Home > Analyses > Basic Materials > LyondellBasell Industries N.V.

LyondellBasell Industries shapes the backbone of modern manufacturing with its advanced chemical and polymer solutions. As a global powerhouse in olefins, polyolefins, and refining, it powers industries from packaging to automotive with unmatched innovation and scale. I’ve observed that its technological edge and diversified operations create a resilient moat. The key question now: can LyondellBasell’s fundamentals sustain its valuation amid evolving energy and material cycles?

Table of contents

Business Model & Company Overview

LyondellBasell Industries N.V., founded in 2009 and headquartered in Houston, Texas, stands as a global leader in the specialty chemicals sector. It operates a vast ecosystem spanning olefins, polyolefins, advanced polymers, and refining. Its integrated product lines—from polyethylene variants to polypropylene and intermediate chemicals—form a cohesive platform driving innovation and market penetration across diverse industrial applications.

The company’s revenue engine balances commodity chemicals production with high-margin technology licensing and advanced polymer solutions. It maintains a strategic footprint across the Americas, Europe, and Asia, leveraging regional strengths in manufacturing and refining. LyondellBasell’s competitive advantage lies in its technology licensing and catalyst manufacturing, cementing its role as a pivotal force shaping the future of chemical manufacturing worldwide.

Financial Performance & Fundamental Metrics

I analyze LyondellBasell Industries N.V.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

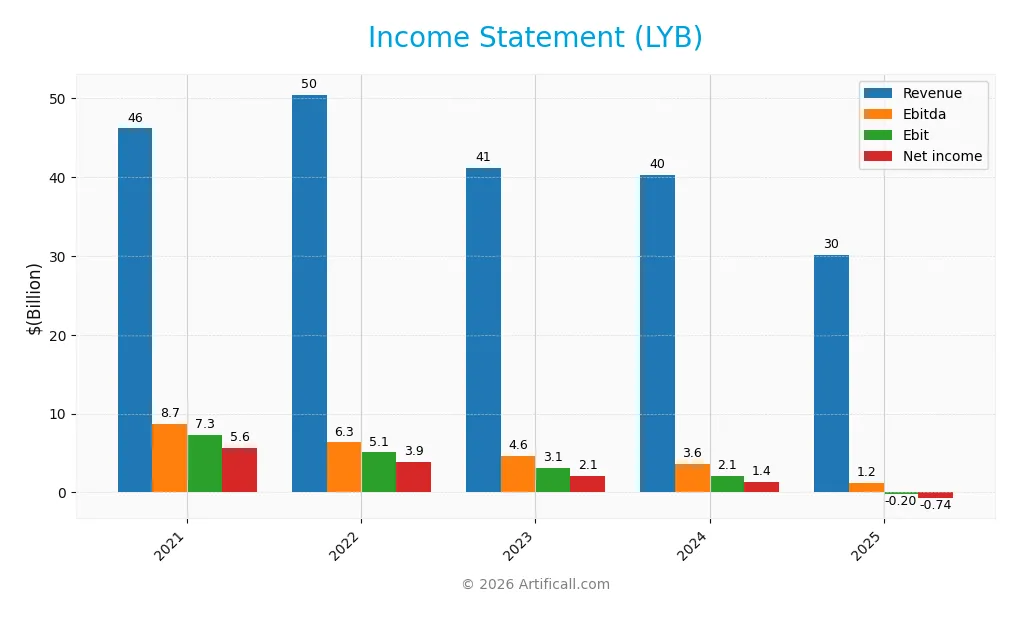

The table below presents LyondellBasell Industries N.V.’s income statement for fiscal years 2021 through 2025, showing key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 46.2B | 50.5B | 41.1B | 40.3B | 30.2B |

| Cost of Revenue | 37.4B | 43.8B | 35.8B | 35.7B | 27.4B |

| Operating Expenses | 2.0B | 1.5B | 2.2B | 2.7B | 3.0B |

| Gross Profit | 8.8B | 6.6B | 5.3B | 4.6B | 2.7B |

| EBITDA | 8.7B | 6.3B | 4.6B | 3.6B | 1.2B |

| EBIT | 7.3B | 5.1B | 3.1B | 2.1B | -0.2B |

| Interest Expense | 519M | 287M | 477M | 481M | 507M |

| Net Income | 5.6B | 3.9B | 2.1B | 1.4B | -0.7B |

| EPS | 16.75 | 11.84 | 6.48 | 4.16 | -2.35 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-27 | 2026-01-30 |

Income Statement Evolution

LyondellBasell’s revenue declined sharply by 25.2% in 2025, continuing a 34.7% drop since 2021. Net income plunged over 113% in the same period, turning negative in 2025. Gross margins held steady at 9.0%, but EBIT and net margins deteriorated significantly, signaling margin compression and operational stress.

