Home > Analyses > Consumer Cyclical > Lowe’s Companies, Inc.

Lowe’s Companies, Inc. transforms everyday living spaces by empowering homeowners and professionals with top-tier home improvement solutions. As a dominant force in the home improvement sector, Lowe’s boasts a vast network of nearly 2,000 stores and a strong digital presence, offering everything from tools to décor with a reputation for quality and innovation. As we analyze Lowe’s current market position, the question remains: does its solid foundation and growth strategy justify its premium valuation in 2026?

Table of contents

Business Model & Company Overview

Lowe’s Companies, Inc., founded in 1921 and headquartered in Mooresville, North Carolina, stands as a dominant force in the home improvement retail sector. Operating nearly 2,000 stores, it delivers a comprehensive ecosystem of construction, remodeling, and maintenance products, blending national brand-name and private label offerings. Its mission unites homeowners, renters, and professionals under one roof, fostering a seamless experience across hardware, tools, and decor.

The company’s revenue engine balances product sales with installation and repair services, enhancing customer lifetime value. Its footprint spans the Americas with strong digital channels, including Lowes.com and mobile apps, enabling global reach. This integration of hardware and service revenue streams forms a resilient economic moat, positioning Lowe’s as a key architect in shaping home improvement’s future landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze Lowe’s Companies, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

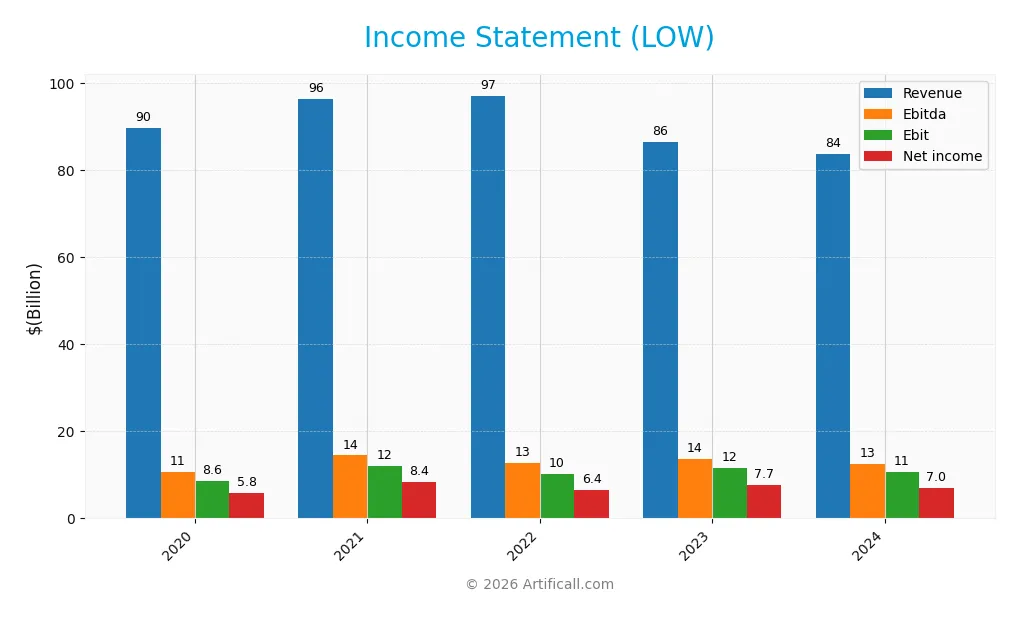

The table below presents Lowe’s Companies, Inc. income statement data for the fiscal years 2020 through 2024, showing key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 89.6B | 96.3B | 97.1B | 86.4B | 83.7B |

