Home > Analyses > Industrials > Lockheed Martin Corporation

Lockheed Martin shapes global security with cutting-edge aerospace and defense technology. Its advanced fighter jets, missile systems, and space solutions set industry standards for innovation and reliability. The company’s deep integration with government defense programs underscores its critical role in national security. As geopolitical tensions evolve, I examine whether Lockheed Martin’s robust fundamentals continue to justify its premium valuation and growth prospects in a complex defense landscape.

Table of contents

Business Model & Company Overview

Lockheed Martin Corporation, founded in 1912 and headquartered in Bethesda, Maryland, stands as a titan in the Aerospace & Defense sector. It integrates cutting-edge technology across Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. Its core mission weaves these segments into a cohesive ecosystem that delivers advanced combat aircraft, missile defense, helicopters, and satellite systems, serving primarily the U.S. government and allied foreign military customers.

The company’s revenue engine balances high-value hardware—such as fighter jets and missiles—with software-driven services like cyber solutions and mission operations support. Lockheed Martin commands strategic footholds across the Americas, Europe, and Asia, leveraging global defense budgets. Its robust portfolio and government ties create a formidable economic moat, cementing its role as a cornerstone in national and international security frameworks.

Financial Performance & Fundamental Metrics

I analyze Lockheed Martin Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder returns.

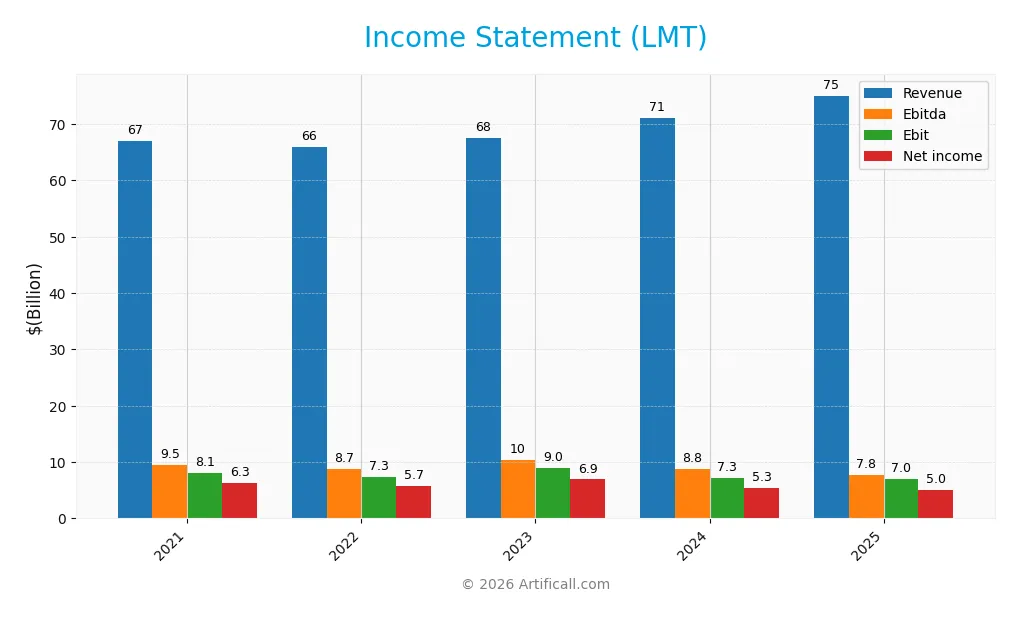

Income Statement

This table summarizes Lockheed Martin Corporation’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue, expenses, and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 67.0B | 65.9B | 67.6B | 71.0B | 75.1B |

