Home > Analyses > Basic Materials > Martin Marietta Materials, Inc.

Martin Marietta Materials, Inc. shapes the very foundation of modern infrastructure by supplying essential building materials that support daily life and economic growth. As a dominant player in construction materials, it delivers high-quality aggregates, cement, and asphalt crucial to projects worldwide. Renowned for its innovation and market influence, Martin Marietta is pivotal in sectors from residential construction to environmental applications. But as the industry evolves, does its current valuation fully reflect its future growth potential?

Table of contents

Business Model & Company Overview

Martin Marietta Materials, Inc., founded in 1939 and headquartered in Raleigh, North Carolina, stands as a dominant player in the construction materials industry. It offers a cohesive ecosystem of natural resource-based products, including aggregates, ready-mixed concrete, asphalt, and specialty cement, serving diverse markets such as infrastructure, residential, nonresidential construction, and environmental sectors. This integrated portfolio supports the company’s core mission to provide essential building materials for critical industrial applications.

The company’s revenue engine balances heavy-side building materials with chemical products like magnesia-based chemicals and dolomitic lime, targeting industrial, agricultural, and environmental uses. Martin Marietta maintains strategic market presence across the United States and international territories, capitalizing on infrastructure demand in the Americas, Europe, and Asia. Its competitive advantage lies in the scale and diversity of its offerings, securing a robust economic moat that shapes the future of construction materials globally.

Financial Performance & Fundamental Metrics

In this section, I analyze Martin Marietta Materials, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

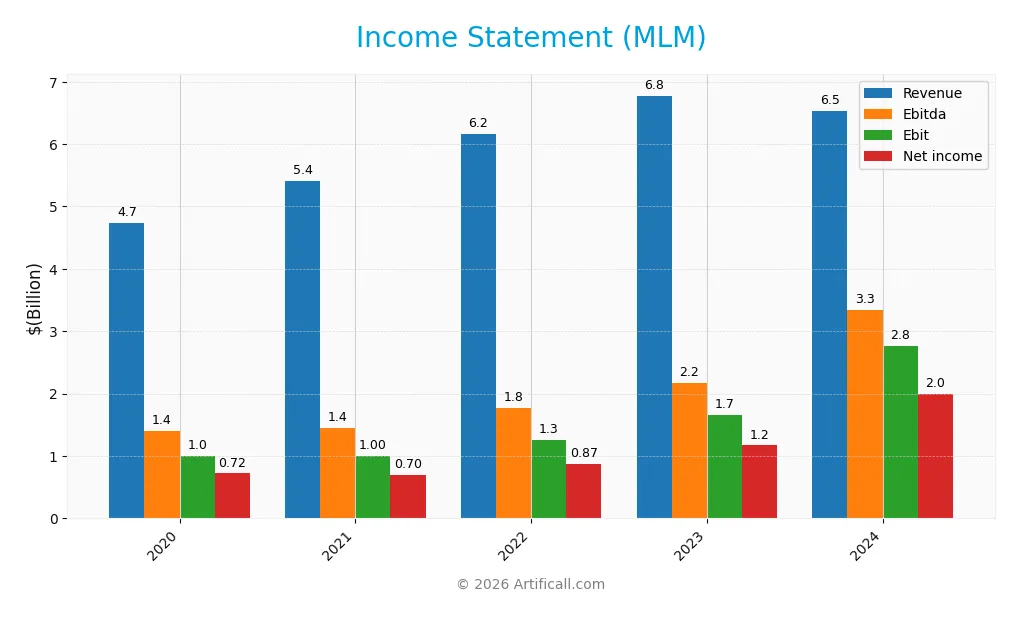

Income Statement

The following table summarizes Martin Marietta Materials, Inc.’s income statement data for the fiscal years 2020 through 2024 in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.73B | 5.41B | 6.16B | 6.78B | 6.54B |

