvell.com