| Cost of Revenue | 58.0B | 57.7B | 59.1B | 64.1B | 67.4B |

| Operating Expenses | -62.0M | -61.0M | -28.0M | -83.0M | -103.0M |

| Gross Profit | 9.1B | 8.3B | 8.5B | 6.9B | 7.6B |

| EBITDA | 9.5B | 8.7B | 10.4B | 8.8B | 7.8B |

| EBIT | 8.1B | 7.3B | 9.0B | 7.3B | 7.0B |

| Interest Expense | 569M | 623M | 916M | 1.0B | 1.1B |

| Net Income | 6.3B | 5.7B | 6.9B | 5.3B | 5.0B |

| EPS | 22.85 | 21.74 | 27.65 | 22.39 | 21.56 |

| Filing Date | 2022-01-25 | 2023-01-26 | 2024-01-23 | 2025-01-28 | 2026-01-29 |

Income Statement Evolution

Lockheed Martin’s revenue rose moderately by 5.7% in 2025, continuing an 11.95% growth since 2021. Gross profit increased 9.9% in the last year, reflecting stable gross margins near 10.1%. However, EBIT and net income declined by about 3% and 11% respectively, signaling margin pressures despite revenue gains.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. The net margin of 6.7% and interest expense ratio of 1.5% appear favorable, supporting profitability. Yet, EBIT margin contraction and declining net income growth over the past year and period point to weakening earnings quality. Overall, the income statement trends toward unfavorable, with declining margins offsetting revenue growth.

Financial Ratios

The table below summarizes Lockheed Martin Corporation’s key financial ratios for recent fiscal years, providing insight into profitability, leverage, liquidity, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.42% | 8.69% | 10.24% | 7.51% | 6.68% |

| ROE | 57.6% | 61.9% | 101.2% | 84.3% | 74.6% |

| ROIC | 20.7% | 19.3% | 20.4% | 16.2% | 17.4% |

| P/E | 15.6 | 22.4 | 16.4 | 21.7 | 22.3 |

| P/B | 9.0 | 13.8 | 16.6 | 18.3 | 16.6 |

| Current Ratio | 1.42 | 1.32 | 1.21 | 1.13 | 1.09 |

| Quick Ratio | 1.20 | 1.13 | 1.03 | 0.95 | 0.94 |

| D/E | 1.07 | 1.68 | 2.55 | 3.38 | 0.17 |

| Debt-to-Assets | 23.0% | 29.4% | 33.3% | 38.5% | 2.0% |

| Interest Coverage | 16.0 | 13.4 | 9.3 | 6.8 | 6.9 |

| Asset Turnover | 1.32 | 1.25 | 1.29 | 1.28 | 1.25 |

| Fixed Asset Turnover | 8.8 | 8.3 | 8.1 | 8.1 | 8.5 |

| Dividend Yield | 2.99% | 2.35% | 2.69% | 2.64% | 2.80% |

Evolution of Financial Ratios

Lockheed Martin’s return on equity (ROE) surged significantly, peaking at 101% in 2023 before settling at 75% in 2025. The current ratio showed a gradual decline from 1.42 in 2021 to 1.09 in 2025, indicating slightly reduced liquidity. Debt-to-equity ratio improved markedly, dropping from above 3.3 in 2024 to 0.17 in 2025, signaling stronger financial health. Profitability margins fluctuated but remained relatively stable.

Are the Financial Ratios Favorable?

In 2025, Lockheed Martin exhibits strong profitability with ROE at 74.65% and ROIC at 17.39%, well above WACC at 4.77%, confirming value creation. Liquidity ratios like current (1.09) and quick (0.94) are neutral, reflecting adequate short-term financial resilience. Leverage is favorable with a low debt-to-equity ratio of 0.17 and debt-to-assets at 1.95%. Market valuation shows mixed signals: P/E is neutral at 22.26, while the P/B ratio is unfavorable at 16.62. Overall, 64% of ratios are favorable, supporting a generally positive financial profile.

Shareholder Return Policy

Lockheed Martin maintains a consistent dividend policy, with a payout ratio around 62% in 2025 and a dividend yield near 2.8%. Dividend payments are well covered by free cash flow, supporting sustainability. The company also engages in share buybacks, complementing its cash returns to shareholders.

This balanced approach aligns with long-term value creation by distributing profits while preserving capital for investments. The dividend coverage and buyback programs suggest prudent capital allocation, reducing risks of unsustainable distributions or excessive repurchases.

