Home > Analyses > Consumer Cyclical > Lululemon Athletica Inc.

Lululemon Athletica Inc. has redefined athletic apparel by blending functionality with style, shaping how millions embrace fitness and wellness daily. Renowned for its premium yoga-inspired clothing and innovative direct-to-consumer platform, Lululemon leads the retail apparel industry with a strong global presence and a loyal customer base. As the brand expands its product range and digital engagement, investors must consider whether its solid fundamentals support continued growth and justify its current market valuation.

Table of contents

Business Model & Company Overview

Lululemon Athletica Inc., founded in 1998 and headquartered in Vancouver, Canada, commands a dominant position in the athletic apparel retail sector. Its cohesive ecosystem blends performance apparel and accessories tailored for yoga, running, and training, creating a lifestyle brand that resonates globally. With 574 company-operated stores spanning North America, Asia, Europe, and Oceania, Lululemon integrates physical retail with digital engagement to support a healthy, active lifestyle.

The company’s revenue engine balances physical retail sales with a growing direct-to-consumer segment, including mobile apps and e-commerce. This dual focus leverages hardware-like apparel products alongside software-driven interactive workouts and fitness accessories. Lululemon’s strategic presence across key global markets—Americas, Europe, and Asia—fortifies its competitive advantage and underpins its expanding economic moat, shaping the future of athletic wear and lifestyle retail.

Financial Performance & Fundamental Metrics

In this section, I analyze Lululemon Athletica Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

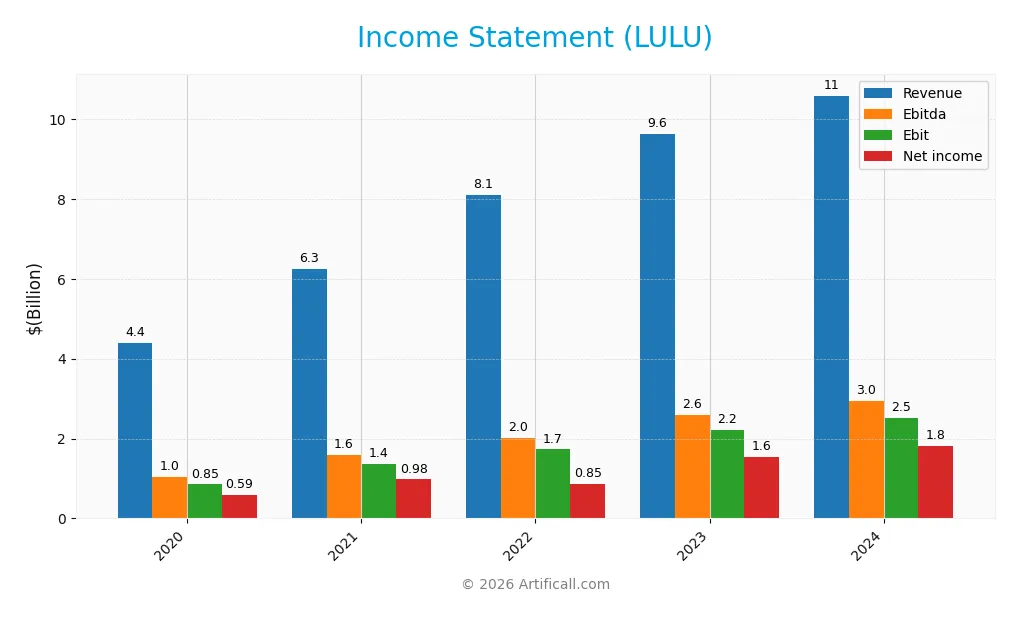

The table below summarizes Lululemon Athletica Inc.’s key income statement figures for the fiscal years 2020 through 2024, presented in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.40B | 6.26B | 8.11B | 9.62B | 10.59B |

| Cost of Revenue | 1.94B | 2.65B | 3.62B | 4.01B | 4.32B |

| Operating Expenses | 1.64B | 2.28B | 3.16B | 3.48B | 3.77B |

| Gross Profit | 2.46B | 3.61B | 4.49B | 5.61B | 6.27B |

| EBITDA | 1.04B | 1.60B | 2.02B | 2.59B | 2.95B |

| EBIT | 850M | 1.37B | 1.73B | 2.21B | 2.51B |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 589M | 975M | 855M | 1.55B | 1.81B |

