Home > Analyses > Energy > Marathon Petroleum Corporation

Marathon Petroleum powers millions of vehicles daily, fueling economies and shaping energy access across the United States. As a dominant force in oil refining and midstream logistics, it commands a vast network of refineries and branded outlets, known for operational efficiency and strategic market reach. I’m intrigued to explore whether Marathon’s resilient business model and steady dividends still justify its premium valuation amid evolving energy dynamics in 2026.

Table of contents

Business Model & Company Overview

Marathon Petroleum Corporation, founded in 1887 and headquartered in Findlay, Ohio, stands as a dominant integrated downstream energy company in the U.S. Its core mission unites refining, marketing, and midstream logistics into a seamless energy ecosystem. The company refines crude oil into transportation fuels, heavy oils, and specialty chemicals, serving wholesale, retail, and international markets through trusted brands like Marathon and ARCO.

Marathon’s revenue engine blends refining margins with stable midstream fees from pipelines and storage. It operates across key U.S. regions—Gulf Coast, Mid-Continent, and West Coast—while its retail network spans 37 states plus Mexico with 7,159 branded outlets. This competitive advantage in refining scale and integrated logistics positions Marathon to shape the energy sector’s future with resilient cash flows and strategic market reach.

Financial Performance & Fundamental Metrics

I analyze Marathon Petroleum Corporation’s income statement, key financial ratios, and dividend payout policy to assess its operational strength and shareholder value.

Income Statement

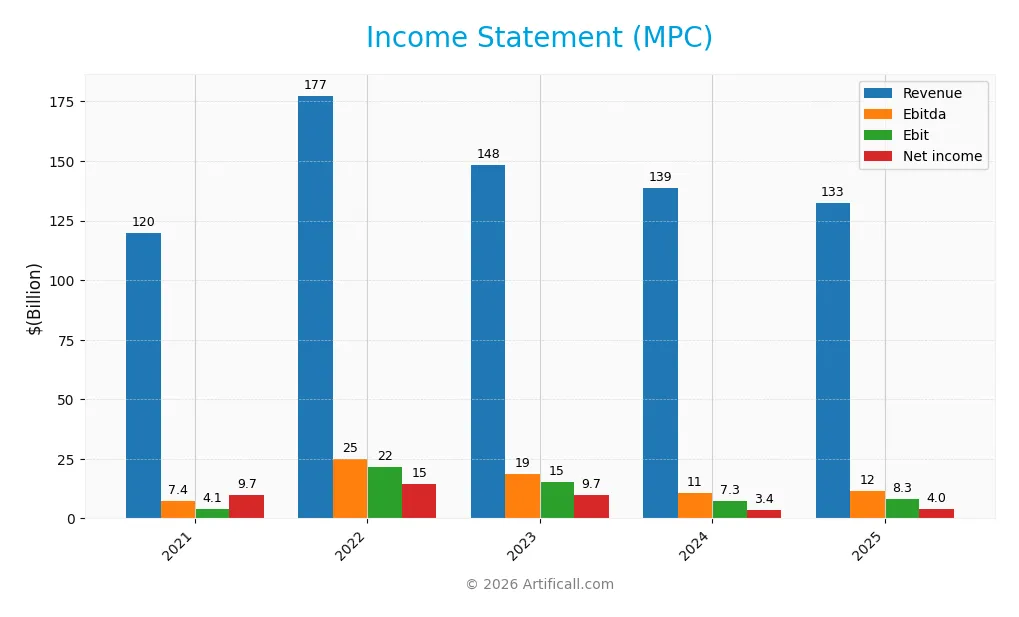

The table below presents Marathon Petroleum Corporation’s key income statement figures for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 120B | 177.5B | 148.4B | 138.9B | 132.5B |