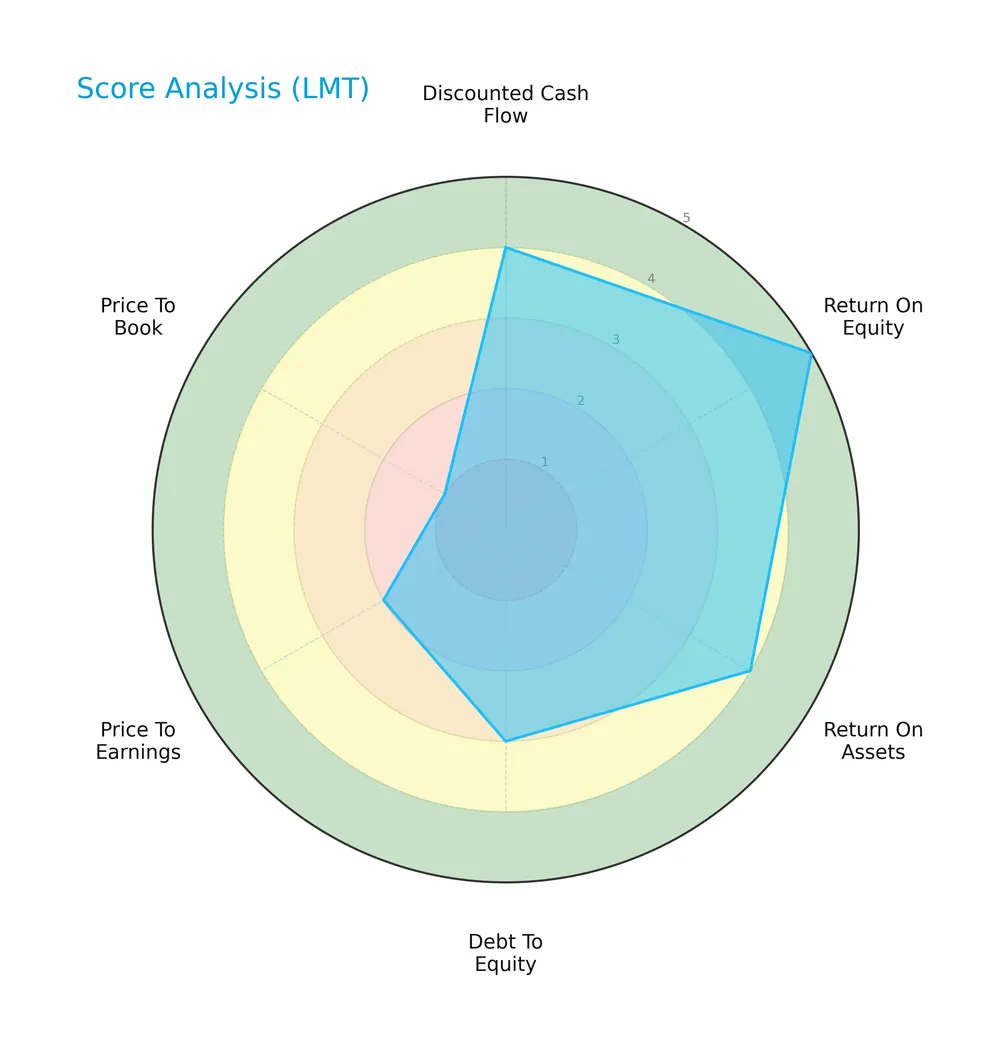

Score analysis

The following radar chart presents Lockheed Martin Corporation’s key financial scores for a clear performance overview:

Lockheed Martin scores very favorably in return on equity (5) and favorably in discounted cash flow (4) and return on assets (4). Debt to equity and price to earnings are moderate (3 and 2), while price to book is very unfavorable (1), indicating valuation concerns.