| EPS | 4.52 | 7.52 | 6.70 | 12.23 | 14.67 |

| Filing Date | 2021-03-30 | 2022-03-29 | 2023-03-28 | 2024-03-21 | 2025-03-27 |

Income Statement Evolution

From 2020 to 2024, Lululemon Athletica Inc. exhibited strong revenue growth of 140.54%, reaching $10.6B in 2024. Net income more than doubled, with a 208.13% increase, totaling $1.81B in the latest fiscal year. Margins improved across the board, with gross margin at 59.22% and net margin at 17.14%, reflecting enhanced profitability and efficient cost management.

Is the Income Statement Favorable?

The 2024 income statement reveals favorable fundamentals, supported by a 10.07% revenue rise and a 13.52% increase in EBIT. Operating expenses grew proportionally to revenue, maintaining margin stability. Net margin expanded by 6.35%, while EPS surged 20%, indicating strong earnings quality. The absence of interest expense further strengthens the financial profile, confirming a solid and favorable income statement.

Financial Ratios

The following table presents key financial ratios for Lululemon Athletica Inc. over the fiscal years 2020 to 2024, offering a concise view of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13% | 16% | 11% | 16% | 17% |

| ROE | 23% | 36% | 27% | 37% | 42% |

| ROIC | 17% | 26% | 20% | 27% | 29% |

| P/E | 74 | 44 | 45 | 39 | 28 |

| P/B | 17 | 16 | 12 | 14 | 12 |

| Current Ratio | 2.41 | 1.86 | 2.12 | 2.49 | 2.16 |

| Quick Ratio | 1.67 | 1.17 | 1.15 | 1.68 | 1.38 |

| D/E | 0.31 | 0.32 | 0.34 | 0.33 | 0.36 |

| Debt-to-Assets | 19% | 18% | 19% | 20% | 21% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 1.05 | 1.27 | 1.45 | 1.36 | 1.39 |

| Fixed Asset Turnover | 2.97 | 3.61 | 3.62 | 3.42 | 3.31 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Between 2020 and 2024, Lululemon Athletica Inc.’s return on equity (ROE) improved significantly, reaching 42.0% in 2024, indicating enhanced profitability. The current ratio demonstrated relative stability, remaining above 2.0, which suggests consistent liquidity. Meanwhile, the debt-to-equity ratio showed a modest increase to 0.36 in 2024, reflecting a stable but slightly higher leverage position.

Are the Financial Ratios Favorable?

In 2024, Lululemon’s profitability ratios, including a net margin of 17.14% and ROE of 41.97%, are favorable, supported by a strong return on invested capital of 29.23%. Liquidity ratios such as the current ratio at 2.16 and quick ratio at 1.38 also appear favorable. Leverage metrics, including a debt-to-equity ratio of 0.36 and a debt-to-assets ratio of 20.73%, indicate prudent debt management. However, market valuation ratios like price-to-earnings at 27.98 and price-to-book at 11.74 are considered unfavorable, while the dividend yield remains at zero. Overall, approximately 71% of key ratios are favorable, suggesting a generally positive financial profile.

Shareholder Return Policy

Lululemon Athletica Inc. does not pay dividends, reflecting a reinvestment strategy likely aimed at supporting growth and operational expansion. The company maintains strong free cash flow, with no dividend payout ratio and zero dividend yield, while engaging in share buybacks to return value to shareholders.

This approach aligns with a focus on long-term value creation by prioritizing capital allocation toward business development rather than immediate income distribution. The absence of dividends combined with buybacks suggests a balanced capital deployment strategy supporting sustainable shareholder returns over time.