| Cost of Revenue | 3.48B | 4.07B | 4.74B | 4.75B | 4.66B |

| Operating Expenses | 247M | 375M | 216M | 427M | -829M |

| Gross Profit | 1.25B | 1.35B | 1.42B | 2.02B | 1.88B |

| EBITDA | 1.40B | 1.45B | 1.77B | 2.17B | 3.34B |

| EBIT | 1.01B | 998M | 1.26B | 1.66B | 2.77B |

| Interest Expense | 118M | 143M | 169M | 165M | 169M |

| Net Income | 721M | 702M | 867M | 1.17B | 1.99B |

| EPS | 11.56 | 11.26 | 13.91 | 18.88 | 32.5 |

| Filing Date | 2021-02-19 | 2022-02-22 | 2023-02-24 | 2024-02-23 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, Martin Marietta Materials, Inc. saw revenue grow by 38.18%, despite a slight 3.56% decline from 2023 to 2024. Net income showed a stronger increase of 176.7% over the period, with a notable 76.95% growth in the last year. Margins improved significantly, with the net margin doubling overall and favorable gross and EBIT margins maintained.

Is the Income Statement Favorable?

The 2024 income statement reveals solid fundamentals: a net margin of 30.52%, an EBIT margin of 42.3%, and an interest expense ratio of 2.59%, all rated favorable. Despite the slight revenue dip, EBIT surged by 66.77% and EPS grew 72.21%, reflecting improved profitability and operational efficiency. Overall, the income statement is assessed as favorable.

Financial Ratios

The table below presents key financial ratios of Martin Marietta Materials, Inc. (ticker: MLM) for the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, efficiency, and dividends:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 13% | 14% | 17% | 31% |

| ROE | 12% | 11% | 12% | 15% | 21% |

| ROIC | 8% | 6% | 7% | 9% | 12% |

| P/E | 24.5 | 39.1 | 24.3 | 26.4 | 15.9 |

| P/B | 3.00 | 4.21 | 2.94 | 3.84 | 3.35 |

| Current Ratio | 3.34 | 2.69 | 1.99 | 3.35 | 2.50 |

| Quick Ratio | 1.92 | 1.69 | 1.39 | 2.50 | 1.40 |

| D/E | 0.52 | 0.85 | 0.76 | 0.59 | 0.61 |

| Debt-to-Assets | 29% | 38% | 36% | 31% | 32% |

| Interest Coverage | 8.5 | 6.8 | 7.1 | 9.7 | 16.0 |

| Asset Turnover | 0.45 | 0.38 | 0.41 | 0.45 | 0.36 |

| Fixed Asset Turnover | 0.83 | 0.80 | 0.92 | 1.03 | 0.62 |

| Dividend Yield | 0.79% | 0.54% | 0.76% | 0.56% | 0.60% |

Evolution of Financial Ratios

Between 2021 and 2024, Martin Marietta Materials, Inc. (MLM) saw its Return on Equity (ROE) improve steadily to 21.1% in 2024, indicating enhanced profitability. The Current Ratio displayed some fluctuations but remained stable around 2.5 in 2024, signaling solid liquidity. The Debt-to-Equity Ratio trended downward from 0.85 in 2021 to 0.61 in 2024, reflecting a moderate reduction in leverage.

Are the Financial Ratios Favorable?

In 2024, MLM’s profitability ratios, including net margin (30.5%) and ROE (21.1%), were favorable, demonstrating strong earnings performance. Liquidity measures such as the current ratio (2.5) and quick ratio (1.4) also appeared favorable. However, efficiency ratios like asset turnover (0.36) and fixed asset turnover (0.62) were unfavorable, showing less effective asset use. Leverage and market value ratios were mostly neutral or unfavorable, with a debt-to-equity ratio of 0.61 and a price-to-book ratio of 3.35, indicating mixed financial health. Overall, the ratio profile is slightly favorable.

Shareholder Return Policy

Martin Marietta Materials, Inc. maintains a consistent dividend policy with a payout ratio around 9-21% over recent years and a dividend yield near 0.5-0.8%. The dividend per share has steadily increased from $2.25 in 2020 to $3.08 in 2024, supported by sound free cash flow coverage and moderate capital expenditures.

The company also engages in share buybacks, complementing dividend distributions. This balanced approach, combining dividends and repurchases with solid profitability and cash flow metrics, suggests a sustainable framework for long-term shareholder value creation, subject to ongoing market and operational conditions.