| Cost of Revenue | 61.4B | 65.9B | 66.6B | 59.3B | 57.5B |

| Operating Expenses | 17.3B | 18.1B | 17.8B | 15.6B | 16.0B |

| Gross Profit | 28.2B | 30.4B | 30.5B | 27.1B | 26.1B |

| EBITDA | 10.7B | 14.5B | 12.7B | 13.6B | 12.6B |

| EBIT | 8.6B | 12.1B | 10.2B | 11.6B | 10.6B |

| Interest Expense | 872M | 859M | 1.1B | 1.5B | 1.5B |

| Net Income | 5.8B | 8.4B | 6.4B | 7.7B | 7.0B |

| EPS | 7.77 | 12.08 | 10.20 | 13.24 | 12.25 |

| Filing Date | 2021-03-22 | 2022-03-21 | 2023-03-27 | 2024-03-25 | 2025-03-24 |

Income Statement Evolution

From 2020 to 2024, Lowe’s Companies, Inc. experienced a decline in revenue by 6.61%, with a 3.13% decrease in the latest year. Gross profit and operating expenses both fell by around 3% in the last year, signaling some contraction. Despite this, net income grew overall by 19.23%, supported by a 27.67% rise in net margin, indicating improved profitability and cost control over the full period.

Is the Income Statement Favorable?

The 2024 fiscal year shows a mixed picture: revenue and earnings before interest and taxes (EBIT) both declined by roughly 8.8%, while net margin dropped by 7%. However, Lowe’s maintained a favorable gross margin of 31.25% and an EBIT margin of 12.69%. Interest expenses remained well-managed at 1.76% of revenue. Overall, the fundamentals present a neutral stance, balancing growth challenges with solid margin performance.

Financial Ratios

The following table presents key financial ratios for Lowe’s Companies, Inc. over the fiscal years 2020 to 2024, offering insights into profitability, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.5% | 8.8% | 6.6% | 8.9% | 8.3% |

| ROE | 4.1% | -175% | -45% | -51% | -49% |

| ROIC | 26.3% | 32.8% | 33.0% | 30.4% | 26.5% |

| P/E | 20.9 | 19.6 | 20.3 | 16.0 | 21.2 |

| P/B | 85.0 | -34.3 | -9.2 | -8.2 | -10.4 |

| Current Ratio | 1.19 | 1.02 | 1.10 | 1.23 | 1.09 |

| Quick Ratio | 0.33 | 0.12 | 0.15 | 0.14 | 0.16 |

| D/E | 18.2 | -6.1 | -2.7 | -2.7 | -2.8 |

| Debt-to-Assets | 54.3% | 63.4% | 83.9% | 92.6% | 89.0% |

| Interest Coverage | 12.5 | 14.3 | 11.1 | 7.8 | 6.9 |

| Asset Turnover | 1.86 | 2.08 | 2.14 | 1.99 | 1.88 |

| Fixed Asset Turnover | 3.90 | 4.15 | 4.60 | 4.04 | 3.91 |

| Dividend Yield | 1.4% | 1.2% | 1.8% | 2.0% | 1.7% |

Evolution of Financial Ratios

Lowe’s Companies, Inc. experienced a decline in Return on Equity (ROE), turning sharply negative to -48.9% in 2024, indicating deteriorating shareholder profitability. The Current Ratio showed slight fluctuation but remained around 1.1, reflecting relatively stable liquidity. Meanwhile, the Debt-to-Equity Ratio improved to a favorable -2.79, suggesting changes in capital structure despite a high Debt-to-Assets ratio near 89%, signaling elevated leverage risk.

Are the Financial Ratios Favorable?

In 2024, Lowe’s profitability metrics were mixed: net margin was neutral at 8.31%, but ROE was unfavorable, contrasting with a favorable 26.54% return on invested capital (ROIC). Liquidity ratios were neutral to unfavorable, with a current ratio of 1.09 and a quick ratio of 0.16. Leverage showed conflicting signs, as the negative debt-to-equity ratio was favorable, yet a high debt-to-assets ratio was unfavorable. Efficiency and coverage ratios, including asset turnover (1.88) and interest coverage (7.23), were favorable. Overall, the company’s financial ratios were slightly favorable but warrant cautious interpretation.

Shareholder Return Policy

Lowe’s Companies, Inc. maintains a dividend payout ratio around 33-37% with a steady dividend per share increase, yielding approximately 1.7% annually. The dividend is well covered by free cash flow, and the company also engages in share buybacks, supporting shareholder returns.

This balanced distribution policy appears sustainable, aligning dividend payments and share repurchases with cash flow generation. It suggests Lowe’s prioritizes long-term value creation without overextending its financial capacity or risking unsustainable payouts.