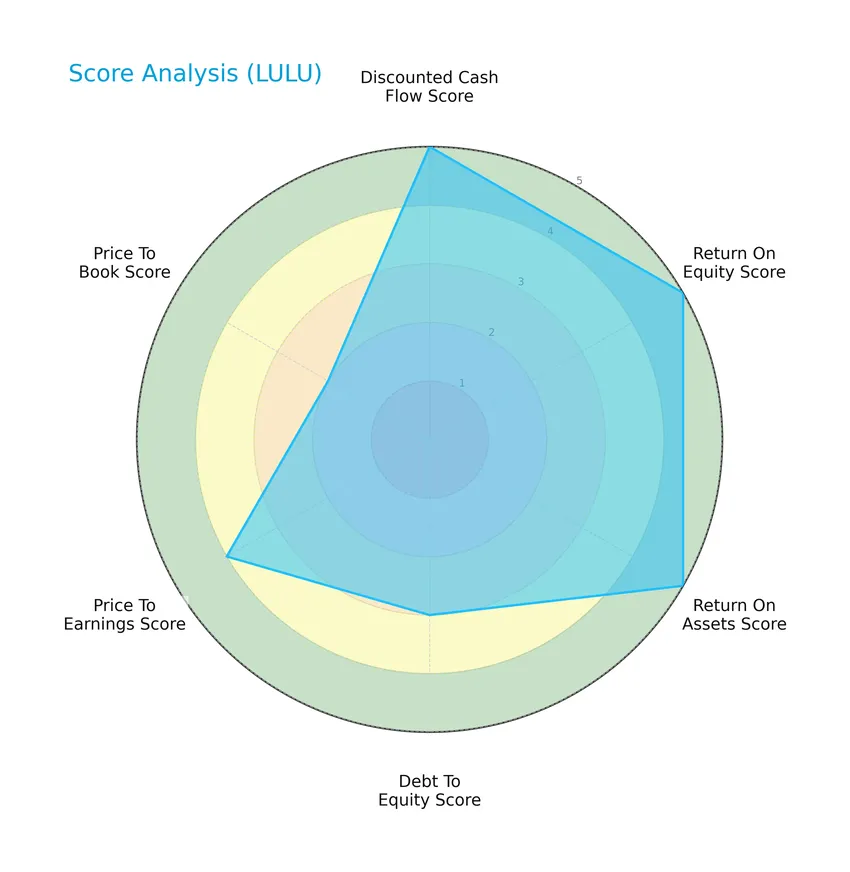

Score analysis

The following radar chart presents a comprehensive view of Lululemon Athletica Inc.’s key financial scores assessing valuation and profitability metrics:

Lululemon scores very favorably on discounted cash flow, return on equity, and return on assets, all rated at 5. The debt-to-equity and price-to-book scores show moderate status at 3 and 2 respectively, while the price-to-earnings score remains favorable at 4.

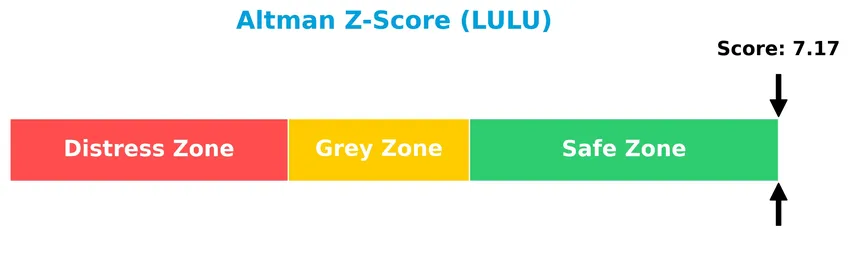

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Lululemon in the safe zone, indicating a very low risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

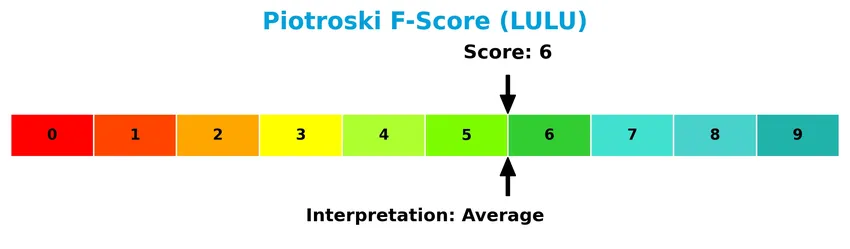

The Piotroski Score diagram below illustrates Lululemon’s financial strength based on nine accounting criteria:

With a Piotroski Score of 6, Lululemon is considered to have average financial health, suggesting a moderate level of strength in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section presents an analysis of Lululemon Athletica Inc.’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Lululemon holds a competitive advantage over its industry peers based on these factors.