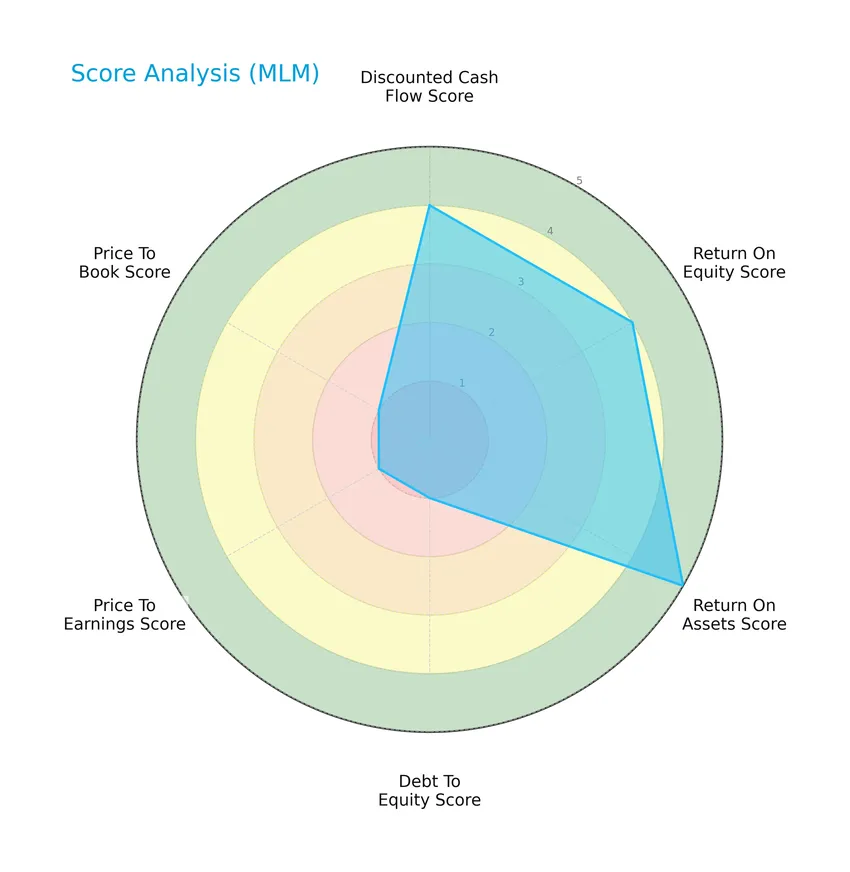

Score analysis

The radar chart below illustrates Martin Marietta Materials, Inc.’s key financial metric scores for a comprehensive overview:

The company shows strong profitability with high scores in discounted cash flow (4), return on equity (4), and return on assets (5). However, its leverage and valuation metrics are weak, scoring very unfavorably at 1 for debt to equity, price to earnings, and price to book ratios.

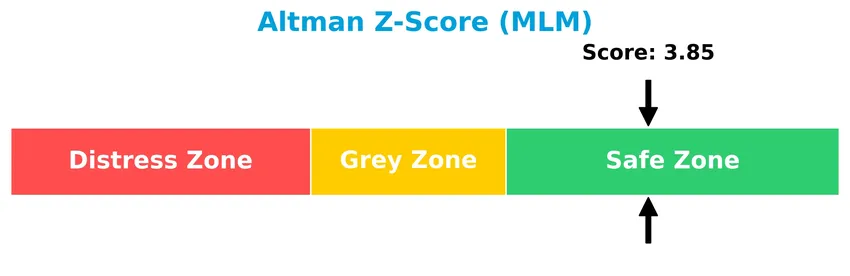

Analysis of the company’s bankruptcy risk

Martin Marietta Materials, Inc. sits comfortably in the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy:

Is the company in good financial health?