Score analysis

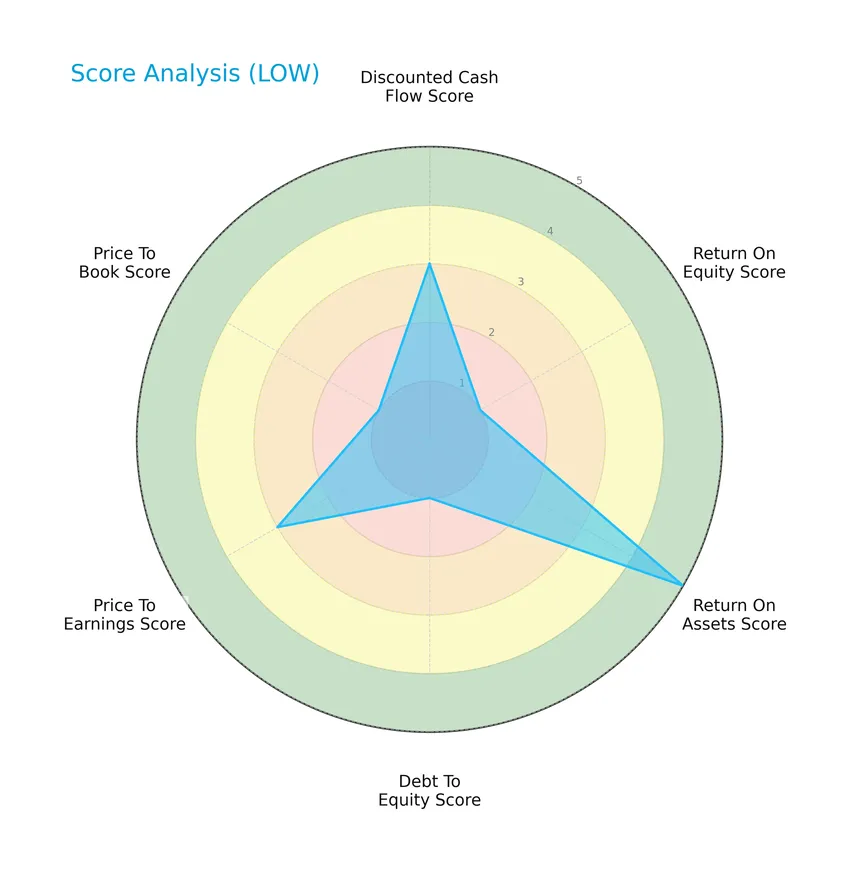

Here is a radar chart summarizing Lowe’s Companies, Inc.’s key financial scores for a comprehensive overview:

The scores show a mixed financial profile: a moderate discounted cash flow and price-to-earnings ratio, very favorable return on assets, but very unfavorable return on equity, debt-to-equity, and price-to-book ratios, indicating areas of concern.

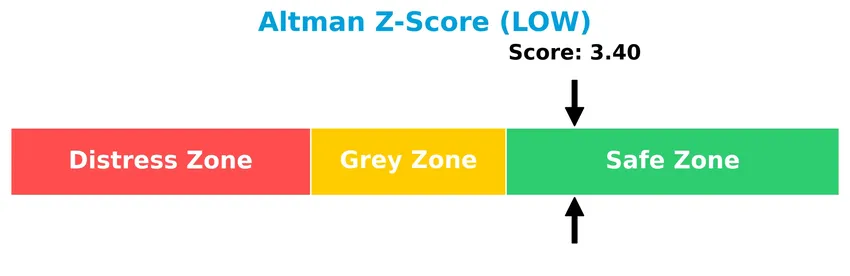

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Lowe’s Companies, Inc. in the safe zone, suggesting a low risk of bankruptcy and financial distress:

Is the company in good financial health?