| Cost of Revenue | 113.4B | 154.9B | 131.9B | 129.6B | 122.7B |

| Operating Expenses | 2.3B | 1.1B | 3.9B | 4.0B | 3.3B |

| Gross Profit | 6.6B | 22.6B | 16.5B | 9.3B | 9.8B |

| EBITDA | 7.4B | 24.9B | 18.6B | 10.6B | 11.5B |

| EBIT | 4.1B | 21.7B | 15.3B | 7.3B | 8.3B |

| Interest Expense | 1.3B | 1.2B | 1.3B | 1.3B | 1.3B |

| Net Income | 9.7B | 14.5B | 9.7B | 3.4B | 4.0B |

| EPS | 2.71 | 28.34 | 23.76 | 10.12 | 13.27 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-28 | 2025-02-27 | 2026-02-03 |

Income Statement Evolution

Marathon Petroleum’s revenue declined 4.55% in 2025 after a 10.47% increase over 2021-2025. Gross profit rose 6.01% last year, improving margins slightly despite top-line pressure. Operating expenses fell in line with revenue, enhancing EBIT growth by 14.12%. Net income contracted sharply over the period, reflecting volatile profitability and margin compression.

Is the Income Statement Favorable?

In 2025, fundamentals show mixed signals but lean favorable overall. Gross margin stabilized at 7.43%, while EBIT margin held neutral at 6.26%. Interest expense improved favorably, supporting net margin growth of 23.08%. EPS surged 31.52%, reflecting efficiency gains. However, revenue decline and net income contraction warrant cautious monitoring of earnings quality.

Financial Ratios

The following table presents key financial ratios for Marathon Petroleum Corporation (MPC) over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.12% | 8.18% | 6.52% | 2.48% | 2.99% |

| ROE | 37.16% | 52.38% | 39.67% | 19.41% | 0 |

| ROIC | 5.69% | 23.50% | 14.73% | 7.26% | 0 |

| P/E | 4.17 | 4.11 | 6.24 | 13.81 | 12.26 |

| P/B | 1.55 | 2.15 | 2.47 | 2.68 | 0 |

| Current Ratio | 1.70 | 1.76 | 1.59 | 1.17 | 0 |

| Quick Ratio | 1.25 | 1.32 | 1.13 | 0.71 | 0 |

| D/E | 1.03 | 1.01 | 1.17 | 1.62 | 0 |

| Debt-to-Assets | 31.51% | 31.04% | 33.15% | 36.47% | 0 |

| Interest Coverage | 3.31 | 17.66 | 9.86 | 3.90 | 0 |

| Asset Turnover | 1.41 | 1.97 | 1.73 | 1.76 | 0 |

| Fixed Asset Turnover | 3.09 | 4.81 | 4.08 | 3.82 | 0 |

| Dividend Yield | 3.66% | 2.15% | 2.09% | 2.43% | 2.29% |

Note: Zero values indicate data not reported for 2025.

Evolution of Financial Ratios

Marathon Petroleum’s Return on Equity (ROE) shows a decline to zero in 2025, indicating significant profitability challenges. The Current Ratio also dropped sharply to zero, signaling liquidity issues. Meanwhile, the Debt-to-Equity ratio moved to zero, suggesting a change or gap in reported leverage data. Profitability margins weakened notably in 2025 compared to prior years.

Are the Financial Ratios Favorable?

In 2025, MPC exhibits mixed financial health. Profitability ratios such as net margin and ROE are unfavorable, reflecting weak earnings performance. Liquidity ratios are also unfavorable due to missing or zero values. However, leverage ratios including debt-to-equity and interest coverage appear favorable, indicating manageable debt levels. Market valuation metrics like P/E and dividend yield remain favorable. Overall, the ratios point to a slightly unfavorable financial position.

Shareholder Return Policy

Marathon Petroleum Corporation maintains a dividend payout ratio around 28%, with a 2025 dividend per share of $3.73 and a yield near 2.3%. The policy appears supported by stable earnings and free cash flow coverage, reflecting prudent capital allocation.