Is the Income Statement Favorable?

The 2025 income statement reveals unfavorable fundamentals. EBIT margin slid to -0.68%, and net margin fell to -2.46%. Despite a favorable interest expense ratio of 1.68%, operating income turned negative, and net loss exceeded $740M. This sizable earnings erosion outweighs the stable gross margin, reflecting operational and market challenges.

Financial Ratios

The following table presents key financial ratios for LyondellBasell Industries N.V. from 2021 to 2025, illustrating profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12.15% | 7.69% | 5.14% | 3.37% | -2.46% |

| ROE | 47.31% | 30.77% | 16.35% | 10.91% | 0% |

| ROIC | 18.57% | 13.53% | 7.94% | 5.15% | 0% |

| P/E | 5.49 | 6.99 | 14.62 | 17.75 | -18.77 |

| P/B | 2.60 | 2.15 | 2.39 | 1.94 | 0 |

| Current Ratio | 1.69 | 1.75 | 1.84 | 1.83 | 0 |

| Quick Ratio | 1.01 | 1.04 | 1.17 | 1.13 | 0 |

| D/E | 1.15 | 1.04 | 1.01 | 1.04 | 0 |

| Debt-to-Assets | 37.01% | 36.23% | 35.14% | 36.15% | 0% |

| Interest Coverage | 13.05 | 17.77 | 6.40 | 3.78 | -0.64 |

| Asset Turnover | 1.26 | 1.39 | 1.11 | 1.13 | 0 |

| Fixed Asset Turnover | 2.80 | 2.95 | 2.41 | 2.44 | 0 |

| Dividend Yield | 4.82% | 11.96% | 5.21% | 7.13% | 12.59% |

Evolution of Financial Ratios

From 2021 to 2025, LyondellBasell’s profitability declined sharply, with net profit margin falling from 12.15% in 2021 to -2.46% in 2025. Return on equity dropped to zero by 2025, indicating no shareholder returns. Liquidity ratios, including the current ratio, deteriorated in 2025, reflecting weakened short-term financial stability. Debt-to-equity figures remained stable but were not reported in 2025.

Are the Financial Ratios Favorable?

In 2025, LyondellBasell’s profitability and liquidity ratios were generally unfavorable, highlighted by negative net margin and poor interest coverage at -0.4. Market valuation metrics like price-to-earnings ratio showed favorable signs, despite negative earnings. Leverage ratios were favorable due to low reported debt. Overall, 57% of ratios were unfavorable, leaving the financial profile weak and largely unfavorable.

Shareholder Return Policy

LyondellBasell maintains a consistent dividend policy, with a 2025 dividend per share at $5.45 despite a negative net income and a dividend payout ratio of -236%. The dividend yield soared to 12.6%, indicating a high distribution relative to the share price, while free cash flow coverage appears insufficient.

The company also engages in share buybacks, though specific figures are not provided. This aggressive dividend payout amid losses raises sustainability concerns. A more cautious capital allocation may better support long-term shareholder value given the current profitability challenges.