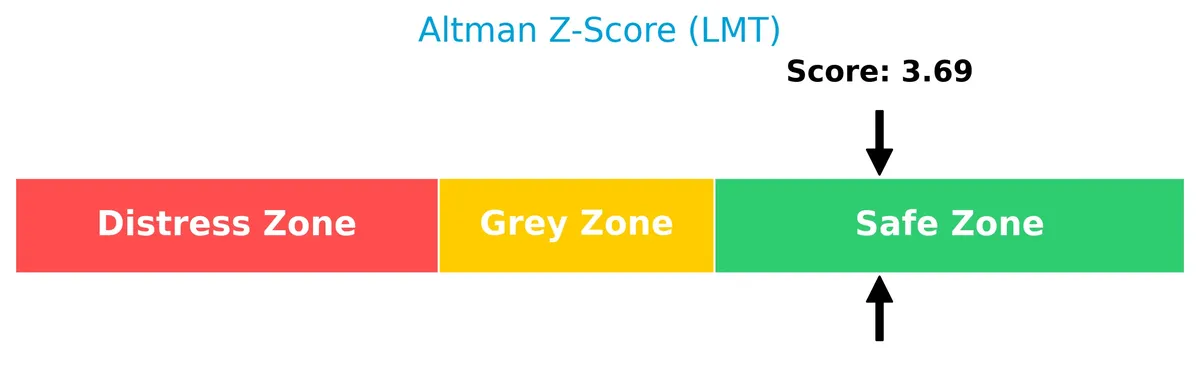

Analysis of the company’s bankruptcy risk

Lockheed Martin’s Altman Z-Score of 3.69 places it firmly in the safe zone, indicating a low risk of bankruptcy:

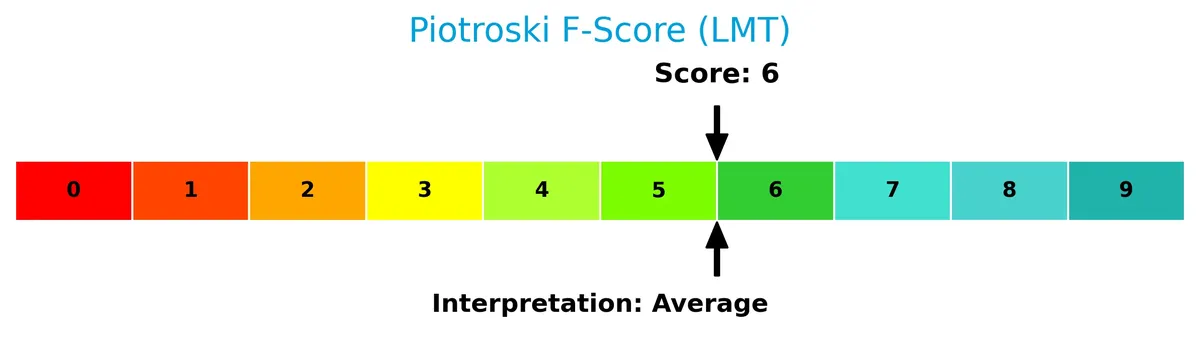

Is the company in good financial health?

The Piotroski Score diagram illustrates Lockheed Martin’s financial health based on key accounting metrics:

With a score of 6 classified as average, Lockheed Martin shows decent financial strength but leaves room for improvement to reach the strong or very strong categories.

Competitive Landscape & Sector Positioning

This section examines Lockheed Martin Corporation’s strategic positioning, revenue breakdown, key products, and main competitors. I will evaluate whether Lockheed Martin holds a competitive advantage in the aerospace and defense sector.

Strategic Positioning

Lockheed Martin maintains a diversified product portfolio with four core segments spanning Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. Geographically, it concentrates heavily on the U.S. market, which accounted for $53.7B in 2025, while also maintaining significant exposure in Europe and Asia Pacific.