The company also executes share buybacks, complementing dividends to return capital. This balanced approach aligns with sustainable long-term shareholder value creation, avoiding excessive distributions while rewarding investors consistently.

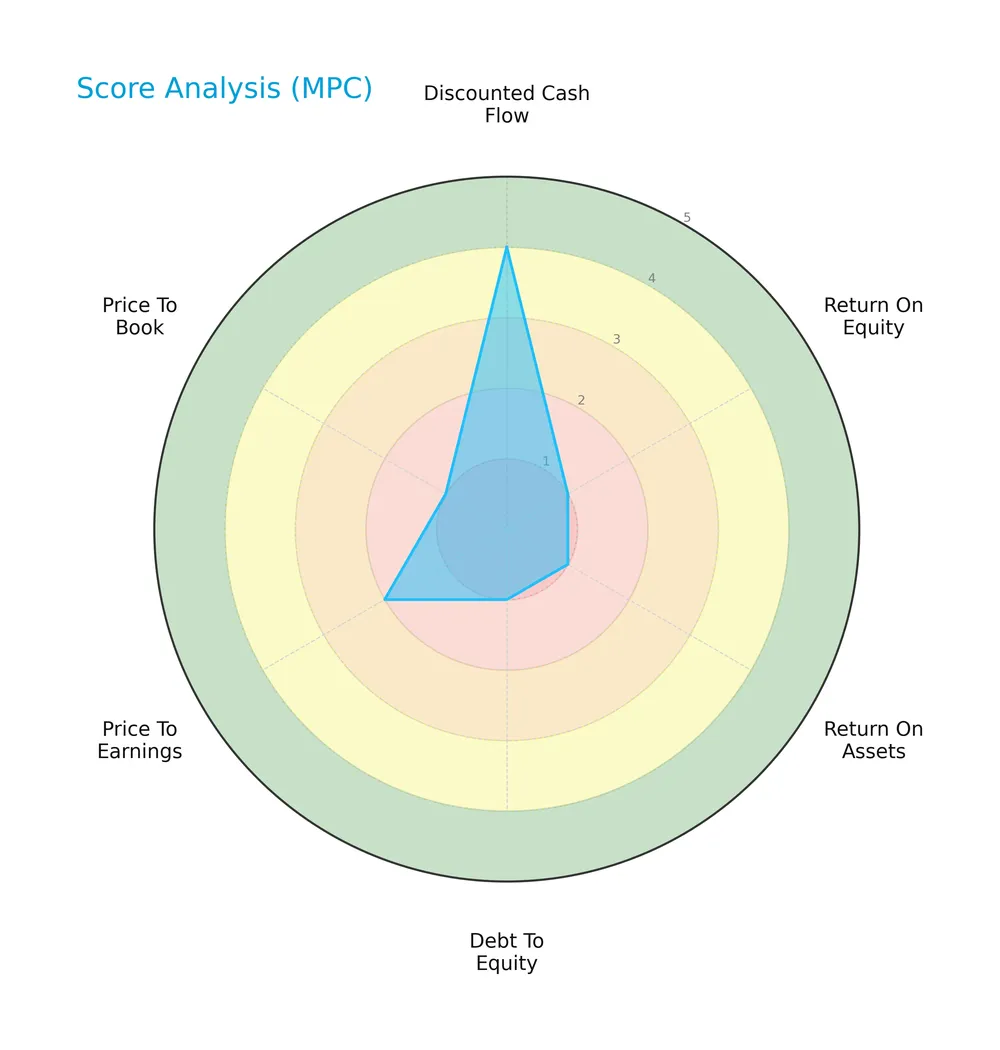

Score analysis

The radar chart below displays Marathon Petroleum Corporation’s key financial scores for a comprehensive overview:

The discounted cash flow score ranks favorably at 4, indicating solid valuation. However, return on equity, assets, debt to equity, and price to book scores are very unfavorable at 1, signaling profitability and leverage concerns. Price to earnings scores moderately at 2.