Strategic Positioning

Lululemon Athletica Inc. maintains a diversified product portfolio focused on athletic apparel for women ($6.7B in 2024) and men ($2.6B), supplemented by other segments ($1.3B). Geographically, it operates extensively in North America, especially the U.S. ($6.5B) and Canada ($1.4B), with growing exposure to China ($1.5B) and other international markets.

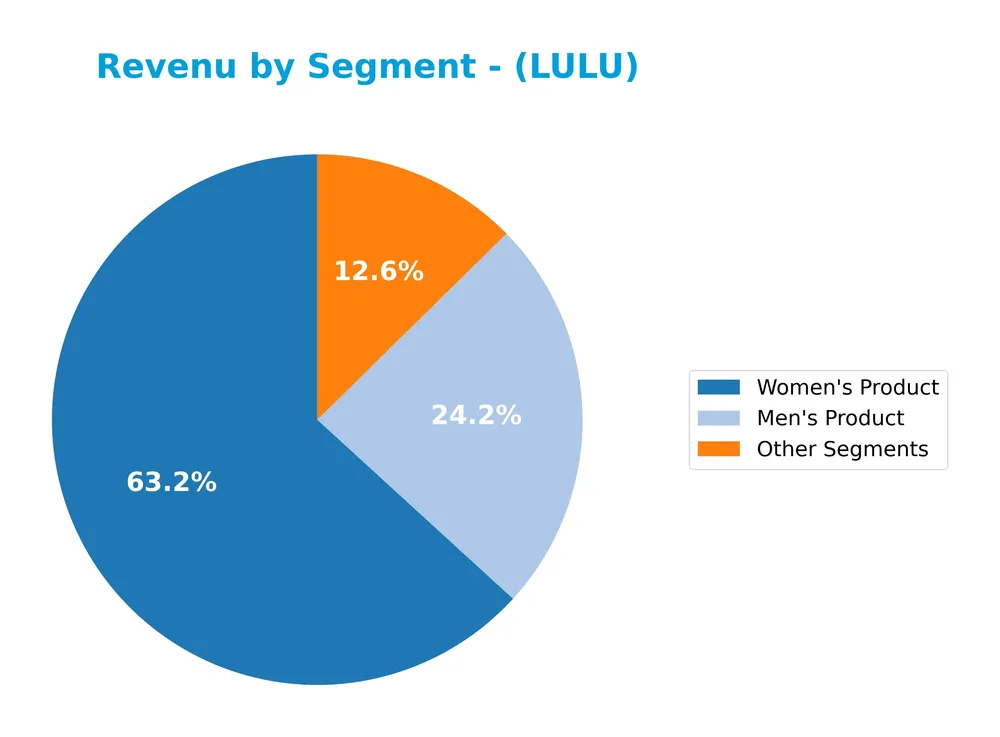

Revenue by Segment

This pie chart illustrates Lululemon Athletica Inc.’s revenue distribution by product segments for the fiscal year 2024.

In 2024, Women’s Product remains the dominant revenue driver with $6.7B, showing steady growth compared to previous years. Men’s Product also continues to expand, reaching $2.6B, reflecting increased market penetration. Other Segments contribute $1.3B, maintaining a stable share. The data highlights Lululemon’s strong focus on gender-specific apparel, with the Women’s segment showing the highest concentration and growth momentum.

Key Products & Brands

The table below summarizes Lululemon Athletica Inc.’s main product categories and their descriptions:

| Product | Description |

|---|---|

| Women’s Product | Athletic apparel including pants, shorts, tops, and jackets designed for yoga, running, training, and other activities. |

| Men’s Product | Athletic apparel similar to women’s line, targeting men’s healthy lifestyle and athletic pursuits. |

| Other Segments | Fitness-related accessories, footwear, and additional product lines beyond core apparel categories. |

Lululemon’s product portfolio primarily focuses on athletic apparel for women and men, complemented by fitness accessories and footwear, supporting a broad range of active lifestyles and sports activities.