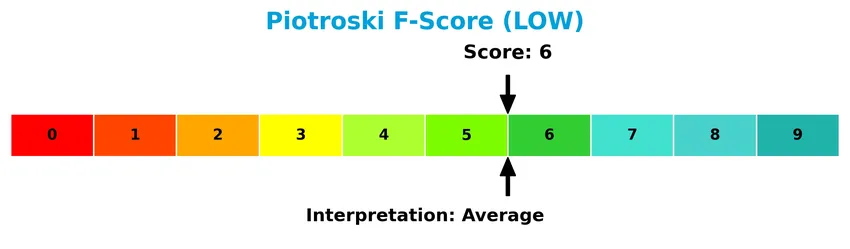

This Piotroski Score diagram helps evaluate Lowe’s Companies, Inc.’s overall financial strength and operational efficiency:

With a Piotroski Score of 6, the company is in average financial health, reflecting moderate strength but with room for improvement in profitability and financial metrics.

Competitive Landscape & Sector Positioning

This section presents an analysis of Lowe’s Companies, Inc. within the home improvement sector, covering key strategic and market factors. I will evaluate whether Lowe’s holds a competitive advantage over its main competitors.

Strategic Positioning

Lowe’s Companies, Inc. maintains a diversified product portfolio across building products, hardlines, and home decor, generating over 83B USD in U.S. sales in 2024, with minimal international exposure. Its strategic focus centers on the U.S. home improvement market with a broad product and service offering.

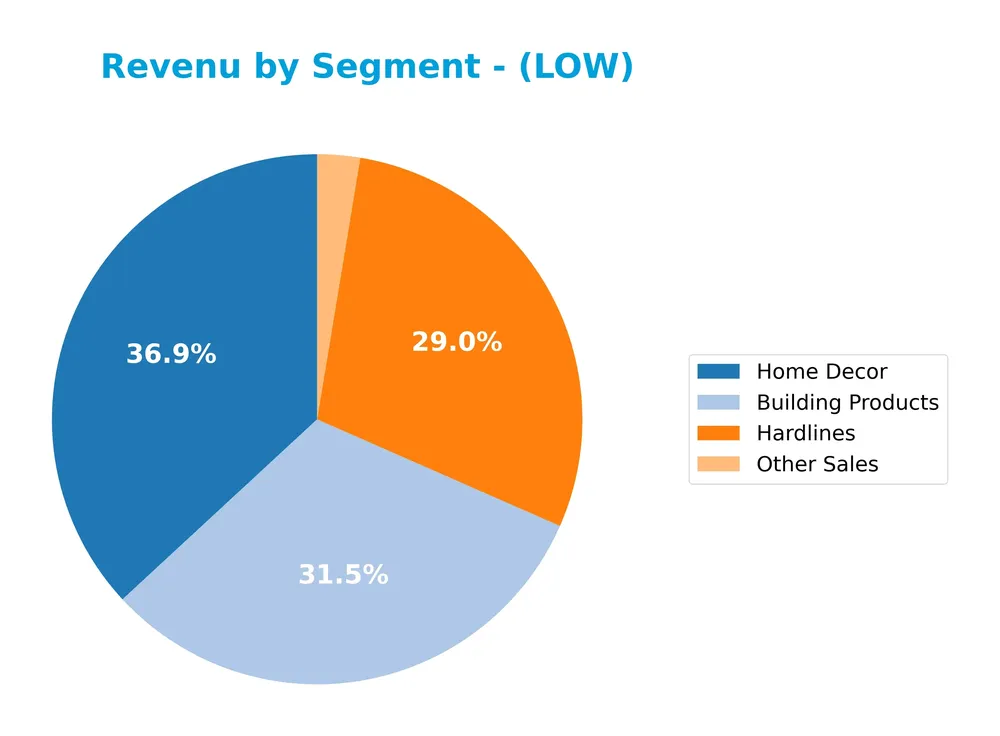

Revenue by Segment

This pie chart illustrates Lowe’s Companies, Inc. revenue distribution by segment for the fiscal year 2024, highlighting the contribution of each product category to the overall sales.

In 2024, Home Decor led revenue with $30.9B, followed closely by Building Products at $26.4B and Hardlines at $24.3B, indicating a fairly balanced portfolio. Other Sales remain a minor contributor at $2.2B. Compared to previous years, there is a modest decline across all main segments, suggesting a slight slowdown. The business remains diversified without overreliance on any single category, which supports risk management.