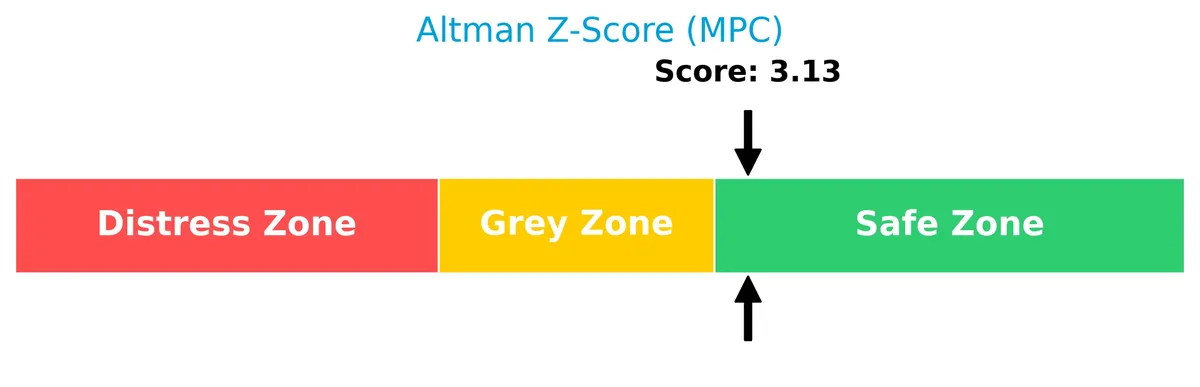

Analysis of the company’s bankruptcy risk

Marathon Petroleum’s Altman Z-Score places it in the safe zone, indicating low bankruptcy risk and financial stability:

Is the company in good financial health?

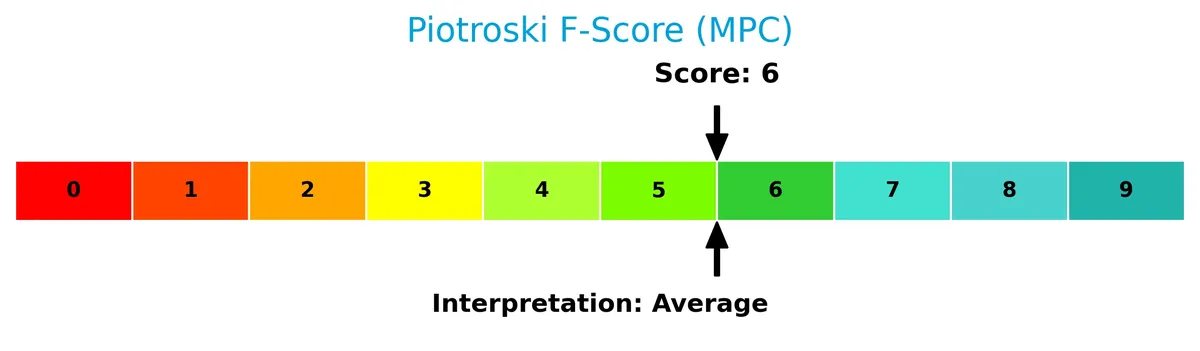

The Piotroski Score diagram highlights the company’s overall financial health assessment:

With a score of 6 categorized as average, the company shows moderate financial strength but does not reach the threshold for strong or very strong health.

Competitive Landscape & Sector Positioning

This section analyzes Marathon Petroleum Corporation’s sector dynamics, focusing on strategic positioning and revenue streams. I will assess whether the company holds a competitive advantage over its main competitors.