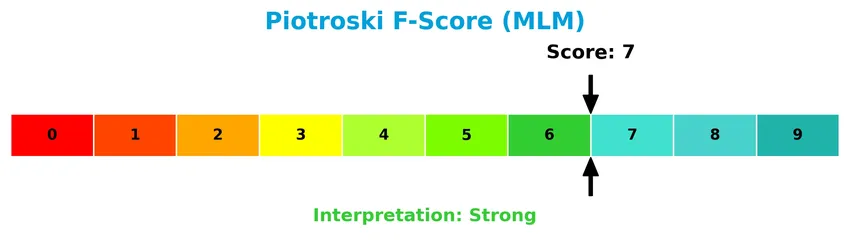

The Piotroski Score diagram provides insight into the company’s financial strength based on nine criteria:

With a Piotroski Score of 7, Martin Marietta Materials, Inc. demonstrates strong financial health, reflecting solid profitability, efficiency, and moderate leverage management.

Competitive Landscape & Sector Positioning

This section provides an overview of Martin Marietta Materials, Inc.’s position within the construction materials sector, focusing on strategic and financial aspects. I will examine the company’s revenue streams, key products, and main competitors in the industry. Additionally, I will assess whether Martin Marietta Materials holds a competitive advantage relative to its peers.

Strategic Positioning

Martin Marietta Materials, Inc. maintains a concentrated product portfolio centered on its Building Materials Business, generating over $6.2B in 2024, complemented by a smaller Magnesia Specialties segment at $320M. Geographically, the company is predominantly US-focused, with $6.49B domestic revenue versus $49M foreign.

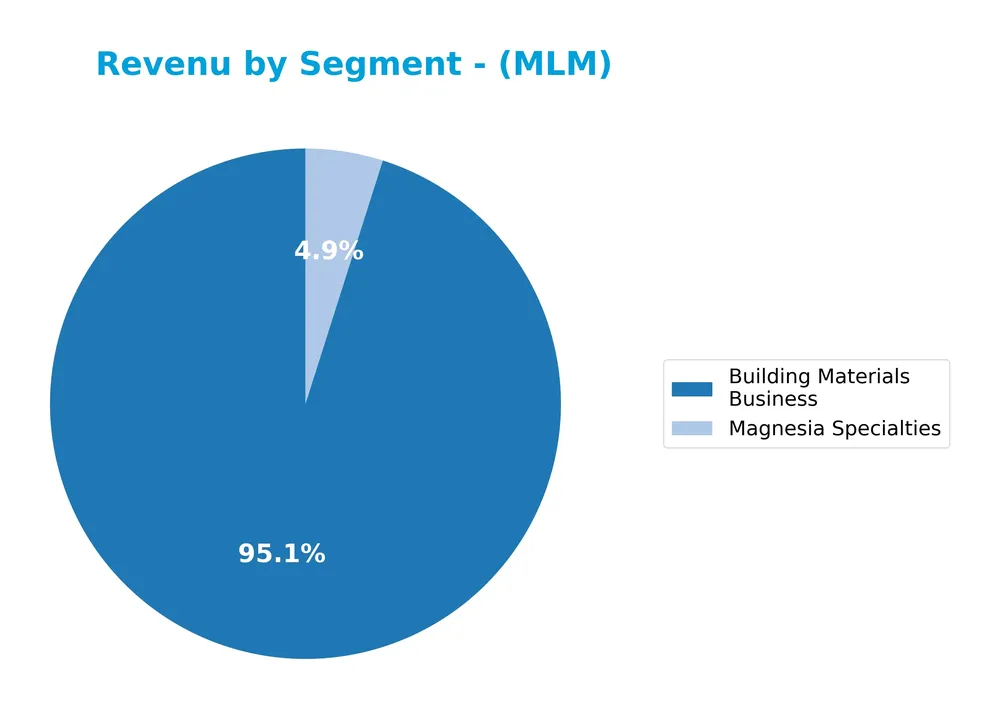

Revenue by Segment

This pie chart illustrates Martin Marietta Materials, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution of each business unit to overall sales.

In 2024, the Building Materials Business overwhelmingly drives Martin Marietta’s revenue with $6.2B, while Magnesia Specialties contributed $320M. The Building Materials segment has shown consistent growth from $4.5B in 2020 to its current scale, indicating steady expansion. Magnesia Specialties’ revenue remains relatively small but stable. The company’s revenue concentration in Building Materials suggests a focus on this core segment, presenting both growth opportunities and concentration risk to monitor.