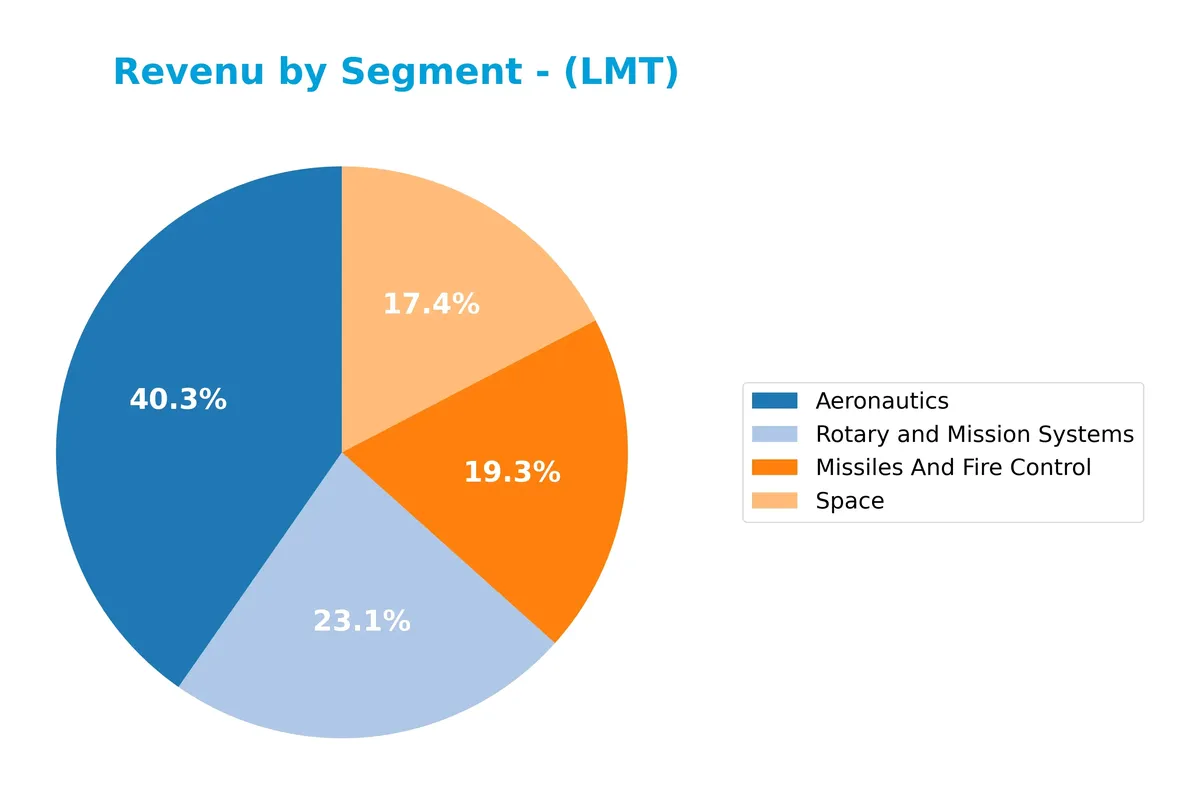

Revenue by Segment

This pie chart illustrates Lockheed Martin Corporation’s revenue distribution by segment for the fiscal year 2025, highlighting key business areas.

Aeronautics leads with $30.3B, reflecting steady growth and strong defense demand. Rotary and Mission Systems follow at $17.3B, closely matched by Missiles and Fire Control at $14.5B. Space generated $13B, showing consistent expansion. The segment mix emphasizes Aeronautics’ dominance, signaling concentration risk but also robust sector positioning in aerospace and defense.

Key Products & Brands

The table below details Lockheed Martin’s major products and segments generating revenue:

| Product | Description |

|---|---|

| Aeronautics | Combat and air mobility aircraft, unmanned air vehicles, and related aerospace technologies. |

| Missiles and Fire Control | Air and missile defense systems; tactical missiles; air-to-ground precision strike weapons; fire control and mission support systems. |

| Rotary and Mission Systems | Military and commercial helicopters, surface ships, missile defense systems, radar, cyber solutions, and training systems. |

| Space | Satellites, space transportation, strategic missile systems, classified national security systems, and intelligence data networks. |

Lockheed Martin’s diversified portfolio spans aerospace, defense, and space sectors. Aeronautics remains the largest revenue driver, complemented by strong growth in missiles, rotary systems, and space capabilities.