Strategic Positioning

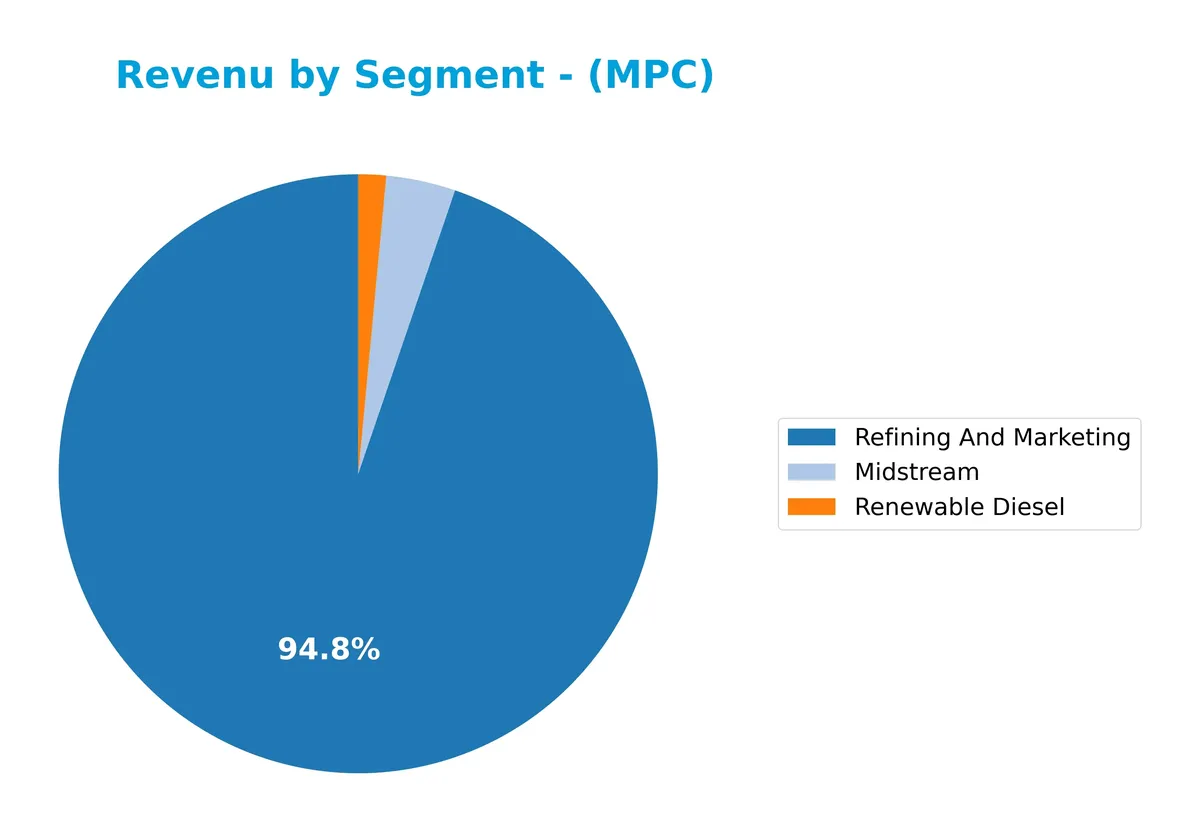

Marathon Petroleum concentrates on refining and marketing, generating $132B in 2024, supplemented by a $5.2B midstream segment and a $2.1B renewable diesel business. Its operations focus primarily on U.S. regions, with limited international exposure through wholesale and branded outlets.

Revenue by Segment

This pie chart illustrates Marathon Petroleum Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of its key business units.

In 2024, Refining and Marketing remains the dominant revenue driver at $132B, though it shows a decline from previous years. Midstream revenue at $5.2B has grown modestly, reinforcing its steady role. Renewable Diesel, a newer segment, contributes $2.1B, signaling strategic diversification. The shift toward renewables is notable, but Refining and Marketing still concentrates most risk and opportunity for MPC.