Score analysis

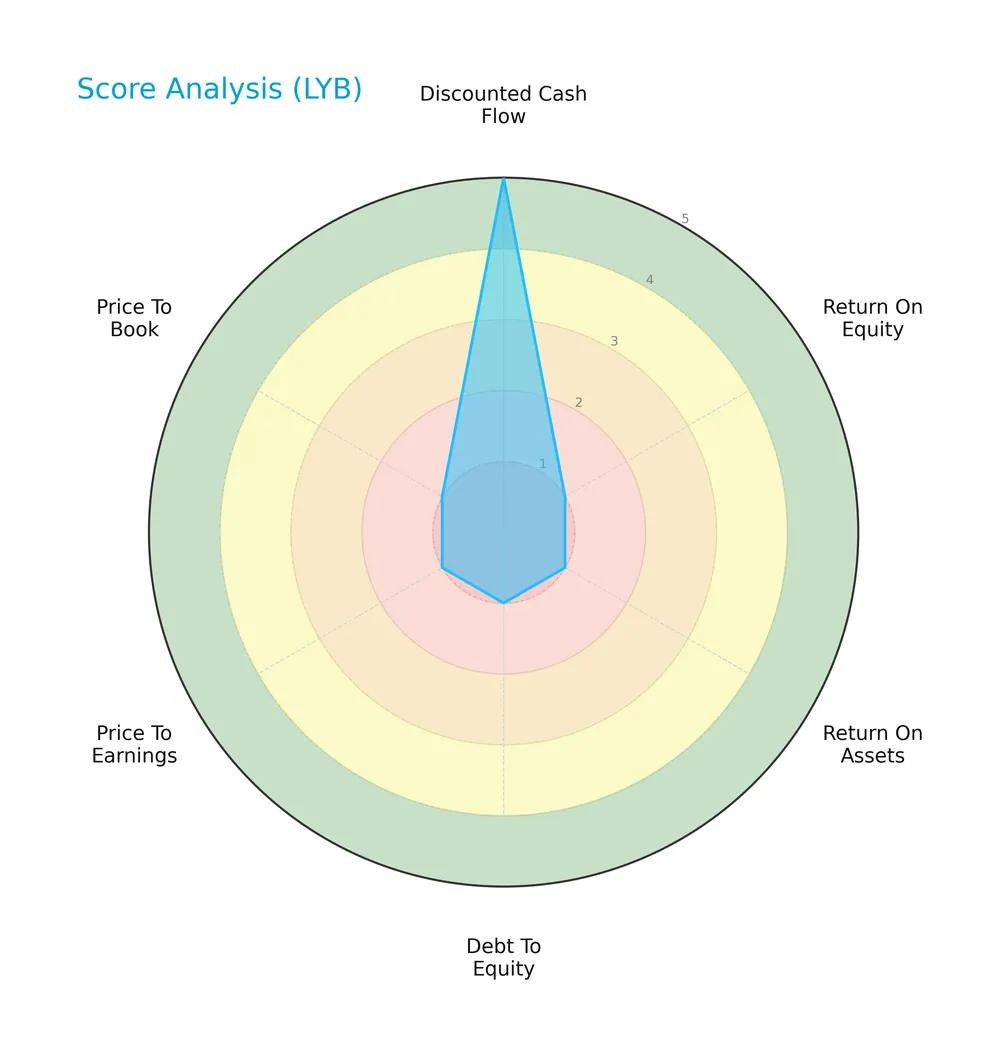

This radar chart presents a comprehensive view of the company’s key financial scores across valuation and profitability metrics:

The discounted cash flow score stands out as very favorable at 5. However, return on equity, return on assets, debt to equity, price to earnings, and price to book scores all rank very unfavorable at 1, indicating weak profitability, high leverage, and expensive valuation relative to benchmarks.

Is the company in good financial health?

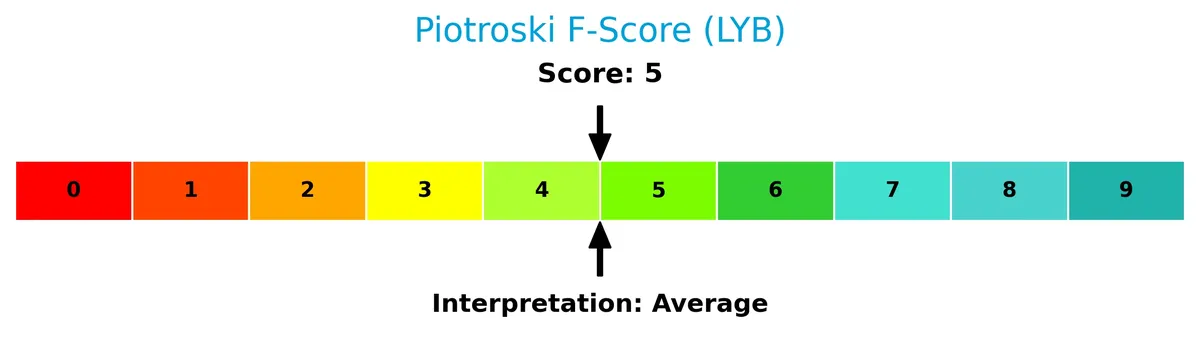

The Piotroski Score diagram illustrates the company’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 5, the company shows average financial health. This middling score suggests moderate profitability and efficiency, but it lacks the robustness found in stronger value investments.