Main Competitors

There are 3 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The TJX Companies, Inc. | 172B |

| Ross Stores, Inc. | 59.4B |

| Lululemon Athletica Inc. | 23.7B |

Lululemon Athletica Inc. ranks 3rd among its competitors, with a market cap approximately 12.5% that of the sector leader, The TJX Companies. The company’s market capitalization is below both the average market cap of the top 10 competitors (85B) and the sector median (59.4B). It stands +177.25% below Ross Stores, its nearest competitor in size.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Lululemon have a competitive advantage?

Lululemon Athletica Inc. presents a competitive advantage, supported by a very favorable economic moat with a ROIC exceeding WACC by over 20%, indicating efficient capital use and value creation. The company shows a growing ROIC trend of nearly 72% over 2020-2024, reflecting increasing profitability and strong management execution.

Looking ahead, Lululemon’s expansion into international markets including China and continued growth in direct-to-consumer sales offer significant opportunities. Its diversified revenue streams across North America, Asia, and other regions position it well to capitalize on new product launches and evolving consumer trends in athletic apparel.

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting Lululemon Athletica Inc. to guide investment decisions.

Strengths

- Strong brand with loyal customer base

- Robust revenue growth of 10% in 2024

- High profitability with 17.14% net margin

Weaknesses

- High valuation multiples (PE 27.98, PB 11.74)

- No dividend yield for income investors

- Dependence on North American markets

Opportunities

- Expanding international footprint, especially in China

- Growth in direct-to-consumer e-commerce

- Rising global demand for athleisure and fitness apparel

Threats

- Intense competition in apparel retail

- Economic downturns impacting discretionary spending

- Supply chain disruptions and raw material cost inflation

Lululemon demonstrates solid strengths in brand equity and financial performance, supported by favorable growth trends and operational efficiency. However, its premium valuation and geographic concentration warrant caution. The company’s strategy should focus on leveraging international expansion and digital sales while managing competitive and economic risks prudently.

Stock Price Action Analysis

The weekly stock chart for Lululemon Athletica Inc. (LULU) over the past 12 months shows significant price fluctuations and recent recovery momentum:

Trend Analysis

Over the past 12 months, LULU’s stock price declined by 58.33%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 464.94 and a low of 159.87, with notable volatility reflected by a standard deviation of 77.06. However, since November 2025, the trend reversed with a 15.01% increase, showing recent bullish momentum.

Volume Analysis

Trading volume for LULU has been increasing overall, with sellers accounting for 55.4% of total volume historically. In the recent period from November 2025 to January 2026, buyer volume dominated at 61.63%, indicating a buyer-driven market. This shift suggests improving investor sentiment and higher market participation.

Target Prices

The consensus target prices for Lululemon Athletica Inc. indicate a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 303 | 146 | 201.3 |

Analysts expect the stock price to range broadly, with a consensus near 201, reflecting confidence in Lululemon’s growth potential balanced by some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide a balanced view of Lululemon Athletica Inc.

Stock Grades

Here is a detailed overview of recent stock grades for Lululemon Athletica Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-20 |

| Telsey Advisory Group | Maintain | Market Perform | 2026-01-13 |

| Stifel | Maintain | Hold | 2025-12-30 |

| Jefferies | Maintain | Hold | 2025-12-18 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Neutral | 2025-12-12 |

| Jefferies | Upgrade | Hold | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-12-12 |

| Stifel | Maintain | Hold | 2025-12-12 |

The consensus among these reputable analysts is largely neutral to hold, with a minority maintaining a buy stance. Notably, Jefferies upgraded their rating from underperform to hold in December 2025, reflecting a cautious but stable outlook.