Key Products & Brands

Marathon Petroleum’s main products and brands span refining, marketing, midstream operations, and renewable diesel:

| Product | Description |

|---|---|

| Refining & Marketing | Refines crude oil into transportation fuels, heavy fuel oil, asphalt, aromatics, propane, and sulfur. Sells through wholesale and branded outlets. |

| Midstream | Transports, stores, and markets crude oil, refined products, natural gas, and natural gas liquids via pipelines and terminals. |

| Renewable Diesel | Produces renewable diesel fuel, reflecting a growing segment within energy transition efforts. |

| ARCO Brand | Operates branded fuel outlets primarily under the ARCO name through long-term supply contracts. |

| Marathon Brand | Independent entrepreneurs operate over 7,100 branded outlets in multiple U.S. states and Mexico. |

Marathon Petroleum’s portfolio focuses on integrated downstream energy operations. Refining & Marketing dominates revenue, supported by Midstream logistics and expanding renewable diesel offerings. The company leverages strong brand presence with ARCO and Marathon outlets.

Main Competitors

The sector features 3 main competitors; the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Phillips 66 | 52.6B |

| Valero Energy Corporation | 51.6B |

| Marathon Petroleum Corporation | 49.6B |

Marathon Petroleum ranks 3rd among its competitors with a market cap about 12% smaller than the leader. It stands above both the average market cap of the top 10 and the sector median. The company trails its closest rival by approximately 12.31%, indicating a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MPC have a competitive advantage?

Marathon Petroleum Corporation does not present clear evidence of a competitive advantage based on available data. Its return on invested capital (ROIC) trend is declining, and no ROIC versus WACC comparison is provided to confirm value creation.

Looking ahead, Marathon’s integrated downstream operations, including refining, marketing, and midstream logistics, position it to capitalize on U.S. energy demand. Expansion through new products and geographic market presence may offer future opportunities despite current margin pressures.

SWOT Analysis

This analysis highlights Marathon Petroleum Corporation’s core competitive position and risks to inform strategic decisions.

Strengths

- Integrated downstream operations

- Strong refining and midstream presence

- Favorable dividend yield and interest coverage

Weaknesses

- Declining ROIC trend

- Net margin and ROE weakness

- Low liquidity ratios (current and quick)

Opportunities

- Expansion in U.S. energy infrastructure

- Growth in renewable fuel blending

- Rising demand for refined transportation fuels

Threats

- Volatile oil prices

- Regulatory and environmental pressures

- Intense industry competition

Marathon’s strengths in integration and stable cash flow support resilience. However, weak returns and liquidity require cautious capital allocation. Growth hinges on strategic adaptation to energy transition and market dynamics.

Stock Price Action Analysis

The following weekly chart illustrates Marathon Petroleum Corporation’s stock price fluctuations over the past 12 months:

Trend Analysis

Over the past 12 months, MPC’s stock price increased by 1.03%, indicating a bullish trend. The price range spanned from a low of 121.07 to a high of 219.13. Despite this, the trend shows deceleration, with volatility measured by a standard deviation of 19.42.

Volume Analysis

Trading volumes have been decreasing overall, with buyers accounting for 53.84% of total volume historically. However, in the recent three months, selling slightly dominates at 58.81%, suggesting weaker buyer interest and cautious market participation.

Target Prices

Analysts set a clear target consensus for Marathon Petroleum Corporation (MPC).

| Target Low | Target High | Consensus |

|---|---|---|

| 174 | 220 | 199.25 |

The target range suggests analysts expect MPC’s stock to appreciate moderately, reflecting confidence in its operational strength.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Marathon Petroleum Corporation’s analyst ratings and consumer feedback to gauge market sentiment and reputation.

Stock Grades

Here are the latest verified grades for Marathon Petroleum Corporation from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-04 |

| Citigroup | Maintain | Neutral | 2026-01-14 |

| Mizuho | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-08 |

The consensus from these firms leans toward a cautious buy, with most maintaining neutral or overweight ratings. No downgrades occurred, indicating stable analyst confidence in MPC’s position.