Competitive Landscape & Sector Positioning

This sector analysis examines LyondellBasell Industries N.V.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage in the specialty chemicals industry.

Strategic Positioning

LyondellBasell operates a diversified product portfolio across seven chemical segments, including polyethylene, polypropylene, and refined products, generating multi-billion-dollar revenues each. Geographically, it spans the US, Europe, and Asia, with the US contributing nearly $19.5B in 2024, reflecting balanced global exposure.

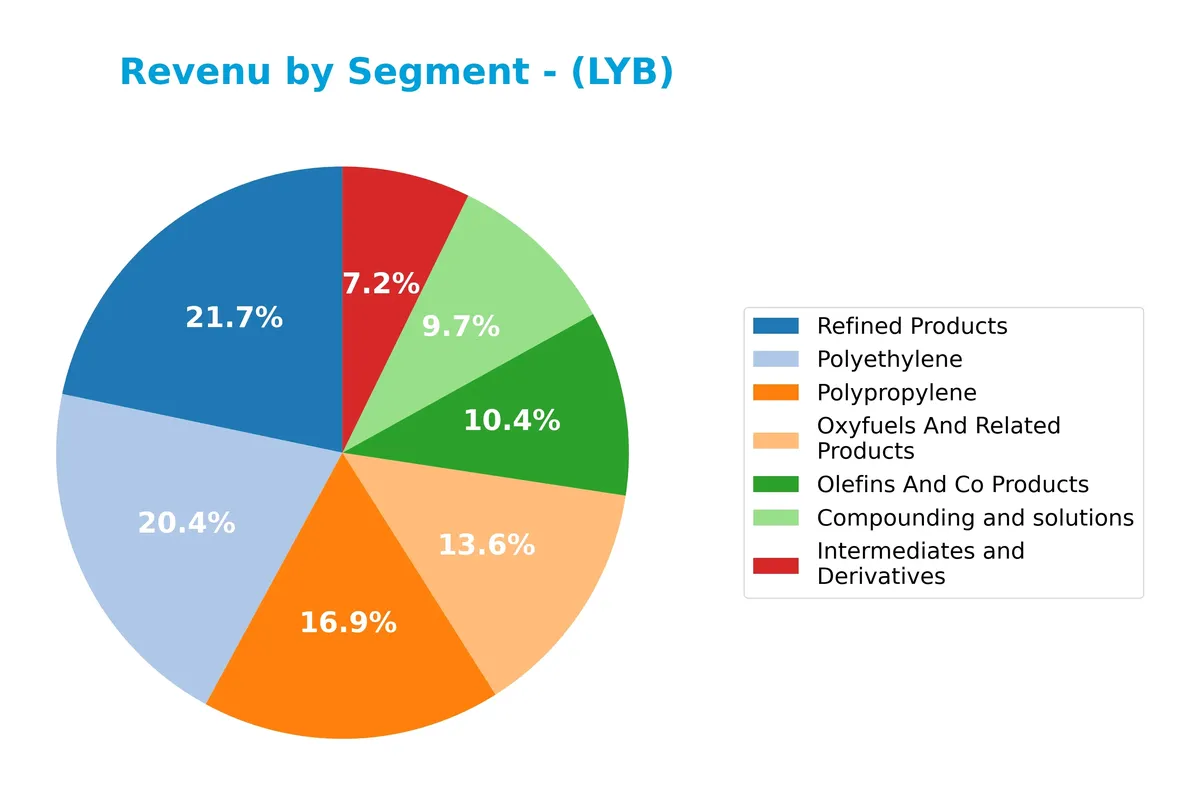

Revenue by Segment

This pie chart breaks down LyondellBasell Industries’ revenue by product segment for fiscal year 2024, illustrating the relative size of each business unit’s contribution.

In 2024, Refined Products lead revenue at 8.1B, followed closely by Polyethylene at 7.6B and Polypropylene at 6.3B. Oxyfuels and Related Products contribute a substantial 5.1B. Notably, Compounding and Solutions and Intermediates and Derivatives trail with 3.6B and 2.7B, respectively. The trend indicates a concentration in refined and polymer segments, with a slight slowdown in Oxyfuels compared to prior years, suggesting evolving market demand and margin pressures.