Key Products & Brands

The table below lists Lowe’s key product categories and their descriptions:

| Product | Description |

|---|---|

| Building Products | Products for construction, maintenance, repair, remodeling, including lumber and building materials. |

| Hardlines | Tools, hardware, plumbing, electrical, and related home improvement merchandise. |

| Home Decor | Items for decorating, lighting, flooring, kitchens, baths, and millwork. |

| Other Sales | Installation services, extended protection plans, repair services, and other miscellaneous sales. |

Lowe’s product portfolio spans essential home improvement categories, catering to both homeowners and professionals with a broad range of merchandise and related services.

Main Competitors

There are 2 main competitors in the Home Improvement industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Home Depot, Inc. | 344B |

| Lowe’s Companies, Inc. | 138B |

Lowe’s Companies, Inc. ranks 2nd among its competitors, with a market cap at 45.1% of the sector leader, The Home Depot. It is positioned below both the average market cap of the top 10 competitors (241B) and the median market cap in its sector. The company shows a significant 121.72% gap to the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does LOW have a competitive advantage?

Lowe’s Companies, Inc. demonstrates a competitive advantage supported by a ROIC well above its WACC, indicating efficient capital use and consistent value creation. The company’s gross margin of 31.25% and net margin of 8.31% further reflect favorable profitability metrics despite recent revenue declines.

Looking ahead, Lowe’s continues to leverage its extensive network of nearly 2,000 stores and digital platforms to serve homeowners and professionals. Opportunities may arise from expanding product lines and installation services, supporting its position in the home improvement sector.

SWOT Analysis

This SWOT analysis highlights Lowe’s Companies, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- Strong market position in home improvement

- Favorable ROIC at 26.5% exceeding WACC

- Stable profitability and competitive advantage

Weaknesses

- Declining revenue trend over recent years

- Negative return on equity at -48.9%

- High debt to assets ratio at 89%

Opportunities

- Expansion of e-commerce and digital sales channels

- Growing demand for home renovation and remodeling

- Potential to improve operational efficiency and margins

Threats

- Intense competition from Home Depot and online retailers

- Economic downturns impacting consumer spending

- Supply chain disruptions and rising costs

Lowe’s benefits from solid market positioning and value creation but faces challenges from declining sales and high leverage. Strategic focus should be on leveraging digital growth opportunities and managing debt risks to sustain long-term profitability.

Stock Price Action Analysis

The weekly stock chart for Lowe’s Companies, Inc. illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, LOW’s stock price increased by 13.09%, indicating a bullish trend. The price ranged between 212.75 and 281.64, with volatility reflected by a standard deviation of 17.52. The trend shows acceleration, supported by recent gains of 18.69% since November 2025.

Volume Analysis

Trading volume has been increasing, with a total of 1.52B shares traded recently. Buyer volume accounts for 51.23%, rising to 58.31% dominance since November 2025, indicating slightly buyer-driven activity. This suggests growing investor interest and positive market participation.

Target Prices

The consensus among analysts for Lowe’s Companies, Inc. indicates a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 325 | 230 | 283.58 |

Analysts expect Lowe’s stock to trade within a range of 230 to 325, with a consensus target near 284, reflecting steady confidence in the company’s growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Lowe’s Companies, Inc. (LOW).

Stock Grades

Below is the latest set of verified stock grades for Lowe’s Companies, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Gordon Haskett | Upgrade | Buy | 2026-01-13 |

| Barclays | Upgrade | Overweight | 2026-01-07 |

| Oppenheimer | Maintain | Outperform | 2025-12-05 |

| Stifel | Maintain | Hold | 2025-12-01 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| Truist Securities | Maintain | Buy | 2025-11-20 |

| DA Davidson | Maintain | Neutral | 2025-11-20 |

| Evercore ISI Group | Maintain | In Line | 2025-11-20 |

The consensus among these grading companies shows a positive tilt with several upgrades to Buy and Overweight, balanced by multiple Holds and Outperform ratings. This pattern indicates cautious optimism with a majority favoring moderate to strong positive outlooks on Lowe’s stock.