Consumer Opinions

Marathon Petroleum Corporation elicits a mix of admiration and frustration among its consumers.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable fuel quality that meets expectations | Customer service response times often lag |

| Competitive pricing compared to regional peers | Occasional inconsistencies in station cleanliness |

| Convenient location network across major routes | Limited amenities at some service stations |

Consumers consistently praise Marathon’s fuel quality and pricing, reflecting strong operational execution. However, customer service and facility upkeep remain areas needing improvement to enhance the overall experience.

Risk Analysis

Below is a summary of key risks facing Marathon Petroleum Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Commodity Price Risk | Fluctuations in crude oil prices affect refining margins. | High | High |

| Regulatory Risk | Stricter environmental regulations could increase compliance costs. | Medium | Medium |

| Operational Risk | Refinery outages or supply chain disruptions may reduce production. | Medium | High |

| Financial Risk | Weak profitability metrics and liquidity ratios raise financial strain concerns. | Medium | Medium |

| Market Risk | Beta below 1 indicates lower volatility, but energy sector cyclicality remains. | Medium | Medium |

The most critical risks stem from volatile oil prices and operational disruptions, which directly pressure margins and cash flow. Despite a strong Altman Z-Score placing MPC in the safe zone, its unfavorable net margin (2.99%) and zero ROE reflect profitability challenges. These factors require close monitoring amid evolving energy regulations and market cycles.

Should You Buy Marathon Petroleum Corporation?

Marathon Petroleum appears to be a company with improving profitability but a declining competitive moat, suggesting operational challenges ahead. While its leverage profile is substantial, the Altman Z-score indicates financial stability. Overall, the rating of C reflects a moderate, cautious investment profile.

Strength & Efficiency Pillars

Marathon Petroleum Corporation presents a solid financial health profile with an Altman Z-score of 3.13, placing it firmly in the safe zone against bankruptcy risk. The Piotroski score is a decent 6, indicating average financial strength. Interest coverage stands favorably at 6.5, reflecting manageable debt servicing ability. While profitability metrics such as net margin (2.99%) and ROE (0%) remain weak, the company benefits from a favorable P/E of 12.26 and a dividend yield of 2.29%, supporting shareholder returns amid moderate operational efficiency.

Weaknesses and Drawbacks

MPC’s profitability is under pressure, evidenced by an unfavorable net margin and zero returns on equity and invested capital. The absence of ROIC and WACC data impedes a full value creation assessment but the declining ROIC trend signals eroding operational efficiency. Weak liquidity ratios (current and quick ratios at 0) highlight potential short-term solvency risks. Market dynamics reveal a recent slight seller dominance at 41.19% buyer volume, hinting at near-term selling pressure despite a broadly bullish trend. The average Piotroski score and very unfavorable price-to-book score also suggest valuation and financial structure concerns.

Our Verdict about Marathon Petroleum Corporation

Marathon Petroleum’s long-term fundamental profile appears moderately favorable due to its strong solvency and manageable leverage. However, the recent period’s slight seller dominance and declining operational returns suggest caution. Despite a broadly bullish stock trend, the current market pressure might imply a wait-and-see approach for a more attractive entry point. Investors may find value in MPC’s dividend yield and stable credit metrics but should remain alert to profitability and liquidity headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Marathon Petroleum Corporation $MPC Shares Sold by swisspartners Advisors Ltd – MarketBeat (Feb 05, 2026)

- Marathon Q4 Earnings & Revenues Beat Estimates, Expenses Down Y/Y – Nasdaq (Feb 05, 2026)

- Marathon Petroleum Corporation (NYSE:MPC) Q4 2025 earnings call transcript – MSN (Feb 04, 2026)

- Marathon Petroleum Corp. Reports Fourth-Quarter and Full-Year 2025 Results – Yahoo Finance (Feb 03, 2026)

- WRD Advances Groundwater Education Through Marathon Petroleum Corporation’s Community Investment Program – PR Newswire (Feb 02, 2026)

For more information about Marathon Petroleum Corporation, please visit the official website: marathonpetroleum.com