Key Products & Brands

The following table summarizes LyondellBasell’s principal products and brands by category and description:

| Product | Description |

|---|---|

| Polyethylene | High, low, and linear low density polyethylene products used in packaging and consumer goods. |

| Polypropylene | Homopolymers and copolymers serving automotive, packaging, and industrial applications. |

| Olefins and Co-Products | Basic chemical building blocks including ethylene and propylene, plus co-products. |

| Intermediates and Derivatives | Chemicals such as styrene monomers, acetyls, ethylene glycols, and ethylene oxides. |

| Compounding and Solutions | Polypropylene compounds, engineered plastics, masterbatches, colors, and advanced polymer solutions. |

| Oxyfuels and Related Products | Fuels and chemical intermediates derived from oxygenated hydrocarbons. |

| Refined Products | Refined crude oil products including gasoline and distillates. |

| Technology | Chemical and polyolefin process technologies developed and licensed by the company. |

LyondellBasell operates a diversified product portfolio spanning core chemicals, polymers, and refining. Its polyethylene and polypropylene product lines generate substantial revenue, reflecting strong market demand. The company’s technological capabilities underpin its competitive position in specialty chemicals.

Main Competitors

There are 9 competitors in total, with the table below listing the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.4B |

| Air Products and Chemicals, Inc. | 55.8B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

LyondellBasell ranks 9th among its competitors and holds roughly 8.65% of the market cap of sector leader Linde plc. It stands below both the average market cap of the top 10 competitors (56B) and the sector median (23.4B). The company is closely trailing Albemarle Corporation, with a narrow market cap gap of about 2.32%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does LYB have a competitive advantage?

LyondellBasell does not currently demonstrate a clear competitive advantage, with declining returns on invested capital and unfavorable income margin trends. Its operating and net margins remain negative, signaling challenges in value creation.

The company’s broad geographic footprint and diversified chemical product lines offer potential avenues for growth. Expansion into advanced polymers and refining technology licensing could present future market opportunities.

SWOT Analysis

This SWOT analysis distills LyondellBasell’s key factors to clarify its strategic position in 2026.

Strengths

- diversified global footprint

- strong presence in olefins and polyolefins

- stable dividend yield of 12.6%

Weaknesses

- negative net margin of -2.46%

- declining revenue and earnings over 5 years

- weak liquidity ratios, signaling financial stress

Opportunities

- expanding demand in emerging markets

- potential technology licensing growth

- cost optimization and refinery integration

Threats

- volatile commodity prices

- regulatory pressures on chemicals

- competition from low-cost producers

LyondellBasell faces profitability and growth challenges but benefits from scale and market reach. Strategic focus must balance cost control and innovation to navigate sector volatility.

Stock Price Action Analysis

The weekly chart below illustrates LyondellBasell Industries N.V. (LYB) stock price movement over the past 12 months:

Trend Analysis

Over the past 12 months, LYB’s stock price fell sharply by 46.07%, confirming a bearish trend with accelerating decline. The price ranged between a high of 104.78 and a low of 43.02, showing high volatility with a standard deviation of 20.15. Recently, from November 2025 to February 2026, the stock rebounded 20.27%, reflecting a short-term bullish correction.

Volume Analysis

Trading volume in the last three months increased, with buyers slightly dominating at 59.92%. This rising volume paired with buyer dominance suggests improving investor interest and growing market participation, signaling a cautiously optimistic sentiment despite the longer-term downtrend.

Target Prices

Analysts set a consensus target price that reflects moderate upside potential for LyondellBasell Industries N.V.

| Target Low | Target High | Consensus |

|---|---|---|

| 36 | 53 | 46.88 |

The target range suggests cautious optimism, with the consensus price implying a steady appreciation from current levels. Investors should weigh this against sector volatility and commodity price risks.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst grades and consumer feedback on LyondellBasell Industries N.V. (LYB).

Stock Grades

Here are the recent verified grades for LyondellBasell Industries N.V. from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-03 |

| RBC Capital | Maintain | Sector Perform | 2026-02-03 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-02 |

| RBC Capital | Maintain | Sector Perform | 2026-01-16 |

| Citigroup | Maintain | Neutral | 2026-01-15 |

| UBS | Maintain | Sell | 2025-12-23 |

| Wells Fargo | Downgrade | Equal Weight | 2025-12-19 |

| Citigroup | Maintain | Neutral | 2025-12-18 |

| BMO Capital | Downgrade | Underperform | 2025-12-15 |

| Mizuho | Maintain | Neutral | 2025-12-11 |

Grades have mostly stabilized around neutral and sector perform, with a few downgrades in late 2025 signaling cautious analyst sentiment. The consensus remains a hold, reflecting tempered expectations.