Consumer Opinions

Lowe’s continues to attract a diverse range of consumer feedback, reflecting its position as a major home improvement retailer.

| Positive Reviews | Negative Reviews |

|---|---|

| Wide product selection and competitive pricing. | Occasional stock shortages on popular items. |

| Helpful and knowledgeable staff in stores. | Some customers report slow checkout experiences. |

| Convenient online shopping with reliable delivery. | Website navigation can be confusing at times. |

| Frequent promotions and loyalty rewards appreciated. | Customer service response times need improvement. |

Overall, consumers appreciate Lowe’s broad product range and helpful staff, though issues with inventory availability and customer service responsiveness are recurring concerns.

Risk Analysis

Below is a summary table highlighting key risk categories, their descriptions, and the assessed probability and impact levels for Lowe’s Companies, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-assets ratio (89%) increases financial risk and interest burden | High | High |

| Profitability | Negative return on equity (-48.89%) suggests challenges in generating returns | Medium | High |

| Liquidity | Low quick ratio (0.16) indicates potential short-term liquidity constraints | Medium | Medium |

| Market Volatility | Beta near 1 (0.957) implies stock price moves closely with market fluctuations | Medium | Medium |

| Operational Risks | Dependence on contractor services and supply chain disruptions | Medium | Medium |

| Economic Cyclicality | Exposure to consumer cyclical sector volatility affects demand | High | Medium |

The most significant risks for Lowe’s are its high financial leverage combined with an unfavorable return on equity, which could pressure profitability and financial stability. Despite a solid Altman Z-Score placing it in the safe zone, investors should monitor debt levels and operational efficiency closely amid economic cycles.

Should You Buy Lowe’s Companies, Inc.?

Lowe’s appears to be generating robust value creation supported by a favorable competitive moat with stable profitability, while its leverage profile could be seen as substantial. Despite mixed financial strength indicators, the overall rating suggests a very favorable profile with moderate risks.

Strength & Efficiency Pillars

Lowe’s Companies, Inc. exhibits notable financial resilience underscored by a robust Altman Z-Score of 3.40, placing it securely in the safe zone against bankruptcy risk. The company is a clear value creator, with a return on invested capital (ROIC) of 26.54% significantly surpassing its weighted average cost of capital (WACC) at 7.25%. This competitive advantage is complemented by a favorable asset turnover of 1.88 and fixed asset turnover of 3.91, signaling efficient asset utilization. Despite a negative return on equity (-48.89%), the overall financial health, reflected by an average Piotroski score of 6, supports operational stability.

Weaknesses and Drawbacks

Conversely, Lowe’s faces challenges that warrant caution. The price-to-book ratio stands at a negative -10.36, flagged as favorable but unconventional, likely reflecting accounting or market distortions, which may obscure true valuation. The debt-to-equity ratio at -2.79 and a high debt-to-assets ratio of 89.02% suggest elevated leverage risk, potentially constraining financial flexibility. Liquidity concerns emerge with a low quick ratio of 0.16, while the modest current ratio of 1.09 offers limited cushion. These factors, combined with a neutral price-to-earnings ratio of 21.19 and a net margin of 8.31%, present headwinds amid market volatility and moderate buyer dominance at 51.23%.

Our Verdict about Lowe’s Companies, Inc.

Lowe’s presents a fundamentally favorable long-term profile, buoyed by strong value creation and solid financial health. The bullish overall stock trend with accelerating price momentum and a recent period of slight buyer dominance (58.31%) may suggest growing investor confidence. Hence, the profile might appear attractive for long-term exposure, though investors should remain mindful of leverage and liquidity risks that could prompt volatility. A measured, risk-aware approach could be prudent to capitalize on the company’s operational strengths while managing potential downside.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Investors Heavily Search Lowe’s Companies, Inc. (LOW): Here is What You Need to Know – Yahoo Finance (Jan 21, 2026)

- If You Invested $1000 In Lowe’s Companies Stock 20 Years Ago, You Would Have This Much Today – Sahm (Jan 24, 2026)

- March 6th Options Now Available For Lowe’s Companies – Nasdaq (Jan 22, 2026)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 21, 2026)

- Lowe’s Companies, Inc.’s (NYSE:LOW) Share Price Not Quite Adding Up – 富途资讯 (Jan 21, 2026)

For more information about Lowe’s Companies, Inc., please visit the official website: lowes.com