Consumer Opinions

Lululemon Athletica Inc. enjoys a largely positive reputation among consumers, reflecting strong brand loyalty and satisfaction with product quality.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great quality and durability of activewear.” | “Pricing is quite high compared to competitors.” |

| “Excellent customer service and easy returns.” | “Limited size options for plus-size customers.” |

| “Stylish designs that are comfortable for workouts.” | “Occasional issues with stock availability.” |

| “Materials feel premium and last long.” | “Some products lose shape after multiple washes.” |

Overall, consumers appreciate Lululemon’s premium quality and stylish designs, but price sensitivity and size inclusivity remain common concerns. Stock consistency also occasionally impacts the shopping experience.

Risk Analysis

Below is a table summarizing key risk categories, their descriptions, and the assessed probability and impact for Lululemon Athletica Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in consumer demand and apparel retail trends could affect revenue stability. | Medium | High |

| Valuation Risk | Elevated price-to-book (11.74) and price-to-earnings (27.98) ratios suggest overvaluation. | High | Medium |

| Competitive Risk | Intense competition in athletic apparel may pressure market share and margins. | Medium | Medium |

| Supply Chain | Disruptions could impact inventory availability and cost structure. | Low | Medium |

| Geographic Exposure | Operations in multiple countries expose Lululemon to geopolitical and currency risks. | Medium | Medium |

Lululemon’s most significant risks lie in valuation and market volatility. Despite strong profitability and solid financial health, the stock trades at high multiples, increasing correction risk. Continued competition and geopolitical factors also require monitoring.

Should You Buy Lululemon Athletica Inc.?

Lululemon Athletica Inc. appears to be characterized by robust profitability with a durable competitive moat, supported by a very favorable rating of A+. Despite moderate leverage metrics, its strong value creation and operational efficiency suggest a financially sound profile.

Strength & Efficiency Pillars

Lululemon Athletica Inc. exhibits robust profitability with a net margin of 17.14% and a strong return on equity of 41.97%, underscoring efficient capital use. Its return on invested capital (ROIC) stands at 29.23%, substantially exceeding the weighted average cost of capital (WACC) at 8.26%, confirming the company as a clear value creator. Financial health is solid, supported by an Altman Z-Score of 7.17, placing it well within the safe zone, and a Piotroski Score of 6, indicating average but stable financial strength. These metrics collectively highlight Lululemon’s durable competitive advantage and operational efficiency.

Weaknesses and Drawbacks

Despite its strengths, Lululemon faces valuation concerns with a price-to-earnings (P/E) ratio of 27.98 and a price-to-book (P/B) ratio of 11.74, both flagged as unfavorable and suggesting a premium market valuation that could limit upside. The lack of dividend yield (0%) may deter income-focused investors. While leverage is moderate with a debt-to-equity ratio of 0.36 and healthy liquidity ratios—current ratio at 2.16 and quick ratio at 1.38—investors should remain cautious of market pressure given the overall bearish trend of a -58.33% price change over the longer term, despite recent positive momentum.

Our Verdict about Lululemon Athletica Inc.

Lululemon’s long-term fundamental profile appears favorable, bolstered by strong profitability and value creation metrics. Although the overall technical trend remains bearish, recent buyer dominance with a 61.63% share and a positive price change of 15.01% since late 2025 suggests improving market sentiment. This combination may appear attractive for investors seeking growth exposure, yet the elevated valuation and historical market pressure suggest a measured, wait-and-see approach could be prudent to optimize entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- lululemon: Beware Of Turnaround Investing In Retail (NASDAQ:LULU) – Seeking Alpha (Jan 21, 2026)

- Lululemon Founder Outraged Over See-Through Leggings: ‘A New Low’ – Benzinga (Jan 23, 2026)

- Does lululemon (LULU) Face a Turning Point in Governance and Brand Control After Get Low Misstep? – Yahoo Finance (Jan 24, 2026)

- lululemon athletica inc. $LULU Shares Purchased by Y Intercept Hong Kong Ltd – MarketBeat (Jan 24, 2026)

- A Look At Lululemon Athletica (LULU) Valuation After Raised Fourth Quarter Earnings Guidance – Yahoo Finance (Jan 20, 2026)

For more information about Lululemon Athletica Inc., please visit the official website: lululemon.com