Consumer Opinions

LyondellBasell Industries (LYB) elicits mixed reactions from its customer base, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| High product quality and reliable supply chains. | Occasional delays in order fulfillment. |

| Strong commitment to sustainability initiatives. | Customer service response times can lag. |

| Competitive pricing compared to industry peers. | Limited product customization options. |

Overall, consumers appreciate LYB’s product quality and sustainability efforts. However, logistical delays and customer service inefficiencies recur as notable pain points.

Risk Analysis

Below is a summary table outlining key risks facing LyondellBasell Industries N.V. as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability Risk | Negative net margin (-2.46%) signals ongoing earnings pressure. | High | High |

| Liquidity Risk | Poor current and quick ratios indicate weak short-term liquidity. | Moderate | High |

| Leverage Risk | Favorable debt metrics may mask potential refinancing risks or interest costs. | Low | Moderate |

| Market Volatility | Beta of 0.707 suggests lower volatility, but stock price dropped 5.6% recently. | Moderate | Moderate |

| Dividend Risk | High dividend yield (12.59%) may not be sustainable given earnings weakness. | Moderate | High |

| Operational Risk | Exposure to global chemical markets with cyclical demand and raw material costs. | High | High |

| Financial Stability | Average Piotroski score (5) and unavailable Altman Z-Score increase uncertainty. | Moderate | Moderate |

Profitability and operational risks dominate due to negative margins and exposure to commodity cycles. The recent 5.6% stock drop reflects investor concerns amid weak earnings. Liquidity remains a red flag, increasing short-term financial vulnerability. Dividend sustainability also demands caution given profit pressures.

Should You Buy LyondellBasell Industries N.V.?

LyondellBasell appears to present a profile of declining operational efficiency and weakening profitability, with a deteriorating return on invested capital. While its leverage profile seems substantial, the overall rating of C suggests moderate value creation amid notable financial challenges.

Strength & Efficiency Pillars

LyondellBasell Industries N.V. shows limited strength in profitability and value creation. The company’s ROE and ROIC stand at 0%, reflecting operational challenges. Altman Z-Score data is unavailable, but a Piotroski Score of 5 indicates average financial health. Despite a 12.59% dividend yield, key efficiency metrics like asset turnover remain unfavorable. No WACC data prevents confirming value creation status, but current indicators suggest weak capital allocation and operational inefficiency.

Weaknesses and Drawbacks

The company faces significant headwinds. Net margin at -2.46% and EBIT margin at -0.68% reveal deteriorating profitability. Revenue and net income have declined sharply over recent years (-25.18% and -113.24% respectively). The stock trades at a negative P/E of -18.77, reflecting losses, while liquidity metrics like current and quick ratios are unfavorable. Interest coverage is negative (-0.4), increasing financial risk. Despite slight buyer dominance recently, the overall bearish trend and 46.07% price drop underscore market pressure.

Our Verdict about LyondellBasell Industries N.V.

LyondellBasell’s long-term fundamental profile appears unfavorable due to persistent profitability and operational challenges. However, recent market activity shows a slightly buyer-dominant trend with a 20.27% price rebound since late 2025. Despite this, the prevailing bearish momentum and weak fundamentals suggest a cautious stance. Investors might consider waiting for clearer signs of sustainable recovery before adding exposure to this stock.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- LyondellBasell Industries N.V. (NYSE:LYB) Held Back By Insufficient Growth Even After Shares Climb 25% – simplywall.st (Feb 05, 2026)

- LyondellBasell Industries N.V. (LYB): A Bull Case Theory – Yahoo Finance (Feb 04, 2026)

- Dow Vs. LyondellBasell: Which Is Best Positioned For An Industry Rebound? (NYSE:LYB) – Seeking Alpha (Feb 05, 2026)

- LyondellBasell Industries N.V. (LYB): A Bull Case Theory – Insider Monkey (Feb 04, 2026)

- LyondellBasell Industries NV (LYB) Q4 2025 Earnings Call Highlig – GuruFocus (Jan 30, 2026)

For more information about LyondellBasell Industries N.V., please visit the official website: lyondellbasell.com