Main Competitors

Lockheed Martin Corporation faces 12 competitors in its sector. The following table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338B |

| RTX Corporation | 251B |

| The Boeing Company | 171B |

| Lockheed Martin Corporation | 116B |

| General Dynamics Corporation | 93B |

| Northrop Grumman Corporation | 84B |

| TransDigm Group Incorporated | 76B |

| L3Harris Technologies, Inc. | 57B |

| Axon Enterprise, Inc. | 44B |

| BWX Technologies, Inc. | 17B |

Lockheed Martin ranks 4th among its competitors with a market cap 41.7% that of the leader, GE Aerospace. It stands above both the average market cap of the top 10 (125B) and the sector median (80B). The company has a 21.6% market cap gap with the next competitor above, The Boeing Company, showing a solid but not dominant position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does LMT have a competitive advantage?

Lockheed Martin demonstrates a competitive advantage by consistently generating ROIC well above its WACC, indicating value creation despite a declining profitability trend. Its diversified aerospace and defense segments support stable revenue streams and market presence.

Looking ahead, Lockheed Martin’s expansion in space systems and missile defense, along with growing international sales, presents opportunities for sustained growth and technological leadership in national security markets.

SWOT Analysis

This analysis identifies Lockheed Martin’s core strengths, weaknesses, opportunities, and threats to guide strategic decisions.

Strengths

- strong market position in aerospace & defense

- high ROE of 74.65% indicating efficient capital use

- diversified global revenue streams with dominant US sales

Weaknesses

- declining ROIC trend signals pressure on profitability

- negative net income growth over 5 years

- high price-to-book ratio indicates overvaluation risk

Opportunities

- growing demand for advanced defense tech globally

- expansion in space and cyber solutions

- potential new government contracts and foreign military sales

Threats

- geopolitical tensions affecting international sales

- defense budget cuts in key markets

- rising raw material and labor costs impacting margins

Lockheed Martin boasts a robust market moat and capital efficiency but faces profitability headwinds. Its strategy should focus on innovation and cost control to capitalize on global defense demand while mitigating geopolitical and budget risks.

Stock Price Action Analysis

The weekly stock chart below illustrates Lockheed Martin Corporation’s price movements over the past 12 months, highlighting key trend shifts and volatility:

Trend Analysis

Over the past year, LMT’s stock price increased by 39.78%, indicating a bullish trend with acceleration. The price ranged from a low of 421.01 to a high of 634.22, reflecting notable volatility with a standard deviation of 49.01. Recent months show a continued upward slope of 17.21.

Volume Analysis

Trading volumes increased over the last three months, driven predominantly by buyers who accounted for 61.75% of activity. This buyer dominance and rising volume suggest growing investor confidence and stronger market participation.

Target Prices

Analysts set a clear target consensus for Lockheed Martin Corporation, reflecting confident growth expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 517 | 695 | 619 |

The target range from 517 to 695 signals robust upside potential. The consensus at 619 suggests steady appreciation aligned with sector leaders.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide insight into Lockheed Martin Corporation’s market perception.

Stock Grades

Here are the latest verified stock grades for Lockheed Martin Corporation from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-02-02 |

| Jefferies | Maintain | Hold | 2026-02-02 |

| Goldman Sachs | Maintain | Sell | 2026-02-02 |

| RBC Capital | Maintain | Sector Perform | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| UBS | Maintain | Neutral | 2026-01-15 |

| Citigroup | Maintain | Neutral | 2026-01-13 |

| Jefferies | Maintain | Hold | 2026-01-12 |

| Truist Securities | Upgrade | Buy | 2026-01-09 |

| JP Morgan | Downgrade | Neutral | 2025-12-19 |

The overall trend shows a cautious stance, with most firms maintaining neutral or hold ratings. Truist Securities stands out with a recent upgrade to buy, while Goldman Sachs remains notably bearish with a sell rating.