Key Products & Brands

The table below summarizes the main products and brands offered by Martin Marietta Materials, Inc.:

| Product | Description |

|---|---|

| Building Materials Business | Comprises aggregates (crushed stone, sand, gravel), ready mixed concrete, asphalt, paving products, and cement used in construction, infrastructure, railroad, agricultural, utility, and environmental markets. |

| Magnesia Specialties | Includes magnesia-based chemicals and dolomitic lime for industrial, agricultural, environmental applications, flame retardants, wastewater treatment, pulp and paper production, and steel production. |

Martin Marietta Materials, Inc. primarily generates revenue from its Building Materials Business, which supplies essential construction materials, complemented by its Magnesia Specialties segment that serves diverse industrial and environmental needs.

Main Competitors

In the Basic Materials sector, there are 3 competitors, with the table below showing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| CRH plc | 84.8B |

| Vulcan Materials Company | 38.7B |

| Martin Marietta Materials, Inc. | 38.3B |

Martin Marietta Materials, Inc. ranks 3rd among its competitors, with a market cap approximately 46.22% that of the sector leader, CRH plc. The company’s valuation is below the average market cap of the top 10 competitors but stands above the sector median. Its market cap is closely trailing Vulcan Materials Company by about 1.28%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MLM have a competitive advantage?

Martin Marietta Materials, Inc. presents a clear competitive advantage, demonstrated by a very favorable moat status supported by a ROIC exceeding WACC by 3.5% and a strong upward trend in ROIC of 49% over the 2020-2024 period. This indicates efficient capital use and consistent value creation for investors, reflecting durable profitability in the construction materials industry.

Looking ahead, MLM’s future opportunities stem from its diversified product range including aggregates, cement, and specialty chemicals, with ongoing supply to infrastructure and environmental sectors. Its established presence in the US domestic market and international reach position the company to benefit from potential expansion and evolving construction demands.

SWOT Analysis

This SWOT analysis highlights Martin Marietta Materials, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong profitability with 30.5% net margin

- growing ROIC well above WACC

- diversified product portfolio serving multiple construction sectors

Weaknesses

- recent 3.6% revenue decline

- unfavorable asset turnover ratios

- low dividend yield at 0.6%

Opportunities

- expanding infrastructure spending in the US

- potential international market growth

- innovation in sustainable building materials

Threats

- cyclical nature of construction industry

- raw material cost volatility

- regulatory and environmental compliance risks

Martin Marietta demonstrates solid profitability and a durable competitive advantage, though recent revenue softness and efficiency metrics warrant caution. Strategic focus should balance growth initiatives and operational improvements while managing sector cyclicality and cost pressures.

Stock Price Action Analysis

The following weekly chart illustrates Martin Marietta Materials, Inc. (MLM) stock price movements over the past 100 weeks, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 12 months, MLM’s stock price increased by 10.09%, indicating a bullish trend with clear acceleration. The price ranged from a low of 460.39 to a high of 666.67, supported by a high volatility level of 46.23 standard deviation. Recent weeks show continued strength with a 6.36% gain and a positive slope of 5.22.

Volume Analysis

Trading volumes are increasing overall, with total volume at 249M shares. Buyer activity slightly dominates at 52.8%. In the recent period (Nov 2025 to Jan 2026), buyer volume accounted for 58%, suggesting a mildly buyer-driven market with strengthening investor participation and confidence.

Target Prices

The consensus target prices for Martin Marietta Materials, Inc. indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 730 | 620 | 689.71 |

Analysts expect the stock price to range between 620 and 730, with a consensus target near 690, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest grades and consumer feedback regarding Martin Marietta Materials, Inc. (MLM).

Stock Grades

The latest stock grades for Martin Marietta Materials, Inc. from recognized analysts are presented in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2026-01-14 |

| Citigroup | Maintain | Buy | 2026-01-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-22 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Morgan Stanley | Maintain | Overweight | 2025-12-01 |

| Stifel | Maintain | Buy | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-11 |

| UBS | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-06 |

| Raymond James | Maintain | Outperform | 2025-10-21 |

Overall, the ratings mainly reflect a positive outlook with multiple buy and overweight ratings maintained, although a recent downgrade by DA Davidson to neutral indicates some caution among analysts. The consensus remains a Buy, supported by 23 buy and 16 hold ratings with no sell recommendations.