Consumer Opinions

Lockheed Martin garners strong respect from consumers for its innovation and reliability in aerospace and defense sectors.

| Positive Reviews | Negative Reviews |

|---|---|

| “Outstanding product quality and durability.” | “Customer service response times can lag.” |

| “Cutting-edge technology drives industry leadership.” | “Pricing seems high compared to competitors.” |

| “Strong commitment to national security and innovation.” | “Complex procurement process frustrates some clients.” |

Overall, consumers praise Lockheed Martin’s technological edge and product reliability. However, service responsiveness and pricing remain consistent concerns among buyers.

Risk Analysis

Below is a summary table of key risks facing Lockheed Martin Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Geopolitical Risk | Dependence on U.S. government and foreign military sales may face policy shifts or budget cuts. | Medium | High |

| Regulatory Risk | Aerospace and defense regulations could tighten, increasing compliance costs. | Low | Medium |

| Market Valuation | High price-to-book ratio signals a potentially stretched valuation. | Medium | Medium |

| Liquidity Risk | Current ratio near 1.1 implies limited short-term liquidity cushion. | Low | Medium |

| Supply Chain Risk | Disruptions in specialized parts or raw materials could delay production. | Medium | Medium |

| Technological Risk | Rapid tech evolution demands continuous innovation; failure risks competitiveness. | Medium | High |

Geopolitical and technological risks pose the greatest threats due to Lockheed Martin’s reliance on government contracts and defense innovation. Despite a strong balance sheet, the stretched valuation and moderate liquidity require caution. The company’s Altman Z-score of 3.69 confirms financial stability, but investors must watch for policy shifts and tech disruption.

Should You Buy Lockheed Martin Corporation?

Lockheed Martin appears to be a profitable firm with a slightly favorable moat, indicating ongoing value creation despite declining returns. Its leverage profile seems manageable, supported by a moderate debt rating. Overall, the company could be seen as a solid B+ investment candidate.

Strength & Efficiency Pillars

Lockheed Martin Corporation demonstrates robust profitability with a return on equity of 74.65% and a net margin of 6.68%, reflecting solid operational efficiency. Its return on invested capital of 17.39% comfortably exceeds a weighted average cost of capital of 4.77%, marking the company as a clear value creator. Financial health metrics reinforce this strength: an Altman Z-Score of 3.69 places it securely in the safe zone, while a Piotroski score of 6 indicates average but stable fundamentals. These pillars suggest disciplined capital allocation and resilience in a complex sector.

Weaknesses and Drawbacks

The company faces valuation headwinds, notably a high price-to-book ratio of 16.62, flagged as very unfavorable, which signals a stretched market valuation. The P/E ratio at 22.26 is neutral but implies limited margin for multiple expansion. Liquidity metrics such as a current ratio of 1.09 and a quick ratio of 0.94 remain neutral yet warrant monitoring for potential short-term constraints. While leverage is favorable with a debt-to-equity ratio of 0.17, these valuation concerns could expose investors to downside risk should market sentiment shift.

Our Verdict about Lockheed Martin Corporation

Lockheed Martin’s long-term fundamental profile appears favorable, driven by strong profitability and sound financial health. The bullish overall stock trend, paired with a buyer-dominant recent period, suggests positive momentum. This combination might appear attractive for long-term exposure, though investors should remain vigilant about valuation risks and recent operational margin pressures. Hence, a measured approach could benefit those seeking strategic entry points in a defensively positioned aerospace and defense leader.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- W.H. Cornerstone Investments Inc. Decreases Stock Position in Lockheed Martin Corporation $LMT – MarketBeat (Feb 05, 2026)

- Lockheed Martin Corporation (LMT): A Bull Case Theory – Yahoo Finance (Feb 03, 2026)

- Lockheed Martin Awarded $328.5 Million Contract to Deliver Legion-ES Systems – Lockheed Martin (Feb 02, 2026)

- Is Lockheed Martin Corp Gaining or Losing Market Support? – Benzinga (Feb 05, 2026)

- Is LMT Stock a Buy, Hold or Sell After 17.8% Rise in a Month? – The Globe and Mail (Feb 05, 2026)

For more information about Lockheed Martin Corporation, please visit the official website: lockheedmartin.com