Consumer Opinions

Consumers generally appreciate Martin Marietta Materials, Inc. for its product quality but express concerns regarding pricing and delivery times.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality construction materials, very reliable for large projects. | Prices tend to be higher compared to some competitors. |

| Excellent customer service with knowledgeable staff. | Delivery delays have occasionally impacted project timelines. |

| Strong commitment to sustainability and environmental practices. | Limited availability in some regional markets. |

Overall, Martin Marietta is praised for product quality and customer service, while pricing and delivery logistics remain common areas for improvement.

Risk Analysis

Below is a summary table outlining the key risks associated with Martin Marietta Materials, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to construction sector cycles and economic downturns affecting demand | Medium | High |

| Valuation Risk | Elevated price-to-book ratio indicating potential overvaluation | Medium | Medium |

| Leverage Risk | Relatively high debt-to-equity ratio, raising financial risk | Medium | Medium to High |

| Operational Risk | Unfavorable asset turnover ratios suggesting potential inefficiencies | Medium | Medium |

| Dividend Yield | Low dividend yield may impact income-focused investors | Low | Low |

| Regulatory Risk | Environmental and safety regulations impacting production and costs | Low to Medium | Medium |

The most significant risks for MLM are market cyclicality and financial leverage. Despite a strong Altman Z-Score placing the company in the safe zone, its debt-to-equity ratio and price valuation metrics warrant caution. The construction materials sector remains sensitive to economic fluctuations, which could affect revenue growth and profitability.

Should You Buy Martin Marietta Materials, Inc.?

Martin Marietta Materials, Inc. appears to be demonstrating robust profitability supported by a durable competitive moat with growing operational efficiency. Despite a challenging leverage profile, its overall B rating suggests a very favorable financial health, indicating cautious value creation potential.

Strength & Efficiency Pillars

Martin Marietta Materials, Inc. delivers robust profitability with a net margin of 30.52% and a return on equity (ROE) of 21.1%, underpinning its operational efficiency. Its return on invested capital (ROIC) stands at 12.01%, comfortably exceeding the weighted average cost of capital (WACC) of 8.51%, confirming the company as a clear value creator. Financial stability is supported by an Altman Z-score of 3.85, placing it in the safe zone, and a strong Piotroski score of 7, highlighting sound financial health and solid fundamentals.

Weaknesses and Drawbacks

Despite its strengths, Martin Marietta faces valuation concerns, with a price-to-book ratio of 3.35 marking it as relatively expensive. Asset turnover metrics are weak (0.36), which could indicate inefficiency in utilizing assets to generate revenue. The dividend yield is low at 0.6%, potentially limiting income appeal. While debt-to-equity is moderate at 0.61, it remains a neutral factor, and the company’s premium valuation reflected in a neutral P/E of 15.9 warrants caution for value-sensitive investors.

Our Verdict about Martin Marietta Materials, Inc.

Martin Marietta presents a favorable long-term fundamental profile, driven by strong profitability and financial health. The bullish overall stock trend, combined with a slightly buyer-dominant recent period, suggests the company may appear attractive for long-term exposure. Investors could consider this profile as a potential core holding, while remaining mindful of premium valuation and operational efficiency challenges that may require monitoring.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Martin Marietta Materials, Inc. Scheduled to Host Fourth-Quarter and Full-Year 2025 Earnings Call on February 11, 2026 – Quiver Quantitative (Jan 21, 2026)

- A Look At Martin Marietta Materials (MLM) Valuation After A Strong Year Of Shareholder Returns – Yahoo Finance (Jan 20, 2026)

- Martin Marietta Announces Fourth-Quarter and Full-Year 2025 Earnings Conference Call – GlobeNewswire (Jan 21, 2026)

- 3 Reasons to Sell MLM and 1 Stock to Buy Instead – Finviz (Jan 21, 2026)

- S&P 500 supplier Martin Marietta sets Feb. 11 call on 2025 results – Stock Titan (Jan 21, 2026)

For more information about Martin Marietta Materials, Inc., please visit the official website: martinmarietta.com